This report provides a comprehensive analysis of the financial situation of Jianan Technology since its expansion into the mining business in 2021.

Author: TaxDAO

Jianan Technology was established in 2013 and went public on November 21, 2019. It is a technology company focusing on ASIC high-performance computing chip design, chip development, computing equipment production, and software services. With the vision of "supercomputing is what we do, and social enrichment is why we do it," Jianan Technology has rich experience in ASIC chip design and streamlined production in the field. In 2013, under the leadership of founder and CEO Zhang Nangeng, Jianan Technology's founding team delivered the world's first batch of Bitcoin mining machines using ASIC technology to its customers, branded as Avalon. In 2019, Jianan Technology completed its initial public offering on the Nasdaq Global Market. Jianan Technology not only provides customers worldwide with comprehensive artificial intelligence (AI) solutions, including AI chips, algorithm development and optimization, hardware modules, end products, and software services, but also provides supercomputing solutions through its proprietary high-performance computing ASICs (Application-Specific Integrated Circuits). As of 2022, Jianan Technology has 541 employees, with business covering Bitcoin mining machines, mining, and artificial intelligence products, mainly distributed in countries and regions such as Indonesia, Malaysia, the United States, Australia, and Kazakhstan.

This report comprehensively analyzes Jianan Technology's financial situation since its expansion into the mining business in 2021, aiming to evaluate the impact of this business decision on the company's financial condition. By reviewing the company's financial data from the beginning of its mining business and comparing the performance of the mining business in the last two quarters, this report reveals Jianan Technology's profitability and cost control in the mining field, and discusses the impact of the mining business on the company's overall financial health and strategic development direction. This analysis not only reflects the company's competitive position in the mining hardware market but also takes into account the impact of industry trends, changes in market demand, and relevant policy environment on Jianan Technology's business expansion decisions.

2 Strategic Analysis of Jianan Technology's Expansion into Mining Business

2.1 Jianan Technology Mining Activity Revenue Report

2.1.1 Mining Activity Revenue

In Jianan Technology's Q2 2023 report, it was disclosed that the mining revenue for Q2 2023 was $15.9 million, a 43.3% increase from Q1 2023's $11.1 million, and a 105.1% increase from the same period in 2022, which was $7.8 million. The quarter-on-quarter growth was mainly driven by the rise in Bitcoin prices and the increase in Bitcoin rewards on the network during the quarter. The year-on-year growth was mainly due to the increase in computing power injected into mining.

In Jianan Technology's Q3 2023 report, it was disclosed that the mining revenue for Q3 2023 was $3.3 million, a 79.5% decrease from Q2 2023's $15.9 million, and a 64.6% decrease from the same period in 2022, which was $9.2 million. The decrease in both quarter-on-quarter and year-on-year was mainly due to the decrease in mining computing power. The decrease in Bitcoin hash rate led to longer transaction confirmation times and reduced mining costs. The reason for the hash rate decrease was the implementation of the "Digital Mining Activity Licensing Rules" in Kazakhstan in July 2023, which required individuals engaged in cryptocurrency mining to obtain professional licenses. Subsequently, the company decided to temporarily shut down its mining computing power of about 2.0 Exahash/s in Kazakhstan to ensure legal compliance. Since early July, the company has been actively working to obtain Class II licenses for mining hardware owners, and its mining business in Kazakhstan has been suspended until Q3 2023.

2.1.2 Sales Activity Revenue

In Jianan Technology's Q2 2023 report, it was disclosed that the product revenue for Q2 2023 was $57.9 million, with mining machine sales revenue increasing from $43.7 million in Q1 2023 to $57.8 million. In comparison, Q1 2023 was $44.1 million, and the same period in 2022 was $238.1 million. The increase compared to Q1 2023 was mainly due to the increase in total computing power sales, despite lower sales prices due to weaker overall purchasing power of market demand. The decrease compared to Q2 2022 was mainly due to the decrease in sales prices caused by the decline in Bitcoin prices. The revenue from artificial intelligence products in Q2 2023 was $1 million, while it was $4 million in Q1 2023 and $2 million in the same period in 2022.

In Jianan Technology's Q3 2023 report, it was disclosed that the product revenue for Q3 2023 was $29.9 million, with the company's mining machine sales revenue for Q3 2023 being $29.75 million. In comparison, Q2 2023 was $57.9 million, and the same period in 2022 was $136.3 million. The decrease compared to Q2 2023 was mainly due to the decrease in total computing power sales volume and sales prices, which was caused by the overall slowdown in market demand. The decrease compared to Q3 2022 was mainly due to the decrease in sales prices, despite the gradual recovery of Bitcoin prices and the increase in total computing power sales volume, but the overall market demand slowed down. The revenue from artificial intelligence products in Q3 2023 was $2 million, while it was $1 million in Q2 2023 and $4 million in the same period in 2022.

2.1.3 Proportion of Mining Activity Revenue

- In Q2 2023, Jianan Technology's total revenue was $73.85 million, with mining revenue accounting for approximately 21.5% of the total revenue.

- In Q3 2023, Jianan Technology's total revenue was $33.32 million, with mining revenue accounting for approximately 9.8% of the total revenue.

Currently, Jianan Technology's mining business revenue proportion is relatively small, and under the requirements of legality and compliance, the decrease in hash rate has led to higher mining costs and a reduction in mining revenue. However, the company will implement a destocking strategy for a longer period to reduce risks and improve operational efficiency. The balance between mining business and mining machine business needs to be further adjusted based on later market performance and company strategy.

2.2 2023 Q2-Q3 Mining Costs and Profits

2.2.1 Direct Costs of Mining Activity

In Q2 2023, Jianan Technology's mining costs were $30.6 million, an increase from $27.3 million in Q1 2023 and $11.5 million in the same period in 2022. These mining costs include the direct costs of mining production (including electricity and hosting fees, etc.), as well as depreciation and amortization expenses. The depreciation expense for deployed mining machines in this quarter was $16.2 million, while it was $16.3 million in Q1 2023 and $10.1 million in the same period in 2022. The year-on-year increase was mainly due to the increase in mining capacity. Therefore, the direct cost of mining activity in Q2 2023 was $14.4 million, accounting for 47.1% of the total cost.

In Q3 2023, Jianan Technology's mining costs were $18.7 million, a decrease from $30.6 million in Q2 2023 and $15.8 million in the same period in 2022. The depreciation expense for deployed mining machines in this quarter was $15.8 million, while it was $16.2 million in Q2 2023 and $7.7 million in the same period in 2022. The year-on-year increase was mainly due to the increase in computing power deployed in the company's mining business. Therefore, the direct cost of mining activity in Q3 2023 was $2.9 million, accounting for 15.5% of the total cost. The proportion of direct costs has decreased.

The product cost in Q3 2023 was $83.7 million, while it was $113.3 million in Q2 2023 and $97.1 million in the same period in 2022. The continuous, year-on-year decrease is consistent with the decrease in the sold computing power. The provision for inventory write-down, provision for prepayments write-down, and provision for inventory purchase commitments in this quarter was $53.9 million, while it was $45.9 million in Q2 2023 and $33.1 million in the same period in 2022. The product cost includes the direct production costs of mining machines and artificial intelligence products, and related indirect costs of production, as well as provisions for inventory write-down, provision for prepayments write-down, and provision for inventory purchase commitments.

From the above data related to mining and mining machine sales, it can be seen that the gross profit margin of the mining business in Q2 2023 was -0.92%, and in Q3 2023, it was -68.47%. At present, Jianan Technology's mining business has not brought significant profits to the company.

2.2.2 Profit Analysis

The net loss in Q2 2023 was $110.7 million, while the net profit in the same period in 2022 was $6.3 million. By Q3 2023, the net loss was $80.1 million, including a provision of $53.9 million for inventory write-down, prepayments write-down, and provisions for inventory purchase commitments in this quarter. These actions are consistent with the company's proactive destocking strategy to cope with challenging market conditions and should be considered as non-cash items. To improve the financial situation, Jianan Technology has implemented strict cost control measures, including layoffs to improve operational efficiency. In the future, Jianan Technology will continue to maintain cash reserves through diversified sales efforts and prudent expense management to ensure operational continuity and position itself to seize future opportunities.

2.3 Impact of Mining Business Expansion on Jianan Technology's Asset-Liability Ratio

2.3.1 Existing Number and Value of Jianan Technology's Mining Machines

In Q2 2023, Jianan Technology's inventory was $272 million, while its fixed assets, including software equipment, were $50.48 million, and the assets under use were $289,600. In Q3 2023, Jianan Technology's inventory was $217 million, with fixed assets, including software equipment, at $34.002 million, and assets under use at $230,000. It can be seen that Jianan Technology has focused its business on more profitable mining machine sales, with the median selling price of mining machines at 140 million RMB (approximately $19.46 million), and the number of mining machines (for sale and mining) stable at around 140,000 units.

2.3.2 Impact of Previous Mining Business Expansion

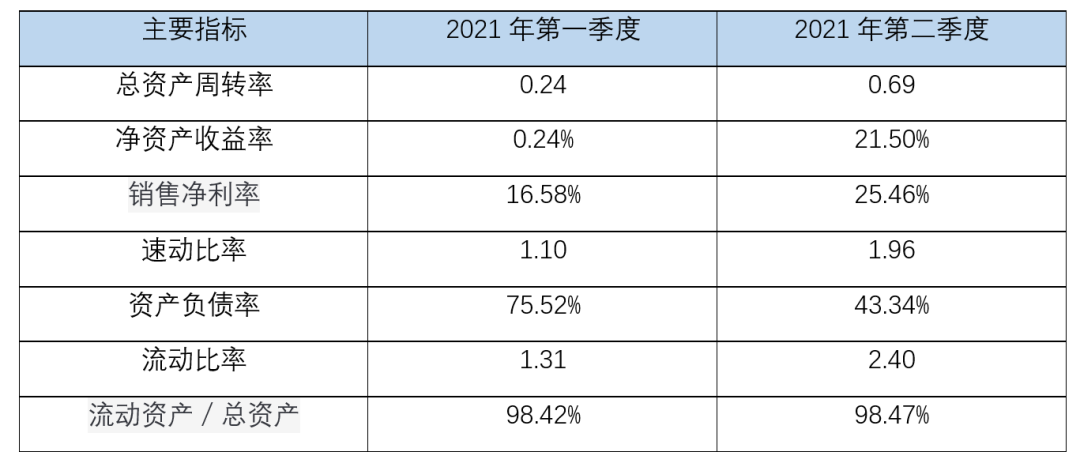

Jianan Technology has been operating a mining business since Q2 2021. By expanding into the global market, the company's relationship with customers has evolved from simple mining machine sales to joint mining, resulting in a closer alignment of interests. Mining is also listed as a separate financial item in the company's financial statements. Therefore, the main indicators from the Q1 2021 and Q2 2021 reports were selected for comparison to analyze the impact of mining activities on the company's asset ratio, as shown in the table below.

The data shows that Jianan Technology's total asset turnover and return on equity have significantly improved after expanding into the mining business, indicating good financial performance for a company that has expanded its business downstream from the traditional upstream industry chain. The increase in current ratio, quick ratio, and the decrease in the debt-to-asset ratio reflect an improvement in the company's financial condition, while the increase in return on equity indicates enhanced profitability and effective use of capital. Specifically:

(1) Increase in current ratio and quick ratio: The increase in these ratios indicates the company's improved ability to pay short-term debts and respond to sudden liabilities, possibly due to increased cash inflows from the mining business and reduced inventory holding, leading to improved liquidity.

(2) Decrease in debt-to-asset ratio: The decrease in this ratio indicates a healthier asset-to-liability ratio for the company, possibly due to increased funding from the mining business to pay off debts or invest in more profitable projects, or more efficient debt management.

(3) Increase in return on equity: The increase in this ratio indicates increased profitability per unit of net assets, possibly due to additional income from the mining business or optimized cost management, leading to improved profitability and effective use of capital.

In summary, the improvement in these financial indicators indicates that Jianan Technology has improved its financial condition, optimized its asset-liability ratio, enhanced profitability, and better met investor expectations through the introduction of the mining business.

Based on past experience, the mining machine business is closely tied to the price of cryptocurrencies. When cryptocurrency prices rise, performance improves, and when prices fall, performance declines. In 2021, cryptocurrency prices fluctuated significantly, reaching a low of around $30,000 per coin and a high of over $60,000 per coin. Despite the challenges from various sources, Jianan Technology's performance trended upwards for four consecutive quarters in 2021, ultimately achieving a year-on-year performance increase of over 10 times, far outperforming the cryptocurrency price trend. This demonstrates that the pioneering and flexible business strategy, stable supply chain capacity, expansion of the mining business, increasing research and development investment, team building, and improving management have been beneficial for Jianan Technology at that time.

In Q4 2021, despite significant fluctuations in cryptocurrency prices, Jianan Technology further expanded into overseas markets such as Southeast Asia and South America, and established partnerships with customers in emerging markets such as Malaysia, the United Arab Emirates, Argentina, and Peru. New customer purchases of computing power accounted for 41%, while repeat customer purchases accounted for 59%. Strong market demand drove the company to sell 7.74 million T of computing power in Q4, a 15% increase from Q3, setting a new single-quarter record.

2.4 Impact of Mining Business Expansion on Jianan Technology's Inventory

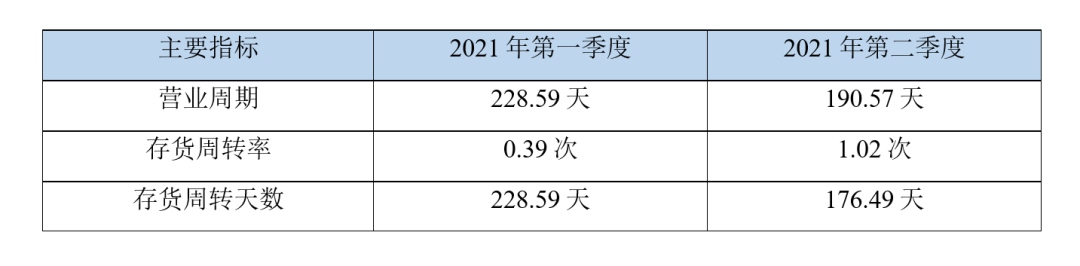

In Q1 2021, Jianan Technology's inventory was $376 million, and in Q2 2021, it was $587 million, a 56.12% year-on-year increase. The impact of this business decision on Jianan Technology's inventory ratio is shown in the table below.

After implementing this business decision, the shortened operating cycle and increased inventory turnover rate reflect the following situations: First, the addition of the mining business may have brought additional sources of income, increasing the company's total revenue. Second, since mining business typically requires less time to convert into cash or other liquid assets, the company's cash flow has improved, leading to a shortened operating cycle. Additionally, the increased inventory turnover rate means the company can convert inventory into sales revenue more quickly, reducing the risk of inventory backlog and improving the efficiency of capital utilization.

In conclusion, the improvement in these indicators indicates that the company's operational efficiency has increased, profitability has strengthened, and market demand has been better met.

Overall, Jianan Technology, based on its main business of mining machine production and sales, has expanded downstream into self-operated mining business to increase its competitive barriers, increase revenue sources, and gradually reduce the risk of a single business model. Although the development of the mining business has been rapid, its proportion in the company's total revenue is still relatively low. According to the company's plan, a certain proportion of production capacity will be deployed for self-operated mining each month, with the specific deployment quantity being flexibly adjusted based on the situation of cooperative mining farms and market demand. These mining farms are mainly located in overseas regions such as Kazakhstan, but the mining market in Kazakhstan is undergoing further adjustments due to compliance requirements, which may increase the company's mining costs.

Although self-operated mining business can superficially reduce risks, due to its high degree of association with the main business and the significant regulatory risks it faces, this may lead to an expansion of risks. If the mining business is a significant asset investment, it may pose serious challenges to Jianan Technology's revenue and cash flow in unfavorable market conditions or tightening regulatory policies. While the mining business provides a certain source of income for the company, its risk factors need to be carefully considered to ensure that the company can maintain stable operations in different market environments.

Since 2021, Jianan Technology's strategic decisions and financial performance have revealed the company's efforts to seek growth and competitive advantage in the global mining hardware market. By vertically integrating upstream and downstream businesses in the industry chain, Jianan Technology has not only strengthened its control in the Bitcoin ecosystem but also diversified market risks, further consolidating its market position. However, the decision has limited diversification effect on market risks due to the significant dependence of mining machine production and sales and mining business growth on the cyclical and volatile nature of Bitcoin.

Despite the negative gross profit margin of the mining business in Q2 and Q3 2023, the short-term financial challenges have not completely offset the long-term value of expanding the mining business strategy. Considering the growth potential of Bitcoin as a long-term investment target, the Bitcoin held by Jianan Technology may realize capital appreciation in the future, thereby compensating for the short-term operating losses. Therefore, the mining business can not only serve as an immediate source of income for Jianan Technology but also lay the groundwork for long-term asset appreciation. Thus, despite the short-term challenge of negative gross profit margin, Jianan Technology's expansion of the mining business is still strategic and forward-looking, offering opportunities for sustained growth and maximization of profits in the ever-changing cryptocurrency market.

In conclusion, Jianan Technology's expansion strategy for the mining business is a strategic decision that takes into account market trends, technological advantages, and long-term investment value. By continuously optimizing its business model, strengthening cost control and risk management, and flexibly adapting to market changes, Jianan Technology is expected to find opportunities in challenges and achieve long-term success and growth in the mining hardware and mining business fields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。