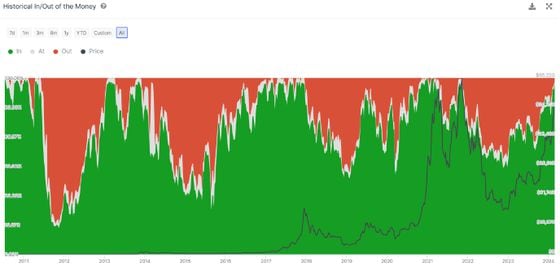

Bitcoin's (BTC) recent bullish momentum has most bitcoin-holding blockchain addresses sitting on unrealized gains on their investments.

More than 97% of BTC addresses are now "in the money," according to data tracked by analytics firm IntoTheBlock. That's the highest proportion since November 2021, when the largest cryptocurrency by market value hit a record high around $69,000.

An address is said to be in the money when BTC's going market rate is above the address' average BTC acquisition cost. In other words, most holders acquired their BTC below the cryptocurrency's current price of about $65,000.

The data has bullish implications for the market, according to IntoTheBlock.

"Given the substantial percentage of addresses in profit, the selling pressure from users attempting to break even no longer has a significant effect," IntoTheBlock said in a newsletter published Friday, when BTC traded near $62,000.

"For newcomers entering the market to purchase coins, they are essentially buying from existing users who are already realizing a profit," IntoTheBlock said.

Bitcoin has risen 54% this year, extending 2022's 154% gain, mainly due to strong inflows into the U.S.-based spot exchange-traded funds approved in January. Wall Street's embrace of the spot ETFs has skewed demand-supply dynamics in favor of the bulls, opening the doors for a rally that could propel it toward a new record high. The CoinDesk 20 Index, a gauge of the broader crypto market, has risen 37.8% this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。