News

According to @ai_9684xtpa's monitoring, a whale/institution that has accumulated 106,159 ETH has once again withdrawn 17,188 ETH from Binance about 2 minutes ago, worth approximately 50.41 million USD.

The address has currently purchased 123,347 ETH, approximately worth 363 million USD.

On February 22, Musk tweeted that Grok is far from perfect at the moment, but will be rapidly improved. The Grok V1.5 version will be released in two weeks.

According to Scopescan data, the address starting with 0xc7c, marked as "Teneo: 3AC Liquidation," currently holds a total value of encrypted assets worth 9.01 billion USD. Its holdings of WLD are currently valued at 6.23 billion USD (75 million tokens).

Market Review

The market fell and then rose yesterday. Bitcoin once dropped to around 50500, while Ethereum hit a low of around 2870. After a night of fluctuations, the market rose again, consistent with the previous expectation mentioned in the article, falling before rising. It also rebounded near the support level. After the stop-loss at 51000 in the actual trading yesterday, it rebounded near 50900. Currently, it is still being held, and the long position at 2880 for Ethereum is still in place. The oscillation is coming to an end, and a breakthrough may be imminent.

Market Analysis

Macro Analysis: Catalysts for Ethereum in the coming months. On-chain data shows that currently over 83% of addresses are in a profitable state. Catalysts mainly come from: 1. Ethereum's March Dencun upgrade, reducing costs and increasing efficiency, may drive demand for Ethereum. 2. The mainnet launch of scaling solutions @blast L2 and re-staking platform @eigenlayer. Currently, Ethereum's staked liquidity is as high as 13.62 million ETH, nearly 39.2 billion USD, and eigenlayer TVL has exceeded 7 billion. 3. Expectations for Ethereum spot ETF, which will continue to be hyped for at least the next five months.

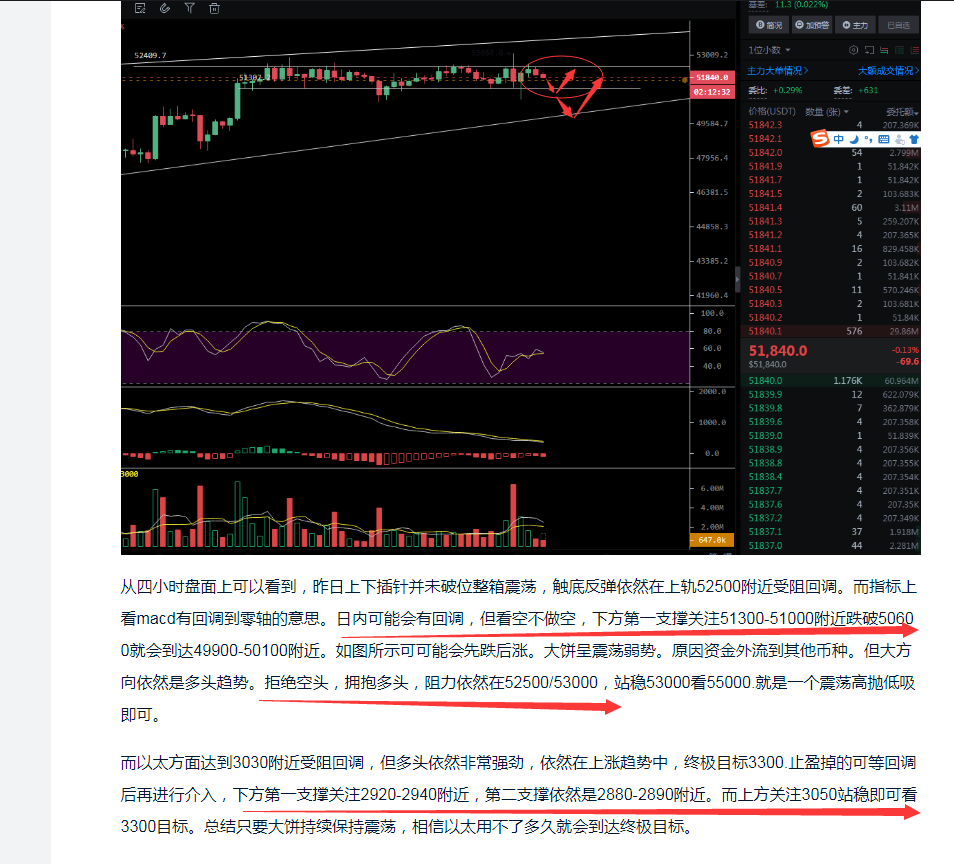

From the four-hour chart, we can see that the MACD has returned to near the zero axis, and the market has once again returned above the moving average. Overall, it is still in a box oscillation. The resistance is still around 52500, and stabilizing at 53000 could lead to a further 7% increase, around 55000. The continued oscillation of Bitcoin will inevitably lead to a new round of rise for altcoins and Ethereum. Currently, the actual long position is still being held. Watch the resistance above. For those who have not entered the market in the short term, pay attention to the support around 51500-51300. Take the opportunity to enter, and if not given the opportunity, consider right-side trading after breaking through 53000.

From the four-hour chart, we can see that the MACD has returned to near the zero axis, and the market has once again returned above the moving average. Overall, it is still in a box oscillation. The resistance is still around 52500, and stabilizing at 53000 could lead to a further 7% increase, around 55000. The continued oscillation of Bitcoin will inevitably lead to a new round of rise for altcoins and Ethereum. Currently, the actual long position is still being held. Watch the resistance above. For those who have not entered the market in the short term, pay attention to the support around 51500-51300. Take the opportunity to enter, and if not given the opportunity, consider right-side trading after breaking through 53000.

As for Ethereum, it continues to be supported around 2880. Every time it hits a new high, it returns to this level, which is like laying a foundation. The more foundations laid, the more solid it will be. Ethereum continues to look for a breakthrough at 3050 and then 3300. Long positions continue to be held. Those who have not entered the market in the short term can seek positions via private message. Exercise caution in your operations. Subsequent real-time market changes will be explained in the actual trading.

Technology is the means, and trend is the king. The dominant force in the currency circle takes you to soar in the sea of coins.

Be cautious when entering the market, as operations involve risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。