The race for re-staking is in full swing. Data shows that the TVL of the Ethereum re-staking protocol based on EigenLayer has reached 3.8 billion USD, with the ether.fi protocol firmly in the lead with a TVL of 1.3 billion USD, representing a growth of over 280% in the past month. However, ether.fi has recently become embroiled in a controversy over "missing points."

Eigen Layer shrinks by half, where did the points go?

On February 19, a community member reported that when the staking amount and staking time were the same, ether.fi had about 10% fewer eigenlayer points compared to Renzo Protocol. However, some pointed out that this could be due to different staking mechanisms.

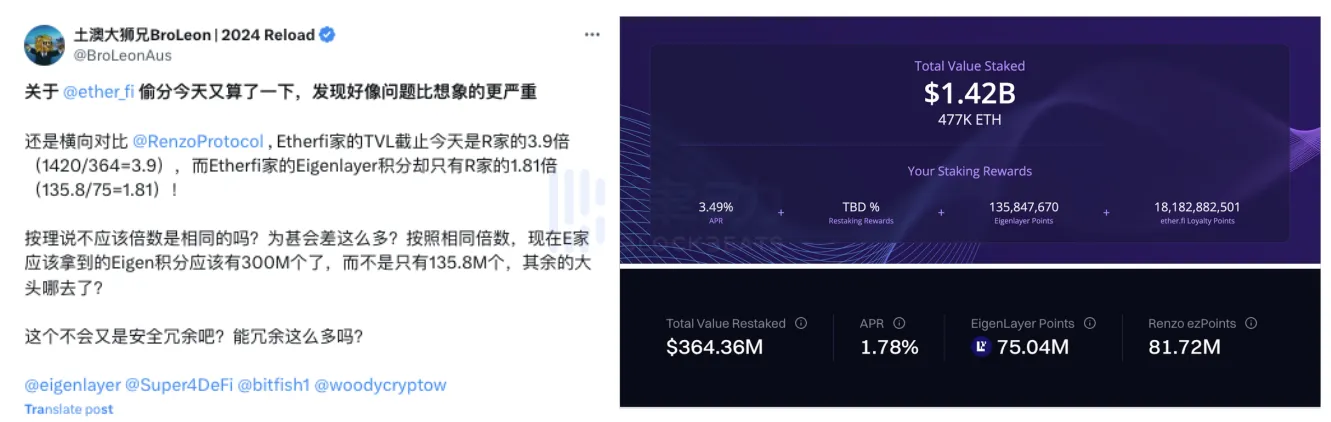

Today, a member calculated that the TVL of ether.fi is 1.42 billion, while Renzo Protocol's TVL is 364.36 million, only about a quarter of ether.fi's. However, the points on ether.fi are only 1.81 times that of Renzo Protocol. Based on the ratio of Renzo Protocol's TVL to EigenLayer points, the points on ether.fi should be about twice the current display. This difference cannot be explained by different staking mechanisms, but ether.fi had not responded to this before.

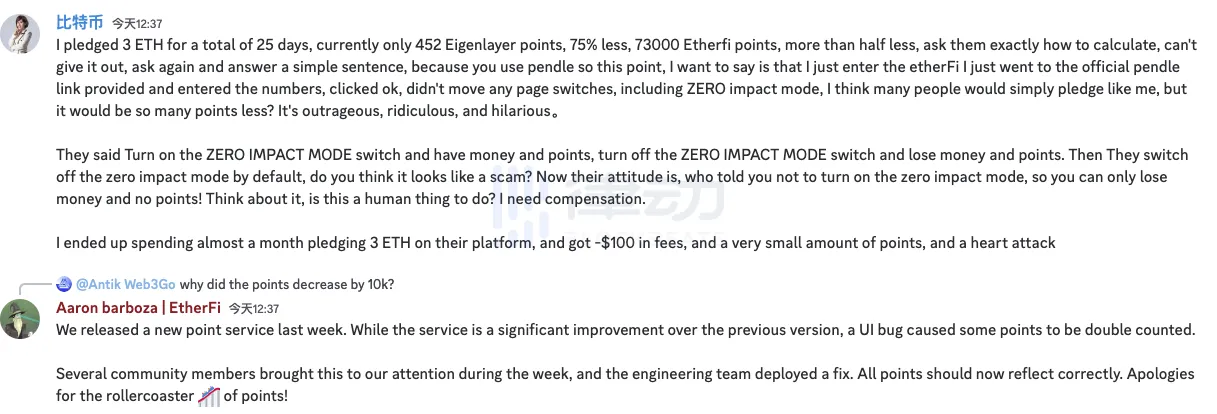

Where did the missing points go? This discovery has sparked discussions in the community. With no response, community members have raised concerns about the team's integrity and approach to handling the situation. In ether.fi's Discord community, a member replied to those who found their points reduced, saying, "If you only lost 10k points, then you are still lucky." On Twitter, early supporters of ether.fi also expressed that they were "not surprised at all."

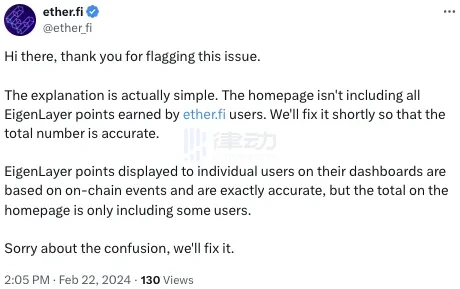

Team response: Different staking mechanisms, but the front-end total points display is incorrect

Why did the points disappear for no reason? Does ether.fi really engage in "point theft"? BlockBeats sought clarification from the ether.fi team on this matter and received an exclusive response.

The ether.fi team initially explained this situation as part of the platform's ETH liquidity management strategy. The EigenLayer points obtained by staking ETH are directly transferred to users at 100%, but the ETH received by ether.fi is not staked immediately. Instead, it is stored in the form of a liquidity pool, allowing users to withdraw ETH instantly and transfer it within and outside the protocol. Therefore, under normal circumstances, users do not receive 24 points daily.

The only way to receive 24 points daily is by joining EigenPod, but this method would mean missing out on opportunities to participate in other DeFi protocols. Since other liquidity staking protocols usually do not offer withdrawal functions, ether.fi may appear "special."

But can different staking mechanisms create such a large difference?

Shortly after explaining the staking mechanism, the ether.fi team once again stated to BlockBeats that the points displayed on the protocol's homepage are indeed incorrect. The actual EigenLayer points obtained by users are much higher than the currently displayed data, and the number of points each user sees on their own dashboard is completely accurate, only the total displayed on the homepage is not reported correctly. The ether.fi team will resolve this issue tomorrow.

At the same time, the ether.fi team also apologized and responded to members who raised the points issue on Twitter and Discord. The "missing points" crisis has been temporarily resolved.

LRT points battle continues

The LRT track is gaining attention due to its three key elements: innovative technology, money-making opportunities, and compelling narratives, as well as offering higher ETH yields. With LRT, users can receive Ethereum staking rewards (~5%) + Eigenlayer re-staking rewards (~10%) + LRT protocol token emissions (~10% and more). When Eigenlayer is fully launched, the expected ETH yield will reach about 25%.

Although Lido has taken the lead in the LST field, the competition for LRT is just beginning with the emergence of numerous LRT protocols.

In the first stage of this competition, points have become the primary weapon. Puffer is a good example, as a latecomer, Puffer offers a 3x point bonus for re-stakers who withdraw stETH from Eigenlayer and deposit it into Puffer, rapidly increasing its market share to 22%, ranking second.

As a project supported by BitMEX co-founder Arthur Hayes, ether.fi has created LRT eETH through EigenLayer local re-staking. Currently, eETH holds a leading position in the LRT market, with a market share (MS) of 39%. In fact, the total locked value (TVL) of eETH in Eigenlayer even exceeds that of stETH.

In addition to equity rewards and the potential use of eETH in DeFi, this circular flow also allows depositors to simultaneously receive ether.fi loyalty points and EigenLayer re-staking points, both of which may involve eligibility for airdrops. It is reported that as of February 10, EtherFi provided 2 million Eigenlayer points (in addition to EtherFi points) from its treasury to new depositors.

Following in Puffer's footsteps, various LRT protocols have also introduced point incentives. Among them, the latecomer Eigenpie proposed that users could receive a 2x point bonus within the first 15 days (as of February 12). The points will be used for airdropping EGP tokens, accounting for 10% of the total supply. With this measure, Eigenpie quickly accumulated a TVL of 184 million USD, with a market share of 6%.

Related reading: "Risks and Best Practices for EigenLayer Re-staking"

Since points imply expectations of airdrops, the issue of "stealing" points naturally sparked community discussions. In addition, as the current Restaking protocols on the market are mostly built on EigenLayer, for users, participating in Restaking means exposing themselves to the following risks, as if the EigenLayer contract is attacked, the project's funds will also suffer losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。