Original Author: Joey Shin, IOSG Ventures

Let's imagine what the world of every financial action is not just a simple transaction.

This is a complex world composed of information, value, and timing, all guided by the "invisible hand" of blockchain oracles. In the vibrant world of DeFi, there is something particularly worth paying attention to, called Oracle Extractable Value (OEV). This is a special value that can be captured due to the way blockchain oracles update prices—or sometimes fail to update prices. This article will take you deep into OEV, exploring its origins, how it works, and how people cleverly extract value from the tiny differences between real-world prices and their lagged updates on the underlying chain/protocol.

But the narrative of OEV is not just that, we should also pay attention to innovative platforms like Uma Oval. They are researching how to make the task of finding OEV benefit everyone in DeFi (not just a few). By delving into the complexity of OEV and emerging solutions like Uma Oval, I have summarized some thoughts and feelings about the OEV field to present this.

TL;DR

OEV Definition: When there is a gap between the real-world asset prices and their (lagged) updates on the blockchain, OEV appears, providing profit opportunities for searchers who take action after these oracle updates.

Overview of Uma Oval: Uma's Oval has adopted a novel approach to manage OEV by utilizing wrapped Chainlink oracle updates, allowing searchers to bid on price feeds. It is then sent to MEV-Share to facilitate a private order auction process and ultimately return value to the protocol.

Key Issues Facing Oval: Oval is built on a complex and delicate incentive balance among different entities involved in typical MEV categories. However, Oval will need to refine some factors through real-world testing and improvement, including potential price delays, specific trust assumptions related to centralization, and other low-level parameter settings.

Theoretical Solutions to OEV: My analysis suggests that while the existence of OEV presents problems, innovative solutions like Uma Oval can mitigate its negative impact, providing a blueprint for a fairer and more sustainable future for DeFi.

Personal Insights for the Future of DeFi: I advocate for the development and implementation of mechanisms that combine protocol-layer and infrastructure-layer solutions to promote a healthier ecosystem and a more reasonable MEV game theory model.

OEV Beginner's Guide

What exactly is OEV?

Oracle Extractable Value (OEV) refers to the maximum value that can be extracted due to oracle price feed updates or lack of updates. Oracles provide external data to blockchain contracts, such as asset prices. However, these updates are discrete rather than continuous, creating information asymmetry and MEV opportunities, also known as OEV. This allows search bots to profit from temporary differences between on-chain prices and real-world spot prices before oracle updates occur.

It is important to note that this can be summarized not only through operations initiated by oracles. For example, if a large trade occurs on a DEX like Uniswap and significantly changes the price, there may also be "internal oracle updates."

Common OEV strategies, such as front-running, involve searchers monitoring pending transactions and inserting higher-fee transactions before scheduled trades to profit from price differences during the delay period; arbitrage, where arbitrageurs trade across assets based on lagged oracle prices before updating and then sell to secure profits; and the most common type, liquidation, where searchers can identify undercollateralized positions based on price changes and quickly liquidate them for a reward.

OEV represents profits captured from temporary differences due to the discreteness of oracle price feed updates. Search bots are able to extract value without contributing value to the protocol. This value belongs to searchers who realize profits, builders incentivized by including large trades in blocks, and validators who subsequently propose blocks. However, this comes at the cost of protocol users facing penalties for large liquidations, loss of arbitrage opportunities, and more.

The negative impact of OEV and why we should care?

OEV can have a negative impact on Dapps and harm end users. Overuse of bots to exploit oracle arbitrage and liquidation increases overall transaction costs, as these bots consistently bid higher than legitimate trades to gain priority inclusion in blocks. This directly increases gas fees for actual users.

Additionally, external arbitrage trades triggered by temporary oracle price differences reduce the profits of liquidity providers in these DeFi ecosystems. Even if current spot prices may offer significant spreads, they are forced to accept lower profits. Over time, continued trading losses on one side of the asset lead to increased permanent losses for liquidity pools/providers. Users attempting to exchange assets also have to deal with degraded user experience, such as delayed trade execution, significantly increased slippage, and greater losses on forced liquidations.

Several common examples briefly illustrate how OEV activities lead to these problems:

Liquidation: MEV bots actively monitor decentralized lending platforms and quickly liquidate any undercollateralized loan positions using price oracle differences to capture bonus payments. This relies on liquidating loans before data inconsistencies exposing favorable liquidation trades are resolved before oracle updates.

Arbitrage: Bots continuously trade against lagged oracle prices on a DeFi platform and then immediately sell the acquired assets on another platform that may already reflect current actual spot pricing. This repeated arbitrage extracts value without providing meaningful trading volume or liquidity to the affected applications.

Front-running: To maximize profits from predictable oracle events, MEV bots insert high-fee orders timed before expected user trades. By confirming their front-run trades within a short delay window before major pricing updates, bots can exploit differences before actual user trades.

However, more disturbingly, bots extract value without engaging in any mutually beneficial interactions or supporting the underlying DeFi protocols. They exploit temporary oracle inaccuracies without actually trading or providing liquidity on these platforms, further incentivizing the dominant builder ecosystem. The fees paid by bots are only to prioritize their trades, exacerbating block space competition and leading to infrastructure centralization rather than benefiting end users or applications.

Overall, a large accumulation of value has been given to oracle data hunters and major blockchain validators, rather than being reinvested to nurture ecosystem growth or sustainability. Draining the income lifeline to external actors seeking one-sided profits severely impacts the growth trajectory of decentralized finance. Shifting the capture of oracle extractable value to value-generating applications provides a path to transform the core economic sustainability of DeFi.

What is Order Flow Auction?

Order Flow Auctions (OFAs) aggregate swap intentions and transactions and rank them based on fair sorting criteria. This model aims to minimize the negative effects of MEV strategies.

OFAs allow traders to easily publish their desired swap intentions, which are then filled by competing external parties. This provides traders with the best prices across various decentralized and centralized liquidity venues without manually seeking the best rates.

In the OFA structure, swappers only need to publish their trade intentions, and specialized fillers optimize and execute trades from various liquidity sources. These liquidity sources include automated market makers, private liquidity pools, etc., which fillers can leverage to meet exchange demands.

Fillers compete actively to provide the most favorable trading fees to initial swappers. Their profits come from the price difference between the actual execution price and the exchange rate provided to the intention traders.

The main benefits of trading with OFA include reducing the negative externalities of MEV by attempting fair trade sorting, providing better prices and overall efficiency for initial traders, simplifying decentralized trading across liquidity sources, and batch trading to improve execution efficiency.

By outsourcing order execution to competitive fillers, the OFA structure simplifies the process of swapping in a complex liquidity landscape, while providing consistently favorable pricing for traders.

Protocol Examples Addressing OEV

API3

API3 addresses issues surrounding OEV by implementing a specific oracle-based OFA mechanism called OEV-Share, which is groundbreaking. It allows searchers to bid for exclusive rights to execute API3 data source updates, sourced from first-party oracles off-chain, owned and operated by API providers themselves, and capture OEV profits associated with these transactions. Meta-transactions cryptographically signed by API3 oracles enable winning bidders to perform data source updates.

API3's introduction of competition-based OEV auctions to existing oracle infrastructure brings several key benefits:

The auction maximizes the efficiency of value extraction by linking oracle events with incentives.

Returning profits to affected Dapps instead of external accumulation prevents value leakage from the network.

Competition pressure in the auction naturally reduces costs and increases the timeliness of updates. This allows API3 to provide large-scale, low-cost, accurate, low-latency data sources, which are a cornerstone for further DeFi adoption.

Overall, API3's OEV architecture creates a sustainable closed-loop model with mutual benefits: search bots gain a pathway to extract OEV profits, Dapps receive new revenue streams and pay lower fees for critical oracle services, and API3 benefits from a profitable model for sustaining oracle infrastructure development and operation.

How does this work within the current "balanced" (not entirely balanced, as it introduces negative externalities, but the interactions of different entities in the MEV architecture are somewhat fixed) MEV incentive mechanism?

Searchers gain an organized pathway to capture overlooked OEV opportunities that go beyond MEV at the transaction level. While structured bidding processes may introduce slight procedural friction, the efficiency gains and reduced competition will ultimately increase revenue. As updates will be designated for execution by specific searchers, it will be compatible with any block generation and validation scheme—e.g., it does not require a private mempool. Then, auction proceeds will be allocated back to the protocol, meaning they will realize the originally potentially leaked revenue.

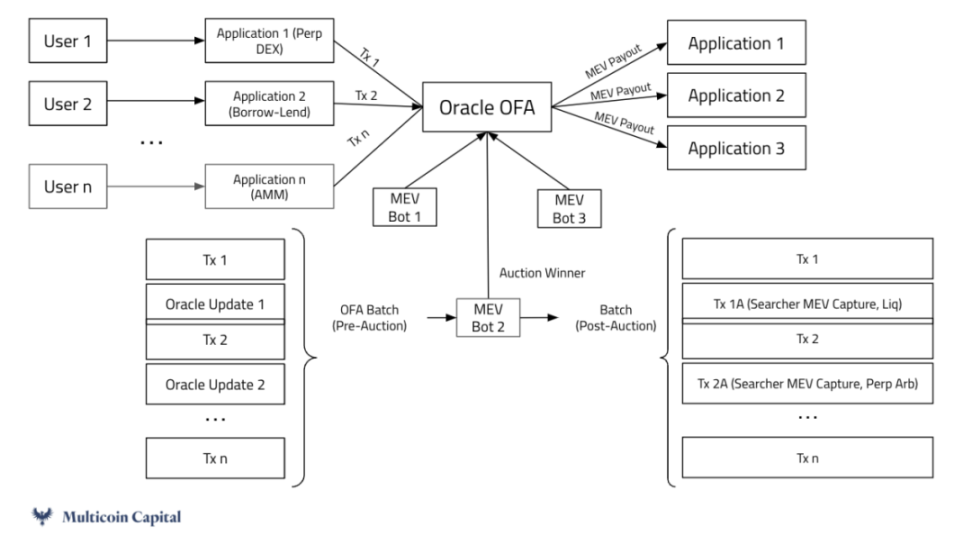

Source: Multicoin Capital

Pyth Network is pioneering a new approach to addressing OEV, based on its leadership position in providing first-party financial data to existing markets. Pyth recognizes that proprietary data obtained directly from market makers, liquidity providers, exchanges, and other direct ecosystem participants offers higher accuracy and timeliness than third-party aggregated pricing.

By accessing these high-quality data streams, Pyth's oracles are designed to provide pricing information with significantly higher fidelity and lower latency for contracts requiring real-world value. Pyth also implements a demand-driven model, allowing contracts to accurately fetch price updates on demand, rather than relying on intermittent push-based delivery. This increases flexibility while reducing network overhead costs.

At the critical intersection of blockchain pricing data and contract execution logic, Pyth appears well-positioned to mediate valuable space around price information. By aggregating access to embedded applications utilizing its oracle information flow, Pyth aims to facilitate global order flow auctions, allocating trading access to specialized bots. Unlike cases of strictly external value accumulation, Pyth can redistribute contract interaction profits back to integrated applications through recovered revenue growth rather than wasted leakage to nurture the ecosystem.

UMA Oval (Oracle Value Aggregation Layer)

Source: https://medium.com/uma-project/announcing-oval-earn-protocol-revenue-by-capturing-oracle-mev-877192c51fe2

Operation

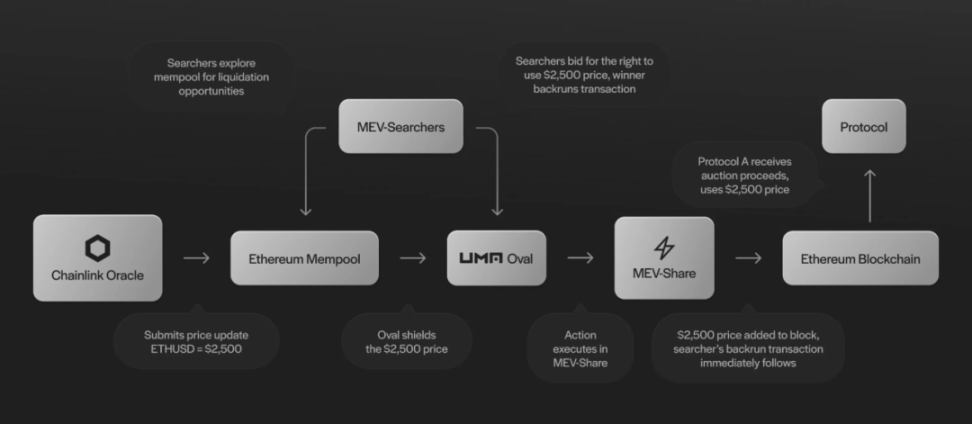

UMA Oval integrates with Chainlink's existing price feed infrastructure and utilizes Flashbots' MEV-Share architecture to facilitate order flow auctions around oracle updates.

When Chainlink's price updates are submitted to the blockchain, Oval essentially wraps access rights to the latest data. This allows search bots to bid and compete for the rights to unlock and "pre-run" these price stream transactions to exploit OEV opportunities.

Trusted intermediary nodes, called Oval nodes, are responsible for verifying searchers' bids and configuring refund rules for value allocation. They submit unlock transactions to release held updates and related pre-run bids as a bundle through MEV-Share.

MEV-Share runs a standardized private order flow auction, coordinating across a broader network of builders and validators. The winning bidder includes their bundled pre-run transactions along with price stream unlocks to exploit arbitrage or liquidation events.

Subsequently, based on refund rules set by Oval nodes, a portion of the profits is redirected back to integrated lending platforms and other protocols using Oval, while also allocating normal amounts to builders and validators (achieved through inherent liquidation bonus rate improvements in the Oval mechanism). This way, value is returned to applications rather than allowing all profits to accumulate to search bots and external validators.

One point to note is that, apart from builders and the protocol itself, no one is affected in the current MEV process. Searchers use existing technology, which allows seamless integration, and fees are reallocated from the profits of builders back to the protocol—this is controlled through metadata bundling. Validators still get paid for proposing blocks, also from the profits of builders, which may result in some block inclusion delay during high congestion periods (further discussed in the report). However, builders can have a stable private order flow through MEV-Share, incentivizing them to produce blocks, especially when MEV value is high, resulting in higher fees allocated to builders for inclusion. It also discourages misconduct, as MEV-Share can blacklist bad actors from the protocol.

In summary, Oval leverages existing oracles and MEV architecture to access valuable data information flow updates. By controlling release timing, search auctions can be conducted, and a portion of the generated profits is returned to affected applications.

Trust Assumptions of Oval

The Oval mechanism has three core components - the protocol of the integrated system, Oval nodes controlling the auction, and builders/miners involved in transaction sorting and confirmation. This introduces potential trust issues:

The protocol relies on Oval nodes to set accurate refund rules to return value, not delay or review price update releases. However, this does not compromise the operations of most protocols using Chainlink, but in the worst case, the protocol may lose income originally belonging to builders and result in price update delays.

Oval relies on MEV-Share/Builders not leaking the latest value of updates, not altering searchers' preferences, and sending the correct pre-run payloads. However, in the worst case, this does not compromise the core operations of the protocol, but the protocol may lose income originally belonging to builders and may result in price update delays.

Both Oval and MEV-Share trust builders to adhere to bundling rules in submitted bundles and not separate transactions to steal profits. Oval selects builders that users can choose. From the builders' perspective, the incentive to profit from OEV is less than the incentive to be banned from receiving this private auction flow. Flashbots have thoroughly explored and field-tested this balance mechanism, where the incentive mechanism prevents bad behavior of builders from stealing MEV profits:

(Github: https://github.com/flashbots/dowg/blob/main/fair-market-principles.md)

The worst-case scenario here is that a specific liquidation unfolds as it does today—a builder capturing OEV is equivalent to a builder capturing the MEV they do today.

While reputation and financial incentives typically enforce good behavior, reliance on intermediaries creates risks. If Oval nodes fail to release updates or redirect profits, income capture will stop, but core pricing functionality will continue through Chainlink's underlying information flow.

In conclusion, Oval leverages existing oracles and MEV architecture to access valuable data information flow updates. By controlling release timing, search auctions can be conducted, and a portion of the generated profits is returned to affected applications.

Potential Risks and Counterarguments

A key question is why UMA chooses to adopt an intermediary auction model through Oval instead of implementing on-chain Dutch auction methods for liquidation events directly in lending protocols. Compared to automated liquidation incentives, Dutch auctions may generate lower and slower revenue for platforms. For high-risk scenarios like undercollateralized loans, maximizing speed and reliability is crucial. Oval's use of existing MEV architecture helps ensure liquidity in these situations.

Another concern is whether users might attempt to bribe validators not to propose unlocking new data in certain blocks to review price update releases. However, maintaining this attack over multiple blocks could be costly. Users would need to significantly outbid the existing fees received by builders and validators to prioritize their transaction bundles. Unless in extreme cases, the incentive for revenue maximization still supports inclusion rather than review.

Another risk issue is what prevents Chainlink from building an alternative proprietary MEV capture system around its own feeds instead of integrating with intermediary solutions like Oval. One mitigating factor is that redirecting MEV income back to the oracle providers can serve as a useful funding mechanism for Chainlink's ongoing development. Oval provides a verification path to achieve this goal through protocol-level integration.

Furthermore, trust assumptions are largely mitigated through potential minor price delays—most likely up to 3 blocks, as previously mentioned. In normal operation of lending protocols, a delay of up to 3 blocks is not expected to have any measurable impact. This is different from how price delays affect market trades or faster-moving product types. When liquidation is needed, the next block (with no delay) has an inclusion rate of 90%, and 2 blocks have an inclusion rate of 99%. Uma's experts do not believe this delay will cause large enough price movements to consume existing liquidation buffers.

Finally, a potential vulnerability is whether builders responsible for order and transaction confirmation might steal OEV profits through backrun instead of respecting the auction mechanism. However, the incentive alignment still supports compliance with Oval's system to gain access to private order flow from Flashbots. Reputation impact and the risk of being cut off from the entire ecosystem provide strong protection against individual theft, and the potential one-time gains pale in comparison to the ongoing income stream obtained from following the rules.

Our Thoughts on OEV

Overall Reflection on OEV

While there are many solutions to address OEV (especially to reinvest value back into the protocol/ecosystem), users are still somewhat negatively affected. Solutions like Broadcaster Extracted Value (BEV) are attempting to mitigate the pressure of MEV on the user side, which may be an interesting direction to consider in the protocol design of other OFA models. To further mitigate some trust assumptions in the OFA model, we are pleased to see that new OFA mechanisms can also be implemented at the protocol level.

For example, summarizing OEV as even internal price changes (as introduced in the introduction) allows the protocol to further reduce negative external effects. Taking Oval as an example, just as wrappers can mediate access to external data oracle events to reallocate value, the protocol can consider these affected transactions as internal data updates.

For example, Uniswap can set a threshold where any trade flow greater than $X must be routed through a wrapping system similar to Oval. This would allow Uniswap to auction access rights, allowing bots to backrun or arbitrage these specific large trades.

Then, just as Oval returns value from liquidation to the lending platform, this Uniswap implementation can return a portion of the profits affected by large trades to the Uniswap protocol, liquidity pools, liquidity providers, and even protocol users.

View on Uma Oval

While UMA Oval cleverly leverages existing architecture to capture and redirect OEV, the system relies on fragile incentive alignment and trusted intermediaries, introducing security risks.

Oval nodes and the order flow mechanism provide optimizations but open up attack vectors. In the worst-case scenario of a breakdown in intermediary trust or incentive models, critical data flow delays may still occur, making more value extraction related to arbitrage possible.

However, this approach does indeed mitigate some negative external effects in the current paradigm. As a temporary solution to increase sustainability, Oval may bring meaningful revenue to affected applications. Nevertheless, concerns about increased centralization, transparency, and delays still exist, and these could become future attack vectors if not thoroughly tested.

In general, UMA Oval represents an innovative attempt aimed at reclaiming value leakage, but it may not fundamentally address all core incentive issues that make extraction opportunities possible. Like any novel crypto-economic system, these mechanisms need extensive review, auditing, and real-world testing under different operating conditions before assessing true robustness and resistance to exploitation.

I am excited to see Oval shift the discussion and inspire ongoing research, as it addresses some prominent issues in the OEV space that have not been directly addressed. However, as adoption considerations unfold, a comprehensive understanding of risks and rewards will be crucial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。