Author: Biteye, Core Contributor Louis Wang

Editor: Biteye, Core Contributor Crush

Community: @BiteyeCN

01

The Wave of Ethereum Staking

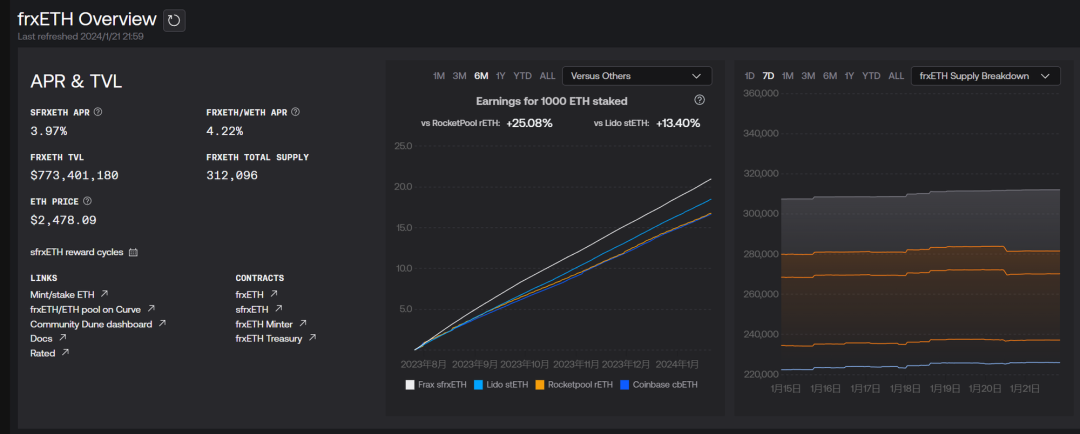

After Ethereum entered the era of 2.0, staking ETH to run nodes has become a new business. Qualified node operators can earn around 4% of ETH-denominated returns annually. In the long run, it is a very good financial choice if ETH continues to rise.

However, the actual threshold for running nodes is not low. It requires a capital threshold of 32 ETH and demands technical and hardware stability for node operation. Carelessness in maintaining the node and accidental disconnection can result in fines.

As a result, a batch of staking projects such as Lido and Rocketpool emerged to help users solve the difficulties of capital and technology.

The amount of ETH staked continues to rise, with over 29 million ETH currently staked on the beacon chain, and the total locked value reaching $71 billion. The staking ratio has increased from 2.4% in January 2021 to the current 24.4%.

(Source: https://cryptoquant.com/asset/eth/chart/eth2/eth-20-staking-rate-percent)

02

Liquid Staking Token (LST) and LSD (Liquid Staking Derivatives) Fi

When users use staking protocols such as Lido, they receive a liquid staking token (LST) such as stETH.

Since LST itself is an ERC20 token, it can easily build liquidity pools, allowing this locked liquidity to become active again and continue to be invested in LSD Fi projects such as Frax and Origin to earn more yield.

(Source: https://facts.frax.finance/frxeth)

LSD Fi is a DeFi project built on the basis of LST and LST derivatives. For example, by depositing stETH, users can obtain principal tokens and yield tokens, thereby deriving yield strategies based on different risk preferences.

03

From Staking to Restaking

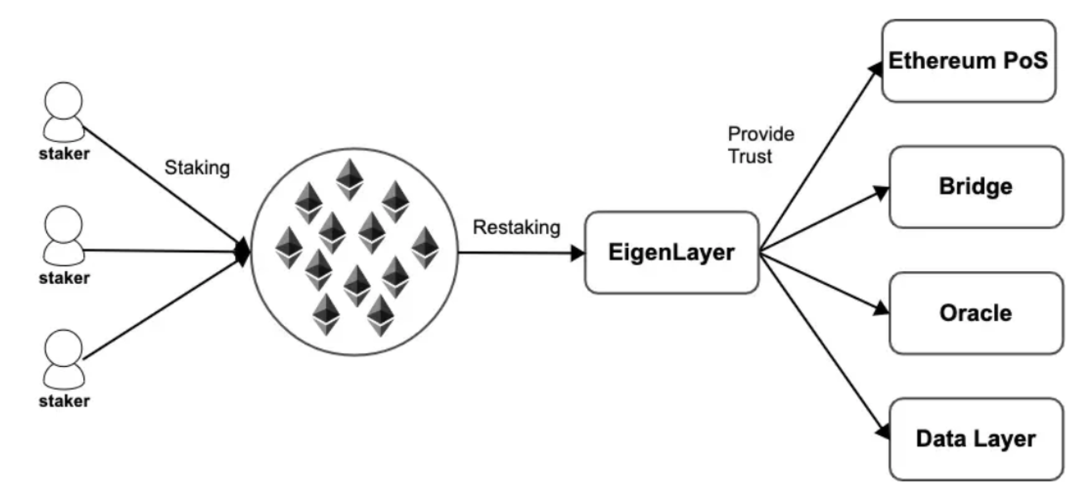

Node staking is essentially a way for users to deposit collateral to operate nodes and maintain project security. Nodes that fulfill their responsibilities will receive returns, while those that are negligent or malicious will be penalized with the loss of collateral.

Therefore, not only public chains need nodes, but also various projects such as cross-chain bridges, oracles, and decentralized autonomous organizations (DAOs) like Chainlink, the Graph, and Celestia, all require staking to ensure the stability and security of their nodes.

The number of Ethereum nodes, their quality, and the massive capital investment make it the most reliable public chain.

However, any module that cannot be deployed or verified on the Ethereum Virtual Machine (EVM) cannot leverage the trust advantage of the Ethereum network and requires someone to operate nodes and provide active validation services (AVS).

Operating nodes also requires users to contribute real money to ensure security, which is inevitably difficult under limited liquidity.

EigenLayer's solution is to enable restaking, allowing other AVS to inherit and share Ethereum's security.

(Source: EigenLayer)

Essentially, EigenLayer provides a pool security mechanism and a security market, where multiple projects can share Ethereum's security pool, and users need to weigh the returns and risks provided by each project to choose to join or exit the restaking module built on EigenLayer.

The economic benefits of restaking are obvious.

For users, they can earn from multiple projects by staking one ETH, including the expected airdrop of unreleased projects (especially EigenLayer);

For project parties, it reduces the pressure of obtaining staking funds while inheriting some of Ethereum's security.

Of course, this is not a completely risk-free win-win situation.

For project parties, the staked tokens are in Ethereum rather than their own tokens, reducing their ability to capture the value of their tokens;

Users add an additional layer of trust in EigenLayer, increasing the risk.

For Ethereum, it is also unsatisfactory, as it is like having an employee working multiple jobs. Additionally, due to the additional staking returns, users will definitely prefer to stake Ethereum in EigenLayer rather than directly in Ethereum, without restrictions. If this employee is penalized for any reason (whether it violates discipline or is mistakenly penalized), it will affect their staked funds in Ethereum, potentially leading to the node becoming invalid and undermining the security of the Ethereum network. Therefore, Vitalik Buterin previously proposed not to overload Ethereum's consensus, specifically pointing out EigenLayer.

04

Liquid Restaking Token (LRT) and LRTFi

For users, restaking in EigenLayer is a good choice with multiple benefits, but it faces several problems:

Difficulty in staking in EigenLayer. Due to the high popularity of EigenLayer, the types and quotas of LST allowed for staking are currently very limited, making it difficult for users to participate;

Once ETH or LST is deposited, liquidity is locked;

The complexity of strategy research increases due to the choice of node operators and risk management in participating projects.

Therefore, the emergence of the LRTFi project mainly solves these problems and lowers the threshold for restaking.

LRTFi returns the liquidity to users in the form of LRT for staking ETH/LST in EigenLayer;

As for EigenLayer points, they are either relinquished by the previous project party or obtained through EigenPod (EigenLayer allows direct restaking on the beacon chain without quota restrictions);

Better risk management strategies, such as Puffer's anti-slashing mechanism (to prevent node slashing).

The returns of LRT are built on top of LST, which obviously leads to higher returns. At the same time, LRT projects also entail higher risks, mainly as follows.

Contract risks associated with multiple protocol nesting, so it is essential to carefully select audited LRT projects;

LRT projects involve multiple assets, thus encompassing the risk of stakable LST;

Participating in more AVS for higher returns increases the risk exposure to collateral slashing;

Additionally, there is the liquidity risk of LRT itself, similar to LST, which may experience phenomena such as de-pegging. These are all risks associated with participating in LRT projects.

05

LRT Projects

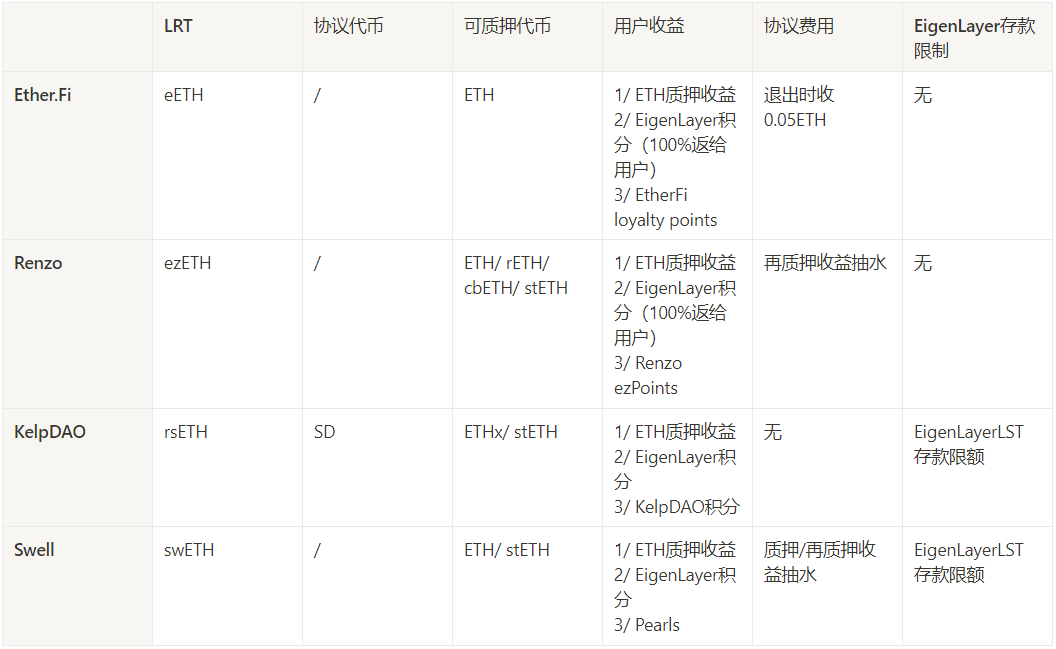

Currently, the LRT projects that have been launched include EtherFi, Renzo, Swell, and KelpDAO, with nearly ten more in the test network. The gameplay of the projects is similar, with the main differences lying in the ability to mine EigenLayer points and the exit liquidity. Next, we will introduce these four projects that have already been launched.

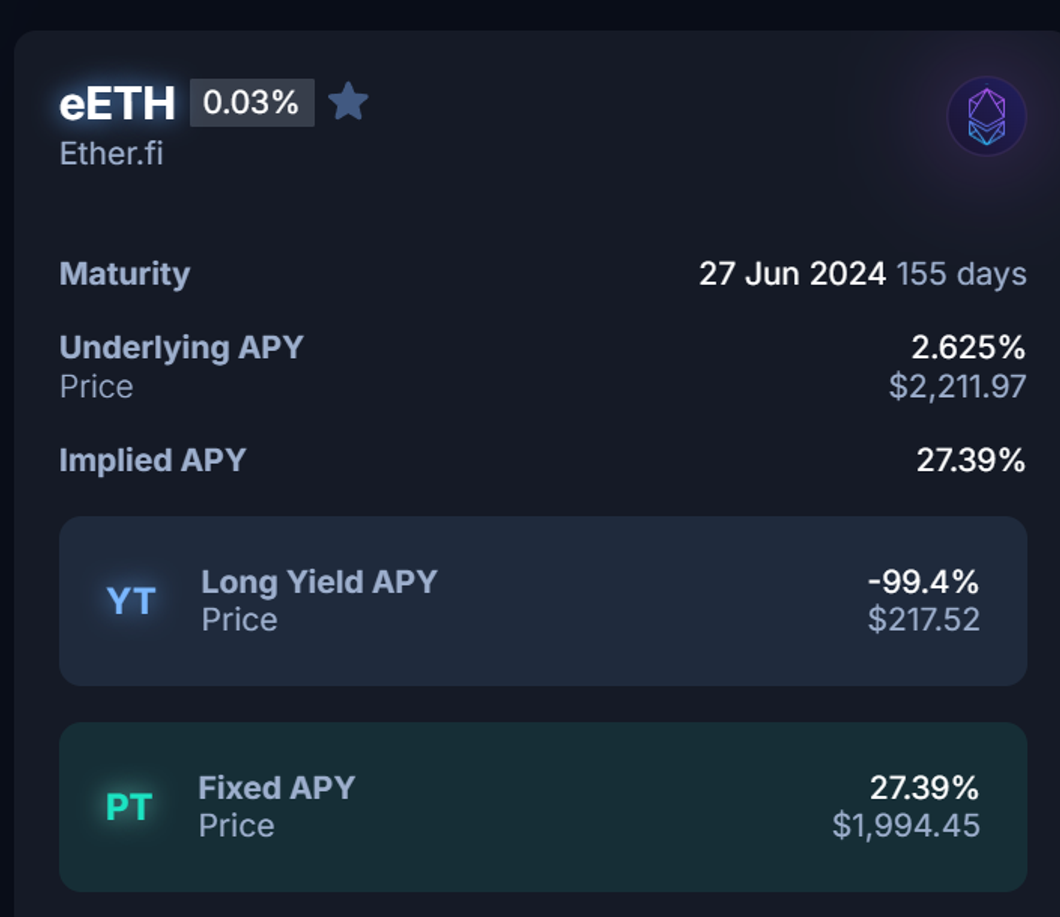

Ether.Fi

EtherFi completed a $5.3 million seed round of financing in February last year, and its TVL currently exceeds $330 million.

- Users can deposit ETH to receive $eETH, and by participating, they can simultaneously earn EigenLayer points and EtherFi's loyalty points, which will be used as reference standards for future airdrops. Exiting liquidity is also convenient, as the unstake function has already been launched.

(Source: https://defillama.com/protocol/ether.fi)

Furthermore, $eETH can be deposited into Pendle for the splitting of PT and YT. Currently, YT has a high premium, allowing for an immediate 10% profit upon selling, while the remaining PT can be redeemed for the full principal upon maturity.

For specific operations, please refer to:

Triple Earning: Using Pendle to Earn Ten Times EigenLayer Points Tutorial

https://mirror.xyz/0x30bF18409211FB048b8Abf44c27052c93cF329F2/X6_C9xgM2-t0fbjCSDtLBwxkXDPVf2rXF-JoKQVwRJg

(Source: https://app.pendle.finance/trade/markets)

Renzo

Renzo has disclosed limited information in the past, but after announcing a $3.2 million seed round of financing led by Maven11 last week, its TVL has surged and currently stands at $100 million.

In addition to ETH, Renzo also supports LSTs such as rETH, cbETH, and stETH. Renzo's LRT token is $ezETH, and it has launched the Renzo ezPoints loyalty program, where points can be obtained by minting $ezETH. Currently, there is no method for exiting liquidity.

(Source: https://defillama.com/protocol/renzo)

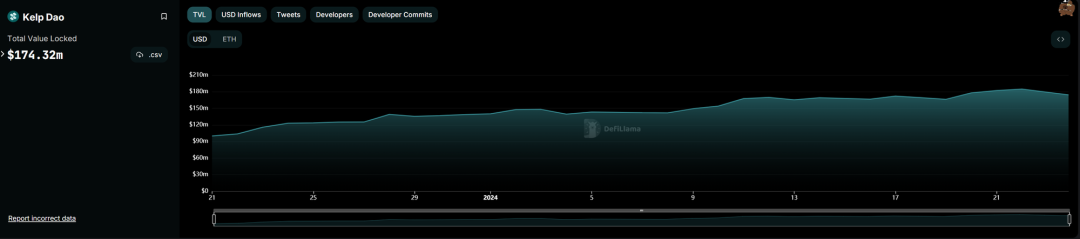

KelpDAO

KelpDAO, launched by the well-established project Stader, allows users to stake and earn LRT $rsETH, which can be used to obtain KelpDAO points.

After EigenLayer opened deposits on January 29th, all deposited coins will be transferred to EigenLayer, allowing for dual points earning. Compared to other projects, there are fewer expectations for airdrops, as Stader's token $SD already exists. Additionally, KelpDAO's staking is done through EigenLayer's LST, so there is a limit to the accommodated funds, and currently, there is no method for exiting.

(Source: https://defillama.com/protocol/kelp-dao)

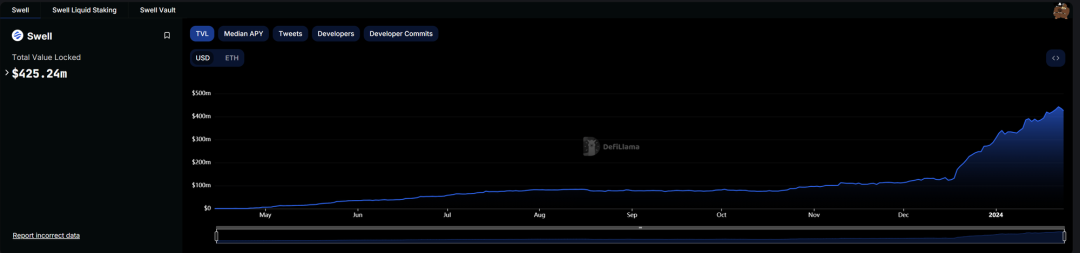

Swell

Swell is an LST project that has joined the ranks of LRT. Users can deposit ETH to earn staking income and can also use swETH to participate in projects such as Pendle.

Its Super swETH product allows users to deposit ETH or stETH to earn up to 18% annualized returns. In addition to staking income, users can also earn Pearls (similar to a type of loyalty point), which may be exchanged for Swell tokens during the TGE.

The protocol currently has a TVL of over $425 million. Depositing swETH will allow users to earn EigenLayer points once mining opens on January 29th, and the subsequent launch of LRT's rswETH will allow for direct dual mining. Exiting liquidity is also very convenient, as there are trading pools for direct ETH swaps.

(Source: https://defillama.com/protocol/swell)

Puffer

Puffer is a liquidity staking protocol based on EigenLayer, and it is a highly technical restaking project. It received early funding from the Ethereum Foundation to develop Secure-Signer technology, aimed at reducing slashing risks and increasing the number of independent operators to achieve network decentralization.

Puffer's nodes serve as both Ethereum validation nodes and native nodes on EigenLayer, allowing them to simultaneously earn rewards from Ethereum and EigenLayer restaking rewards. Puffer received a $5.5 million seed round investment, with investors including the founder of EigenLayer.

Both Ethereum and EigenLayer have penalty mechanisms, and Puffer's node private key security and anti-slashing are protected by Secure-Signer, RAV software, and TEE hardware, effectively reducing the risk of LSD and LSDFI assets.

Summary of Launched Projects:

LRT projects based on EigenLayer are quite complex, involving various details.

For example, the types of tokens that can be staked (ETH, LSTs), the protocol's own token (LRT), the source of distributed rewards, the protocol's fee structure, and the method of staking into EigenLayer (whether through LST staking or EigenPod staking, which determines the protocol's fund cap).

Similar to LST projects, under the premise of secure contract audits, protocols that go live earlier have a first-mover advantage, allowing them to build their own brand and network effects.

With limited funds in the market, seizing the initiative and leading position is crucial. However, LRT has its complexity, and effective risk management is also a major competitive advantage for LRT projects.

Like LST projects, LRT projects will seek to collaborate with DVT technology projects to ensure stable node operation, such as Obol and SSV. Additionally, lending, dex, and derivatives based on LRT will gradually emerge. Furthermore, providing support for multi-chain projects will also be one of the development directions for LRT projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。