The development of the Jupiter trading aggregator function is approaching its peak, and the protocol has launched the Launchpad platform Jupiter Start and the incubator Jupiter Labs for horizontal expansion.

By: First Warehouse

Jupiter is a trading aggregator built on the Solana network. Jupiter went live in October 2021 and has since become the favorite trading front end for Solana users, aggregating over half of Solana's trading volume. The development of Jupiter's trading aggregation function is approaching its peak. The protocol has launched the Launchpad platform Jupiter Start and the incubator Jupiter Labs for horizontal expansion. Jupiter has a large user base and resources, ensuring the quality of projects on the Launchpad platform. Additionally, its Jupiter Labs derivative project has a high TVL and trading volume. Therefore, we choose to focus on Jupiter.

Investment Summary

Jupiter is a trading aggregator built on the Solana network, with a user interface similar to 1inch. The protocol provides trading aggregation, limit orders, and dollar-cost averaging (DCA) functions. Jupiter aggregates over half of Solana's trading volume, with limited room for further development in trading aggregation. The protocol has horizontally expanded by launching Jupiter Start and Jupiter Labs, similar to launch platforms. As of January 15, 2024, the protocol has not disclosed any financing information.

The Jupiter trading aggregation function has reached its peak, with limited room for increasing the proportion of trading volume aggregated on the Solana network. Jupiter has always been the only competitive trading aggregator on the Solana network. With its excellent trading experience and user interface, the protocol's 24-hour trading volume is approximately $460 million. It is conservatively estimated that its aggregated trading volume has exceeded 50% of the overall trading volume on the Solana network, with limited room for further growth.

JupiterStart, as a project promotion plan launched by Jupiter, has great potential with the support of resources and user base. Jupiter has launched Jupiter Start, a launch platform with key features such as Launchpad and Atlas, which are not yet available. However, with Jupiter's large user base on the Solana network, combined with its own Jupiter Labs project resources and collaborative projects, the quality of Jupiter Start projects is guaranteed, making this feature worth paying attention to.

Jupiter Labs projects are fork versions of star products on other chains, with great potential under Jupiter's promotion. Jupiter Labs has temporarily launched two projects, derivatives and the LSD stablecoin, which are very similar to GMX V1 and Lybra in form. Currently, the derivatives project is in use, with a daily trading volume of nearly $90 million (limited by TVL). It can be seen that under Jupiter's promotion, Jupiter Labs' products have attracted market attention and a considerable number of users and funds. The subsequent LSD stablecoin protocol has made minor innovations in lending rates and redemption mechanisms, filling a gap in the Solana-related field.

Overall, Jupiter has no competitors in the trading aggregation sector on Solana and aggregates over half of the trading volume, making DEX the underlying liquidity protocol on Solana. With the support of a large user base and project resources, its horizontally expanded Jupiter Start and Jupiter Labs also have strong market potential, and Jupiter Start and Jupiter Labs may have a synergistic effect. Considering the above conditions, we choose to focus on Jupiter.

1. Basic Overview

1.1 Project Introduction

Jupiter is a trading aggregator built on the Solana network, aggregating over 50% of the trading volume on the Solana network, making it the preferred choice for user transactions. Its aggregation function has reached its peak, and the protocol is horizontally expanding to further develop. Jupiter has launched the launch platform Jupiter Start and the incubator Jupiter Labs to increase its influence.

1.2 Basic Information

Establishment Date

May 2021

Country

United States

Sector

DeFi - Trading Aggregator

Fundraising Situation

Funding amount not disclosed

2. Project Details

2.1 Team

The main personnel of the team are Meow and Ben Chow, both of whom founded Jupiter in May 2021 and are also members of the liquidity platform Meteora on Solana.

Co-founder - Meow: Co-founder of Jupiter and builder of DEX Meteora on Solana.

Co-founder - Ben Chow: With years of experience in interaction design and product, he is one of the founding members of the social gaming company Hive7 and co-founder of several other companies. In May 2021, Ben and Meow founded Jupiter Aggregator.

2.2 Funding

Jupiter has not disclosed any fundraising.

2.3 Code

Jupiter was audited by OtterSec, which has previously audited well-known projects such as Solana, Aptos, Sui, and Wormhole (mostly Solana's well-known projects and U.S. projects). It has rich auditing experience and a certain industry reputation.

2.3 Products

As a trading aggregator built on the Solana network, Jupiter is one of the main choices for Solana traders. It currently mainly provides trading aggregation, limit orders, DCA, and Jupiter Start. Additionally, Jupiter Labs has independently launched projects, including perpetual contract products and the LSD stablecoin.

2.3.1 Trading Aggregation

Like most trading aggregators, users can select trading pairs and enter the trading quantity in Jupiter, which will automatically find the best exchange path in supported decentralized exchanges. For tokens with liquidity only on individual DEXs, trading aggregation can directly find liquidity. For larger token trades, trading aggregation can provide better trade prices/slippage through multiple paths. Before trading, users can choose to modify parameters such as trading fees, slippage size, and whether to use a direct path.

Jupiter's trading interface is relatively clean (similar to 1inch) and provides a good trading experience. In the settings, users can adjust the language, block explorer, and RPC nodes to meet different needs and avoid single points of failure. Jupiter currently supports 29 applications with trading functionality. DEXs integrated by Jupiter must meet certain conditions, including liquidity and security audits. DEXs need at least $500,000 in liquidity to ensure a certain level of trading volume, and their code needs to be audited to ensure security.

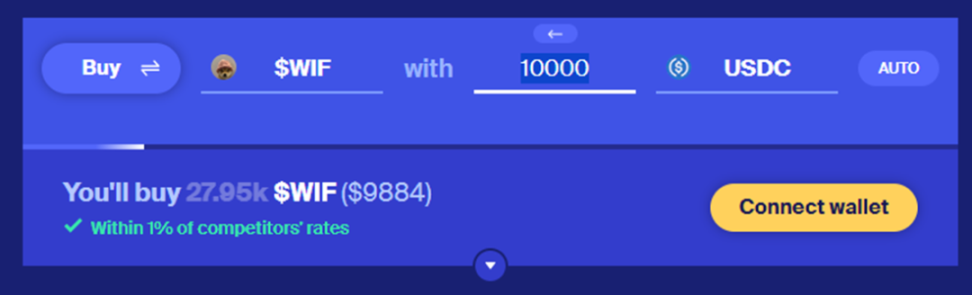

Jupiter aggregates most of the trading volume on Solana, partly due to user interface issues. Orca is the DEX with the strongest liquidity on Solana, with $190 million in liquidity. Raydium comes next, with Orca having more liquidity than Raydium in mainstream token pairs, except for Raydium's native token RAY. However, Orca's trading volume often falls short of Raydium's (Orca's trading volume mostly comes from Jupiter aggregation). Orca's trading interface is not the conventional interface similar to Uniswap, but rather allows users to choose "buy/sell" and then enter the quantity, which does not align with user habits. Additionally, WIF has not been added to Orca's whitelist (requires entering the contract address). While Orca can meet users' small trading needs, the trading experience is far inferior to Jupiter.

Figure 2-1 Orca Trading Interface

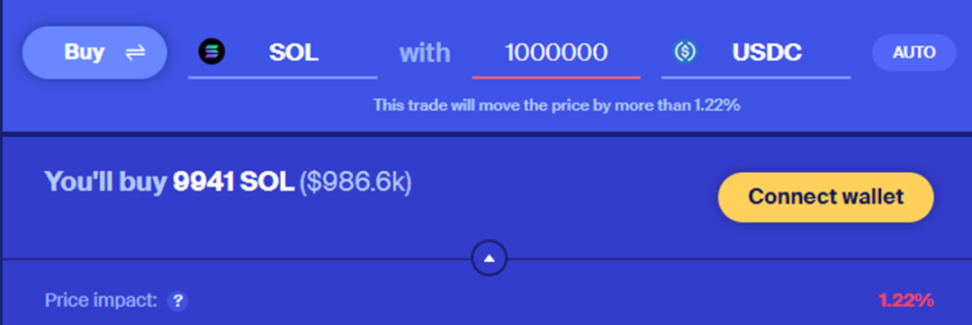

Furthermore, the overall liquidity of tokens on Solana is not strong. Using an aggregator for large trades can reduce slippage losses. For example, when exchanging SILLY for SOL with one million USDC, the slippage loss is close to 1.22%. Using Jupiter, the slippage loss is close to 0.4%, meaning the aggregator can reduce slippage losses/price impact by 0.8%.

Figure 2-2 Orca SOL/USDC Large Trade Display

Overall, the reasons for Jupiter's widespread use are mainly due to user interface, liquidity, and airdrop reasons. After getting used to using the aggregator, users will prefer to use the aggregator rather than DEX for trading, showing a certain level of user stickiness.

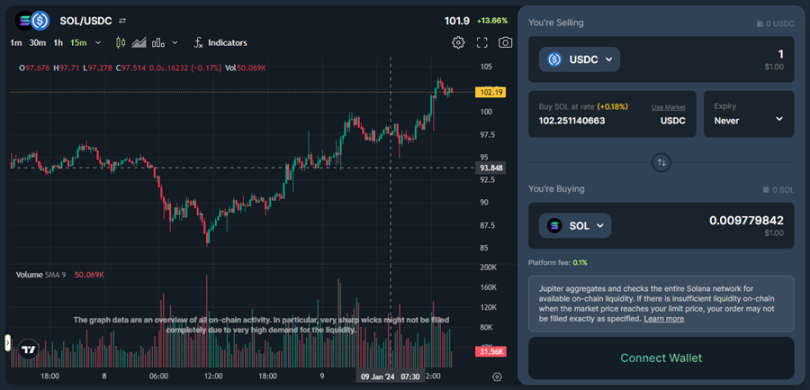

2.3.2 Limit Orders

Jupiter also provides limit order functionality, which avoids cost increases and slippage issues caused by price impact during trading (MEV issues do not exist). When not fully executed, limit orders can be partially completed and receive partial trading tokens. During trading, users can choose the order validity period, exchange price, and exchange quantity. The protocol collaborates with Birdeye and TradingView, with Birdeye providing on-chain token price data, and Jupiter using TradingView's technology for chart data display. The overall trading experience is very similar to that of centralized exchanges.

Figure 2-3 Jupiter Limit Order Functionality Display

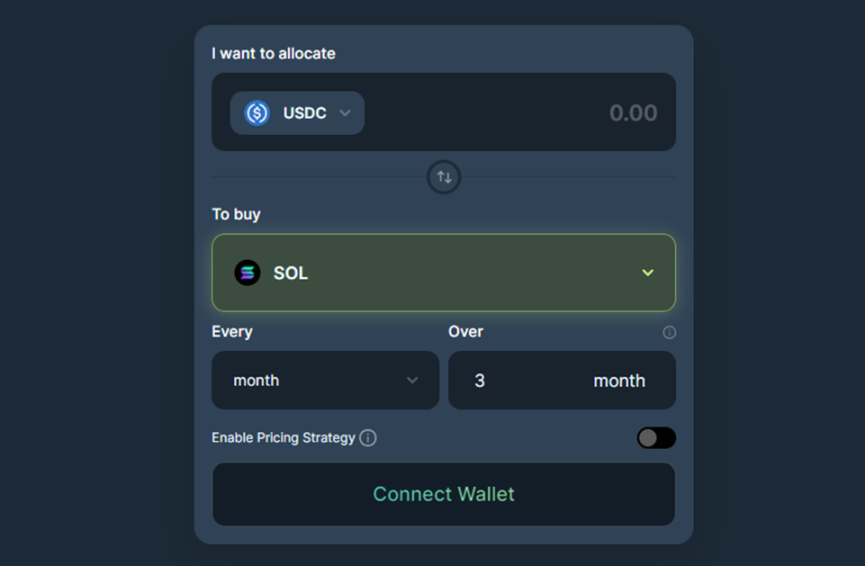

2.3.3 DCA/Dollar-Cost Averaging

DCA (Dollar Cost Averaging), also known as regular investment, involves investing multiple times over a certain period to average the purchase cost. Jupiter offers a minimum frequency of minutes and a maximum frequency of months for DCA. Users can choose the DCA frequency, total time period, and price range for DCA.

Figure 2-4 Jupiter DCA Interface Display

When starting DCA, tokens will be transferred to the relevant account for DCA, and trading operations will be conducted at regular intervals (trading may experience fluctuations of 2-30 seconds to prevent MEV). After the trade is completed, the DCA account will be closed automatically, and all tokens will be transferred to the wallet. The protocol charges a fee of one-thousandth for DCA. DCA is suitable for accumulating tokens in a bear market and gradually selling tokens with weak liquidity, but overall demand is relatively low.

2.3.4 Jupiter Start

Jupiter will establish its own project promotion platform, Jupiter Start, dedicated to promoting the development of new projects while protecting investor interests. The JupiterStart process consists of five sections: social introduction, education, pre-launch, Launchpad, and Atlas. The community introduction will last for a week, mainly introducing the project's concept, economic model, and conducting community discussions. Education will involve placing individual projects on the website, allowing eligible users to earn tokens by reading materials and performing on-chain operations. Pre-launch allows users to place limit orders and DCA operations before adding liquidity.

Currently, the community introduction, education, and pre-launch functions have been launched, and Launchpad and Atlas (not yet specified) functions are worth looking forward to. Given that Jupiter Labs' projects will issue their own protocol tokens, their Launchpad projects may be derivative projects.

2.3.5 Jupiter Labs

Jupiter Labs operates independently of Jupiter, and Jupiter users and the community will have certain priority usage rights and token incentives. The projects launched by Jupiter Labs are currently perpetual contracts and the LSD stablecoin.

Jupiter Perpetual

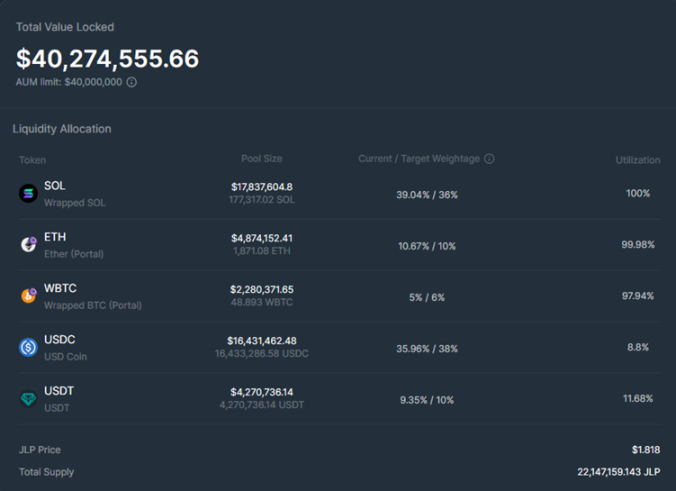

Jupiter Perpetual is a derivative protocol launched by Jupiter Labs, similar to GMX V1, and is currently in use. Protocol users are mainly divided into liquidity providers and traders. Liquidity providers' provided liquidity is exchanged for a basket of tokens (currently including BTC, ETH, SOL, USDC, and USDT), with SOL and USDC having higher weights in the token pool, making SOL the main trading target.

When traders engage in leveraged trading, they borrow tokens from the pool to establish leveraged positions. Derivative traders do not need to bear trading slippage, only trading fees and borrowing fees, with borrowing fees depending on token utilization. Liquidity providers receive 70% of trading fees and all borrowing fees. Correspondingly, liquidity providers also bear the risk of traders' profits and token depreciation losses. Since the end of 2023, the price of JLP has been fluctuating around $1.8.

Figure 2-5 JLP Data

LSD Stablecoin

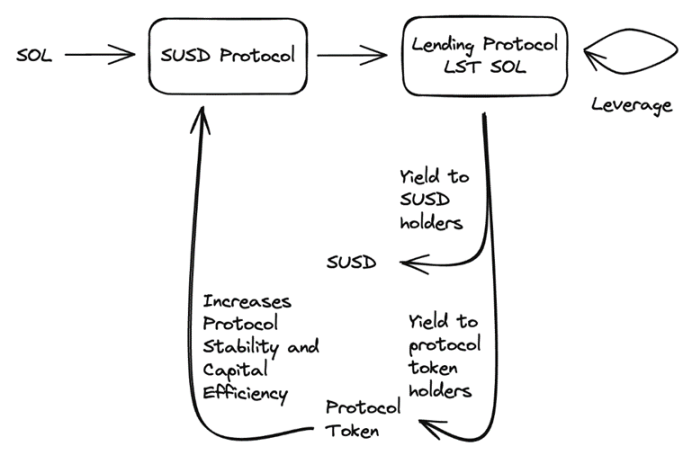

Jupiter Labs' LST stablecoin protocol XYZ has not been launched yet. According to its documentation, the protocol is similar to Lybra V1. Users can mint interest-bearing stablecoin SUSD by collateralizing SOL (without borrowing interest). The protocol generates staking income from pledged LST, which is distributed to SUSD holders and the protocol's governance token. A key feature of the protocol is that when the LST yield is higher than the SOL borrowing rate, SOL LST will be pledged in the lending protocol and used to borrow SOL and convert it into LST, maximizing profits through leveraged arbitrage. Additionally, the protocol may use a redemption mechanism to ensure the stability of SUSD's price. Frequent redemptions may impact borrowers' positions, especially when there are delays in market volatility oracles (SUSD holders exchanging SUSD for borrowers' LST). The protocol mitigates the impact on borrowers by introducing small price range governance token redemptions. When the price of SUSD is between $0.95 and $1, the protocol may use SUSD redemption governance tokens to reduce the frequency of borrower redemptions.

Leveraged arbitrage increases profits but also introduces additional protocol and oracle pricing risks for borrowers and SUSD holders. Borrowers require higher governance token incentives to maintain a certain amount of minted SUSD. Small price range governance token redemptions can significantly mitigate the impact on borrower positions but also bring new issues. Small range governance token redemptions may result in the majority of redemptions being governance token redemptions, leading to significant token issuance if the price continues to stay below $1.

Figure 2-6 XYZ Operational Logic[3]

In summary, Jupiter offers trading aggregation, limit orders, and DCA functionality. The overall trading method is very similar to 1inch. The DCA function allows users to set price ranges, time, and frequency, as an additional feature. The Launchpad and Atlas functions of Jupiter Start have not been launched yet and may be the focus of future development. The Jupiter Labs protocol is incubating two new protocols, derivatives, and the LSD stablecoin. The new protocols will operate independently in the future and provide Jupiter users and the community with certain priority usage rights and incentives.

3. Development

3.1 History

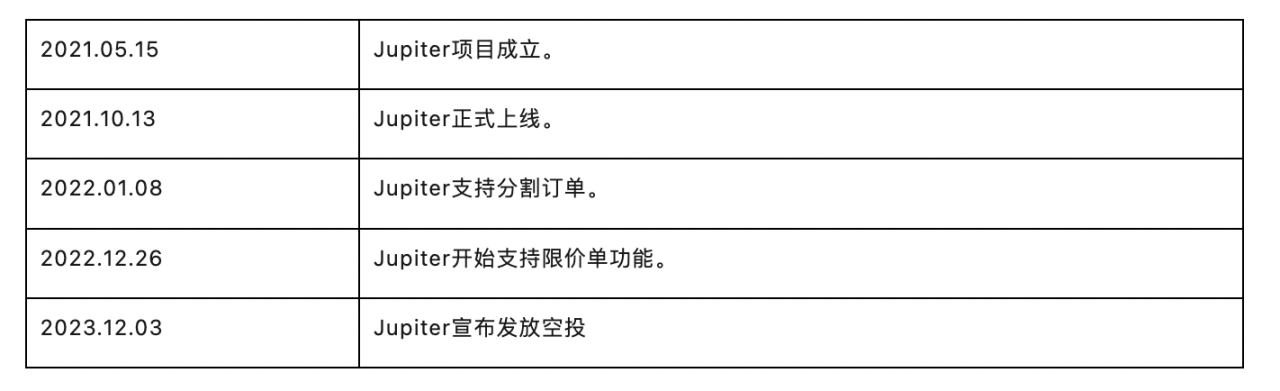

Table 3-1 Major Events of Prisma Finance

3.2 Current Status

3.2.1 Business Data

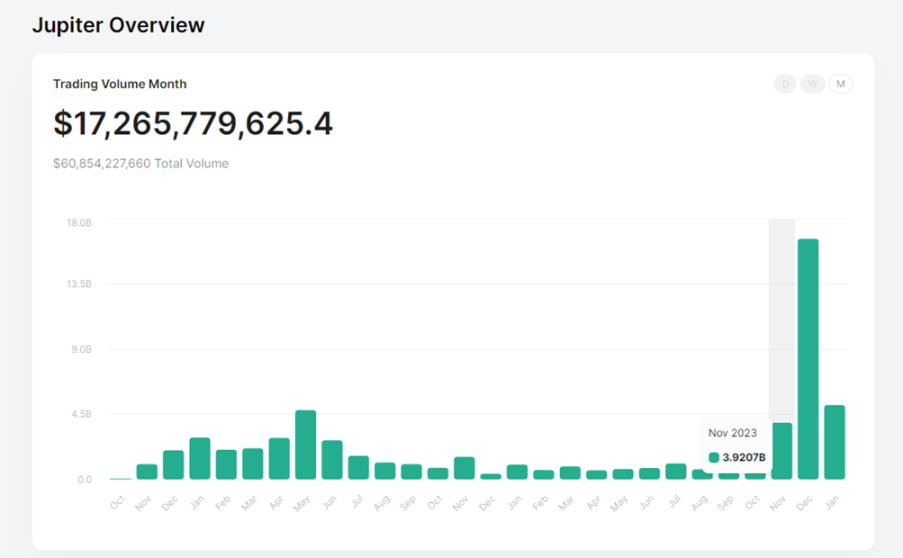

Jupiter is the only competitive trading aggregator on Solana, with a significant portion of the network's trading volume passing through Jupiter. Looking at the trading volume in November and December, the total DEX trading volume on the Solana network was $8 billion and $28 billion, respectively, while the trading volume aggregated by Jupiter in these two months was $3.9 billion and $17 billion, respectively. From the trading volume perspective, Jupiter guides over half of the DEX trading volume on Solana, indicating that users prefer to trade through Jupiter rather than directly on DEX, effectively positioning DEX as the underlying liquidity protocol.

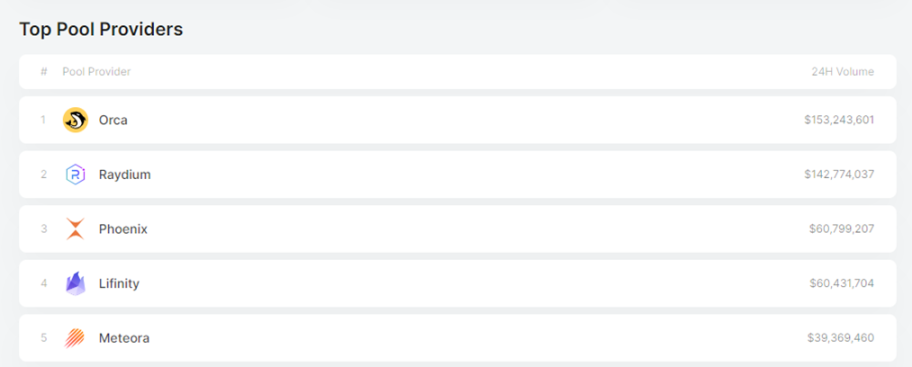

Currently, Jupiter aggregates liquidity from 29 protocols, with the top five protocols in terms of trading volume generated through trading aggregation being Orca, Raydium, Phoenix, Lifinity, and Meteora. The top five protocols account for close to 90% of Jupiter's trading volume. It is worth mentioning Meteora, whose team members include Meow and Ben Chow, and the protocol's predecessor is the decentralized exchange Mercurial Finance. After the FTX collapse, Mercurial Finance announced its shutdown and a snapshot of token holders receiving 20% of Meteora tokens, with Jupiter planning to launch tokens/add liquidity on Meteora. Meteora has already started an incentive program for liquidity providers (allocating 10% of tokens to LPs before adding liquidity).

3.2.2 Social Media Scale

Discord

Telegram

Followers

160,000 followers

75,823 members

N/A

As of January 15, 2024, Jupiter has a large community, with high activity on Discord, mainly discussing topics such as JUP airdrops and Meteora liquidity-related issues.

3.3 Future

Jupiter currently does not have a clear roadmap. Considering the upcoming token issuance, further action should involve establishing a DAO for protocol governance. The Launchpad and Atlas functions of Jupiter Start will be launched in the future. As a star project on Solana with a large user base, Jupiter has a significant resource advantage for Jupiter Start.

In summary, since its launch in October 2021, Jupiter has gained a significant amount of trading volume. With the collapse of FTX, Orca became the DEX with the highest TVL (the user interface provides a slightly inadequate trading experience), and Raydium has high TVL and liquidity for some meme tokens. Jupiter's ease of use and comfortable user interface have won favor with more users. As of January 15, 2024, over 50% of the trading volume occurs on Jupiter. The upcoming Launchpad function is worth looking forward to.

4. Economic Model

4.1 Token Distribution

Jupiter's token is JUP, with a total supply of 10 billion tokens. 40% of the tokens (10% in the first round, totaling 4 rounds) will be used for airdrops, 20% for liquidity and community incentives, and 40% for the team and strategic reserves. The protocol commits to allocating 50% of the tokens to the community and has allocated a cold wallet for both the team and the community. The initial circulating tokens are expected to be 5% for adding liquidity and 10% for airdrop tokens (there may be an additional 2% or so of unlocked tokens).

4.2 Token Utility

Jupiter has not yet disclosed the specific utility of the JUP token. In the short term, JUP is mainly used for community governance. Future projects from Jupiter Labs may airdrop to JUP holders and provide priority testing rights. Additionally, Jupiter may follow 1inch in providing positive slippage income to stakers.

5. Next Steps

Jupiter has already aggregated 50% of the trading volume on Solana, and the main development in the future lies in the Jupiter Start function and Jupiter Labs.

5.1 Overview of the Solana DEX Industry

Jupiter has always been the only competitive trading aggregator on the Solana network. With its smooth user experience and comfortable interface, Jupiter has attracted an increasing number of users. Jupiter aggregates over 50% of the trading volume on Solana, making DEX the true underlying liquidity protocol on the Solana network. With further development of the protocol and upcoming airdrop plans, the proportion of trading volume aggregated by Jupiter is expected to increase further. Jupiter has captured almost all of the aggregator market on Solana, and further development lies in Solana itself rather than further optimization of Jupiter.

5.2 Jupiter Start

In the limited case of further growth in trading aggregation, JupiterStart is another direction for Jupiter to expand its footprint. Currently, JupiterStart only has introductions, education, and pre-launch functions, and the core function of Jupiter Start, Launchpad, has not been launched yet. Jupiter has a large user base, and there is a strong traffic effect. Considering its own resource advantage, the projects launched on it may have high quality.

5.3 Jupiter Labs

Jupiter Labs collaborates with JUP DAO, the Solana community, and Jupiter users to launch new DeFi protocols. Projects within Jupiter Labs will eventually operate independently, but Jupiter users, the community, and token holders will have early priority usage rights and token rewards. Projects from Jupiter Labs may also be launched on Jupiter Start.

The current products launched by Jupiter Labs are the derivatives protocol and the LSD stablecoin protocol. The derivatives protocol is in the early usage stage, with liquidity (JLP) limited to $50 million, and the overall protocol is very similar to GMX V1. Another protocol is the LSD stablecoin protocol XYZ, which is similar to LybraV1 but increases the income of stablecoin holders and protocol token holders through interest rate arbitrage (collateralizing LSD, borrowing SOL, and converting it back to LSD). Additionally, while other stablecoin protocols maintain the price by directly redeeming collateral, XYZ uses governance tokens for redemption in the case of small-scale disanchoring (5%) to maintain the borrower's position, thereby increasing the dilution risk of governance tokens while protecting the borrower.

In summary: Jupiter's trading aggregation business has almost reached its ceiling, and it has adopted a strategy of expanding horizontally into the DeFi sector, launching the Launchpad platform Jupiter Start and the incubation platform Jupiter Labs. Jupiter has strong resource advantages (a large user base and Jupiter Labs projects), and the Launchpad projects are worth paying attention to. Although Jupiter Labs is relatively less innovative, it fills the gap in related projects on Solana and still has great potential with the support of Jupiter.

6. Risks

1) Code Risk: Jupiter has been audited by OtterSec, but there is still code risk.

2) Derivatives Project Risk: The derivatives project is still in the beta stage and may have risks such as oracle attacks that could drain protocol liquidity[5].

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。