Author: Kris Xu, CoinW Academy

In 2023, we witnessed the vigorous development of the cryptocurrency field together. During this period, conflicts and integrations intertwined, demonstrating the multi-faceted trend of rapid industry evolution. In this fast-evolving environment, regulation and compliance have become the main theme of this year.

The growth of the cryptocurrency market stems from the widespread acceptance and application of cryptocurrencies globally, and this trend of globalization has had a significant shaping and influencing effect on the market. Looking back at 2023, it became necessary to deeply analyze the development dynamics of the cryptocurrency market and the evolution of the market structure.

Today, we will take a macro perspective to examine the cryptocurrency field, from the development of blockchain technology to the race tracks of various sub-sectors, comprehensively analyzing and evaluating the current situation of the cryptocurrency industry. While considering technological changes, a comprehensive analysis of industry trends, regulatory trends, and market performance is conducted in order to gain a deeper understanding and grasp the development direction of the cryptocurrency industry.

Overview of the 2023 Cryptocurrency Market

The market value data of the cryptocurrency market in 2023 revealed the comprehensive development trend. Initially, the market value experienced continuous and gradual fluctuations, rapidly soaring to over $1 trillion at the beginning of 2023. Subsequently, the market value showed relatively large fluctuations, but the overall trend continued to grow steadily. In the second and third quarters of 2023, the market value showed a fluctuating trend, maintaining in the range of $1.1 trillion to $1.3 trillion, and then broke through and stabilized above $1.5 trillion in the fourth quarter. The market value once climbed to $1.6 trillion and continued to maintain at this level, marking a perfect conclusion for the cryptocurrency market in 2023.

Figure 1: Total Market Value of Cryptocurrencies in 2023

Inventory of Race Tracks

In 2023, the cryptocurrency field witnessed unprecedented turbulence and innovation, with Ethereum and Bitcoin leading a new era of competition. During this year, numerous infrastructure and public chain projects flourished, not only making breakthroughs in decentralization, but also focusing on providing fast and convenient trading experiences, actively shaping practical application scenarios that meet market demands. These innovators continuously pushed the boundaries of technology and applications, leading the cryptocurrency industry into a more diversified and mature development stage.

Upgraded Ethereum in Shanghai

In the first half of 2023, the focus of the cryptocurrency field was entirely on the Shanghai upgrade of Ethereum (EIP-4895). This upgrade was a highly anticipated major change for Ethereum stakers. It allowed stakers to unlock the funds staked as validators.

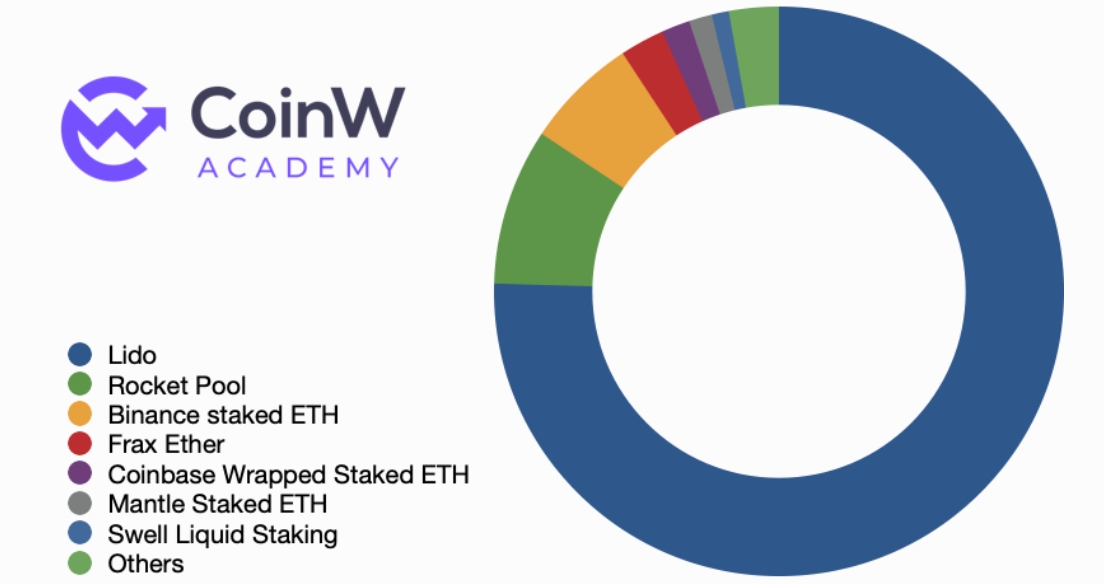

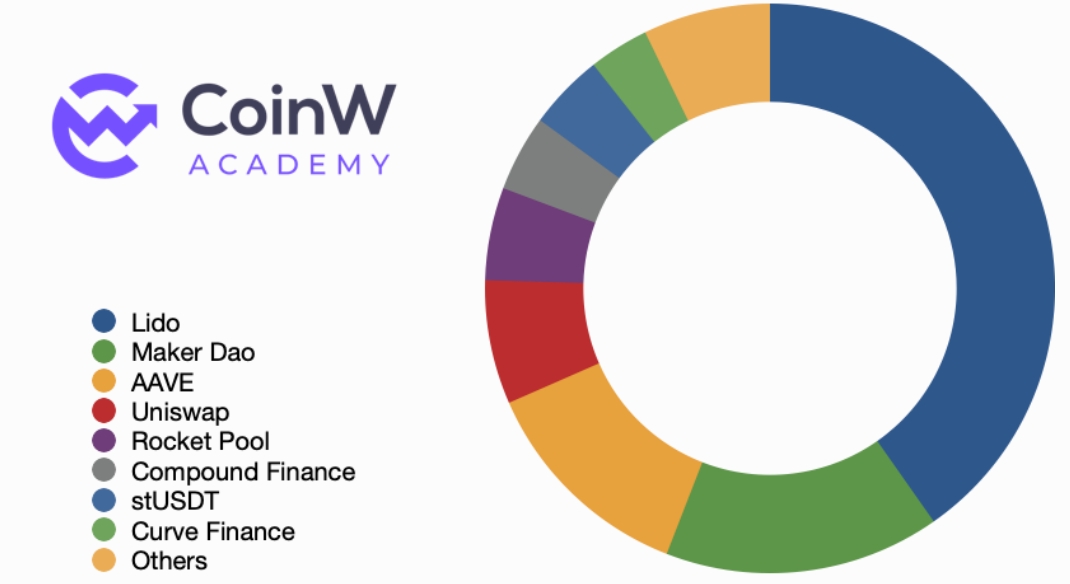

Liquid Staking Derivatives

Staking ETH as part of Ethereum's proof-of-stake mechanism requires stakers to lock up 32 ETH to run a validator node, ensuring network security and validating the validity of transactions. The implementation of the Shanghai upgrade granted stakers the right to withdraw these locked ETH, which accelerated the evolution of the liquid staking derivatives (LSD) market. Through LSD services, people can trade staked Ethereum (ETH) and derive tokenized versions (such as sETH) on different platforms. With the increased liquidity of tokenized versions of staked ETH, it reduced the significant selling pressure that ETH might have originally faced, significantly impacting the stability of Ethereum's price. LSD also became the hottest area in 2023, and governance tokens of excellent LSD service providers such as Lido Finance and Rocket Pool became one of the hottest trading tokens.

Figure 2: LSD TVL

Layer 2

Layer 2 technology is an important solution to address the congestion of the Ethereum network. It aims to increase transaction speed, reduce transaction fees, and improve user experience. Currently, the mainstream Layer 2 technology is dominated by Rollups, with Optimistic Rollup occupying a dominant position. Currently, Arbitrum and Optimism in Optimistic Rollup account for 74.7% of the Total Value Locked (TVL) of all Rollup-type Layer 2 public chains, and the ecosystem protocols, projects, and tools account for as high as 66.8%. It can even be said that Arbitrum and Optimism are the absolute core of Layer 2 public chains.

In 2023, Rollup-type Layer 2 showed epic growth, with its TVL soaring from $4.44 billion at the beginning of the year to $17.84 billion today. Compared to Optimistic Rollup, ZK Rollup clearly suffered a setback in 2023. Representative projects zkSync and Starknet did not formulate a clear token deployment plan in 2023, and faced multiple issues in terms of compatibility with the Ethereum Virtual Machine (EVM). These challenges caused ZK Rollup's market share to lag far behind Optimistic Rollup.

Although ZK Rollup technology has the advantages of high security and mathematical verification, it still needs to overcome multiple challenges in practical application and widespread adoption. With the launch of Starknet's airdrop plan and the increasing maturity of zkSync's EVM compatibility, we are optimistic about the development of ZK Rollup.

Figure 3: Layer 2 TVL

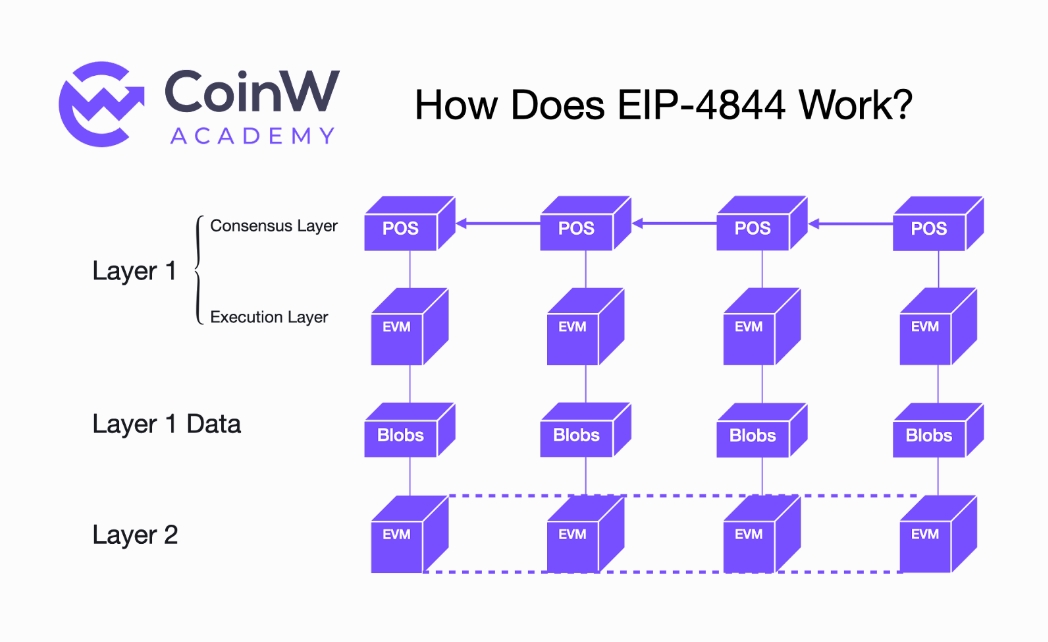

Cancun Upgrade and EIP-4844

The Cancun upgrade is an additional improvement to Ethereum (ETH) after the Shanghai upgrade, mainly including the much-anticipated EIP-4844. EIP-4844 introduces a new transaction type, Blob, which moves transaction data to a temporary "blob" storage, achieving low storage costs. This upgrade aims to increase the speed of Ethereum Layer 2, with claims that it could increase it by 10 times or even 100 times, while significantly reducing costs.

The target launch time for the Cancun upgrade is early 2024, and the current test network Devnet is actively conducting testing to ensure the smooth deployment of the Cancun upgrade. This upgrade will greatly stimulate the development of the Layer 2 ecosystem. In the past, the vast majority of the transaction costs paid by users of Layer 2 Rollups were due to data storage. The implementation of EIP-4844 will reduce the transaction costs of Layer 2 by an order of magnitude, making the cost of each transaction several times cheaper. This will drive lower transaction costs and better trading experiences, potentially giving rise to more application scenarios. We believe that the Cancun upgrade will be an important turning point in the development of Ethereum Layer 2.

Figure 4: Illustration of EIP-4844

Renaissance of the Bitcoin Ecosystem

In the development of the Bitcoin ecosystem, various methods have been explored to stimulate its vitality, whether it's off-chain verification, the Lightning Network, or forks caused by a certain divergence. Unexpectedly, the Ordinals protocol, or "engraving" as it's known, has become a catalyst for awakening the Bitcoin ecosystem.

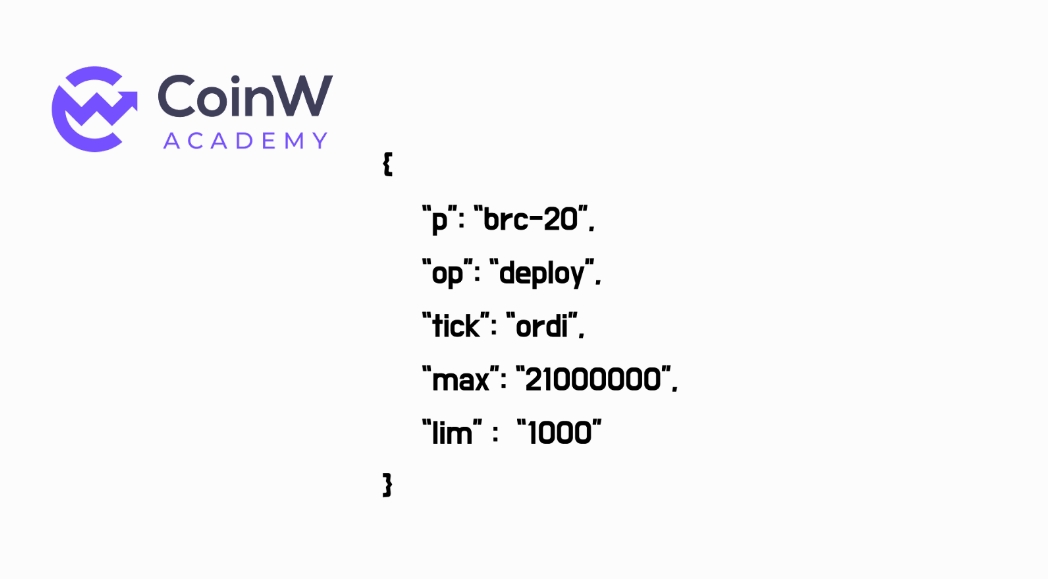

Fair Launch, a New Way of Issuing Cryptographic Assets

In the past, the traditional token issuance model was often limited to investment from VC institutions, developed by the project party, and eventually distributed to early investors as a way of return. This method often left ordinary investors only able to participate in secondary market investments. This token issuance method often shrouded in a "black box," with unfair token distribution and lack of transparency in information. Large investment institutions often enjoyed more "investment privileges," sometimes even engaging in behaviors such as early token unlocking or hidden token unlocking, which contradicted the promises of token economics in the white paper.

Fair Launch has disrupted the traditional token issuance model in decentralized crypto networks. It gives the earning, ownership, and management power of tokens to the community, ensuring that everyone has the opportunity to participate from the beginning. The core idea of Fair Launch is to prevent early access, pre-mining, or unfair token distribution.

Bitcoin (BTC) is considered one of the earliest Fair Launch tokens. Anyone can obtain tokens by providing computing power to the Bitcoin network. Today, this tradition has extended from Bitcoin to the Bitcoin ecosystem token BRC-20. Fair Launch makes token distribution more inclusive, allowing the community to participate in token creation and operation in a fair and transparent manner.

Figure 5: ORDI Deployment Code

In the crypto market, the popularity of cryptocurrency assets like ORDI and SATS is due to various reasons. The popularity of these BRC-20 tokens has sparked imitation from other public chain networks and even attracted many blockchain networks that support smart contracts to join this "Renaissance."

However, it is worth acknowledging that BRC-20 tokens still have some limitations. One significant issue is that they are subject to third-party indexing systems, leading to the entry of many counterfeit coins into the market, as seen with the recent appearance of a counterfeit SATS token. This token was used by hackers to fraudulently exploit the TS hyphen and successfully bypass the detection of the indexing system, being listed on the DEX market. This exposed some weaknesses in the indexing verification and filtering of BRC-20 tokens.

Figure 6: ORDI Price Trend in 2023

The prosperity of the inscription market has brought endless controversy. Due to the inherent issues in the BTC network, high gas fees and abnormal congestion on the chain have been widely criticized. Frequent BRC-20 token transactions have led to a surge in gas fees on the BTC network, with gas fees even soaring to 300 sat/vb at one point, especially during the concentrated minting of popular token products. This situation has been welcomed by Bitcoin miners, and some believe that miners are the driving force behind the prosperity of the Bitcoin ecosystem.

At the same time, these issues have caused dissatisfaction among many Bitcoin purists. On December 6, 2023, Luke Dashjr, a developer of Bitcoin Core, pointed out that Bitcoin inscriptions were using a vulnerability in Bitcoin Core to attack the Bitcoin blockchain. This "garbage" data left on the Bitcoin chain has caused network congestion. Luke Dashjr hopes to finally fix this issue before the release of version 27 in 2024, fundamentally addressing the hazards brought by inscriptions.

However, it is evident that the profits and popularity brought by the inscription market have united the majority of node maintainers and miners. We believe that the market has its own rules and patterns. As a representative of decentralization, it is difficult for developers to act unilaterally. The market and users will make the right choices. Diverse development will become the main theme of the BRC20 market and even more blockchain network ecosystems and their tokens.

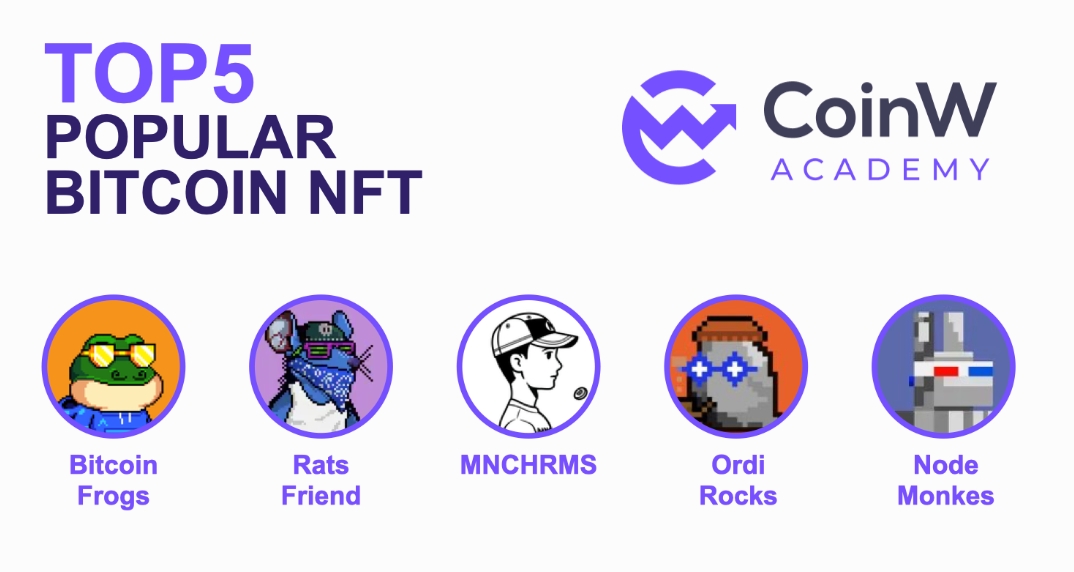

True Digital Collectibles—Bitcoin NFT

When the Ordinals protocol first appeared, Bitcoin NFTs were the earliest application instance. Bitcoin Punks, based on the Bitcoin mainnet Ordinals protocol, was minted on February 9, 2023, at 15:00, with a total of 10,000. Although it imitated the well-known blue-chip NFT project Crypto Punk on Ethereum, it still sparked widespread speculation and discussion. Subsequently, Bitcoin Ape was also replicated on the Bitcoin network in a 1:1 format. People began to realize that even though the Bitcoin blockchain cannot create smart contracts, it can still have NFTs.

Elon Musk once stated on the "Joe Rogan Experience" that many NFTs are not fully stored on the chain, and some people's NFTs are stored on external servers, which could pose a risk to the holders. In other words, he believes that NFTs on Ethereum and other EVM-based public chains are not "true NFTs," as these NFTs only upload metadata to the chain, while the actual data such as images is stored on centralized external servers.

This viewpoint provides new evidence for the development path of Bitcoin NFTs, as NFTs on the Bitcoin blockchain are truly engraved on the chain. This feature is considered "true NFTs."

Yuga Labs, focused on the NFT market, launched the first NFT collection on the Bitcoin network, TwelveFold, which is Yuga Labs' first NFT collection on the Bitcoin network. Subsequently, more and more institutions began to pay attention to the potential of the Bitcoin NFT market, and the market also experienced epic growth.

The first blue-chip project "Bitcoin Frogs" ignited the NFT market. As one of the earliest 10K NFTs, the value of Bitcoin Frogs quickly soared, and its floor price has now reached 0.28 BTC. The Bitcoin NFT market has also seen many original artworks that fully utilize the characteristics of the Bitcoin blockchain, such as MNCHRMS' work, which perfectly embodies the concept of simplicity and eternity in Bitcoin with its black and white colors.

Figure 7: Popular Bitcoin NFTs

As of now, the sales of Bitcoin NFTs on-chain have reached $1.83 billion, ranking third in NFT sales, only behind Ethereum ($42.12 billion) and Solana ($4.62 billion). The potential of the Bitcoin NFT market is still waiting to be further explored.

The Heir of Memes, DRC-20

Dogecoin was initially seen as a clone of Bitcoin, known for its humorous nature and meme-like attributes, and gained worldwide popularity, becoming the well-deserved "king of memes." With the wild growth of BRC-20 ecosystem tokens in the cryptocurrency market, in order to explore more possibilities and the potential prospects of meme culture in the inscription market, DRC-20 emerged.

The Ordinals protocol plays a crucial role in the BRC20 ecosystem, and Cardinals is the biggest boost to the DRC20 ecosystem, defining the smallest indivisible unit in Dogecoin—"elon." In the Dogecoin system, 1 Dogecoin equals 100 million elons. Each elon is sequentially numbered based on the order of mining, starting from 0. These numbers are called "cardinals," representing the sequence of each elon in the total supply.

The DRC-20 standard not only brings new development prospects to Dogecoin but also represents an interesting and creative change to the traditional cryptocurrency paradigm. By introducing Cardinals, the Dogecoin community has established a unique connection between memes and cryptocurrencies, laying a solid foundation for the future development of DRC-20 tokens.

We believe that in the era when the Fair Launch model is popular, Memecoins have inherent advantages. In addition to the Bitcoin ecosystem led by BRC20, the Dogecoin ecosystem led by DRC20 should not be underestimated in the future.

DeFi, Returning to the Financial Essence of Cryptocurrencies

At the end of 2022, the Lehman moment of FTX cast a shadow over centralized exchanges (CEX), prompting users to urgently focus on how to securely handle their crypto assets. Compared to the era of DeFi innovation in 2021 and the financial opportunities brought by DeFi Summer, the main theme of the DeFi industry in 2023 has shown a stable development trend. This can be seen from the total locked value (TVL) of all DeFi projects. Compared to the total market value of the cryptocurrency market, which grew by 205.89% throughout the year, the total locked value of DeFi projects only increased by 51.04%.

Figure 8: DeFi TVL

Currently, the heat in the DeFi sector is mainly focused on liquidity mining, lending protocols, cross-chain bridges, decentralized exchanges, stablecoins, and Real World Assets (RWA) protocols. Protocol revenue has become an important indicator for measuring the value of DeFi projects.

Since 2022, Maker has gradually been purchasing US Treasury bonds to benefit from rising interest rates. In 2023, the Federal Reserve raised interest rates by 25 basis points four times and maintained rates four times. Maker, as one of the beneficiaries, ranked first in DeFi project revenue with a revenue of $95.91 million.

Benefiting from the successful implementation of the Shanghai upgrade and the vigorous development of the LSD track, Lido ranked second with a revenue of $55.79 million. The overview of the LSD track was mentioned earlier and will not be repeated here. Following closely is PancakeSwap, ranking third with a revenue of $52.31 million; the fourth is the asset management protocol Convex Finance, with a revenue of $42.23 million; and the fifth is the decentralized perpetual swap exchange GMX, with a revenue of $37.52 million.

Figure 9: 2023 DeFi Protocol Revenue Rankings

In the distribution of DeFi protocols on public chains, Ethereum is undoubtedly the leader. Ethereum has 2363 DeFi protocols on-chain, with a total locked value (TVL) of up to $33.298 billion. Tron comes next, with just over 20 protocols, but its TVL of $8 billion still puts it in a leading position.

Of particular note is Solana, which has seen a staggering 98.98% growth in TVL in the past month. We will continue to monitor Solana and look forward to its future development.

How are Real World Assets (RWA) Tokenized?

We have noticed that Real World Assets (RWA) is one of the hottest tracks this year. Many established DeFi projects have entered the field, but the overall market is still in its early stages. Constrained by the current needs of traditional finance and regulatory institutions for compliant development of cryptocurrencies, RWA seems to be a good topic. Well-known Wall Street institutions such as BlackRock and JPMorgan believe that RWA will be a trillion-dollar market.

In 2023, many RWA projects made substantial breakthroughs and progress. MakerDAO is one of the earliest protocols in the DeFi field to adopt RWA. As early as 2020, it began to incorporate RWA into its strategic planning to expand the issuance of the DAI stablecoin. DAI, as a stablecoin pegged to the US dollar, is one of the most common applications of MakerDAO.

The protocol has established multiple RWA vaults, mainly using US Treasury bonds as collateral. Especially in the current downturn of the DeFi industry as a whole, MakerDAO has further expanded its layout in RWA, especially in US Treasury bond investments. In 2023, the platform continued to expand the scope of RWA, including a partnership with Coinbase to open real asset vaults through its custody service and inject up to $500 million USDC stablecoins, paying 2.6% annual interest. MakerDAO also purchased and invested heavily in US Treasury bonds through RWA vaults. By more effectively allocating assets to government bonds and investment-grade bonds and increasing fees charged to DAI borrowers, MakerDAO's revenue has significantly increased. As mentioned earlier, Maker, as the biggest beneficiary of purchasing US Treasury bonds, ranked first in DeFi project revenue with a revenue of $95.91 million.

In addition to MakerDAO, Compound is also one of the leaders in the RWA track. Compound announced the establishment of a new company, Superstate, focused on on-chain bonds. The fund of Superstate will invest in "ultra-short-term government securities," including US Treasury bonds and securities.

When it comes to Real World Assets (RWA), most projects currently focus on investments in US Treasury bonds and securities. However, many projects are also making unremitting efforts in exploring on-chain lending, synthetic assets, on-chain real estate, carbon trading, and other real-world collectible trading. We believe that with the compliant development of the blockchain industry, the RWA track in 2024 will create even greater market value. With continuous innovation, more creative new types of on-chain assets are also expected to emerge.

X to Earn

X To Earn has been hailed as the perfect integration of Web2 and Web3, attracting the attention of major investment institutions. This model originally originated from early DeFi staking projects, namely Stake to Earn, which allows users to earn staking rewards by staking tokens. With the continuous development of the cryptocurrency market, this model has been applied to more and more fields.

The "X" in X to Earn usually represents the application scenario of the project, while "to Earn" indicates its profit model. This model has penetrated into all aspects of life, with gaming being one of the best points of integration. The blockchain game Axie Infinity first proposed the concept of Play to Earn, and gameplay, token economics, and the NFT market revolve around the Play to Earn model. Since then, more and more concepts have begun to introduce the idea of X to Earn and the corresponding asset issuance methods.

In 2023, a large number of X to Earn projects emerged, with Play to Earn and Social to Earn being the most prominent. These projects have extended and developed many mature economic models and financial systems, namely what we know as GameFi and SocialFi.

GameFi

Decentralized application technology is becoming increasingly mature, and NFT application scenarios on major public chains continue to expand, leading to explosive growth in the GameFi market. According to the Global Games Market Report published by GameIndustry.biz, the total revenue of the global games market is approximately $184 billion. This huge market has attracted the attention of numerous investment institutions and game developers, who are beginning to explore the integration with Web3 technology, and even many Web2 games are attempting blockchain transformation.

Traditional game developers typically rely on unique game content and excellent game experiences to attract players to pay. GameFi operates in a completely different way, first establishing a complete token economic system and attracting players to participate in the game by allowing them to earn income through gameplay (Play to Earn). Countless Web3 game developers are exploring this path, but attracting new users has become a challenge. They rely on the performance, fees, and convenience of transactions on public chains. At the same time, limited by costs and talent shortages, the lack of game experience is also a significant issue. However, games are still an ideal entry point into the Web3 world. We expect that in the future, GameFi will grow into a market worth tens of billions of dollars.

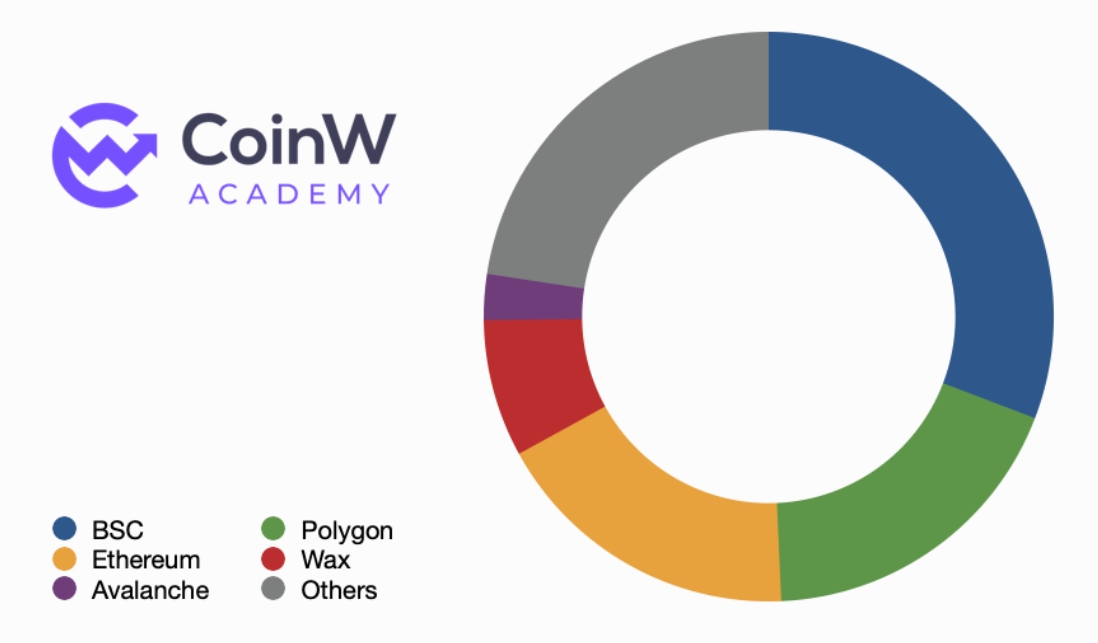

Figure 10: GameFi Public Chain Distribution

So far, there are over 2700 games active on the blockchain, and the GameFi market value has reached $8.56 billion, with over 1.23 million daily active players. Among these games, 30.8% run on the BSC chain, 18.5% on Polygon, and 17.7% on Ethereum, with these three accounting for the vast majority of GameFi market share.

It is worth noting that many emerging blockchain games are active on Arbitrum, such as the recent popular xPET. xPET is a pet-raising game based on the extension program embedded in X, where pets can engage in activities such as Twitter companionship, farming, adventures, PVE, and ultimately generate token income. Players can upgrade their pets by consuming tokens, thereby expanding related earnings. This combination of GameFi and SocialFi is a new attempt, using existing social networks to expand pet games, which may be a breakthrough for GameFi to attract new users.

SocialFi

The discussion of SocialFi mainly focuses on two core aspects: first, establishing a decentralized social media model, and second, building viable economic models to support these platforms. In this field, many projects have explored different angles. For example, Lens Protocol has established a fully decentralized social application, and FriendTech has achieved success in the economic model.

However, an effective way to effectively combine these two key points has not been found, leading to the rapid rise and subsequent decline of many SocialFi projects. For example, FriendTech is a decentralized social application that integrates financial engineering. The application provides a chat room that allows users to purchase keys to access the internal group chats of Twitter KOLs or others. The price of the keys fluctuates with market demand, with the platform charging a 10% fee shared with the chat room creator.

This economic model quickly attracted many influential individuals on social media to join. Their fans were willing to spend high fees to purchase keys in order to access exclusive information. However, as the enthusiasm of these influencers waned, coupled with the platform's lack of effective methods to maintain activity and the continuous rise in key prices, this social experiment ultimately led to a complete failure.

Outlook for 2024

Welcoming 2024, CoinW Academy will continue to conduct in-depth research on the cryptocurrency and blockchain industry, committed to providing richer and higher-quality research content. We are confident in the future of the cryptocurrency and blockchain industry and believe that the prospects for future development will be remarkable. The following are the areas we are focusing on and expect to see significant progress in 2024:

The revival of DeFi (Decentralized Finance): With the continuous development of DeFi and in line with the global trend of regulatory compliance in the cryptocurrency market, we expect to witness the emergence of more compliant decentralized financial products and services, as well as more robust governance models and efficient liquidity solutions. Additionally, traditional financial institutions' cryptocurrency wealth management products may also emerge, benefiting more funds, marking the forefront of the revival of DeFi.

Bitcoin Inscription Market: Bitcoin and other public chain inscriptions will continue to see innovation. Despite the limitations of the inscription indexing mechanism and current immature technology, hacker attacks and unknown vulnerabilities may impact the inscription industry, but the development and exploration of more underlying infrastructure will also drive the development of this field. In addition to tokenized inscriptions, image NFT-type inscriptions will also become an important research direction.

Fair Launch: Fair launch assets became the hottest asset issuance method in 2023, attracting a large number of new participants. As the cryptocurrency field gradually integrates into regulatory frameworks, the fair launch token issuance method is gradually gaining more recognition and acceptance from mainstream institutions. The legitimacy of fair and equitable token issuance is receiving attention and recognition, and this trend is expected to continue to expand in 2024. We expect fair launch assets to continue to expand their influence, becoming the mainstream token issuance method and potentially extending to more asset types.

RWA: With the advancement of spot Bitcoin ETFs, more and more traditional financial institutions' funds are expected to enter the cryptocurrency industry. Existing decentralized financial projects in the cryptocurrency industry will continue to integrate more real-world assets (RWA) and expand into more categories of real-world assets, especially projects and applications that align with blockchain concepts such as carbon neutrality, real estate, and securities.

GameFi: Games are an important bridge connecting traditional internet (Web2) and Web3, and games are also an important entry point for attracting new users. In 2024, we expect to see more exclusive public chain projects dedicated to games, and more blockchain-transformed games joining the ranks of blockchain. More games that integrate social elements will combine SocialFi and GameFi, addressing pain points and eliminating weaknesses, making efforts to improve game quality and user growth.

Non-EVM Public Chains: This will be an era of diversity, with more public chain projects no longer limited to the Ethereum Virtual Machine. Research and development of non-EVM high-performance public chains will yield more valuable results. Additionally, cross-chain bridges and interoperability among various chains will be important research topics, and more modular blockchain and application chains will also appear in the market, awaiting user validation.

Layer 2: The highly anticipated airdrops of Starknet and zkSync will be the focus of the Layer 2 track in 2024. The performance improvements brought to many Layer 2 public chains after the Cancun upgrade should not be underestimated, and a diverse range of dapps and low-cost high-quality on-chain interactions will soon become possible.

CoinW Academy will continue to monitor the development of these areas and maintain close contact with industry experts, scholars, and developers to provide timely and accurate information and insights to learners. In this ever-changing field, we believe that knowledge and understanding will be the key to success. Therefore, let us look forward together and work hard to shape a bright future for the cryptocurrency and blockchain industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。