Pandora, as the first ERC404 token, has pioneered a business, and its role may not only be limited to being a trailblazer, but also has the opportunity to become the "TIA argument" and "meme coin" of the 404 ecosystem.

Author: TENG YAN / Source

Translation: Blockchain in Plain Language

The birth of Pandora/ERC404 originated from an accident.

It all started with a new token, EMERALD. The concept was to combine ERC-20 (fungible) and ERC-721 (non-fungible) tokens, but it was abused due to a lack of developers.

After the disaster, a determined trio emerged: 0xacme (former Coinbase engineer), ctrl, and searnseele, who decided to turn this idea into reality.

They did it. Since its founding on February 2nd, Pandora (the first ERC404 token) has experienced astonishing growth, leaping from obscurity to a token with a market value exceeding $100 million.

Its rise has sparked a fervent interest in launching new 404 tokens. In just two weeks, we have seen the emergence of other 404 token standards. For example, well-known developer cygaar has launched DN404, an enhanced open-source token standard with features similar to ERC404.

But why all the fuss?

(For simplicity, I will refer to ERC404, DN404, and similar token standards collectively as "404".)

1. NFT Fractionalization Has Failed

NFT fractionalization has failed. Despite people's fascination with NFT fractionalization over the years, it is not a new concept.

The idea is simple: a CryptoPunk NFT is worth $150,000 today. Few can afford a single Punk.

But what if you could own 1/100th of the same Punk for just $1,500? Suddenly, this opportunity becomes more feasible. If the value of the Punk triples in the next NFT bull market, the $1,500 investment could inflate to over $4,500.

However, previous attempts at fractionalization have always struggled to gain traction:

NFTX has been trying for years to achieve this through fractionalizing vaults (depositing Punk NFTs and receiving PUNK fungible tokens), but even today, it has not seen significant adoption.

Flooring Lab launched a similar idea a few months ago: deposit an Azuki NFT and receive 1 million u AzukiTokens, which can be traded like meme coins. Its performance has been decent, mainly because it used a new token, FLC, to incentivize liquidity and kickstart the protocol.

In my opinion, despite the best intentions, these types of protocols have essentially died in the early stages.

To use these fractionalization protocols, users need to approve multiple transactions. Each transaction incurs a fee. This quickly adds up, both in terms of cost and the mental effort required to understand each step. People constantly worry that mistakes could lead to the loss of valuable NFTs. For most people, NFT perpetuals (nftperp or Tribe3) may be a more effective way to capture the upside potential of NFTs.

The difference here is that: by making each NFT default to fractionalizable while seamlessly combinable as a whole, 404 solves the UX issues associated with fractionalization.

Yes, it's an old saying in the tech field: the fewer the steps, the higher the conversion rate.

I have considered two complementary perspectives on the potential use cases of 404:

1) Can NFTs benefit from greater fungibility?

2) Can fungible tokens benefit from becoming NFTs?

2. Can NFTs Benefit from Greater Fungibility?

In the crypto space, liquidity is crucial.

By allowing investors to buy and sell affordable portions of NFTs, fractionalization can greatly increase liquidity and expand the market for potential participants.

Additionally, fractionalization makes price discovery more rapid. In 2023, many NFTs experienced slow downward trends, stemming from their inherent illiquidity, leading to longer time for fundamentals to align with prices.

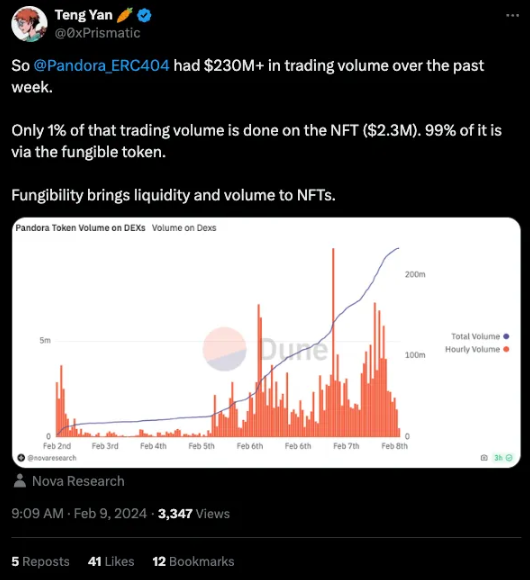

To illustrate how fungibility increases liquidity, just look at the case of PANDORA. 99% of the trading volume is completed through fungible tokens rather than NFTs.

@Ctrl believes that by making NFTs fungible, the valuation of NFT collections (top tier worth around $1 billion) can be closer to top meme tokens (over $60 billion) as capital flows increase.

This creates some interesting use cases for 404 tokens:

High-value art and collectibles: These are typically very scarce and valuable. Tessera, backed by Paradigm, attempted to achieve this through its fractional platform, but had to shut down last year due to limited adoption. The key barrier is effectively reassembling NFTs after fractionalization for resale, a process often hindered by complex DAO governance. 404 tokens can alleviate this issue.

Real estate: Real estate is being digitized on the blockchain, leveraging the RWA trend. Various startups are exploring different methods, from using NFTs to directly represent properties (Roofstock) to using fungible tokens for ICO-style fundraising to acquire properties (CitaDAO). 404 has the potential to integrate these approaches.

Palette is an example: this collection uses 404 to introduce native art fractionalization with a "reset" function to regenerate the artworks in its collection. It makes collecting art more interesting through a new interactive layer.

3. How Can Fungible Tokens Benefit from Becoming NFTs?

While much of the focus of 404 has been on greater fungibility of NFTs, the other side of the coin is: fungible tokens can also benefit from transforming into NFTs.

Here are ways various types of fungible tokens can gain significant upgrades through 404:

1) Governance tokens granting holders voting rights in DAOs. By making these tokens also become NFTs with different reputation statuses (in the metadata) depending on the holder's contributions, a new governance dimension can emerge. Imagine a governance NFT granting different levels of exclusive functionality access based on the holder's historical participation in the community. This incentivizes active participation and promotes a more elitist governance model.

2) Utility tokens can incorporate unique features to provide users with a personalized experience. For example, a gaming platform's token can be tied to NFTs, featuring different in-game assets or abilities based on characteristics and rarity. This not only enhances community engagement around the token but also creates new practical value for it.

3) Memecoins (such as WIF, DOGE, PEPE), typically associated with internet culture and viral trends, can better attract and expand their communities through NFT mechanisms. By introducing rare features and loot box mechanisms, they can make user interactions more gamified. The NFT bull market cycle in 2021 showed how much we love "tokens with pictures". The fusion of memes and NFTs not only adds to the fun factor but also fosters a stronger sense of belonging.

Aevo is a decentralized trading platform for options and perpetual contracts, and it is the first pioneer to integrate 404 tokens. It uses the 404 mechanism in the background to make DeFi yield farming more interesting. When users participate in AEVO airdrop mining by trading on the platform, they have the potential to receive a 100x mining bonus.

4. Future Prospects of 404

The 404 community may strive to improve their token standards and address issues such as gas fees. Collaborating with protocols to ensure that trading platforms and block explorers understand these standards will be a top priority. Open sourcing encourages broader participation in the development of 404.

However, real use cases will take time to materialize. We have seen this story before, and new token standards are no exception:

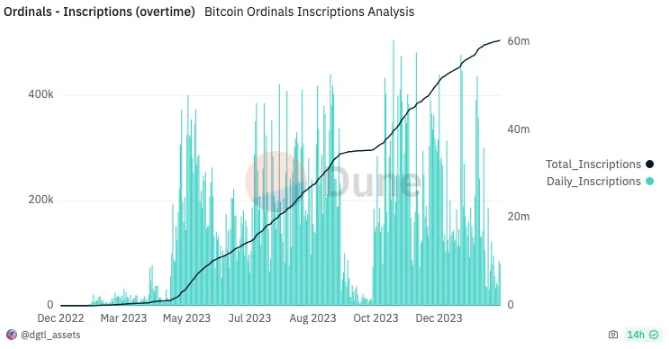

Ordinals (Bitcoin NFTs) was launched in December 2022, but digital inscriptions did not start to show parabolic growth until four months later in April 2023.

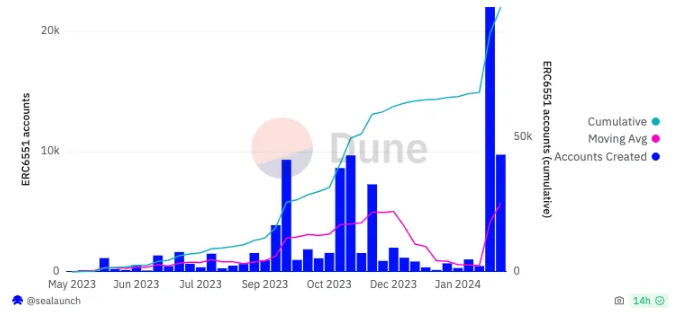

Similarly, ERC-6551 is a groundbreaking standard that allows NFTs to have wallets, and it seemed to gain attention six months after its launch in May 2023.

Building new use cases and introducing the potential of 404 to users undoubtedly takes time. However, these are important steps towards realizing the long-term vision of 404.

But what about Pandora?

Despite being the creator of the first 404 token, Pandora lacks any direct value accrual mechanism. Using the 404 standard does not incur any fees. After all, 404 is intended to be open source and accessible to everyone.

The market is realizing this: driven by speculation, the price of PANDORA soared to $32,000 at one point, but then dropped by 60% to $12,600.

However, in the coming days, PANDORA may present two notable narratives:

Meme Coin: As the first 404 token, if 404 tokens gain wider adoption, Pandora may attract considerable attention, just as ORDI achieved an astonishing $1.5 billion market value simply for being the first BRC-20 token.

"TIA Argument": Similar to TIA's exponential price growth due to bettors' expectations of a Cosmos protocol airdrop, new 404 projects may distribute airdrops to Pandora holders, as they may be staunch supporters of 404. For example, Palette plans to airdrop 5% of its tokens to Pandora holders.

Undeniably, tokens that can deliver new functionalities are indeed exciting. It is these innovations that drive the thriving development of cryptocurrencies.

Source: TENG YAN's Thoughts

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。