In trading or settlement operations, we must be decisive, persist in the right direction, and when the direction is wrong, adjusting the strategy is progress, and turning around is profitable. Although the road may be rough, following the market's guidance can always lead us to a bright future.

After reaching 64000, we need to look at the previous high and observe the weekly chart. From the perspective of the chart pattern, there should be no problem breaking the previous high. Currently, as long as it is an individual, everyone will know to go long in this market. However, what is a reasonable layout? Like last night, even though it rose by more than three thousand points later, I didn't take action because it was already very high at that time. Once it goes down, it will be a deep abyss from which you absolutely cannot climb out!

We positioned a long at 56000 before 60000, and this position can be held risk-free for an upward move. There is no need to bear any consequences because the strength of the bull market is not limited to this. The layout needs to be reasonable, and the train of thought needs to be clear. Take one step at a time and look two steps ahead!

Layout strategy for Thursday's Asian market

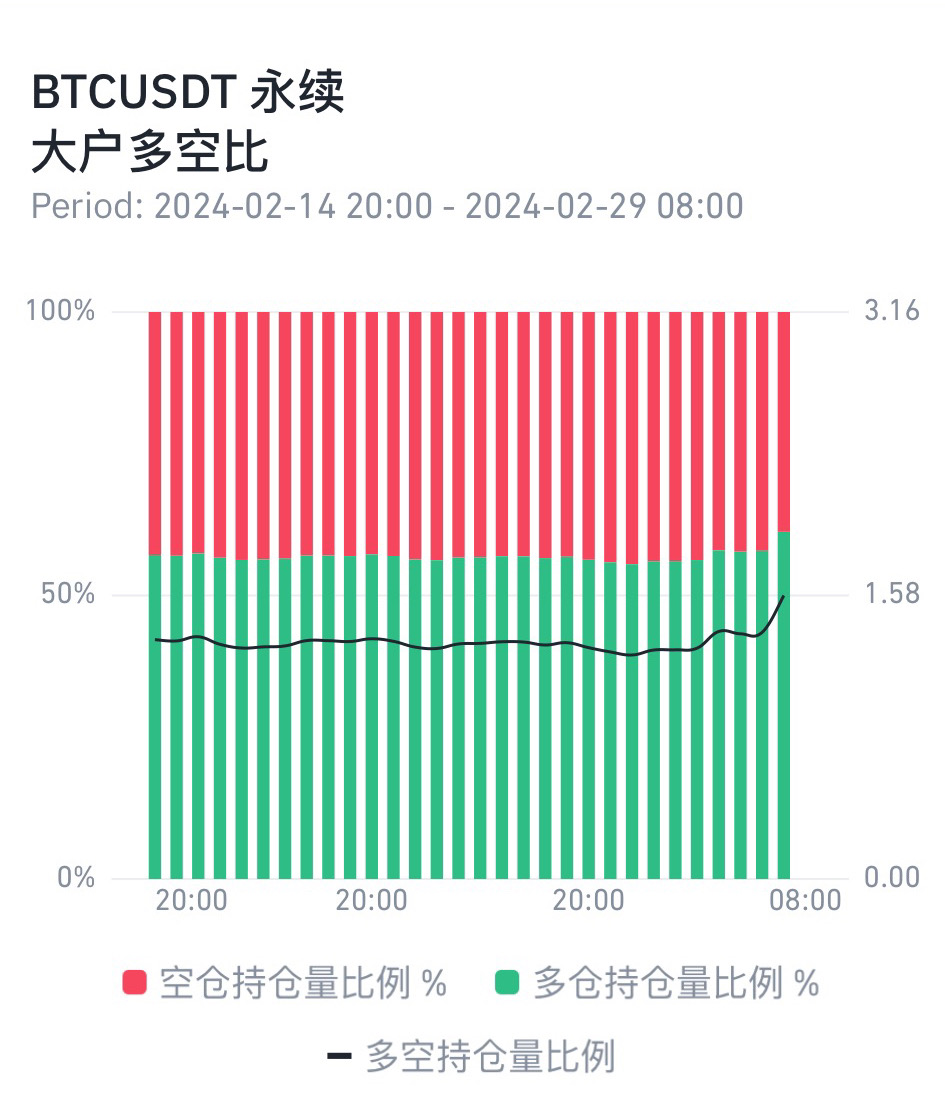

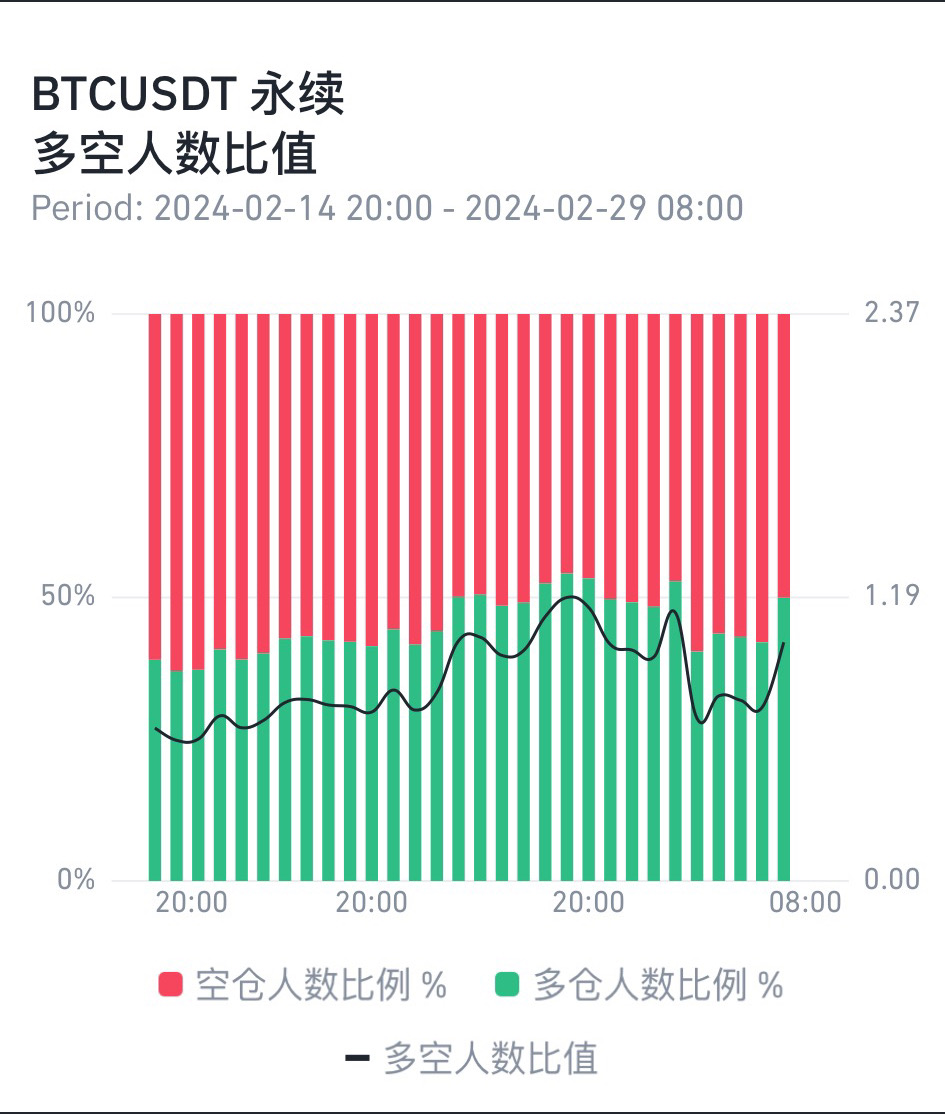

After seeing five consecutive positive days on the daily chart, last night, after piercing 64300, it fell below the 60000 mark. Fortunately, it was a false breakdown, and the forced liquidation is still extending, coupled with the high position, but looking at the long and short ratio of major players in the market over the past half month, the bull side is still the preferred choice for the masses. I suggest not to enter blindly. Technical analysis has little effect now, and the layout for the future still depends on the overall release of strength. My personal strategy for the Asian market on this trading day is to first look for a pullback and then go long at a lower level.

Expected entry for long position: 61000-60900 range

Target: 62500-63000 range, with a defensive space of 600 points

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。