Student author | @yelsanwong

Supervising teacher | @CryptoScott_ETH

Initial release date | 2024.2.23

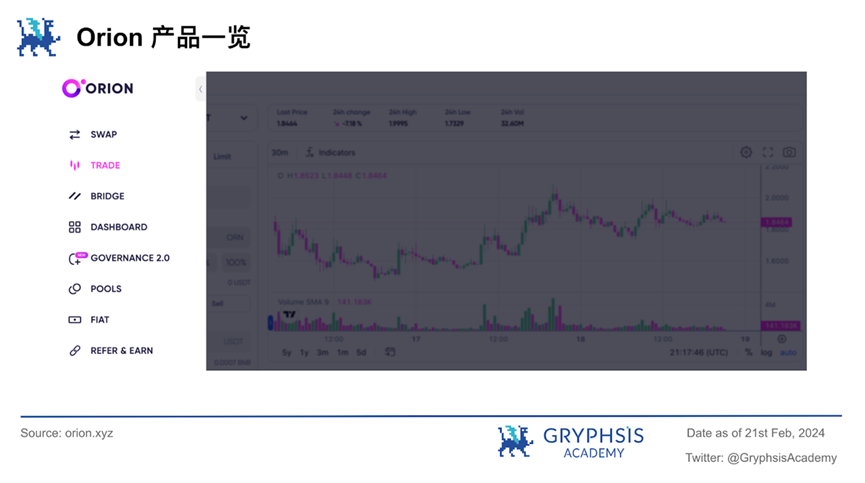

- Orion aggregates liquidity, virtual order books, and integrates high-security cross-chain bridges to consolidate the liquidity of decentralized exchanges (DEXs) and centralized exchanges (CEXs) into a single access point, greatly simplifying the user's trading process and providing a seamless user experience.

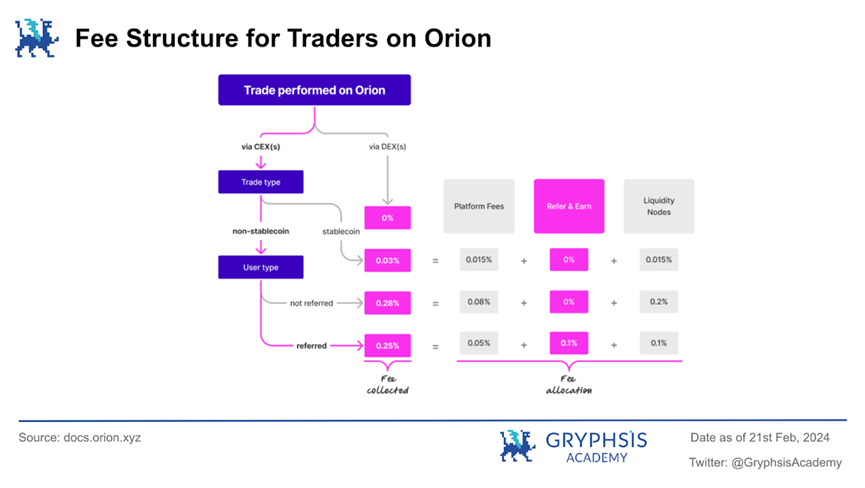

- Recently, Orion launched the Refer&Earn campaign to encourage influential individuals and loyal users of the protocol to refer new users and provide corresponding incentives such as $ORN and reduced transaction fees. This reward-based referral mechanism not only rapidly increases the platform's user base but also spreads the Orion brand through the natural social networks of community members, achieving organic growth.

- Orion recently launched the BRC20 cross-chain bridge, greatly expanding the functionality of the Orion protocol, enabling it to support token creation and exchange on the Bitcoin network. This development not only enriches the application scenarios and value of Bitcoin but also provides Orion with a unique opportunity to connect BTCFi with a broader decentralized finance (DeFi) ecosystem. Considering the rapid expansion of the Bitcoin ecosystem last year, we expect BTCFi to become a high-growth area, and Orion, through its cross-chain bridge solution, is expected to achieve significant growth in this area.

Orion Protocol was founded in 2018 with the initial purpose of providing a unified, decentralized trading solution that connects to all major centralized cryptocurrency exchanges (CEXs) and decentralized exchanges (DEXs) through a liquidity aggregator, allowing users to access the liquidity of the entire market on its decentralized platform to obtain the best prices for any token in the market.

Orion Protocol also aims to improve trading efficiency, reduce costs, and provide a seamless user experience through the integration of high-security cross-chain bridges and virtual order books. The core of the platform lies in its integration of decentralized market liquidity into a single access point, simplifying the user's trading process while maintaining the characteristics of high transparency, high security, and independence from intermediaries in DeFi.

In November 2023, Orion Protocol announced the rebranding of 'Orion Protocol' to 'Orion' to revitalize the protocol and provide a clearer and more targeted value proposition, while expanding the utility and potential of the ORN token.

Alexey Koloskov (Founder & CEO)

Before serving as the CEO of Orion Protocol, Alexey was the Chief Architect at Waves, where he successfully led the architectural design and development of the Waves decentralized exchange. Since June 2017, as the founder and CEO of Orion Protocol, he has led the project for over 6 years, responsible for formulating company strategies, overseeing product development, and driving innovation and growth for Orion Protocol in the blockchain industry.

Kal Ali (Co-founder & COO)

Kal Ali, an early strategic advisor and co-founder of Orion Protocol, currently also serves as a General Partner at Dominance Ventures, a venture capital firm that has made early investments in projects such as Cosmos, Gunzilla Games, and Avalanche.

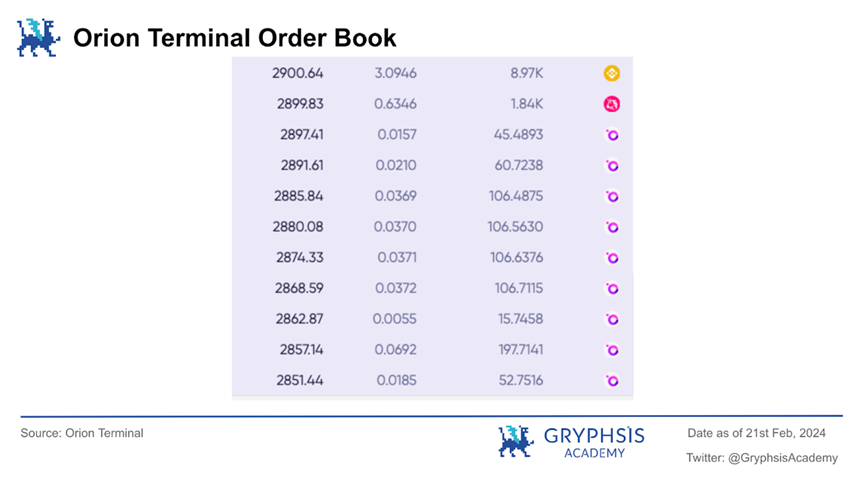

Orion Terminal, as the core product of Orion Protocol, provides real-time access to and integration of order books from multiple exchanges through its unique liquidity aggregation mechanism. This mechanism covers a wide range of exchanges, including centralized and decentralized platforms, ensuring that users can obtain the best trading prices and depth across the entire market through a single interface.

This innovation not only provides users with optimized trading execution and pricing strategies but also effectively reduces trading costs and improves the overall efficiency of the market. The following is the implementation path of this mechanism.

Through Orion Terminal, users do not need to create personal accounts in centralized exchanges, eliminating the need for personal KYC and other cumbersome procedures. By establishing an account in CEX through Orion, known as a liquidity node or liquidity provider, users initiate transactions by sending them to the liquidity node through atomic transactions (which complete all stages of the transaction in a single step through smart contracts, ensuring that the transaction either fully succeeds or does not occur at all, with no intermediate state), and the node executes the transaction on CEX, immediately receiving the tokens. Unlike traditional DEXs that use the AMM mechanism, deCEX provides real-time order books, offering more accurate and immediate trading data.

Security Deviation Mechanism (SD):

Although atomic swaps may ensure that users can send trade requests at ideal prices while ensuring the security of their funds, how does Orion ensure that users can complete trades at the best prices? To address this, Orion has set up the Safe Deviation (SD) mechanism for trades.

In simple terms, SD is an automated preset trade slippage. For USDT trading pairs in CEX where most trading pairs have sufficient liquidity, the SD is set to 0. For non-USDT trading pairs in CEX (such as ETH/BTC), a 0.4% SD is applied. In DEX, a single swap applies a 0.15% SD, and for multi-step swaps, the 0.15% is multiplied by the corresponding number of steps. Throughout this process, Orion does not charge any additional fees apart from the actual commission and network fees calculated based on the order volume.

Unlike user-set slippage, although both SD and user-set slippage affect trade prices, SD, as a fixed and predefined mechanism, provides users with a certain level of transparency and predictability of price changes.

Even in extreme market conditions, the system automatically takes measures to facilitate trades. Additionally, the SD mechanism may adopt different coefficients based on different market conditions (such as liquidity and volatility of trading pairs), providing flexibility and adaptability beyond what manually set slippage can offer, especially in cases of significant short-term market price fluctuations.

However, the SD mechanism itself has certain limitations. For example, in a liquidity pool with insufficient reserves, a large trade may significantly impact the token price in that pool, and the preset 0.15% slippage may not be sufficient to address such changes, leading to the failure of the trade.

Liquidity Nodes/Liquidity Providers:

During trade execution, Orion assigns orders to specific liquidity nodes through its virtual order book. To maintain the network's decentralized nature and improve efficiency, Orion has introduced the Delegated Proof of Liquidity (DPoL) mechanism.

Through this mechanism, liquidity nodes are required to stake ORN tokens to participate, with nodes with higher stakes being more likely to be selected to execute trades. However, this selection process considers not only the stake amount but also evaluates the types of tokens provided by the node, the blockchain network they are on, and their reserve situation to ensure smooth trade execution.

DPoL also allows users to influence node selection by delegating ORN tokens to specific liquidity nodes, aiming to balance the interests of users and nodes. By allowing nodes to set trade fees and share profits with users, this process enhances the network's decentralization and user participation.

Asset Security and Autonomy:

In terms of asset security and user control, Orion Terminal provides a mode for trading directly from the user's wallet. Through the liquidity aggregator, users are essentially the order entrustor. After creating an order through Orion, the aggregator interacts with liquidity nodes for acceptance. Information such as the order address, trading platform, and order quantity for each order is publicly viewable and verifiable.

This mode strengthens asset security, ensuring that users' funds are always under their direct control, reducing the risk of fund theft and abuse present in traditional centralized exchanges. Even if Orion Terminal experiences a malfunction, the liquidity node network and smart contracts continue to operate normally, allowing users to continue participating in trades through Orion's liquidity and financial services.

This design embodies the core concept of decentralization, allowing users to trade securely and freely without needing to trust any third party.

Traditionally, decentralized exchanges (DEXs) such as Uniswap V3 use the Automated Market Maker (AMM) mechanism, which uses its price curve to determine prices, unlike centralized exchanges (CEXs) that use order books to clearly list buy and sell orders for comparison and trading. The AMM price curve makes it difficult to directly compare its liquidity with that of centralized exchanges.

Orion's innovation lies in converting the AMM price curve into a traditional order book format, allowing AMM liquidity, such as that of Uniswap V3, to be displayed and compared just like on centralized exchanges like Binance or OKX.

This conversion not only makes price comparison easier but also allows for the setting of limit orders on AMM, enhancing trading opportunities. Additionally, by converting the AMM price curve into an order book, Orion ensures that AMM liquidity can seamlessly integrate with and be compared to CEXs, creating a unified trading platform for users.

The Virtual Order Book (VOB) combines the direct trading method of traditional order books (OOB) and the liquidity model of AMM, creating a unified trading platform. VOBs not only display information for direct trades but also reveal the potential liquidity advantages of multi-step swaps.

For example, trading token A for token C through an intermediate token (Token B). Continuously calculating complex swaps means that it can continuously update and optimize trading opportunities, providing traders with new and competitive prices, as well as arbitrage opportunities that may not have been discovered previously.

Combining these three key technologies, Orion Terminal undoubtedly represents an initial ideal form of a liquidity aggregation trading product. However, its specific reliability and value discovery capabilities still await market validation.

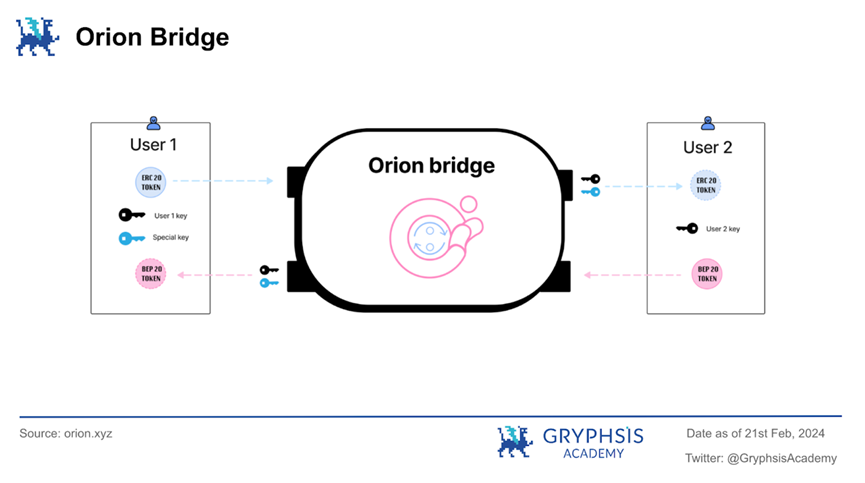

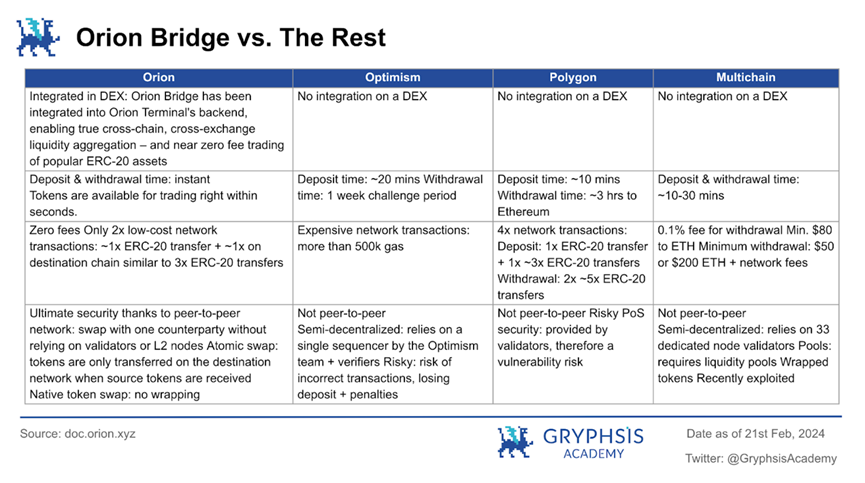

To a certain extent, Orion Bridge addresses the challenges of cross-chain transactions in the cryptocurrency market, achieving a truly efficient decentralized cross-chain bridge. The core of this technology lies in its integration, directly embedding cross-chain and cross-exchange liquidity aggregation into the backend of Orion Terminal, providing users with a seamless, fast, and secure trading environment. Compared to existing bridges, Orion Bridge offers an unrestricted, delay-free, order rejection-free, fund lock-free, and exploitation-free trading experience, largely addressing many issues present in other cross-chain bridges in the market.

Orion Bridge is supported by three core technologies: Atomic Swaps, Peer-to-Peer Network, and Broker Network. Atomic Swaps allow for instant exchange of assets on different blockchains without the need for wrapping assets or delays. P2P technology achieves true decentralization, enabling assets to be exchanged directly between individuals without the involvement of central institutions. The Broker Network ensures the immediacy and smoothness of trades, regardless of trade scale.

In the first iteration of Orion Bridge, seamless connections between Ethereum and BSC have been achieved, and the BRC20 cross-chain bridge will be launched soon, allowing BRC20 tokens to be traded on EVM-compatible chains such as MATIC and BSC. It is worth noting that ORN is the only token listed on Binance with the concept of BTCfi.

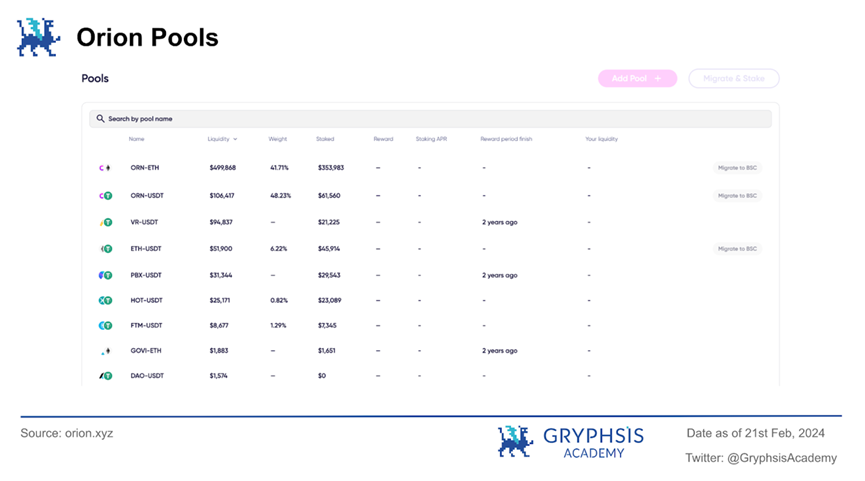

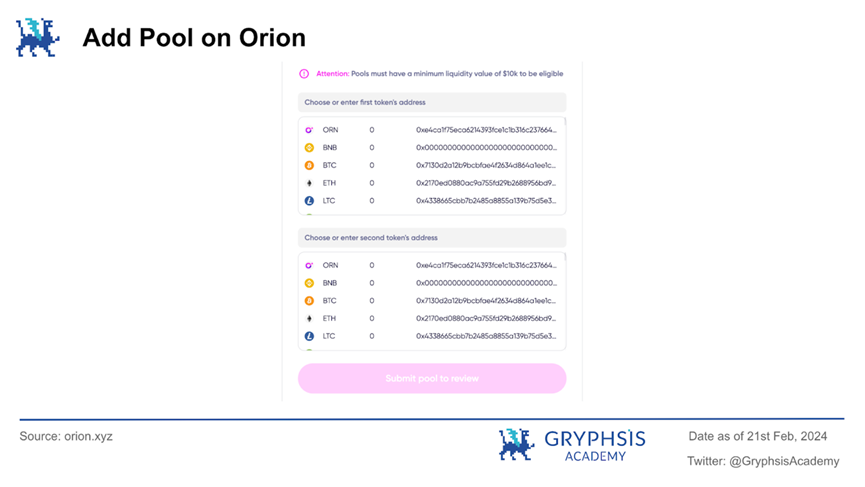

Orion Pools is a decentralized liquidity pool platform built on the Uniswap V2 model. The platform allows users to contribute liquidity, create new liquidity pools, and personalize their experience by adding custom logos, ensuring an active and vibrant trading environment.

The design philosophy of Orion Pools emphasizes empowering users, providing them with the ability to create, contribute to, and customize liquidity pools through a simplified user interface and process.

In terms of operations, Orion Pools provides intuitive guidance, allowing users to easily create new pools or add liquidity to existing ones. The process of creating a new pool includes selecting or adding new tokens, proposing pairing with USDT to ensure integration across the Orion platform, uploading token icons (for new tokens), and completing the transaction to confirm the creation of the new pool. The process of contributing liquidity includes selecting the preferred pool, inputting the amount of assets to contribute, and confirming the transaction through the wallet. These processes are not only user-friendly but also enhance platform liquidity and trading efficiency.

By contributing assets to liquidity pools, users not only facilitate seamless trading on the platform but also receive a portion of the trading fees as a reward, creating a mutually beneficial relationship. Orion Pools not only provides an opportunity to earn rewards but also allows users to become part of a broader trading ecosystem, enhancing user participation and a sense of belonging.

With the implementation of the new governance and liquidity mining system, Orion Pools is transitioning to a more sustainable and growth-oriented model. The new system came into effect on December 5, 2023, emphasizing support for protocol growth and sustainability while ensuring alignment with user interests. This transition not only enhances the platform's attractiveness but also aims to attract more users to participate in the Orion ecosystem.

Orion Protocol's Orion Widget is an innovative application designed for cryptocurrency trading platforms and decentralized application (dApp) developers, aiming to quickly implement token trading functionality on any webpage or application through a simplified integration process. Leveraging Orion's centralized and decentralized exchange (CEX and DEX) liquidity, the tool allows users to trade directly by connecting their wallets, enhancing trading convenience and user experience.

The core advantage of the Orion Widget lies in its high level of customization and ease of integration. Developers can customize the appearance and functionality of the Widget through a series of predefined parameters, including theme style, default tradable assets, tradable asset lists, initial trade amounts, and fee assets, to meet the specific needs of different platforms and user groups. This flexibility ensures that the Widget can seamlessly integrate into various web and app environments while maintaining brand consistency and user-friendliness.

Additionally, the integration process for the Orion Widget is extremely simple, supporting integration through scripts and iframes, requiring minimal coding work. This significantly reduces the technical barriers, allowing even non-technical developers to easily deploy trading functionality on their platforms. This not only accelerates the development cycle but also reduces development costs, providing greater flexibility and scalability for projects.

In terms of token listing, the Orion Widget supports hundreds of tokens listed by the Orion Protocol and ensures support for unlisted tokens through its extensive liquidity sources, further expanding users' trading choices. This feature is particularly suitable for projects that wish to offer specific token trading services on their platforms without worrying about liquidity or token support issues.

Orion Protocol's Refer & Earn program is a plan aimed at expanding its user base. Through this program, Orion encourages influencers and loyal users to refer new users, offering $ORN tokens as a reward incentive. Participants can apply to join this program by contacting @TradeOnOrion on Telegram.

Referrers can earn rewards of over 70% based on the trading fees generated from their referrals, with rewards distributed in real-time through the $ORN token on the BNB Chain. As the program progresses, more opportunities will be opened up for users who want to become referrers.

Additionally, active referrers and high trading volumes have the opportunity to earn additional $ORN token rewards on the leaderboard. Rankings on the leaderboard are based on trading volume within the network and the amount of ORN tokens in the wallet over a 14-day period. Orion adjusts the leaderboard budget monthly to temporarily increase referral rewards, with rewards distributed hourly and claimable on the BNB Chain.

This reward-based referral mechanism not only rapidly increases the platform's user base but also organically spreads the Orion brand through the natural social networks of community members, leading to organic growth. Community members directly benefit from their referral behavior, strengthening their loyalty and enthusiasm for the platform.

Additionally, the "Refer & Earn" program incentivizes users who trade through referral links with a 10% trading fee discount, not only directly reducing users' trading costs but also potentially attracting more trading activity to the Orion platform. With increased trading volume, platform liquidity will also be enhanced, attracting more users and traders, creating a positive cycle. Furthermore, increased trading activity can also enhance the platform's market competitiveness, attracting more projects and partners to pay attention to and join the Orion ecosystem.

By implementing a multi-tiered reward system, Orion encourages chain referrals between users, which will continuously promote community activity and participation. The real-time distribution of rewards and additional incentive mechanisms based on leaderboards further increase the attractiveness of activities and stimulate active participation from users. Long-term user participation and community building are crucial for the stable growth and continuous development of the platform.

According to OrdSpace data, there are currently as many as tens of thousands of BRC20 tokens with a total market value of over $20 billion, demonstrating the popularity of this market and the high demand for such assets by users. Orion, as a cross-chain bridge connecting Bitcoin and other blockchain networks (such as Ethereum, BNB Smart Chain, etc.), is one of the few infrastructures that support the BRC20 standard. This gives Orion the advantage of being a market leader, helping to attract early adopters and investors.

Furthermore, by supporting the BRC20 cross-chain bridge, Orion can attract users and developers who wish to explore new financial products and services on the Bitcoin network. This cross-chain functionality will significantly increase the liquidity and trading volume of the Orion platform.

The introduction of the BRC20 cross-chain bridge enables Orion to support the creation and transfer of interchangeable tokens on the Bitcoin network, providing an important foundation for the development of the BTCFi ecosystem. This not only increases the use cases and value of Bitcoin but also provides Orion with a unique opportunity to connect BTCFi with the broader DeFi ecosystem.

With the rapid development of the BTC ecosystem last year, we expect BTCfi to be a rapidly growing track, and Orion may have strong growth potential through its cross-chain bridge product.

In September 2020, Uniswap announced an airdrop of its governance token UNI. All Ethereum addresses that interacted with Uniswap V1 or V2 before the airdrop deadline were eligible to receive at least 400 UNI tokens.

Drawing on Uniswap's airdrop history and success, if Orion Protocol considers implementing a similar airdrop strategy, we can anticipate several potential growth points and positive effects, including but not limited to attracting new users, promoting community governance and participation from existing users, increasing project exposure, acquiring new partners, obtaining valuable user feedback, and promoting its own technological improvements.

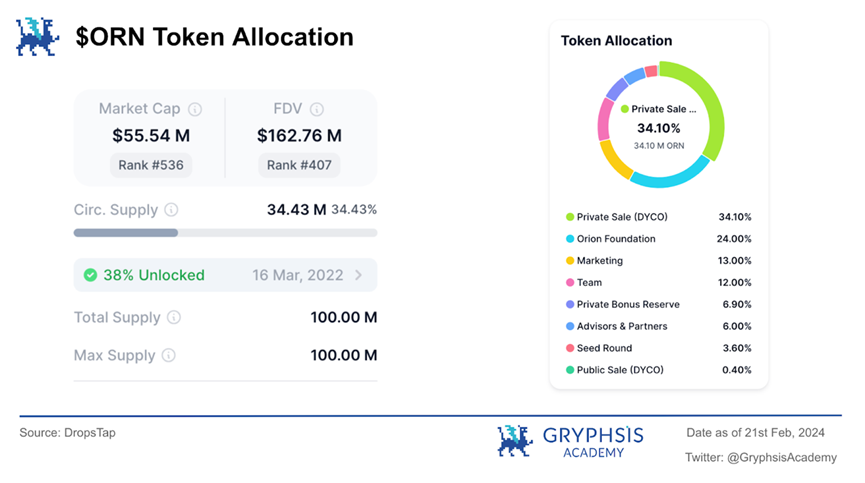

Orion Protocol's Governance 2.0 represents a fundamental change in its governance mechanism, aiming to build a resilient future by enhancing community interaction and influence, creating a reward commitment, and ensuring that every participant can contribute to Orion's long-term success. At the core of Governance 2.0 is the introduction of veORN (Vote-Escrowed ORN), a non-transferable token representing the locked ORN of users, equivalent to their voting rights and influence within Orion.

In the initial stage, veORN is primarily used for voting in liquidity pools, but its design is flexible and may expand to new governance capabilities as the Orion ecosystem develops. The veORN mechanism encourages users to increase their participation and influence in Orion's governance by locking ORN for the long term, strengthening community control over the platform's development direction.

Users obtain veORN by staking ORN and selecting a lock-up period, further engaging in Orion's governance process. The choice of lock-up period reflects the depth of a user's commitment to Orion's governance, with longer lock-up periods resulting in more veORN and increased influence in governance decisions. This mechanism aims to reward users with long-term commitments to the Orion ecosystem, ensuring that rewards are directly proportional to the level of user participation and commitment through a carefully designed reward system.

Additionally, the introduction of the veORN decay mechanism in Governance 2.0 aims to incentivize continuous participation in Orion's governance. Over time, veORN that has not undergone additional staking or lock-up period extensions will gradually decrease, requiring users to increase ORN staking or extend lock-up periods to maintain or increase their influence in governance. This design ensures the vitality and fairness of the Orion governance ecosystem, encouraging new user participation while rewarding existing users with long-term and active participation.

As an incentive in the Refer & Earn program: fee generation from referrers (weighted at 70%) and users' ORN balances (weighted at 30%). A higher ORN balance can significantly increase the received rewards.

The cross-chain bridge project carries high risks within the DeFi field, including security vulnerabilities and operational risks. As a cross-chain bridge project, Orion needs to pay close attention to these risks and implement corresponding security measures and risk management strategies to protect user assets and enhance community trust.

The Orion protocol provides its unique liquidity aggregation service by integrating multiple decentralized and centralized exchanges, involving complex system integration work. While this integration provides users with extensive liquidity access and optimized trading experience, it also brings system integration risks.

These risks may include technical compatibility issues, where different platforms' APIs and data formats may have differences that require careful adjustments and adaptations to ensure seamless integration. Additionally, maintaining the stability and reliability of this integration is also a challenge, as any updates or failures of a platform could affect the entire system's operation. This highly dependent strategy on external platforms may be affected by policy changes or service interruptions from these platforms.

Therefore, while system integration brings significant advantages to Orion, such as enhanced liquidity and improved user experience, it also requires Orion to invest continuous efforts in managing and mitigating these integration risks to ensure platform stability and security, protecting users' interests from being affected.

References

[1]https://docs.orion.xyz/overview/mission-and-vision

[2]https://trade.orion.xyz/dashboard/overview

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。