The discussion around Solana is getting more and more lively, and there are also more and more activities in the Solana ecosystem. Of course, there are also more and more developers and users who hope to interact with this ecosystem. Now is the best time to deeply understand bridging Solana.

Author: Arjun Chand, LI.FI Researcher

Translator: xiaozou, Golden Finance

Main Points of This Article

- The bridging activities in the Solana ecosystem have significantly increased, especially since November 2023. Bridges such as Wormhole, Allbridge, and deBridge (early supporters of the Solana ecosystem) are likely to benefit from this surge.

- The demand from users to transfer funds to Solana has sparked a surge in liquidity bridges to Solana. In December alone, Synapse, Meson, and Hashflow added support for pathways to Solana. Soon, the demand for aggregation platforms like Jumper to support Solana will become apparent.

- In terms of messaging protocols, Wormhole provides the most powerful tools for developers, while deBridge's DLN is becoming the preferred liquidity bridge for asset transfers.

- There are almost no built-in bridging functions for applications on Solana, but this is changing. Phantom and Jupiter are at the forefront of this development, embedding bridging functions in their services.

- Upcoming projects such as Circle's CCTP, Wormhole's Cross-Chain Queries, and Jumper Exchange's Cross-Chain Swaps will enhance the connection of Solana with a wider blockchain ecosystem. In addition, innovations such as Tinydancer's light client and Picasso's IBC Guest blockchain concept are expected to achieve trust-minimized cross-chain interactions.

Introduction

The discussion around Solana is getting more and more lively, and there are also more and more activities in the Solana ecosystem. Of course, there are also more and more developers and users who hope to interact with this ecosystem. Now is the best time to deeply understand bridging Solana.

This article is an authoritative resource for anyone interested in understanding Solana. The goal of this article is to serve the intentions of two main groups: developers who are eager to build cross-chain applications using messaging protocols, and users who are transferring assets to Solana in search of the next meme coin for a thousandfold growth, hoping that this article can be their ticket to an early retirement.

This article is mainly divided into three parts:

Part One: In-depth understanding of messaging protocols on Solana—this section will analyze the messaging protocols currently running in the Solana ecosystem. We will study the technical inputs, operational mechanisms, and inherent trade-offs associated with these protocols, with the goal of providing key information to developers to help them choose a messaging protocol that meets their application needs, while also providing users interested in learning more about the origin, functionality, and security aspects of the applications they use.

Part Two: Applications supporting Solana cross-chain exchanges—this second part of the article will explore various applications that support Solana bridging and cross-chain exchanges. We will discuss how these applications work, their best features, their impact on user experience, and how they contribute to the liquidity and accessibility of the Solana ecosystem.

Part Three: Interesting developments in Solana's interoperability scenarios—this final part will highlight the most noteworthy recent developments in Solana's interoperability scenarios, covering new projects, interesting new versions of existing protocols, and other initiatives that can positively impact the way Solana interacts with the wider blockchain ecosystem in the future.

Now, let's take a closer look at each section.

1. In-depth understanding of messaging protocols on Solana

This section will research the design, security, and trust assumptions of various messaging protocols that connect Solana to the wider ecosystem, highlighting their unique features and understanding their trade-offs.

This part will cover the following:

- Overview of messaging protocols: a deep introduction to the project's product suite, performance data, key network effects, and security information.

- How it works: transaction lifecycle—understanding the process of transferring user funds from one blockchain to another through a liquidity network built on messaging protocols, and understanding the different components of bridging design.

- Trust assumptions and trade-offs: trade-offs of various messaging protocols and their potential impacts.

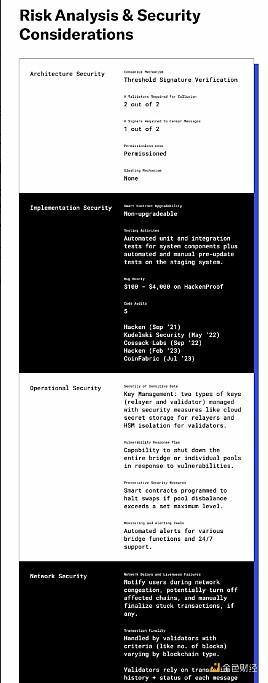

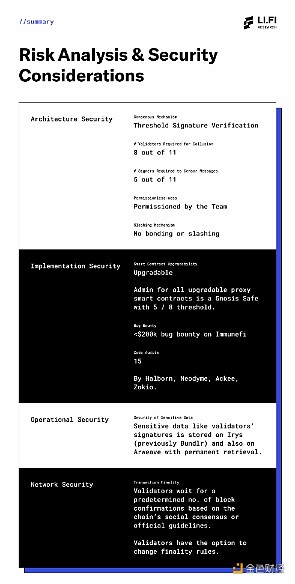

- Risk analysis: architecture design and security considerations—a summary of the architecture, implementation, operation, and network security of messaging protocols based on the cross-chain risk framework developed in collaboration with LI.FI and Consensys.

- Community and resources: tracking updates on the project and accessing all resources related to its product services.

1.1 Wormhole

1.1.1 Overview

Wormhole is a messaging protocol released in October 2020, aimed at enabling developers to build cross-chain native applications across multiple chains. Wormhole originally originated as a hackathon project with the goal of finding a solution for blockchains to "talk to each other."

Wormhole was initially incubated and supported by Jump, and its first version (Wormhole V1) focused primarily on establishing a bidirectional token bridge between Ethereum and Solana. As the project progressed, Wormhole evolved into a general messaging protocol, connecting multiple chains in the ecosystem. This evolution is in line with its broader vision of becoming a foundational layer for developers to build various cross-chain applications on. As a result, Wormhole V1 gradually phased out, and the Wormhole network was launched in August 2021.

Product Services

In response to the growing demand for multi-chain ecosystems, several cross-chain native applications have emerged on top of Wormhole, including products from the Wormhole team:

- Portal—a token locking and minting bridge that allows users to bridge tokens and NFTs on Wormhole-compatible chains. It was one of the earliest applications to use Wormhole's messaging functionality and made significant contributions to the development of Wormhole.

- Connect—a tool that allows developers to integrate a Portal-like interface for bridging tokens into their applications. It provides a simple and quick way for developers to add bridging functionality to their applications.

- Gateway—a specific application blockchain designed to improve the connection of Cosmos-based application chains with the wider ecosystem. It uses a liquidity router as a unified liquidity layer across Cosmos chains. This tool is beneficial for developers aiming to attract users and liquidity to Cosmos application chains, as well as for users seeking to transfer funds to the Cosmos ecosystem. Gateway is currently available for developers and accessible to users through Portal.

- Queries—a tool for cross-chain data queries that allows applications to read on-chain data from any EVM chain within the Wormhole ecosystem. This data is validated by a 2/3 absolute majority of 19 Wormhole Guardians. The product is still in the early stages of development, and Synthetix is expected to be an early adopter.

These products have received further support and features from multiple friendly solutions and developers of the Wormhole team (many of which are now developed and maintained by contributors to the newly established Wormhole Foundation), such as:

- xAssets—enables bridging assets across any Wormhole-supported slippage-free chain. For example, the Pyth Network recently launched their PYTH governance token as a Wormhole xAsset, available to users on 27 chains.

- Automatic Relayers—a relayer relay network that can pass messages across any Wormhole-supported chain. This feature allows developers to build cross-chain applications on Wormhole without the need to set up and maintain their own off-chain relayer.

- Wormholescan—a cross-chain block explorer and analytics platform covering the Wormhole ecosystem. This tool can be used to track cross-chain transactions and understand network activity across the entire Wormhole ecosystem.

Network Effects

Given Wormhole's early development and continued focus on the Solana ecosystem, it is not surprising that Solana has become the most active chain on Wormhole in terms of transaction volume.

Interestingly, Wormhole's traffic data is mainly dominated by bridging traffic to and from Terra, an ecosystem that no longer has any significant developments or activities. Currently, the transaction volume is primarily distributed across Ethereum, Solana, Sui, followed by EVM L1 chains and rollups.

Factors contributing to the growth of Wormhole and positioning it as one of the top messaging protocols in the ecosystem include:

- Over 200 projects built on Wormhole—Wormhole has established significant distribution in the ecosystem, with several applications using it to build use cases, such as liquidity bridges (Allbridge, Mayan, Magpie), multi-chain tokens (PYTH), token standards (Nexa), in-app bridging using Connect (Astroport, Uniwhale, YouSUI), and cross-chain deposits (Friktion, PsyOptions, Aftermath Finance).

- Wormhole x NFT—Wormhole's cross-chain NFT standard is favored by Dust Labs, using it to migrate their NFT collections (DeGods and y00ts) from Solana to Ethereum and Polygon, respectively. This NFT standard is also used by Aptos NFT Bridge, supporting developers and users to bridge NFTs to or from the Aptos network.

- $50 million Wormhole Ecosystem Fund—The $50 million ecosystem fund provides much-needed financial support for developers leveraging Wormhole's messaging infrastructure to build cross-chain applications. Managed and operated by Borderless Capital, the fund has received financing support from prominent investors such as Jump Crypto, Polygon Ventures, and the Solana Foundation.

- xGrant Program—In early 2023, Wormhole launched the xGrant program to support developers, researchers, and founders. The program not only provides financial assistance but also offers guidance and resources to foster the development of innovative projects. Grants cover various expenses such as software development, marketing, team costs, and other expenses required for project growth and expansion.

- Bitcoin tBTC on Solana—Threshold Network launched tokenized Bitcoin (tBTC) on Solana, using Wormhole for asset minting. This marks the first extension of tBTC to a non-EVM ecosystem, enabling users to use Bitcoin in the Solana DeFi ecosystem.

- Wormhole partners with Uniswap—after a comprehensive evaluation of 6 different bridges, the Uniswap Bridge Evaluation Committee approved the use of Wormhole for all cross-chain deployments, significantly elevating Wormhole's position as one of the secure messaging protocols in the ecosystem. Additionally, Uniswap actively uses Wormhole for cross-chain messaging (especially for chains like Celo), further solidifying Wormhole's position as a reliable choice for secure messaging needs.

- Wormhole partners with Circle CCTP—Wormhole has successfully integrated Circle's Cross-Chain Transfer Protocol (CCTP), allowing other applications to access it through Connect, and users to access it through Portal. The release of CCTP on Solana has sparked great interest, with teams like Jupiter announcing plans to support CCTP within their applications through Wormhole.

- Wormhole raises $225 million in funding, valued at $25 billion—Wormhole recently achieved a significant funding milestone, raising $225 million at a valuation of $25 billion. This substantial investment highlights the strength of the Wormhole team, widespread adoption of its product services, and the overall quality of its product services. This funding has also caught the attention of airdrop farmers, who now closely compare Wormhole to LayerZero, considering Wormhole a "highly valuable competitor in the interoperability space." With the ongoing Solana airdrop season and Wormhole's strategic plans (such as offering "early" roles to Discord users, which may attract significant attention from airdrop farmers in the near future).

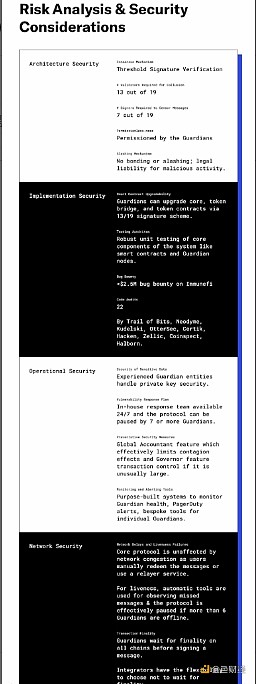

Security Check

- Audits—Wormhole's architecture consists of several key components, such as Guardian nodes and smart contracts for different chains and execution environments. Each part of their technical stack has undergone 22 audits by Neodyme, Kudelski, Trail of Bits, CertiK, Runtime Verification, OtterSec, and Zellic. It is worth noting that while we consider each entry as a separate audit, these specific contract audits are likely part of a larger audit of the Wormhole technical stack.

- Bug Bounty Program—since September 2022, Wormhole has been running a $2.5 million bug bounty program on Immunefi, focusing on the security of Wormhole smart contracts and Guardian nodes.

- Security Vulnerability—in February 2022, the Wormhole network experienced a security vulnerability, where an attacker "exploited a signature verification vulnerability in the Wormhole network to mint 120,000 Wormhole-wrapped Ether on Solana," resulting in an estimated loss of approximately $326 million. This vulnerability was fixed within a few hours, and Wormhole quickly went back online, with Jump providing the necessary funds to cover the gap.

Following this vulnerability attack, the Wormhole team announced the following future security plans:

- Ongoing Audits—Comprehensive and ongoing audits of the Wormhole codebase are being conducted, with plans in place to prevent future vulnerabilities.

- Advanced Monitoring Tools—Utilizing features such as accounting mechanisms and monitoring tools to isolate cross-chain risks and detect threats early, ensuring successful dynamic risk management.

- Bug Bounty Program—Wormhole launched a bug bounty program on Immunefi shortly after the vulnerability attack.

Given these security upgrades, the Uniswap Bridge Evaluation Committee acknowledged Wormhole's efforts in their report, stating:

"After the vulnerability attack, Wormhole made substantial improvements to its practices, such as improving deployment processes, clearer event response plans, and robust unit testing. These improvements are commendable and demonstrate the protocol's development and maturity."

Wormhole has added the following security features to its technical stack:

- Global Accountant—This tool monitors the total circulating supply of all Wormhole assets across all chains. Essentially, it prevents any blockchain from transferring assets beyond what is actually allowed.

- Governor—As a complement to the Global Accountant, the Governor tracks the inflow and outflow of assets on all chains. It has the authority to delay suspicious transfers and limit the impact of vulnerability attacks by allowing Guardians to hold them for 24 hours when the value of the Wormhole message is too large. The Governor's restrictions can be adjusted as the chain ecosystem matures.

- Open Source Codebase—By open-sourcing its codebase, Wormhole effectively reduces barriers for white-hat hackers to identify and report vulnerabilities.

- Comprehensive Monitoring by Guardians—Wormhole Guardians are professional verification companies with expertise in running, monitoring, and protecting the secure operation of blockchains. They continuously track the activity of blockchains and smart contracts and ensure the security of the Wormhole network through tools like Governor.

- Integration of ZK (Zero-Knowledge Proof) with Wormhole—Wormhole is actively integrating message ZK verification into its technical stack.

Growth Data

1.1.2 Operation Principles—Transaction Lifecycle

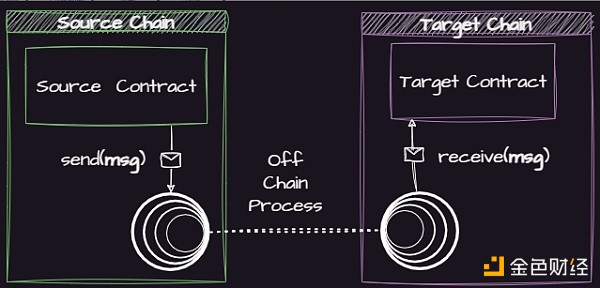

The process of transmitting messages from the source chain to the target chain through the Wormhole architecture is very complex, but it is straightforward at a high level. Here is a simple breakdown:

1) Message Dispatch: Each message originates from a "core contract" on the source chain.

2) Guardians Verification and Signing: The message is then verified and signed by 19 Guardians off-chain. A message is considered genuine only when it receives signatures from at least two-thirds (13 out of 19) of the Guardians.

3) Forwarding to the Target Chain: Once the message is verified and signed, it is forwarded to the core contract on the target chain.

A closer look reveals that several key components work together to ensure secure cross-chain message transmission:

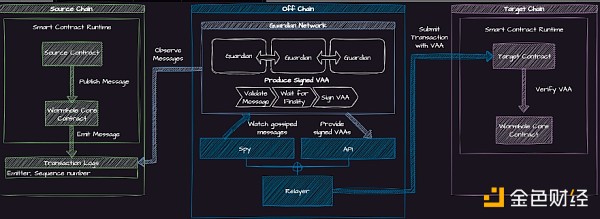

Let's take a deeper look at how the Wormhole Guardian network verifies messages:

- Step 1: The core contract on the source chain dispatches the message.

- Step 2: Guardians observe and verify the authenticity of the message.

- Step 3: Guardians wait for the final confirmation of the message on the source chain, then sign the hash value of the message body to prove its validity.

- Step 4: The signatures of each Guardian are assembled into a multi-signature file, known as VAA (Verifiable Action Approvals).

- Step 5: Relayers transmit the VAA to the core contract on the target chain.

Note: "Spies" monitor all messages transmitted through the Guardian network and record them in a storage system (such as an SQL database) for analysis and further use.

1.1.3 Trust Assumptions and Trade-offs

Here are some noteworthy trust assumptions and trade-offs of Wormhole:

- External validation by a set of validators—Wormhole's authority proof system inherently trusts Guardians to validate transactions and assumes that more than two-thirds of the Guardians will not collude within a specific timeframe. If the majority of Guardians collude, users' funds could be at risk of theft.

- Censorship risk—7 out of 19 Guardians may collude to censor messages.

- Lack of penalty mechanism for Guardians—In the Wormhole system, there is no implemented penalty mechanism for Guardians. However, accountability is a key aspect of the network design. Any malicious activity can be directly attributed to a specific Guardian. This direct attribution means that the involved Guardian may face legal consequences and significant reputational damage in the event of fraud or misconduct.

- Permissioned Guardian network—Adjustments to the Guardian set, whether adding new Guardians or removing existing ones, are managed by a 13/19 signature scheme.

1.1.4 Risk Analysis: Architecture Design and Security Considerations

1.1.5 Community and Resources

You can learn more about Wormhole through the following channels:

● Official website

● Documentation

● Wormhole for developers

● Github

● Explorer

● Medium

● Wormhole Scan

You can follow Wormhole on the following platforms to stay updated on the latest community developments:

● Discord

● Telegram

● Youtube

1.2 Allbridge

1.2.1 Overview

Allbridge was launched in July 2021 and is a blockchain bridge within the Solana ecosystem. It was initially named Solbridge, as its focus at the time of release was to expand the usage of Solana in the ecosystem by connecting Solana to other chains. Over time, the protocol's scope expanded beyond Solana, leading to its rebranding as Allbridge.

Product Services

Allbridge Classic is the first version of Allbridge. It supports asset transfers across 20 chains, including EVM and non-EVM chains such as Solana and Stellar. This version of the protocol is responsible for handling the majority of Allbridge's transaction volume.

In June 2022, Allbridge launched Allbridge Core, a new-generation bridging platform focused on cross-chain stablecoin exchange. This new version addresses pain points of the old version, with one of the most prominent being the cumbersome and time-consuming process of deploying bridged tokens through Allbridge and exchanging them for desired assets.

Allbridge Core simplifies the bridging experience by focusing on stablecoin exchange. As most bridging activities involve stablecoins, Allbridge Core is able to meet the needs of most users while maintaining product simplicity and lightweight characteristics. Currently, Allbridge Core has 11 liquidity pools for stablecoin exchange across 7 chains.

Additionally, Allbridge Core introduces unique features such as:

● Support for multiple messaging protocols—In addition to supporting cross-chain message transmission through Allbridge, Allbridge Core also supports other messaging protocols such as Wormhole. This integration allows it to support unique chains accessed through Wormhole and provides alternative/backup options for the chains already supported by Allbridge.

Furthermore, Allbridge Core recently integrated Circle's Cross-Chain Transfer Protocol (CCTP). This new feature enables Allbridge Core to support the transfer of USDC across CCTP-compatible chains without the need to maintain liquidity pools on those chains. Additionally, users have the option to choose from three different messaging protocols, each with different transfer fees and times.

Currently, CCTP support is only available on EVM chains. However, this is expected to change soon, as CCTP is already supported on Solana's devnet and will soon be launched on the mainnet.

● Additional gas on the target chain—This feature addresses the "cold start" issue when users bridge assets to a new chain. With this feature, users can easily bridge some additional funds to pay for gas fees on the target chain.

The "additional gas" feature is gradually becoming a standard in multi-chain ecosystems. For example, in the Solana ecosystem, Phantom uses it as a "refueling" feature for its "Cross-Chain Swapper," with support provided by Allbridge Core.

In addition to user-facing products like Allbridge Classic and Allbridge Core, Allbridge also offers a white-label bridging solution called Allbridge BaaS (Bridging as a Service). This allows projects to use Allbridge's cross-chain messaging capabilities and set up dedicated bridging for their tokens. Allbridge charges a one-time bridging setup fee of $20,000.

Network Effects

From initially focusing on Solana to winning the Solana Hackathon in 2021, Allbridge's roots are closely tied to the Solana ecosystem. It has proven beneficial as Solana remains the most active chain on Allbridge. Since its launch, Allbridge Classic has processed over 190,000 transactions on Solana, with a total transaction volume exceeding $1.44 billion, generating $535,000 in fees on Allbridge Classic alone.

Other major ecosystems that have contributed to Allbridge's growth include well-known names across all bridging platforms, such as Ethereum, Avalanche, BNB Chain, and Polygon. Interestingly, for Allbridge Core, the Tron network is an intriguing ecosystem.

It is noteworthy that popular L2 solutions such as Arbitrum and Optimism, which typically dominate data metrics for EVM bridges, are not included in the list. Additionally, Allbridge does not support several major emerging L2 solutions, such as Base, zkSync, and Linea, with Allbridge Core only supporting USDC on Arbitrum.

Recently, Allbridge Core integrated with LI.FI, entering the world of LI.FI's 120+ cross-chain swapping protocols. Furthermore, Allbridge is currently the only bridge provider supporting EVM > Solana transactions in the Phantom Cross-Chain Swapper feature. This exclusivity allows Allbridge to benefit from larger transaction volumes until support for other bridge providers is added.

Additionally, Allbridge conducted a testnet demo of the CCTP integration at the Breakpoint 2023 conference. The strategic partnership with Circle to launch CCTP on Solana will also benefit the protocol's development.

Security Checks

- Audits—Allbridge's architecture has undergone 5 audits. These include the initial audit by Hacken in September 2021 (audit score: 10), audits by Kudelski Security in May 2022 and Cossack Labs in September 2022, an audit by Hacken in February 2022 (audit score: 9.8), and an audit by CoinFabric in July 2023.

- Bug Bounty Program—Allbridge has an open bug bounty program on HackenProof, with rewards ranging from $100 to $4,000.

- Security Vulnerabilities—In April 2023, Allbridge Core suffered a security vulnerability attack due to a flash loan exploit on the BNB Chain, resulting in a loss of $650,000. The attacker exploited a logic flaw in the withdrawal function to manipulate the pool's transaction price.

The Allbridge team recovered "most of the stolen funds" and compensated the difference, compensating affected users who filled out the application form. After the attack, the protocol was restarted and the following fixes and additional security features were implemented:

- Correction of liquidity calculations for deposits and withdrawals—extensively tested.

- Introduction of Rebalancer permissions through a special account—allowing the team to rebalance pools in extreme and emergency situations by using the bridge without paying fees.

- Automatic closure of pools in extreme imbalance situations, such as stablecoin decoupling.

- Support for manual bridge closure to improve response time in case of accidents.

- A public code repository, highlighting the team's efforts for open-source and inviting white-hat researchers to review the bridge contracts.

The L2BEAT team stated that Allbridge Core "contains many unverified core smart contracts" and that if these contracts contain malicious code, users' funds could be at risk.

It is worth noting that after the security vulnerability attack, the contracts for Allbridge Core were redeployed. The main contracts have now been verified. Additionally, the Allbridge Classic contracts have also been verified.

However, the L2BEAT team noticed that certain bridge contracts are still unverified. The Allbridge team explained that this is due to a complex issue caused by the overlap of old Core contracts existing before the security incident and the related contracts of Allbridge Classic. Allbridge is actively taking steps to address and clarify this discrepancy on the L2BEAT website, ensuring everyone has a clearer and more transparent understanding.

Growth Data

1.2.2 Operation Principles - Transaction Lifecycle

Allbridge Core

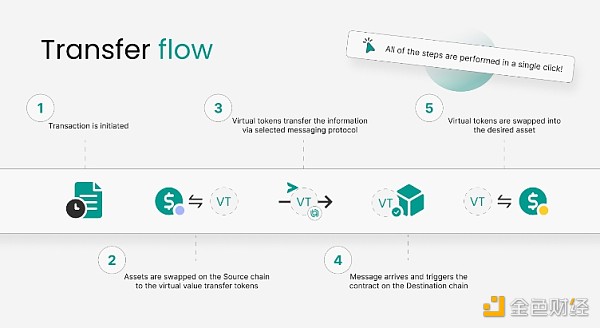

Here is how assets move from the source chain to the target chain through the Allbridge Core architecture:

- User sends assets to the liquidity pool on the source chain, where the assets are locked.

- These assets are exchanged for virtual tokens (VT) representing their dollar value. For example, when a user sends 100 USDC, the amount is converted to VT based on the current exchange rate of VT to USDC.

- The virtual tokens with transaction information are transferred to the target chain via the selected messaging protocol. Validators of the messaging protocol verify that the funds are locked on the source chain and accurately exchanged for "virtual tokens."

- The message reaches the target chain, triggering the smart contract.

- The smart contract exchanges the virtual tokens in the liquidity pool on the target chain for the desired tokens and sends them to the user's address.

Although these may seem like different steps on different chains, for the user, it all happens with just one click.

Allbridge Classic

Allbridge Classic widely supports tokens such as aeUSDC (USDC wrapped by Allbridge on Ethereum).

Here is the process of assets moving from the source chain to the target chain through Allbridge Classic:

- User sends funds to the Allbridge smart contract on the source chain. In this step, the user can send two types of assets: 1) Native assets—where the assets are locked in the liquidity pool on the source chain. 2) Wrapped assets—where the assets are destroyed by the smart contract on the source chain.

- A transaction record is created, requesting validation from Allbridge validators.

- Validators verify the funds' lock on the source chain.

- Once validation is complete, validators issue a signature to the user.

- The user forwards this signature to the smart contract on the target chain.

- The funds are transferred to the user. The process varies depending on the type of assets the user expects to receive on the target chain.

Specifically:

1) If it is a native asset, the assets are unlocked from the smart contract on the target chain and then transferred to the user's wallet.

2) If it is a wrapped asset, the assets are minted by the smart contract on the target chain and then transferred to the user's wallet.

1.2.3 Trust Assumptions and Trade-offs

Here are some notable trust assumptions and trade-offs regarding Allbridge:

- External validation by a set of validators—Allbridge relies on third-party validators to validate user transactions, depending on the underlying messaging protocol used (Allbridge, Wormhole, or CCTP).

- Small validator set—Allbridge's validator set consists of only 2 validators. These two validators could collude to relay malicious messages and steal users' funds.

- Review risk—A single validator in Allbridge's validator set can review messages.

- Permissioned validator set—The validators running in the system are operated and/or chosen by the Allbridge team.

- Lack of penalty mechanism—There is currently no mechanism for penalizing validators for collusion or review.

- Allbridge team can review users—While special accounts give the Allbridge team more control to react quickly in emergency situations, it could also be abused to improperly review user deposits, withdrawals, and transactions.

1.2.4 Risk Analysis: Architecture Design and Security Considerations

1.2.5 Community and Resources

You can learn more about Allbridge through the following channels:

- Official website

- Allbridge Core documentation

- Allbridge Classic documentation

- Medium

- Messari for Allbridge Core

- Messari for Allbridge Classic

You can follow Allbridge on the following platforms to stay updated with the latest community developments:

- Telegram

- Discord

1.3 deBridge

1.3.1 Overview

deBridge is an interoperability protocol released in August 2021, supporting cross-chain message transmission and liquidity. The project started as a hackathon project in the Chainlink Global Hackathon in April 2021 and later secured $5.5 million in funding.

deBridge's expansion into the Solana ecosystem began in June 2021 with a $20,000 grant from the Solana Foundation. Unlike the protocols discussed earlier, deBridge was initially specifically designed for EVM-compatible chains. It wasn't until June 2023 that deBridge arrived on Solana, becoming one of the early participants in its success.

Product Services

deBridge's product suite includes a range of cross-chain applications utilizing its messaging capabilities:

[Continued…]

- deSwap Liquidity Network (DLN) - DLN is a liquidity network that enables low-cost and fast cross-chain transactions on any chain supported by deBridge. Unlike the traditional model relying on liquidity pools, DLN utilizes market makers to provide on-demand cross-chain liquidity, achieving asset transfers with zero TVL. To ensure sufficient liquidity for large cross-chain orders, the deBridge team collaborates with established market makers such as RockawayX and Fordefi.

- dePort - As a lock-and-mint bridge, dePort allows applications to create debridge-wrapped assets, known as deAssets, on various chains. These minted assets are backed one-to-one by the original tokens on the source chain, ensuring the integrity of the entire network's assets.

In addition to user applications directly used for cross-chain exchanges, deBridge also extends these products to other applications and projects, including wallets, through seamless API integration. Furthermore, bloXroute Labs is developing an SDK aimed at integrating DLN into their blockchain distribution network. This integration will enable bloXroute users, including MEV searchers, institutional DeFi traders, and various projects, to execute cross-chain exchanges supported by DLN.

Additionally, deBridge offers deBridge IaaS (Interoperability-as-a-Service), a subscription-based service that enables EVM and SVM blockchains to integrate deBridge products into their respective ecosystems. The monthly subscription fee for this service is $11,000, and the quarterly subscription fee is $10,000 per month. Neon Labs is the first user of this service.

Network Effects

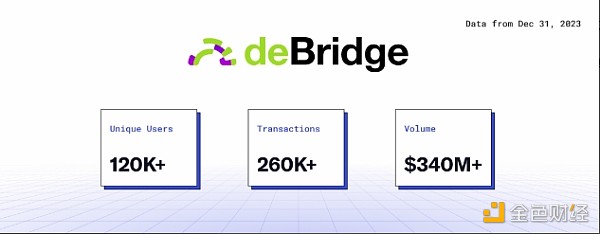

Since its release, deBridge has been experiencing stable and continuous growth. The protocol has recently seen a surge in usage, especially with increased activity on Solana. The Solana > Ethereum path has quickly become the busiest corridor on DLN. The strategic move to integrate support for Solana has evidently paid off, indicating significant potential for future growth.

The nearly instant cross-chain order settlement capability of DLN has rapidly made it the preferred platform for users looking to transition from other blockchains to Solana. Recently, DLN achieved a significant milestone, with daily trading volume surpassing $10 million for the first time—demonstrating its increasing popularity, and this achievement may only be the beginning as the Solana ecosystem continues to accelerate.

In addition to individual users, deBridge is also gaining popularity in the B2B space, with more and more applications on Solana integrating deBridge's services into their products. Notable examples include MoonGate, Birdeye, and the Jupiter bridge comparator tool.

This trend indicates that deBridge's strategic positioning will leverage the expansion of the Solana ecosystem in the upcoming cycle.

Security Checks

- Audits - deBridge has demonstrated its strong commitment to security, with its smart contracts on EVM chains and Solana successfully undergoing 15 comprehensive audits. These audits were conducted by renowned security firms, including Halborn, Neodyme, Zokyo, and Ackee.

- Bug Bounty Program - Since January 2022, deBridge has been running a $200,000 bug bounty program on Immunefi, focusing on ensuring the security of its smart contracts.

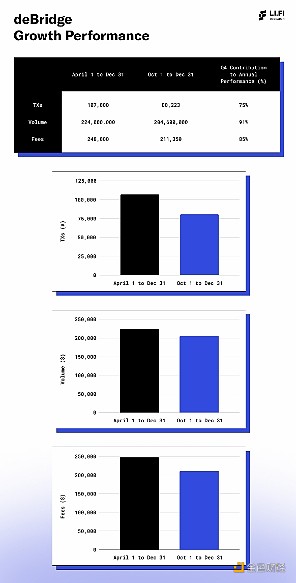

Growth Data

In the fourth quarter of 2023, DLN performed exceptionally well in the liquidity network, showing remarkable growth trajectories in TVL and trading volume, similar to the overall Solana ecosystem during the same period.

To understand DLN's performance in the last quarter, here is a quick overview of its fourth-quarter performance compared to the cumulative performance for the full year 2023 (April 1, 2023, to December 31, 2023):

1.3.2 Operation Principles - Transaction Lifecycle

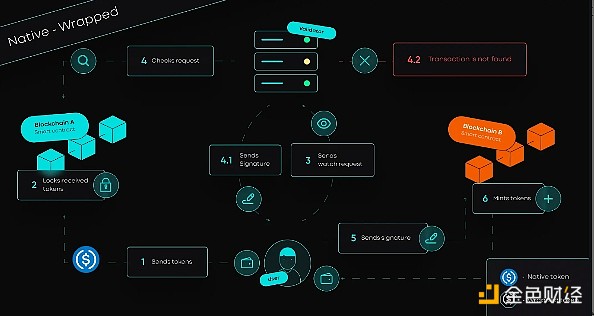

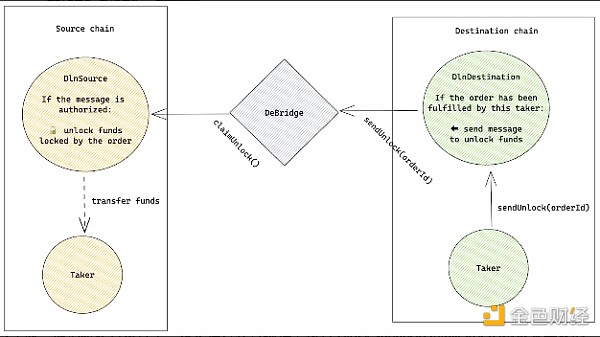

The following illustrates how assets are transferred from the source chain to the target chain in a cross-DLN transaction:

- User (Maker) initiates an order on the source chain. This is done by calling the DlnSource.createOrder() function, providing transaction details and locking input tokens in the contract.

- Market makers, known as Takers, monitor these off-chain orders. When they identify an order that aligns with their criteria (such as profitability and token availability), they fulfill the order. This is achieved by executing the DlnDestination.fulfillOrder() function on the target chain, providing the tokens requested by the Maker.

- Upon receiving the order, DlnDestination verifies the details and completes the transaction by sending the tokens to the recipient address on the target chain. The order is then marked as "fulfilled."

- The Taker who fulfilled the order subsequently calls the DlnDestination.sendunlock() function. This action triggers a cross-chain message through deBridge's infrastructure, sending it to the DlnSource smart contract on the source chain.

- DlnSource verifies the authenticity of the message and releases the previously locked input tokens, transferring them to the Taker who fulfilled the order.

1.3.3 Trust Assumptions and Trade-offs

Like all interoperability protocols, deBridge operates under certain trust assumptions and trade-offs that users should be aware of:

[Continued…]

- External validation by a group of validators - The deBridge network is secured by a relatively small set of 11 nodes acting as validators. To confirm transactions, it requires signatures from at least two-thirds of the validators, meaning at least 8 out of the 11 validators need to sign. This structure introduces the risk of collusion among 8 validators, potentially jeopardizing the security of user funds.

- Review risk - If a minority of validators (especially 5 out of the 11 validators) decide to collude, there is a potential risk of review, leading to intentional blocking or delaying of message delivery.

- Lack of penalty mechanism for validators - Although deBridge's documentation references the future implementation of staking and penalty mechanisms as crucial for protocol security, these features have not been activated. Without penalties, there are no direct economic consequences to deter validators from engaging in fraudulent or malicious behavior. However, it is important to note that the current validator set is selected and authorized by the deBridge team and consists of established entities, facing the indirect form of accountability through potential legal action and reputational damage.

- Malicious upgrade of target token contracts by validators - L2BEAT indicates that all upgradeable proxy smart contracts are managed by a Gnosis Safe with a 5/8 threshold. Therefore, if the target token contract is maliciously upgraded or deployed without proper security measures, user funds could be at risk of theft.

Note: It is important to note that deBridge is moving towards decentralization. The issues mentioned above, such as the lack of penalty mechanisms and the permissioned nature of the validator set, are expected to be addressed with the launch of deBridge's native token, which will enhance the protocol's economic security and governance.

1.3.4 Risk Analysis: Architecture Design and Security Considerations

1.3.5 Community and Resources

You can learn more about deBridge through the following channels:

- Official website

- Documentation

- DLN documentation

- deExplorer

- Github

- Medium

- Blog

You can stay updated on the community's latest developments through the following platforms:

- Discord

- Telegram

1.4 Comparison Analysis of Message Passing Protocols and Their Liquidity Networks

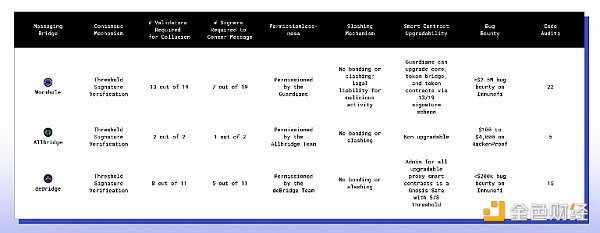

After analyzing the design and characteristics of different message passing protocols, we will now summarize their architecture and deployment security. Our goal is to quickly compare the security considerations related to different message passing protocols and enable developers to make choices based on their preferred trade-offs and security assurances.

In the specific analysis, we will see the comparison based on the following metrics:

- Consensus mechanism - How does the protocol determine the validity of messages?

- Collusion of validator set - The minimum number of validators that can collude to steal funds.

- Censorship resistance - The minimum number of signers required to censor messages passed through the protocol.

- Permissionless nature - Is the validator set permissionless? Can anyone become a validator and contribute to determining the validity of messages?

- Penalty mechanism - Does the protocol have an active penalty or slashing mechanism to deter malicious behavior by validators?

- Upgradability of smart contracts - Are the protocol's smart contracts upgradeable? If so, who performs the upgrades?

- Bug bounty - The maximum amount of bug bounty that white-hat hackers can receive for critical vulnerabilities found in the protocol's code.

- Audits - The number of audits each protocol has undergone (more is better).

The following is a comparison of message passing protocols on Solana:

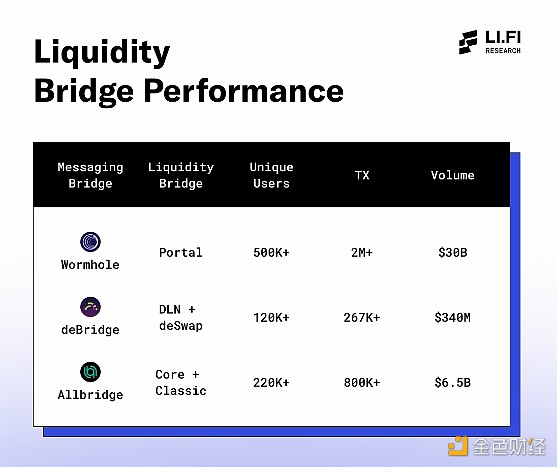

Next, we will analyze the performance of various liquidity networks as of December 31, 2023, and specifically look at three key metrics:

- Unique user count - How many unique users have used the liquidity network since its launch?

- Transaction count - How many transactions have been executed using the liquidity network since its launch?

- Bridged transaction volume - What is the transaction volume through the liquidity network since its launch?

The following is a performance comparison of liquidity networks built on top of message passing protocols:

2. Applications Supporting Solana Cross-Chain Swaps

In the previous section, we discussed the potential of various message passing protocols and their ability to create cross-chain applications. Building on that, we will now focus on one of their most prominent use cases: liquidity networks. This section will primarily focus on various liquidity networks that connect Solana to the broader ecosystem, helping users easily transfer funds across chains.

Additionally, we will look at some interesting applications and features launched around liquidity aggregation, aimed at helping users find the best liquidity network to meet their needs.

Our goal is to help users make better choices when exchanging assets between the Solana and EVM ecosystems.

Let's get started!

2.1 DLN (deSwap Liquidity Network)

2.1.1 Overview

DLN is a cross-chain trading protocol supported by deBridge, facilitating the creation and fulfillment of cross-chain orders.

The protocol architecture primarily consists of two layers: the protocol layer and the infrastructure layer.

Protocol Layer - This layer consists of smart contracts deployed on compatible chains. These contracts allow market participants to interact in a decentralized environment, enabling them to create, monitor, and settle orders:

- Makers refer to users who create orders by locking input tokens in the DlnSource smart contract on the source chain.

- Takers refer to market makers who fulfill orders by providing output tokens to the DlnDestination contract on the target chain.

Once the order is fulfilled, the DlnDestination contract communicates with the DlnSource contract through the infrastructure layer to release the input tokens and transfer them to the Taker, completing the cross-chain transaction.

Infrastructure Layer - This layer processes cross-chain message passing through deBridge validators. It enables the DlnDestination contract to reliably convey the fulfillment of orders to the DlnSource contract, completing the settlement.

2.1.2 Key Features

- All orders on DLN have zero slippage - Trades on DLN have zero slippage, meaning that users can obtain the expected price regardless of the order size. This feature effectively addresses the slippage issues associated with traditional liquidity pools.

- Fast settlement - Due to DLN's asynchronous design and the ability to leverage market maker liquidity on demand, transactions on DLN settle much faster than traditional liquidity bridges.

- Rapid scalability - DLN's design allows it to handle a large volume of transactions, as it is not limited by the throughput of liquidity pools or bridges. Over the past month, DLN's transaction volume has been steadily increasing.

Note: The minimum fee for each transaction on DLN is 8 bps. This fee is evenly split between the DLN protocol and the completing Taker of the order, with each receiving 4 bps. However, if a user places a limit order, the fee allocated to the completing Taker of the order may exceed 4 bps.

2.2 Portal

2.2.1 Overview

Portal, supported by Wormhole, is part of the Wormhole network and facilitates the transfer of assets between blockchains.

The Portal bridge aims to securely and seamlessly transfer both fungible and non-fungible tokens across blockchains.

When assets are passed through Portal, the original tokens are locked in a smart contract on the source chain, while a new Portal-wrapped counterpart is created on the target chain. This counterpart can be exchanged for other native tokens available on that chain.

2.2.2 Key Features

- Access to multiple ecosystems - Users can move assets between many different ecosystems and markets supported by Wormhole. This expands the range and utility of user assets.

- Security - Wormhole's Guardian node network and signature messages provide a reliable security model for verifying cross-chain transactions. Additionally, transparent management of Wormhole updates and upgrades is facilitated through on-chain governance via the Guardian network.

2.3 Mayan Finance

2.3.1 Overview

Mayan Finance is a cross-chain exchange protocol supported by Wormhole, allowing users to exchange tokens across different blockchains with a single click.

Currently, Mayan supports token exchanges between Ethereum, Solana, Avalanche, and Polygon networks. However, the protocol plans to expand support to more blockchains in the future.

2.3.2 Key Features

- Cross-chain swaps - Mayan enables users to exchange tokens from one blockchain for tokens on another compatible blockchain in a single transaction.

- English auction mechanism - Mayan uses an English auction mechanism to facilitate cross-chain transactions. When a user initiates an exchange, Mayan holds an auction on the target blockchain to obtain the best exchange rate. This ensures that the user's order receives the highest bid.

- Token support - Mayan currently supports many ERC-20 and SPL tokens and plans to add support for more tokens and blockchains.

- Integration tools - Mayan provides integration tools such as SDKs and widgets, allowing other applications to directly embed Mayan's exchange functionality into their platforms. This enables any project to offer cross-chain token exchange services through Mayan's infrastructure.

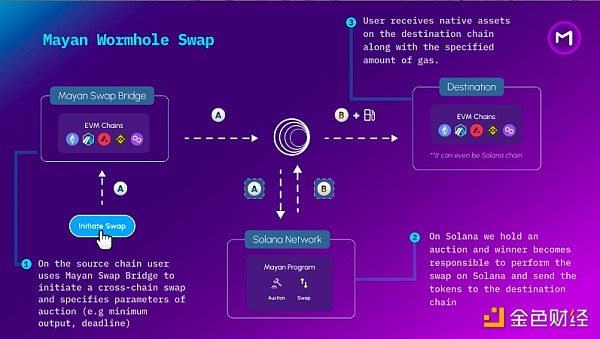

2.3.3 Operation - Transaction Lifecycle

Step 1: Initiate exchange on the source chain

Users initiate the process on the source chain by interacting with the Mayan Swap Bridge. They initiate a cross-chain exchange and set auction parameters, including minimum output and deadline.

Step 2: Auction on Solana

The transaction then moves to Solana, where an auction takes place. The winner of the auction is responsible for executing the transaction on the Solana network.

Step 3: Receive assets on the target chain

Finally, the user receives the native assets on the target chain. These assets are sent along with the specified amount of gas required for the transaction.

Assets are exchanged between different blockchain networks, utilizing the Solana network as an intermediate auction platform. Solana's Mayan program handles the auction and exchange mechanism, while the Mayan Swap Bridge interfaces with the Ethereum Virtual Machine (EVM) for initiating and completing exchanges. The destination can be another EVM chain or even the Solana chain itself.

Note: Users are required to pay relayer fees, including gas fees and fees for relayers to forward transactions. These fees vary based on the dynamics of the assets and chains. Relayer fees are significantly reduced if the transaction fails.

2.4 Meson

2.4.1 Overview

Meson Finance is a cross-chain DEX that enables fast, low-cost exchanges across multiple blockchains. It uses Hash Time Locked Contracts (HTLC) and out-of-order swaps to complete exchanges in minutes, much faster than traditional cross-chain bridges.

Currently, Meson supports exchanges between 16 blockchains, including Ethereum, Solana, BNB Chain, Polygon, Avalanche, and L2 rollups like Arbitrum and Optimism.

Meson also plans to support more tokens, covering more stablecoins and assets such as BTC/ETH. In the future, Meson will continue to integrate various rollups and non-EVM chains.

2.4.2 Key Features

- Direct exchange of native assets - Meson supports direct exchanges between major stablecoins such as USDT and USDC, without the need for wrapped tokens as intermediaries. This greatly simplifies the exchange process.

- Security - While utilizing existing bridging technologies, Meson does not heavily rely on any single bridge. Funds do not need to be locked in bridge pools, increasing utilization while ensuring security.

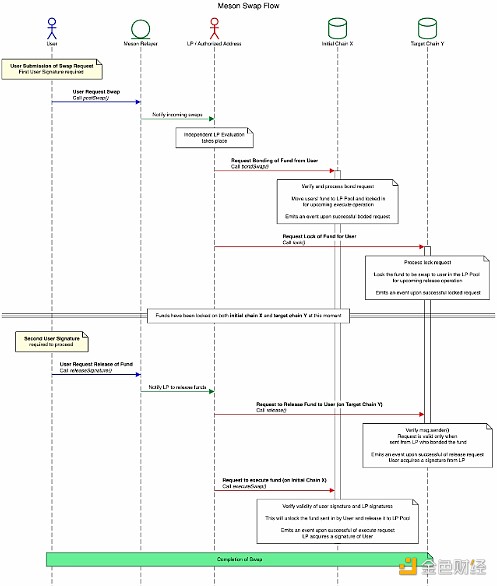

2.4.3 Operation - Transaction Cycle

- Step 1: User creates exchange request off-chain, specifying exchange amount, source chain, target chain, and token type.

- Step 2: To submit the request, the user needs to sign a message authorizing the Meson contract to lock the matching exchange amount and fees. The signed request is broadcast to the LP network.

- Step 3: LP verifies the request and calls the "postSwap" method on the source chain to publish and bind the exchange. Meson transfers the funds and locks them for 1-2 hours.

- Step 4: LP calls the "lock" method on the target chain to temporarily lock the exchange funds for 20 minutes.

- Step 5: The user verifies steps 2 and 3, then creates and broadcasts a signature to release the funds.

- Step 6: Anyone can call the "release" method on the target chain. If the signature is valid, the locked funds will be paid to the specified recipient.

- Step 7: LP calls "executeSwap" on the source chain with the release signature to retrieve the initial funds deposited by the user.

- Step 8: LP can withdraw the funds or transfer them to a liquidity pool on the source chain, completing the transaction.

Note: Users can currently exchange up to 5000 USDC/USDT to Solana from various chains through Meson. In addition to a 0.05% service fee, an outbound fee of 0% to 0.1% may be charged depending on the source chain. Therefore, the total cost of the exchange to Solana ranges from 0.05% to 0.15%. This means the fee ranges from 0 to $7.50, depending on the token amount and the source chain.

2.5 Jupiter Bridge Comparator

In September 2023, Jupiter launched the Bridge Comparator, allowing users to more easily transfer funds from other chains to Solana. The Bridge Comparator provides users with a platform where they can compare quotes for bridge and cross-chain exchange orders in one place.

The feature has been widely praised by the Solana community for its simplicity, chain compatibility (9 chains), and the details it provides about output prices, expected time, gas usage, and bridge provider fees.

Currently, the Bridge Comparator is a frontend aggregation solution, meaning it displays the best bridge options for users' orders and guides them to the interface of the recommended bridge provider to execute the orders. In the future, Jupiter may expand the Bridge Comparator to a Bridge Aggregator and add the ability to execute orders from the Jupiter interface.

Additionally, in early December, Jupiter announced the integration of Wormhole Connect on its bridge page, allowing users to bridge ETH, WETH, or WBTC from Ethereum to Solana with zero slippage. The next step after this integration is integration with Circle CCTP.

2.6 Synapse - Supported by deBridge

Synapse recently launched a cross-chain exchange frontend for Solana, supported by deBridge. This move can be seen as a temporary check to assess user needs and collect behavioral data related to Solana bridging activities before investing resources to build a feature-rich Solana deployment.

Observers may speculate that the timing of this development deployment by Synapse aligns with the release of Solana's CCTP. This speculation is based on the fact that Synapse has already utilized CCTP for cross EVM chain USDC transfers.

2.7 Phantom's Cross-Chain Swapper - Supported by LI.FI

In November 2023, Phantom released the Cross-Chain Swapper, a wallet-integrated bridging feature that allows users to transfer funds from Ethereum and Polygon, among other EVM chains, to Solana (and vice versa). It includes a built-in Refuel feature that allows users to send additional gas tokens in the same transaction.

Wallet-integrated cross-chain exchanges are a powerful primitive. They provide users with the convenience of finding the best rates for cross-chain exchange orders in bridging solutions, even without leaving the wallet interface. This shortens the time for users to find suitable bridging solutions and makes it easy for everyone to transfer assets to Solana.

The Cross-Chain Swapper uses LI.FI at the backend to facilitate bridging transactions. Currently, LI.FI supports:

- Allbridge for bridging transactions from Ethereum to Solana. (Note: Support for Circle's Cross-Chain Transfer Protocol (CCTP) is currently being tested on devnet)

- cBridge, Across, Hop, Polygon PoS, Allbridge, Stargate, and CCTP for bridging transactions from Ethereum to Polygon.

Additionally, Phantom combines it with DEX aggregators (such as 0x on the EVM side and Jupiter on Solana) to allow users to bridge and exchange in the same process.

In the future, the entire cross-chain exchange process is likely to be supported by LI.FI, as it already supports 30 DEXs and multiple DEX aggregators on the EVM side and covers integration with native Solana aggregators like Jupiter on its roadmap. This will further reduce maintenance costs for Phantom and expand the range of assets users can directly exchange to Solana.

Note: Phantom charges a 0.85% fee for certain trading pairs. Additionally, users may need to pay bridge providers (such as Allbridge), typically around 0.3% of the transfer amount, varying by provider. (LI.FI does not charge fees).

3. Interesting Developments in Solana Interoperability Scenarios

Solana has always focused on building a state-of-the-art blockchain for fast and low-cost transactions. This approach sets it apart from other blockchain ecosystems (such as Ethereum and Cosmos) that emphasize interoperability with other ecosystems. As a result, Solana's connectivity to other blockchains has been somewhat limited.

Recognizing this difference, several interesting project developments have recently emerged aimed at enhancing Solana's interoperability. If these initiatives reach their full potential, they could significantly enhance the ability of Solana-based tokens and applications to interact with a wider ecosystem.

Let's take a closer look at these promising development projects that are paving the way for a more closely related Solana ecosystem.

3.1 Circle's Cross-Chain Transfer Protocol (CCTP)

The Cross-Chain Transfer Protocol (CCTP) developed by Circle enables the native transfer of USDC stablecoin tokens between different blockchain networks.

By directly burning and minting tokens on the relevant blockchains, CCTP simplifies the process of transferring USDC between networks, bypassing the need for wrapped tokens. The introduction of CCTP on Solana is expected to further streamline the transfer of USDC from other chains to Solana.

Solana's CCTP is currently in the devnet testing phase and is scheduled to go live in early 2024. The Solana community eagerly anticipates its release and widespread adoption.

3.2 Interoperability between Solana and Bitcoin

A major innovation in 2023 was the introduction of an experimental alternative token standard, the BRC-20 token standard on the Bitcoin blockchain, which is a use case enabled by Ordinals (NFTs on Bitcoin) and the Taproot network upgrade in 2021.

The increasing popularity of BRC-20 tokens (such as ORDI) has driven the development of several bridges aimed at connecting Bitcoin to other blockchain ecosystems. These bridges allow users to use their BRC-20 tokens on EVM chains and Solana, expanding the utility and accessibility of Bitcoin-based tokens. One of these bridges is the SoBit protocol, released in December 2023.

Solana's interoperability with Bitcoin is not limited to BRC-20 tokens. For example, SolLightning is a cross-chain DEX that allows users to exchange USDC/SOL on Solana with native BTC on the Bitcoin network. Interestingly, the largest native Bitcoin exchange platform, THORChain, has expressed its intention to add support for Solana in the near future, which could significantly increase the liquidity and activity of BTC on Solana.

Zeus Network, a messaging protocol, is another interesting project contributing to Bitcoin-Solana interoperability. Apollo, the first product built on the Zeus Network, is set to be released soon. It will allow users to stake their native Bitcoin and receive zuBTC, a 1:1 pegged token that can be used in applications on Solana.

3.3 Trust-Minimized Cross-Chain Interaction with Tinydancer and Sovereign Labs

Light clients play a crucial role in blockchain ecosystems, allowing users to securely access and interact with blockchains without synchronizing full blockchain data. This is advantageous as light clients have lower resource requirements and faster synchronization speeds compared to full nodes.

A key feature of light clients is their ability to verify transactions and proofs from other blockchains in a trust-minimized manner. Currently, on the Solana blockchain, light clients cannot locally verify transaction inclusion without fully downloading block data. This is expected to change soon with Tinydancer, a project building light clients, proposing the SIMD-0052 (consensus and transaction proof verification) improvement plan to address this limitation. This will enhance the current functionality of Simplified Payment Verification (SPV).

Additionally, Sovereign Labs has recently developed a concept proof of an on-chain light client on Solana without altering the current structure.

In the future, this light client functionality can also facilitate improvements in blockchain interoperability solutions such as IBC and Layerzero. By reducing trust requirements and enabling light client verification, it can facilitate asset transfers between blockchains without the need for full nodes.

However, this work is still in the early stages and requires further research and development for full implementation.

3.4 IBC Supported by Guest Blockchain Concept on Solana

The guest blockchain concept proposed by Picasso is enabling IBC on Solana. This approach aims to achieve interoperability between blockchains that currently do not support state proofs and light clients, which is a key requirement of the Inter-Blockchain Communication (IBC) protocol.

Guest blockchains run as smart contracts within the host blockchain. This enhances the host's capabilities to support interoperability protocols such as IBC. This integration promotes trust-minimized cross-chain interactions without altering the underlying protocol of the host blockchain.

Furthermore, guest blockchains extend the functionality of the host blockchain by implementing the features required for IBC. For example, they store data in Merkle trees to generate state proofs and organize blocks into epochs, selecting validators to generate new blocks. Validators sign blocks with state proofs, which are then relayed to other connected blockchains through a trustless relay. If validators misbehave, proofs can be submitted to slash their staked assets in the guest contract.

Guest blockchains, deployed as smart contracts, maintain the core structure of the host blockchain, making this solution highly adaptable to blockchains not yet ready to support IBC, such as Solana, NEAR, and TRON. Composable Finance has initiated concept proof projects for Solana and NEAR to demonstrate this interoperability in practice.

Once connected to IBC-compatible chains, guest chains can facilitate asset, data, and value transfers on previously isolated chains. This breakthrough paves the way for new cross-chain applications, all leveraging IBC within the Solana ecosystem.

3.5 Ethereum Wallet on Solana

MoonGate provides an SDK aimed at enabling developers to seamlessly integrate Ethereum wallet functionality into their Solana-based dApps. By leveraging MoonGate, developers can build dApps on the faster and more affordable Solana platform while still tapping into the Ethereum community and liquidity.

Through its developer-friendly SDK, MoonGate allows dApp developers to seamlessly incorporate existing Ethereum wallet and functionalities with just a few lines of code. This eliminates a significant amount of complexity associated with blockchain integration.

The SDK also plans to provide embedded deposit and exchange functionalities for dApps. MoonGate plans to introduce in-app instant bridging using deBridge to facilitate smooth asset transfers between Ethereum and Solana networks within dApps, greatly enhancing the user experience.

3.6 Cross-Chain Queries Introduced by Wormhole

Wormhole Queries is a new primitive introduced by Wormhole to support data retrieval from other blockchains.

With Wormhole Queries, integrators can now submit query requests to the Wormhole Guardian network to retrieve cross-chain data in a pull-based manner. Guardians process the requests and publish the results, allowing integrators to securely and quickly verify and use on-chain data. This has clear benefits such as simplifying cross-chain development, reducing gas fees, and enabling rapid data retrieval in seconds. It leverages the existing security of Wormhole Guardians for authenticated data retrieval.

Some key potential use cases of Wormhole Queries include providing real-time cross-chain price data for applications. This enables platforms to access the latest price information from multiple blockchains. Wormhole Queries also support cross-chain asset verification, allowing users to prove ownership of assets on one chain and use them in applications on other chains.

You might ask, isn't this just an Oracle? We believe it's more than that.

Current oracle solutions are limited in cross-chain functionality, primarily focusing on providing off-chain price data to blockchains. Retrieving on-chain data from other chains is also restricted.

With Wormhole Queries, applications may one day access a wide range of interoperable data sources across multiple blockchains, not limited to accessing prices.

Additionally, projects like Herodotus and Axiom aim to store historical block data on-chain in a verifiable decentralized manner. As these protocols mature, they can serve as an "Ethereum library" and be accessed from Solana through Wormhole Queries.

3.7 Nexa Network's Full-Chain Token Standard

Due to the release of many blockchains and rollups with different architectures and specifications, token standards and liquidity are fragmented. This issue is particularly evident in the Ethereum ecosystem, where inter-chain token standards such as OFT, Layerzero, and xERC20 (also known as ERC-7281) are used.

Nexa Network is developing a solution for this problem, currently only supporting EVM. However, with the use of Wormhole and support from the Wormhole team, Nexa Network plans to add support for Solana in the near future.

The CAT standard is a token standard developed by Nexa Network. It supports token bridging across multiple blockchains while maintaining fungibility and issuer control.

CAT provides a standardized approach for cross-chain token bridging while maintaining issuer sovereignty and offering a unified user experience through fungible secure tokens. This approach is very similar to xERC20 (ERC-7281) in the EVM ecosystem.

Key points about CAT:

- Token issuers deploy CAT contracts on various chains and whitelist bridges, and mint tokens from these contracts. Deployment can be seamlessly completed using CAT's dashboard.

- All tokens bridged by different whitelisted bridges are fully fungible, avoiding the liquidity fragmentation issues seen today.

- Issuers can set minting restrictions for each bridge, allowing fine-grained secure control over bridged tokens.

- Seamless cross-chain bridging with no slippage for a smooth user experience.

3.8 Hyperlane: Permissionless Interoperability Supporting Solana and SVM Chains (such as Eclipse)

Hyperlane is a messaging protocol that supports permissionless interoperability. This feature is crucial for expanding the blockchain ecosystem as it allows anyone to deploy the Hyperlane technology stack on any blockchain without permission, unlocking stronger network connections.

Hyperlane recently collaborated with Eclipse to deploy its technology stack compatible with SVM. This deployment is currently running in the production environment of the Nautilus Chain and is planned to integrate with Eclipse's infrastructure in the near future.

This development has significant implications for the adoption of the Solana ecosystem and the broader SVM. By being able to deploy Hyperlane on any blockchain without permission, new SVM chains do not need to wait for existing messaging protocols to add support for their chains. They can proactively deploy Hyperlane and establish connections with the broader ecosystem.

3.9 LI.FI Supported Cross-Chain Exchange on Solana and SVM Chains

LI.FI is a protocol that aggregates liquidity across multiple blockchains through the integration of bridges, DEX, DEX aggregators, and solvers.

When a swap request is made, LI.FI's routing algorithm determines the optimal bridge and DEX path to use. Factors such as speed, fees, and reliability are considered to find the best-performing route.

LI.FI recently launched in the Solana ecosystem, with Phantom as its launch partner. This can improve Solana by providing seamless cross-chain functionality through the integration of the LI.FI API, without the need to manage direct bridge connections, thus offering secure connections to other blockchain ecosystems.

Additionally, LI.FI has developed a solution that will support chains compatible with Solana Virtual Machine (SVM) in the future. This development indicates that LI.FI's cross-chain exchange functionality will expand to users and applications on SVM-compatible chains (such as Eclipse). Therefore, applications running on SVM chains will be able to leverage liquidity from any chain, simplifying user onboarding through the integration of LI.FI's API, SDK, and Widget. Additionally, users can choose to swap and bridge directly to SVM chains through Jumper.exchange.

- Conclusion

The messaging protocols and liquidity networks built on this foundation are critical infrastructure for any ecosystem. They can be seen as infrastructure investments in a country's economy—just as highways, ports, and railways are crucial for economic development by promoting trade and circulation, these protocols and applications are vital tracks for the development of the Solana ecosystem, enabling assets and information to flow securely.

We believe that this cross-chain liquidity will be crucial for the continued success of Solana, as it has a profound impact on the onboarding experience for users from different DeFi ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。