Ethereum's Cancun upgrade in March and Bitcoin's halving in April have become catalysts for the bull market starting in 2024, and the market has continued to rise recently. With the SEC's decision on the Ethereum ETF imminent, Ethereum has become the focus of the market, forming an excellent opportunity window for investment in Ethereum's ecosystem projects. In the previous bull market, Ethereum's DeFi track was undoubtedly the main battlefield, and whether the DeFi ecosystem in this round can continue to lead the trend and create popular projects has become a hot topic of discussion within the industry.

I. Overview of Ethereum

Ethereum (ETH) is not just a cryptocurrency, but also a blockchain platform with a wide range of applications, nurturing numerous innovative projects and becoming the largest ecosystem in the cryptocurrency industry. Ethereum is an open-source blockchain platform with the ability to execute smart contracts, incentivizing the sharing of computing resources in the network through its native cryptocurrency, ETH, and supporting the development and operation of decentralized applications (DApps). The underlying mechanisms of Ethereum mainly include:

1. Ethereum Virtual Machine (EVM): The EVM is the core of Ethereum, providing an execution environment for smart contracts. It is a completely isolated execution environment, ensuring that each contract execution in the network takes place in a secure and independent environment.

2. Consensus Mechanism: Initially, Ethereum adopted the Proof of Work (PoW) mechanism to maintain network security and consensus. In recent years, Ethereum has been transitioning to the Proof of Stake (PoS) mechanism (referred to as Ethereum 2.0) to improve the network's scalability, security, and sustainability, while reducing energy consumption.

3. "Gas" Mechanism: "Gas" in Ethereum is the internal billing unit required for executing operations such as transactions and smart contract execution. It aims to allocate network resources and limit network abuse, ensuring the efficiency and security of the network's operation. Each operation requires a certain amount of gas, and the gas price is determined by market supply and demand.

The characteristics of the Ethereum network mainly manifest in:

1. Decentralization: Ethereum achieves decentralization of data and operations through distributed ledger technology, ensuring the platform's openness and transparency, and reducing the risk of censorship and fraud.

2. Security: Using blockchain technology, Ethereum ensures the immutability of data and the security of the network. The execution of smart contracts relies on encryption technology, ensuring the security of transactions and contracts.

3. Scalability: Despite facing some scalability challenges, Ethereum is improving its network's processing capacity and efficiency through various solutions such as sharding technology and layer 2 scaling solutions.

4. Automatic Execution of Smart Contracts: Once deployed on the Ethereum network, the logic of smart contracts can be automatically executed without human intervention, greatly enhancing the automation and efficiency of various applications.

II. Current Development of Ethereum's DeFi Ecosystem

Technological Aspect:

Ethereum is undergoing a significant transition from Proof of Work (PoW) to Proof of Stake (PoS), known as Ethereum 2.0. This upgrade aims to improve the network's scalability, security, and energy efficiency. The Beacon Chain has already been launched, marking the beginning of the first phase of Ethereum 2.0.

The Ethereum Cancun-Dencun upgrade is set to be launched on March 13, 2024, aiming to achieve "Ethereum 2.0" and improve the scalability, security, and usability of the Ethereum network. In addition, after the approval of the Ethereum futures ETF by the U.S. Securities and Exchange Commission (SEC) in 2023 and the approval of the Bitcoin spot ETF on January 10, 2024, market participants expect the next ETF to be launched will be the Ethereum spot ETF. Currently, the SEC is reviewing eight applications for permission to obtain an Ethereum spot ETF, with the first formal deadline for a decision being May 23, 2024.

Ecosystem Development Aspect:

To address network congestion and high transaction fees, the Ethereum community is actively promoting Layer 2 scaling solutions such as Rollups and sidechains, which can significantly improve transaction speed and reduce costs.

The Ethereum DeFi ecosystem covers a wide range of applications and services, with new projects and innovations constantly joining, leading new narrative trends, and driving the diversification and maturity of the ecosystem. Leading projects such as Uniswap, Aave, MakerDAO, and Lido in the DeFi track occupy leading positions in their respective fields, driving the overall development of the Ethereum ecosystem.

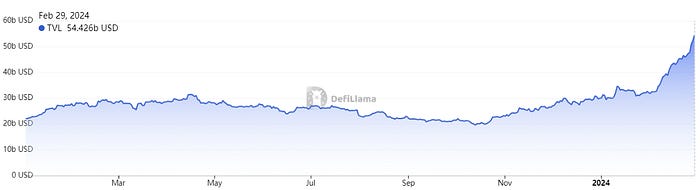

As of February 29, the Ethereum network has a total of 981 DeFi protocols recorded by DefiLlama, with a total value locked (TVL) exceeding $54.4 billion.

The current top 10 projects in the Ethereum ecosystem by market capitalization include:

III. Potential Tracks and Opportunities in Ethereum's DeFi Ecosystem

The Ethereum ecosystem has recently seen many significant developments, especially in new tracks such as AI narratives, Restaking economics, and Real World Asset (RWA) tokenization.

1. AI Narrative Projects

Render Network supports cloud rendering through its GPU computing network, meeting the market's high demand, but attention should be paid to competition with traditional industries. Fetch.ai has proposed innovative concepts to promote the development of the digital economy through its blockchain platform for AI and machine learning. Akash Network, as the first open-source, decentralized cloud computing marketplace, provides low-cost cloud services. SingularityNET has created a decentralized AI platform dedicated to connecting various AI tools. Worldcoin showcases strong technical support and financial strength with its unique global fair digital identity and currency tether concept. These projects reflect the high expectations of the cryptocurrency market for the integration of AI technology.

2. Restaking and LST Projects

EigenLayer introduces the concept of Restaking, allowing users to restake already staked Ethereum or Liquidity Staking Tokens (LST) to provide additional security and earn additional rewards. Restake Finance is the first protocol to launch modular liquidity restaking, allowing users to deposit LST and generate restaking certificates (rstETH) through its protocol, enabling users to earn returns from DeFi protocols while receiving EigenLayer rewards.

KelpDAO and ether.fi have demonstrated their business models and growth potential in the liquidity restaking and LST sectors, respectively.

3. Development of RWA Track

MakerDAO has made inroads into the tokenization of real-world assets (RWA) and launched the first formal RWA project, New Silver, showcasing the huge potential of the RWA market. Prisma has received joint endorsements from multiple project founders and investors, focusing on its development in the RWA direction.

4. DEX and Aggregator Narrative Projects

Uniswap v4 and Uniswap X have been launched to provide the best trading experience by increasing hooks and optimizing routing while maintaining the commitment to decentralization and censorship resistance. Uniswap's proposal to distribute protocol fees proportionally to UNI token holders has driven a surge in UNI prices, demonstrating strong market appeal. CowSwap, as a DEX aggregator, uses batch auctions as the core price discovery mechanism, solving the front-running problem in real-time execution mode, showcasing the innovative potential in the DEX field.

IV. Risk and Challenge Analysis of Ethereum's DeFi Ecosystem

Although the Ethereum ecosystem is full of opportunities, it also faces many challenges and risks, including network congestion, high transaction fees, and security issues.

Energy Consumption: Although Ethereum's energy consumption has been significantly reduced by 99.9% through the transition to the PoS mechanism, this change has introduced new issues, including concerns about centralization, MEV, and censorship.

Centralization of Power: Although the PoS mechanism reduces the hardware requirements for participating in network operations, theoretically providing the possibility for more people to participate, power may still be concentrated in a few large staking pools.

Censorship and Centralization Issues: The sanctions by the U.S. Department of the Treasury have sparked discussions about how the Ethereum network handles censorship and compliance. Currently, about 65% of Ethereum blocks censor Tornado Cash transactions, leading to internal debates within the community about balancing principles and rules.

Uncertainty of Technological Upgrades: The successful execution of technological upgrades is crucial for the long-term health and performance of the network. The failure or delay of the upcoming Cancun upgrade may have adverse effects on the market performance of the Ethereum ecosystem.

Market Competition and Differentiation: With the development of the Bitcoin ecosystem, Solana ecosystem, parallel EVM, Layer 2 solutions, and other blockchain platforms, the market may further differentiate, and users and capital may flow to platforms that offer lower fees, higher performance, or more innovation.

6. Regulation and Transparency: It is expected that the regulation of the DeFi field will undergo significant changes in 2024. Although true DeFi projects may be less directly affected by regulation, there will be a certain degree of regulatory pressure on hybrid finance (HyFi) projects with a level of centralization control. Regulatory authorities in regions such as the United States may strengthen their crackdown on HyFi, while true DeFi projects will continue to operate on the regulatory edge due to their inability to be regulated under existing regulatory models.

V. Prospects for the Development of the Ethereum DeFi Ecosystem

In the long run, with technological advancements and ecosystem maturity, the Ethereum ecosystem is expected to address existing challenges and further consolidate its leadership position in the cryptocurrency and blockchain industry. The comprehensive upgrade to Ethereum 2.0 will bring higher scalability and lower transaction costs to the ecosystem, providing a more solid foundation for DeFi, NFT, and other fields.

Technological Innovation and Upgrades: With the advancement of Ethereum 2.0, the Ethereum ecosystem will have higher processing capacity and lower transaction costs.

Continued Improvement of Layer 2 Scaling Solutions: Layer 2 scaling solutions (such as Rollups, sidechains, etc.) will continue to develop and improve, increasing Ethereum's transaction processing speed and scalability, providing users with lower transaction costs and a better experience.

Continued Prosperity and Innovation of DeFi Projects: DeFi protocols will explore more innovative directions and new narratives, such as AI, liquidity restaking, etc., continuing to drive the growth and prosperity of the Ethereum ecosystem.

On-chain Real World Assets: MakerDAO has already invested in U.S. government bonds and corporate bonds and provided loans collateralized by RWA through cooperation with traditional banks. These initiatives are expected to become more widespread in 2024, becoming the primary opportunity to combine traditional institutions with DeFi liquidity.

Growth of DAOs: The DAO mechanism can promote decentralized decision-making and management. The maturity of DAO structures will promote the gradual development and improvement of decentralized mechanisms.

In conclusion, the heat of the Ethereum ecosystem continues to rise, attracting widespread attention from global investors. Currently, the Ethereum ecosystem is in a period of rapid development and change, and its core advantages and innovative potential will continue to enable it to play a leading role in the cryptocurrency and blockchain field, becoming a pioneer in the bull market and the main battlefield for investment and trading.

Hotcoin Community

Official Chinese Group: https://t.me/hotcoinglobalcn

Official English Group: https://t.me/HotcoinEX

Official Korean Group: https://t.me/hotcoinkorea

Discord: https://discord.gg/NwYqKWkcZn

Facebook: https://www.facebook.com/HotcoinExchange

Twitter: https://twitter.com/HotcoinGlobal

Hotcoin Official Website: https://www.hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。