On December 28th, Jiashi International successfully issued Hong Kong's first tokenized fund.

Author: Bowen, Bailu Salon

On January 12, 2024, Jiashi International Asset Management announced on its official public account: On December 28, 2023, Jiashi International successfully issued Hong Kong's first tokenized fund.

The tokenized fund completed its filing with the Hong Kong regulatory authorities in November 2023, making it the first fixed-income tokenized fund launched by a Chinese financial institution in Hong Kong. The fund is only available to professional investors and invests in high-rated US bonds. Jiashi International Asset Management, a subsidiary of Jiashi Fund in Hong Kong, serves as the fund manager, while Meta Lab HK provides tokenization solutions.

With the implementation of the 2023 Hong Kong STO new policy, more and more traditional financial institutions are beginning to focus on innovative tokenized investment products. Jiashi International, as one of the early responders, quickly completed the issuance of the tokenized fund, indicating the potential for greater application of fund tokenization.

In this article, Bailu Salon shares and analyzes the advantages of Jiashi International's tokenized fund and asset tokenization, helping readers make better judgments about the future development prospects in this field.

Getting to Know Jiashi International

In 1999, Jiashi Fund Management Co., Ltd. was established as one of China's first asset management companies. In 2008, Jiashi Fund established a wholly-owned subsidiary in Hong Kong, Jiashi International Asset Management. Currently, Jiashi Fund's management scale exceeds $200 billion, with public funds generating returns of over $30 billion and a research team of over 300 people.

In 2018, Jiashi International established an international ESG expert team, incorporating quantitative and qualitative ESG research into the investment process. In 2020, Jiashi Fund Management was awarded an A+ rating in the "Strategy and Governance" module by the Principles for Responsible Investment (PRI) for its efforts to incorporate ESG considerations into investment decisions.

Zhao Xuejun, CEO of the group, holds a Ph.D. in Economics from Peking University's Guanghua School of Management and has over 20 years of experience in financial investment, capital market operations, and corporate management. He is one of the longest-serving CEOs in the Chinese fund industry. Currently, Zhao Xuejun serves as a mentor at Peking University's postdoctoral research center, a lecturer in the Executive Master of Business Administration (EMBA) program at Tsinghua University's PBC School of Finance, and a part-time vice chairman of the China Securities Investment Fund Association, among other positions.

Jiashi International has a long-standing foundation. The issuance of the tokenized fund in response to the innovative attempt of the 2023 Hong Kong STO new policy has reference significance for subsequent similar business implementations.

Advantages of Asset and Fund Tokenization

According to Forbes, Nadine Chakar, who was responsible for managing the digital asset department of US Bank Dufu, once said, "Whether at BlackRock and Goldman Sachs, or at Citigroup and JPMorgan, all employees are talking about tokenization as a future trend."

What potential does asset tokenization have?

First, it improves efficiency: After tokenizing assets, asset transactions achieve atomic settlement, shortening settlement time and reducing settlement and counterparty risk. For example, the tokenized green bonds issued by the Hong Kong government earlier this year significantly shortened the settlement process from the traditional bond issuance, which usually takes 5 business days (T+5), to 1 business day, a benefit recognized by the market and regulatory authorities in the short term and even in the future.

Secondly, it enhances liquidity. Tokenization can improve asset liquidity by dividing assets or increasing trading flexibility. However, the practice of tokenizing assets and establishing a secondary market to enhance liquidity poses certain difficulties in risk control and investor protection due to strict regulatory constraints.

In addition, tokenization can also save operating costs and enhance compliance by utilizing smart contracts for automation, embedding traditional compliance operations into token smart contracts, thereby reducing costs.

Global market responses also reflect the advantages of asset tokenization. For example, in Singapore, the Monetary Authority of Singapore (MAS) established the Project Guardian initiative in November 2022, conducting pilot projects with major global financial institutions on asset tokenization and DeFi applications. Large financial institutions such as DBS Bank, HSBC, UBS, JP Morgan, and Ant Financial have joined the initiative and achieved certain results.

Hong Kong has shown greater support for the tokenization of assets and investable products, providing significant policy convenience. On November 2, 2023, the Securities and Futures Commission of Hong Kong issued the "Circular on Intermediaries Engaging in Activities Related to Tokenized Securities" and the "Circular on Tokenized SFC Recognized Investment Products." On one hand, Hong Kong has made new regulations for the issuance of tokenized securities, allowing them to be offered to retail investors; on the other hand, it has regulated the issuance of STO products, formally recognizing the introduction of tokenized investable products. Hong Kong encourages companies to attempt the issuance of tokenized investable products through its policies.

For more information on the 2023 Hong Kong virtual asset policy, please refer to: 2023 Hong Kong Virtual Asset Policy Annual Review: Dawn Has Emerged

Jiashi International's Tokenized Fund

The encouragement of policies has become a driving force for Jiashi International to attempt the issuance of tokenized funds. William, Chief Advisor of Jiashi International Asset Management, briefly introduced the fund to the Hong Kong news website.

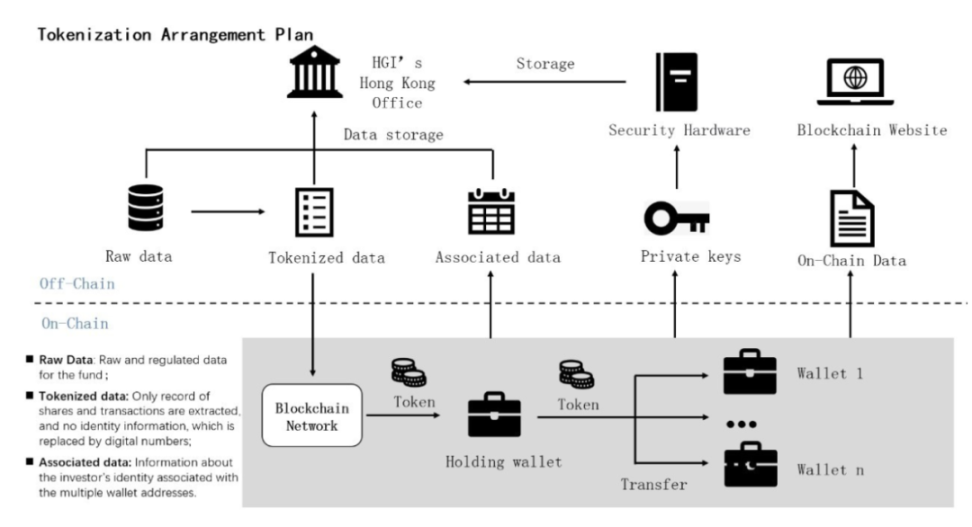

The tokenization arrangement for the fund mainly adopts public non-permissioned chain technology to record ownership of fund shares and transaction records on the blockchain. Specifically, each token represents a record of a fund share, and after the tokens are minted, they are initially stored in a general wallet and then transferred to the corresponding wallet address based on subscription records. Similarly, after investors redeem, the tokens in the corresponding wallet address will be transferred to the destruction address, thereby forming subscription and redemption records on the chain. Users can access relevant on-chain information through a custom browser. In addition, sensitive data on the blockchain has been desensitized and does not disclose any regulated information, with regulated data stored in accordance with legal requirements in the corresponding location to comply with Hong Kong's legal requirements.

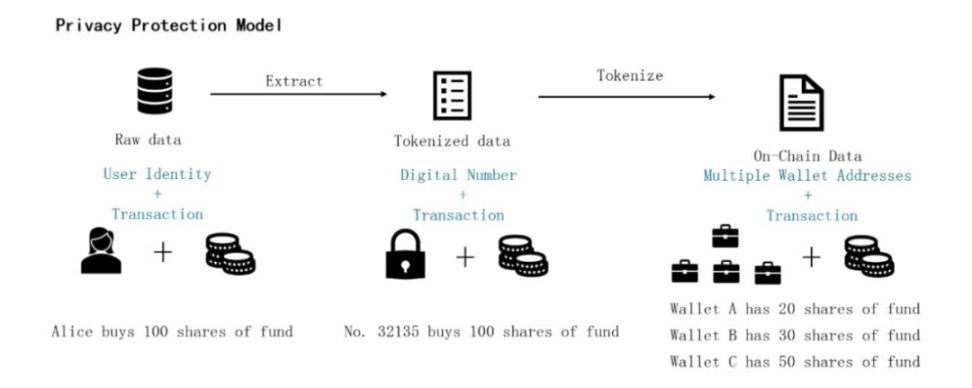

In terms of privacy protection, the tokenization arrangement for the fund has established a new privacy model. External parties often associate customer identity information with a wallet address through some clues, leading to privacy exposure. For example, if an outsider knows that someone holds 1000 shares of a fund, and there is only one wallet with 1000 tokens on the chain, they can establish a link between identity and the wallet, resulting in privacy leakage. To address this, Jiashi International adopts a "one-to-many" approach, randomly distributing the fund shares held by an investor to multiple wallets to strengthen the protection of investor privacy.

However, William pointed out that the issuance of tokenized funds still faces challenges. First, there is a lack of infrastructure for tokenized fund issuance. For example, the available blockchain development platforms and custody facilities are relatively scarce, and some blockchain platforms still require the construction and operation of nodes, leading to high costs. On the other hand, these blockchain platforms differ from traditional financial infrastructure in terms of standards and compatibility, causing traditional institutions to hesitate.

Second, there are still many issues to be resolved in terms of institutional arrangements. For example, security standards for blockchain development platforms, arrangements for the secondary market, cross-jurisdictional movement of tokens, etc., are currently unclear.

Regardless of the outcome, including the issuance of tokenized green bonds led by the Hong Kong government, it has gradually proven that tokenized investable products are likely to become a future trend. Hong Kong has prepared a favorable regulatory environment for tokenization innovation, and what needs to be done next is to keep an eye on this field and wait for more outstanding institutions to deliver results.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。