This article is only a personal market view and does not constitute investment advice. If you operate according to this, you are responsible for your own gains and losses.

Less than 40%: The original "Beijing drift trader," a trend trader with a winning rate of less than 40%.

Let's review the viewpoints from the previous articles:

In the article on the 4th, many long-term investors (2 years, 3 years) have not sold in the past, not because they don't want to sell, but because the market's liquidity does not allow them to sell. Only with the liquidity brought by the listing of spot ETFs on the US stock market can they sell. The actual situation also meets expectations, with the ETF listing marking the peak. From on-chain data, it can also be seen that long-term investors have started significant selling. Comparing the amount of selling by Grayscale and the proportion of selling by long-term holders, it is clear that the long-term investors selling are not just Grayscale.

In the article on the 12th, the future logic of the two main lines of BTC growth: one is the institutional funds inflow brought by ETFs, and the other is the increase in liquidity brought by interest rate cuts. Currently, neither of these has a clear landing time. Therefore, a new uptrend cannot start in the short term.

In the article on the 15th, it was pointed out that the 3D MACD has already crossed downwards, which has historically been an effective signal for the start of a pullback. This morning, the price dropped to as low as 40,600 yuan.

Returning to the market itself, let's start with the conclusions:

The downtrend of BTC has already begun, and the short-term uncertainty depends on whether 40,000 yuan can hold. If it holds, there may be a short-term rebound.

If BTC falls below 40,000 yuan, the next major support level is expected to be around 36,000 yuan (still early, let's talk about it if it falls below).

The ETH exchange rate is still strong. If BTC can hold, ETH may have an independent market trend.

First, let's look at the CME BTC futures chart, which has been continuously diverging at the daily level and is now falling. It has also broken two upward trend lines in a row. There is a gap around 40,000 yuan waiting to be filled.

Now let's look at the trend of GBTC, which also shows continuous divergence at the top. It has currently broken an upward trend line and has been continuously falling on high volume, with no sign of the end of the decline for the time being.

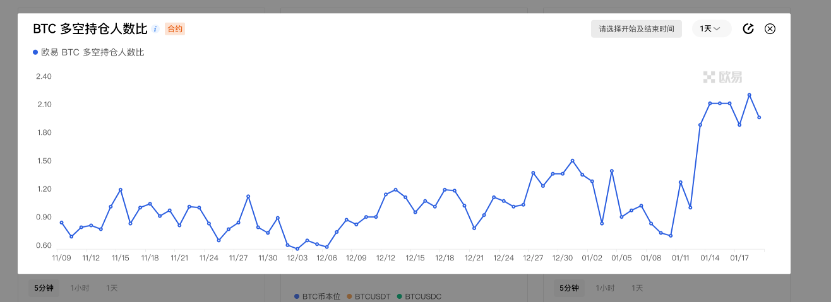

Although many people say that they are bearish in the short term after the listing of ETFs, their actual behavior is not so. Starting from the 10th, the BTC long/short position ratio has been rising rapidly. It has risen from 0.7 to around 2. Coupled with the recent pullback of BTC, the sentiment of retail investors to buy the dip is strong. Long-term holders are selling, while retail investors are buying. Who has a greater chance of winning? It's not that long-term holders cannot sell all at once, but selling slowly is more cost-effective.

Now let's look at the ETH exchange rate. Since the 12th, it has been running above the 200-day moving average and has made two consecutive attempts to break the downtrend line that started in September 2022. Therefore, relative to BTC, ETH still maintains its strength. Once ETH breaks the downtrend line, there may be an opportunity for an independent market trend.

Combining the fact that BTC has not yet fallen below the support area, the opportunity for ETH should be greater.

Follow me to maximize trend profits with minimal operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。