Bitcoin Historical Milestones

Author: Block Rhythm Jaleel Kaori / Source

This is a historic moment worthy of attention in the history of Bitcoin and the entire cryptocurrency market. The spot Bitcoin ETF has finally been approved, opening a new chapter for Bitcoin.

01

List of 11 approved spot Bitcoin ETFs

At 4 am on January 11th, Beijing time, the U.S. Securities and Exchange Commission (SEC) simultaneously approved 11 spot Bitcoin ETFs, including:

1) Grayscale Bitcoin Trust

2) Bitwise Bitcoin ETF

3) Hashdex Bitcoin ETF

4) iShares Bitcoin Trust

5) Valkyrie Bitcoin Fund

6) ARK 21Shares Bitcoin ETF

7) Invesco Galaxy Bitcoin ETF

8) VanEck Bitcoin Trust

9) WisdomTree Bitcoin Fund

10) Fidelity Wise Origin Bitcoin Fund

11) Franklin Bitcoin ETF

Six of the ETFs will be listed on the Chicago Board Options Exchange (CBOE), three will be listed on the New York Stock Exchange (NYSE), and two will be listed on the Nasdaq Exchange.

Among these approved lists and applicants, Grayscale (GBTC) stands out with its approximately $46 billion in assets under management, and iShares under Blackrock also holds a leading position in the industry with its massive $9.42 trillion in assets under management. Following closely is ARK 21Shares (ARKB), managing approximately $6.7 billion in assets. In comparison, Bitwise (BITB) has a smaller scale but still manages approximately $1 billion in assets.

Other important participants include VanEck, managing approximately $76.4 billion in assets; WisdomTree (BTCW) with $97.5 billion in assets under management; Invesco Galaxy (BTCO) and Fidelity Wise Origin, managing $1.5 trillion and $4.5 trillion in assets, respectively.

Among them, BlackRock and ARK Invest's spot ETF applications were the most talked about in the market.

BlackRock, which missed only once

Looking back at 2023, BlackRock's application for a spot Bitcoin ETF was seen as an important turning point in the bull and bear trends of the cryptocurrency market. As an asset management company with assets under management exceeding $10 trillion, BlackRock's managed assets even far exceed Japan's GDP of $4.97 trillion in 2018. BlackRock, Vanguard Group, and State Street Bank were once known as the "Big Three," controlling the entire index fund industry in the United States.

More importantly, BlackRock has an impressive track record of success in obtaining SEC approval for its ETF applications. According to historical data, BlackRock's ratio of successfully approved ETFs by the SEC is 575 to 1, meaning that out of 576 ETFs it applied for, only one was rejected.

Therefore, when BlackRock submitted its spot Bitcoin ETF documents to the SEC in June, it caused quite a stir in the community. The community generally believed that BlackRock's entry meant the inevitable approval of the spot Bitcoin ETF.

Recently, on January 3, 2024, BlackRock allocated $10 million as startup capital for its spot Bitcoin ETF, a significant increase from the initial $100,000 seed capital invested in October. This move demonstrates BlackRock's commitment and expectations for the launch of the Bitcoin spot ETF. The ETF is named iShares Bitcoin Trust and will be traded on the stock market under the ticker symbol IBIT once launched.

In addition, BlackRock has actively communicated with the U.S. Securities and Exchange Commission (SEC) to address regulatory issues surrounding its spot Bitcoin ETF application. After discussions with the SEC, they submitted updated/revised S-1 forms and met with the SEC multiple times in the past month. BlackRock also adjusted its approach from physical to cash mode to comply with SEC requirements, demonstrating their flexibility and proactiveness in complying with regulatory standards.

ARK Invest, the latecomer

As expected, Ark Invest was among the first to be approved in this batch of lists.

On October 12, 2023, Eric Balchunas, a senior ETF analyst at Bloomberg, stated on social media that ARK had submitted an updated prospectus for its spot Bitcoin ETF. At the time, he stated that although approval might not come immediately, the "back and forth communication" with the SEC was a very positive sign.

At the same time, starting from August last year, Ark Invest gradually reduced its holdings of GBTC. Many speculated that the reason for the savvy "Wood Sister" to reduce its GBTC holdings might be to prepare for its own spot Bitcoin ETF fund.

According to ARK Ark Fund holdings data, in October, the ARK Ark Fund reduced its holdings of GBTC by a cumulative 146,242 shares without any purchases. In September, it bought 11,249 shares of GBTC but sold 67,494 shares. In August, it bought 106,413.91 shares of GBTC but sold 108,776.24 shares.

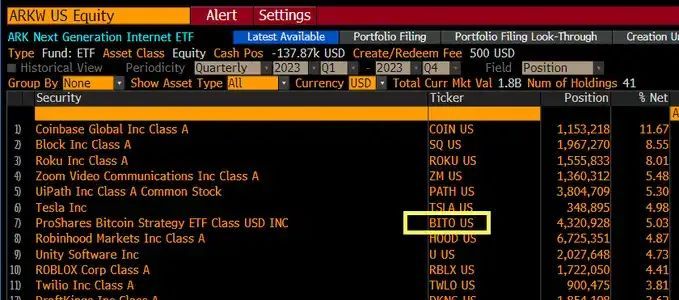

By December, according to Bloomberg analysts, the ARK Ark Fund had sold over 2 million shares of Grayscale Bitcoin Trust (GBTC) and completely cleared its remaining GBTC positions, using approximately half of the funds to purchase ProShares Bitcoin Strategy ETF (BITO) stocks worth around $100 million.

Stocks of ProShares Bitcoin Strategy ETF (BITO) purchased by ARK Ark Fund

02

Spot ETF approved, Bitcoin and cryptocurrencies enter a new historical starting point

The importance of the spot Bitcoin ETF is mainly reflected in two aspects: first, it increases accessibility and popularity. As a regulated financial product, the Bitcoin ETF provides a chance for a wider range of investors to access Bitcoin. With the spot Bitcoin ETF, financial advisors can begin guiding their clients to invest in Bitcoin, which is significant for the wealth management field, especially for capital that cannot directly invest in Bitcoin through traditional channels.

Second, it gains regulatory recognition and enhances market acceptance. An ETF approved by the SEC will alleviate investors' concerns about safety and compliance because it provides more comprehensive risk disclosure. A more mature regulatory framework will attract more investment, and this regulatory clarity is crucial for market participants to conduct business in the cryptocurrency industry.

The approval of the spot Bitcoin ETF undoubtedly marks a new historical starting point for Bitcoin and cryptocurrencies. We can also perceive the current market sentiment through data such as the estimated market size of the spot Bitcoin ETF and the estimated performance of Bitcoin prices.

ProShares' Bitcoin Strategy ETF BITO has surpassed $2 billion in assets under management, attracting a net inflow of $506 million in 2023 and $30 million in the first eight days of 2024. This demonstrates the fundraising ability of the Bitcoin spot ETF.

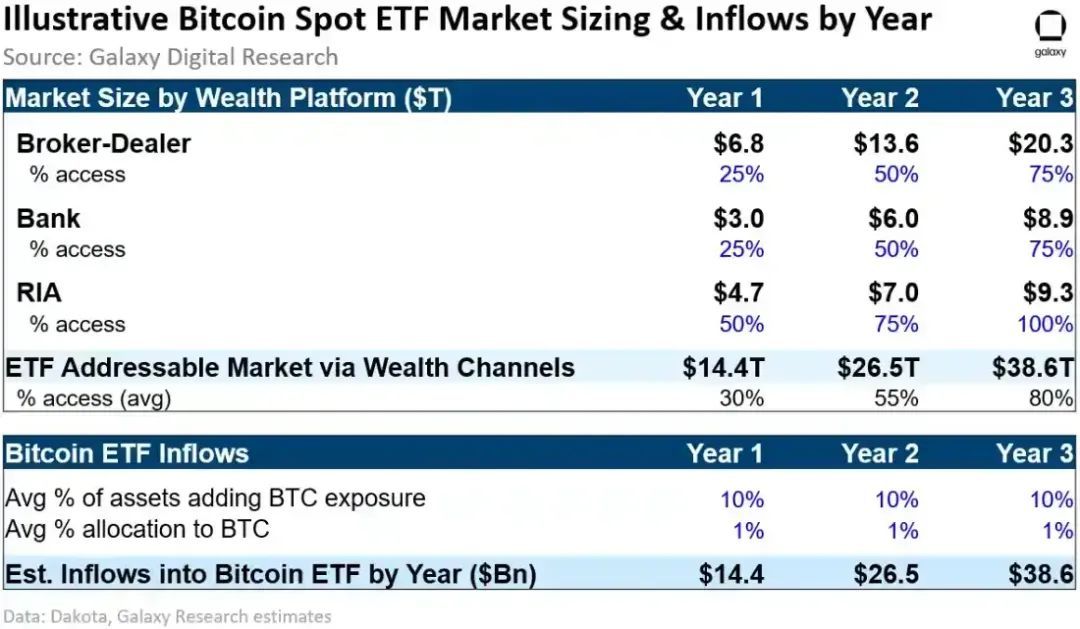

According to a report by Galaxy Digital in October 2023, the approval of a Bitcoin ETF may have a direct impact on the U.S. wealth management industry. The accessible market for Bitcoin ETFs and the indirect impact and coverage of the approval will extend far beyond U.S. wealth management channels (such as international markets, retail markets, other investment products, and other channels), potentially attracting more funds into the Bitcoin spot market and investment products.

If it is assumed that Bitcoin is adopted in 10% of the total available assets in each wealth channel, with an average allocation of 1%, the report estimates that there will be a $14 billion inflow in the year following the release of the Bitcoin ETF, increasing to $27 billion in the second year, and reaching $39 billion in the third year after the release.

Market size and inflow of Bitcoin spot ETF divided by year

Furthermore, the second-order effects of the approval of the Bitcoin ETF may have a greater impact on global Bitcoin demand. It is expected that other countries will follow in the footsteps of the United States and approve and launch similar Bitcoin ETF products to meet the needs of a broader range of investors. In the long run, as Bitcoin becomes monetized, its market share in different asset categories may increase, expanding the market size of Bitcoin.

Estimated Bitcoin Price Performance

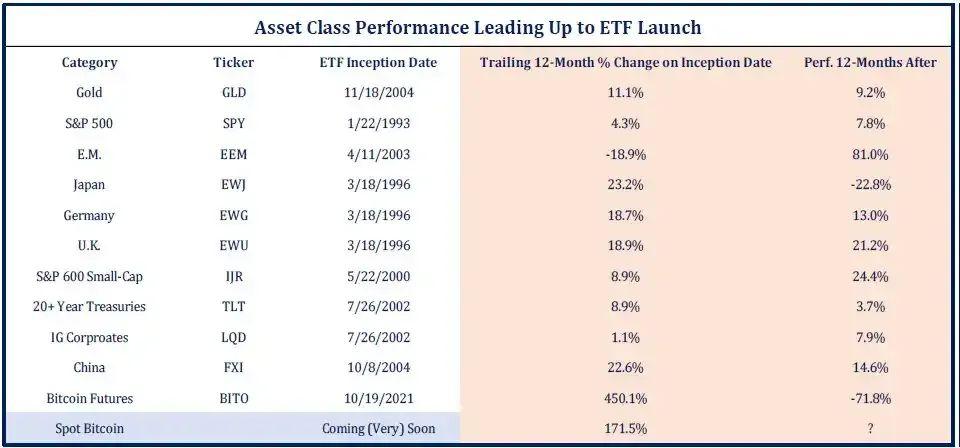

Bitcoin is hailed as "digital gold," and both are considered a store of value. Due to this association, it is widely believed that studying the development history and historical price trends of gold ETFs is of significant importance for predicting the future trends of Bitcoin ETFs.

In October 2004, the SEC approved the first gold ETF in the United States, StreetTracks Gold Trust (GLD). After the approval, the price of gold continued to make a slight surge. In November of the same year, the U.S. gold ETF GLD was officially listed on the New York Stock Exchange, and in the two months after trading began, the market fell by about 9%, briefly falling below the price at the time of ETF approval. After nearly 8 months of consolidation, gold began to enter a period of rapid growth. In the following years, gold ETF products sparked a buying frenzy globally, becoming a mainstream gold investment tool and attracting a large amount of funds. It is widely believed that the approval of the gold ETF directly led to the 10-year bull market in gold that followed.

Performance of asset categories before the ETF launch

As of September 30, 2023, according to data from the World Gold Council, global gold ETFs collectively held about 3,282 tons (approximately $198 billion in assets under management), accounting for approximately 1.7% of global gold supply. Meanwhile, the total amount of Bitcoin held in investment products, including ETPs and closed-end funds, was 842,000 bitcoins (with assets under management reaching $21.7 billion), accounting for 4.3% of the total supply.

According to the Galaxy Digital report, based on prices in October 2023, the market value of gold is 24 times that of Bitcoin, while the amount held is 36% less than Bitcoin. Assuming the same amount of funds flowing in has 8.8 times the impact on the Bitcoin market compared to the gold market. This estimate indicates that if there is a $14.4 billion inflow in the year following the approval, the price of Bitcoin may rise by 6.2% within a month and accumulate a 74% increase within a year.

Yesterday, Steven McClurg, co-founder of Valkyrie Investments, estimated that as much as $200 million to $400 million will flow into their ETF in the week following approval, with the entire market reaching $5 billion in the initial weeks of trading. When asked how Valkyrie plans to profit with such low fees, Steven McClurg stated that such products may incur losses in the early stages, but Valkyrie expects its ETF to be profitable in the first year of trading.

03

Bloopers in the Bitcoin spot ETF application process

As one of the most anticipated developments in the global cryptocurrency market, the spot Bitcoin ETF product's every move has a significant impact on this already fragile market. Everyone has been waiting for too long, leading to several "false approvals" bloopers in the past.

In the early hours of January 10th, the official U.S. SEC account on social media posted a message stating that the Bitcoin spot ETF had been approved. This tweet instantly gained millions of views. With emotions building up to this point, coupled with the news that the cryptocurrency industry had been waiting for for years, no one would think that these few lines would have any issues.

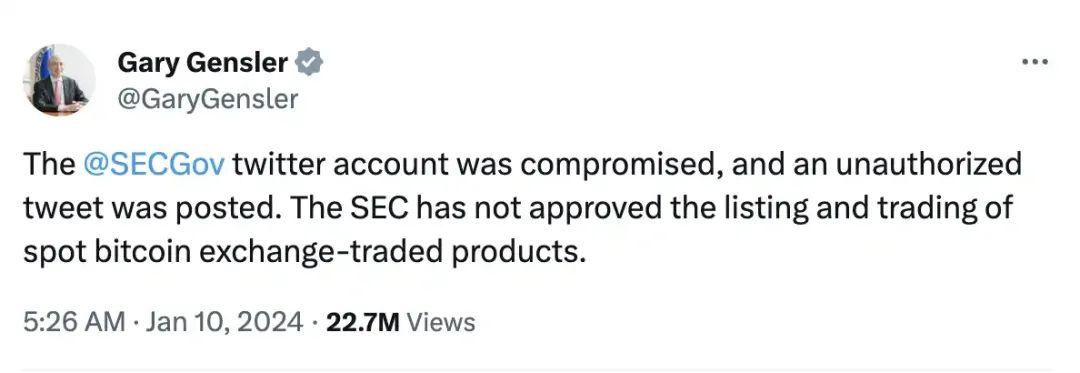

SEC Chairman Gary Gensler stated a few minutes later that the "spot ETF had been approved" was false news. The reason was that the official SEC Twitter account had been hacked, and the previous tweet was posted by hackers.

Translation: @SECGov Twitter account has been compromised and unauthorized tweets have been posted. The U.S. Securities and Exchange Commission has not approved the listing and trading of spot Bitcoin trading products.

Affected by the false news, the price of Bitcoin experienced drastic fluctuations, rising to nearly $48,000 before quickly dropping to below $45,000, with a short-term fluctuation of nearly 10%. According to Coinglass data, the Bitcoin market liquidated $56.2 million in nearly 1 hour, with long positions accounting for about 60%.

However, this is not the first "false approval" blooper in the Bitcoin spot ETF.

In October last year, the well-established cryptocurrency media Cointelegraph posted the news of the SEC's approval of a Bitcoin ETF on social media in all capital letters. In less than half an hour, the tweet had nearly 1.5 million views, demonstrating the immense attention the cryptocurrency industry receives. The market also quickly reacted, with the $550 billion Bitcoin market breaking through multiple integer levels, with the price briefly surpassing $30,000, seemingly heralding the return of a bull market.

Translation: Breaking news: The U.S. Securities and Exchange Commission approves ISHARES Bitcoin spot ETF

However, the market quickly realized that the situation was not right. Mainstream media such as Bloomberg had not reported on such significant news. James Seyffart, an ETF analyst at Bloomberg, stated on social media that this news was likely false, and there was currently no evidence to confirm it.

Subsequently, with various debunking efforts, the price of Bitcoin fell back to above $27,000. After this frenzy that lasted for only about 10 minutes, nearly $100 million was spent in the market for this false news, with short positions liquidating $72 million and long positions liquidating $26 million. In hindsight, these "false" news of previous false approvals now seem more like genuine news that was leaked in advance.

Living in this era, we have not only witnessed the birth of a financial product, the "Bitcoin spot ETF," but also personally witnessed a brand new era of cryptocurrency.

Original source: https://www.theblockbeats.info/news/49752

END

Source: https://www.theblockbeats.info/news/49752

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。