Written by: THOR, HYPHIN

Compiled by: Luffy, Foresight News

Speculation is the lifeblood of the cryptocurrency market, and savvy opportunists often find new ways to bet on assets. In most cases, people invest in existing things because there is some data that can help people make wise decisions. However, recent market trends indicate an increase in airdrop distribution and trading volume of unreleased assets.

Introduction

The surge in pre-market trading interest is largely attributed to numerous airdrop activities and highly anticipated projects hoping to leverage the booming market and positive sentiment to launch their tokens into the public market.

With all the necessary catalysts of the new narrative in place, protocols such as Aevo, Hyperliquid, and Whales Market have seized this opportunity. These platforms offer perpetual futures for unreleased tokens.

Pre-market trading volume of Aevo, Whales Market, and Hyperliquid

It is important to remember that these tools are highly volatile and should be used with caution, as their liquidity is questionable, and determining the fair value of their underlying assets is very difficult.

Given the highly speculative and risky nature of the aforementioned financial products, what value and opportunities do they offer to traders? We will attempt to find the answers in this article by analyzing market data.

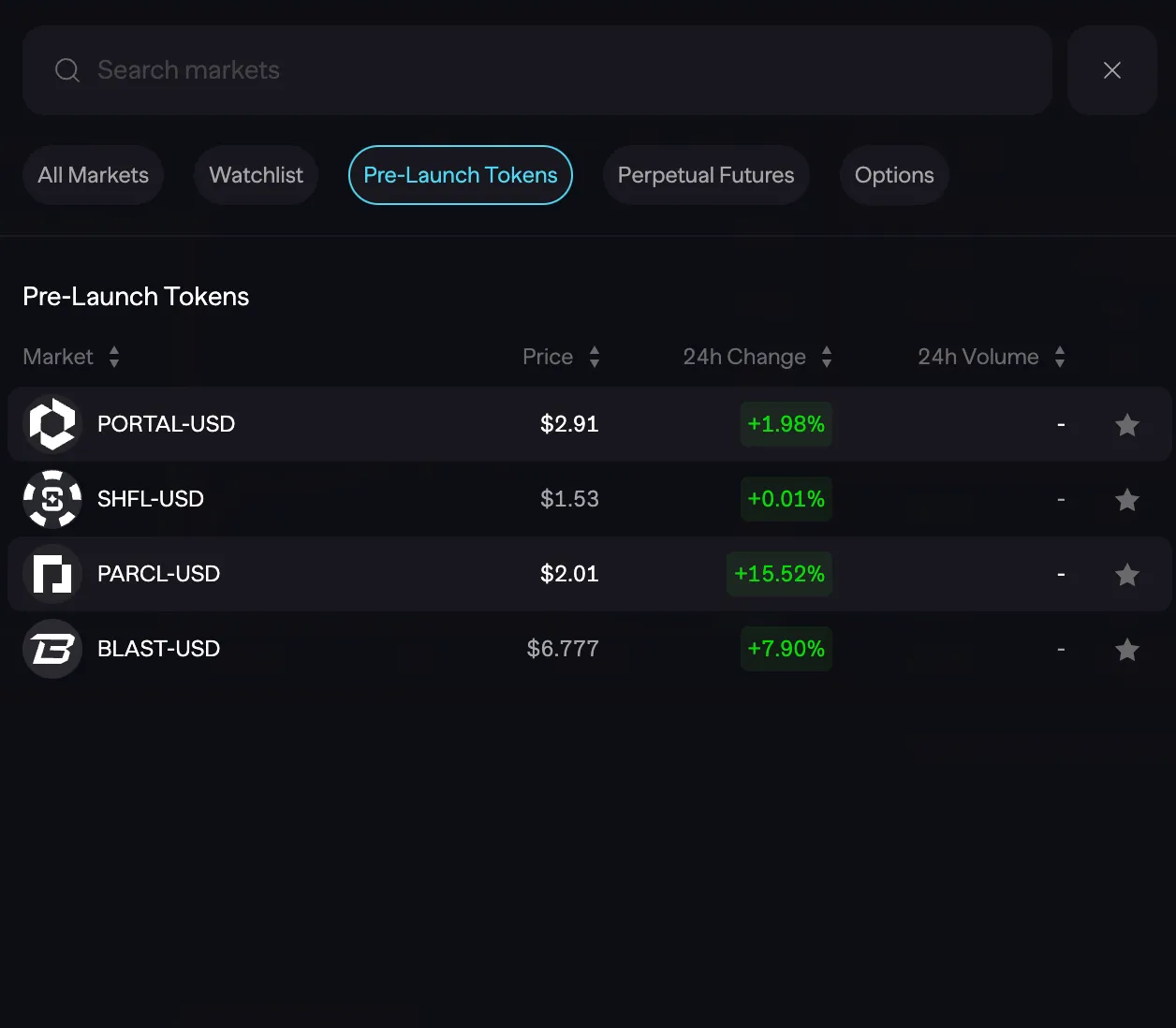

Pre-launch market of Aevo

Historical Performance

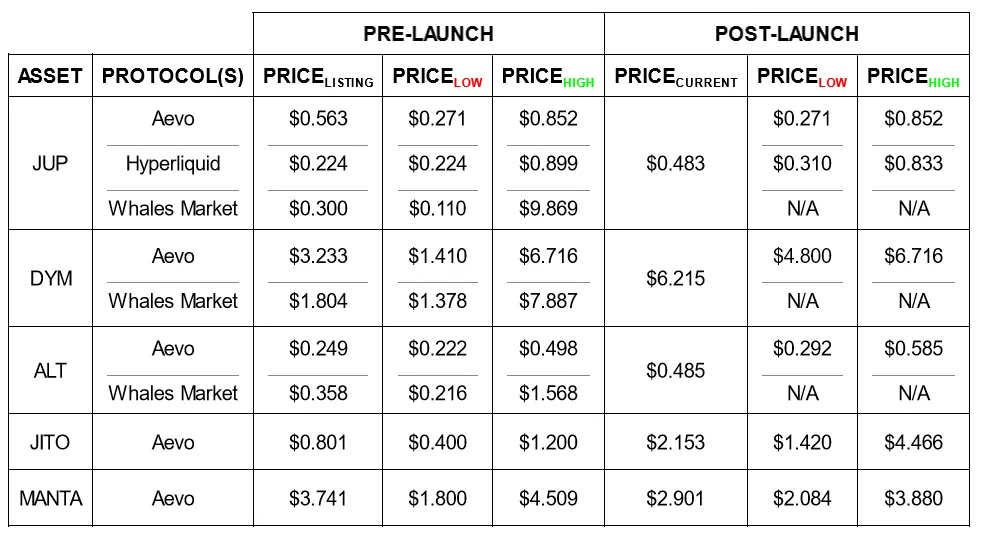

With the help of exchange APIs and historical data, we can observe the price performance of all assets that have traded in the pre-market and understand their performance after official listing.

Comparison of asset prices before and after the launch of some protocols

The common pattern for most of these assets is relatively low trading volume after listing, and as the release date approaches, volatility and trading volume peak, followed by a decrease in activity.

Objectively speaking, the initial listing price of each asset in the table was not its price peak. Airdropped tokens have performed exceptionally well over the past 6 months, despite the general belief that airdropped tokens would have a significant impact on prices once tradable.

However, this does not mean that people should immediately buy assets once they are listed in the pre-market. Price movements may lead to liquidation of positions, and due to unknown listing standards, returns are not guaranteed.

In terms of trading volume, it is clear that assets that are hyped, rather than just circulated on Twitter due to their incentives, have received more attention than other upcoming tokens, with most tokens having a daily trading volume of less than $100,000.

Trading volume distribution of JUP in different pre-markets

In the case of Jupiter, after being hyped during the Solana expansion, they have stolen the show by absorbing massive liquidity.

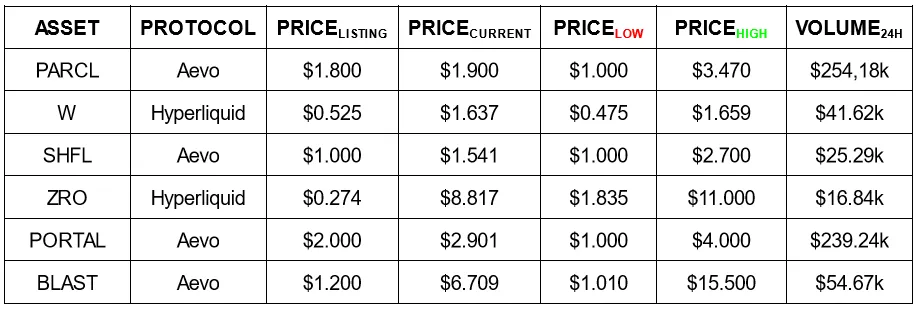

Current pre-launch market

Having reviewed historical data, let's look at the current opportunities. As of today, there are a large number of unreleased tokens available for trading on Aevo and Hyperliquid.

Currently active pre-launch assets on Aevo and Hyperliquid

Apart from the recently listed Parcel and Portal, there is not much active trading happening. From the price performance, most tokens have performed well, with a few tokens seeing several-fold increases over a few months.

Let's select some interesting projects from the list and see if we can determine if their valuations are comparable to similar protocols:

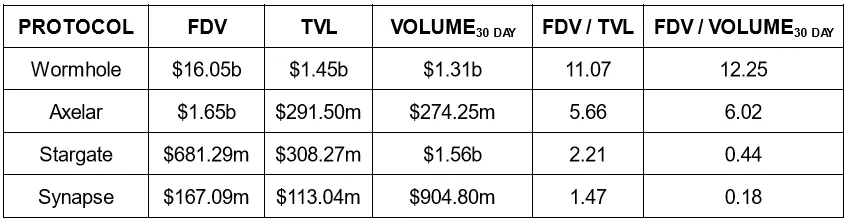

Wormhole (W)

The FDV of Wormhole is derived by multiplying the W/USD token price on Hyperliquid by the total supply of tokens (100 billion)

Compared to alternative solutions in the market, the current theoretical valuation of Wormhole may be exaggerated. Unless groundbreaking progress is announced, the token price may decline after the token generation activity ends, as the trading volume reflects low investor interest.

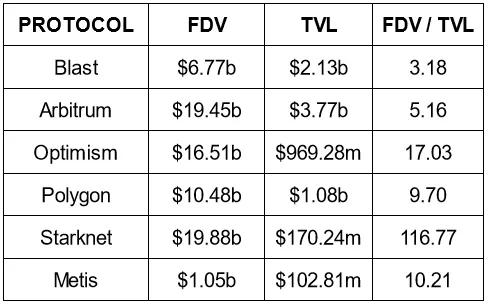

BLAST

The FDV of Blast is derived by multiplying the BLAST-USD token price on Aevo by the total supply (10 billion)

Although the speculative nature makes the FDV subject to changes of several billion dollars at any time, the TVL metric indicates a clear interest in the Blast ecosystem (likely due to the airdrop expectation).

From the L2 pricing perspective, Blast currently seems undervalued on paper, but more information needs to be considered when trying to draw a definitive conclusion. Unfortunately, apart from TVL, there is little information about its on-chain status, making the evaluation process difficult.

Token Trading

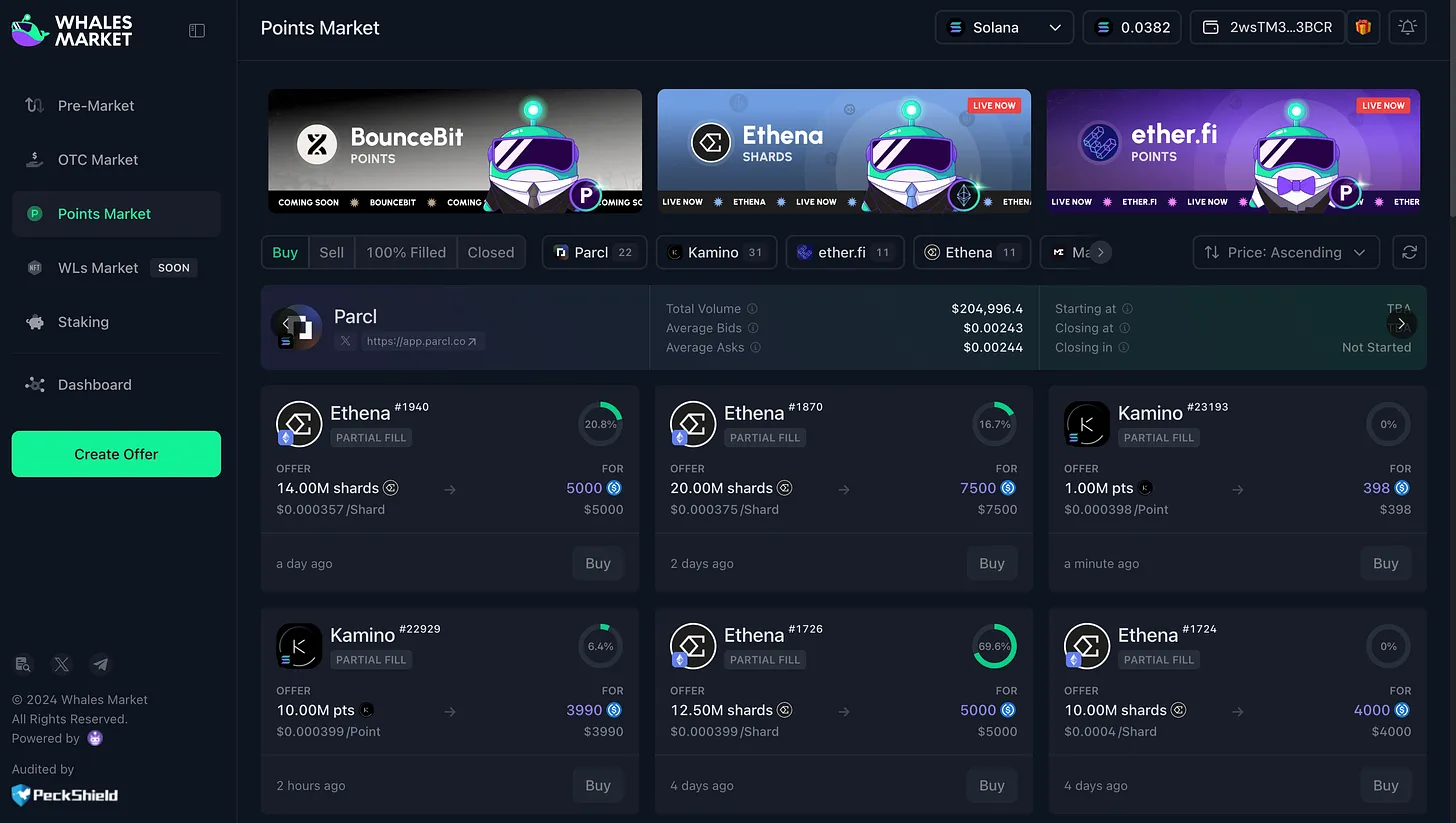

Token trading on Whales Market

Tokens can now be traded on the decentralized over-the-counter platform Whales Market.

"2024 will be the 'golden year' of airdrops" - @CC2Ventures

One of the most prolific airdrop farmers in the crypto space has stated that being an airdrop farmer has never been more profitable than it is now. The sheer number of protocols announcing token programs has brought us to the point of user interaction monetization, and incentives are a must if you want a project to gain attention.

The emergence of token trading markets is natural. Such channels allow airdrop farmers to cash out their harvest in advance.

So far, Whales Market has facilitated $6.3 million worth of peer-to-peer token trading, and it is poised for further growth with more quotes being listed.

Currently, 9 protocols can engage in token trading on the platform: Parcl, Kamino, Ethena, Magic Eden, Hyperliquid, EigenLayer, friend.tech, and ether.fi. In the near future, Marginfi, Drift, and Blast are also expected to be listed.

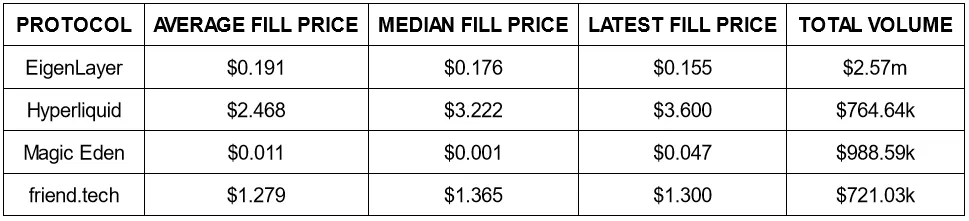

Here is an overview of the most popular token trading:

Observing the average order price and median order price, it is clear that in some cases, the price distribution is not concentrated.

So far, the fair value of some tokens seems to have been determined, but what does the value of tokens really mean?

The price of a token may imply the market's expectation of the current valuation of the upcoming protocol. As more tokens are issued, their prices may decrease due to reward dilution, unless market sentiment changes and expected valuations rise.

Let's take EigenLayer as an example to test this idea.

Price per token = 0.155

Total tokens = 1,963,113,523

Airdrop value = Price per token * Total tokens = 304,282,596

(Theoretical) Airdrop allocation = 0.1 (10%)

Fully diluted value = Airdrop value / Airdrop allocation = 3,042,825,960

Since the snapshot date is usually kept strictly confidential, we cannot determine how many tokens will ultimately be generated.

Conclusion

By observing historical patterns and considering the frequent trading patterns, these pre-market assets continue to perform well even after being listed, especially in bullish trends, with the peak usually occurring on the token release day. The Aevo, Hyperliquid, and Whales Market protocols provide another way for users to bet on airdrops.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。