These trends cover various aspects from technological innovation to regulatory frameworks, from market dynamics to user participation, providing our insights and response strategies for the upcoming industry changes.

Authors: Yu Jianing, Romeo Wang (Fang Jun, Zhou Fangge, Li Qihong, Zhang Ruibin also contributed to the writing of this report)

Producer: Uweb & Techub News

Every technological revolution in history has taught us that the key to success lies not only in early exposure to technology and practice, but also in a profound understanding of the essence of technology, an accurate grasp of market trends, and a keen insight into future development. This unconventional cognitive perspective is the key factor in enjoying the benefits of Web3.0. In 2024, the shift in mindset is particularly important. In view of the industry trends for this year, we have conducted in-depth analysis and predictions, and put forward six key trends. Our aim is to provide a new perspective for everyone, helping those who are interested in Web3.0 to seize the opportunities of the times and achieve sustainable growth and development. These trends cover various aspects from technological innovation to regulatory frameworks, from market dynamics to user participation, providing our insights and response strategies for the upcoming industry changes. This article will share the six core trends of the "2024 Web3.0 Digital Asset Trends Report."

Trend One: The approval of the US BTC spot ETF will open up a large-scale entry channel for funds and establish BTC as a mainstream asset

When looking at the industry development trends for 2024, our first focus is on the impact of spot ETFs (exchange-traded funds) on the digital asset market, especially Bitcoin. The probability of the approval of a Bitcoin spot ETF in the United States in 2024 is increasing, indicating that the digital asset market may be at a new historical starting point. Although from a short-term perspective, the approval of a Bitcoin spot ETF may not have a significant stimulating effect on the market, many institutional investors usually adopt a more cautious investment strategy and may not rush to make large-scale capital investments in the early stage, so the market reaction may be relatively moderate.

However, in the long run, the existence of a Bitcoin spot ETF will significantly enhance the compliance and investability of digital assets. It will provide a safe and regulated investment channel for a large number of investors, especially traditional financial institutions, promoting the compliance entry of funds. The increasing inflow of compliant funds will significantly improve the market depth and liquidity of digital assets, help reduce market volatility, and enhance investor confidence.

We can draw lessons from history: since the launch of the first gold ETF on March 28, 2003, ETFs have clearly brought long-term benefits to the gold market. In November 2004, the first gold ETF in the United States began trading (GLD), and by 2007, GLD held over 600 tons of gold, with gold trading volume reaching 16 million ounces, and the total value of fund shares reaching 14.5 billion US dollars. From November 2004 to November 2021, during these seven years, the price of gold rose from the $435 range to $1883, an increase of 333%. This historic growth provides a strong case for the future potential of a Bitcoin spot ETF.

The premium rate of Grayscale GBTC also indicates some future trends. Data shows that starting from 2022, the bear market caused a negative premium of GBTC trading price relative to its held Bitcoin value. The negative premium of GBTC intensified at the beginning of 2023 after Genesis, a subsidiary of Grayscale's parent company Digital Currency Group, collapsed, reaching a historical high of nearly 50%. The rebound of the premium rate represents an increasing market expectation for a Bitcoin ETF. In addition, the final ruling by the Washington, D.C. Circuit Court of Appeals on the dispute between the SEC and Grayscale on October 24 seems to indicate that regulatory agencies are gradually softening their stance on Bitcoin ETFs, and the approval of a large number of Bitcoin spot ETFs may be on the way.

Assuming that these Bitcoin spot ETF funds can all be approved, this means that the door to the trillion-dollar scale digital asset market will be opened. The total AUM of the various applicants for Bitcoin spot ETF issuers currently exceeds 15 trillion US dollars. In such a market size, even if Bitcoin ETFs only account for five percent of the total assets under management of the market issuers in the future, it represents approximately 750 billion US dollars in market value. Considering that the current total market value of the entire digital asset industry is about 16 trillion US dollars, this indicates a significant potential and room for imagination for incremental funds.

However, we must also recognize that the total holdings of existing Bitcoin financial products, including ProShares Bitcoin Strategy ETF (BITO), Purpose Bitcoin ETF (BTCC), and 3iQ CoinShares Bitcoin ETF (BTCQ), are still relatively small, totaling about 100,000 coins, accounting for only 0.51% of the current total circulation of Bitcoin, with a total value of only 4 billion US dollars based on the current Bitcoin price (44,000 US dollars). This means that the market size of other ETFs is currently not large, and the market acceptance of such new financial instruments will take time. Looking at the market acceptance process of similar financial products in the past, although the foundation has been laid, explosive growth still takes time. Therefore, in 2024, we expect to witness how Bitcoin ETFs gradually promote market maturity and drive the entire digital asset industry towards new milestones.

Entering 2023, the regulatory environment for Web3.0 in the United States is relatively severe, but this has not stopped compliant institutions from continuing to explore and innovate. In fact, these institutions are actively seeking new methods and paths that comply with regulatory requirements to promote the development and application of technology.

In this context, Coinbase, as a representative of compliant institutions, its custody business has gradually become a necessity for ETF issuers, providing compliant asset management solutions for institutional investors. As a secure and reliable asset custody solution, the custody business provides institutional investors with a compliant asset management method. This cooperation model has brought new business growth points for Coinbase and provided an example of compliance and trust enhancement for the entire industry. The Coinbase custody business department is also gradually becoming one of the company's core businesses.

However, the outbreak of the FTX incident undoubtedly had a profound impact on the digital asset market, which has devastated the digital asset industry and prompted regulatory agencies in various countries to strengthen their scrutiny and regulation of Web3.0 and related areas. In the negative policy environment and its impact, some key global Web3.0 market infrastructure has been severely affected, and the coupling of the digital asset system with the US dollar has decreased. This decoupling may mean that the digital asset market is becoming more autonomous to a certain extent.

In this context, despite the optimistic performance of the Bitcoin spot ETF, there is still significant uncertainty due to the regulatory and monetary policies in the United States. Especially before the election, the trend of stricter regulatory policies may continue. Hester Peirce, a commissioner of the U.S. SEC, emphasized the need for better regulation of digital assets in an interview in November, highlighting the necessity of establishing a regulatory framework that encourages innovation and allows digital asset-related companies to operate in the United States. During the U.S. election, the regulation of digital assets may become a hot topic, possibly leading to a change in the U.S. attitude towards the regulation of digital assets.

Another important consideration is the upcoming initial digital asset accounting standards in the United States. According to Bloomberg, the Financial Accounting Standards Board (FASB) has published the first set of digital asset accounting rules, requiring companies to measure their held digital assets at fair value. This new regulation, expected to take effect in 2025 but allowing early adoption, provides clear guidance for the financial reporting of digital assets, emphasizing the importance of digital assets in the balance sheets of companies. The change in these accounting rules reflects the maturity of the regulatory environment in the digital asset industry and marks the formal integration of digital assets into traditional financial systems. With the clarification of digital asset accounting standards, companies will be able to more accurately record the value fluctuations of their digital asset holdings and directly include these changes in net income. This will prompt companies to manage and report on digital assets in a more transparent and responsible manner, while also providing investors with more accurate information to make wiser investment decisions. The implementation of the new regulations will further drive the standardization and regulation of the digital asset market.

Another key factor to consider is the implementation of the EU's Markets in Crypto-Assets Regulation (MiCA). After two years of in-depth negotiations, this regulation provides a comprehensive regulatory framework for digital assets, marking the formal acceptance and standardized management of such emerging assets by major global economies. The implementation of MiCA not only clarifies the scope of regulatory application and the classification of digital assets but also covers multiple aspects including regulatory bodies, information reporting systems, business restriction systems, and behavioral regulation systems. This means that the digital asset market will operate in a more clear and stable legal environment, helping to reduce regulatory uncertainty, enhance market transparency, and improve investor protection.

The implementation of this EU regulation may have two important impacts. Firstly, it may promote the further standardization and maturity of the digital asset market. As compliance requirements for digital assets increase in major markets such as the EU, related companies and service providers will be forced to enhance their compliance and transparency, which will help purify the market environment, suppress misconduct, and attract more traditional financial institutions and large investors to enter the market. Secondly, the implementation of MiCA will set an important reference standard for global digital asset regulation, possibly prompting other countries and regions to accelerate the establishment and improvement of their own digital asset regulatory frameworks. The coordination and standardization of this global regulatory framework will help reduce the complexity and cost of cross-border transactions, and drive further integration and development of the global digital asset market. This development trend, along with the approval and growth of Bitcoin spot ETFs, the innovative efforts of compliant institutions, and changes in the regulatory environment, will collectively shape the future of the digital asset industry in 2024 and beyond. Despite facing many challenges and uncertainties, the digital asset industry continues to progress and mature, providing new opportunities and challenges for market participants.

Trend Two: Hong Kong's Web3.0 triggers the fourth wave of financial innovation, leading the global East

Since 2022, a series of measures in the Hong Kong Special Administrative Region have demonstrated its active layout and leadership on the global digital economy stage. The "Hong Kong Virtual Asset Development Policy Statement" issued by the Financial Services and the Treasury Bureau of Hong Kong is an important policy milestone and a declaration of Hong Kong's future in digital assets and Web3.0.

The Hong Kong SAR government has taken concrete measures to promote digital assets. For example, by issuing blockchain-based tokenized green bonds, the Hong Kong SAR has demonstrated its ability to innovate financial instruments using blockchain technology. In addition, the successful launch of Bitcoin and Ethereum ETFs by the Hong Kong Stock Exchange provides investors with more diversified investment choices and sets a new benchmark for the global digital asset trading field. Hong Kong is actively promoting research on the digital Hong Kong dollar, reflecting its forward-thinking in exploring central bank digital currencies (CBDC). In terms of regulation, Hong Kong has expanded the participation in the digital asset market and improved market transparency and security by issuing virtual asset trading and asset management licenses to institutions that can serve retail investors. In December, Hong Kong announced its readiness to accept applications for digital asset spot ETFs and the regulation of stablecoin issuance, providing a boost to the development of Web3.0 in Hong Kong.

Innovation is the foundation of transformative development, and every important innovation in the Hong Kong financial market has strengthened its position as an international financial center. The introduction of H-shares, the creation of the VIE structure, and the realization of mutual market access with the mainland market can be seen as the first three waves of innovation in the Hong Kong capital market. The first wave of innovation in the Hong Kong capital market was the introduction of H-shares, bringing the stocks of mainland Chinese companies to the Hong Kong capital market. The listing of H-shares fundamentally changed the interaction between mainland companies and the international capital market, promoted capital flow, and introduced a large number of new asset categories to the Hong Kong financial market.

The second wave of innovation was the creation of the VIE structure, which allowed foreign investment in specific industries in China through a special corporate structure, innovatively linking securities with underlying assets, enabling Chinese companies to utilize global capital and resources for rapid development, further enhancing Hong Kong's position as a global financial center. The third wave of innovation was the mutual market access mechanism between the mainland and Hong Kong stock markets, namely the implementation of Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, directly connecting the stock markets of the mainland and Hong Kong, providing investors with more convenient cross-border trading methods, and enhancing the liquidity of the secondary markets in both places.

The gradual realization of Web3.0 may be the fourth wave of innovation in the Hong Kong capital market. In particular, the tokenization of RWAs by establishing a connection between physical assets and the digital economy not only brings new asset categories and high-quality liquidity but also brings new vitality and broader development prospects to Hong Kong's financial system, strengthening its role as a "super value-added person."

The key to the development of Hong Kong's Web3.0 lies in the construction of its financial infrastructure. It is expected that in the future, Hong Kong will have four major international clearing and settlement systems operating in parallel, including settlement systems based on offshore renminbi and CIPS, international settlement systems based on the US dollar and SWIFT, real-time payment settlement systems based on the Hong Kong dollar (RTGS system), and new settlement systems based on digital assets and blockchain. The parallel operation of these four systems will be key to building "International Financial Center 2.0," requiring the improvement of their respective regulatory systems, business institutions, assets and talent reserves, and technological accumulation.

Hong Kong has made significant progress in the rapid advancement of compliance processes, and the value of licenses is gradually becoming apparent, laying the foundation for the industry's great development. Comparing the stock price of OLS (formerly BC Technology) with the Hang Seng Index (HSI), we can observe that OLS's stock price significantly outperformed the market in the second half of the year. Especially on August 3rd, after Hashkey and OLS announced the approval for the upgrade of the Hong Kong Securities and Futures Commission's Type 1 and Type 7 licenses, OLS's stock price experienced significant volatility in the short term. The subsequent rise in the stock price may indicate the market's positive response to this strategic investment, believing that it will bring long-term positive impact to the company. This performance likely reflects the recognition of mainstream institutional investors of the growth potential and long-term value of the Web3.0 field. It also reflects the gradual widespread attention and trust of the mainstream investment market in the Web3.0 industry. Investors and analysts are closely monitoring this emerging field to seize the investment opportunities it brings.

Currently, more and more institutions, including traditional financial institutions such as China Pacific Insurance Group's China Taiping Investment Management (Hong Kong), have obtained approval from the Hong Kong Securities and Futures Commission to upgrade their existing Type 1 (securities trading) and Type 4 (advising on securities) regulated business licenses. After the upgrade, they can provide distribution and investment advisory services to funds with a virtual asset investment ratio exceeding 10%. This indicates that traditional companies will be heavily involved in the digital asset field in the future. In 2024, we can expect the further integration of Hong Kong's financial system with Web3.0 technology, opening up new possibilities for the global digital economy and blockchain technology.

Trend Three: BRC20 Inscriptions are just the beginning of a new era for BTC, BTC ecosystem innovation revitalizes digital computing power

The exploration of the Bitcoin ecosystem is like an explorer leaping into the unknown abyss. The birth of the Ordinals protocol, the BRC20 standard, and the rise of inscriptions are not only a new starting point for the development of the BTC ecosystem but also a signal of new opportunities for the entire digital mining and trading platform.

In the field of digital assets, we believe that the innovation of underlying technology often heralds significant market fluctuations, especially with the arrival of a bull market. In recent market developments, the innovation of inscriptions can be seen as a significant upgrade to the issuance of digital assets. The innovation in the issuance of digital assets has evolved from the initial issuance of blockchain-native assets (such as BTC, ETH) to assets based on smart contract technology (EVM-based assets), and now to the issuance of assets such as inscriptions, witnessing a continuously evolving development trajectory.

Inscriptions, with its unique approach of issuing derivative assets using native assets of existing chains, has shown many advantages compared to traditional smart contract-based asset issuance. Its independence, fairness, and security have been highly praised in the market. Each inscription of an asset is carried out on a recognized secure chain like Bitcoin, eliminating concerns about backdoor operations or centralization risks. This approach ensures the transparency and fairness of issuance, with each transaction and inscription having its unique identifier, and traceability and tamper resistance being its core features. In addition, compared to smart contracts, inscriptions reduce the risks associated with contract vulnerabilities, providing a more robust security guarantee. In terms of cost, as a method of issuing assets based on native assets, inscriptions avoid the high costs of creating and maintaining independent chains, as well as the complexity and potential costs introduced by smart contracts. In terms of consensus, inscriptions leverage the strong user base and widely recognized value of the Bitcoin network, ensuring a higher level of market acceptance and community trust.

This innovation is an important milestone for the entire industry, as it not only enhances the uniqueness and traceability of assets but also provides new sources of income for miners, helping to maintain and strengthen the security and stability of the Bitcoin network. Through inscriptions, we can issue and trade non-fungible digital assets on the most secure and decentralized network of Bitcoin, undoubtedly expanding the application scenarios of Bitcoin and bringing unprecedented new opportunities to market participants. It is such underlying technological innovation that is driving the industry towards a more mature and complex direction. We have reason to believe that with the further development and improvement of inscriptions, as well as a deeper understanding of this new asset issuance method in the market, it will attract more investors and bring about a new bull market.

Ordinals has inspired the emergence of more token and protocol standards, opening up a broader application space and potential for the Bitcoin network, enriching the Bitcoin ecosystem, and further realizing technological progress and value.

From a data perspective, Ordinals' daily inscription count has repeatedly reached new highs, demonstrating the market's high recognition of this innovation. In 2023, the transaction volume related to the BRC20 protocol on the BTC network once exceeded the transaction volume of non-Ordinals protocols. On May 7th, the transaction volume of the BRC20 protocol accounted for over 65%, and in August, September, and November, it also exceeded 60% several times. As of December 8th, there have been over 37,643 BRC20 projects with a total market value exceeding 3.5 billion USD.

On December 21st, the cumulative total of inscriptions for the Bitcoin NFT protocol Ordinals exceeded 46.58 million, and on November 12th, it set a new record of over 500,000 inscriptions in a single day.

The rise of inscriptions has changed the traditional mode of asset issuance, heralding the large-scale rise of the Bitcoin ecosystem, and may also make transaction fees the main source of income for miners, thereby enhancing the stability and security of the Bitcoin network.

Therefore, we can see that the situation of Bitcoin mining in 2023 indicates a sustained growth trend, with the inscriptions frenzy greatly driving on-chain transactions and raising transaction fees, fundamentally changing the income structure of miners. This new trend has once again sparked interest in the mining industry. On October 19th, according to a survey by The Times, Chinese companies were found to own or operate Bitcoin mines in at least 12 states in the United States, with an energy consumption equivalent to the energy consumption of 1.5 million households. Many mines are equipped with mining machines manufactured by Bitmain. Records show that since May 2021, the number of devices shipped by Bitmain to the United States is 15 times the total for the past five years.

Correspondingly, the stock prices of listed mining companies have also experienced significant rebounds, but there is a clear differentiation in the market's evaluation of these companies. For example, the leading mining companies Marathon Digital Holdings (RARA) and Riot Blockchain (RIOT) saw increases of 393.53% and 369.73% respectively in 2023, while the emerging mining company CleanSpark (CLSK) achieved an increase of 141.43%. However, some established listed mining companies such as Hive Blockchain (HIVE) and Hut8 Mining Corp (HUT) are still following the fluctuations in Bitcoin's price. This indicates that the growth potential of the mining industry may have just begun to be recognized by the market, and investors may not fully understand this change.

In addition, in the development of the Bitcoin and Ethereum ecosystems, we should not view them as opposites, but rather as complementary entities. They represent the Proof of Work (POW) and Proof of Stake (POS) that collectively meet the diverse needs of the Web3.0 world, promoting the construction of a long-term coexisting ecosystem. It is crucial to avoid falling into biased cycles of technology and market, and to maintain an open and exploratory spirit in order to truly seize the opportunities of the Web3.0 era. We should maintain an open attitude, stay hungry, stay foolish, and embrace new technological trends with an open mindset.

On the other hand, due to the rise and frenzy of inscriptions, digital asset trading platforms are undergoing a profound transformation. This transformation lies not only in the diversification of trading methods but also in catalyzing the integration of trading platforms and wallet services. Traditionally, trading platforms and wallets are separate entities, with one focusing on asset trading and the other on asset storage. However, the popularity of inscription technology, especially in the application within the Bitcoin network, has forced trading platforms to reconsider their service scope, expanding functionality to meet the needs of users to trade and store assets on the same platform.

This trend of integration is a great boon for users. It lowers the barriers to participating in digital asset trading, simplifies the operation process, and allows users to complete the entire process from purchasing, storing, to trading without switching between multiple platforms. For trading platforms, this also means the ability to provide more comprehensive services, increase user stickiness, and open up new revenue channels.

We expect that future trading platforms will adopt more of this one-stop service model, integrating wallet functionality to provide a more secure and convenient user experience. The integration of trading platforms and wallets will become a major trend in the digital asset service field, bringing more liquidity and vitality to the entire digital asset ecosystem. As trading platforms gradually shift towards a one-stop service model, the market value of platform tokens will also be closely related to their ability to integrate future services. This one-stop service not only includes traditional trading and asset storage functions but also extends to the integration of emerging digital assets such as inscription technology. As a core component of these platforms, the market value and application scope of platform tokens will directly reflect the platform's performance in technological adaptability and market leadership.

Overall, the inscription frenzy is just the beginning of a new ecosystem, the first wave of bottom-up innovation in the digital asset ecosystem. Historically, every wave of bottom-up technological innovation has been accompanied by three stages of development: technological validation, bubble formation, and finally, a return to rationality in the market. Each wave has brought enormous opportunities and risks, attracting the keen attention of capital and innovators. In this process, the initial bubble may bring rapid wealth growth, but it is often short-lived and unstable. As the market gradually saturates and returns to rationality, these bubbles will eventually dissipate.

For investors, the key is to recognize the cyclical market fluctuations and adhere to the stage they are most familiar with and proficient in when making investment decisions. Investors should seek opportunities in areas they understand and can effectively assess risks, while avoiding blindly chasing market hotspots and bubbles. Only in this way can they achieve stable returns and minimize potential significant risks in this cycle of technological innovation and market fluctuations.

Trend Four: The basic model of RWA tokenization has been preliminarily verified, but it will take time for the outbreak to occur

In fact, the upgrade brought about by Web3.0 is not just an upgrade of the Internet, but also a digital upgrade of the global financial system, with the rise of digital assets as its core element. Digital assets include two types: native digital tokens and real-world asset tokens. Financial institutions issue digital assets corresponding to real-world assets on the blockchain to achieve the tokenization of real-world assets. They can also issue asset packages or complete securitization, and then other institutions can map the asset packages or securities to the blockchain to form digital assets for tokenization.

Based on these two types of digital assets, Web3.0 is triggering a global digital financial revolution. RWA will play a crucial role, acting as a bridge between the digital economy and the traditional economy, allowing real-world assets to be traded and financed in a decentralized network. The tokenization of RWA not only provides asset owners with higher liquidity and broader market access but also allows global investors to directly access assets that were previously restricted by traditional financial barriers. This digital transformation of assets has brought profound changes to the financial market, broadening the categories of assets and improving market efficiency.

According to research by the Boston Consulting Group, the global scale of tokenization of real-world assets is expected to grow to $16.1 trillion by 2030 (accounting for approximately 10% of global GDP in 2030), including $3.2 trillion in real estate tokens, $3.9 trillion in equity tokens, $1.2 trillion in debt and investment fund tokens, $3 trillion in alternative financial asset tokens, and $4.8 trillion in other tokenized assets.

Citibank believes that by 2030, the global scale of tokenization of real-world assets (digital securities segment) will reach $4 trillion to $5 trillion, including $1.9 trillion in tokenized corporate bonds and quasi-sovereign bonds, $1.5 trillion in tokenized real estate funds, $700 billion in tokenized private equity and venture capital funds, and $500 billion to $1 trillion in tokenized securities financing and collateral. Additionally, $1 trillion of global trade finance assets will be tokenized.

In September 2023, the Federal Reserve released a working paper on tokenization, stating that tokenization is a new and rapidly growing financial innovation in the digital asset market, analyzing it from the perspectives of concept, scale, advantages, and risks. The Federal Reserve emphasized the multiple advantages of tokenization. It not only opens the door for investors to enter high-threshold markets but also brings new vitality to the underlying asset market through the programmability of tokens and the capabilities of smart contracts. In addition, tokenized assets as collateral for lending can simplify the asset settlement process and increase the liquidity of the underlying asset market. To some extent, the mechanism of Exchange-Traded Funds (ETFs) is similar to tokenized assets, meaning that the greater liquidity brought by tokenization in the digital asset market will be more conducive to the value discovery of underlying assets.

Currently, the model of RWA tokenization has been preliminarily verified. Although the entire industry is still in the incubation period, it has revealed long-term key opportunities. In this process, the role of Hong Kong is becoming increasingly important, and RWA tokenization is making it a "super value-added person" in the digital economy era. Hong Kong is gradually becoming an important link between the traditional financial market and the emerging digital economy. This transformation injects new vitality into its financial ecosystem, accelerating its evolution into an innovative and technologically advanced global financial center. With the advancement of RWA tokenization, Hong Kong will play a more crucial role in technological innovation and policy formulation in the Web3.0 era.

At the same time, the actions of the Monetary Authority of Singapore also indicate the popularization of blockchain technology and the expansion of asset tokenization. In November 2023, the Monetary Authority of Singapore and the progress of Project Guardian in collaboration with the financial industry have shown the penetration of digital assets in traditional institutions, the release of liquidity, and the improvement of financial market efficiency. All of this paves the way for financial innovation and integration in the region, heralding the formation of a more open and interconnected global financial network. These measures in Hong Kong and Singapore not only provide examples for the practice of RWA tokenization but also set the tone for the future development of digital assets.

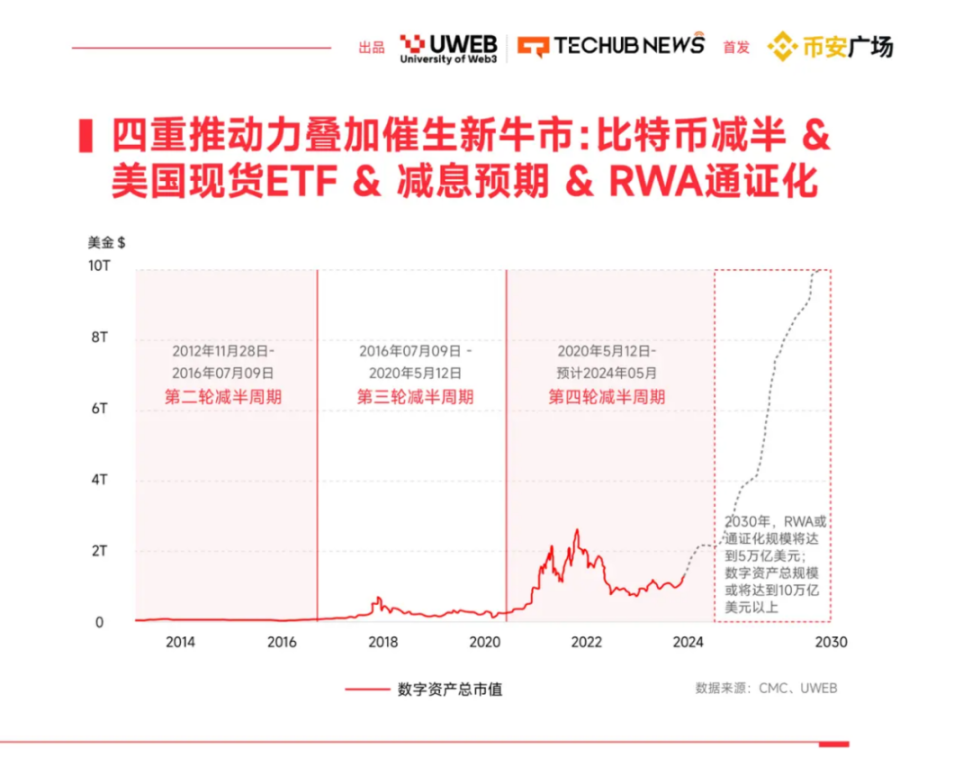

With the next round of Bitcoin halving cycle bull market, we anticipate four driving forces to work together: the natural relief of supply pressure brought by Bitcoin halving, the potential approval of the US spot ETF, market expectations for interest rate cuts, and the advancement of RWA tokenization. These factors, when combined, may bring unprecedented growth and opportunities to the digital asset market. We expect that by 2030, the scale of RWA tokenization may reach $5 trillion, and the total scale of digital assets is expected to exceed $10 trillion.

We have reason to believe that the continuous integration of tokenized assets and traditional financial services will make future financial markets more diverse, inclusive, and dynamic. The advancement of RWA tokenization will provide asset owners with more liquidity choices and open the door for investors to enter emerging markets, stimulating broader participation and innovation in economic activities. All of these will shape a broader and more profound financial ecosystem for 2024 and beyond.

Trend Five: The application layer is about to experience explosive development, and AIFi and AI DePIN will be key themes of Web3.0

In 2023, ChatGPT led by Sam Altman sparked widespread enthusiasm for artificial intelligence worldwide. Altman has profound insights into the impact of artificial intelligence on the global economy. His entrepreneurial project Worldcoin in the Web3.0 field aims to explore how generative artificial intelligence can reshape the world economy.

In the era of generative artificial intelligence, Altman particularly emphasizes the importance of distinguishing between human and artificial intelligence identities. This is not only a technological challenge but also a fundamental guarantee for achieving socio-economic goals, such as universal basic income (UBI). The Worldcoin project attempts to provide a solution in this regard by using unique biometric technology to establish a fairer and more intelligent economic system, where human identity and rights are clearly protected, while also fully leveraging the potential of artificial intelligence.

Altman's views and practices reflect the current technology leaders' thinking about the future socio-economic structure and also indicate the potential development direction of the Web3.0 field. Under his influence, we can foresee more innovative applications of artificial intelligence being developed and implemented in the Web3.0 field, which will not only impact the economy but may also change the way we understand and practice social equity and economic inclusivity.

We expect an important trend shift in the digital asset industry in 2024: the comprehensive outbreak of the application layer, especially in the integration of artificial intelligence and Web3.0. AIFi (AI Finance) and AI DePIN (AI Decentralised Physical Infrastructure Networks) will become the core themes of this bull market. This trend not only reflects the forefront of technological innovation but also reflects the strong market demand for more efficient and intelligent financial services.

AIFi represents a new paradigm of the integration of artificial intelligence and financial services in the Web3.0 era. It not only simplifies and automates traditional financial processes but also provides unprecedented innovation in intelligent asset management, risk assessment, and investment strategy formulation. AI DePIN, on the other hand, explores the decentralization of artificial intelligence infrastructure. It achieves distributed deployment of data processing and storage capacity by building decentralized physical network infrastructure. This not only provides a broad platform for AI but also drives the arrival of the Web3.0 era.

The combination of these two major trends indicates that the future financial and digital asset markets will become more intelligent and personalized. With the further maturity and application of AI technology, it is expected that AIFi and AI DePIN will continue to be the core driving forces of the bull market in 2024 and beyond, propelling the entire industry into a new development stage.

At the same time, the development of GameFi has brought about a "breaking of boundaries" for Web3.0 in a broader sense. This branch of the gaming industry has not only attracted a large number of non-traditional digital asset users but also demonstrated the enormous potential of blockchain technology in entertainment and interactive content. Through GameFi, more people will experience new gameplay and value models brought by blockchain, thereby promoting the popularization and growth of the entire Web3.0 ecosystem. As of December 21, 2023, the vigorous development of GameFi has been significantly reflected in the market value of its related tokens, reaching approximately $7.5 billion. This data not only reflects the strong growth momentum of GameFi as an emerging field but also indicates its increasing importance in the entire digital asset ecosystem. In the development of the gaming track, BNB Chain, Ethereum, and Polygon continue to lead the traditional public chains. These public chains provide solid infrastructure for various GameFi projects with their stability, efficiency, and wide application support.

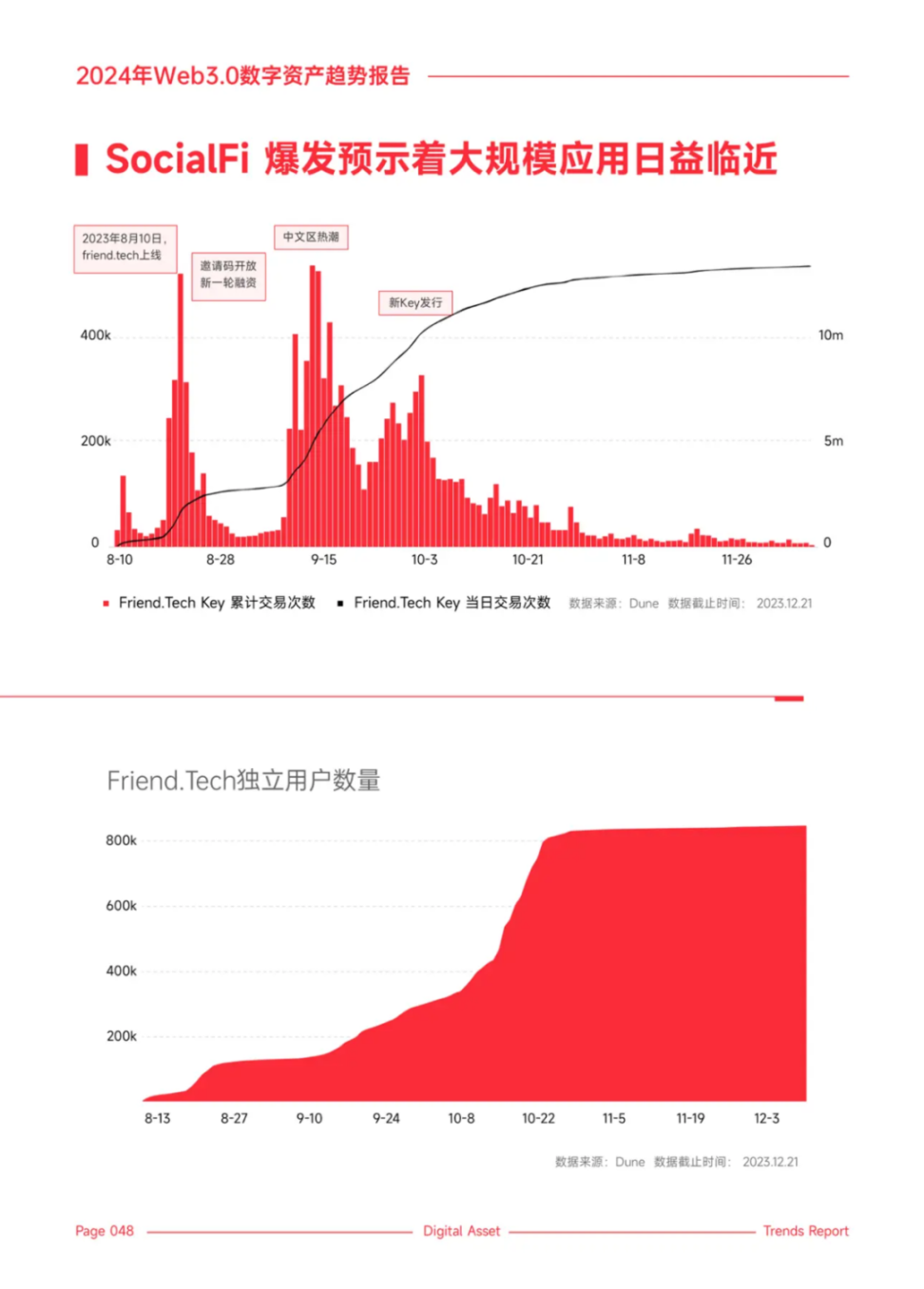

Furthermore, the rapid development of SocialFi also indicates that the large-scale application of decentralized applications is increasingly imminent. The core of SocialFi lies in combining social networks with financial services to create a more transparent and fair social economic system. With increasing user concerns about data privacy and content value, SocialFi will lead a new wave of digital identity, content assetization, and decentralized social interaction in 2024.

TON (Telegram Open Network) has been chosen as the Web3.0 infrastructure by Telegram, a communication platform with 800 million users. On July 13, 2023, Telegram Wallet launched Wallet Pay, an encrypted payment solution based on the TON blockchain. It supports users to directly make payments to merchants using USDT, TON, and BTC within the Telegram application. By the third quarter of 2023, the number of TON accounts had grown to over 3.5 million, the number of active wallets on the chain was close to 815,000, and the number of validators had reached 344, distributed in 24 different countries, with a total staking amount close to 500 million TON. More notably, on November 3, 2023, TON received recognition from the Dubai Financial Services Authority (DFSA). This certification has opened the door for its further expansion and application on a global scale.

In summary, the industry development trends in 2024 will focus on the multi-faceted breakthrough of the application layer, with the integration of AI and Web3.0 as the core driving force. The development of GameFi and SocialFi will break traditional boundaries, bringing new experiences and value to a wider user base. The combination and interaction of these trends indicate the accelerated formation of a more diverse, intelligent, and interconnected digital asset world.

Trend Six: The competition of public chains is not over yet, and the differentiated competition of Layer1 and the incremental layout of Layer2 are equally important

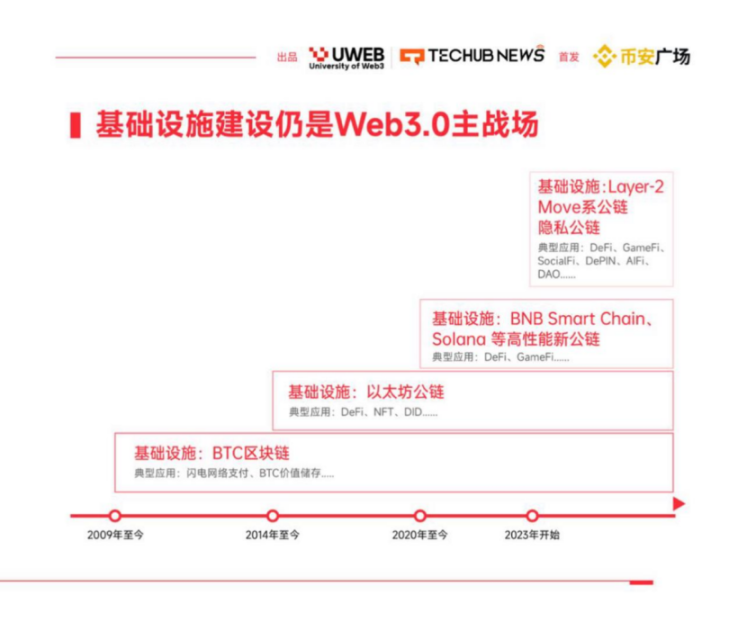

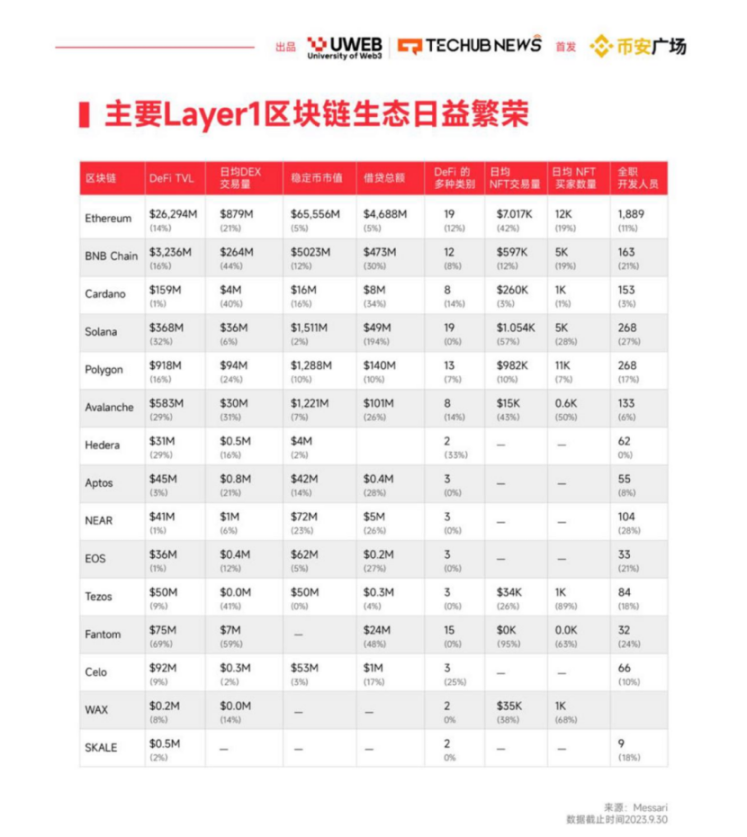

The competition in the public chain field in 2023 is still fierce, with the growth space and differentiated competition of Layer1 public chains being the core opportunities. The construction of infrastructure remains the main battlefield of Web3.0, which is particularly evident in the development trends of public chains.

Since Ethereum led the new era of smart contract public chains in 2015, the competition in the public chain space has never stopped. From 2018 to 2020, the public chain battle intensified, and since 2020, Ethereum's Layer2 and other Layer1 public chains have started to carve out their own competitive tracks, marking the diversification and specialization of blockchain infrastructure construction.

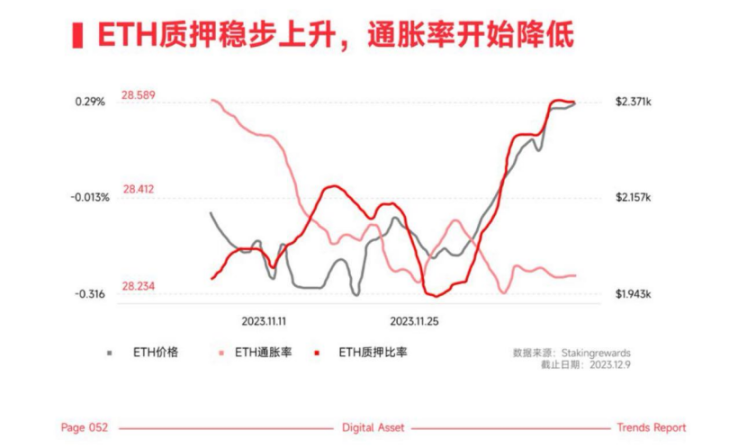

Currently, as the dominant force in the market, Ethereum's steady increase in staking quantity and gradual decrease in inflation rate indicate the maturity of its network and market recognition. However, Ethereum is not the only player, as other Layer1 blockchains such as Solana are also seeking their position in the competition.

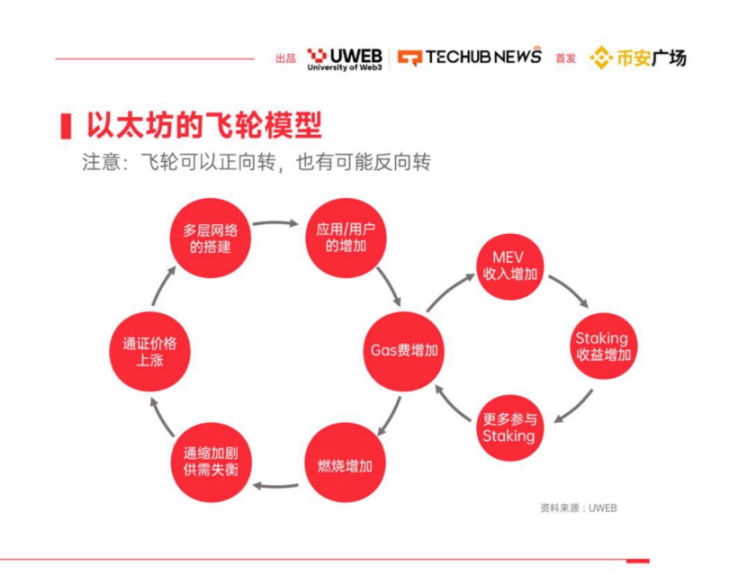

Understanding Ethereum's flywheel model is key to understanding the continuous growth and expansion of the Ethereum ecosystem. This model is essentially a self-reinforcing mechanism that drives the development and growth of the entire system through multiple interconnected links.

Specifically, the construction of Ethereum's multi-layer network attracts more developers and better development infrastructure, bringing more applications (DApps) to the Ethereum ecosystem, attracting more users, leading to more transaction volume and higher network fees (Gas). This will increase the burning of ETH, leading to deflation and imbalance of supply and demand, causing the price of ETH to rise. On the other hand, higher Gas fees also increase MEV income, leading to increased Staking rewards, attracting more people to participate in ETH Staking, further accelerating the flywheel cycle. It is worth noting that in the case of smooth development, the flywheel can demonstrate the above positive cycle; however, if there are problems with internal and external factors, the flywheel may also experience a reverse cycle.

It is worth noting that Ethereum's "Cancun Upgrade" is expected to launch in January 2024, marking another important milestone in the development history of the Ethereum network. After the Cancun upgrade, transaction costs on the Ethereum Layer2 network are expected to significantly decrease, improving the scalability of the entire network, providing users and developers with a more efficient and cost-effective blockchain experience. This upgrade not only represents technological progress but also will further drive the development and prosperity of the Ethereum ecosystem.

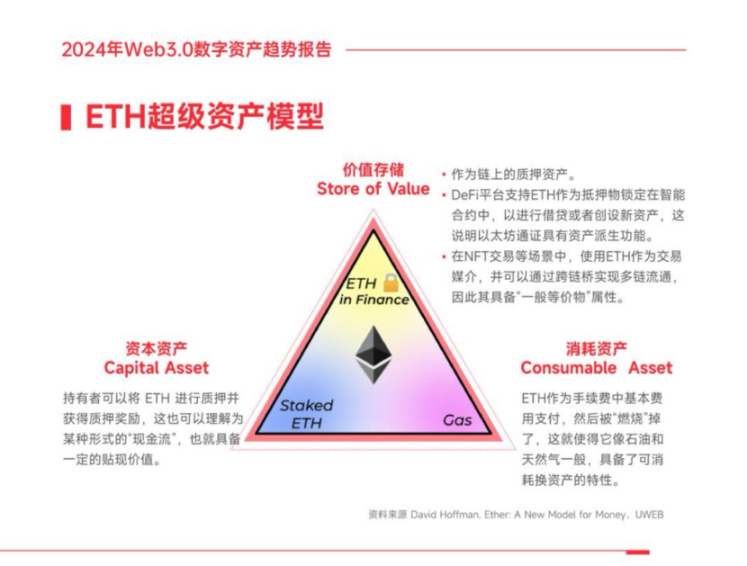

At the same time, ETH itself possesses the properties of capital assets, consumable/convertible assets, and value storage assets, forming a "super asset" that spans three major asset categories.

First, ETH has the characteristics of consumable/convertible assets. A large amount of ETH is burned as the basic fee in transaction fees, similar to the consumption/convertibility of oil and natural gas. Demand for usage becomes a key factor, with higher usage demand leading to lower circulation, thereby affecting the value of the entire system.

Second, ETH has the properties of capital assets. After the Ethereum upgrade, holders can stake ETH and continuously receive rewards in digital assets. This can be understood as holding ETH can bring a form of "cash flow".

Third, ETH has the dimension of a value storage asset. After Ethereum fully adopts the proof-of-stake consensus mechanism, the annual supply growth rate of ETH (similar to "inflation rate") may gradually decrease from 4% and may even become negative, leading to deflation. In addition, many DeFi platforms support ETH as collateral locked in smart contracts to lend out other digital assets or as "reserves" to issue new digital assets, indicating that ETH has asset derivative functions. In scenarios such as NFT transactions, ETH is the main trading medium and can circulate on multiple blockchains through cross-chain bridges, giving it the property of a "general equivalent". These characteristics are similar to the position of gold in the world economy, indicating that ETH possesses the properties of a value storage asset.

Therefore, we can see that Ethereum continues to maintain market dominance in the major Layer1 blockchain ecosystems. However, after Solana's DeFi ecosystem experienced the impact of the FTX incident, it has shown growth in the process known as "Solana DeFi 2.0".

Middleware technologies such as Layer2 and oracles as the foundation for large-scale applications have optimistic development prospects in 2024. Layer2 technology provides a feasible path for the expansion and efficiency improvement of public chains with its unique solutions. In response to the "blockchain trilemma," Layer2 technology aims to improve the scalability of blockchain systems without sacrificing decentralization and security. Layer2 solutions achieve transaction processing capacity and cost reduction by building an additional network layer on top of Layer1 public chains.

Rollup, as an advanced technology in Layer2, has attracted particular attention in the market. It achieves efficient expansion of the main chain by aggregating and compressing a large number of transactions for verification on the main chain. Optimistic Rollup adopts an optimistic strategy, assuming that most transactions are valid and allowing challenges to the validity of transactions within a specific time window. On the other hand, ZK Rollup verifies the validity of each transaction using zero-knowledge proof technology, without waiting for a challenge window, directly improving transaction processing speed and security.

Although Optimistic Rollup has relatively lower development costs and difficulty, ZK Rollup demonstrates greater potential in future development, security, and efficiency. The development of this technology not only promotes the performance improvement of main chains such as Ethereum but also provides scalable solutions for other public chains to learn from. We expect the Layer2 track to continue to attract capital investment, incubate more innovative applications, and gradually address the performance bottlenecks faced by existing public chains, laying a solid technical foundation for large-scale Web3.0 applications.

As of December 21, 2023, the total locked value (TVL) of the Layer2 track has reached $16.1 billion, with Optimistic Rollup and ZK Rollup being the dominant technologies in the market. Among them, Arbitrum has established its leadership position in the Layer2 track with significant market share and a substantial increase in transaction volume in 2022. Projects such as Base, zkSync, and Mantle have not only made significant technological breakthroughs but also achieved significant market share growth.

In addition, against the backdrop of the rapid development of Web3.0, oracle technology, as a key bridge connecting real-world data with blockchain smart contracts, is increasingly receiving market attention. As of December 31, 2023, the entire oracle market presents a tripartite pattern, with Chainlink, WINLink, and Chronicle Labs occupying over 88% of the market. As an industry leader, Chainlink's decentralized oracle network provides a secure and reliable data source, supporting complex financial smart contracts and providing infrastructure for diverse Web3.0 applications. Its unique design concepts and technical implementations, including the use of multi-signature and decentralized nodes, ensure the credibility of data sources and the robustness of the network. These features make Chainlink an indispensable component for DeFi, gaming, insurance, and other decentralized applications. The increasing market demand for oracles has led to the continuous expansion of their functions, including privacy-protected data transmission and cross-chain capabilities. These innovations not only improve the efficiency and practicality of oracles but also lay the foundation for further market growth.

Looking ahead, we expect to see more innovation and competition, with Layer1 public chains and Layer2 scalability continuing to drive the development and transformation of the entire industry. Additionally, the oracle market is expected to continue its expansion trajectory, especially as interaction between on-chain and off-chain worlds becomes the norm. We look forward to seeing oracle technology bring more innovation and be more widely integrated into finance, supply chain, IoT, and other fields, further promoting the maturity and development of the entire Web3.0 ecosystem.

As a professional educational institution in the Web3.0 industry, Uweb is committed to providing professional Web3.0 education and training, as well as the most in-depth and forward-looking industry insights and analysis for participants in the digital asset market. In writing this annual report, our pursuit is not only to track trends and capture opportunities but also to embark on a deeper journey of wealth exploration that aligns with individual beliefs and cognition.

As the ancient saying goes, "Weak water can carry a boat; a small amount of water can be taken in a ladle." In this era full of variables and choices, we emphasize following personal beliefs and focusing on familiar and self-matching areas of cognition. In this annual report, we not only present the overall picture of the digital asset market but, more importantly, guide each investor on how to find the right "ladle" of water in the complex and diverse information. Through in-depth analysis and accurate interpretation of market dynamics, everyone can find a path to wealth that matches their cognition, achieving stable and long-term development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。