Author: RootData

Table of Contents

Overall Development Trends of the Web3 Industry

1.1. Bitcoin Leads the Global Asset Growth, Bitcoin Spot ETF Will Drive Long-term Industry Development

1.2. Total Financing Amount in 2023 Reaches $9.043 Billion, Interconnection of Primary and Secondary Markets Boosts Industry towards a New Cycle

1.3. Primary and Secondary Markets are Becoming New Choices for Investment or Exit

1.4. Infrastructure and CeFi Dominate the Development of the Web3 Industry in 2023, with 6 New Unicorns

1.5. Number of Failed Web3 Projects Decreases by 50% in 2023

Characteristics and Sector Trends of Web3 Assets Development

2.1. The Essence of the Four Waves of Innovation in the Web3 Industry is to Find the Native Assets with the Largest Consensus

2.2. Number of Web3 Developers Increases by 66% YoY, Ethereum Ecosystem Has Overwhelming Advantage

2.3. Rotation of Popular Web3 Sectors: L1/L2, DeFi, GameFi Still the Most Focused Segments in the Market

2.4. Stanford Produces the Most Web3 Practitioners, Google-backed Projects Have the Highest Financing Amount

Characteristics and Trends Analysis of Fund Flow in Web3

3.1. Analysis of Investment Institution Styles and Activity in Web3 in 2023

3.2. Analysis of the Increase and Decrease in the Number of Investments by Web3 Investment Institutions in 2023

3.3. Research and Analysis of the Top Ten Projects in the Infrastructure Sector in Annual Financing Amount

3.4. Research and Analysis of the Top Ten Projects in the DeFi Sector in Annual Financing Amount

3.5. Research and Analysis of the Top Ten Projects in the CeFi Sector in Annual Financing Amount

3.6. Research and Analysis of the Top Ten Projects in the GameFi Sector in Annual Financing Amount

2023 ROOTDATA LIST

4.1. Top 50 Projects in the Web3 Industry

4.2. Top 100 Investment Institutions in the Web3 Industry

4.3. Vertical Sector Lists in the Web3 Industry

- Top 20 Projects in the CeFi Sector

- Top 20 Projects in the Layer1 Sector

- Top 20 Projects in the GameFi Sector

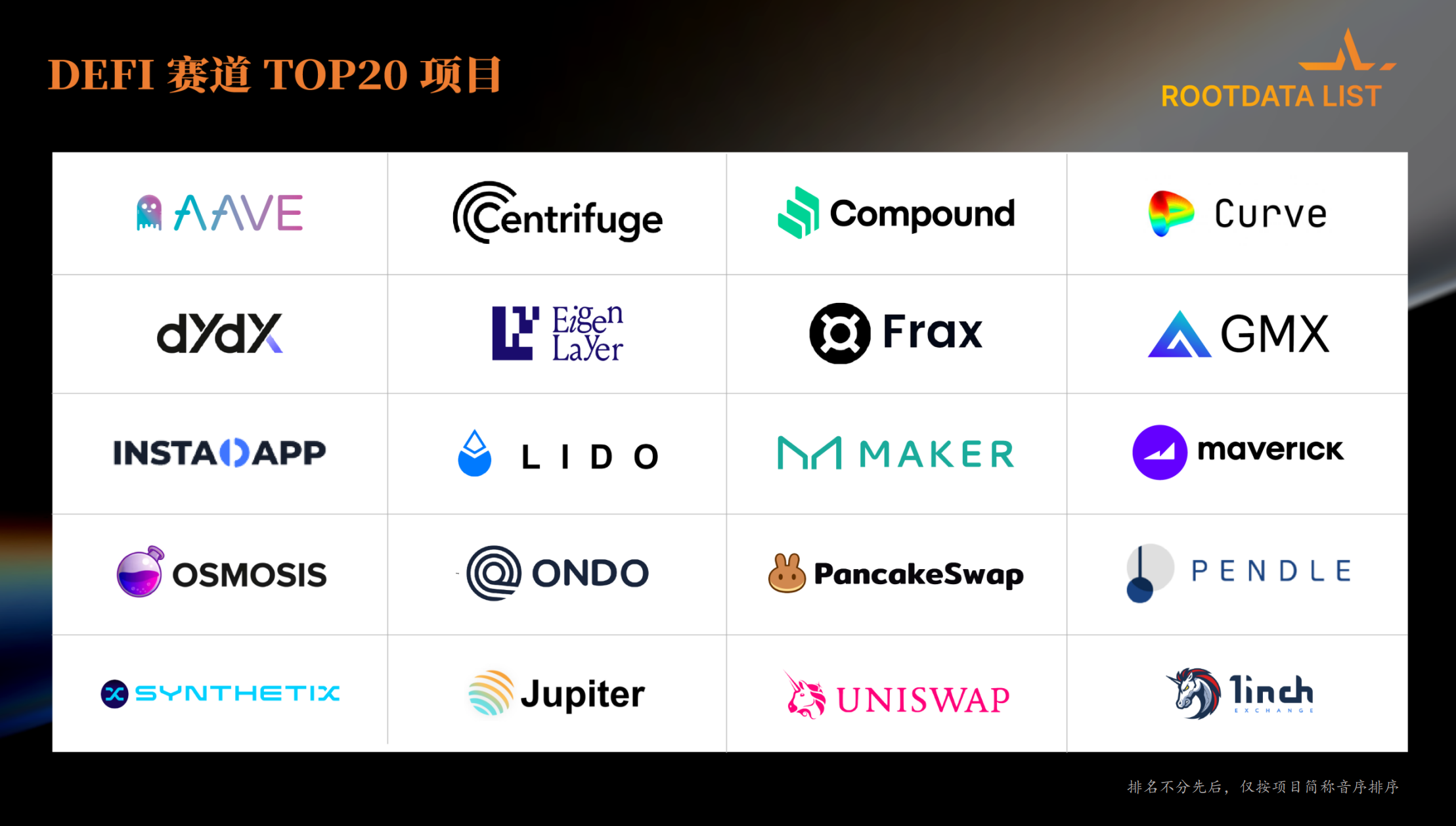

- Top 20 Projects in the DeFi Sector

- Top 20 Projects in the Layer2 Sector

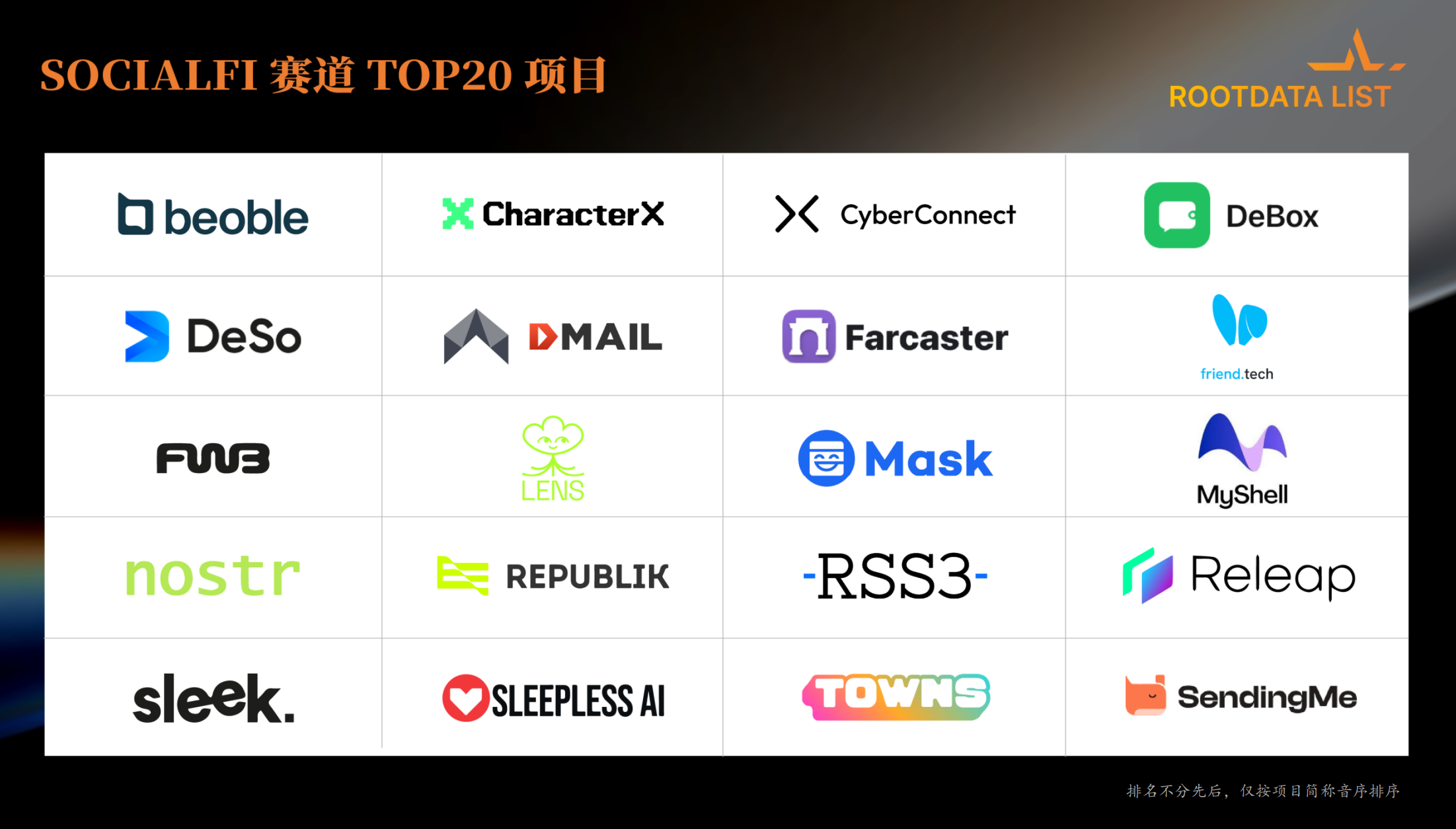

- Top 20 Projects in the SocialFi Sector

The Web3 industry as a whole is showing a strong rebound trend, with Bitcoin achieving the highest annual increase of 160%, leading the global asset return rate. The Bitcoin spot ETF has become a new channel for incremental funds.

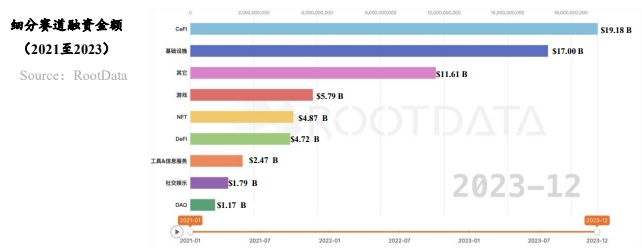

The total financing amount in the Web3 industry reached $9.043 billion in 2023. The financing performance in different sectors varies, with enterprise-level infrastructure and wallet directions being favored by capital. In the DeFi trend, DEX competition is fierce, and derivatives and RWA are receiving attention. The total financing amount in the CeFi sector has decreased, but opportunities in the Bitcoin ecosystem are attracting capital.

Finding the native new assets with the largest consensus has become an important rule for the development of the Web3 industry. The number of developers has increased by 66% YoY, and the Ethereum ecosystem leads the trend with overwhelming advantages. The popular sectors are concentrated in traditional areas such as DeFi, L1/L2, and Game, but opportunities in compliance and social directions are becoming important consensus in the market.

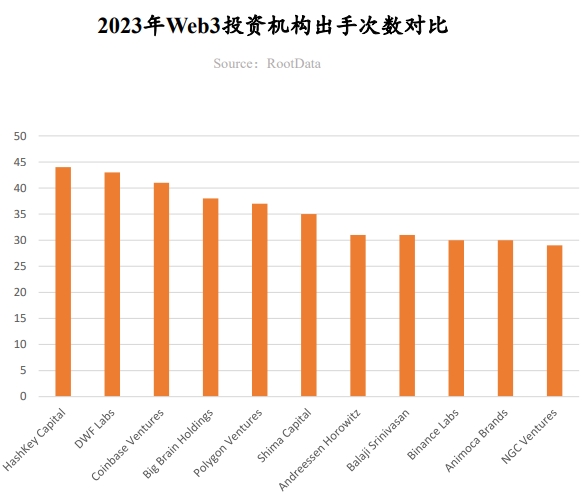

In 2023, over 10 institutions led investments at least 8 times. HashKey Capital jumped to the top of the annual investment frequency list for the first time, with extensive layout in the Asia-Pacific region in the infrastructure and DeFi directions. DWF Labs became a dark horse of the year, mainly investing in projects that have been issued but are not highly popular in the market.

I. Overall Trends of the Web3 Industry

1.1. Secondary and Macro Analysis: Bitcoin Leads the Global Asset Growth, Spot ETF Opens a New Dimension for Market Growth

1. Bitcoin: A Highlight in the Global Asset Field

In 2023, Bitcoin performed well as an asset category. According to NYDIG statistics, as of October 2023, Bitcoin with a 63.3% increase became the best-performing asset among 40 selected asset categories. This exceeded the growth rate of US growth stocks (28.2%), as well as other major asset categories such as the US stock market (12.2%), commodities (6%), cash (3.8%), and gold (1.1%). In addition, analysis by Kaiko Research shows that despite macroeconomic tensions and headwinds in the crypto industry, Bitcoin's increase in 2023 still exceeded 160%.

2. Bitcoin Halving: New Market Opportunities for Supply and Demand

The Bitcoin halving event will occur in Q2 2024. Historically, after each halving, the price of Bitcoin has significantly increased, but it has also been accompanied by increased volatility. In terms of demand, according to Glassnode data, as of December 22, 2023, the number of non-zero balance Bitcoin addresses has exceeded 50 million. The increase in this data reflects the growth of the user base. These factors collectively impact the market value and trading activities of Bitcoin.

3. Bitcoin Spot ETF: Leading the Growth Trend

The Bitcoin spot ETF market has performed outstandingly, with a trading volume exceeding $1.8 billion on January 16, three times the total volume of 500 other ETFs on the same day. The trading volume in the first three days was nearly $2 billion. This includes funds managed by Grayscale, BlackRock, and Fidelity. The head of forex research at Standard Chartered Bank predicts that the inflow of funds in 2024 may reach $50 billion to $100 billion. This reflects the high interest and growth potential of these ETFs in the market.

4. Monetary Policy Shift: Catalyzing a New Bull Market Wave for Web3

The previous bull market was related to loose US monetary policy, and the latest data shows that the Federal Reserve may cut interest rates in 2024. In this context, cryptocurrencies such as Bitcoin, due to their non-correlation and hedging properties, may become a diversified choice for investors. After the approval of the Bitcoin spot ETF, Bitcoin has shifted from individual investment to institutional investment, reducing circulation and increasing scarcity. Expectations of a Federal Reserve interest rate cut and inflation measures may prompt more investors to allocate Bitcoin, indicating the start of a new bull market cycle for the Web3 industry.

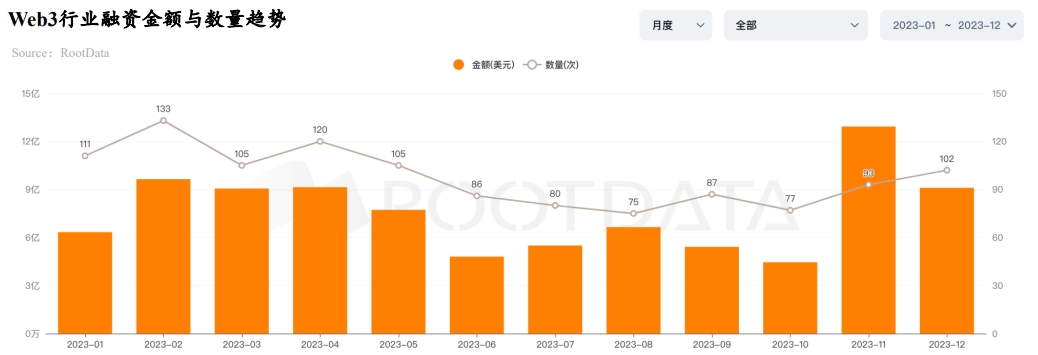

1.2. Total Financing Amount Reaches $9.043 Billion in 2023, Interconnection of Primary and Secondary Markets Drives Web3 Industry Recovery and Growth

Stimulated by the favorable news of the Bitcoin spot ETF, after multiple tests of the $30,000 mark, the BTC price broke through. With prominent bullish sentiment in the market, as of December 31, the total financing amount in the Web3 industry in 2023 reached $9.13 billion, with the highest monthly financing amount reaching $1.312 billion in November. The financing amount in Q4 exceeded the total of the previous three quarters, which is greatly related to the short transmission path of the primary and secondary markets in the Web3 industry, indicating that the primary market is gradually entering the track of recovery and growth.

Since the third quarter of 2023, several funds have announced the completion of fundraising. Web3 fund Lightspeed Faction announced the completion of a $285 million fundraising (oversubscribed by 14%), Standard Chartered Bank and Japanese financial giant SBI launched a $100 million Web3 fund, and CMCC Global, supported by Li Ka-shing, completed a $100 million fundraising.

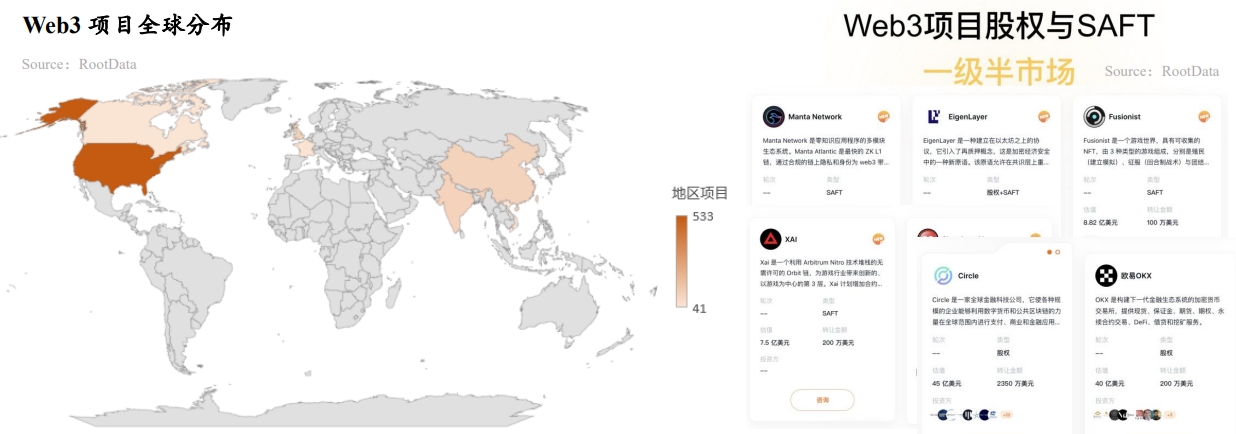

1.3. Primary and Secondary Markets are Becoming New Choices for Investment or Exit, Fireblocks has the Most Withdrawal in Off-market Valuation, EigenLayer has the Most Increase in Off-market Valuation

- As Web3 accelerates towards compliance, the highly interconnected primary and secondary markets are more likely to cause investors' FOMO sentiment and high project valuations. More and more investors are viewing the primary and secondary markets as important investment and exit paths.

- Among the 45 projects listed on the RootData primary and secondary markets, Fireblocks' off-market trading valuation has seen the most significant decrease compared to the financing valuation, reducing by approximately $4 billion. Copper and Dune Analytics both experienced a decrease of several hundred million dollars in off-market valuation. EigenLayer, on the other hand, has shown strong performance, with an off-market trading valuation of $25 billion, five times the latest round financing valuation of $5 billion. The off-market valuations of projects like Aleo and LayerZero have remained relatively stable.

1.4. Infrastructure and CeFi Dominate the Web3 Industry Development in 2023, with 6 New Unicorns

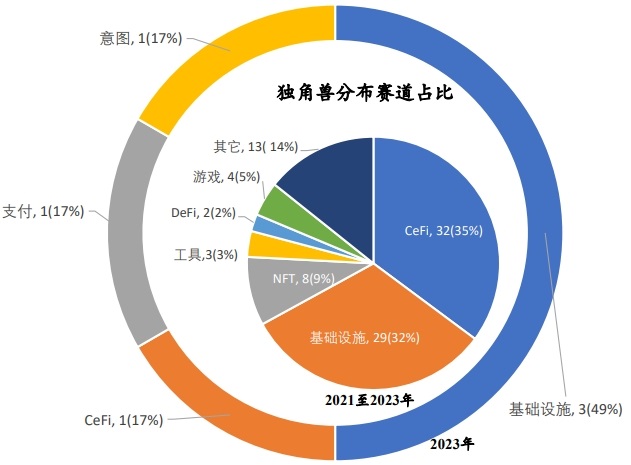

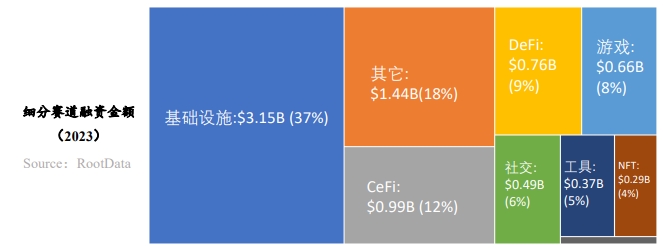

According to RootData, in the past three years, infrastructure, CeFi, gaming, NFT, and DeFi have been the most funded sectors. The average financing amount in 2023 was $9.9 million, compared to $18.8 million in 2022, a reduction of about half. Despite enduring a bear market for two years, infrastructure has always been a high-heat sector.

As of December 31, 2023, a total of 91 unicorn projects have emerged in the Web3 industry, with 32 in CeFi, 29 in infrastructure, and 8 in NFT. However, with the market downturn in the past two years and the slowdown in primary market investments, the number of Web3 unicorn projects that emerged in 2023 (Andalusia Labs, Scroll, Flashbots, BitGo, Wormhole, Ramp) is only one-fifth of that in 2022.

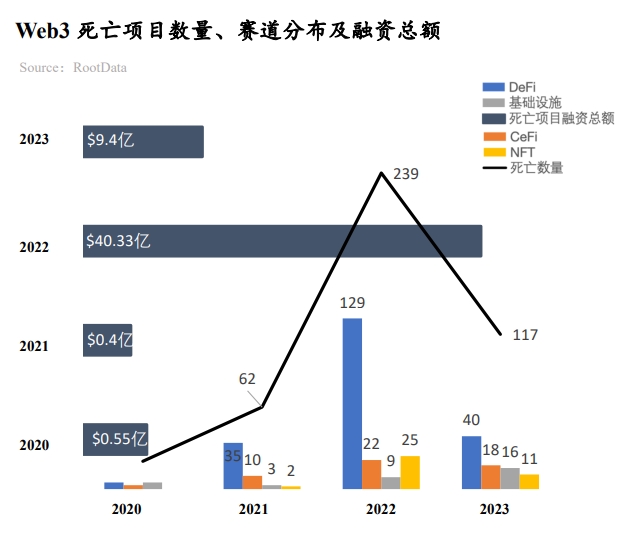

1.5. The Web3 Industry is Moving towards Maturity: Number of Failed Projects Decreases by 50% in 2023

According to RootData, about 120 projects announced bankruptcy or ceased operations in 2023, with a total financing amount reaching $940 million. Compared to 239 projects that failed in 2022, with a total financing of $4.033 billion, there has been a significant decrease, reflecting the gradual maturity and stability of the industry. These failed projects are distributed across various sectors, with the most in the DeFi sector (40), followed by CeFi (18) and infrastructure (16).

The top three projects that closed down before financing were Prime Trust (total financing of $163 million), Voice (total financing of $150 million), and Rally (total financing of $72 million). Insufficient funds were the main and most direct reason for project shutdown, and other reasons included lack of market fit for the product, stricter regulatory policies, and hacker attacks.

2. Characteristics and Sector Trends Analysis of Web3 Assets Development

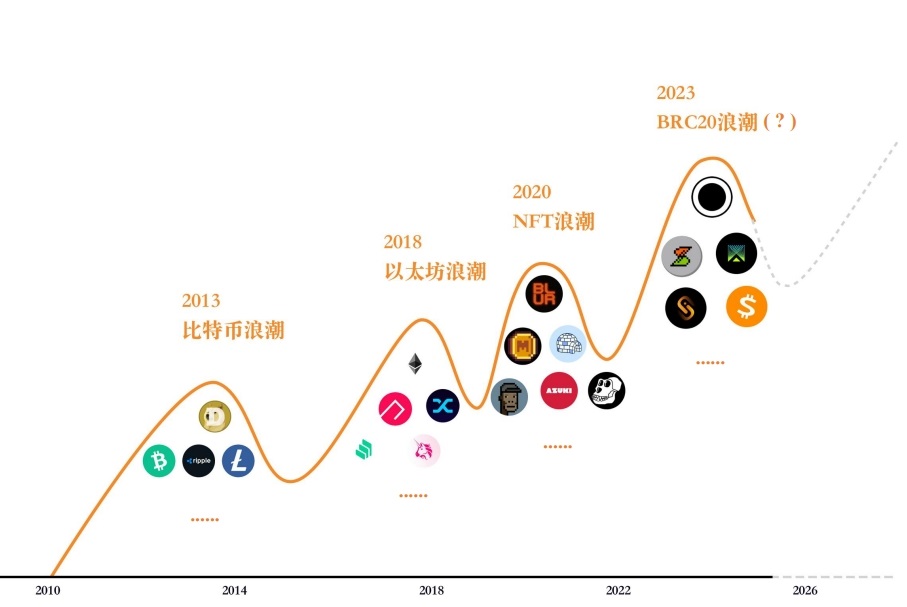

2.1. The Four Waves of Innovation in the Web3 Industry: Finding the Native Assets with the Largest Consensus

The essence of the four waves of innovation in the Web3 industry is to find the native assets with the largest consensus. New assets drive the influx of funds, so it becomes important to find the path and scenario for the birth of new assets in the Web3 industry, especially native assets, as they have less resistance and greater narrative space compared to non-native assets.

2.2. Number of Web3 Developers Increases by 66% YoY, Ethereum Ecosystem Has Overwhelming Advantage

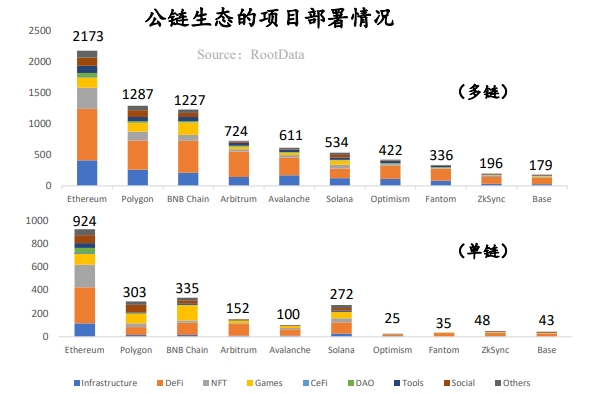

- Ethereum ecosystem has the greatest advantage: Whether it's a single chain or multi-chain, the Ethereum ecosystem has an overwhelming advantage, with other ecosystems mainly receiving the overflow of value from Ethereum.

- Solana has become the most prominent public chain in 2023: SOL token has seen an increase of nearly 1000%, and the Solana Foundation has announced that the monthly active developers have remained above 2500, with star projects in the ecosystem taking turns to shine, including both established DeFi projects like Raydium, Orca, Solend, and current stars like Jito, Jupiter, Pyth Network, gradually forming a unique ecological advantage.

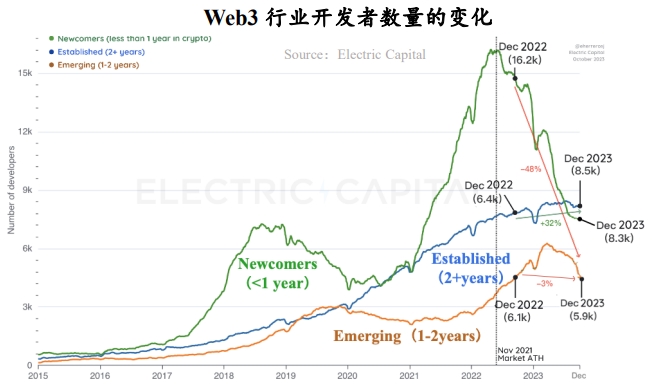

- Overall increase in the number of developers compared to the previous cycle: The number of developers has increased by 66% compared to the previous bear market.

- Changes in developer types: Mature developers and builders are still strong in the Web3 industry, while speculative developers are leaving in large numbers. Looking at the data for the entire year of 2023, the biggest change in this bear market cycle is the decrease in new developers (a decrease of 58%), while the number of experienced developers is growing, with developers with over 1 year of experience accounting for 75% of code submissions.

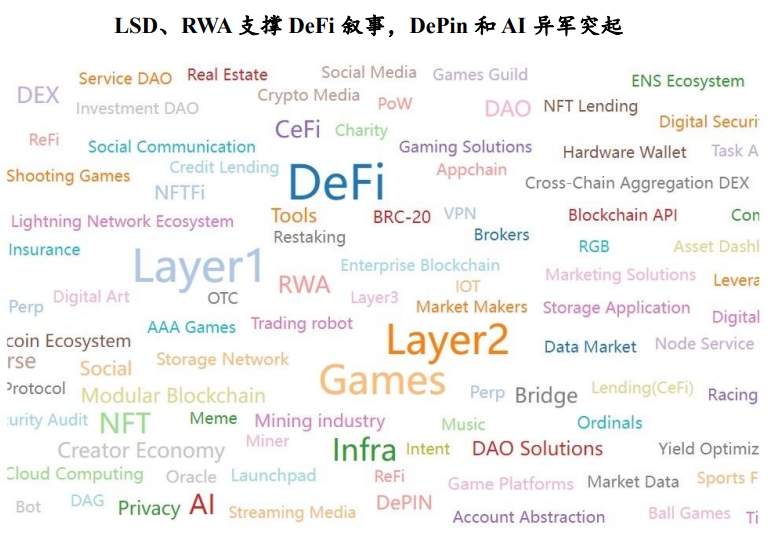

2.3. Rotation of Popular Web3 Sectors: L1/L2, DeFi, Game Still the Most Focused Segments in the Market, with Layer3, Restaking, and Other Sectors Gaining Market Attention

- Based on the millions of tag clicks on RootData, DeFi, L1/L2, and Games are the most popular tags. Leading staking service Lido and the RWA concept pioneer MakerDAO are revitalizing the DeFi sector.

- Layer3, Intent, and Restaking are gaining market attention. EigenLayer is introducing Ethereum-level trust into middleware and has already created a brand-new restaking ecosystem.

- Binance has listed a total of 26 new tokens in 2023, covering over 20 popular tags such as infrastructure, Layer1, and Meme, with significant decreases in search popularity for tags like NFTFi, DAG, and DOV.

2.4. Stanford Produces the Most Web3 Practitioners, Google-backed Projects Have the Highest Financing Amount

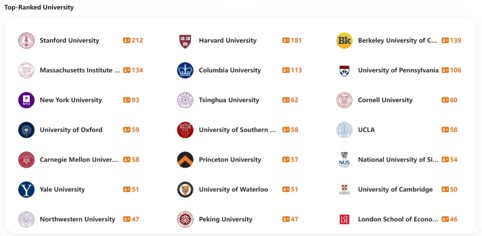

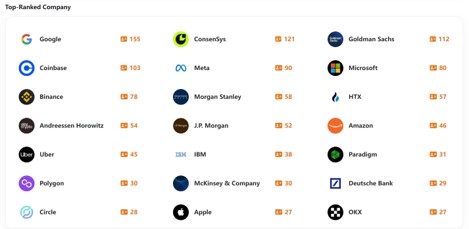

- In terms of education and work experience, the United States, China, and Singapore are the main countries where Web3 projects are born, and mainstream Web3 practitioners generally possess dual capabilities and resources in finance and technology.

- Harvard University-affiliated Web3 entrepreneurial teams and Google-affiliated entrepreneurial teams have the highest cumulative financing amounts, while Peking University-affiliated Web3 entrepreneurial teams rank fifteenth in cumulative financing amount, and Binance-affiliated entrepreneurial teams rank tenth. Among Chinese practitioners, Binance and HTX-affiliated entrepreneurial teams are the most numerous. In addition, the number of entrepreneurial teams affiliated with OKX and Bitmain is continuously increasing. Non-native practitioners among Chinese practitioners mainly come from Alibaba and Tencent.

Three, Characteristics and Trends Analysis of Web3 Capital Flow

3.1. Analysis of Investment Institution Styles and Activity in 2023: HashKey Capital Most Willing to Invest, a16z Crypto Prefers Lead Investment

HashKey Capital becomes the institution with the most investment activities in the year

HashKey Capital has risen to the top of the list for the number of investments in a year for the first time, with a wide-ranging layout in infrastructure, DeFi, and a special focus on projects in the Asia-Pacific region. In January 2023, it announced the completion of a $500 million fundraising for its third fund, providing strong support for its high-frequency investments. Typical investment cases: MyShell, DappOS, Supra, SynFutures, PolyHedra.

DWF Labs emerges as the dark horse of the year

DWF Labs mainly invests in projects that have already issued tokens and are not highly popular in the market, and its style has sparked much controversy. Typical investment cases: EOS, Conflux, Mask Network, Synthetix, Fetch.ai.

a16z Crypto prefers lead investments and large investments

a16z Crypto prefers lead investments and large investments, maintaining an active investment posture in infrastructure, gaming, entertainment, and other fields. Typical investment cases: Gensyn, Mythical Games, Proof of Play, Story Protocol, CCP Games.

In 2023, over 10 institutions led investments at least 8 times

In terms of the number of lead investments, in 2023, Andreessen Horowitz, Polychain, Bitkraft Ventures, Dragonfly, 1kx, Hack VC, Shima Capital, Jump Crypto, and ABCDE Capital ranked in the top ten, leading investments at least 8 times.

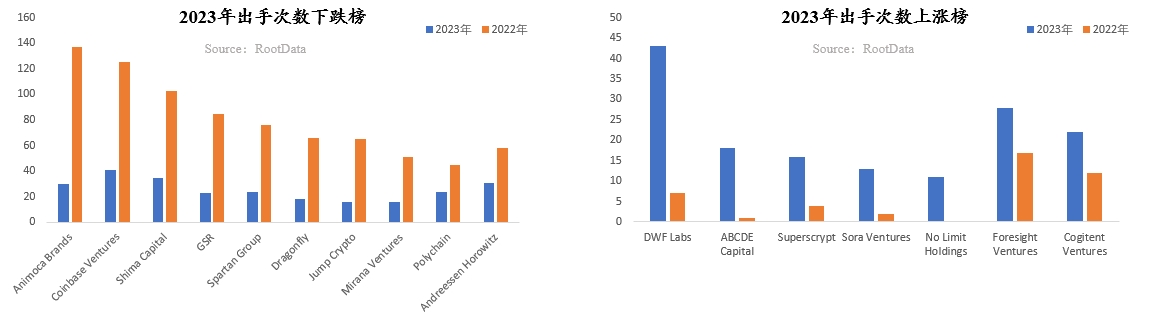

3.2. Analysis of Changes in the Number of Investments by Web3 Investment Institutions in 2023: Animoca Brands Experienced the Largest Contraction, 85 Institutions Invested Over 10 Times in the Year

- In terms of the number of investments, a total of 85 investors made over 10 investments, with 9 investors making over 30 investments, a significant decrease compared to the average in 2022, reflecting that the vast majority of investment institutions have been significantly reducing their investment frequency due to difficulties in fundraising and lack of confidence.

- Among them, investment institutions such as Animoca Brands, GSR, Coinbase Venture, Shima Capital, Spartan Group, a16z, Paradigm, Circle Ventures, and Mirana Ventures all experienced significant decreases in the number of investments in 2023, with a decrease of over 40%.

- Web3 investment institutions are generally facing difficulties in fundraising, with only Blockchain Capital, HashKey Capital, CMCC Global, Bitkraft Ventures, and No Limit Holdings announcing fundraising amounts exceeding $50 million.

- At the same time, a small number of investment institutions are increasing their investment frequency, injecting momentum into the bleak market. According to statistics, investment institutions such as ABCDE Capital, Superscrypt, Foresight Ventures, OKX Ventures, Sora Ventures, and No Limit Holdings all significantly increased their number of investments in 2023, with an increase of over 50%.

- In the year-end Bitcoin ecosystem boom, investment institutions such as ABCDE Capital, Sora Ventures, and Waterdrip Capital maintained an active stance and became the main investors in Bitcoin ecosystem projects.

3.3. Infrastructure Sector: Cross-chain Direction Sees the Largest Financing Case of the Year, Enterprise-level Infrastructure and Wallets Attract Capital

Cross-chain sector sees the largest financing case of the year

Wormhole announced a $225 million financing in November 2023, becoming the project with the highest financing of the year, and cross-chain is also one of the hottest industry trends in 2023. With the widespread emergence of Layer1, Layer2, and even Layer3, the demand for cross-chain assets and data from users is rapidly growing, and Wormhole and LayerZero have broken down barriers between various blockchains through cross-chain communication.

Wallets receive capital support as traffic entry points

As the entry point for user traffic, the wallet sector continues to attract capital. Cryptocurrency hardware wallet Ledger and social login wallet Magic both received substantial financing, reflecting the demand for security and convenience in wallets. Their development and evolution are crucial for blockchain to support the next billion users.

Enterprise-level infrastructure becomes a key focus

Enterprise-level infrastructure has become a key focus. Digital asset custody and issuance infrastructure Auradine, and blockchain development platform QuickNode mainly target enterprise-level clients, helping enterprises solve issues on the asset side such as asset issuance and application development, thereby continuously delivering high-quality assets and projects to the market.

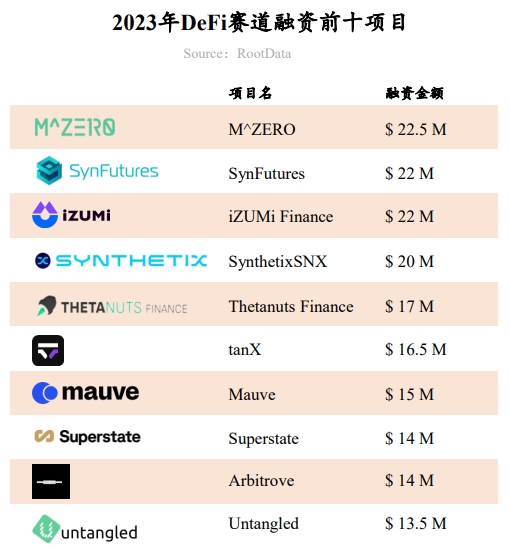

3.4. DeFi Sector: Intensifying Competition in the DEX Sector, Derivatives and RWA Become Industry Focus

Derivatives protocols become the focus of capital attention

Derivatives protocols are the focus of the DeFi sector, revolving around perpetual contracts, synthetic assets, structured products, etc. Protocols such as SynFutures, Thetanuts Finance, and Synthetix have received capital support, with their core highlights being more transparent, permissionless operation mechanisms, and more user-friendly products.

Intensifying competition in the DEX sector in compliance, order book, and cross-chain directions

The decentralized exchange track also has many highlights, including Mauve, which focuses on compliance, tanX, which focuses on order book trading, and iZUMi Finance, which focuses on multi-chain. They are competing for market share from leaders like Uniswap by targeting specific markets and functionalities, and are highly anticipated by investment institutions.

High expectations for RWA in the market

RWA assets are becoming the most prominent direction in the DeFi market. Assets such as real estate, government bonds, and bills have stable yields, making RWA able to provide sustainable and diverse real yields for the crypto market. Superstate, founded by the founder of Compound, is one of the latest major players in the RWA track. The project is dedicated to purchasing short-term US government bonds and tokenizing them on the chain for direct on-chain trading circulation.

3.5, CeFi Track: The largest drop in total financing among major tracks, Bitcoin ecosystem opportunities attract capital

Largest drop in total financing among major tracks

In 2023, the total financing amount for the CeFi track was $1.18 billion, a 75% decrease, making it the track with the largest drop among major tracks. This is mainly due to the impact of the malicious CeFi blowout events that began in 2022.

Capital bets on Bitcoin-related financial services

Bitcoin-related financial services are receiving the most attention from capital. Companies like Swan, Unchained, and River Financial provide solutions for the Bitcoin ecosystem, offering savings, lending, brokerage, and other services. As the most valuable crypto asset, Bitcoin is brewing significant untapped value for its holders.

Turning point for the exchange track

After the FTX incident, the vacant market space in the exchange track continues to attract the attention of many capital investors. Exchanges such as Blockchain.com and One Trading have received substantial financing due to their vertical business, regional, or licensing advantages.

3.6, GameFi Track: Total financing amount drops by over 57%, 3A games still favored by investment institutions

Over 57% drop in total financing amount for the GameFi track

Affected by the secondary market situation, the total financing amount for the GameFi track has dropped by over 57%. Large-scale financing is mainly initiated by institutions such as a16z Crypto, Griffin Gaming Partners, and Bitkraft Ventures.

Emphasis on playability becomes the mainstream trend

3A games, in particular, are favored by investment institutions, and the prospects for traditional Web3 games such as football, shooting, and adventure games are also promising. Emphasis on playability has become the trend for GameFi. In addition, full-chain games are highly anticipated by both capital and the market.

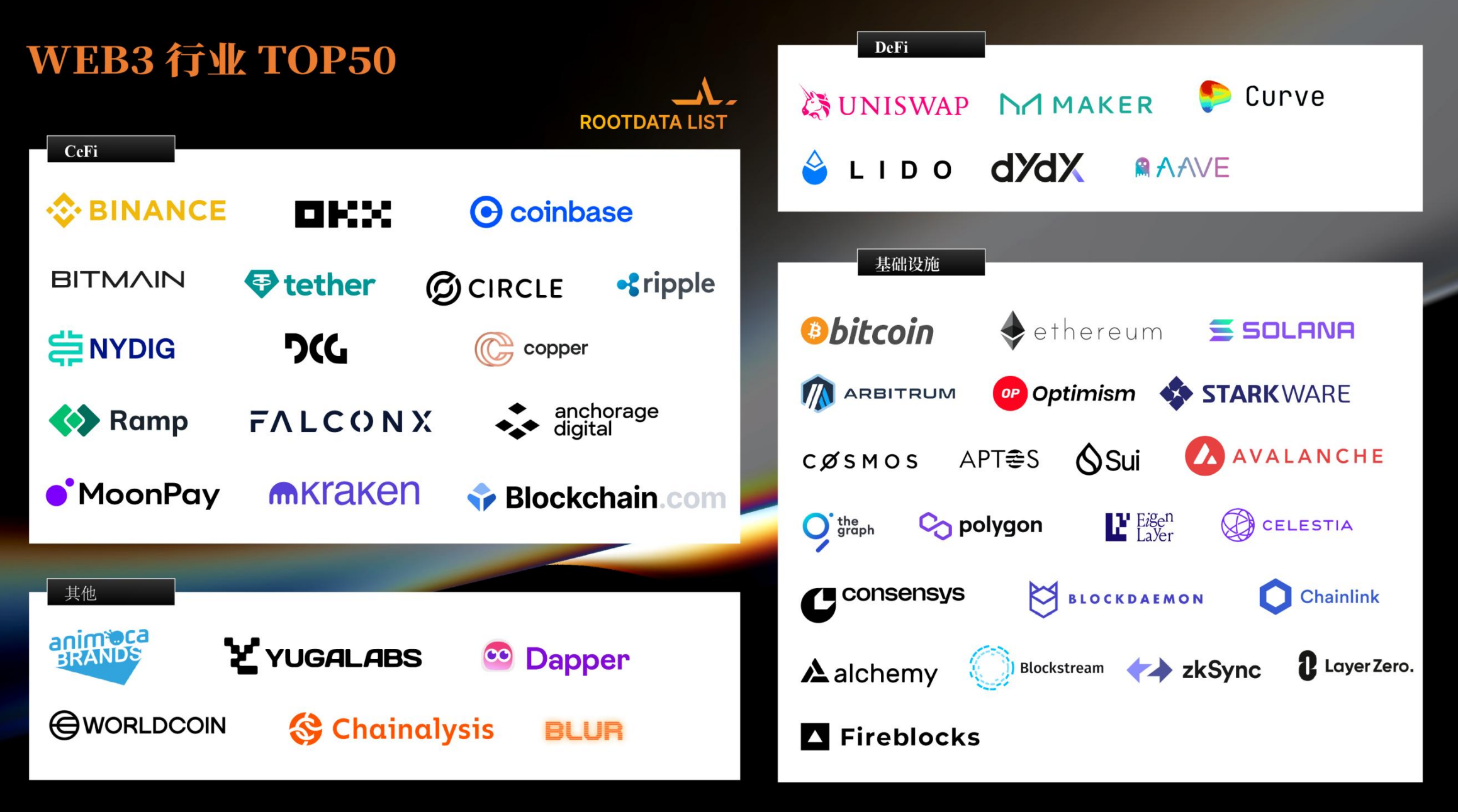

Four, 2023 ROOTDATA LIST

Web3 is becoming an important transformative force that cannot be ignored by global society. In order to present these significant Web3 forces more clearly, RootData, relying on its leading and rich data advantages and over tens of millions of user visits and queries, adheres to the principles of professionalism, objectivity, rigor, and fairness, and is committed to creating a data-driven and industry-credible list—ROOTDATA LIST, presenting more industry representatives in the Web3 field and promoting high-quality industry development.

The 2023 ROOTDATA LIST includes "TOP 50 Projects in the WEB3 Industry," "TOP 100 Investment Institutions in the WEB3 Industry," "TOP 20 Projects in the CEFI Track," "TOP 20 Projects in the DEFI Track," "TOP 20 Projects in the LAYER1 Track," "TOP 20 Projects in the LAYER2 Track," "TOP 20 Projects in the GAMEFI Track," and "TOP 20 Projects in the SOCIALFi Track."

Selection criteria explanation:

Institution selection: Core measurement indicators include the number of investments, lead investments, investment project quality, media attention, and RootData popularity.

Project selection: Core measurement indicators include market value/valuation, media attention, total lock-up value, financing amount, RootData popularity, investment institution quality, narrative, and track positioning.

About RootData

RootData is a data platform for Web3 asset discovery and tracking, pioneering the encapsulation of on-chain and off-chain data for Web3 assets, with higher data structuring and readability, and is committed to becoming a productivity-level tool for Web3 enthusiasts and investors.

Website: https://www.rootdata.com/zh

Twitter: https://twitter.com/RootDataLabs

Discord: https://discord.gg/AeKsqq9738

Note: This report was produced by RootData Research. The information or opinions expressed in this report do not constitute investment strategies or advice for anyone. The information, opinions, and speculations in this report only reflect the judgment of RootData Research on the day of publication. Past performance should not be used as a basis for future performance. At different times, RootData Research may issue reports that are inconsistent with the information, opinions, and speculations contained in this report. RootData Research does not guarantee that the information contained in this report is up to date, and readers decide to rely on the information in this material on their own. This material is for reference only.

The complete PDF version of this report can be downloaded through this link.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。