Here is the English translation:

The following is the total increase in BTC holdings by whales since 2024, according to on-chain data.

One interesting metric is "supply distribution," which shows the total amount of BTC held by different wallet groups on the network. Addresses are divided into different wallet groups based on the amount of BTC in their current balance.

In the context of the current topic, two groups are particularly relevant: "sharks" and "whales." "Sharks" typically refer to investors holding 100 to 1000 BTC, while "whales" refer to investors holding 1000 to 10000 BTC.

Because both of these groups hold a large amount of BTC, they have a certain influence in the market. Of course, "whales" are the more powerful of the two groups because they hold a larger amount.

Generally, the individual actions of members of these groups will not have a significant impact on the market, but when these investors act as a group, their scale becomes large enough to create shockwaves for crypto assets.

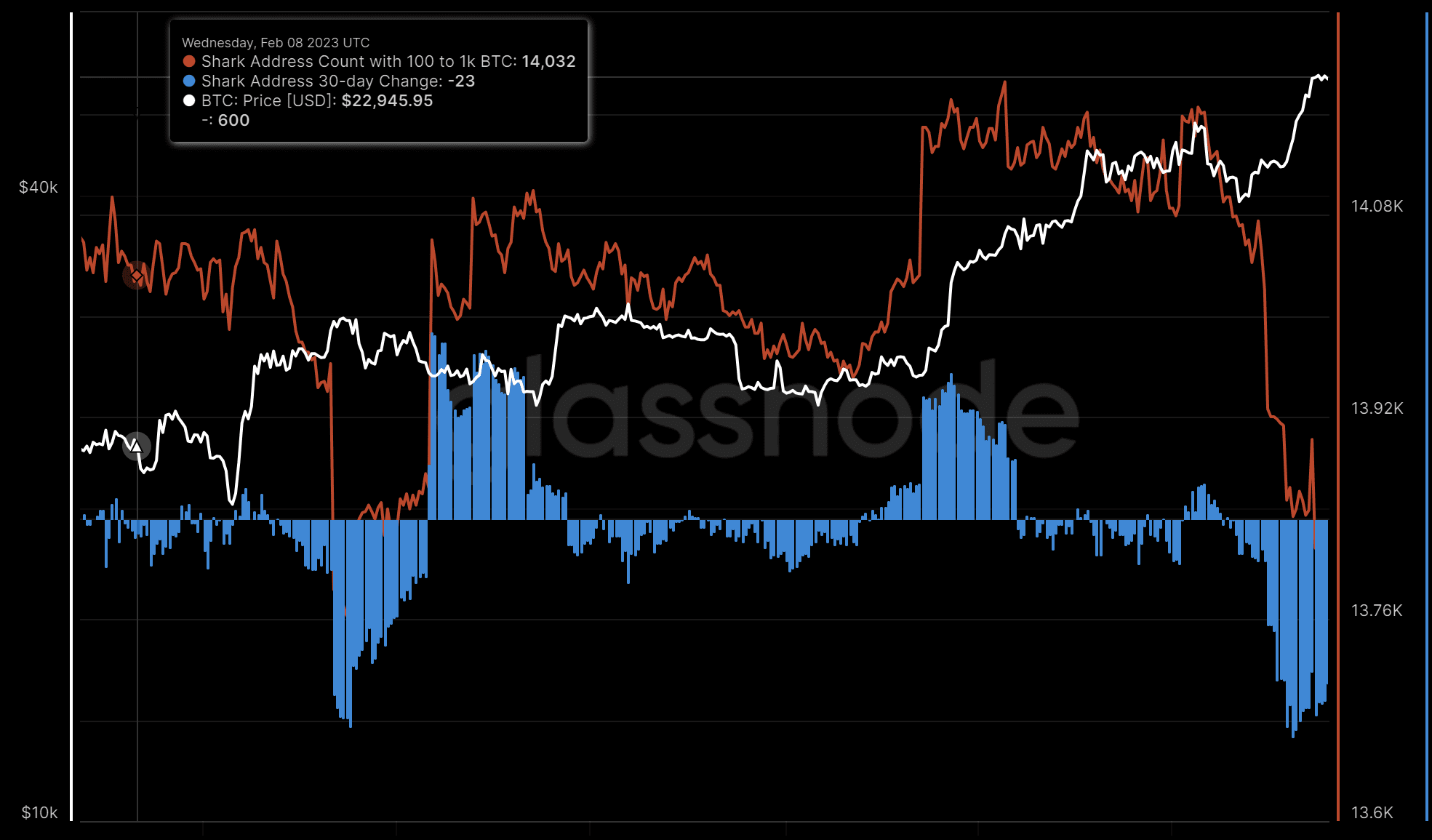

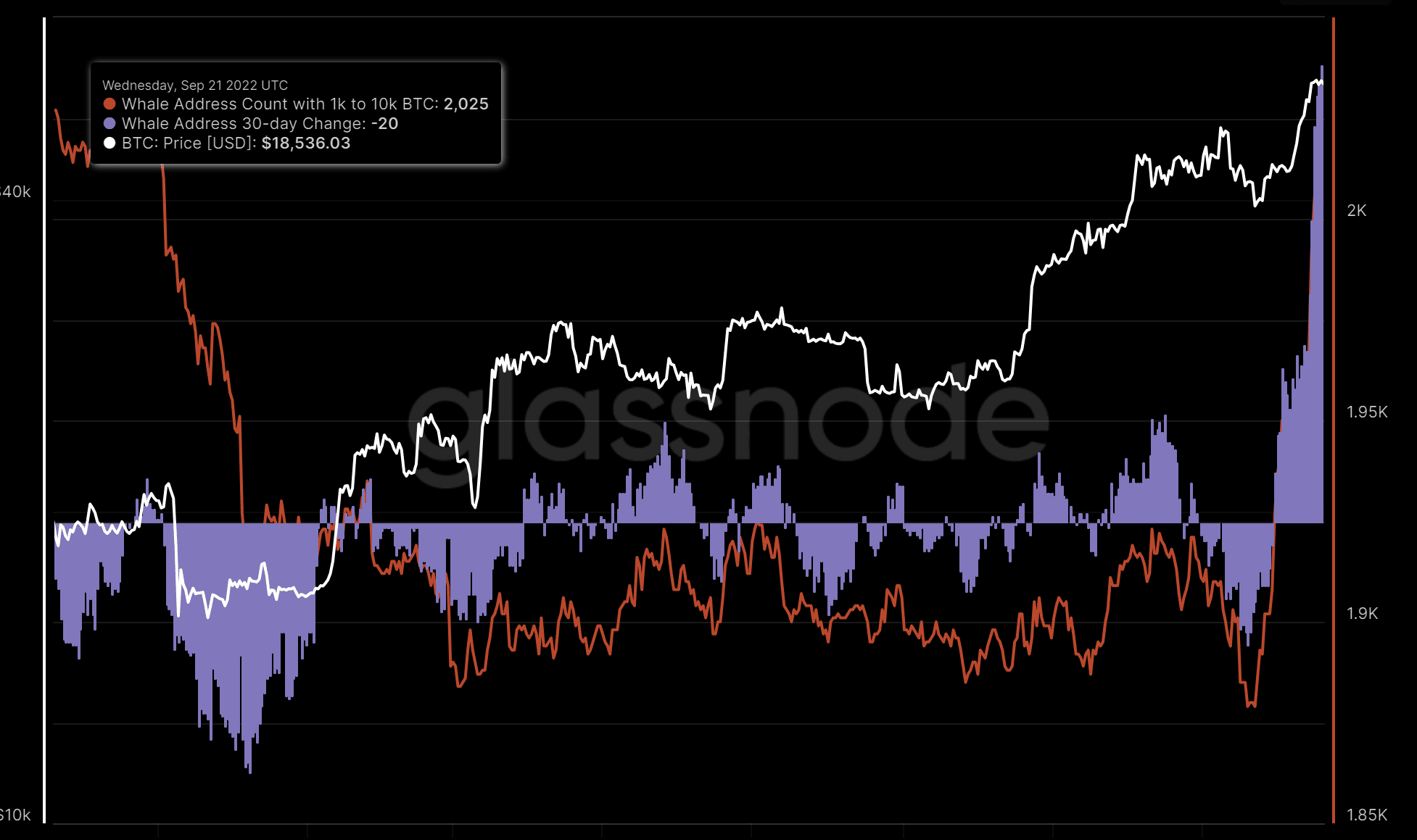

The chart below shows the trend of BTC supply distribution for these two types of investors over the past year:

As shown in the charts above, since the beginning of this year, the BTC supply of "sharks" has decreased significantly, while the BTC supply held by "whales" has been sharply increasing.

The wallet group holding 1000-10000 BTC has increased by a total of 248,900 BTC, while the wallet group holding 100-1000 BTC has sold 151,200 BTC.

Based on the current asset prices, the value of these two transactions is approximately $13 billion and $8 billion, respectively.

Clearly, although "sharks" have participated in some selling, the more influential "whales" buying has offset this loss. In terms of net worth, these large holders have accumulated $5 billion in value for the market.

In fact, some apparent selling by the "shark group" may only be because some members of the group have bought enough BTC to surpass the 1000 BTC threshold and become members of the "whale group".

In any case, the strong accumulation of "whales" is naturally a positive signal for crypto assets, as it indicates that these massive holders have provided support during the recent bullish trend in crypto assets.

In the chart, another data point can be seen: the 30-day trading volume of "whales" has recently reached its highest value in the last 30 days since June 2022, showing how these large investors are strengthening their activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。