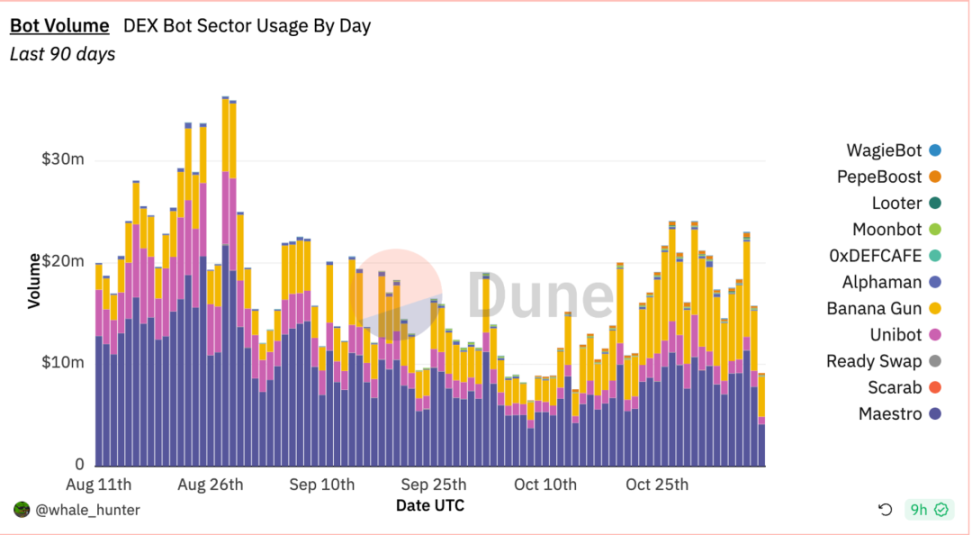

In the fierce competition of the BOT track, Banana Gun's performance is particularly eye-catching, especially its significant growth in key data indicators. This track shows significant fluctuations in overall data, especially in terms of trading volume, number of transactions (Tx count), and user count.

Specifically, Banana Gun's trading volume has dropped from nearly $30 million per day at its peak to about $10 million, and the Tx count has decreased from the daily peak of 80,000 to 40,000. However, the decrease in the number of users is relatively small, averaging around 10,000 per day, providing an opportunity for emerging forces like Banana Gun.

Next, let's introduce the Banana Gun project and the reasons for its roller-coaster data performance.

The preferred sniper token tool for Ethereum chain users, Banana Gun has two core functions: speed and security

As a Telegram bot, Banana Gun's main function is to help users quickly snatch tokens in the cryptocurrency market, especially adept at sniper operations at the opening. This feature has made Banana Gun highly regarded among users on the Ethereum platform, becoming one of their preferred sniper tools.

Similar to its competitor Unibot, Banana Gun's emergence signifies the popularization of sniper operations in the cryptocurrency trading field. Traditionally, sniping has been the exclusive domain of technical experts, requiring a deep understanding of smart contracts and configuration capabilities. However, Banana Gun simplifies this process through its platform's automation, allowing ordinary users to participate easily. Users only need to provide the contract address, and Banana Gun can automatically handle the rest of the operations, such as identifying method IDs, calculating tax rates, and setting maximum trading volumes, reducing the technical threshold for users.

The unique value of Banana Gun lies in its emphasis on centralized automation and defense against Rug Pull (fraud). It provides users with an additional layer of security by executing Ethereum transactions privately according to user settings. This private transaction mechanism not only reduces costs in high gas fee environments but also protects users from sandwich attacks—strategies that exploit transaction order by placing trades before and after user transactions. Banana Gun can even cancel transactions when it detects potential sandwich attacks, a meticulous feature lacking in its competitors like Maestro.

Speed is crucial in this field. Since its launch, Banana Gun has become one of the fastest retail sniping bots in the market. Since its introduction in early June 2023, it has quickly attracted around 700 daily active users and has accumulated a user base of over 12,000.

In terms of user interface, Banana Gun has adopted a unique design. Once a user completes a purchase, the interface automatically switches to the selling channel, allowing users to focus more on sales strategies. This design differs from other sniping bots, which typically handle both buying and selling operations on the same interface, potentially causing confusion for users.

These innovative features of Banana Gun, including its simplified operational process, enhanced security performance, and efficient interface design, have set it apart in the BOT track, making it an important tool in the cryptocurrency trading field. Nevertheless, its future development and continued competitiveness in the market still require observation of market reactions and long-term user acceptance. As the cryptocurrency market continues to evolve and user demands diversify, the role and importance of Banana Gun and similar tools will continue to evolve.

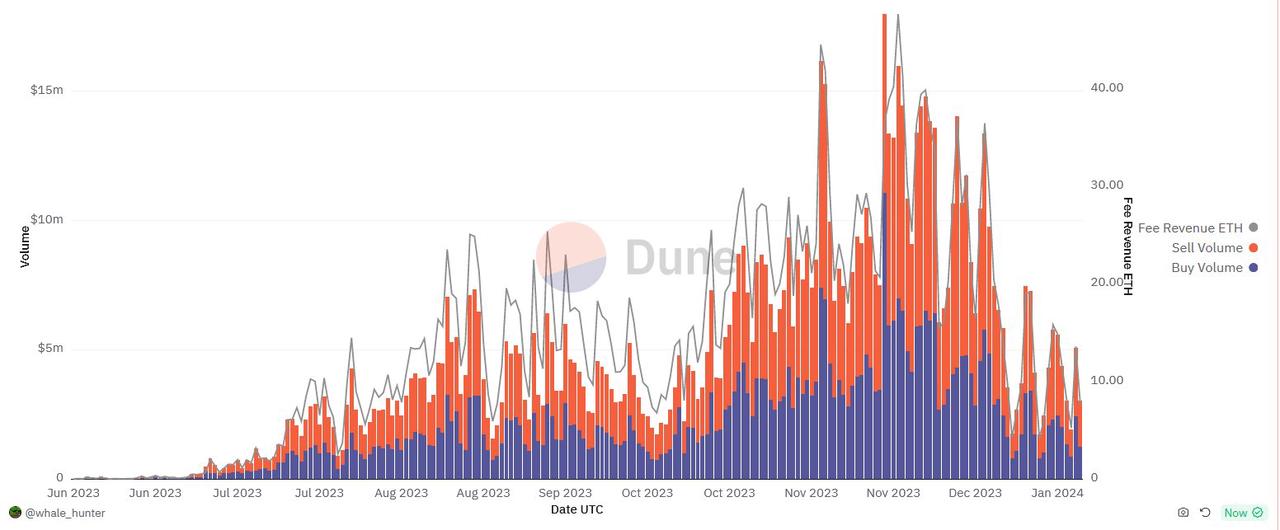

With key performance support, Banana Gun's data performance continues to rise significantly

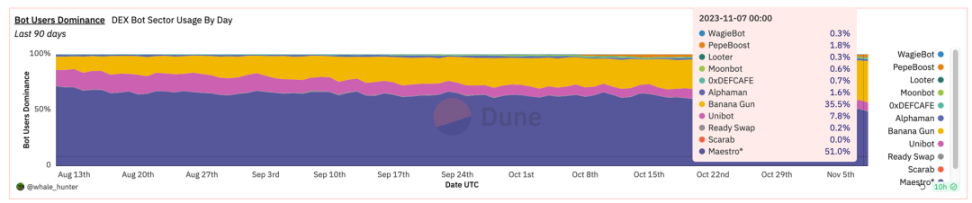

In the TG Trading Bot track, Banana Gun's rapid rise is particularly notable. From a data perspective, Banana Gun has not only achieved stable growth in trading volume and number of transactions but has also made significant breakthroughs in the number of users. In early September, Banana Gun successfully surpassed Unibot, climbing to the second position in the market with about 35% of the user share. Meanwhile, Unibot, once the market leader, has seen continuous declines in data and user numbers after reaching its all-time high (ATH), with the user count even dropping below 10%.

Banana Gun's ability to stand out in such a market environment is attributed to a series of innovative strategies and competitive advantages. Initially, Banana Gun attracted a large number of new users through an airdrop activity, and then successfully consolidated this user base with its unique MEV Bribe Snipe feature and a relatively low 0.4% service fee. More importantly, Banana Gun has continued to progress in product innovation, with the recent introduction of limit orders with Bribe functionality receiving widespread acclaim in the market and bringing significant profits to users. In terms of the MEV Bribe sniping new coins feature, Banana Gun has clearly taken the lead over its competitors in the market. Data shows that in the past ten days, Banana Gun users' total bribes to the MEV Builder have exceeded 1700E, far surpassing Maestro's 65E, while Unibot has not demonstrated equivalent competitiveness in this area.

Furthermore, the BananaGun team recently announced that its protocol's total trading volume has reached a staggering $388 million, solidifying its position as the second in the BOT track. At the same time, its token's on-chain daily trading volume has also reached a new high of $8.65 million, bringing in $28,000 in transaction fees. To further enhance user participation, BananaGun plans to increase rewards to 15%, providing users with higher fee rebates.

Overall, Banana Gun's rapid rise in the BOT track is due to its quick response to market dynamics, continuous product innovation, and significant improvements in key data indicators.

Detailed explanation of the $Banana token economic model: 25% of tokens from presale and liquidity pools are available for circulation

The economic strategy and market behavior of the $Banana token revolve around its unlocking plan, liquidity, and tax policies. This strategic layout aims to balance token supply and market demand while providing incentives for holders and users.

According to the disclosed information, the liquidity and unlocking plan for the $Banana token is as follows:

Founding tokens: 20% of the supply, i.e., 2,000,000 tokens, are immediately available for circulation with no lock-up period.

Advisory airdrop: 5% of the supply, i.e., 500,000 tokens, will be locked for 2 years.

Airdrop: 1.2% of the supply, i.e., 120,000 tokens, with a portion reserved for NFT and social tasks.

Team tokens: 10% of the supply, i.e., 1,000,000 tokens, will be unlocked and released in two stages.

Treasury: Occupying the largest proportion of 63.8%, i.e., 6,380,000 tokens, will gradually unlock to the community based on contributions.

The total supply is 10,000,000 tokens, with 25% of tokens from presale and liquidity pools available for circulation, aiming to provide sufficient liquidity to the market and reduce price fluctuations.

The tax mechanism is designed such that each transaction incurs a 4% tax, with the following allocations:

Token holders: Receive a 2% distribution from the tax to reward long-term holding.

Team: Receive a 1% tax distribution to support the project's ongoing operations.

Treasury: Also receive a 1% distribution to provide liquidity and ensure market stability.

The project plans to provide initial liquidity with 500,000 $Banana tokens and $325,000, establishing $Banana's initial market value at $1.63 million, aiming to be consistent with the presale price.

The $Banana token economic model also includes holder income sharing and user rewards, aimed at increasing user participation and rewarding long-term investment:

Holder income sharing: Derived from a portion of the income and tax from robot trading, this income is only distributed to users holding unlocked tokens. Although the team's tokens account for a large proportion, they are not included in income sharing due to their lock-up.

User Rewards: The project encourages users to use the Banana Gun bot for trading through a reward mechanism. This includes partial refunds of trading fees in the form of $Banana tokens and incentivizing users to hold through a token income sharing plan.

The $Banana token model aims to promote the growth and stability of token value through various mechanisms:

Buyback Mechanism: Utilizing treasury taxes for token buybacks to counteract inflationary effects.

Adjustment Coefficients: Providing tools for the project to adjust the supply in response to market changes.

Ape-to-earn Strategy: Increasing trading volume by incentivizing users to trade with the bot, promoting economic activity.

High Proportion Income Sharing: Encouraging investors to hold tokens long-term, reducing selling pressure in the market.

These strategies and measures of the $Banana token economy aim to create an ecosystem that rewards participants and protects investors. In this way, $Banana aims to establish a healthy token economy, promoting a positive cycle while maintaining a balance between token supply and demand. This balance is achieved through incentive measures, adjustment tools, and market strategies, and its ultimate effect will depend on the response of market participants and the effectiveness of project execution.

Risks and Opportunities Coexist: Users and Investors Need to Rationally Evaluate Various Situations in the Operation of Banana Gun

The market valuation of the Banana Gun project showed initial investor confidence before the launch, revealing an estimated valuation of approximately $6.48 million based on presale data. This figure is based on a presale amount of 800E and a market price of $1621 per Ethereum, considering the 20% presale proportion, we arrive at a relatively optimistic initial market assessment.

However, the market reaction after the token listing led to a leap in valuation, with the token price soaring to $8.493, resulting in a fully diluted valuation (FDV) of nearly $84.90 million, approximately 13 times the initial valuation. This significant growth may indicate that the market holds high expectations for the functionality and future potential of Banana Gun, or it may reflect confidence in the project team and roadmap.

An analysis of potential risks indicates that the significant growth in market valuation is accompanied by a series of considerations. The use of private keys in the project's operation mode presents a significant security challenge, which may become a weak link in the security of user assets. In addition, a large amount of presale tokens may lead to market selling pressure in the future, affecting the price stability and sustained growth of the token. Investors need to have a deep understanding of these factors when considering investment.

Furthermore, early technical issues with the project highlight potential shortcomings in the development team's ability to address market demands and technical challenges. Investors need to conduct a comprehensive assessment of the team's technical capabilities, project implementation plans, and future maintenance support.

In summary, the valuation and market performance of Banana Gun provide investors with a dynamic perspective, demonstrating its growth potential and acceptance in the market. However, any rapid growth in market valuation is accompanied by corresponding investment risks, including concerns about project security, management of market liquidity, and uncertainty about the team's execution capabilities. While pursuing potential high returns, investors must remain sensitive and vigilant to these risk factors, making balanced investment decisions to ensure long-term capital appreciation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。