Author: Jiang Haibo, PANews

Decentralized perpetual contract exchanges (referred to as Perp DEX or Perps) may be one of the few tracks with confirmed value and a large number of innovative projects. Although projects such as dYdX, GMX, Synthetix, etc., occupy the main market, several popular unissued projects have recently shown strong competitiveness, including Aark Digital, Drift, Zeta, MYX, Hyperliquid, Jupiter, etc. Most projects use points and other forms to achieve cold start, and early layout may provide better opportunities. PANews will provide detailed introductions in the following sections.

Aark Digital

Aark Digital is a Perp DEX based on Arbitrum, which announced the completion of a seed round of financing led by Delphi Digital in July this year, with participation from OKX Ventures, Big Brain Holdings, and Keyrock. The specific amount of financing has not been disclosed.

The main features of Aark Digital include:

- Adoption of a virtual liquidity pool model, where liquidity providers (LP) still act as counterparties to traders.

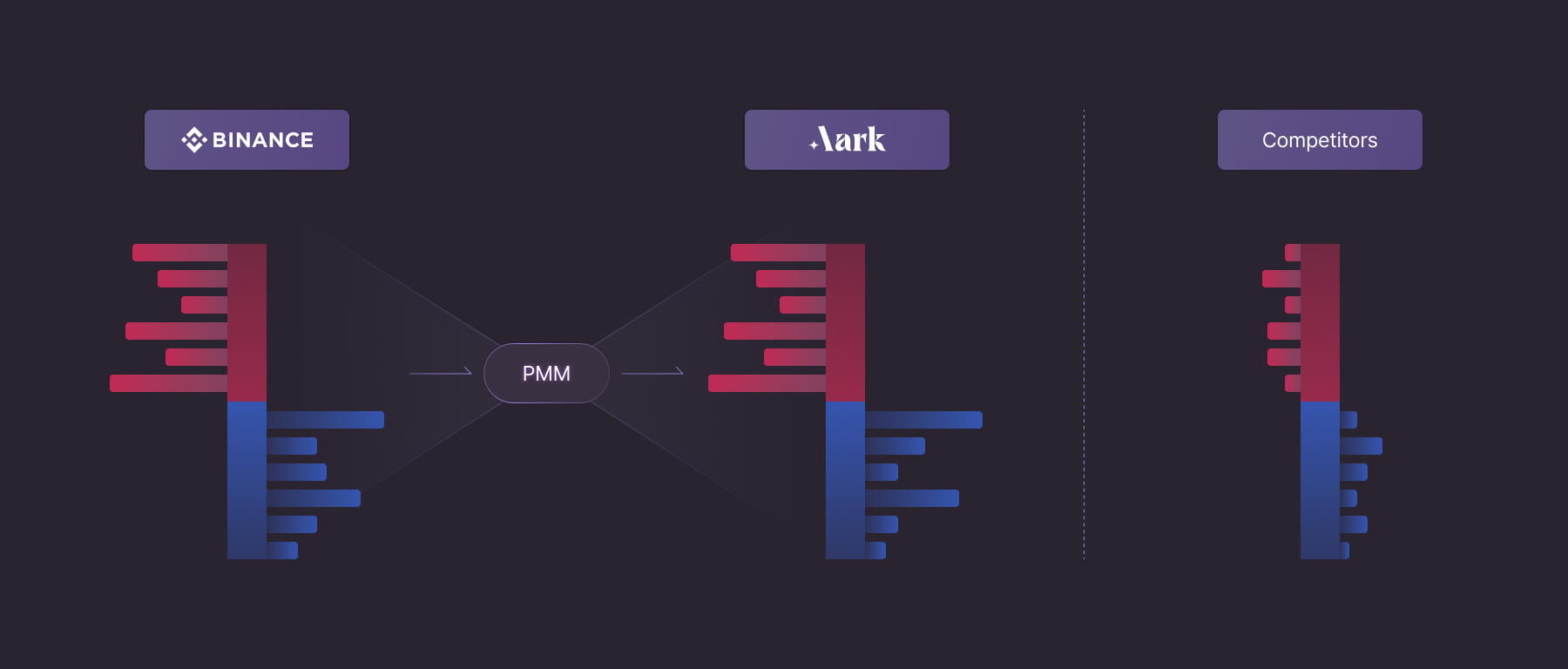

- Parallel market maker (PMM) architecture. It aggregates liquidity from centralized exchanges (CEX) and decentralized exchanges (DEX). Because it reflects the liquidity depth of CEX, it can prevent arbitrage losses caused by price manipulation and support long-tail assets. At the same time, it incentivizes long and short positions to achieve balance through funding costs, price impact, etc.

- Support for full cross-margin mode with multiple collateral types. Assets including common stablecoins (USDC, USDT, DAI), ETH, and WBTC can be used as collateral for trading, with each collateral type having a preset weight. When trading, users still hold their own collateral assets, and only calculate profits and losses in USDC at settlement.

- Providing liquidity is a process similar to trading, supporting leveraged liquidity and the use of multiple collateral types.

- Efficient settlement process. In Aark, clicking on an order completes the transaction without waiting for the wallet to pop up the transaction and sign, solving on-chain delays and gas issues, and avoiding front-running issues.

Overall, Aark Digital is indeed a Perp DEX with a very smooth user experience. To achieve a cold start, Aark Digital has taken a series of measures to incentivize liquidity and trading volume. For liquidity, there are two rounds of liquidity soft lock plans, with the ongoing second round from December 20 to February 20, with a total of 200,000 AARK tokens (out of 100 million) as rewards. For trading volume, starting from October 11, there has been an 18-week mining activity, with 200,000 AARK allocated per week.

Drift

Drift is a decentralized trading platform based on Solana, offering spot trading, leveraged trading, perpetual contracts, lending, and yield earning, among other functions. The project completed a $3.8 million financing round led by Multicoin Capital in 2020, with participation from Jump Capital, Alameda Research, etc.

Drift's features and characteristics include:

- Building a full set of products for spot, leveraged, and perpetual contract trading.

- Various liquidity mechanisms, including virtual automated market maker (Drift AMM), decentralized limit order book (DLOB), and just-in-time (JIT) auction liquidity, ensuring on-chain liquidity.

- All trades are first conducted through short-term Dutch auctions, followed by execution by DAMM, with limit orders on the order book as a final supplement.

- There is an insurance fund that can receive a portion of protocol fees, but in the event of a loss, this portion of funds will be prioritized for compensation. Depositing $10,000 into the insurance fund entitles one to a trading fee discount.

- Supports multiple collateral types as margin, and collateral automatically earns interest. User profits and losses are settled regularly, with these funds converted into user deposits or debts, and also generating or requiring interest payments.

- Liquidity providers (DLP) can use leverage, potentially losing all of their margin, and can open independent sub-accounts for providing liquidity.

- Makers not only do not need to pay fees, but also receive a 2bp fee rebate.

Drift is a powerful DEX and has the highest TVL in Solana's Perp DEX. Currently, Drift has a weekly lottery activity called Drift Draw, based on Taker trading volume, with the prize pool coming from the insurance fund, but Drift has not explicitly stated incentives for traders and liquidity providers with native tokens.

Zeta

Zeta is a derivative protocol on Solana, providing perpetual contract trading services. It completed an $8.5 million financing round led by Jump Capital in 2021, with participation from Electric Capital, Wintermute, Alameda Research, Solana Capital, etc.

Zeta's product is very simple, with only a fully on-chain limit order book for trading perpetual futures, similar to dYdX.

Zeta currently has a point system called Z-Score, with more points resulting in more tokens. The first season of the Z-Score activity has ended, during which 1 point was earned for every $1 traded as a Taker. However, Takers also have a relatively high fee ratio (0.1%); Makers are fee-free and therefore do not earn points. Zeta also collaborates with other projects to issue Zeta Cards, with destroyed cards earning double points. The second season of the Z-Score activity is about to begin.

MYX

MYX is a highly scalable perpetual contract protocol, which announced the completion of a $5 million financing round led by HongShan in November 2023, with participation from Consensys, Hack VC, OKX Ventures, etc.

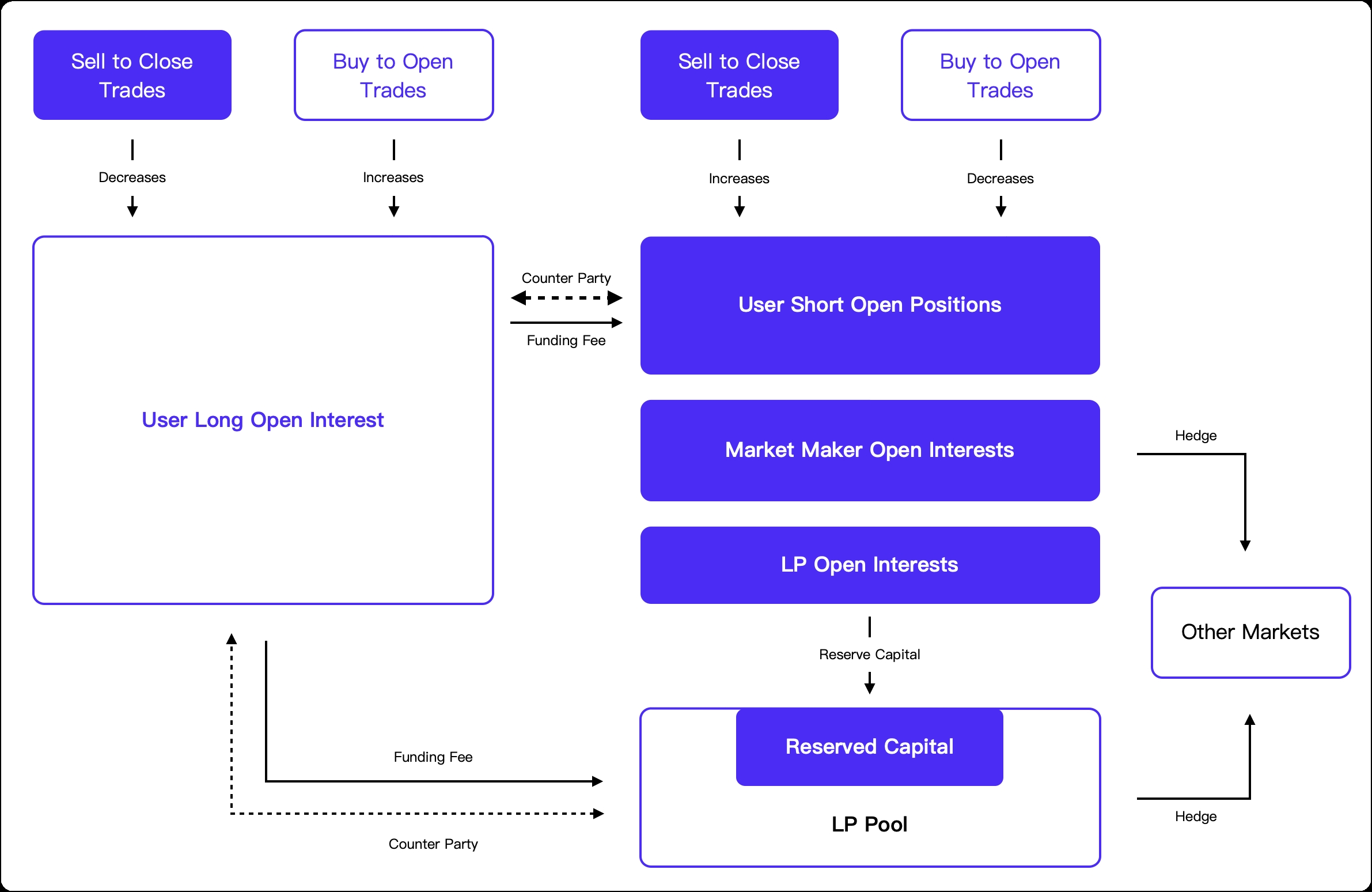

MYX can be said to directly address the pain points of GMX. In most Perp DEX, including GMX, both long and short positions will occupy a portion of liquidity. When the liquidity occupation reaches the limit, it means that the unclosed amount has reached the limit, and only closing, not opening, is possible. MYX adopts a unique matching pool mechanism, with a liquidity pool still acting as a counterparty to traders. When the long and short positions are equal, at this point, the LP does not have counterparty risk as a trader, as MYX believes that the LP does not hold any positions at this time. If the long and short balance is maintained, theoretically the unclosed amount can be unlimited. Only the difference between long and short positions will expose the LP to risk, and funding costs can incentivize long and short positions to remain balanced.

Since the unclosed amount is no longer limited by the funds in the liquidity pool, the same liquidity in MYX may bring higher trading volume, allowing concessions in other aspects, such as achieving zero slippage and no borrowing costs.

Currently, MYX is in the second phase of testing, and users who have joined the waiting list to participate in the testing can receive rewards.

Hyperliquid

Hyperliquid is a decentralized perpetual exchange running on its own Layer 1, providing similar functionality to traditional centralized exchanges.

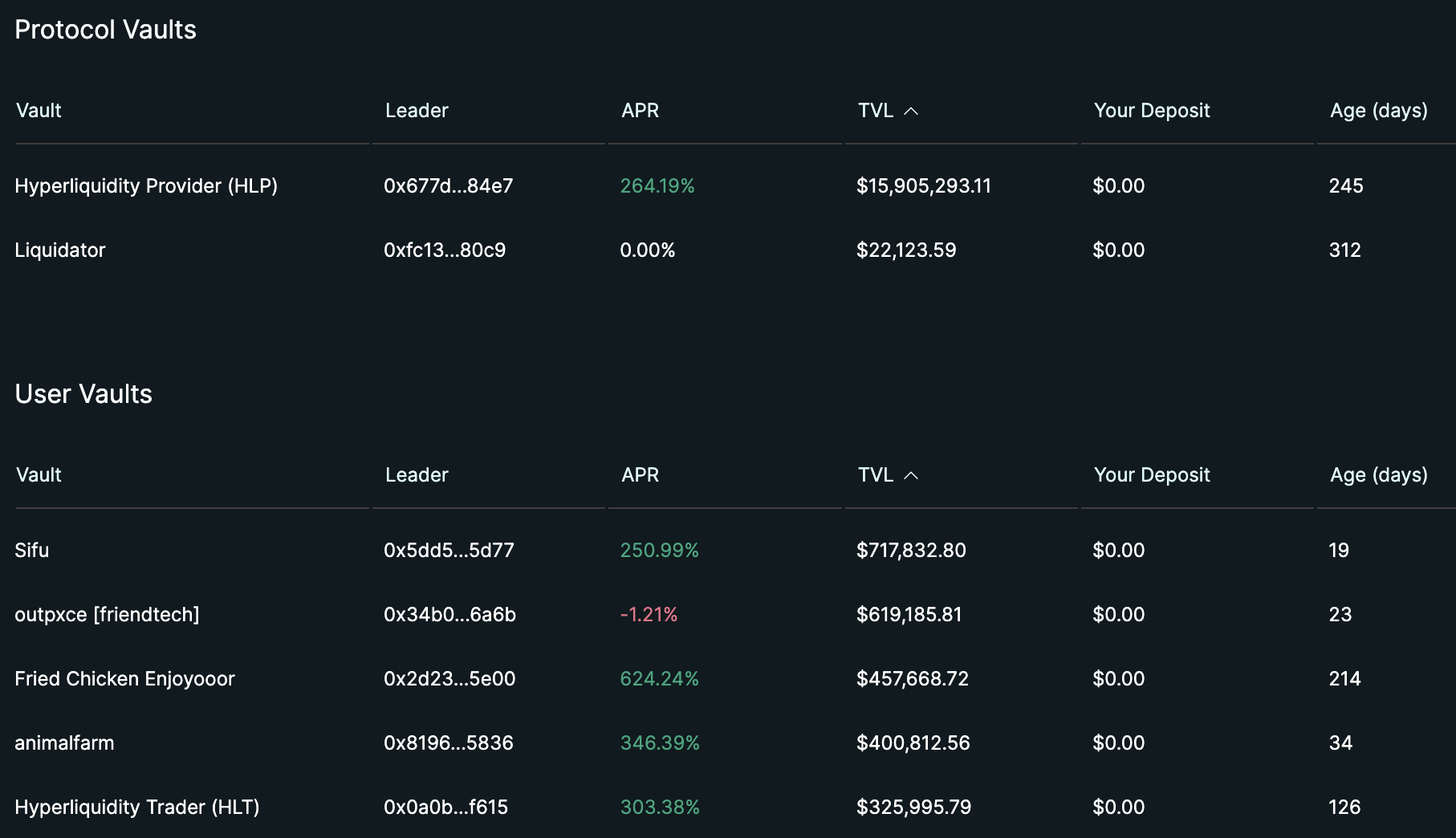

It mainly consists of an order book exchange for trading with USDC as collateral. Its feature is the support for trading many long-tail assets, and it may be the only project supporting leverage or perpetual contract trading for certain specific assets (such as CANTO) on-chain. In addition, Hyperliquid provides multiple liquidity strategy Vaults, such as HLP (Hyperliquidity Provider), currently displaying an APR of 264%, but this may be due to recent market volatility.

Starting from November 1, Hyperliquid has implemented a point system, allocating 1 million points to users each week over a period of 6 months.

Jupiter

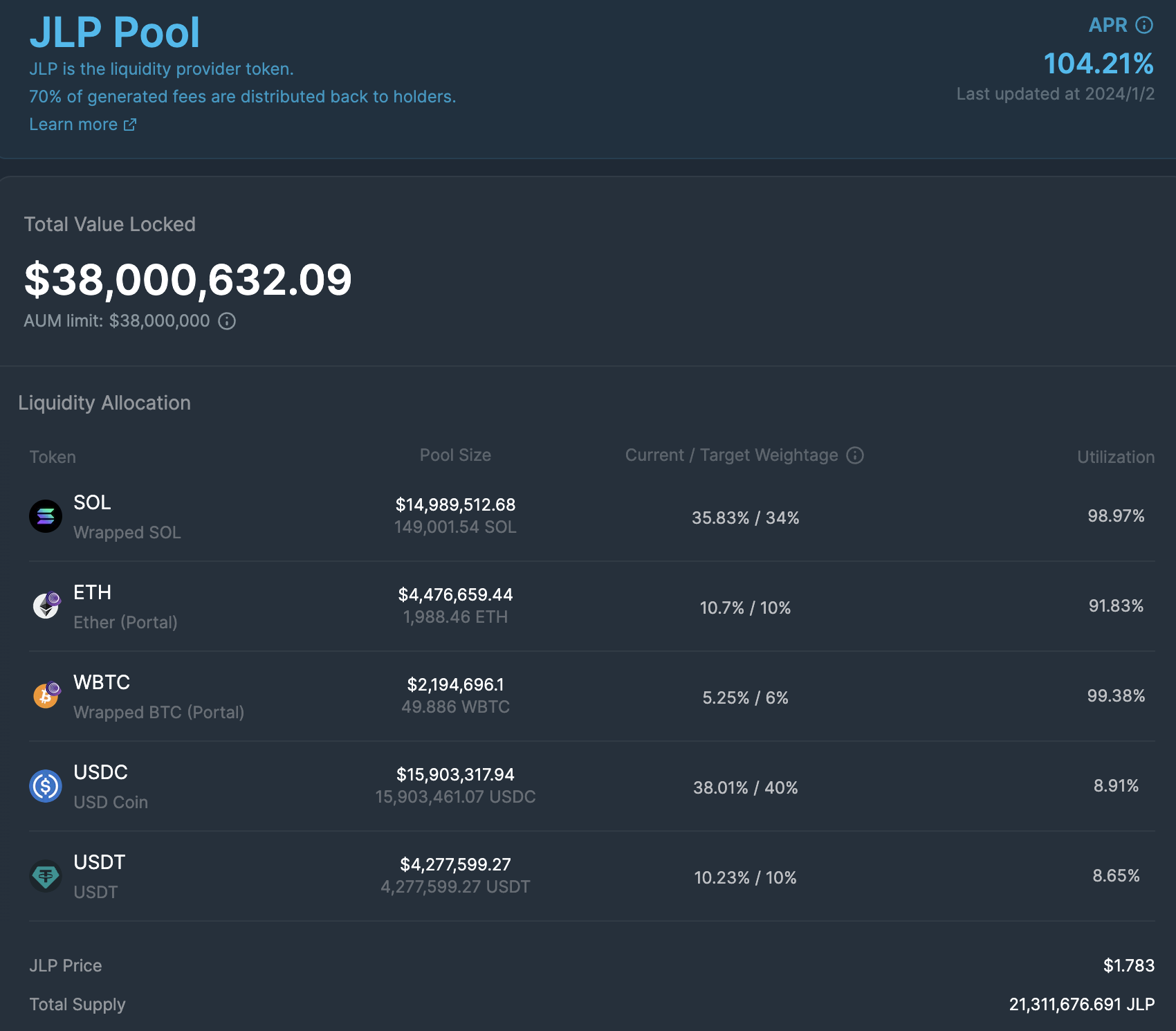

Jupiter's JLP is a product on Solana similar to GMX's GLP, providing perpetual contract trading services through a basket of assets.

Although it lacks innovation, it is exceptionally popular on Solana. The capacity of JLP has consistently been at the upper limit for a long time, quickly reaching the limit each time it is raised. JLP may trade at a 10% premium in the secondary market, and the utilization rates of SOL, BTC, and ETH in perpetual contracts often reach 100%.

The main reason may be Jupiter's extremely high valuation (exceeding $6 billion in Aevo) and 40% of the tokens being used for airdrops. Some users who purchase JLP at a premium and traders on Jupiter's perpetual contracts may be considering potential airdrops.

Summary

The development of Perp DEX is not perfect, but some projects demonstrate the diversity and innovation of this track. Combined with different incentive measures, there may be projects that can replace the current positions of GMX or Synthetix. For users, it may be more advantageous to participate early.

However, it is important to note that security incidents are frequent in this track. Even leading projects such as dYdX, GMX, and Synthetix have experienced attacks to varying degrees, although in most cases only a small amount of funds were lost. New projects may have higher risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。