Last summer, the U.S. Securities and Exchange Commission (SEC) sued crypto exchanges Coinbase and Binance, alleging they listed and traded unregistered securities in the form of various cryptocurrencies. This week, the regulator's legal teams faced the exchanges in court as the companies argued the SEC did not make the case that those cryptos are securities.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

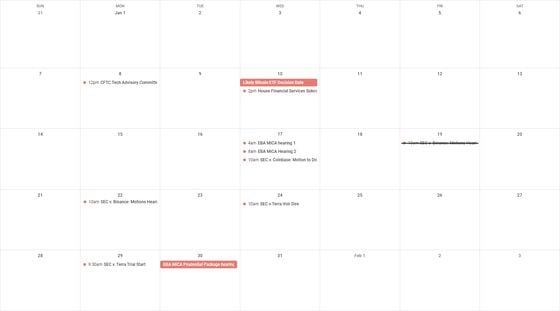

There's no rest for the weary: While the story last week was about whether or not the SEC would approve spot bitcoin exchange-traded funds (ETFs) and the rough sequence of events that occurred before the approval was final, this week found us back in court as the regulator's Enforcement Division argued that it has a case to make about cryptos being securities.

A hefty chunk of the U.S. crypto industry may well hinge on how the SEC's cases against Coinbase, Binance/Binance.US and Kraken play out. If federal judges agree that various digital assets are securities, and the SEC has the latitude to say which are, that'll impose new registration and reporting requirements on issuers and trading platforms. If, instead, judges find consensus in saying that the SEC has overreached or that Congress should create some tailored laws, that'll give a green light to a huge chunk of the industry.

In June 2023, the SEC sued Coinbase and Binance, alleging the companies listed digital assets like solana (SOL), filecoin (FIL) and axie infinity (AXS), among others, but that these assets were really unregistered securities.

The industry – naturally – was pretty upset about these suits, despite SEC Chair Gary Gensler telegraphing for quite a while that these suits would happen. Over the course of the last few months, we've seen lawmakers, industry lobbyists and others file amicus briefs urging the courts to agree with the defendants' motions to dismiss the cases entirely.

Jesse Hamilton previewed Wednesday's Coinbase hearing here, and a lot of the core ideas are functionally identical to the Binance case. The entire article is worth your attention of course, but one of his most important points may be that a dismissal at this stage is unlikely.

Judge Katherine Polk Failla asked a number of tough questions during the hearing, but hasn't made a ruling just yet.

An SEC attorney said the token itself was not a security, but rather the actual transactions involved during the hearing.

A Friday hearing for the SEC's case against Binance was pushed to Monday due to snow in the Washington, D.C. area.

A separate hearing of interest occurred before the U.S. Supreme Court, where two parties are challenging a longstanding Supreme Court precedent known as the Chevron doctrine, which gives federal regulatory agencies latitude to interpret federal laws for rulemaking purposes.

This precedent may be overturned, SCOTUSblog reported after the hearing.

Michael Passalacqua, an associate with Willkie Farr & Gallagher LLP, said the case is worth watching, as regulatory agencies "would be less inclined to discover new meanings within ambiguous (and often dated) statutes."

"We may even see crypto legislation gain momentum again in Congress as Congress may be incentivized to pass new laws to regulate the industry (as opposed to deferring to agency interpretations)," he said.

Wednesday

Friday

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。