Author/Jasmine

Editor/Wendao

On February 27th, the BNB price of BNBChain Gas token broke through $400, rising 63.93% from the beginning of 2023 to $244, and 27.79% from the New Year to $313, with a market value of $61.763 billion.

Of course, the rise of BNB, ranked third in market value, is accompanied by the "early spring" of the cryptocurrency market since it started on February 8th. In addition to this, it also benefits from Binance, the initial starting point of BNB, which has been actively operating its new asset issuance section, LaunchPool, recently.

Since December 2023, LaunchPool has accelerated the pace of new listings, with the number of new listings in the first two months of this year almost half of the total for the entire previous year (11). The value of LaunchPool lies in providing benefits to users and helping to lock in the outflow of BNB and stablecoins.

The fast pace of LaunchPool's new listings coincided with Binance's need for additional funds after reaching a $4.3 billion settlement with the US Department of Justice. There was a voice suggesting that Binance might be short of funds, defending its user fee income base.

Has Binance really faced revenue pressure after being restricted by US regulations?

Although the 2023 annual report of Binance did not disclose revenue data, the registered user count (170 million) and third-party statistics on trading volume ($16.69 trillion) that have been exposed both saw significant increases of 70% and 215.5% respectively compared to 2022.

In 2022, Binance disclosed a revenue of $12 billion. Considering the overall upward trend in the market last year, it is highly likely that the platform's revenue in 2023 will exceed the $20 billion disclosed during the cryptocurrency bull market in 2021.

In 2024, as the new cryptocurrency bull market begins to brew, Binance, which is definitely not short of funds on paper, is seizing the opportunity once again, but its goals are changing.

LaunchPool Frequently Lists New Tokens, with an Average Lockup of 15.2 Million BNB

On February 27th, BNB reached a new high of $404, surpassing the $398 from November 8, 2022, which was contributed by sell orders, but now it is driven by strong buy orders. This price is less than halfway to BNB's all-time high of $669.3 on November 7, 2021.

The current cryptocurrency market has completely shaken off the bearish trend of 2022. Analysts have positioned it as the early stage of a new bull market, with Bitcoin (BTC) still leading the market. When BNB broke its record high, the market-leading BTC soared to $54,910, and has now surpassed $57,000, followed closely by Ethereum (ETH), which rose to a high of $3,280.

With a market value of $61.335 billion, BNB, following behind BTC (market value of $1.1 trillion) and ETH (market value of $390 billion), has been rising in tandem, clearly possessing a unique advantage in the market during this uptrend.

BNB's growth is also benefiting from its ecosystem.

On BNBChain, the blockchain network where BNB operates as Gas, the total value locked (TVL) of cryptocurrency assets is $4.491 billion. According to DeFiLlama, a third-party data website, there are over 600 DeFi applications on the BNBChain network, with 102 of them having a TVL of over a million dollars, supporting the activity on the BNBChain network and increasing the on-chain circulation of BNB.

Among the top 10 Layer1 chains by market value, BNBChain (formerly known as BSC) has seen its TVL recover since the second half of last year, with data second only to the original Ethereum.

BNBChain TVL recovery growth

BNBChain TVL recovery growth

In addition, BNB continues to maintain a significant amount of token burning off-chain. As of now, BNB has burned a total of 52,457,076.73 tokens in 26 quarters, with 25.96% of BNB already out of circulation.

Outside the chain, the most stimulating action driving BNB prices comes from Binance, which has actively operated its important use case for BNB within the platform, LaunchPool, since the end of last year.

Users familiar with LaunchPool know that it is a channel for staking BNB or stablecoins to obtain new assets. Users do not need to incur any additional costs. By depositing BNB or stablecoins into the open LaunchPool for new listings, they can receive the distributed Web3 project assets within a limited time.

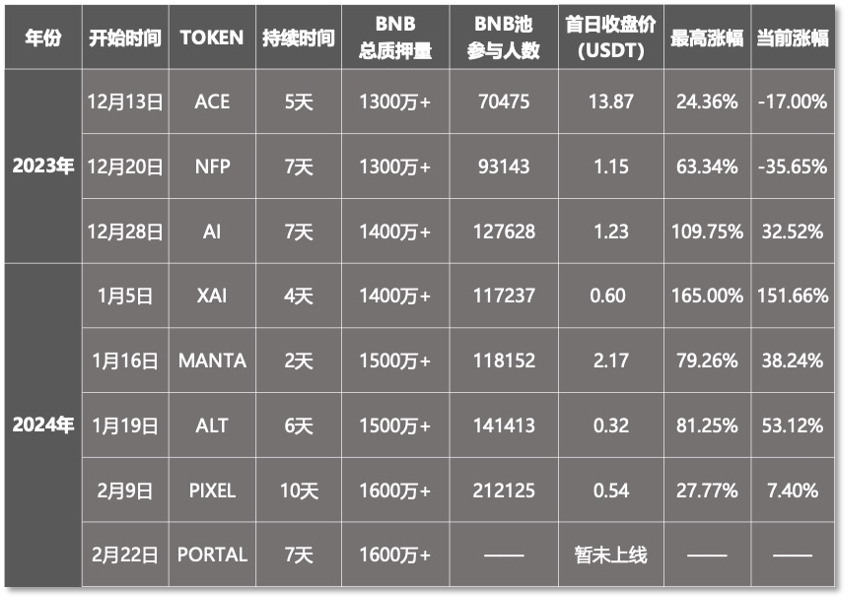

Since December 2023, the pace of monthly "new token mining" on LaunchPool has accelerated, with three new assets listed that month. In January of this year, the pace continued with three new listings, and from February to the present, two new listings have been added. It's worth noting that LaunchPool only started listing new assets in April last year, releasing a total of 11 new assets for the entire year, while in the first two months of this year, LaunchPool has completed nearly half of that "task".

New assets listed on LaunchPool from the end of last year to the beginning of this year

New assets listed on LaunchPool from the end of last year to the beginning of this year

Looking at the performance in the secondary market, the new assets listed on LaunchPool have also seen a reversal since December last year.

In December, the first two new assets, ACE and NFP, are still in a downtrend, but the third new asset, AI, has risen by 32.52% from its closing price on the first day. XAI, a gaming blockchain listed on January 5th, saw its highest increase reach 165%, and still has a 151.66% increase. However, for users who purely obtain new tokens by staking through LaunchPool, it's considered "pure profit".

The LaunchPool product has brought a win-win situation for users and Binance—users receive airdrops for free, and if BNB rises during the same period, users staking BNB can enjoy dual benefits. Meanwhile, Binance retains users and their BNB and stablecoins through this, benefiting from it.

In just January and February of this year, Binance has locked a total of $9 billion in stablecoins and 15.2 million BNB through LaunchPool, with the latter being worth approximately $22.8 billion, resulting in a total locked value of $31.8 billion. Considering the overlap of users participating in new listings, the average locked value of LaunchPool is approximately $5.56 billion.

According to DeFiLlama data, during the same period, the total asset value on the Binance chain ranged from $80 billion to $90 billion, and when LaunchPool was launched, at least 6%-7% of the assets remained on Binance.

Don't underestimate this proportion. After reaching a $4.3 billion settlement with the US Department of Justice on November 23rd last year, the platform lost $2 billion in just one week. The start of the accelerated pace of new listings on LaunchPool coincided with that black swan event for Binance.

After the disclosure of the hefty $4.3 billion fine, combined with Binance's actions to retain users and assets, there has been a growing sentiment in the market and even within the Web3 community that Binance is short of funds and is holding onto its user fee income base.

Following the settlement, although Binance's new CEO Richard Teng has repeatedly emphasized in public statements that the company's "financial strength has not been affected," "there is no debt in the capital structure, expenses are within a reasonable range, and there are still considerable income and profits," the market still seems to doubt Binance's ability to withstand the pressure of regulation and even fines.

So, does Binance really lack funds? Ultimately, it will depend on its ability to make money, in other words, its revenue and profits.

How much money did Binance make last year?

Given that Binance is not a publicly traded company and its business scope is not limited to trading, obtaining accurate revenue data depends largely on its willingness to disclose it. In January of this year, Binance's blog published a "2023 Annual Review," which did not include revenue data. However, this does not prevent us from using estimation and comparison to get a glimpse of the profit-making ability of this "world's largest cryptocurrency exchange platform."

Based on Binance's year-end summary and third-party statistics on annual trading volume, the platform maintained strong growth in 2023. Although this year's revenue data is "confidential," historical data from previous years remains in the memory of the internet.

Binance's disclosed data for 2023

Binance's disclosed data for 2023

According to the "Review," Binance added over 40 million new users in 2023, increasing the registered user count to 170 million, compared to 128 million in 2022. Third-party statistics show that Binance's trading volume in 2023 reached $16.69 trillion, a 215.5% increase from $5.29 trillion in 2022.

Although the revenue for 2023 was not disclosed, Binance disclosed a revenue of $12 billion in 2022. During the previous cryptocurrency bull market in 2021, Binance publicly reported a revenue of $20 billion. It is evident that a cryptocurrency bull market is an absolute revenue-generating year for trading platforms.

Binance's historical revenue, user, and trading volume data

Binance's historical revenue, user, and trading volume data

In 2023, Binance saw growth in both registered user count and annual trading volume, with the latter nearly tripling. The simultaneous growth in user count and trading volume will contribute to an increase in transaction fee revenue, which is the primary source of revenue for cryptocurrency trading platforms. A conservative estimate suggests that Binance's revenue for the past year is not less than $20 billion.

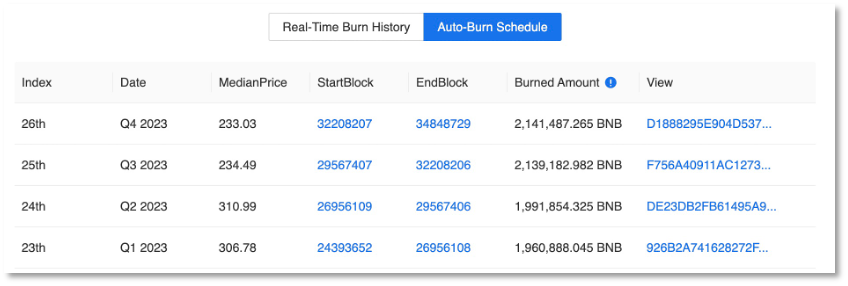

As for profits, if we follow Binance's previous rule of "burning BNB based on 20% of profits," and calculate based on the total amount of BNB burned in the four quarters of 2023, 8,233,412.617, and the median price of BNB for each quarter, Binance's profit for the entire year of 2023 is $11.08 billion.

BNB's quarterly burn quantity in the past year

BNB's quarterly burn quantity in the past year

Overall, since its inception, Binance has consistently maintained high-speed growth in market share, user base, and revenue, still upholding its title as the "world's largest cryptocurrency exchange platform."

It is worth noting that amidst this growth trend, Binance has begun to expand its own boundaries. In addition to the "Review" for 2023, the company published a blog post revealing the performance of Binance Pay in the payment field.

Binance Pay, a cryptocurrency payment method launched in 2021, has seen its total transaction volume reach $120 billion after 3 years of development and iteration. For comparison, this data is equivalent to 0.4% of China's third-party payment transaction volume in 2023 ($28.33 trillion).

The proportion may be small, but the growth rates of various indicators are significant. In 2023, Binance Pay added thousands of merchants, with active users increasing by 70% to reach 12 million, and the total transaction volume reaching $77 billion. This means that over the past year, each user completed an average of $6,410 in transactions using this payment method, with the main scenarios being payments, gifting, sending, or receiving cryptocurrency assets.

Binance CEO Richard Teng believes that cryptocurrency assets and Binance Pay will bring convenient experiences to populations in underdeveloped countries and regions where traditional payment methods are inconvenient. "Now, they can use cryptocurrency for payments, transfers, and remittances 24/7, at a cost that is only a small fraction of traditional finance."

In the face of global observation, intervention, and regulation of cryptocurrency assets and emerging finance, Binance seems to be seeking new breakthroughs beyond trading services, and is getting closer to the core mission Richard presented when he first took office: to promote financial compliance and broader freedom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。