Some DA solutions are specialized L2 or L1, even BTC L2 and L1 EVM chains such as Near and EigenLayer are taking EVM compatibility as an important development direction, so EVM compatibility is synonymous with compatibility.

Author: Zuo Ye

Abstract

- Everything is modular, Ethereum self-modularizes, Bitcoin is modularized

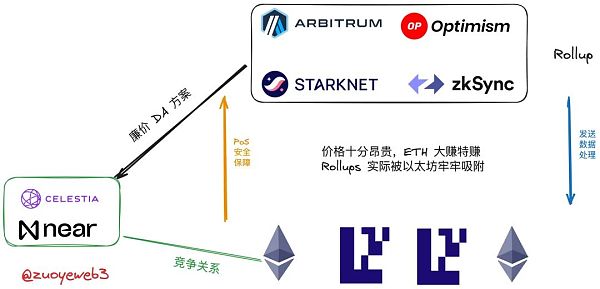

- After the launch of Rollup, the narrative stops, and the narrative economics migrates to the DA layer/chain

- Orthodoxy and generality become the main focus, in reality, transaction fees and issuance are the key

With the StarkNet airdrop as a sign, the competition for Ethereum Rollup has come to an end. Next, let's talk about DA. In my opinion, the term "Data Availability" (DA) is an incomplete expression, lacking a clear subject and predicate, only describing the importance of transmitting transaction data to layers outside the execution layer. Furthermore, the DA mechanism involves the basic operation principles of blockchain, which I have detailed in the Rune article using Bitcoin as an example.

Ethereum's narrative is weak, DA takes over midway

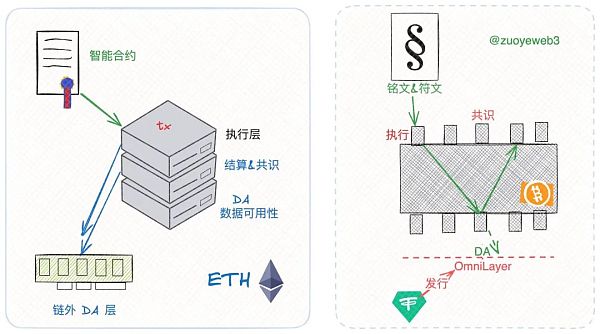

Modularity is a prerequisite for DA. Ethereum's horizontal modularity is sharding, and vertical modularity is layering. Rollup is responsible for transactions, while the mainnet is responsible for DA and consensus. The popularity of DA implies that the concept of layering has become a consensus. Furthermore, the Rollup battle has ended, and it's all about patching up from now on.

The mainnet's upgrade plan has become a daily and yearly topic, with limited confidence boost for the overall market. In this context, the narrative rhythm cannot start from the top layer of Rollup and the bottom layer of the mainnet. DA that can link the two becomes the best choice.

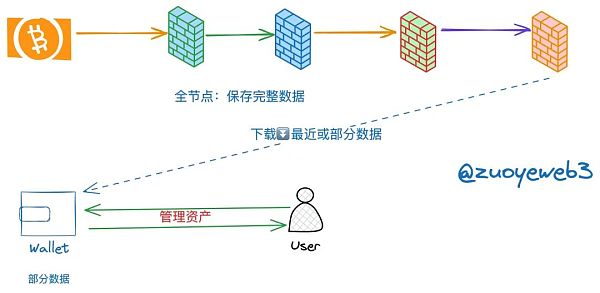

First, let's complete the expression of DA. Data availability, in a narrow sense, refers to how lightweight nodes, such as wallets, efficiently verify full node data, which involves two premises.

- Premise one: Lightweight nodes do not download or cannot download complete full node data, especially when prioritizing user experience.

- Premise two: Full node data may be subject to falsification, with no admission mechanism, whether it is PoS or PoW, there may be malicious nodes.

DA originates from practical needs

On a single-chain like Bitcoin, this is not a problem because the block header already contains rich verifiable information, and the PoW mechanism ensures that a 51% hash power attack only exists in theory. However, on a modular chain, the problem becomes complex, as transaction execution, settlement, consensus, and DA may not be on different layers, and may not even be on the same blockchain.

It is important to note that, according to Vitalik, data availability ≠ data retrieval ≠ data storage, but is equivalent to the release of data under the premise of non-tampering. As for storage and retrieval after release, they are not the focus of DA. The difference between the two lies in:

- Data release: On Ethereum, lightweight nodes can directly prove the validity of transactions without holding all the data.

- Data recovery: For Ethereum, using Ethereum for DA does not require concern about security, so the term "release" can cover it. However, Celestia and others need to prove: the data existing in my system is equivalent to being stored on Ethereum, so there may be retrieval or recovery mechanisms.

From Vitalik's perspective, once data is released on the Ethereum mainnet, the entire process is completed, and there is no need to overly worry about storage and retrieval afterwards. This actually makes sense. As the second most important existence after Bitcoin, Ethereum's security does not need technical terms to prove it.

However! There are exceptions. If transaction data and consensus data do not circulate entirely within the Ethereum system, then the release, retrieval, and even recovery of data need to be carefully considered. This is also a key point for Celestia, Near DA, and others to prove themselves.

Narrow relativism of DA: Everything can be modularized

Modularity is the direct driver of the rise of the DA narrative. Ethereum actively chose to transform itself into a modular public chain, currently in a transitional phase of hybrid architecture. Bitcoin can be used as a modular layer, as seen in the early practice of OmniLayer and the current BTC L2, both carrying this implication.

The concept of modularity here is my own definition, which includes outsourcing or being outsourced the functions of a single chain, not equivalent to Ethereum's discourse system.

Any public chain can be modularized

Alternatively, consider this: in the past, there were also issues with lightweight nodes, partial nodes, and user-verified full nodes on traditional blockchains, but it was not a large-scale market demand. Only on modular chains, the separation of layers has led to a huge problem of state synchronization, data storage, release, and recovery. After all, no one wants to see a second rollback after The DAO.

First, let's understand modularity. The earliest practice should be the Lightning Network, where modularity is similar to DePIN, another example of "practice precedes theory," outsourcing some functions or modules of the blockchain, can be understood as a delayed settlement accounting system.

For example, the earliest issuance of USDT was on Bitcoin's OmniLayer, which ultimately released data on Bitcoin, indicating that the UTXO model of blockchain can also be modularized.

The account model blockchain, such as Ethereum's modularity, is simpler, and Near DA and Celestia also follow this approach. Since everything can be decoupled, the Ethereum mainnet does not possess the extreme sanctity of Bitcoin, so it is reasonable for both Bitcoin to be used as the data release object and to "assist" Ethereum in processing data.

Without modularity, the concept of DA may still be popular, but it would not receive such a high level of attention.

The end of Ethereum Rollup battle, the rise of BTC L2

With modularity, there are leaders. Before the concept of DA, the Rollup route won the victory in the capacity expansion war, and there is even a trend spreading to BTC L2. From a more extreme perspective, modularity is the ultimate solution for capacity expansion. Regardless of the demand for security, scalability, or decentralization, it can be separated from the mainnet, built separately, and then connected to the mainnet.

However, this also brings up an interesting problem. In the case of Bitcoin, which has almost no large-scale capacity expansion solutions, BTC L2 projects have also begun to flourish. For example, B² Network uses fraud proofs to transmit data back to the Bitcoin mainnet, which is also a way of using it as a DA layer. Furthermore, Alt L1 is making a greater effort to enter the DA market. Why should Ethereum's DA monopolize the market? Orthodoxy must be overthrown, and then trampled upon, as Near DA says, they are also ready to do so.

In a sense, Ethereum is an improvement over Bitcoin, with four major differences: PoW-->PoS, UTXO-->account model, single entity-->modularity, script-->smart contracts. The interaction point between the two is precisely modularity, the convergence of the capacity expansion route. The difference is that Bitcoin is passively modularized, and more and more L2s treat Bitcoin as the DA and settlement or consensus layer.

Therefore, it must be acknowledged that "the emergence of the market demand for DA was preceded by the modularity of Ethereum, which led to the popularity of the DA layer," with the implicit premise that Rollup is no longer the protagonist, at least on Ethereum.

Here is the translation of the provided markdown:

It is necessary to make a distinction, at least between the Ethereum-based DA solutions, such as Ethereum, EigenLayer, Celestia, and Near DA, and the Bitcoin-based Lightning Network, OmniLayer, and B² Network, which effectively serve as DA solutions on the Bitcoin network.

The difference lies in the fact that for Ethereum, the solutions of Ethereum itself and EigenLayer still revolve around ETH and the Ethereum network, ultimately empowering ETH. This is rooted in the economic design of Rollup, where Rollup needs to submit "tolls" to the mainnet to use the security guarantee of the ETH PoS network. These tolls mainly refer to the DA costs, which are the costs of publishing Rollup transaction data to Ethereum for final processing.

Economic aspects of DA

For Bitcoin, it is much simpler. Bitcoin lacks smart contracts and node scrutiny, so you can write anything into the transaction data as long as you pay the miner fee. However, it is important to note that once written, there is no turning back, and data cannot be rolled back or any nodes slashed. BTC L2 must handle transaction conflicts on its own.

Ideology on the lips, business in the heart

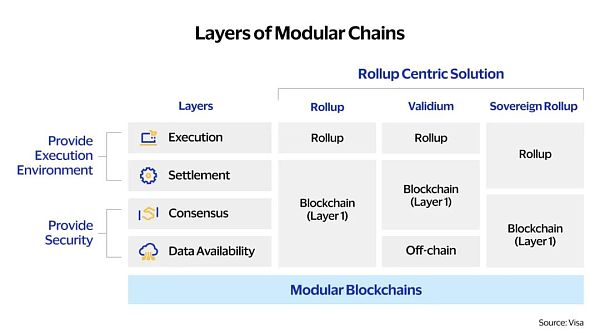

Vitalik initiated a debate on the definition and classification of L2 and Rollup, distinguishing between Rollup, Validium, and Sovereign Rollups. The main dimension lies in the choice of DA solutions. Even after the end of the Middle Ages, we can still see familiar "excommunication" operations.

Rollup distinctions summarized by Visa

We only need to remember that the issue of data availability is not purely a technical solution and definition dispute. The core lies in the cost of ETH in the PoS era, which is a matter of real money. The technical dispute is just a superficial aspect, so only a simple introduction is provided.

Narrowly speaking, data availability is about "how lightweight clients verify full node data." It can be deduced based on the following logic, originating from Vitalik and the founder of Celestia:

- Full nodes may be falsified, meaning the data provided may be problematic.

- In at least one full node, there is an honest node that has saved complete or genuine data.

- Lightweight clients must have the ability to "distinguish truth from falsehood" and promptly correct falsified data. For example, multiple lightweight nodes can cross-verify different data, which is a sampling mechanism.

The core here is the proof mechanism. In the case of Celestia, fraud proof is the core of DA operation, using fraud proof to promptly correct errors. Additionally, verifying fraud proof is faster than generating it, allowing lightweight clients to quickly complete verification without affecting user usage.

A deeper discussion of fraud proof reveals that it is very close to the optimistic verification process of OP-style Rollup, assuming it is true first and then dealing with any issues.

The reasoning logic of fraud proof:

- There is at least one honest node in the full node.

- The broadcast mechanism can operate normally, with delays below the network's validity limit.

- There is a certain number of lightweight nodes that can combine to recover complete data or equivalent data proof.

Based on this logic, it can be concluded that the security and effectiveness of lightweight nodes are equivalent to full nodes.

Since there is OP, it naturally follows that there is a ZK-style imitation. In fact, Ethereum and EigenLayer both follow the "validity proof" route, meaning that validity proofs are generated and distributed in advance, but the generation itself requires a significant amount of computational resources.

In summary, Celestia and Near DA constitute off-chain + fraud proof (OP-like) + low cost + native token DA solutions, while Ethereum and EigenLayer constitute on-chain + validity proof (ZK-like) + higher cost + ETH DA solution lineup.

Comparison of DA solutions

It should be noted that developing a DA solution based entirely on EigenLayer may not be as expensive as directly using Ethereum, and EigenLayer may also issue its own tokens. However, the central position of ETH will not change.

Secondly, the cost of each DA solution, according to Near's calculations at the end of last year, cannot represent real-time and fixed prices. Additionally, Ethereum's ongoing upgrades will also accelerate fee reductions, but the overall comparison landscape will not change.

From the perspective of the Rollups' interests, open source and cost reduction are two ways to make money. Transaction fees and token issuance are their sources of profit, which cannot be relinquished. The only way to increase profits is through cost reduction. If Ethereum continues to be used, security is sufficient, but the cost is too high, then Celestia has an opportunity.

EigenLayer is centered around ETH, while Celestia is centered around TIA. From Vitalik's perspective, this is no different from a vampire attack, using Ethereum's existing ecosystem but ultimately empowering its own token.

Orthodoxy and generality, discussing both Bitcoin and Ethereum

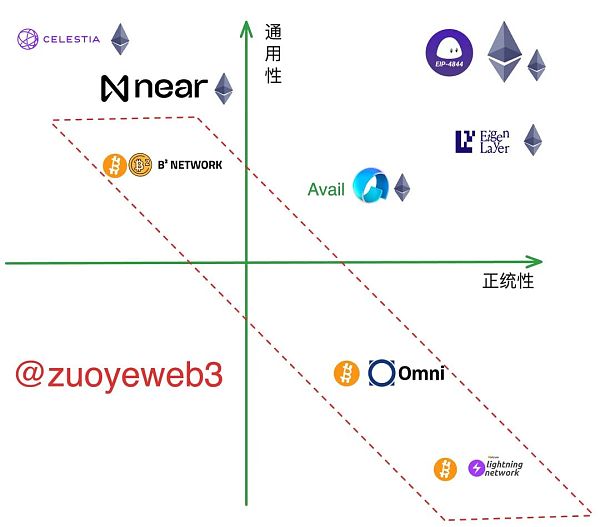

In my opinion, fractured Ethereum lacks orthodoxy, but the on-chain DA layer still possesses the highest level of security. This is true for both Bitcoin and Ethereum. Orthodoxy can also be understood as the adaptability to Ethereum and the degree of dependence of capacity expansion solutions on the Bitcoin mainnet.

In terms of generality, the design thinking of each DA solution needs to be deeply considered. Some DA solutions are specialized L2 or L1, even BTC L2 and L1 EVM chains such as Near and EigenLayer are taking EVM compatibility as an important development direction, so EVM compatibility is synonymous with compatibility.

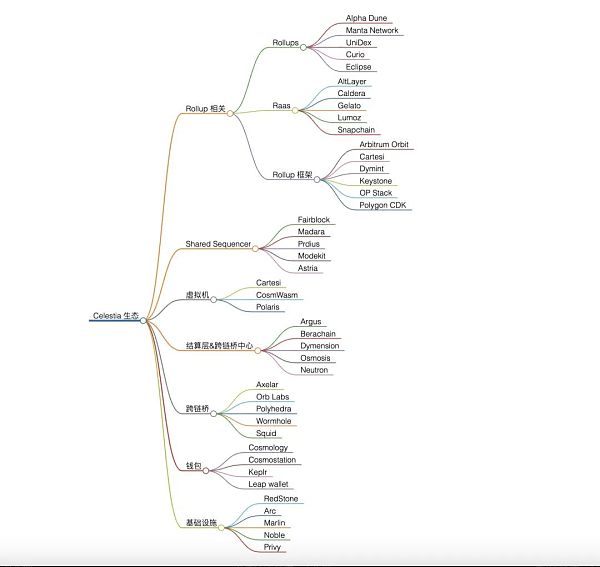

Here, the situation with Celestia is quite special. It introduces off-chain computation, so theoretically it can be compatible with any virtual machine (VM), including EVM. Additionally, Celestia is actively expanding its ecosystem, and cross-chain dApp invocation is also part of its planning.

Of course, the modularization and DA approaches of Bitcoin and Ethereum are not consistent, but doing so is just for fun.

Comparison of DA solutions

Bitcoin's DA Transformation

Strictly speaking, Bitcoin is forcibly being used as a DA layer, whether it's Pionex, Rune, or BTC L2, all emphasize the importance of storing data on Bitcoin.

At this level, the Lightning Network and B² Network represent two extremes. The Lightning Network relies entirely on the Bitcoin mainnet for settlement and does not issue its own tokens. In daily operation, it requires BTC for collateral. However, as I mentioned in the BTC L2 article, the Lightning Network is only a simple payment channel, lacking the ability to support smart contracts, and is a product of high orthodoxy and low EVM compatibility/generality.

For comparison, the orthodoxy and EVM compatibility/generality of DA in ETH, EIP-4844 ETH, and EigenLayer are similar. The only difference is that the latter three inherently have smart contract functionality, indirectly proving that the central position of ETH is not only an economic consideration but also a responsibility for the long-term development of the ecosystem. Once the ability to capture the value of ETH is lost, the entire EVM ecosystem is at risk of collapse.

In comparison, OmniLayer has made more progress, using the Bitcoin mainnet as a data publishing solution. Although it still requires nodes to download complete data and lacks an efficient proof mechanism, it also does not support complex operations. This is the main reason why USDT abandoned OmniLayer and is preparing to switch to RGB. It is difficult to call it a Bitcoin-based DA solution, but considering this is already an "ancient" product, it is purely for the sake of comparison and not a strict requirement for the old folks.

On a side note, projects like RGB++ and CKB are exploring new ways to build BTC L2, and I will publish a comprehensive article on the new developments in BTC L2 at an appropriate time. For now, I'll just lay the groundwork for future updates.

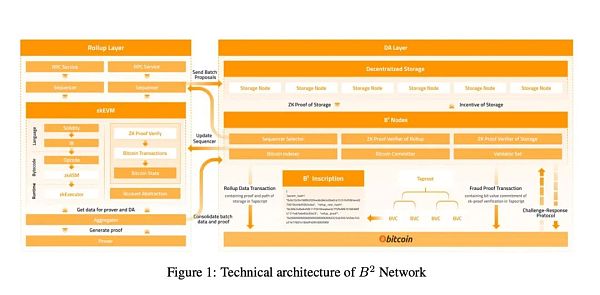

Next, taking B² Network as an example, I will explain how the "new era" BTC L2 solutions use Bitcoin as a DA layer. Unlike the unconscious usage of the Lightning Network and OmniLayer, B² Network plans to combine the data feedback and fraud proof mechanism of the Rollup layer, with a similar overall approach to Celestia.

Technical architecture of B² Network

In its design, B² Network partially separates the role of Bitcoin as a DA, with the Bitcoin mainnet playing a more settlement-oriented role. The data storage of the B² Network DA layer requires additional incentive mechanisms from B² nodes to cover the cost of decentralized storage.

The EVM compatibility of B² Network does not need to be overly scrutinized, but it is highly likely that it will issue its own tokens. Additionally, the cost-effectiveness of interacting with the Bitcoin mainnet also needs to be considered, as the cost of using Bitcoin is very high.

Overall, the DA transformation of Bitcoin is still in its early stages. It will require the widespread practical use of Pionex, Rune, and BTC L2 to generate real demand. However, it will not deviate from the path of Ethereum in practice, but there will be differences in the implementation path, considering the dual constraints of script language and storage cost.

Ethereum DA: Containing Celestia

DA is now well known and is closely related to Celestia. It was Vitalik who, in 2018, jointly published a paper titled "Fraud and Data Availability Proofs: Maximising Light Client Security and Scaling Blockchains with Dishonest Majorities" with Celestia founder Mustafa, which led to the development of the mechanism and implementation principles of DA.

Celestia's fraud proof mechanism, lightweight clients, and the minimization of the number of honest full nodes are all demonstrated in it. Subsequently, Mustafa built the precursor to Celestia under the name LazyLedger.

However, it was unexpected that after Celestia was launched in the market, it would face resistance from Vitalik, with economic disputes being the core reason, as previously analyzed and not further elaborated here.

Naturally, Celestia does not have much orthodoxy and belongs to the DA layer outside of Ethereum. Choosing Celestia as the Rollup layer of the DA has also been stripped of its name, but it still attracts more and more projects under the law of cost-effectiveness.

The operation mechanism of Celestia is not complicated, with the core being the efficient verification of full node data by lightweight nodes through the DAS (Data Availability Sampling) mechanism.

The cost-effectiveness of Celestia comes from transferring computation off-chain, which not only allows the DA layer to operate at high speed but also effectively enables compatibility with any programming language and VM (virtual machine). This also makes it friendly for the rapid development of the ecosystem for dApp development.

Currently, various applications such as Rollup solutions, RaaS, Rollup development architecture, settlement layers, cross-chain bridges, and wallets can all be developed through Celestia in a one-stop manner.

Celestia ecosystem

Facing the attack of outsiders, Ethereum emphasizes that it can also take on the role of the DA layer itself and that the cost will continue to decrease with ongoing upgrades. However, it is not wise to engage in a price war with Celestia and Near, given the existing architecture. EigenLayer has been pushed to the forefront of resistance.

Unlike Celestia, EigenLayer is essentially a collection of smart contracts on Ethereum. From this perspective, EigenLayer is Ethereum itself, but it can also be seen as an abstract virtual chain, allowing it to balance the central role of ETH and extend its role in different dimensions, such as DA, sequencer, cross-chain bridges, and L2 bridges, all of which can be built using EigenLayer. This is the essence of Eigen DA.

In simple terms, EigenLayer's so-called Liquid Restaking is a nested version of Lido. If ETH can earn income through staking while also being exchangeable for stETH as a token, then stETH can also continue to be nested, generating tokens through restaking, which serve as income certificates and can also function as complete tokens for daily use.

After the transition to the PoS mechanism, the amount of ETH staked directly relates to the health and security of the network. Currently, there are approximately 30 million ETH staked in the network, worth around $100 billion, with the attack cost second only to Bitcoin.

Since staking ensures the security of Ethereum, LSD/LRT can theoretically be nested indefinitely, continuously amplifying the token income from staking. Based on a base price of $100 billion, even a tenfold increase is only $1 trillion, which is enough to support the value of Ethereum.

The architecture of Eigen DA is not important; what is crucial is whether EigenLayer's economic model can be sustained. Even if EigenLayer fails, there is no problem using the Ethereum mainnet.

Due to space constraints, there will be no in-depth discussion of EigenLayer/ETH/EIP-4844 ETH, Near DA, and Avail. Just remember that they are all dealing with the issue of providing validity proofs without full node data.

Conclusion: DA is a long-term competition

1. The Ethereum DA market will continue to face competition for some time

The Ethereum DA market has already started, with Celestia being the first to issue the TIA token. Although EigenLayer is centered around ETH, projects that do not issue their own tokens are rare these days, so we'll have to wait and see the aftereffects.

While new DA solutions may emerge, the land grab in the Ethereum DA market has basically been completed, and there will not be much new innovation.

2. The DA transformation of Bitcoin is still facing incremental competition, and we need to wait for BTC L2 to determine the winner

In my opinion, the likelihood of Bitcoin being used as a role similar to Ethereum's DA is not very high, with the lack of smart contracts being secondary. The main issue is still the high cost, as compressing data by hundreds or thousands of times is still too expensive. Ultimately, Ethereum is not suitable for data storage, let alone Bitcoin.

References:

Mustafa Al-Bassam: "LazyLedger: A Distributed Data Availability Ledger With Client-Side Smart Contracts", 2019; arXiv:1905.09274.

Mustafa Al-Bassam, Alberto Sonnino, Vitalik Buterin: “Fraud and Data Availability Proofs: Maximising Light Client Security and Scaling Blockchains with Dishonest Majorities”, 2018; arXiv:1809.09044.

Suwito, M.H., Ueshige, Y., & Sakurai, K. (2021). Evolution of Bulletin Board & its application to E-Voting - A Survey. IACR Cryptol. ePrint Arch., 2021, 47.

EigenLayer: The Restaking Collective

Modular Blockchains: A Deep Dive

Monolithic vs. modular blockchain

The Ethereum Off-Chain Data Availability Landscape

On data availability layers

NEAR Foundation Launches NEAR DA to Offer Secure

Why NEAR Data Availability?

A comparison between DA layers

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。