Entangle envisions a DeFi dApp that is not limited by a single blockchain in the future.

Author: Luccy

On January 10th, the cross-chain DeFi protocol Entangle announced the completion of a $4 million seed and private placement round of financing, with participation from institutions such as Big Brain Holdings, Launch Code Capital, LBank Labs, Skynet EGLD Capital, Cogitent Ventures, Owl Ventures, Faculty Group, and Seier Capital. The new funds will be used to enhance its protocol technology, expand global influence, and strengthen its role in cross-chain and interoperable data advancement.

Previously, Entangle gained attention for its cross-chain liquidity through Liquid Vaults. With the staking race heating up, this protocol, which began laying out staking projects a year ago, has entered the public eye. In addition, the project's investor, Big Brain Holdings, is also one of the reasons why this project is worth paying attention to.

This crypto venture capital firm, established in 2021, is not particularly prominent in the industry in terms of reputation. However, many outstanding projects can be seen from its "track record," including its investment in the NFT project Pudgy Penguins in May last year, as well as the modular blockchain Dymension.

Recently, in the financing data compiled by BlockBeats, Big Brain Holdings' presence has been frequent. As Big Brain Holdings' first investment project in 2024, the cross-chain DeFi protocol Entangle, which comes with its own staking narrative, is worth mentioning.

Big Brain Holdings: From Solana to Cosmos

Big Brain Holdings is a crypto fund that invests in seed, pre-seed, and early-stage projects. According to rootdata, since October 2021, Big Brain Holdings has invested in a total of 163 projects, with DeFi projects being the main focus of its investments.

In Big Brain Holdings' investment list, it can be seen that as early as February last year, Big Brain Holdings led the investment in Dymension. At that time, the Dymension team had only 9 employees. Now, with the 70 million DYM genesis airdrop, the project has become well-known in the community, yet Big Brain Holdings did not gain much exposure from this.

From an ecological perspective, Big Brain Holdings' early investment direction was mainly based on Solana ecosystem projects, such as real-time streaming payment protocol Zebec Pay based on Solana, Solana infrastructure Helius, privacy protocol Elusiv, Solana fund management platform MeanFi, DeFi super app Hawksight, and the online horse racing game DarleyGo built on Solana, among others.

In the latter half of 2023, as the Solana ecosystem heated up again, Big Brain Holdings continued to focus on Solana, investing in projects such as the lightweight wallet TipLink, digital gift NFT project Drip, and the social platform Sleek. During this period, there was little attention given to investments in projects based on Polygon, Avalanche, Aptos, or other Layer1 ecosystems. Compared to "dollar-cost averaging" into Solana, there was hardly any investment strategy for other ecosystems.

Building on this foundation, after leading the investment in Dymension in February 2023, Big Brain Holdings did not have any Cosmos projects, but in recent consecutive investments, both are related to Cosmos, including the modular token issuance and liquidity solution Eclipse Fi, and the cross-chain DeFi protocol Entangle detailed in this article.

How Entangle Achieves Cross-Chain Liquidity

Entangle is a DeFi protocol that uses synthetic derivatives to coordinate liquidity and give value to liquidity in a universal Layer1 and Layer2 ecosystem. It consists of three core components: Entangle blockchain, Entangle Oracle, and Entangle DEX.

Entangle DEX allows users to exchange between USDC and LSD, and create, trade, and manage their LSD. Entangle DEX also supports cross-chain exchanges through Entangle Oracle. Entangle Oracle is a decentralized oracle solution that allows cross-chain communication and data transmission between different blockchains and protocols, supported by trusted validators and oracle networks that stake NGL as collateral.

Two LSD Applications

Entangle envisions a future for a DeFi dApp that is not limited by a single blockchain, establishing an interoperable cross-chain liquidity sublayer that seamlessly connects different chains, allowing users to access liquidity positions on any chain with just one click.

In simple terms, Entangle allows users to seamlessly interact with liquidity pools across chains.

This process utilizes synthetic derivatives to coordinate liquidity. To this end, Entangle provides two applications that utilize LSD: Liquid Vaults and Synthetic Vaults.

Synthetic Vaults is a protocol that allows users to create synthetic assets LSD. Users can deposit USDC into Synthetic Vault and receive LSD that tracks the price of any asset (such as stocks, commodities, or cryptocurrencies). Then, users can use their LSD to access different markets, hedge risks, or exchange on Entangle DEX.

Synthetic Vaults allow the optimal utilization of liquidity positions (xLSD) across multiple chains. For example, Pete provides liquidity on CurveFinance and receives the corresponding LP tokens, which are then staked on Entangle. Entangle will automatically compound the LP tokens to ConvexFinance for additional returns.

Liquid Vaults, on the other hand, is a protocol that allows users to create yield assets LSD. Users can deposit their liquidity tokens (such as LP tokens or staking tokens) into Liquid Vault and receive LSD as a reward. Then, users can stake the LSD to secure infrastructure or exchange on Entangle DEX.

Entangle's Liquid Vaults unlock over $14 billion of idle LP tokens and convert them into composable LSD.

Liquid Vaults supports a 1:1 asset-backed LSD with a wider utility of yield assets, optimizing liquidity, for example, in lending and derivatives protocols. Users can deposit into Liquid Vault as collateral to borrow assets or increase yield.

Entangle Infrastructure

To ensure seamless cross-chain communication and interoperability, Entangle has developed a custom oracle infrastructure. This infrastructure utilizes DPoS Cosmos-SDK EVM Compatible and Tendermint consensus algorithms for validation on an Oracle-centric blockchain.

With the support of Entangle infrastructure, Liquid Vaults can also serve as an interoperable medium for synthetic RWA, while maintaining composability and transferability across multiple ecosystems.

The core of Entangle infrastructure is its customizability, providing complete customization options for builders and protocols to secure, verify, and interoperate data. This includes a modular blockchain center for launching and executing smart contract operations. Currently, builders can design custom systems to enhance control over handling and executing cross-chain operations.

Additionally, the Entangle infrastructure offers flexibility with custom consensus mechanisms and custom on-chain entities for data collection and verification, both on-chain and off-chain. This design allows for the integration of custom administrator data aggregation and verification processes.

As mentioned earlier, Entangle consists of three core components: Entangle blockchain, Entangle Oracle, and Entangle DEX.

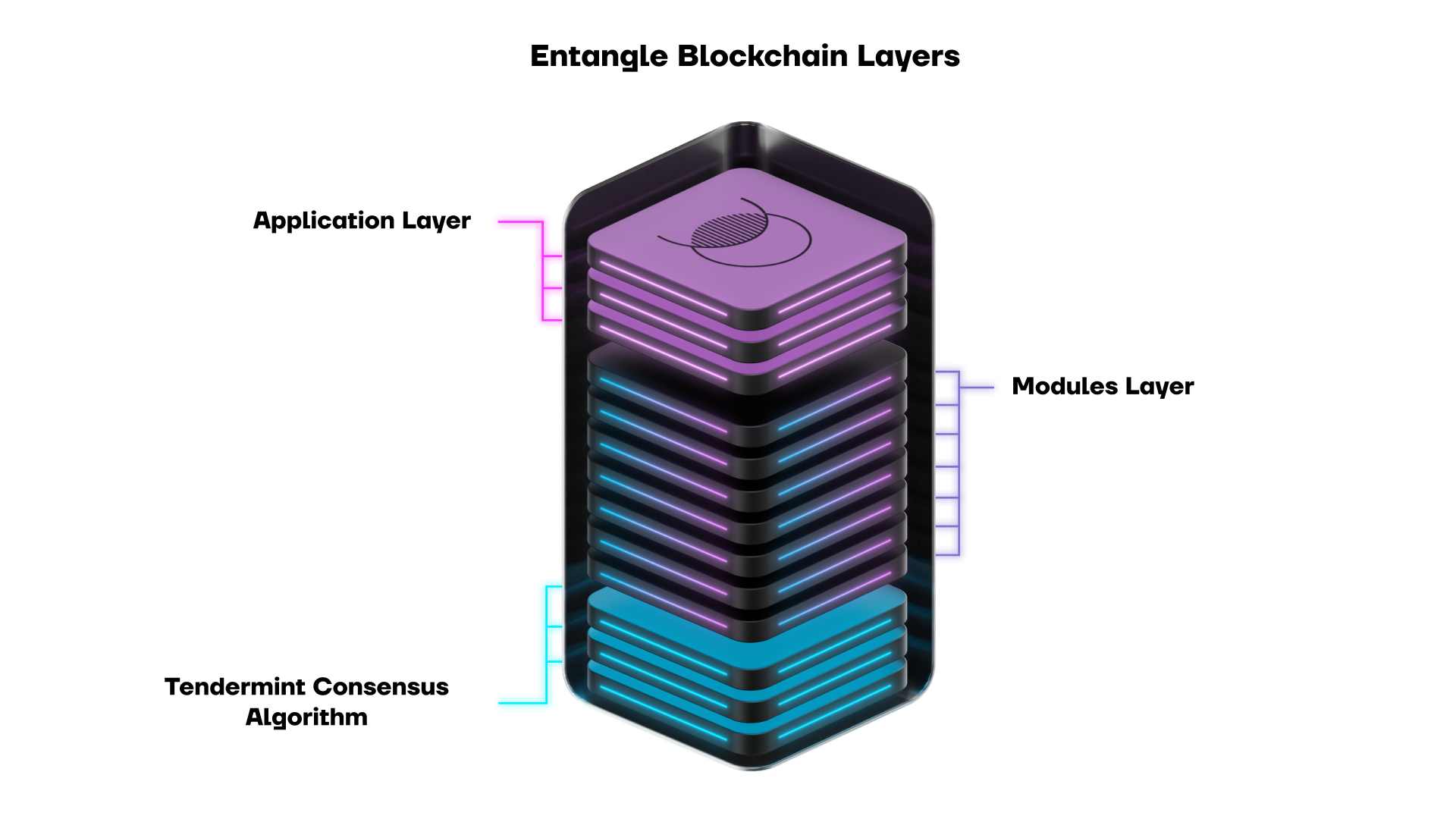

The Entangle blockchain is a custom blockchain built on Cosmos SDK, hosting the Entangle Oracle solution and Entangle DEX. It is protected by DPoS Tendermint consensus algorithm and uses NGL as its native token, divided into application layer, module layer, and core layer. The Oracle solution acts as a bridge, enabling effective communication and information sharing between different chains.

Source: Entangle Documentation

Builders use the Ethermint library to achieve EVM compatibility and deploy observer contracts written in Solidity on the Entangle blockchain. These contracts act as decision-making entities responsible for generating specific operations based on input data or the overall state of their protocols.

The Entangle blockchain serves as a central communication hub, where data is stored, verified, and processed. Its low gas fees and sub-3-second block confirmation time contribute to the economic efficiency and rapid completion of operations on Entangle. It employs a sophisticated messaging layer that can replicate states across different chains, ensuring seamless transfer of information and assets, enhancing interoperability, and providing cross-chain liquidity.

Interacting with Entangle

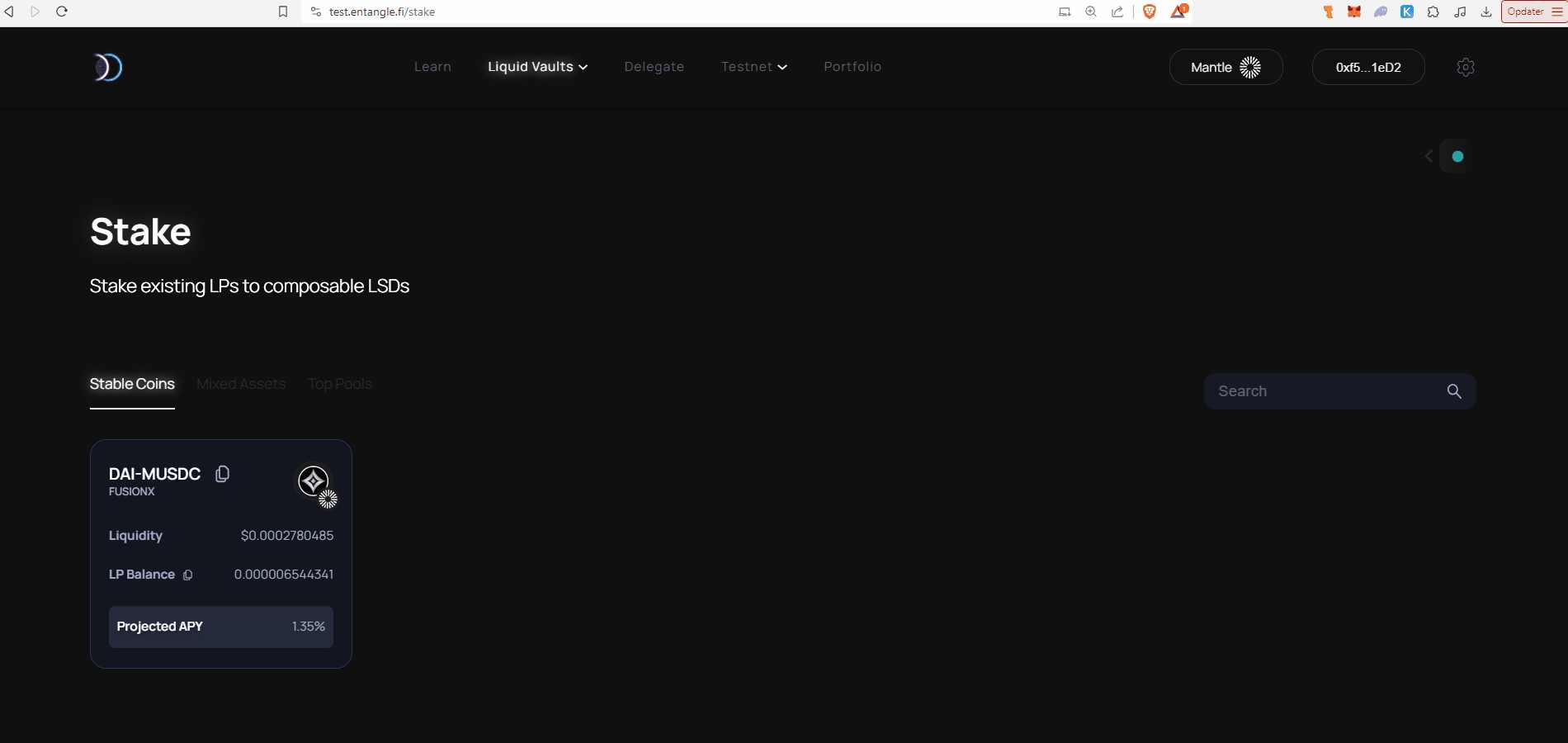

According to the official documentation, Liquid Vaults are currently deployed on 11 networks, with integrated DEX including Curve, PancakeSwap, Wombat Exchange, TraderJoe, Stargate, SpookySwap, Velodrome, FusionX, and AshSwap.

Users can deposit into Liquid Vault as collateral to borrow assets against the original LP position while continuing to earn yields on the underlying assets. This utility further extends to re-staking in derivative protocols.

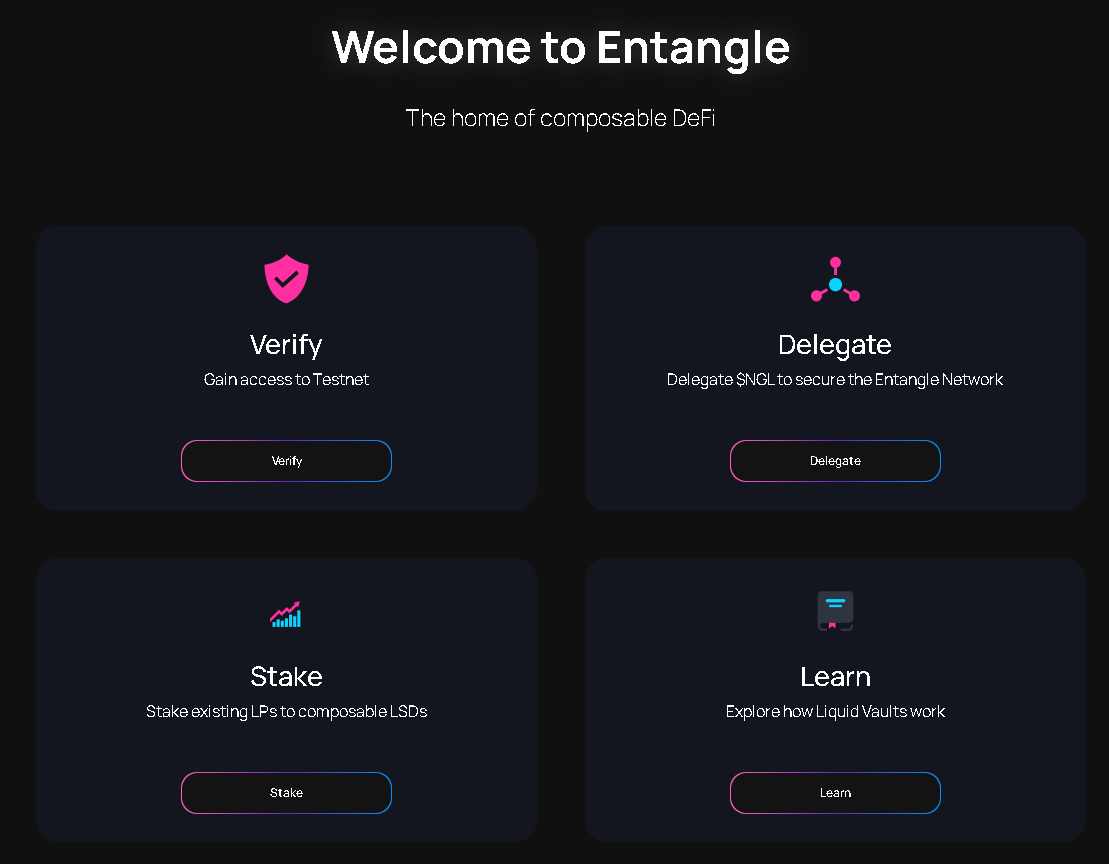

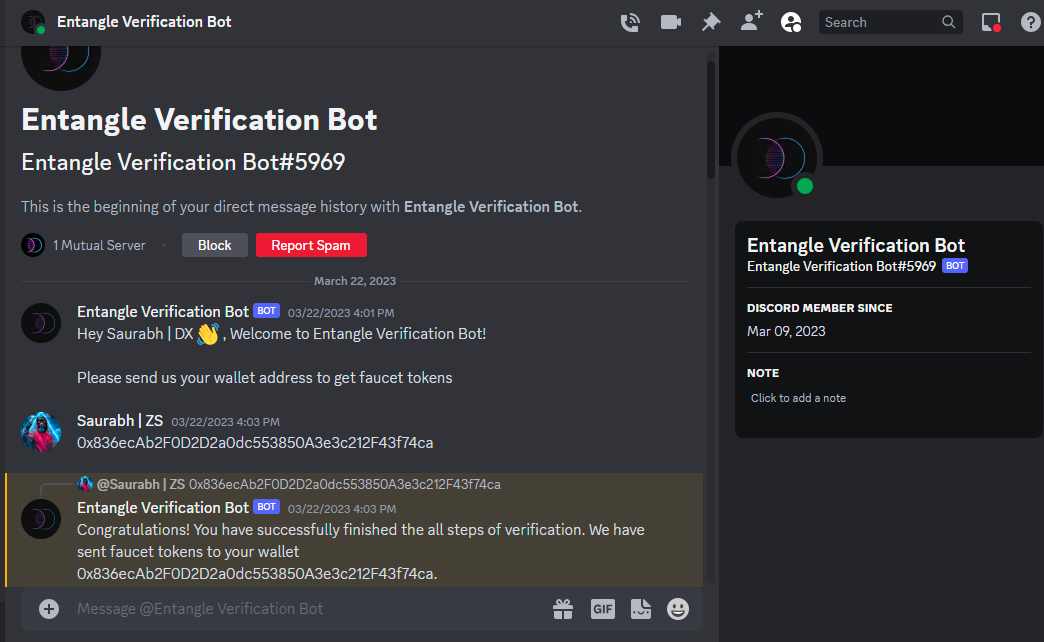

- Open the Entangle official website, click on "Verifi" to enter the testnet, and connect your wallet. In the wallet dropdown list, select the Entangle network, click the "Approve" button to add the new network to your wallet. On the next page, click to get faucet tokens and verify your Discord account.

- Enter the #faucets sub-channel, click on verify. Then, you will see a DM pop-up window in the top left corner. Click on DM, paste your wallet address into the Faucet token bot, and send the message. If you have added the Entangle Testnet network and received faucet tokens, you can participate in the Entangle Testnet.

- Return to the official website, ensure your wallet is connected, select the Stake option from the Liquid Vaults dropdown list, and choose the Mantle testnet network. Select a pool and the desired amount of LP tokens to stake. Approve and confirm the transaction, and in return, you will receive Liquid Vaults.

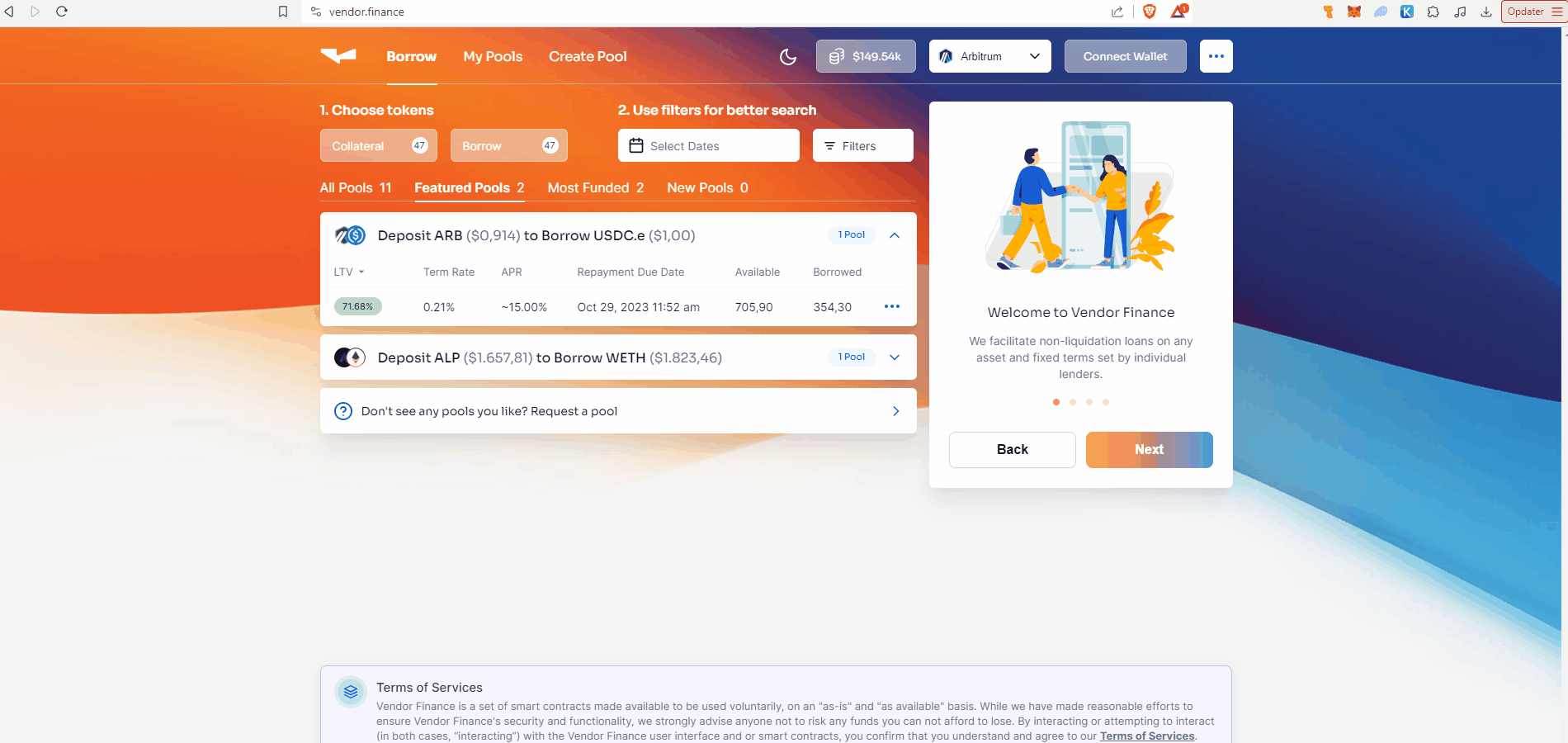

- Open Vendor Finance, connect your wallet, and select the Mantle Testnet network. Choose the FMDUC pool and enter the desired amount of Liquid Vaults as collateral, approve the transaction, and confirm. This way, you have successfully borrowed USDC using Liquid Vaults as collateral.

You can go to "My Pools" and select the "Borrowed" section to repay the USDC loan. Enter the required amount of USDC for repayment and receive Liquid Vaults as a reward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。