The adoption rate of cryptocurrencies in Thailand ranks among the top in the world, on par with other countries.

Author: MIIX Captial

Thailand is a multi-ethnic country with a highly visible wealth gap due to its outward-oriented economy. Persistent low inflation is causing the devaluation of the Thai currency and continuous economic shrinkage. Since 2017, the adoption rate of cryptocurrencies in Thailand has been high, and the government has been continuously promoting the implementation of related regulatory policies. It hopes to alleviate some of the economic development issues through the openness of the cryptocurrency market policy, providing a good market and policy environment for the rooting and development of the cryptocurrency industry in the local area.

1. Macroeconomic Indicators and Current Situation

Thailand is a middle power in global affairs and a founding member of ASEAN. It has a high Human Development Index and is the second-largest economy in Southeast Asia and the 23rd largest economy in the world.

In 2014, a Credit Suisse report stated that Thailand was the third most unequal country in the world, following only Russia and India. The top 10% of the wealthy hold 79% of the national assets, and the total net assets of the 50 wealthiest families account for 30% of the GDP. In 2016, Thailand ranked 87th in the Human Development Index and 70th in the Inequality-adjusted Human Development Index.

1.1 Geographic Location and Population Size

The Kingdom of Thailand, commonly known as Thailand, with its capital in Bangkok, is located in the central and southern part of the Indochinese Peninsula. It has a tropical monsoon climate and covers a total area of 513,000 square kilometers, with a coastline of 2,705 kilometers. The country is divided into five regions and has 77 provinces.

According to the latest United Nations data compiled by Worldometer, as of January 2, 2024, the population of Thailand is 71,844,093. Urban population accounts for 52.0% of the total population (37,322,064 in 2023). Thailand's population represents about 0.89% of the world's total population. There are over 30 ethnic groups, with the Thai people being the main ethnic group, accounting for 40% of the total population, and the rest being Lao, Chinese, Malay, Khmer, as well as various hill tribes. Over 90% of the population practices Buddhism, while the Malay people adhere to Islam, and a small percentage follow Christianity, Catholicism, Hinduism, and Sikhism.

1.2 Economic Structure and Size

Thailand is an emerging economy and is considered a newly industrialized country in Southeast Asia, the second-largest economy after Indonesia. Its three main economic sectors are agriculture, manufacturing, and services. Thailand pursues a free economic policy and relies heavily on external markets such as China, the United States, and Japan. Agricultural products are one of Thailand's main sources of foreign exchange income.

In the 1980s, industries such as electronics experienced rapid development, leading to sustained high economic growth, and Thailand was classified as a middle-income country in 1996. Thailand's annual export of goods and services exceeds $105 billion. Major export products include automobiles, computers, electronics, rice, textiles, footwear, fishery products, rubber, and jewelry.

1.3 GDP Ranking 9th in Asia

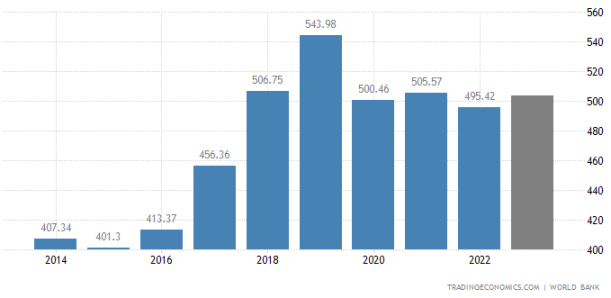

According to official data from the World Bank, Thailand's GDP in 2022 was $495.42 billion, accounting for 0.21% of the world economy, with a growth rate of 2.6%, making it the ninth-largest economy in Asia.

Thailand's economy heavily relies on exports, with exports accounting for more than two-thirds of the Gross Domestic Product (GDP). According to a report by the Bank of Thailand, during the period from 2006 to 2016, only 6% of companies were engaged in the export industry, while the export industry accounted for 60% of the country's total income.

1.4 Per Capita GDP Ranks 4th in Southeast Asia

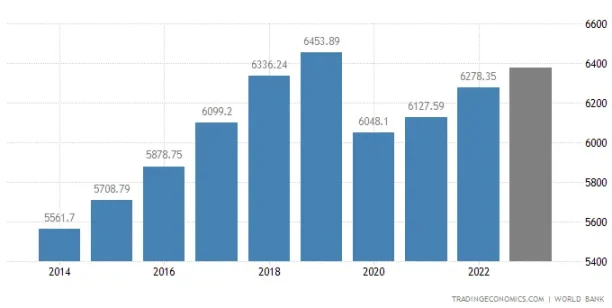

In 2022, Thailand's per capita GDP was $6,278.35. Thailand's per capita GDP is equivalent to 50% of the world average. From 1960 to 2022, Thailand's average per capita GDP was $2,976.71, reaching its highest point in 2019 at $6,453.89.

Thailand ranks as a middle-income country in the wealth distribution of Southeast Asia. In terms of per capita Gross Domestic Product, Thailand is the fourth wealthiest country, following Singapore, Brunei, and Malaysia.

1.5 Inflation Rate Continuously Below Predicted Levels

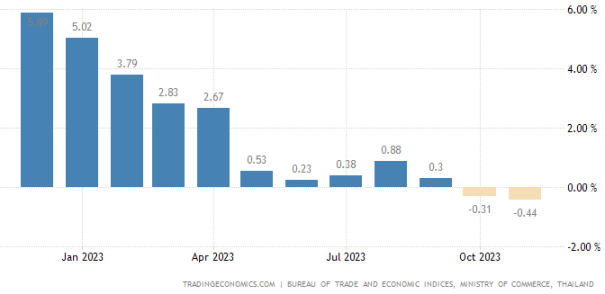

In December 2023, Thailand's consumer prices fell by 0.83% year-on-year, marking the third consecutive deflation after a 0.44% decrease in November, exceeding the expected 0.3% decrease. This also signifies the most severe deflation in 34 months and the eighth consecutive month exceeding the central bank's target of 1% to 3%. The main contribution was the government measures leading to a decrease in energy prices, namely electricity and gasoline prices.

The core inflation rate in December was 0.58%, unchanged from November, marking the lowest level since January 2022, while the expected increase was 6%. The Ministry of Commerce stated that the inflation rate for 2023 was 1.23%, with this year's forecast ranging from -0.30% to 1.7%. The monthly Consumer Price Index (CPI) decreased by 0.46%.

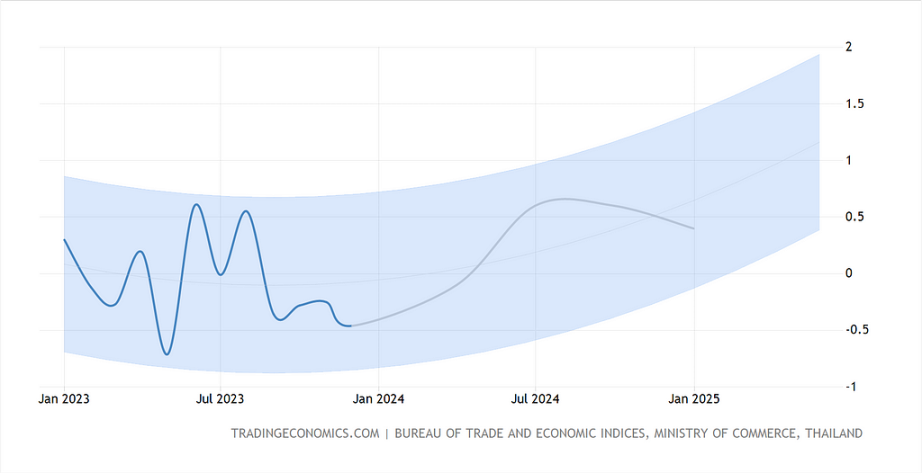

According to the global macro model and analyst expectations from Trading Economics, Thailand's inflation rate is expected to be -0.10% by the end of this quarter. In the long term, Thailand's inflation rate is projected to be around 0.40% in 2024 and around 0.30% in 2025. This means that if the government does not take strong measures to change, the devaluation of Thailand's currency, continuous economic shrinkage, and the resulting widening of the wealth gap will continue into 2024.

1.6 Legal Currency of Thailand

The currency of Thailand is the Thai Baht, with the code THB. It is the 10th most frequently used currency in the world and one of the strongest currencies in Southeast Asia. The Thai Baht is becoming increasingly popular among foreign exchange traders. Thailand's fundamental economic factors, including a healthy tourism industry and strong exports, have solidified the consistent performance of the Thai Baht.

The developing economy and growing middle class make Thailand an extremely attractive place for doing business. The Bank of Thailand is responsible for managing the Thai Baht, and its strong policies help maintain exchange rate stability.

2. Users and Market in Thailand

2.1 Adoption Index Ranks 10th

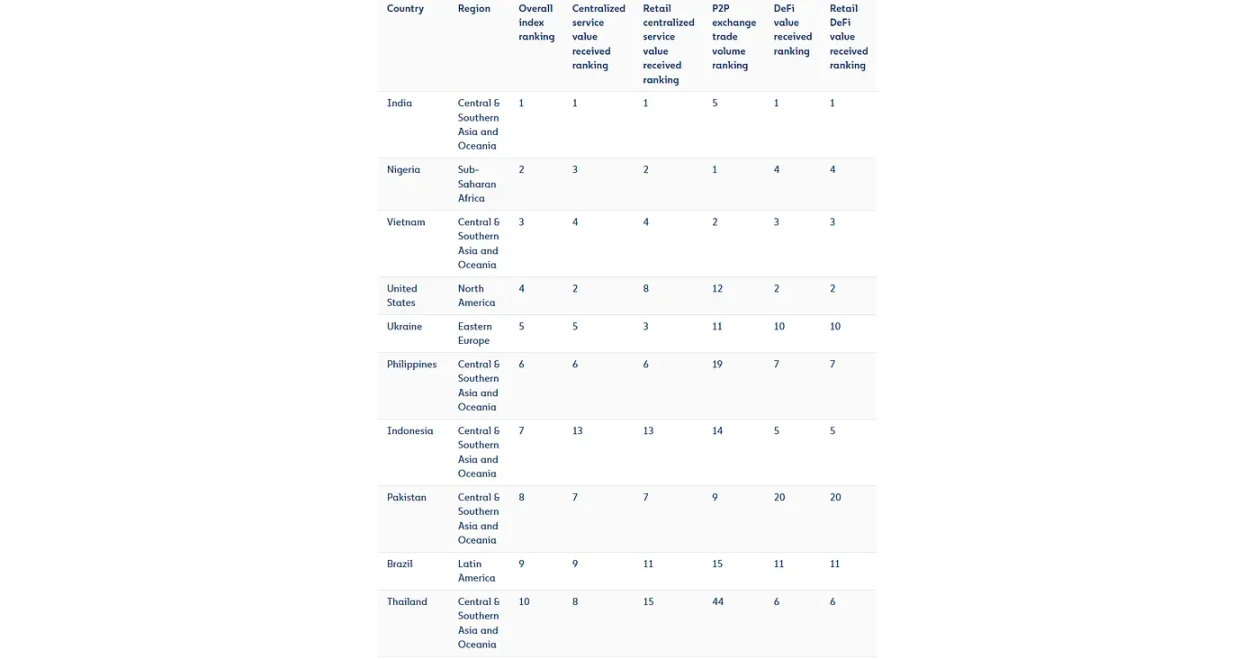

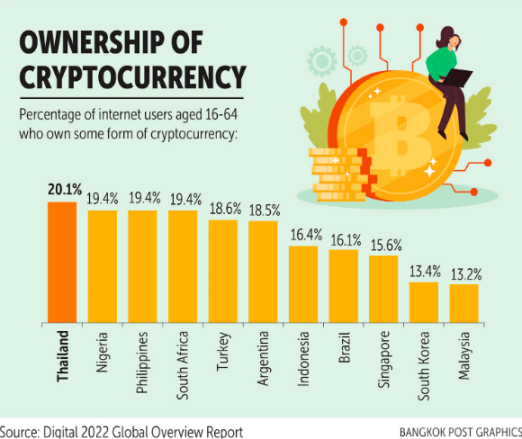

Thailand has performed well in civilian adoption, ranking 10th in Chainalysis' "2023 Global Cryptocurrency Adoption Index." According to the "2022 Global Digital Overview Report," Thailand is one of the countries with the highest proportion of cryptocurrency ownership among internet users globally.

2.2 Continuous Growth in Cryptocurrency User Percentage

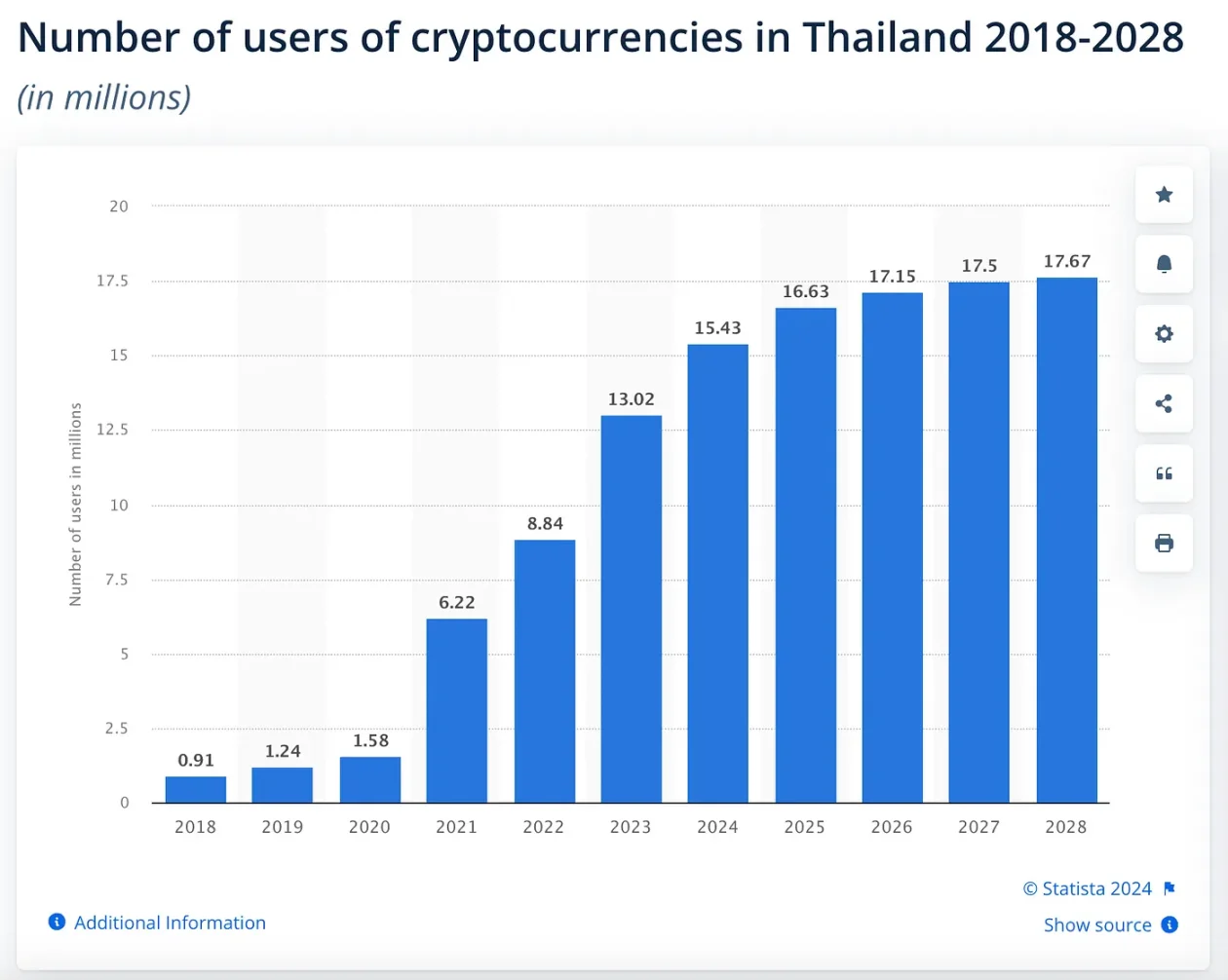

According to Statista.com data as of January 11, 2024, Thailand has 13.02 million cryptocurrency users as of 2023, accounting for approximately 18.1% of the population. It is projected that after ten consecutive years of growth, this figure is expected to reach 17.67 million users and reach a new peak in 2028. It is worth noting that the number of users in the financial technology market "cryptocurrency" has been continuously increasing over the past few years.

2.3 Young Males are the Core User Group

There is limited data on cryptocurrency market users in Thailand. According to a report by Datareportal in collaboration with Hootsuite and WeAreSocial in 2022, Thailand leads the world in the proportion of internet users aged 16 to 64 who own cryptocurrencies (20.1%), which is the highest globally.

- Cryptocurrency investors are predominantly male, accounting for 52.9% of the total investors, and cryptocurrency has become an urgent investment form for the people of Thailand.

- Approximately 75% of cryptocurrency investors are between the ages of 18 and 24, with only 1.1% of investors aged 55 and above.

### 3. Thailand User's CEX Preferences

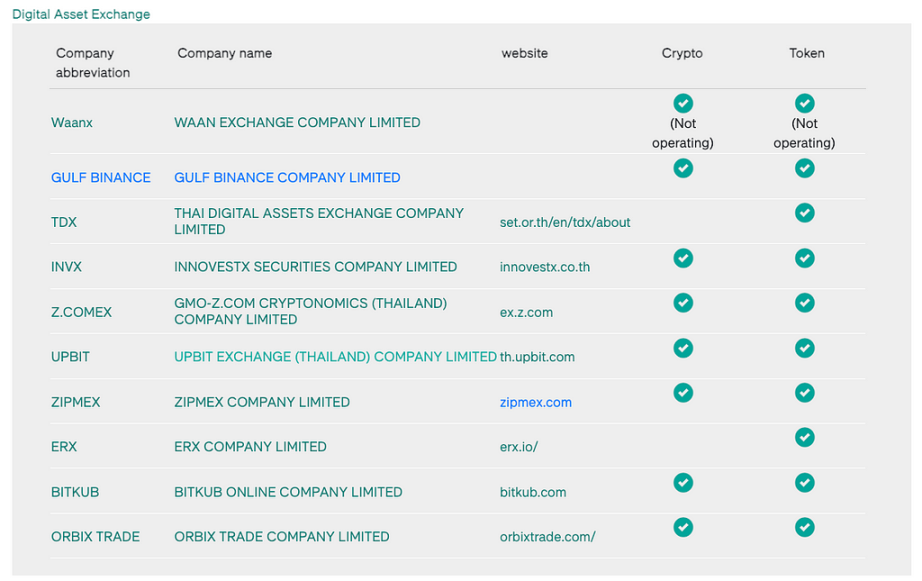

According to the regulations of the Securities and Exchange Commission of Thailand, there is a list of registered and licensed CEX allowed to operate in Thailand. The following exchanges are permitted to operate in Thailand:

3.1 Bitkub - SEC Approved CEX

Bitkub, located in the center of Bangkok, has been officially approved by the Securities and Exchange Commission (SEC) of Thailand and has an excellent reputation. According to Coingecko.com, as the largest cryptocurrency exchange in Thailand, Bitkub provides Thai Baht exchange services, occupying 75.4% of the market share in the country.

3.2 Zipmex - Thailand's Second Largest CEX

Founded in 2018 and headquartered in Singapore, Zipmex is a cryptocurrency exchange serving retail and institutional investors. It provides secure investment, savings, and consumption opportunities using blockchain technology in Southeast Asia. According to Coingecko.com, as of 2022, based on trading volume, Zipmex holds a market share of 14.78% in Thailand.

3.3 ORBIX - Most User-Friendly CEX

ORBIX is a reliable digital asset trading and exchange center, the first regulated digital asset exchange in Thailand, providing Thai Baht cryptocurrency trading services, allowing users to trade digital assets more securely.

3.4 Bitazza - CEX Engaged by Brokers

According to Coingecko.com, Bitazza is the third-largest cryptocurrency exchange based on trading volume, with a market share of 8.52%. Bitazza is a local digital asset platform in ASEAN, composed of related exchanges and brokers established in various parts of Asia, holding local operating licenses. Customers can directly access their respective personal brokers for trading accounts (not just email and bots).

Bitazza provides easy access to local digital asset financial and custodial services, as well as easy and fast deposits, withdrawals, and conversions between local fiat-crypto-fiat assets.

3.5 Binance - Localized Operation through GulfBinance

Binance, the world's largest cryptocurrency exchange by trading volume with 172 million users, has a joint venture with Gulf called GulfBinance. It has obtained a digital asset operator license from the Thai Ministry of Finance, and its digital asset platform is regulated by the Securities and Exchange Commission of Thailand, commencing operations in Thailand in the fourth quarter of 2023. GulfBinance will advance plans to establish compliant digital asset exchanges and digital asset brokers in accordance with local regulatory guidelines.

3.6 Upbit - Licensed Korean CEX

Upbit is another centralized cryptocurrency exchange allowed to operate in Thailand. Established in 2017, Upbit is a South Korean cryptocurrency exchange operated by Dunamu, one of the highest-valued startups in South Korea. Upbit has also obtained licenses in South Korea (holding a 48% market share), Singapore, and Indonesia, aiming to become one of the top centralized exchanges in Southeast Asia.

### 4. Thailand's Web3 Projects

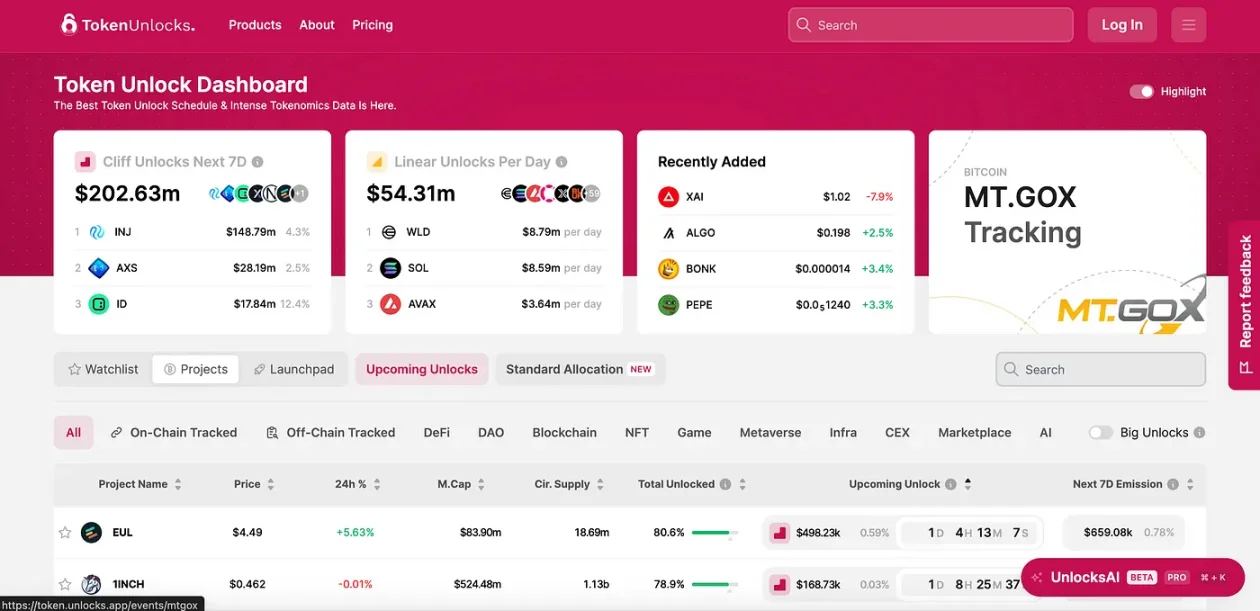

4.1 Token Unlocks - Token Data Analysis Platform

Token Unlocks has developed a token analysis platform that integrates on-chain and off-chain data to provide the best user experience. Their services include structured and tagged on-chain and off-chain token data, as well as customized on-chain monitoring for tracking token projects. This enables traders to make informed investment decisions by obtaining accurate token information and staying updated on project dynamics.

4.2 GuildFi - Empowering Gamers' Guilds

GuildFi is a gaming platform that empowers the entire gaming community and creates interoperability between metaverses. Its investors include Coinbase Venture, Animoca Brands, and Pantera, among others. They are building an infrastructure to connect players, guilds, and investors to accelerate game financing in the blockchain economy, from Play-To-Earn games to the Metaverse.

GuildFi has its own Treasury Zone, which includes different areas such as Growth Fund, Development Fund, and Risk Fund, as well as a Tool Zone for user statistics and game-related data. Despite having a certain gap compared to the total volume of YGG guild, GuildFi is not inferior in terms of functionality and popularity, and its potential should not be underestimated.

4.3 Together.ai - Decentralized Cloud Services Platform

Together.ai operates a technology service platform focused on providing decentralized cloud services for artificial intelligence. Their platform is specifically built for large, user-friendly, and open-source models, enabling researchers, developers, and companies to utilize and enhance artificial intelligence through an intuitive platform covering data, models, and computation.

4.4 Token X - Financing and Asset Tokenization Service Provider

Token X Co., Ltd. is a subsidiary of SCBX, providing ICO portal services and digital asset tokenization services. The company aims to be a successful partner in tokenization, offering services such as tokenization consulting, blockchain technology development, and blockchain networks. Their client base primarily consists of companies seeking more flexible financing solutions. ICOs provide token issuers with more options to support assets, which can be traditional real estate, rights, and services.

4.5 3Landers - Adventure Cooperative Collectible NFTs

3Landers is a community-centered collectible NFT project focused on community, adventure, and cooperation. Each 3Lander is a unique, non-fungible token (NFT) residing on the Ethereum blockchain, composed of unique feature combinations and underlying "DNA."

Holding 3Landers NFT makes you a member of the 3Lander world and community, dedicated to building meaningful long-term connections through collaboration, adventure, construction, creation, and dreaming.

4.6 Bitkub Chain - Ethereum Forked Public Chain

Bitkub Chain, developed by Bitkub Blockchain Technology Co., Ltd., is a blockchain platform forked from Ethereum with comparable technical standards. Its native token, Bitkub Coin (KUB), is listed on multiple exchanges.

The platform supports tokens based on the KAP-20 standard, such as KKUB, KUSDT, KBTC, LUMI, and DK, among others. Bitkub Chain utilizes Ethereum-compatible datasets, making it easy to develop decentralized applications (DApps). The platform features fast block validation and finality in seconds, maintaining low transaction fees through the Proof of Staked Authority (PoSA) consensus algorithm.

- Cryptocurrency Venture Capital in Thailand

Venture capital in Thailand mainly consists of traditional large enterprises, including the two major banks, Siam Commercial Bank (SCB) and Kasikornbank (KBANK). SCB 10X is the venture capital arm of SCB, and KX is the venture capital arm of KBTG, a subsidiary of KBANK.

5.1 SCB 10X

In Thailand, traditional banks can participate in the cryptocurrency space by establishing subsidiaries. SCBX (Siam Commercial Bank) operates within this framework through SCB 10X, one of Thailand's most successful cryptocurrency venture capital companies.

Established in 2020 and headquartered in Bangkok, SCB 10X tends to invest in projects related to big data analytics, machine learning, blockchain, fintech, decentralized finance, digital work, and lifestyle. These projects cover countries such as the United States, China, Israel, and Southeast Asia. SCBX has also launched TokenX as a web3 project incubator, and their portfolio includes Together.ai, Visai.ai, and Ai21.com, among others.

5.2 KBTG

Kasikorn Business Technology Group (KBTG) has launched a $100 million fund called KXV, specifically dedicated to investing in startups related to web3 and artificial intelligence. The fund is overseen jointly by Krating Poonpol, Chairman of KBTG, and Jom Vimolnoht, Managing Director of KXVC.

The fund's primary focus is to identify and support AI, web3, and deep tech fintech startups globally, with a potential focus on the Asia-Pacific region. In the web3 space, KXVC will actively consider various tech startups, including innovative technologies such as zero-knowledge proofs and liquidity-backed derivatives.

KBTG is the technology arm of KBANK, the second-largest bank in Thailand in terms of asset size.

6. Cryptocurrency Regulatory Framework in Thailand

Prior to 2018, Thailand had adhered to a regulatory approach of "strictly prohibiting cryptocurrency trading." In 2017, following the surge of domestic cryptocurrency projects launching ICOs, the Securities and Exchange Commission of Thailand (SEC) decided to introduce guidelines for cryptocurrency and initial coin offerings (ICOs) after months of public consultation, and prepared to accept cryptocurrency trading.

6.1 Development of Cryptocurrency Industry Regulations

- May 2018, the Emergency Decree on Digital Asset Business officially came into effect, stipulating that the Securities and Exchange Commission (SEC) is the official regulator of all digital assets in Thailand, requiring all parties involved in digital asset trading to register with the SEC and obtain a business license.

- June 2018, Thailand published guidelines for digital asset regulation, allowing investors to legally trade seven mainstream cryptocurrencies and allowing ICO issuers to apply for token issuance and provide digital tokens.

- July 2018, the Thai SEC issued standards supporting the operation of digital asset businesses, requiring cryptocurrency businesses operating in Thailand to obtain a digital asset business operation license issued by the Ministry of Finance, as stipulated by the decree.

- August 2020, the SEC required strict adherence to KYC standards for cryptocurrency trading accounts, requiring cryptocurrency businesses to establish KYC levels to facilitate the use by different types of customers.

- February 2021, the SEC required cryptocurrency businesses to comply with investor knowledge testing standards, conducting knowledge tests for cryptocurrency users before providing services and refusing to serve users who do not pass the test.

- May 2021, the SEC stipulated that DeFi businesses involving the issuance of digital tokens must comply with regulations, requiring DeFi projects operating in Thailand that issue digital tokens to users to obtain a business license and comply with the Digital Asset Decree.

- August 2021, the SEC stipulated that cryptocurrency businesses must protect platform user assets, requiring multi-signature authorization for platform client funds withdrawals or transfers, prohibiting the use of user-held cryptocurrency assets for other purposes, and prohibiting the placement of user funds in commercial banks to seek interest.

- February 2022, the SEC amended advertising regulations, restricting cryptocurrency advertising from being misleading, requiring clear and appropriate advertising, and mandating that cryptocurrency advertisements be published on official channels of cryptocurrency businesses and not in public areas.

- March 2022, the SEC issued the "Regulatory Standards for Digital Asset Business Operators," requiring cryptocurrency businesses not to use cryptocurrency to pay for goods or services to avoid affecting Thailand's financial security.

- December 2022, the SEC released a draft of the "Regulatory Standards for ICO Portals and Digital Token Issuance," refining the principles of ICO portal regulation and related digital token issuance rules.

- March 2023, the SEC released the "Overall Digital Asset Regulatory Policy," covering regulatory policies for the entire industry chain of the cryptocurrency field, including primary market token issuance and secondary market exchange operation regulation, among others.

- November 2023, the SEC updated the standards for debt-based ICOs and infrastructure supporting ICOs, adding debt-based ICOs and infrastructure-based ICO products, requiring the credibility of these two types of cryptocurrency projects to be assessed and disclosed through ICO portals, as well as conducting due diligence and asset evaluation for ICO projects.

From 2018 to 2023, Thailand's cryptocurrency regulatory policies have undergone multiple refinements and updates, with the entire regulatory scope delving into every aspect of the cryptocurrency industry. Whether it's enterprise registration, digital asset issuance, cryptocurrency trading, user asset protection, cryptocurrency derivative regulation, KYC due diligence, upstream and downstream cryptocurrency industry norms, or ICO portal issuance, investor guidance, and cryptocurrency business registration guidelines, it all indicates that Thailand's approach to the cryptocurrency industry is not just about regulation, but about deep involvement and embracing, rapidly guiding the development of the domestic cryptocurrency market.

6.2 Prohibition of Corporate Acceptance of Cryptocurrency

Since April 2022, the Securities and Exchange Commission of Thailand has begun to prohibit companies from accepting cryptocurrency to maintain economic stability. Despite the cancellation of the 7% tax on digital asset investments, the country explicitly banned cryptocurrency companies from providing pledging and lending services in September 2022.

This contrasts sharply with Thailand's supportive blockchain policies and poses a challenge to Thailand's goal of becoming a major hub for blockchain innovation. In a joint statement, the Securities and Exchange Commission of Thailand and the Bank of Thailand expressed concerns about the risks associated with widespread use of digital assets for trading goods and services.

In addition, Thai banks are also prohibited from directly participating in cryptocurrency trading, and a unique verification process is required for first-time cryptocurrency investors, using a "dip-chip" machine to scan national identity documents for on-site verification. For transactions exceeding 100,000 baht, exchanges must retain data for at least ten years to prevent money laundering.

6.3 Taxation of Cryptocurrency Business

For individuals, trading any cryptocurrency in Thailand, or deriving benefits from cryptocurrency through mining, pledging, and other activities, requires the payment of withholding tax and personal income tax.

- Withholding tax requires a 15% tax on profits derived from cryptocurrency activities such as investment and mining.

- Personal income tax is progressive, with general tax rates ranging from 5% to 37%. All Thai residents or residents who have lived in Thailand for at least 180 days are required to pay personal income tax on income derived from cryptocurrency.

- Businesses with turnover exceeding 1.2 million baht are subject to a 7% value-added tax, and in some cases, value-added tax can be refunded.

In general, investors in Thailand only need to pay withholding tax, value-added tax, and personal income tax as required. However, there may be new tax types arising from residency status or other special requirements, and investors need to confirm during the annual tax payment process to avoid omissions.

- Establishing a cryptocurrency business in Thailand requires payment of corporate income tax, value-added tax, withholding tax, and special business tax based on the circumstances.

- Corporate income tax in Thailand is also tiered. Net profits less than 1 million baht are subject to a 20% tax; net profits between 1 million and 3 million baht are subject to a 25% tax. However, companies entering Thailand typically enjoy various tax exemptions based on different circumstances.

- Businesses with turnover exceeding 1.2 million baht are subject to a 7% value-added tax, but in some cases, a refund can be applied for, depending on the specific situation.

- For cryptocurrency businesses legally operating in Thailand, withholding tax can be exempted, but if it is a foreign company or its legal entity, a 15% withholding tax must be paid as usual.

- There are currently no specific regulations for special business tax, but it will be a variant of value-added tax, and cryptocurrency businesses only need to pay special business tax.

7. Conclusion

Thailand, located in Southeast Asia, heavily relies on exports and ranks 9th in GDP among Asian economies. Driven by the three major sectors of agriculture, manufacturing, and services, Thailand has transformed from an underdeveloped country to a "middle-income" country, and its legal tender is one of the strongest currencies in the Southeast Asian region.

Thailand's adoption of cryptocurrencies ranks among the highest globally, on par with other countries. Currently, 13.02 million people (9.3% of the total population) own cryptocurrencies. Thailand's cryptocurrency ecosystem is quite developed, with traditional banks entering this emerging industry by establishing venture capital funds and investing in native cryptocurrency and artificial intelligence startups, further driving the growth of cryptocurrency adoption and market development in Thailand.

The Thai government has a fairly positive attitude towards cryptocurrencies and recognizes them as "digital assets" regulated by the Securities and Exchange Commission of Thailand, requiring operators to obtain licenses. Thai citizens can buy and sell cryptocurrencies, but businesses are prohibited from accepting cryptocurrencies as a form of payment.

In terms of regulation, Thailand is at the forefront. For cryptocurrency investors, whether participating in cryptocurrency trading in Thailand or engaging in derivative businesses such as DeFi, users do not need to worry about the security of assets held on centralized platforms under regulation. This also minimizes the risk of falling victim to cryptocurrency scams. As the industry continues to develop, Thailand's cryptocurrency ecosystem is expected to generate a similar "siphon effect," attracting more projects and funds and giving rise to more innovative technologies and products that can drive industry development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。