Author: Zhichun Capital

On January 10th, the US SEC approved 11 applications for Bitcoin spot, officially marking the entry of crypto assets into the core asset allocation pool of global mainstream institutions. However, on the first day of ETF trading, the price trend of Bitcoin was completely opposite to the previous market enthusiasm, dropping from a low of $49,000 to $41,500, wiping out almost all the gains of the past month. What exactly happened in the meantime? What caused this major drop, and why did a large amount of funds flow out of the BTC market through ETF after its approval instead of flowing in? After practical operation, the author uses a $1,000 investment in ETF as an example to help investors better grasp the investment opportunities of crypto assets in the era of ETF.

Part 1: Revealing the fund flow process behind ETF through a $1,000 operation

Part 2: ETF secondary market trading volume ≠ net inflow and outflow of funds in the Bitcoin market

Part 3: Why did Grayscale Bitcoin ETF experience a large outflow of funds? How long will this outflow continue?

Part 4: ETF will bring a wider range of investors into the crypto market, which is a long-term benefit

Part 5: In the next three months, there are three key points in the crypto market

Part 1: Revealing the fund flow process behind ETF through a $1,000 operation

First, it is necessary to understand the four important participants in the Bitcoin spot ETF system:

Sponsor: Responsible for designing and managing ETF products, calculating the daily net asset value (NAV) of ETF products, and collecting management fees. Currently, there are 11 approved sponsors, such as Blackrock, Fidelity, Ark, Grayscale, etc.

Authorized Participant (AP): The only institution authorized to directly purchase and redeem shares from the issuer, generally asset management companies/brokers.

Market Maker: Provides liquidity in the secondary market, buys and sells ETF shares, and requests the purchase/redemption of ETF shares from authorized participants (AP) when liquidity is insufficient/excessive.

Investors: Individual or institutional investors who buy and sell ETF shares in the secondary market.

Now, let's follow a $1,000 ETF investment to reveal the fund flow process behind it.

It should be noted that since the US SEC has only approved Bitcoin ETFs based on cash purchase and redemption, all currently issued Bitcoin ETFs cannot be physically purchased or redeemed. Therefore, the fund flow process can only be carried out in the following ways:

When you decide to buy a Bitcoin spot ETF with $1,000, you would typically choose an online trading platform, such as Robinhood, IBKR, place an order at the market price, and upon successful trading, your $1,000 will flow to the market maker.

At the same time, the market maker may receive many buy orders of $1,000, and the ETF shares held may not be sufficient to meet the demand, causing the ETF price to rise. If the market value relative to the total Bitcoin assets held by the issuer becomes unanchored, the market maker will request the authorized participant (AP) to assist in purchasing ETF shares. A portion of your $1,000 will be transferred to the authorized participant, for example, $200.

Upon receiving the purchase request and $200, the authorized participant will apply to the sponsor to purchase ETF shares, and the $200 will be transferred to the sponsor.

The sponsor will use the $200 to purchase Bitcoin through platforms such as Coinbase. Depending on the agreement of different funds, the time for purchasing Bitcoin can be from the day of purchase to 1-2 days after purchase, ultimately leading to the inflow of funds into the cryptocurrency market.

Part 2: ETF secondary market trading volume ≠ net inflow and outflow of funds in the Bitcoin market

Through the study and operation of the fund flow process, we can conclude that the trading volume in the ETF secondary market does not equal the net inflow and outflow of funds in the Bitcoin market. These two values cannot be directly equated but have mutual influence.

When discussing the impact of Bitcoin spot ETFs on the price of Bitcoin, the most important issue is to focus on how much USD has flowed into the Bitcoin market to purchase Bitcoin spot through ETF from the traditional financial market, i.e., the total net inflow.

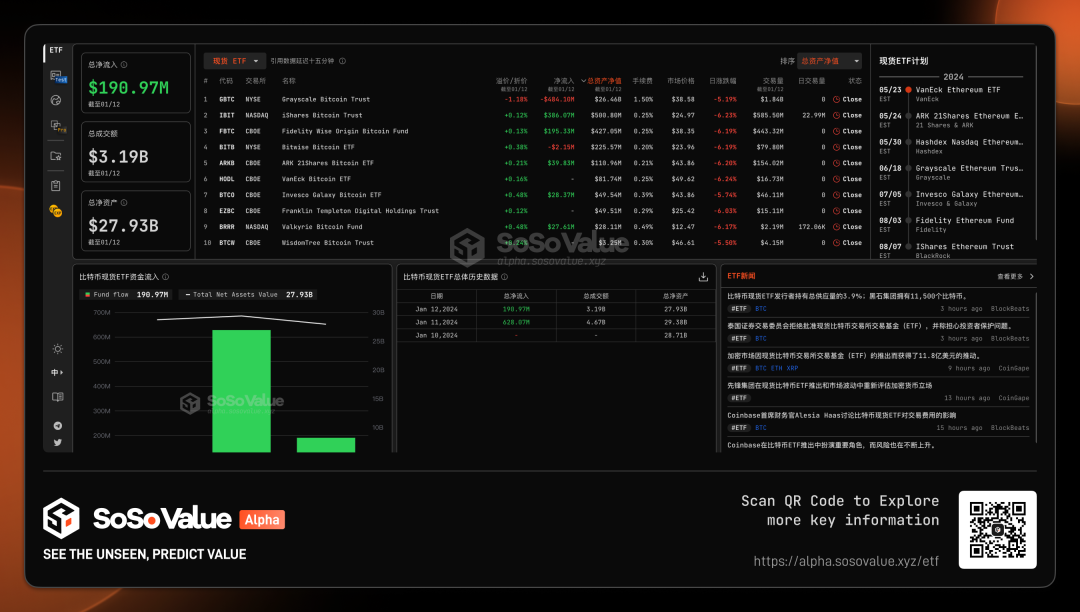

So, how is the net inflow calculated? By summing up the overall purchase and redemption data of these 11 ETFs, the total net inflow can be calculated. Each sponsor will disclose the corresponding values on their official websites, and professional data tracking tools such as Bloomberg or SoSo Value's ETF section can be used for daily queries. Taking SoSo Value's ETF dashboard as an example.

We can see that Grayscale GBTC in the Bitcoin ETF had a net outflow of $594 million on January 16th (the third trading day after approval). In the two trading days after the ETF approval (January 11th and 12th), there were also redemptions, with net outflows of $95 million and $480 million, totaling $580 million. Therefore, although the total trading volume of all ETFs on the 11th and 12th reached $4.67 billion and $3.19 billion, other ETFs such as ARK, Blackrock, and Fidelity received a net inflow of $1.4 billion. However, due to the large net outflow of Grayscale ETF, the overall net inflow of funds into the Bitcoin market was significantly lower than market expectations, leading to the Bitcoin correction starting on the 12th (see the image below for the January 12th cross-sectional data).

Source: SoSo Value January 12, 2024, cross-sectional data (https://alpha.sosovalue.xyz)

Source: SoSo Value January 12, 2024, cross-sectional data (https://alpha.sosovalue.xyz)

Part 3: Why did Grayscale Bitcoin ETF experience a large outflow of funds? How long will this outflow continue?

The continuous redemptions of Grayscale Bitcoin ETF for three days brought about selling pressure of approximately 26,000-28,000 Bitcoins, increasing market caution. According to SoSo Value data, Grayscale GBTC had redemptions on January 11th, January 12th, and January 16th, with a total net outflow of $1.174 billion.

Source: SoSo Value January 16, 2024, cross-sectional data (https://alpha.sosovalue.xyz)

Source: SoSo Value January 16, 2024, cross-sectional data (https://alpha.sosovalue.xyz)

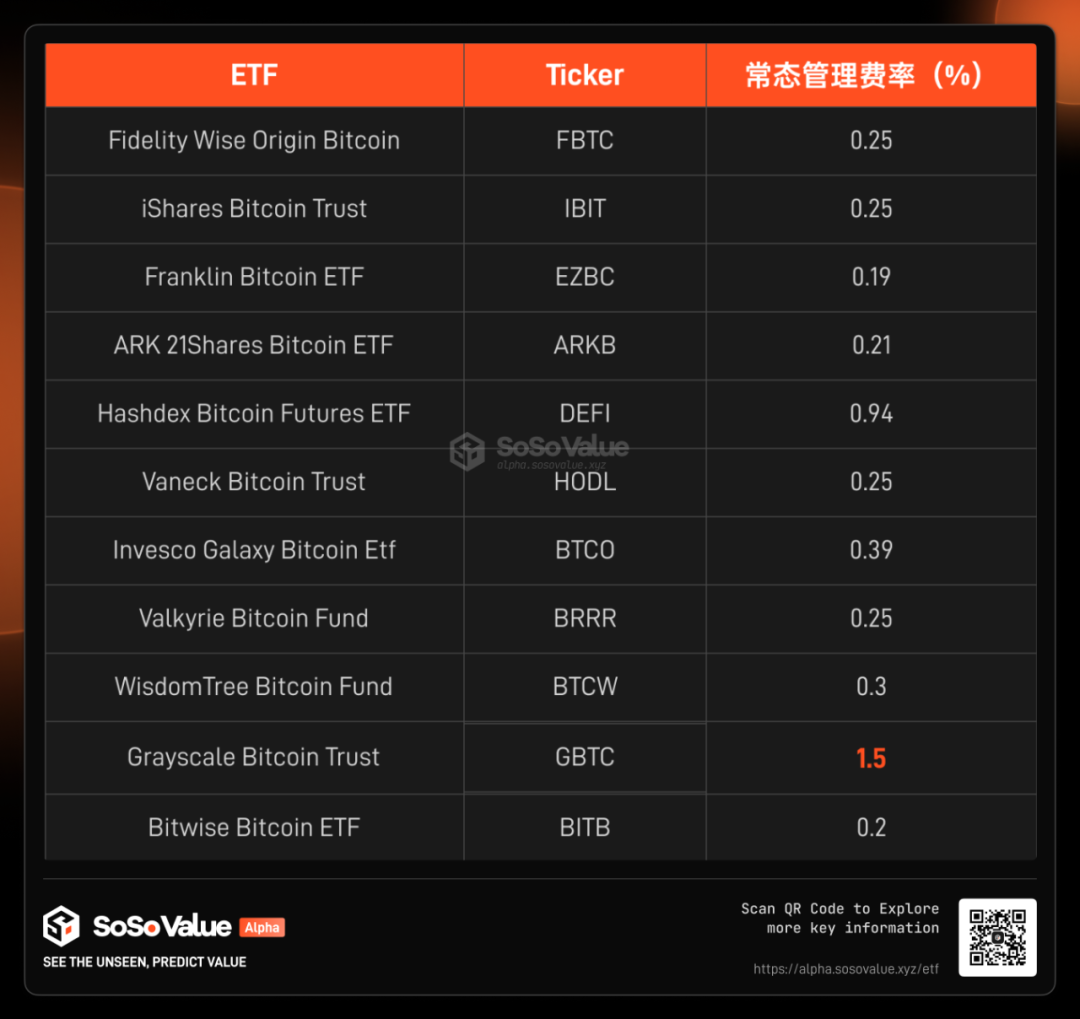

The two main reasons for the net outflow of Grayscale Bitcoin ETF are management fees 6 times higher than competitors and closing of arbitrage positions in the previous trust discount.

Grayscale Bitcoin Spot ETF (stock code GBTC), previously a Bitcoin trust, only allowed for subscription and secondary market trading, with no redemption allowed. From the perspective of the Bitcoin market, the Bitcoin trust subscribed through Grayscale, where funds flowed into Bitcoin, could not flow out, creating a one-way flow of funds into Bitcoin. Since its launch 8 years ago, GBTC has accumulated holdings of approximately 620,000 Bitcoins. On January 10th, it was upgraded to an ETF approved by the SEC, allowing investors to freely redeem through authorized participants (AP), converting their ETF shares into US dollars, thereby opening up the funds from Grayscale to flow out of the cryptocurrency market. Specific redemption transactions can be divided into two major types based on the different attributes of investors. By analyzing the trading intentions and behaviors of these two types of investors, we can more clearly analyze and predict the duration of the net outflow of Grayscale ETF and its impact on the price of Bitcoin.

First type of investors: Those who have a long-term positive outlook on Bitcoin assets but are moving their positions to other ETFs due to the high management fees of Grayscale. When comparing 11 ETFs, the management fee of Grayscale GBTC is 5-6 times higher than its competitors, with a management fee rate of 1.5%, while others are generally below 0.3%, and early investors are given a fee reduction discount. For investors with a large amount of funds, there is a strong incentive to sell Grayscale ETF and switch to other ETFs. For example, Ark was once among the top ten investors in GBTC and is expected to transfer its positions to its own ETF (ARKB) in the future. Whether Blackrock and Fidelity, who may have held corresponding positions in Grayscale, need to move their positions is unknown. The redemption process of such repositioning will bring about a time difference in fund outflows and inflows into the cryptocurrency market, and the time difference causing the price of BTC to drop will increase the cautious sentiment of newly added funds in the market.

Second type of investors: Arbitrage of the Grayscale GBTC discount rate, hedging BTC off-exchange. Due to the chain reaction in the cryptocurrency market caused by the FTX collapse, the Grayscale GBTC trust shares cannot be redeemed, resulting in a maximum discount rate of up to 49%, and a long-term maintenance of around 20%. Six months ago, the market began to anticipate that the SEC would approve Bitcoin spot ETFs, and GBTC could be converted from a trust to ETF shares redeemable based on NAV, causing the discount to disappear. Arbitrage funds began to intervene, arbitraging the discount rate by buying discounted GBTC and shorting BTC off-exchange. After the launch of the Bitcoin spot ETF on January 10th, the discount rate of GBTC on January 12th was only -1.18%. Therefore, for investors hoping to profit from the disappearance of the discount, there is a strong incentive to close their positions. Since most of the funds arbitraging the discount rate should have corresponding hedging mechanisms off-exchange, after closing their profitable positions, the off-exchange hedging short positions will also be correspondingly closed. Therefore, logically, the funds arbitraging the discount rate will not have a significant impact on the price of BTC.

Based on the analysis above, we can conclude that the selling pressure of Grayscale GBTC in the next 1-2 months will directly affect the price of Bitcoin. So, how long will the net outflow of Grayscale GBTC continue? Based on the current total holdings of Bitcoin by Grayscale, which is around 620,000 Bitcoins, and the average daily sales of about 9,000 Bitcoins over the past three trading days, the impact of the net outflow of Grayscale GBTC on the fluctuation of Bitcoin prices should not exceed two months at the current outflow rate.

Part 4: ETF will bring a wider range of investors into the crypto market, which is a long-term benefit

Although Grayscale has brought about a certain amount of selling pressure on Bitcoin spot in the short term, looking at all Bitcoin spot ETFs, from January 11th to January 16th, they brought about a net buying volume of $740 million for Bitcoin. Among them, IBIT from Blackrock ETF had the highest net inflow of $710 million over the three days. After the news of Grayscale transferring 9,000 Bitcoins to Coinbase on the 16th caused a rapid drop, the price quickly rebounded to around $43,000, showing a trend of stabilization.

The reason behind this is that the redemption pressure from Grayscale has a short-term impact on the overall Bitcoin market, while a more diverse group of investors participating in crypto asset investment is the main narrative of the ETF era. As analyzed in the previous section, investors who are only moving their positions due to management fees are expected to continue to contribute to the buying volume for Bitcoin by buying into other Bitcoin ETFs. Investors looking to profit from the disappearance of the discount have a neutral impact on Bitcoin. However, on the other hand, let's take a look at the strength of the newly added Bitcoin spot ETF managers. The approved sponsors, such as Blackrock (with total assets under management of $8.59 trillion), Fidelity (with total assets under management of $4.5 trillion), and Invesco (with assets under management of $1.6 trillion), are all top-tier companies in the global asset management industry. Among them, Blackrock, Vanguard Group, and State Street Bank were once known as the "Big Three," controlling the entire index fund industry in the United States, while the entire cryptocurrency market currently has a market size of only $1.7 trillion. Top asset management companies are generally considered to have more abundant management experience, stricter compliance processes, and stronger loss acceptance capabilities, which can enhance investor trust in emerging assets like Bitcoin. Additionally, the globally accumulated brand network of top brands over the years will help promote the new category of Bitcoin spot ETF assets more effectively.

Part 5: In the next three months, there are three key points in the crypto market

In order of importance:

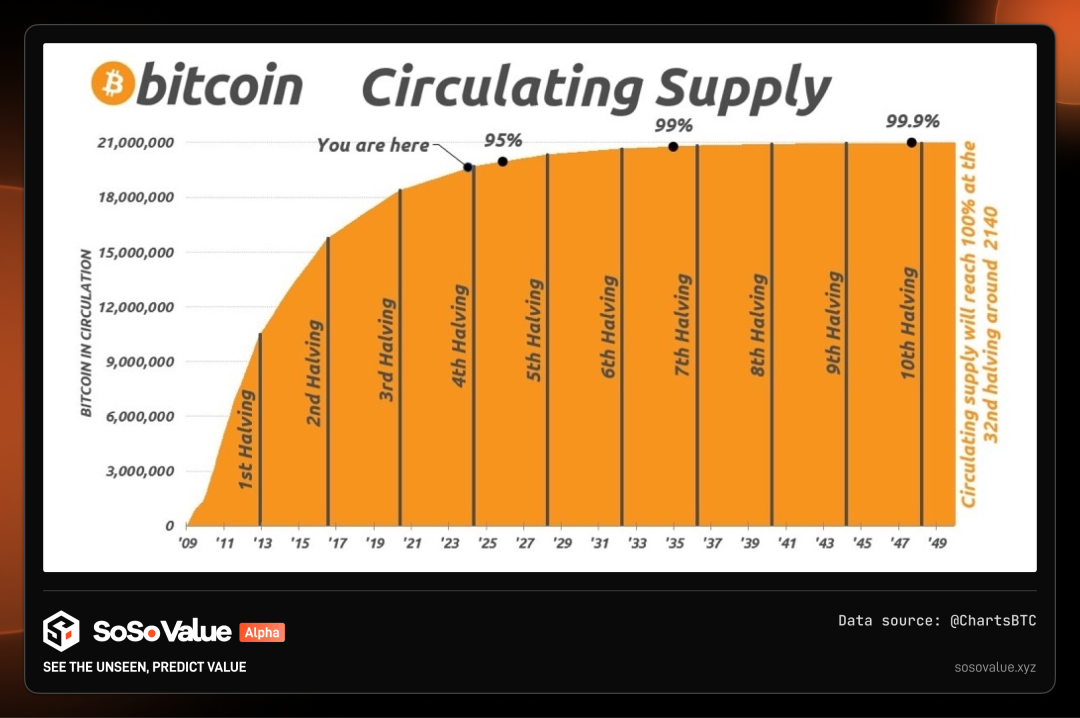

1/ Bitcoin Halving: Expected in April 2024, the significant reduction in new Bitcoin supply, along with increased demand due to ETFs.

The mechanism of Bitcoin halving ensures that its total supply will never exceed 21 million coins, and halving will directly lead to a significant reduction in the new supply of Bitcoin. With the passage of Bitcoin ETFs, the channel for funds to flow into Bitcoin has been opened, bringing about a significant increase in new demand for Bitcoin. On one hand, the new supply of Bitcoin is about to be halved, and on the other hand, demand is continuously increasing. Additionally, the US dollar's interest rate reduction cycle will increase the preference for risk assets, and cryptocurrency market investors generally believe that 2024 will usher in a new round of growth, commonly referred to as the bull market.

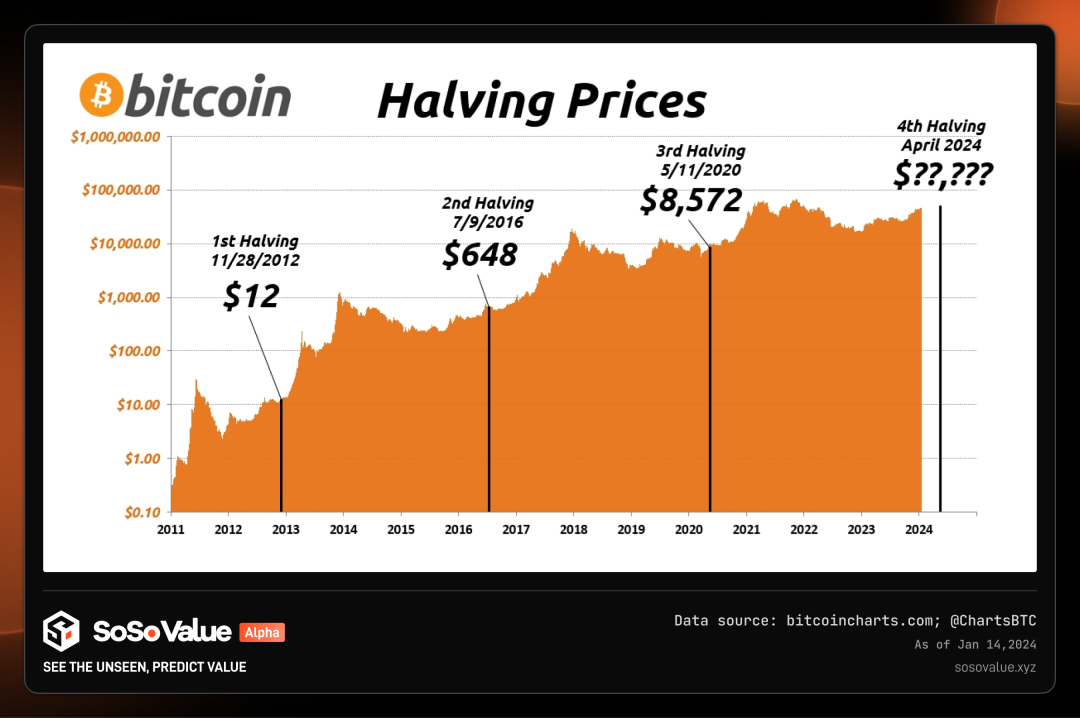

We can refer to the price changes of Bitcoin in the year following previous Bitcoin halvings. Bitcoin was issued in 2009, with mining output of 50 BTC per block at the time. It has since undergone three halvings.

The first halving occurred in November 2012, reducing the mining output from 50 BTC per block to 25 BTC, and the price of Bitcoin rose from $13 to a high of $1,152 within a year.

The second halving took place in July 2016, further reducing the mining output to 12.5 BTC per block, and the price of Bitcoin rose from $664 to a high of $17,760.

The third halving occurred in May 2020, reducing the mining output to 6.25 BTC per block, and the price of Bitcoin rose from $9,734 to a high of $67,549.

The next halving is expected to take place in April 2024.

In addition, according to a Coinshares report, after this Bitcoin halving, the average mining cost per Bitcoin for miners (excluding one-time mining machine costs, including electricity consumption and maintenance costs) will rise to $37,856.

2/ Approval of Ethereum Spot ETF: Expected in May 2024. Institutions such as Blackrock, Fidelity, and Invesco have also applied for Ethereum spot ETFs, and the likelihood of approval is high. With the passage of the Bitcoin ETF, the market has begun to anticipate the approval of the Ethereum ETF in May, and the price has already begun to react to this.

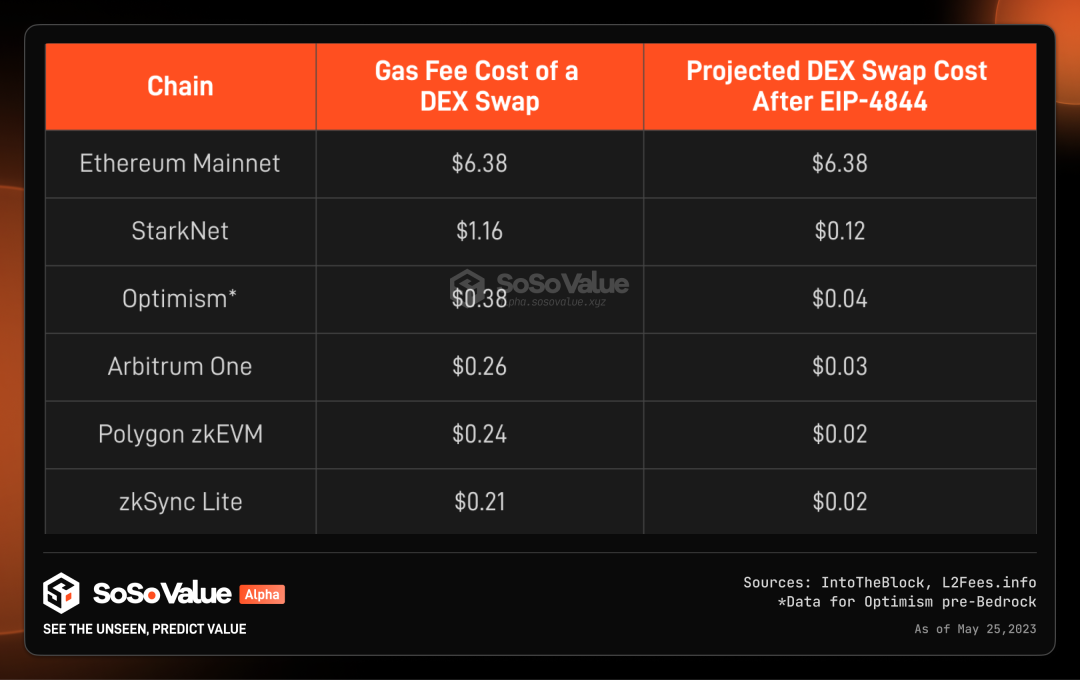

3/ Ethereum Cancun Upgrade: Expected in February-March 2024, which will reduce transaction costs on the Ethereum Layer2 network to one-tenth. The Cancun upgrade for Ethereum may be similar to the iPhone moment for mobile internet. Lower transaction costs and a better trading experience will give rise to more application scenarios that can truly serve a large user base.

Most of the time, people tend to overestimate short-term impacts and underestimate long-term impacts. The launch of the Bitcoin spot ETF is a milestone, the first gateway to bring crypto assets into the core assets of finance, and looking back in many years, it will undoubtedly be a long-term benefit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。