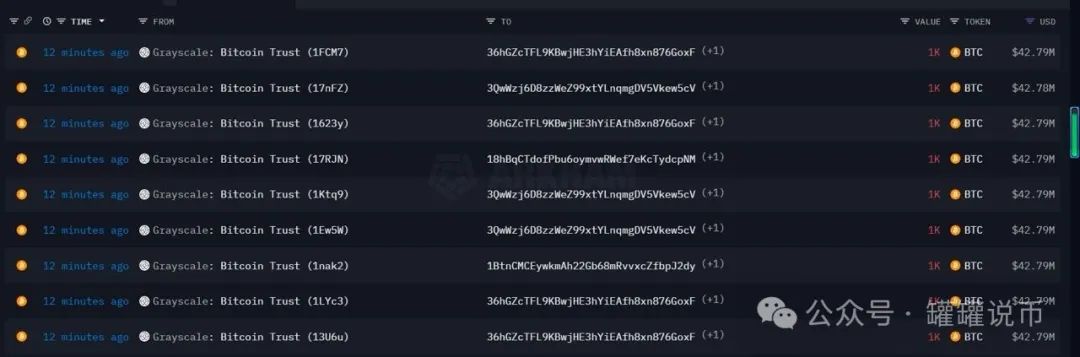

Yesterday, after the opening of the US stock market, Grayscale transferred 9,000 BTC to Coinbase, sparking market discussions. Is Grayscale going to start dumping its holdings? Grayscale currently holds over 600,000 BTC. What would happen to the market if they start dumping, and can it be sustained?

If you have a basic understanding of Grayscale, you should know that the over 600,000 BTC they hold does not belong to them, but to their users. Their early fund, GBTC, had a very high premium. By directly purchasing BTC and converting it to GBTC, they could profit from the price difference. However, since GBTC cannot be redeemed, early investors can only profit by selling GBTC on the secondary market. In bear markets, GBTC's negative premium is very high. Those who bought GBTC at that time could profit by redeeming it when possible, directly earning a profit difference of several tens of percentage points. Therefore, when applying for a spot ETF this year, GBTC's negative premium is gradually being smoothed out. Now that the Bitcoin spot ETF has been approved, the original GBTC also has redemption functionality. Users who were locked in early can now exit, including those who bought at a negative premium this year can also profit.

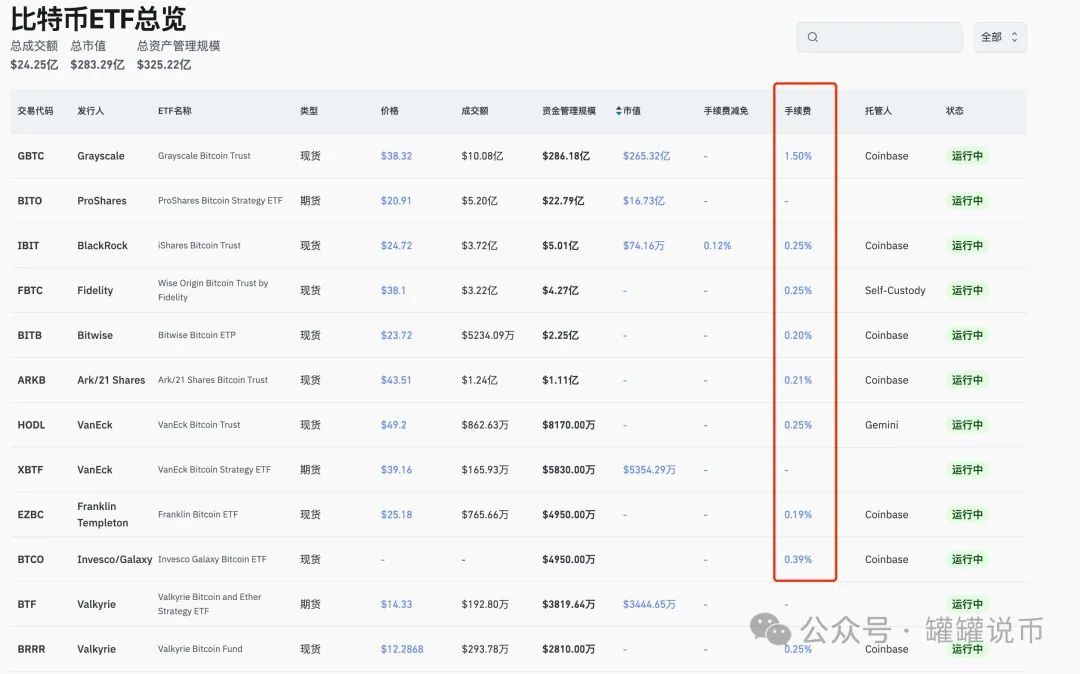

Through data, we can see that in the past three trading days, approximately $1.1 billion has flowed out of GBTC, but the entire ETF market still has a net inflow.

From this perspective, you can understand that the coins held by Grayscale cannot be dumped at will. These coins come from users, and if users want to redeem their funds and exit, Grayscale will transfer BTC to users for redemption.

Another important piece of data is that GBTC currently has the highest trading fees because they have a very large fund size and are taking advantage of this round to harvest. Therefore, many users are likely to choose ETFs issued by other institutions instead of GBTC. As for whether the Bitcoin transferred to Coinbase by Grayscale is used for dumping, we only need to verify it through price data.

Has Grayscale's total asset under management decreased (calculated under unchanged prices)?

Coinbase's BTC spot trading volume

For example, after the rapid price drop following yesterday's opening, the short-term trading volume was only over 800 BTC. Throughout the entire opening time of the US stock market, Coinbase's trading volume was only over 8,000 BTC, which is still less than the amount transferred by Grayscale, so there is no need to be overly concerned.

Most of these ETF issuing institutions are custodied at Coinbase, and the transfer of BTC may also be a preparatory action. By constantly monitoring the abnormal movements in the volume and price of Coinbase's spot, we can basically judge whether institutions are selling, and then consider the situation of their custodial scale reduction comprehensively.

For those who want to seek warmth or have doubts, feel free to join us - Public Zonghao: Guanguan Shuibi VX: 3379276514

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。