Author: Fred

This article is 24,000 words long, with an estimated reading time of about 25 to 30 minutes.

I. Introduction: Historical Development of the BTC Ecosystem

The recent popularity of Bitcoin's inscriptions has sparked a frenzy among Crypto users. Originally considered as "digital gold," Bitcoin, which was once more of a store of value, has once again attracted attention to the development and possibilities of the Bitcoin ecosystem due to the emergence of the Ordinals protocol and BRC-20.

As the earliest blockchain, Bitcoin was born in 2008, created by an anonymous entity named Satoshi Nakamoto, marking the birth of a decentralized digital currency that challenges the traditional financial system.

In response to the inherent shortcomings of centralized financial systems, Bitcoin was created as an innovative solution, introducing the concept of a peer-to-peer electronic cash system that does not require the involvement of intermediaries, thereby achieving trustless and intermediary-free transactions. The underlying technology of Bitcoin, the blockchain, fundamentally changed the way transactions are recorded, verified, and secured. The release of the Bitcoin whitepaper in 2008 laid the foundation for emphasizing a decentralized, transparent, and tamper-resistant financial system.

After its inception, Bitcoin experienced a gradual and stable growth phase. Early adopters were mainly technology enthusiasts and cryptography supporters who began mining and trading Bitcoin. The first recorded actual transaction occurred in 2010 when programmer Laszlo purchased two pizzas in Florida for 10,000 bitcoins, marking a historic moment for the adoption of cryptocurrencies.

As Bitcoin gained increasing attention, related ecosystem infrastructure began to take shape. Exchanges, wallets, and mining pools emerged in large numbers to meet the needs of this new type of digital asset, Bitcoin. With the development of blockchain technology and the market, the ecosystem expanded to involve more stakeholders, including developers, entrepreneurial teams, financial institutions, and regulatory bodies, driving the diversification of the Bitcoin ecosystem.

The long-dormant market in 2023 was reignited by the popularity of the Ordinals protocol and BRC-20 Token, bringing about the summer of inscriptions and reigniting people's attention to the oldest public chain, Bitcoin. What will be the future development of the Bitcoin ecosystem? Will the Bitcoin ecosystem become the engine of the next bull market? This research report will delve into the historical development of the Bitcoin ecosystem and its three core directions: asset issuance protocols, scalability solutions, and infrastructure, analyzing its current status, advantages, and challenges to explore the future of the Bitcoin ecosystem.

II. Why Do We Need the Bitcoin Ecosystem

1. Characteristics and Development History of Bitcoin

Before discussing why we need the Bitcoin ecosystem, let's first take a look at the basic characteristics and development history of Bitcoin.

Unlike traditional financial accounting methods, Bitcoin has three core characteristics:

Decentralized distributed ledger: The core of the Bitcoin network is blockchain technology, a decentralized distributed ledger that records all transactions on the Bitcoin network. The blockchain consists of blocks, with each block containing the hash value of the previous block, forming a chain structure that ensures the transparency and tamper resistance of transactions.

Accounting through Proof of Work (PoW): The Bitcoin network uses a proof of work mechanism to verify transactions and maintain accounts. This mechanism requires network nodes to solve mathematical problems to verify transactions and record them on the blockchain, ensuring the security and decentralization of the network.

Mining and Bitcoin issuance: Bitcoin issuance is achieved through mining. Miners solve mathematical problems to verify transactions and create new blocks. As a reward, miners receive a certain amount of bitcoins.

It can be seen that unlike common account models such as PayPal, Alipay, and WeChat Pay, Bitcoin does not achieve transfers by directly increasing or decreasing account balances. Instead, it uses the UTXO (Unspent Transaction Output) model.

Here, let's briefly explain the UTXO model, which helps everyone understand the technical solutions of ecosystem projects. UTXO is a way of tracking ownership and transaction history of bitcoins. Each unspent output (UTXO) represents a transaction output in the Bitcoin network that has not been used in previous transactions and can be used to construct new transactions. Its characteristics can be summarized as follows:

Each transaction generates a new UTXO: When a Bitcoin transaction occurs, it consumes previous UTXOs and generates new UTXOs, which will serve as inputs for future transactions.

Transaction verification depends on UTXO: When verifying transactions, the Bitcoin network checks whether the UTXOs referenced by the transaction inputs exist and have not been used to ensure the validity of the transaction.

UTXO as transaction inputs and outputs: Each UTXO has a value and an owner's address. In new transactions, some UTXOs will be used as transaction inputs, while others will be created as transaction outputs, which may be used in subsequent transactions.

The UTXO model can provide higher security and privacy because each UTXO has its own owner and value, allowing transactions to be more finely tracked. In addition, the design of the UTXO model allows for parallel processing of transactions, as each UTXO can be used independently without resource competition.

However, due to the limitation of block size and the non-Turing complete development language, Bitcoin has largely played the role of "digital gold" and has not been able to support more projects.

After the birth of Bitcoin, colored coins appeared in 2012, allowing certain bitcoins to represent other assets by adding metadata to the Bitcoin blockchain. In 2017, the debate over block size led to hard forks, including BCH and BSV. After the fork, BTC continued to explore scalability solutions, introducing the SegWit upgrade in 2017, which introduced extended blocks and block weight, expanding block capacity. The Taproot upgrade in 2021 improved transaction privacy and efficiency. These key upgrades laid the foundation for the subsequent development of various scalability and asset issuance protocols, leading to the popularity of the Ordinals protocol and BRC-20 Token.

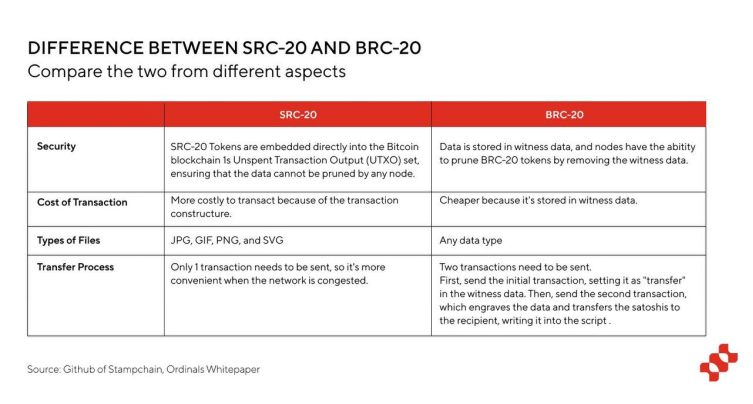

Under the Stamps protocol, the SRC-20 token standard emerged, which is comparable to the BRC-20 token standard.

- In the BRC-20 standard, all transaction data is stored in segregated witness data. Due to the adoption rate of SegWit not being 100%, there is a risk of being pruned.

- In the SRC-20 standard, data is stored in UTXO, making it permanently part of the blockchain and cannot be deleted.

BTC Stamps supports various types of assets, including NFTs, FTs, and more. The SRC-20 Token is the FT standard, with features of more secure data storage and tamper resistance. However, the drawback is that the minting cost is very high. Initially, the Mint fee for SRC-20 was around 80U, several times higher than the minting cost of BRC-20 tokens. However, after the upgrade to the SRC-21 standard on May 17 last year, the cost of a single Mint was reduced to 30U, similar to the Mint fee of ARC-20. Despite the cost reduction, it is still relatively expensive, about six times that of BRC-20 tokens (the recent Mint fee for BRC-20 is 4-5U).

Although the Minting cost of SRC-20 is relatively high, similar to ARC-20, SRC-20 only requires one transaction during Minting, while BRC-20 tokens require two transactions for Minting and transfer. When the network is smooth, the number of transactions has little impact, but once the network is congested, the time cost of initiating two transactions will significantly increase, and users will need to pay more gas to expedite transactions. Additionally, it is worth mentioning that SRC-20 Token supports four types of BTC addresses, including Legacy, Taproot, Nested SegWit, and Native SegWit, while BRC-20 only supports Taproot addresses.

In general, SRC-20 tokens have significant advantages in terms of security and transaction convenience compared to BRC-20. The non-prunable feature of SRC-20 tokens is in line with the security-focused needs of the Bitcoin community, and their free-splitting feature appears more flexible compared to the limitation of one token per satoshi in the ARC-20 standard. On the other hand, transfer costs, file sizes, and type restrictions are the current challenges facing SRC-20, and further exploration and development of SRC-20 are anticipated.

5) ORC-20

The ORC-20 standard aims to enhance the use cases of BRC-20 tokens and address existing issues with BRC-20. Currently, BRC-20 tokens can only be traded on secondary markets, and the total token supply cannot be changed. There are no mechanisms for staking or minting additional tokens to activate the entire system, as seen in the ERC-20 standard.

Furthermore, BRC-20 tokens heavily rely on external indexers for indexing and accounting. Additionally, there is a risk of double-spending attacks, as demonstrated in the early stages of Unisat's development in April 2023, when a hacker attempted a double-spending attack. Fortunately, the issue was promptly addressed and did not escalate.

To address the challenges faced by BRC-20, the ORC-20 standard was introduced. ORC-20 is compatible with the BRC-20 standard and offers improved adaptability, scalability, security, and eliminates the possibility of double spending.

Technically, ORC-20 tokens, like BRC-20 tokens, are added to the Bitcoin blockchain as JSON files. The differences include:

ORC-20 has no restrictions on names and namespaces and has flexible keys. Additionally, ORC-20 supports a wider range of JSON data formats, and all ORC-20 data is case-insensitive.

Unlike BRC-20, which has a fixed initial minting value and immutable supply after deployment, the ORC-20 protocol allows for changes to the initial issuance value and maximum minting value.

ORC-20 transactions use the UTXO model, where the sender specifies the amount to be received by the recipient and the remaining balance to be sent back to themselves. This process is similar to the UTXO process in Bitcoin, and incomplete transactions can be canceled midway. The UTXO model fundamentally prevents double spending, as UTXOs can only be used once.

ORC-20 tokens are deployed with an ID identifier, allowing even tokens with the same name to be distinguished by their IDs.

In summary, ORC-20 can be seen as an upgraded version of BRC-20, providing BRC-20 tokens with greater flexibility and a richer economic model. Due to its compatibility with BRC-20, it is also easy to package BRC-20 tokens as ORC-20 tokens.

6) Taproot assets

Taproot assets are an asset issuance protocol introduced by the Lightning Labs development team for Bitcoin's Layer 2 network. It is directly integrated with the Lightning Network. The core features and current status can be summarized as follows:

Fully based on UTXO, meaning it can integrate well with Bitcoin-native technologies such as RGB and Lightning.

Unlike Atomicals, Taproot assets, like the Runes protocol, allow users to customize the quantity of token transactions, enabling the creation or transfer of multiple tokens in a single transaction.

Integrated directly with the Lightning Network, allowing users to initiate Lightning channels with Taproot transactions, reducing transaction costs within a single Bitcoin transaction.

However, there are some drawbacks to consider:

Malicious behavior risk: Taproot Assets metadata is not stored on the chain but relies on off-chain indexers to maintain state, requiring additional trust assumptions. Data is stored locally or in the Universe (a collection of servers containing historical data and verification information for specific assets) to maintain token ownership.

Not a fair launch: Users cannot mint tokens on the Bitcoin network themselves; all tokens are issued by the project and transferred to the Lightning Network, with issuance and distribution controlled by the project, essentially losing the characteristic of a fair launch.

Elizabeth Stark, co-founder of Lightning Labs, aims to lead a Bitcoin renaissance through Taproot Assets and promote the Lightning Network as a multi-asset network. Due to the native integration of Taproot Assets with Lightning, users can directly store Taproot Assets in Lightning channels for easier transactions.

7) Current Status Analysis Summary

In summary, the emergence of the Ordinals protocol and BRC-20 token standard has brought about the craze for inscriptions and refocused attention on asset issuance protocols on Bitcoin. This has led to the emergence of diverse asset issuance protocols such as Atomicals, Runes, BTC Stamps, and Taproot Assets, as well as standards like ARC-20, SRC-20, and ORC-20.

In addition to the mainstream asset issuance protocols mentioned above, many other asset protocols are also being conceived and developed. For example, BRC-100 is a decentralized computing protocol based on the Ordinals theory, aiming to enrich the use cases of assets and support applications such as DeFi and GameFi. The BRC-420 standard, similar to ERC-1155, can combine multiple inscriptions into a complex asset, with many applications in gaming and the metaverse (e.g., the ERC-1155 protocol is suitable for NFT and FT combinations in gaming scenarios). Even meme coin communities are starting to introduce new asset protocols on Bitcoin, such as the Dogecoin community's introduction of DRC-20, presenting a diverse landscape of asset protocols.

From the current project status, asset issuance protocols can be divided into the BRC-20 camp and the UTXO camp. The former includes BRC-20 and its enhanced version, ORC-20, which engraves data in segregated witness script data and relies on off-chain indexers for indexing and accounting. The latter mainly includes ARC-20, SRC-20, Runes, and Pionex's asset types, as well as Taproot Assets.

The two camps of BRC-20 and ARC-20 also symbolize two approaches to Bitcoin ecosystem asset protocols:

One is the highly concise solution represented by BRC-20. Although its functionality is not complex, the entire approach and code are very simple and elegant, satisfying the minimum unit of requirements with just a few lines of innovation, making it a very good MVP version.

The other is represented by protocols like ARC-20, which address issues as they arise. In the development process of ARC-20, many bugs and areas needing optimization have emerged, but addressing issues as they arise leans more towards a bottom-up development approach.

Currently, due to its first-mover advantage, BRC-20 has already taken the lead in asset protocols. In the future, standards such as SRC-20 and ARC-20 will compete with BRC-20, and we eagerly await who will take the lead and even surpass BRC-20.

Returning to the essence, on the one hand, the "inscription" track has brought a new mode of fair launch to retail investors, bringing significant attention to the Bitcoin ecosystem. On the other hand, according to OKLink's data, since December last year, miners' income from transaction fees has exceeded 10%, bringing tangible benefits to miners. With the driving force of the Bitcoin ecosystem community, the inscription ecosystem and asset issuance protocols on Bitcoin will continue to enter a new era of exploration and development.

2. On-chain Scalability

The asset issuance protocol has sparked renewed interest in the Bitcoin ecosystem. However, due to the scalability and transaction confirmation time challenges of Bitcoin, addressing on-chain scalability is an area that requires attention for the long-term development of the ecosystem.

In terms of improving Bitcoin's scalability, there are currently two main development paths: on-chain scalability, optimizing on the Bitcoin Layer 1, and off-chain scalability, commonly known as Layer 2. In this section and the next, we will discuss the development of the Bitcoin ecosystem from the perspectives of on-chain scalability and Layer 2. In terms of on-chain scalability, the goal is to increase the transactions per second (TPS) through block size and data structure optimization, as seen in BSV and BCH. However, these approaches have not gained consensus in the mainstream BTC community. Among the mainstream on-chain scalability upgrade solutions, the most noteworthy are the SegWit upgrade and the Taproot upgrade.

1) SegWit Upgrade

In July 2017, Bitcoin underwent the Segregated Witness (SegWit) upgrade, significantly improving scalability. It was a soft fork.

The main goal of SegWit was to address the transaction processing capacity limitations and high transaction fees faced by the Bitcoin network. Prior to SegWit, Bitcoin transactions were limited by 1MB blocks, leading to transaction congestion and high fees. SegWit reorganized the transaction data structure by separating the witness data (including signatures and scripts) and storing it in a new part called the "witness area." By separating the transaction signature data from the transaction data, SegWit effectively increased the block's capacity.

SegWit introduced a new block size measurement unit called weight units (wu). Blocks without SegWit had 1 million wu, while blocks using SegWit had 4 million wu, allowing block size to exceed the 1MB limit, effectively increasing block capacity. This increased the Bitcoin network's throughput, enabling each block to accommodate more transaction data. Additionally, due to the increased block capacity, SegWit allowed more transactions to enter each block, reducing transaction congestion and the rise in transaction fees.

Furthermore, the significance of the SegWit upgrade extends beyond these improvements. It also paved the way for many significant events, including the subsequent Taproot upgrade, which to a large extent, built upon the foundation of the SegWit upgrade. For example, the explosive growth of the Ordinals protocol and the operation of BRC-20 tokens in 2023 were also based on segregated data. In a sense, the SegWit upgrade became a booster and foundation for this summer of inscriptions.

2) Taproot Upgrade

The Taproot upgrade is another important upgrade to the Bitcoin network, implemented in November 2021, combining three related proposals: BIP 340, BIP 341, and BIP 342, with the aim of improving Bitcoin's scalability. The goal of the Taproot upgrade is to enhance the privacy, security, and functionality of the Bitcoin network. It achieves this by introducing new smart contract rules and cryptographic signature schemes, making Bitcoin transactions more flexible, secure, and privacy-enhanced.

The core advantages of the upgrade can be summarized as follows:

Schnorr Multi-Signature Aggregation: BIP 340 introduces Schnorr signatures, allowing multiple public keys and signatures to be aggregated into a single public key and signature, reducing the size of transaction data. By aggregating signatures, the network can process more transactions, making overall operations faster, cheaper, and maximizing block space savings.

Stronger Privacy: BIP 341's P2TR uses a new script type that combines the functionalities of the previous two scripts, P2PK and P2SH, introducing another privacy element and providing a better transaction authorization mechanism. P2TR also makes all Taproot outputs look similar, eliminating distinctions between multi-signature and single-signature transactions. This makes it more difficult to identify the transaction inputs of each participant storing private data.

Enabling More Complex Smart Contracts: Previously, Bitcoin's smart contract functionality was limited, but the Taproot upgrade allows multiple parties to sign a single transaction using Merkle tree. Taproot introduces a new script type called "Tapscript," allowing developers to write more complex smart contracts, including conditional payments, multi-party consensus, and other functions, opening up more possibilities for Bitcoin's future development.

In summary, through the SegWit and Taproot upgrades, the Bitcoin network has improved its scalability, transaction efficiency, privacy, and functionality, laying a solid foundation for future innovation and development.

3. Off-chain Scalability: Layer 2

Due to the inherent limitations of Bitcoin's chain structure and the decentralized nature of the Bitcoin community consensus, on-chain scalability solutions often face community skepticism. As a result, many builders have begun to explore off-chain scalability, building off-chain scalability protocols or Layer 2 solutions on top of the Bitcoin network.

Currently, Bitcoin's Layer 2 types can be roughly categorized based on data availability and consensus mechanisms as state channels, sidechains, Rollups, and others such as the RGB scalability protocol to enhance network scalability.

1) State Channels

State channels are temporary communication channels created on the blockchain for efficient interactions and transactions off-chain. They allow participants to engage in multiple interactions with each other and record the final results on the blockchain. State channels can improve transaction speed, throughput, and reduce associated transaction fees.

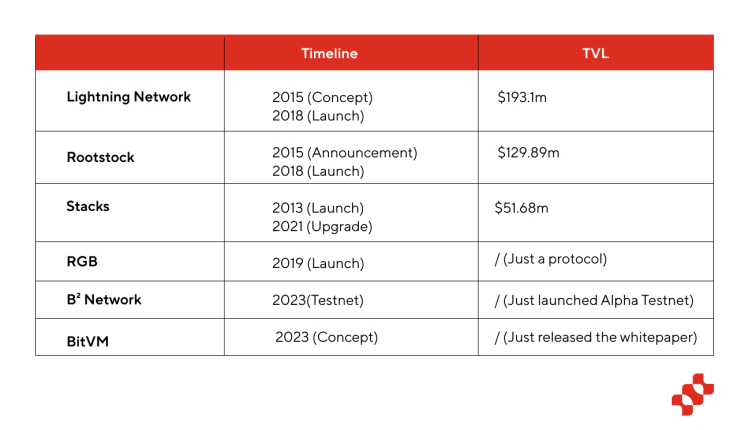

When discussing Layer 2 state channels, the most essential mention is the Lightning Network. The earliest state channel project on the blockchain was the Lightning Network on Bitcoin. The concept of the Lightning Network was first proposed in 2015, and it was implemented by Lightning Labs in 2018.

The Lightning Network is a state channel network built on the Bitcoin blockchain, allowing users to conduct fast transactions off-chain by opening payment channels. The successful launch of the Lightning Network marked the first implementation of state channel technology and laid the foundation for subsequent state channel projects and developments.

Next, let's focus on the implementation technology of the Lightning Network. As a Layer 2 payment protocol built on the Bitcoin blockchain, the Lightning Network aims to facilitate fast transactions between participating nodes and is considered an effective solution to Bitcoin's scalability issues. The core of the Lightning Network lies in the majority of transactions occurring off-chain, with the final state confirmation recorded on-chain.

First, parties use the Lightning Network to open payment channels and transfer funds to Bitcoin based on smart contracts as collateral. Then, parties can conduct any number of off-chain transactions using the Lightning Network to update the temporary allocation of channel funds, without the need for on-chain recording. When parties complete transactions, they close the payment channel, and smart contracts allocate the committed funds based on the transaction records.

The next step is the closure of the Lightning Network. A node first broadcasts the current transaction record status, including settlement proposals and the allocation of committed funds, to the Bitcoin network. If both parties confirm the proposal, the funds are immediately paid on-chain, completing the transaction.

Another scenario is abnormal closure, such as when a node exits the network or broadcasts an incorrect transaction status. In this case, settlement is delayed until the dispute period, during which nodes may raise objections to settlement and fund allocation. If the challenging node broadcasts an updated timestamp, including some transactions omitted from the initial proposal, the correct result will be recorded based on the subsequent correct result, and the collateral of the malicious node will be confiscated and rewarded to the other node.

From the core logic of the Lightning Network, it has the following advantages:

Real-time payments, no need to create transactions for each payment on the blockchain, payment speed can reach milliseconds to seconds.

High scalability. The entire network can process hundreds of millions to tens of billions of transactions per second, far exceeding traditional payment systems' capacity, and can be operated and paid without relying on intermediaries.

Low cost. By conducting transactions and settlements off the blockchain, the Lightning Network has extremely low fees, making it possible for emerging applications such as instant micropayments.

Cross-chain capability. Atomic swaps can be performed off-chain using heterogeneous blockchain consensus rules. As long as the blockchain supports the same cryptographic hash function, cross-chain transactions can be conducted without the need for a trusted third-party custodian.

Although the Lightning Network also faces some challenges, such as the need for users to learn and understand its usage, opening, and closing, overall, the Lightning Network, by establishing a Layer 2 transaction protocol on Bitcoin, allows a large number of transactions to occur off-chain, relieving the burden on the Bitcoin mainnet. The total value locked (TVL) has now reached nearly $200 million.

However, Layer 2 state channels, such as the Lightning Network, are limited to transaction scenarios and cannot support a wider range of applications and scenarios like Ethereum's Layer 2. This has led many Bitcoin developers to consider broader Bitcoin Layer 2 solutions.

After the birth of the Lightning Network, Elizabeth Stark has also introduced asset protocols such as Taproot Assets to enrich and broaden the usage scenarios of the Lightning Network. Additionally, some scalability solutions have integrated with the Lightning Network to expand their usage. The Lightning Network is not only a state channel but also a foundation for various BTC ecosystem developments.

2) Sidechains

The concept of sidechains was first mentioned in the 2014 paper "Enabling Blockchain Innovations with Pegged Sidechains" by Adam Back, the inventor of Hashcash. It proposed that if Bitcoin were to provide better services, there would be much room for improvement. Therefore, the sidechain technology was introduced to enable the transfer of Bitcoin and other blockchain assets between multiple blockchains.

In simple terms, a sidechain is an independent blockchain network running parallel to the main chain, with custom rules and functionality to achieve higher scalability and flexibility. In terms of security, these sidechains need to maintain their own security mechanisms and consensus protocols, so their security depends on the design of the sidechain. Sidechains typically have greater autonomy and customization but may have lower interoperability with the main chain. Additionally, a key element of sidechains is the ability to transfer assets from the main chain to the sidechain for use, often involving cross-chain transfers and asset locking operations.

For example, Rootstock ensures the security of the sidechain network through merged mining, while Stacks uses the Proof of Transfer (PoX) consensus mechanism. The following examples will help to understand the current status of BTC sidechain solutions.

First, let's take a look at Rootstock. Rootstock (RSK) is a sidechain solution for Bitcoin, aiming to provide more functionality and scalability to the Bitcoin ecosystem. RSK's goal is to introduce smart contract functionality to the Bitcoin network, providing a more powerful decentralized application (DApp) development platform and advanced smart contract capabilities. The TVL has reached $130 million.

The core design of RSK is to connect Bitcoin with the RSK network through sidechain technology. The sidechain is an independent blockchain that can interact bidirectionally with the Bitcoin blockchain. This enables the creation and execution of smart contracts on the RSK network while leveraging the security and decentralization of Bitcoin.

RSK's core advantages include Ethereum language compatibility and merged mining:

Ethereum language-friendly: One of RSK's main advantages compared to other smart contract platforms like Ethereum is its compatibility with Ethereum. RSK's virtual machine (RSK Virtual Machine) is an improved version of the Ethereum Virtual Machine (EVM), allowing developers to use Ethereum smart contract development tools and languages to build and deploy smart contracts. This provides developers with a familiar development environment and the ability to leverage Bitcoin's strong security.

Merged mining to incentivize miner participation: RSK also introduces a consensus algorithm called "merged mining," which is combined with Bitcoin's mining process. This means that Bitcoin miners can mine RSK while mining Bitcoin, providing security for the RSK network. This mechanism aims to increase the security of the RSK network and provides an incentive for Bitcoin miners to participate in the operation of the RSK network. Since both blockchains use the same consensus, Bitcoin and RSK consume the same mining power, allowing miners to contribute hash rate to mine blocks on RSK. Ultimately, merged mining can increase miners' profitability without requiring additional resources.

RSK attempts to address Bitcoin's long transaction confirmation times and network congestion by placing smart contracts on the sidechain. It provides a powerful platform for developers to build decentralized applications and adds more functionality and scalability to the Bitcoin ecosystem, promoting greater adoption and innovation.

RSK creates a new block approximately every 30 seconds, significantly faster than Bitcoin's 10-minute block time. In terms of transactions per second (TPS), RSK ranges from 10-20, significantly faster than the Bitcoin network. However, it still falls short compared to the high performance of Ethereum Layer 2 and faces some challenges in supporting high-concurrency applications.

Next, let's look at Stacks. Stacks is a Bitcoin-based sidechain with its own consensus mechanism and smart contract functionality. The Stacks blockchain interacts with the Bitcoin blockchain, achieving security and decentralization, and provides incentives through the Stacks token (STX).

Stacks, initially known as Blockstack, began its project in 2013. The Stacks testnet was launched in 2018, and its mainnet was released in October 2018. In January 2020, with the release of Stacks 2.0 mainnet, the network underwent a significant update. This update natively connected and anchored Stacks with Bitcoin, allowing developers to build decentralized applications.

One notable aspect of Stacks is its consensus mechanism—Proof of Transfer (PoX). PoX is a variant of Proof of Burn (PoB). PoB was initially proposed as the consensus mechanism for the Stacks blockchain. In the "Proof of Burn" mechanism, miners participating in the consensus algorithm send Bitcoin to a burn address to prove that they have incurred costs for the new block. In the PoX mechanism, this approach is modified: the cryptocurrency used is not destroyed but distributed to a group of participants who help ensure the security of the new chain.

In Stacks' consensus mechanism, miners who want to mine the Stacks token STX and participate in the consensus need to send Bitcoin transactions to predefined random Bitcoin addresses to generate blocks on the Stacks blockchain. The selection of the miner who can generate a block is ultimately determined by sorting. The probability of being selected increases with the amount of Bitcoin transferred to the list of Bitcoin addresses, and the Stacks protocol rewards them with STX.

In a sense, Stacks' consensus mechanism mimics Bitcoin's proof-of-work mechanism. However, Stacks miners do not consume energy to mine new blocks but use Bitcoin to maintain the Stacks blockchain. In terms of Bitcoin's programmability and scalability, Proof of Transfer is a very sustainable solution. Due to the relatively niche development language Clarity used by Stacks, the number of active developers has not been particularly high, and ecosystem development has been relatively slow, with the current TVL at only $50 million. Although the official claim is that it is a Layer 2, it currently falls more into the category of a sidechain.

It will only become a true Layer 2 after its Nakamoto upgrade planned for the second quarter of this year. The Nakamoto Release is a hard fork set to be launched on the Stacks network, increasing transaction throughput and achieving 100% finality for Bitcoin transactions.

One of the most significant changes in the Nakamoto upgrade is the acceleration of block confirmation time, reducing transaction confirmation time from Bitcoin's 10 minutes to a few seconds by increasing block production rate to approximately one new block every 5 seconds. Transactions may be confirmed within a minute, which is very beneficial for the development of DeFi projects.

In terms of security, the Nakamoto upgrade will align the security of Stacks transactions with the security of the Bitcoin network. Network integrity has also been improved, enhancing the network's ability to handle Bitcoin reorganizations. Even in the event of a Bitcoin reorganization, most Stacks transactions will remain valid, ensuring the network's reliability.

In addition to the Nakamoto upgrade, Stacks will also introduce sBTC. sBTC is a decentralized programmable 1:1 Bitcoin-backed asset that can be deployed and transferred between Bitcoin and Stacks (L2). sBTC enables smart contracts to write transactions to the Bitcoin blockchain, and in terms of security, transfers are secured by the entire Bitcoin hash power.

In addition to Rootstock and Stacks, there are different sidechain solutions such as Liquid Network, which aim to improve the scalability of the Bitcoin network through different consensus mechanisms.

3) Rollup

Rollup is a Layer 2 solution built on the main chain, which improves throughput by moving most of the computation and data storage from the main chain to the Rollup layer. In terms of security, Rollup relies on the security of the main chain, and transaction data on the chain is usually batched and submitted to the main chain for verification. Rollup often does not require direct asset transfers, as assets remain on the main chain, and only verification results are submitted to the main chain.

Although Rollup is often considered the most orthodox Layer 2 solution, with broader use cases compared to state channels and inheriting Bitcoin's security more than sidechains, development is still in a very early stage. Here, we briefly introduce Merlin Chain, B² Network, and BitVM.

Merlin Chain is a Layer 2 solution developed by the Bitmap and BRC-420 development team Bitmap Tech, which aims to improve Bitcoin's scalability through ZK-Rollup. Bitmap, as a fully on-chain, decentralized, and fair-launch metaverse project, has over 33,000 holders of its asset Bitmap, surpassing Sandbox as the project with the most holders in the metaverse.

Merlin Chain has recently launched its testnet, allowing for free cross-chain asset transfers between Layer 1 and Layer 2, and supports the native Bitcoin wallet Unisat. In the future, it will also support Bitcoin native asset types such as BRC-20, Bitmap, BRC-420, Atomicals, SRC20, and Pipe.

In terms of implementation, the sequencer on Merlin Chain batch processes transactions, generates compressed transaction data, ZK state roots, and proofs. The compressed transaction data and ZK proofs are uploaded to BTC network's Taproot by decentralized oracles to ensure network security. In terms of decentralized oracles, each node needs to stake BTC as a penalty, and users can challenge ZK-Rollup based on compressed data, ZK state roots, and ZK proofs. Successful challenges will confiscate BTC from the staking node, preventing oracle misconduct. The network is still in the testing phase, and it is expected to go live on the mainnet within two weeks.

In addition to Merlin Chain, another Bitcoin Layer 2 Rollup solution is B² Network, which aims to increase transaction speed and diversify applications without sacrificing security. Its core features can be summarized in the following two aspects:

Rollup solution: B² Network provides an off-chain transaction platform that supports Turing-complete smart contracts, improving transaction efficiency and reducing costs. Unlike sidechains and scaling solutions, Rollup better inherits the security of the Bitcoin blockchain.

Combining ZKP and fraud proofs: By combining zero-knowledge proof (ZKP) technology and a challenge-response protocol for fraud proofs with Bitcoin's Taproot, it ensures enhanced transaction privacy and security.

Regarding how B² Network implements BTC Layer 2 Rollup, we can look at its core Rollup Layer and DA Layer (Data Availability Layer). In terms of the Rollup layer, B² Network uses ZK-Rollup as the Rollup layer, responsible for executing user transactions within the Layer 2 network and producing related proofs. The DA layer includes decentralized storage, B² nodes, and the Bitcoin network. This layer is responsible for permanently storing rollup data copies, verifying rollup ZK proofs, and ultimately confirming them through Bitcoin.

Additionally, BitVM aims to reduce congestion on the Bitcoin blockchain by processing Turing-complete smart contracts and complex computations off-chain. In October 2023, Robin Linus released the BitVM whitepaper, hoping to improve Bitcoin's scalability and privacy through the development of zero-knowledge proof (ZKP) solutions. BitVM uses Bitcoin's existing script language to represent NAND logic gates on Bitcoin, enabling Turing-complete smart contracts.

In BitVM, there are two main roles: provers and verifiers. Provers are responsible for initiating computations or assertions, essentially presenting a program and asserting its expected result. Verifiers verify this claim to ensure the accuracy and trustworthiness of the computation results.

In case of disputes, such as verifiers questioning the accuracy of the provers' assertions, the BitVM system uses a challenge-response protocol based on fraud proofs. If the prover's claim is not true, the verifier can send a fraud proof to the immutable ledger of the Bitcoin blockchain, proving fraudulent behavior and maintaining the overall trustworthiness of the system.

However, BitVM is still in the whitepaper and development stage, and it will be some time before actual use. Overall, the entire BTC Rollup track is still in a very early stage, and the future performance of these networks, whether in supporting DApps or TPS and other performance indicators, still needs to be tested by the market after the networks go live.

4) Others

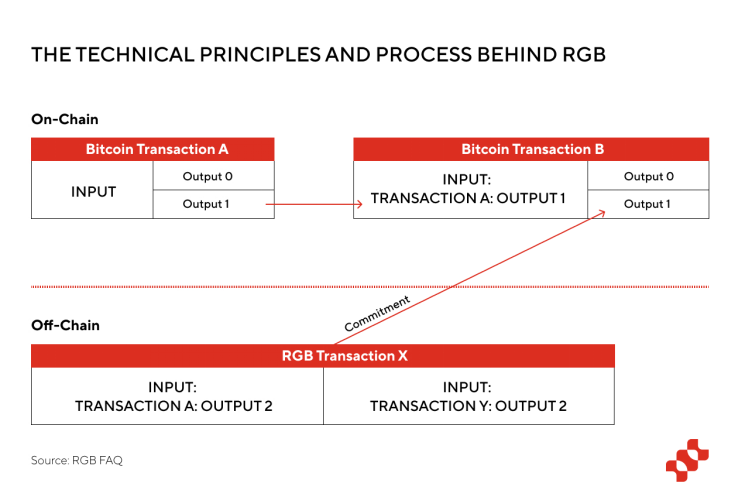

In addition to the aforementioned state channels, sidechains, and Rollup, there are also some off-chain scaling solutions that use client-side validation, with the most representative being the RGB protocol.

RGB is a private and scalable client-side validated smart contract system developed by the LNP/BP Standards Association on Bitcoin and the Lightning Network. Initially proposed by Giacomo Zucco and Peter Todd in 2016, RGB was named with the intention of becoming a "better version of colored coins."

RGB addresses Bitcoin's scalability and transparency issues by using smart contracts. In the smart contract, two users reach an agreement in advance, and once the conditions of the agreement are met, it is automatically completed. Additionally, since RGB is integrated with Lightning, there is no need for KYC, maintaining anonymity and privacy, as there is actually no need to interact with the Bitcoin main chain.

The RGB protocol aims to open up a scalable new world for Bitcoin, including issuing NFTs, tokens, fungible assets, implementing DEX functionality, and smart contracts. Bitcoin Layer 1 serves as the foundational layer for final settlement, while Layer 2 solutions such as the Lightning Network and RGB are used for faster anonymous transactions.

RGB has two core features: client-side validation and one-time sealing.

Client-side validation mode: RGB operates in client-side validation mode, implementing smart contracts. In RGB, data is stored off-chain, and smart contracts are only responsible for validating the data's validity and executing related logic. Bitcoin transactions or Lightning channels are only used as anchor points for validating data, while the actual data and logic are validated by the client. This design allows RGB to build a smart contract system on top of Bitcoin and the Lightning Network without modifying their protocols.

One-time sealing: RGB tokens need to be associated with specific UTXOs. When spending UTXOs, a Bitcoin transaction will include a message commitment, indicating that the message contains RGB inputs, the destination UTXO, asset ID, and amount. Although transferring RGB tokens requires a Bitcoin transaction, the output UTXO for RGB transfer does not need to be the same as the Bitcoin output UTXO, meaning that tokens on RGB can be output to a completely unrelated UTXO without leaving a trace on Bitcoin. Once you send assets through RGB, you will not be able to see where they went, and even if you receive assets, their transaction history is difficult to trace, providing greater privacy protection for users.

From the one-time sealing mentioned above, it can be seen that each contract state in RGB is associated with a specific UTXO and is restricted by Bitcoin scripts to access and use that UTXO. This design ensures the uniqueness of contract states, as each UTXO can only be associated with one contract state and cannot be reused after use, and different smart contracts do not directly intersect in the transaction history. Anyone can verify the validity and uniqueness of contract states by checking Bitcoin transactions and related scripts.

By leveraging Bitcoin's script functionality, RGB has established a secure model where ownership and access rights are defined and executed by scripts. This allows RGB to build a smart contract system on the security foundation of Bitcoin and ensure the uniqueness and security of contract states.

Therefore, RGB smart contracts provide a more layered, scalable, private, and secure approach. As an innovative attempt in the Bitcoin ecosystem, it aims to support the construction of more diverse and complex applications and functionalities without sacrificing the security and decentralization of Bitcoin.

5) Current Situation Analysis Summary

Since the birth of Bitcoin, many developers have been working on scaling Bitcoin and building Layer 2 solutions to enable more applications. The popularity of NFTs has brought attention back to the Bitcoin Layer 2 field.

In terms of state channels, the Lightning Network is one of the earliest and most well-known Layer 2 solutions, reducing the load and transaction latency of the Bitcoin network by establishing bidirectional payment channels. Currently, the Lightning Network has gained widespread adoption and development, with increasing numbers of nodes and channel capacity. This provides faster transaction speeds and low-cost micropayment capabilities for Bitcoin. In terms of TVL performance, the Lightning Network still has the highest TVL among Layer 2 solutions, approaching $200 million, far ahead of other solutions.

In the sidechain field, Rootstock and Stacks are working to improve the scalability of the Bitcoin ecosystem in different ways. RSK incentivizes Bitcoin miners to participate in the operation of the RSK network through merged mining, providing a platform for developers to build decentralized applications. Stacks provides additional functionality and scalability to the Bitcoin network through the transfer of proof and smart contract capabilities. However, it still faces some challenges in ecosystem development and developer activity. Additionally, after the future Nakamoto upgrade, Stacks is expected to become a true Bitcoin Layer 2 solution.

In terms of Layer 2 Rollup, development is relatively slow, with the main idea being to offload the execution process to off-chain and then prove the correctness of smart contract execution on-chain through different methods. Currently, Merlin Chain and B² Network have launched testnets, and their performance is yet to be observed. BitVM is still in the whitepaper stage, with a long way to go in its future development.

In addition, there are off-chain scaling protocols like RGB, which operate in client-side validation mode to implement smart contracts. RGB stores data off-chain, and smart contracts are only responsible for validating the data's validity and executing related logic. Bitcoin transactions or Lightning channels are only used as anchor points for validating data, while the actual data and logic are validated by the client.

Overall, Bitcoin developers are working and experimenting in different directions such as state channels, sidechains, scaling protocols, and Layer 2 Rollup. The emergence of these scaling solutions brings more functionality and scalability to the Bitcoin network, injecting more possibilities into the development of the Bitcoin ecosystem and the cryptocurrency industry as a whole.

4. Infrastructure

In addition to asset issuance protocols and scaling solutions, there is a growing number of projects emerging, with particular attention to the infrastructure sector. Wallets that support NFTs, decentralized indexers, cross-chain bridges, launchpads, and more are flourishing. Since most projects are still in the very early stages, here are some key projects in various infrastructure areas.

1) Wallets

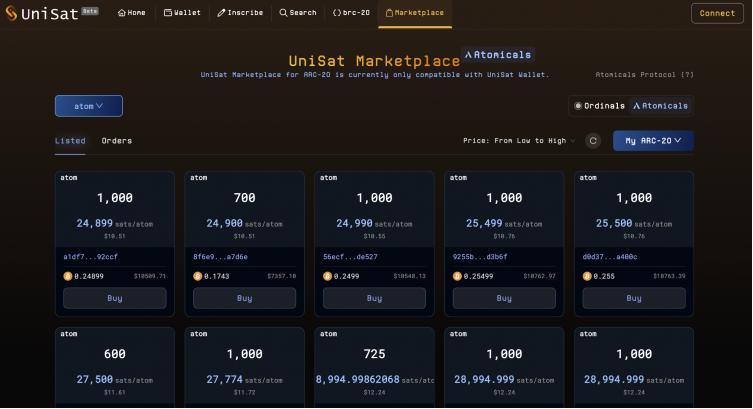

During the surge of the BRC-20 protocol, wallets played a crucial role. There are increasingly more Pionex wallets on the market, including Unisat, Xverse, and recently launched Pionex wallets by OKX and Binance. This section will focus on Unisat, a key driver in the Pionex wallet track, to help better understand this area.

UniSat Wallet is an open-source wallet and indexer for storing and trading Ordinals NFT and BRC-20 tokens.

When it comes to the surge of Ordinals and BRC-20, Unisat is an unavoidable topic. Initially, when Ordinals NFT was launched, it did not attract enthusiastic pursuit but instead raised many doubts, with some believing that Bitcoin's function as digital gold for payments was sufficient and there was no need to build an ecosystem. In the very early stages, purchasing Ordinals NFT could only be done through off-exchange transactions, leading to serious decentralization and trust issues.

After Domo introduced the BRC-20 token standard in March 2023, many people also believed that there was a significant difference between adding a JSON code and smart contracts, and the market was still in a stage of skepticism and observation.

The Unisat team chose to focus on the Ordinals and BRC-20 tracks, becoming one of the earliest wallets to support Ordinals NFT and BRC-20 tokens, and also the official wallet of the Ordinals protocol. This allowed users to trade Ordinals NFT and BRC-20 tokens relatively smoothly, similar to trading other tokens, which were previously only available through off-exchange transactions.

With the skyrocketing popularity of the first Pionex Ordi, a large number of users began to enter the BTC ecosystem. Unisat, as a leading supporter of the BRC-20 ecosystem, also gained widespread attention. Its main features and functions include:

- Storage and trading of Ordinal NFTs, storage, minting, and transfer of BRC-20 tokens

- Open-source indexing code, allowing more exchanges and projects to enter the BRC-20 indexing track

- Instant registration without the need to run a full node

In addition, Unisat has been very quick to support various Bitcoin asset protocols, not only BRC-20 tokens but also other asset types, such as Atomicals protocol's ARC-20 tokens, indicating Unisat's development towards a comprehensive trading platform for BTC ecosystem asset protocols.

(Source: Unisat's official website supports asset types of Ordinals and Atomocials protocols)

In general, as one of the earliest wallets and indexers to support BRC-20, Unisat has lowered the barrier for user participation in Pionex, attracting more users to enter the BTC ecosystem. To some extent, the rapid development of Unisat and BRC-20 mutually promote and achieve each other.

2) Decentralized Indexing

Currently, BRC-20 tokens require off-chain third-party servers for accounting and indexing, leading to centralization issues in off-chain indexers and potential risks. Some projects are dedicated to developing decentralized indexing services to address these issues.

Trac Core is a decentralized indexer that also provides oracle services, developed by founder Benny. The asset issuance protocol Pipe, mentioned earlier, was also introduced by Benny, aiming to provide better services for various aspects of the BTC ecosystem.

Trac Core's core function is to address indexing and oracle issues, serving as a comprehensive tool to provide services for the Bitcoin ecosystem, including filtering, organizing, and simplifying access to Bitcoin data. As mentioned earlier, the current BRC-20 tokens require off-chain third-party servers for accounting and indexing, leading to centralization issues in off-chain indexers and potential risks. Trac Core aims to introduce more nodes to achieve decentralized indexing.

Additionally, Trac Core will establish channels to obtain external data off-chain to serve as a Bitcoin oracle, providing more comprehensive services.

In addition to Trac Core and Pipe, Benny, the founder of Trac, has also developed the Tap Protocol, aiming to enrich the Ordinals ecosystem, allowing tokens to engage in more DeFi activities such as lending, staking, and leasing, thereby enabling the possibility of "OrdFi" for Ordinals assets. Currently, the three projects in the Trac ecosystem, Trac Core, Tap Protocol, and Pipe, are still in the very early stages, and their future development requires continuous attention.

Furthermore, projects like Unisat and Atomic.finance are also exploring and developing decentralized indexing, with hopes for further breakthroughs in the decentralized indexing direction for BRC-20, providing users with more comprehensive and secure services.

3) Cross-Chain Bridges

In the Bitcoin infrastructure, asset cross-chain interoperability is a crucial part. Projects like Mubi and Polyhedra are making efforts in this direction. Here, an analysis of the Polyhedra Network will help understand the situation of BTC cross-chain bridges.

Polyhedra Network is a cross-chain interoperability infrastructure that allows multiple blockchain networks to securely and efficiently access, share, and verify data. This interoperability enhances the overall functionality and efficiency of the blockchain ecosystem through seamless communication, data transmission, and collaboration between systems.

In December 2023, Polyhedra Network announced its zkBridge support for the Bitcoin message transmission protocol, enabling the Bitcoin network to interact with other blockchain Layer1/Layer2 solutions, enhancing Bitcoin's interoperability.

When Bitcoin acts as the message sending chain, zkBridge allows the receiving chain's updated contracts (i.e., light client contracts) to directly verify Bitcoin's consensus and each transaction on Bitcoin through verification of Merkle proofs. This compatibility ensures that zkBridge can comprehensively protect Bitcoin's consensus proofs and transaction Merkle proofs. zkBridge allows Layer1 and Layer2 networks to access current and historical data on Bitcoin.

When Bitcoin acts as the message receiving chain, to ensure the correctness of written information, zkBridge adopts a mechanism similar to Proof of Stake (PoS), inviting validators from the sending chain to stake native tokens, and these validators are authorized to write data on the Bitcoin network. Validators use the MPC protocol, and if a malicious entity controls the MPC protocol members and alters messages, users can initiate zkBridge requests to send malicious messages to Ethereum. The punishment contract on Ethereum evaluates the validity of the message, and if the message is malicious, the staked tokens of the malicious MPC members are confiscated to compensate for user losses.

In summary, cross-chain bridge protocols can effectively tap into the potential of idle Bitcoin and strengthen secure communication between Bitcoin and PoS chains, providing more cross-chain and scenario possibilities for assets on the Bitcoin chain.

4) Staking Protocols

Since its inception, Bitcoin has been limited to the realm of digital gold for transactions. Therefore, many Bitcoin developers are exploring how to unlock the potential of idle Bitcoin to generate more asset income and empowerment. In the field of Bitcoin staking protocols, projects like Babylon and Stroom are making attempts. This section will focus on how Babylon achieves Bitcoin staking and incentives.

The Babylon project was launched by consensus protocol researchers and experienced engineering teams from Stanford University, including David Tse and Fisher Yu, aiming to extend Bitcoin's security to protect the entire decentralized world.

Unlike other projects, Babylon does not build new layers on Bitcoin or create new ecosystems. Instead, it aims to extend Bitcoin's security to other blockchain networks, including Cosmos, BSC, Polkadot, Polygon, and other PoS chains, to share security.

Its core function is the Bitcoin staking protocol, which allows Bitcoin holders to stake their BTC on PoS chains and earn rewards to protect the security of PoS chains, applications, and app chains. Unlike existing methods, Babylon does not bridge to PoS chains but instead uses remote staking, eliminating the need to bridge, wrap, or custody staked Bitcoin. On one hand, this allows Bitcoin holders to participate in staking and earn currency incentives from idle BTC, and on the other hand, it enhances the security of PoS chains and app chains. This transforms Bitcoin from a static asset to a dynamic contributor to network security.

Additionally, through the Bitcoin timestamp protocol, Babylon places timestamps of events from other blockchains on Bitcoin, allowing these events to enjoy Bitcoin's timestamps like Bitcoin transactions, enabling fast staking and unbonding, reducing security costs, and providing cross-chain security functions.

In conclusion, the development of Bitcoin staking protocols like Babylon brings new use cases for idle Bitcoin, transforming Bitcoin from a store of value and exchange to a dynamic contributor to network security. This transformation may lead to wider adoption and create a more powerful and interconnected blockchain network.

IV. Challenges and Limitations in the Development of the Bitcoin Ecosystem

1) BRC-20 Needs to Address Decentralized Indexing Issues

While the popularity of BRC-20 has brought traffic and attention to the Bitcoin ecosystem and led to the emergence of many different types of asset protocols, such as ARC-20, Trac, SRC-20, ORC-20, Taproot Assets, and other standards aiming to address the issues of BRC-20, it has also created many new asset standards.

However, currently, among all asset types in the Bitcoin ecosystem, BRC-20 still maintains a leading position. According to CoinGecko's data, the current market value of BRC-20 tokens has exceeded $2.3 billion, approaching the market value of RWA ($2.4 billion) and even surpassing Perpetuals ($1.7 billion). This indicates its significant position in the Web3 industry.

In the BRC-20, a current concern is the decentralized indexing dilemma. Since BRC-20 tokens cannot be recognized and recorded by the Bitcoin network, third-party indexers are needed locally to record the BRC-20 ledger. Currently, both Unisat and OKX's third-party indexers still operate in a centralized manner, requiring extensive local accounting and indexing. There is a risk of mismatched information between indexers and the inability to compensate for attacks on indexers.

As a result, some developers have begun to explore and develop decentralized indexers. For example, Trac Core is striving towards decentralized indexing, and projects like Best In Slots and Unisat are also exploring and experimenting in this direction. However, there is currently no mature, viable, and recognized solution, and the exploration is still in its early stages.

2) Scalability is still in a very early stage and cannot support large-scale applications

Bitcoin was originally conceived as a decentralized currency for peer-to-peer payments, and as a result, it has some technical limitations, including restrictions on transaction throughput, delays in block confirmation times, and energy consumption issues.

To build more complex applications on the Bitcoin network, two challenges need to be addressed:

Increase TPS to make the network faster

Support smart contracts to enable more applications to be built in the Bitcoin ecosystem

Current scalability solutions such as the Lightning Network, RGB, Rootstock, Stack, and BitVM are attempting scalability from different angles, but their scale and adoption rates are still limited. For example, the Lightning Network, with the highest TVL among current scalability solutions ($200 million), is limited in its use cases, only facilitating transaction behavior and unable to support more scenarios. Scalability protocols like RGB and sidechains like Rootstock and Stacks are still in the early stages, with relatively weak scalability effects and smart contract functionality compared to Ethereum's layer2, and are currently unable to support large-scale applications.

3) The Bitcoin ecosystem needs to find its native scenarios, as simply copying existing applications is difficult to break through

After the explosion of BRC-20, builders have been wondering what the next popular application for Bitcoin will be. Due to Bitcoin's inherent lack of Turing completeness, simply transplanting Ethereum's applications to the Bitcoin network is unlikely to lead to new breakthroughs. More opportunities need to be triggered by Bitcoin's own characteristics, rather than following the old path of Ethereum.

Bitcoin's core feature is its asset properties. As the earliest and most reputable cryptocurrency, Bitcoin's market value is close to $800 billion, accounting for about half of the total cryptocurrency market value.

Starting from Bitcoin's three core features—asset security, asset issuance, and asset returns—there is much exploration to be done.

First, in terms of asset security, the core lies in users' ownership of Bitcoin. In Ethereum's staking, once users stake ETH, ownership is transferred to the protocol and no longer belongs to the user. Bitcoin believers and large holders are very concerned about Bitcoin ownership. Therefore, if operations can generate income without changing ownership, it may be a new way forward. Additionally, the security of asset cross-chain and scalability protocols is also one of the most critical factors for BTC holders to consider interaction.

In terms of asset issuance, the birth of BRC-20 to some extent signifies users' yearning for fair launches, symbolizing anti-elitism and VC. Each user stands in a more equal position to obtain alpha. Therefore, to make new breakthroughs in asset issuance, it may be necessary to explore what advantages can be given to the public in addition to fairness to attract more people to participate.

In terms of asset returns, exploring how users' BTC and BRC-20 tokens can have more income scenarios, including lending, collateral, derivatives, liquidity mining, and more, is also a path worth exploring.

V. Conclusion

Bitcoin has been around for 15 years, from the 2008 white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" by Satoshi Nakamoto, to the official launch of the Bitcoin network in 2009, becoming the world's first cryptocurrency. As the first decentralized digital currency, Bitcoin has led the wave of cryptocurrency development since its inception in 2009.

In terms of impact, Bitcoin has not only changed the landscape of the financial industry but also had a broad and profound impact on the world.

First, it provides a convenient way for cross-border transfers and payments without the intervention of third-party institutions. This provides an opportunity for financial inclusion on a global scale and improves the accessibility of financial services.

Second, Bitcoin's decentralized nature allows individuals to have complete control over their funds, enhancing personal financial security and privacy protection.

Additionally, Bitcoin has sparked the development of blockchain technology, paving the way for decentralized applications and innovation in digital assets.

In terms of financial inclusion, some countries have begun to accept and use cryptocurrencies as legal tender. El Salvador became the world's first country to adopt Bitcoin as legal tender in 2021, and the Central African Republic also accepted Bitcoin as legal tender in 2022. Other countries are also exploring similar initiatives, considering incorporating cryptocurrencies into their legal tender systems. In regions with inadequate financial infrastructure or difficult access to financial services, Bitcoin provides a fast, low-cost cross-border payment and transfer method. It offers financial inclusion opportunities for those without bank accounts or unable to access traditional financial services. Additionally, the approval of the U.S. Bitcoin spot ETF on January 10, 2024, symbolizes a significant step for Bitcoin in the traditional financial world.

In terms of blockchain technology development, after Bitcoin, more blockchain technologies supporting smart contracts, such as Ethereum, Solana, and Polygon, have emerged, allowing blockchain to expand beyond just a store of value and exchange to include DeFi, NFTs, Gamefi, Socialfi, DePIN, and more, attracting a more diverse range of users and builders.

With the development of the blockchain industry, more attention has been focused on chains like Ethereum that support smart contracts, while attention to Bitcoin has remained more in the "digital gold" stage. The recent explosion of BRC-20 has redirected the focus of users and builders back to the Bitcoin ecosystem, prompting consideration of whether the Bitcoin ecosystem can continue to give rise to different application scenarios. This has led to the birth of many new asset protocols, including BRC-20, ARC-20, SRC-20, ORC-20, and some interesting explorations, such as BRC420 and Bitmap, hoping to better explore asset issuance from different perspectives. Unfortunately, after BRC-20, other asset protocols and projects have not been able to create waves as big as BRC-20.

For builders, the BTC ecosystem is still in its very early stages, with project teams mostly consisting of independent developers and small teams. For teams truly looking to make a difference and innovate, there are many opportunities and spaces for exploration in the BTC ecosystem.

In terms of scalability, over the past 15 years, Bitcoin has undergone multiple technical upgrades and improvements, including reducing transaction confirmation times, discussing scalability solutions, and enhancing privacy protection. Currently, scalability exploration includes state channels such as the Lightning Network, scalability protocol RGB, sidechains like Rootstock and Stacks, and Layer2 Rollup BitVM, but the road to supporting diverse applications through scalability is still in its very early stages. There is still much exploration and experimentation to be done in achieving scalability on a non-Turing complete Bitcoin.

In conclusion, the recent explosion of BRC-20 has redirected the focus of users and builders back to the Bitcoin ecosystem. Whether it is the yearning for fair asset launches or the faith in Bitcoin as the most orthodox and decentralized public chain, more and more developers are starting to build in the Bitcoin ecosystem. For the future development of the Bitcoin ecosystem, Bitcoin needs to take a different path from Ethereum, find native application scenarios around its asset properties, and perhaps usher in a second spring for the Bitcoin ecosystem.

Finally, a big thank you to partners such as Constancie, Joven, Lorenzo, Rex, KC, Kevin, Justin, Howe, Wingo, Steven, and others for their help and willingness to share during the communication process. I sincerely hope that all builders in this race will continue to improve!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。