This article is only a personal market view and does not constitute investment advice. If you operate according to this, you are responsible for your own gains and losses.

Less than 40%: The original "Beijing drift trader," a trend trader with a winning percentage of less than 40%.

During the Chinese New Year, I took the opportunity to carefully review the market. As those who have been following my articles know, throughout 2023, I subjectively believed that it was just a rebound market. Therefore, during the uptrend, I always advocated taking profits when things were going well and had no intention of holding for the long term. I also believed that there would be another long-term decline in the future, which formed the basis of my trading logic over the past year.

From the beginning of 2023 to early October, BTC's largest rebound was about 1x, and the entire uptrend showed a clear surge, completing all the gains in just a few days, followed by endless sideways fluctuations. This is clearly not the behavior of a bull market. However, starting from the middle and late October, the market underwent a significant change. BTC doubled in just 4 months. Not only BTC, but the entire market has experienced a very significant uptrend since the middle and late October, and new hotspots have emerged, such as NFTs. More importantly, the uptrend since October is no longer a surge, and the distribution of the uptrend compared to 2023 is more even. Many indicators show that it has moved away from the bear market range, and small coins have also formed many bottom patterns.

Based on this, it is indeed necessary to review one's own trading logic.

Today, I happened to look at the total market value trend of the cryptocurrency market excluding BTC and ETH (i.e., the trend of altcoins), and my confusion about the market was resolved. The cryptocurrency market is a whole, where one's prosperity benefits all, and one's loss affects all. For individual currencies, there are differences in strength and weakness in their trends; but for the entire cryptocurrency market, the timing of the bull-bear transition will not differ much.

The following chart shows the weekly K-line of the total market value of altcoins. From this chart, it can be clearly seen that the last small downtrend ended in the middle of October 2023. The uptrend before the middle of October was a clear 3-wave uptrend, which is a typical rebound trend. The entire bottoming process from December 2022 to October 2023 has already experienced nearly a year of significant fluctuations, and the recovery time has been sufficient.

I also looked at the trends of the top 20 currencies by market value and the ORDI of this round of hotspots. The lowest prices of most currencies appeared in the middle of September or October 2023. Among them, the three strongest currencies are: BTC, ETH, and SOL, which have already moved away from the overall trend of the cryptocurrency market.

My focus has always been on BTC, and I have been very confident in my judgment before October 2023. The trend after October was too strong, but I couldn't find a firm basis to change my views. Faced with a chorus of bullish voices and huge price increases, I felt a bit lost.

But now, combined with the trend of the total market value of altcoins and other indicators, I really believe that the bull market has truly begun. The starting point of the bull market is around the middle of October. This is just the first wave of the bull market. Looking at individual currencies, many currencies have completed a clear 5-wave uptrend from October to January.

Although the response was a bit slow, it does not affect the overall situation, after all, the entire bull market still has a long time to go. A change in mindset corresponds to a change in trading logic. If it is judged to be a rebound, then take profits when things are going well. But if it is judged to be a bull market, then I will no longer engage in spot trading for short-term trends. I will hold spot positions for the long term, and if the price experiences a significant drop, I can consider adding positions at the right time or adding a small amount of leverage.

Returning to the recent market trends, the price of BTC has already approached nearly 53,000 during the Chinese New Year, and the uptrend has been rapid. But the accumulated risks are also significant.

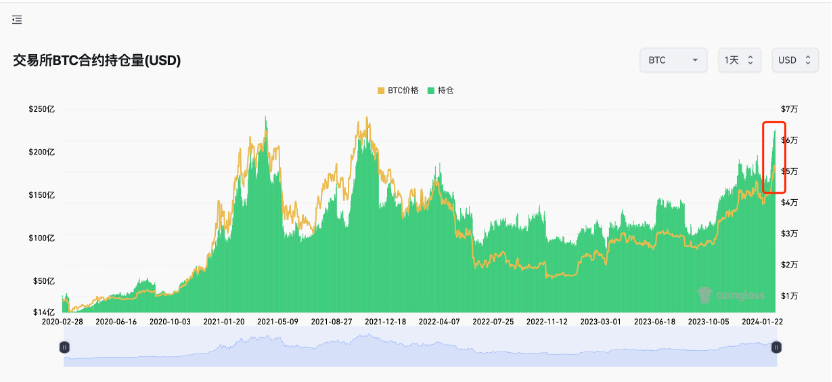

The overall open interest in contracts is close to its historical high. There is a gap of less than 1 billion USD. The growth rate of open interest since February has also been rapidly increasing.

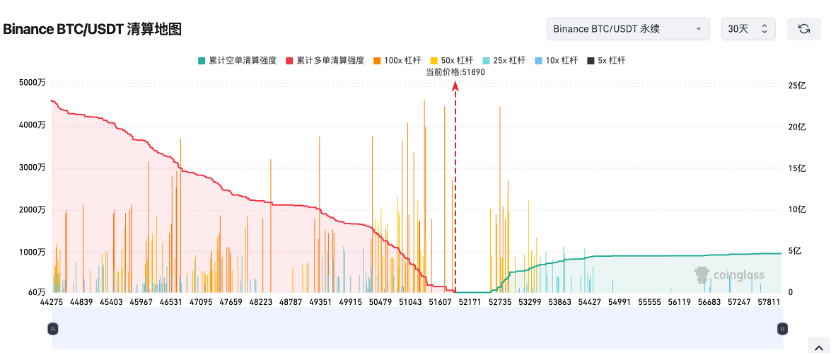

Looking at the liquidation map from Coinglass, the liquidation volume of long positions in Binance's USDT perpetual contract far exceeds that of short positions. After the price exceeds 54,000, there are basically no more liquidations for short positions.

Looking at the 8-hour trend of BTC itself, it has been in a sideways pattern at the top for some time. If it falls below 51,000, it may start another round of pullback.

Follow me and earn maximum trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。