This article will comprehensively compare various LRTs, provide seven distinctive strategies, and help you create infinite possibilities with your limited ETH.

Author: CapitalismLab

Eigenlayer LRTs are emerging one after another. Which one should you choose to maximize your returns? What strategy is most suitable for your needs? Eigenlayer will briefly open LST deposits on February 5th, and it's time to make a decision!

This article will comprehensively compare various LRTs, analyze the characteristics of major projects, and provide seven distinctive strategies to help you create infinite possibilities with your limited ETH.

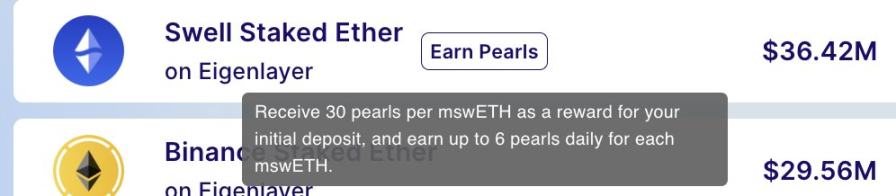

One Fish, Three Eats: swETH+Eigenpie

Deposit swETH into Eigenpie:

Eigenpie points correspond to a total of 10% airdrop + 24% IDO $3 million FDV - Swell pearls correspond to a total of 7% airdrop.

Airdrop of Eigenlayer points.

You can benefit from both sides and earn full returns from the two major platforms. In the future, you can continue to earn more returns on Pendle or other platforms using mswETH. The feature of this strategy is the ultimate point multi-eating.

It is important to note that Eigenpie operates in a fleet mode, and the larger the fleet, the higher the increase.

Follow Binance: Puffer+stETH

Puffer Finance has received investments from Binance Labs and Eigenlayer, and the community generally expects high listing prospects on Binance, with rapid TVL growth.

Puffer focuses on Anti-Slash LRT, and it is important to note that due to Puffer Mainnet not yet being launched, the current pre-mainnet activity only supports stETH. However, stETH is likely to reach the single LST 33% limit set by Eigenlayer, meaning that each ETH can obtain fewer Eigenlayer points.

Therefore, the key of this strategy lies in speculating on Puffer's listing on Binance, while there may be a certain disadvantage in obtaining Eigenlayer points.

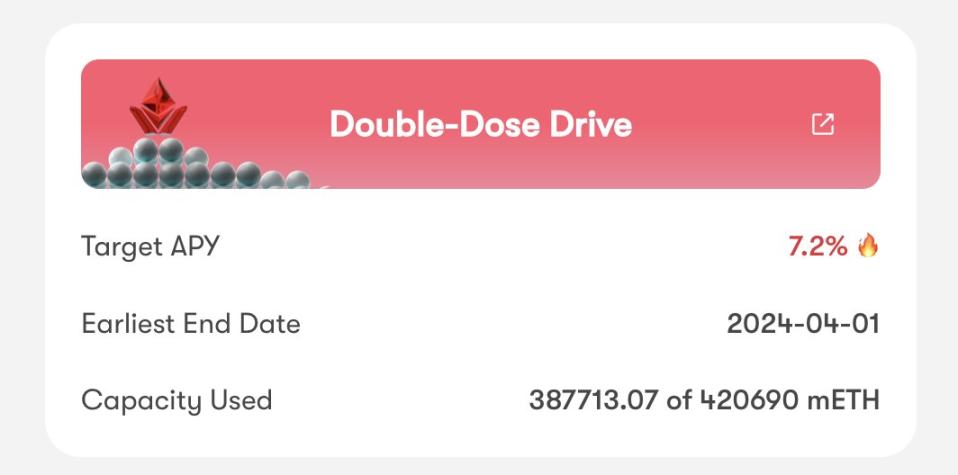

Stick to the Basics: mETH+Eigenpie

With the subsidy from Mantle Treasury, mETH's 7.2% APR is more than double that of other LSTs and will continue until April 1st. With high basic returns and additional benefits from Eigenpie, the ceiling is also high.

The feature of this strategy lies in sticking to the basics while being able to obtain high returns with certainty and also speculate on surprises from LRT.

mETH can be minted on the Mantle official website. If the limit is reached, you can also try to exchange stETH on NativeX without slippage. It is important to note that Eigenpie operates in a fleet mode, and the larger the fleet, the higher the increase.

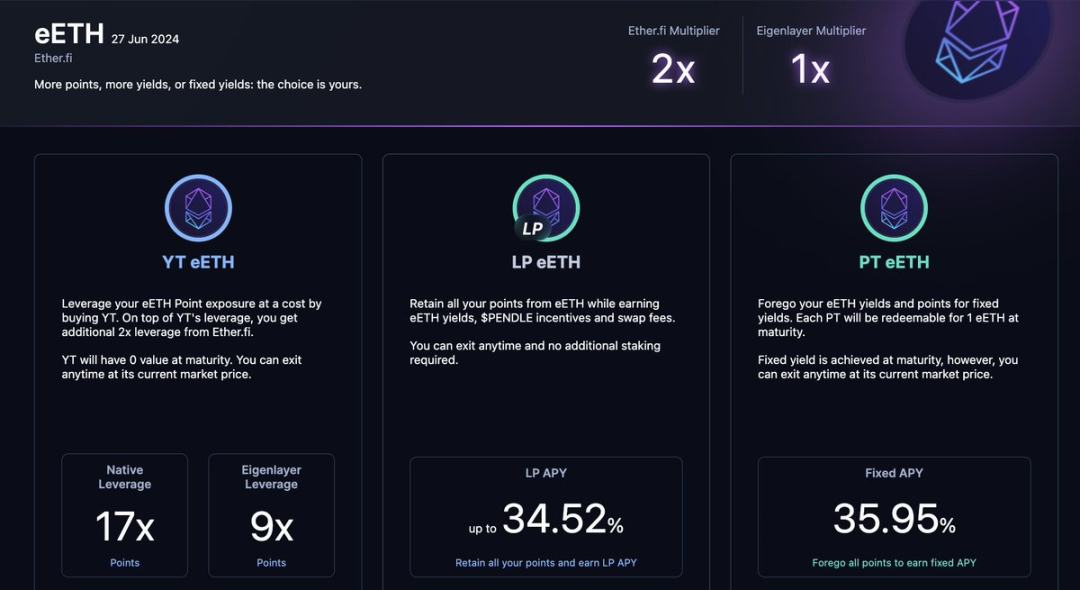

Leave a Way Out: EtherFi

Unlike other projects that generally only support DEX Swap back to ETH, EtherFi is currently the only one that supports unstaking. Users can not only swap back to ETH through DEX Swap but also redeem ETH at a 1:1 ratio through unstaking, with a waiting time of possibly 7+ to 14+ days.

In addition, EtherFi can currently obtain double points through combinations on DeFi platforms such as Pendle, as well as incentives from these DeFi platforms.

EtherFi's previous airdrop was somewhat ambiguous, and the project's airdrop returns have a high degree of uncertainty. Therefore, the feature of this strategy is for users with high liquidity needs and low tolerance for depeg losses, as well as users who are more concerned about Eigenlayer airdrops compared to LRT airdrops, making it easier to exit with low losses when there is a need for liquidity.

EtherFi is also holding a MegaWeek event this week, where using an invitation link to deposit can earn 5 times the one-time deposit points of EtherFi and participate in the additional reward of sharing 1 million Eigenlayer points.

Lock in Returns (Buy PT on Pendle) or 6. Small-scale Speculation (Buy YT on Pendle)

Pendle has launched a dedicated page for LRT. It can be seen that every 1YT eETH represents the ability to obtain 17 eETH of EtherFi points and 9 eETH of Eigenlayer points, with PT having a fixed interest rate of 36%.

This means that if you buy PT, you are giving up all point returns and staking returns, and until the maturity date on June 27th, you can obtain a 36% APY on eETH.

If you buy YT, it is equivalent to leveraging 10x to mine points. If the points ultimately bring a return of 36% APY, you will break even; if it is higher, you will make a profit. For the specific calculation formula, please refer to this link.

Currently, EtherFi/KelpDAO/Renzo are all listed on Pendle, but the rules are different for each. It is recommended to fully understand them before proceeding.

Bold Moves: Buy and Lock vlPNP/vlEQB to Earn Bribe Points

Currently, due to the various listings on Pendle, various platforms are also offering Penpie and Equilibria bribe returns.

How do you judge if it's worth it? Voting is once a week, so you can calculate how many points 1 PNP/EQB can earn per day, and then see how many points 1 ETH can earn per day to have an idea. According to calculations by various experts, there is generally a ten to several tens times efficiency.

However, please note that this vote can only earn LRT points and not Eigenlayer points. The mechanism is complex and has significant loss and liquidity risks, so it is not recommended for those unfamiliar with Pendle and Convex flywheel strategies to operate.

Summary

Market Situation:

- The six giants' layout: EtherFi / KelpDAO / Puffer / Renzo / Eigenpie / Swell;

- stETH is likely to reach the single 33% limit set by Eigenlayer, obtaining fewer points.

Characteristics of each project:

- Eigenpie: Best benefits, highest certainty of returns, and highest ceiling.

- Puffer: Best background, highest expectations for listing on Binance.

- EtherFi: Largest scale, best liquidity, and supports unstaking.

- KelpDAO: Second largest scale, launched by the LST team Stader.

- Renzo: Supported by Chinese capital such as OKX/SevenX, Native & LST.

- Swell: LST+LRT, can form triple point mining with Eigenpie.

Currently, all six projects are either backed by well-known investors or are initiated by well-established teams, so those interested can try, but there may still be risks.

Seven distinctive strategies:

- 1. One Fish, Three Eats: swETH+Eigenpie, swell+Eigenpie+Eigenlayer triple point mining.

- 2. Follow Binance: Puffer has received investments from Binance Labs and Eigenlayer, with the community generally expecting high listing prospects on Binance.

- 3. Stick to the Basics: mETH+Eigenpie, mETH's 7.2% APR is more than double that of other LSTs, with high basic returns and additional benefits from Eigenpie, and a high ceiling.

- 4. Leave a Way Out: EtherFi, supports unstaking, allowing smooth low-loss exits for large funds.

- 5. Lock in Returns: Buy PT on Pendle, give up point sharing for fixed high returns.

- 6. Small-scale Speculation: Buy YT on Pendle, equivalent to leveraging a dozen times to speculate on points.

- 7. Bold Moves: Buy and Lock vlPNP/vlEQB to Earn Bribe Points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。