Ethereum staking is steadily increasing, gas consumption is shrinking, exchange balances are decreasing, Eigenlayer holds a large amount of staking, and Altlayer token airdrops have attracted attention, with the overall supply and demand situation being good.

Author: @Evan_ss6 / Source

Translation: Blockchain in Plain Language

As the Ethereum staking rate increases, the demand for re-staking services also grows. This article will detail several key aspects of Ethereum's supply dynamics:

(1) ETH Staking

(2) Gas Usage

(3) Exchange Platform Balances

(4) Re-staking, Liquid Staking, and Eigenlayer

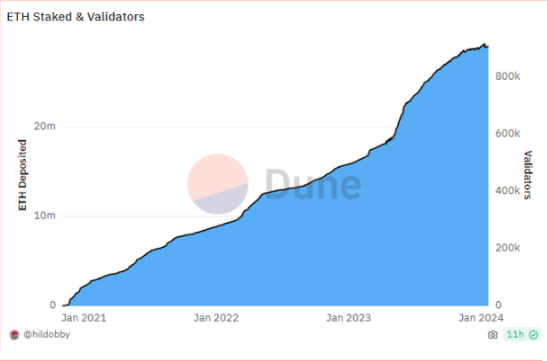

1. ETH Staking

Starting with the total Ethereum staking, it is currently in a huge upward trend and is near its historical high.

Despite the largest redemption in history by Celsius/Figment, approximately 573,000 ETH, Ethereum's staking continues to grow steadily.

On the other hand, a large amount of new Ethereum is being staked, much of which is driven by Eigenlayer (to be detailed later).

2. Gas Usage

Next, let's take a look at gas usage.

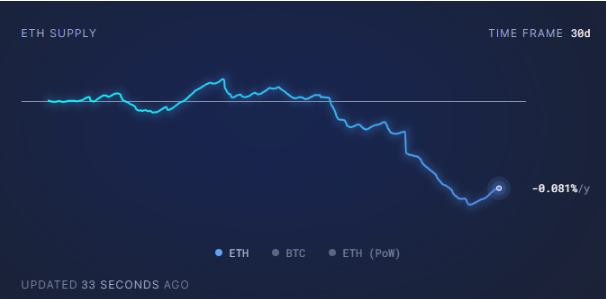

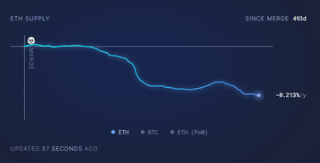

Over the past 30 days and the past 493 days (since the merge), Ethereum has been in a state of deflation.

Gas consumption is mainly driven by Uniswap, Ethereum transfers, Tether/USDC, Layer 2 scaling solutions (L2s), Metamask, and OpenSea/Blur.

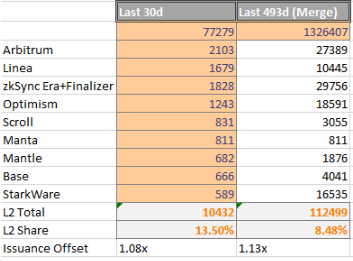

A closer look at Layer 2 scaling solutions (L2s):

Their share of total gas consumption is on the rise. In Dencun, EIP-4844 will change some of the situation, but here are the data within the mentioned time frame (may miss some contracts, actual numbers slightly higher):

The issuance offset ratio in the past 30 days and 493 days is 1.08 times/1.13 times, mainly influenced by the bear market/recovery phase.

3. Exchange Platform Balances

Next, let's look at the balances of Ethereum on exchange platforms. We can see that in the past year, the Ethereum balance on exchange platforms has decreased from 19.6 million to a low of 14.9 million.

The amount of Ethereum in smart contracts continues to increase and is almost close to its historical high (sorry, no chart for reference) :(

4. Re-staking, Liquid Staking, and Eigenlayer

Finally, let's summarize the situation of re-staking.

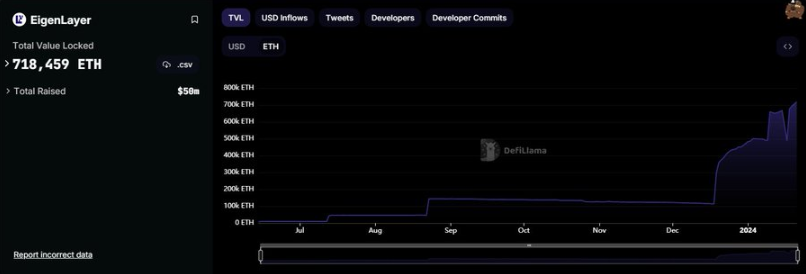

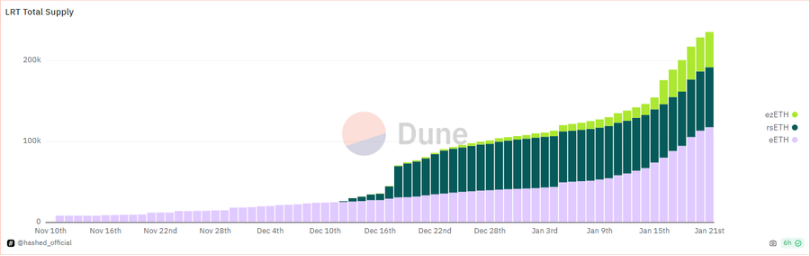

@eigenlayer currently holds approximately 745,000 staked Ethereum (note that the Llama chart may be a bit outdated). Although the main Liquidity Staking Tokens (LST) have reached their limit, the amount of re-staking continues to grow steadily due to the protocol EtherFi, Kelp, and Renzo driving Liquidity Reward Tokens (LRT).

Since early December, these protocols have added approximately 220,000 staked Ethereum and have continued to grow steadily before the launch of @eigen_da, a competitor aligned with Ethereum.

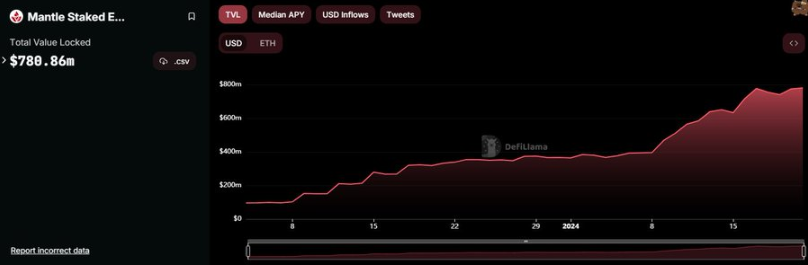

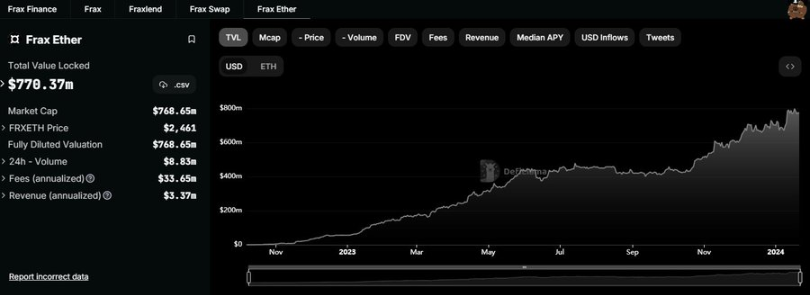

With the increase in the limit, they also seem prepared to add a large amount of LST from @fraxfinance and @0xMantle.

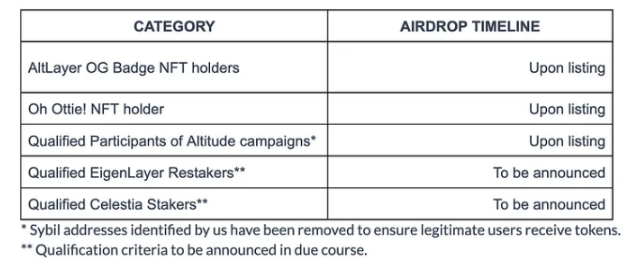

In addition to the general excitement for Eigenlayer, the announcement of an airdrop to the stakers of @CelestiaOrg and the re-stakers of @eigenlayer by the re-staking Rollup BN Launchpool project @alt_layer, supported by Polychain, has added fuel to the fire.

Altlayer plans to launch its token on the 25th of this week.

This airdrop announcement undoubtedly sparked speculation about other Alternative Verification Systems (AVS) and related projects potentially airdropping to the re-stakers of Eigenlayer in the future.

In summary, the supply and demand situation looks positive on both fronts. Projects such as DeFi, L2s, and Eigenlayer continue to absorb more and more Ethereum, while the supply side shows a trend of net deflation. Celsius has finally stopped selling, and speculation on ETH spot ETFs is gradually gaining momentum.

In addition to these projects, I expect several important Ethereum projects to launch their tokens in the first half of 2024, with @LayerZero_Labs already confirmed, and Starkware/zkSync widely anticipated.

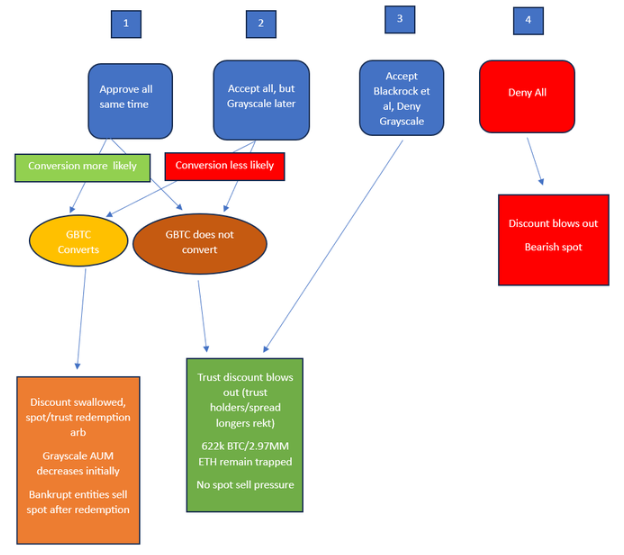

In a very favorable supply and demand situation, the timeline has reached a peak of sentiment of "Ethereum is dead," especially for those who have been following my analysis of the Grayscale ETF scenario in October.

Source: https://twitter.com/Evan_ss6/status/1749158472363430229

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。