Before the dust settles on the ETF, as long as the market sentiment and trend have not completely reversed, this "flash crash" may still be attributed to the category of "bull market rapid decline."

By Frank, Foresight News

January 3, 2024, is the 15th birthday of Bitcoin - on January 3, 2009 (January 4, Beijing time), Satoshi Nakamoto mined the first block of the Bitcoin network on a small server in Helsinki, Finland, and received the first batch of 50 bitcoins as a mining reward.

But the market seems to celebrate with a flash crash. Starting from 17:00 today, Bitcoin has successively fallen below the integer thresholds of 45,000 USDT and 44,000 USDT (OKX market data), and has continued to accelerate, quickly turning into a rapid decline, reaching a low of 40,157.3 USDT, with a drop of over 10% in 24 hours.

At the same time, ETH also dropped from around 2,380 USDT to 2,051.76 USDT, and altcoins saw a snowball effect of 20% declines. Coinglass data shows that in the past hour, the entire network has liquidated 489 million US dollars, with long positions accounting for 466 million US dollars, exceeding 95%, setting a record for liquidation since "8·18," completing a violent deleveraging process (recommended reading "Why did the market crash? The amount of liquidation is catching up with 3·12 and 5·19").

Against the backdrop of the imminent key point of the spot Bitcoin ETF, this market flash crash has made the originally optimistic market expectations even more confusing.

Reasons for the sharp decline

To briefly summarize the possible reasons for this sharp decline, it should mainly be divided into two dimensions, including external factors such as the sluggish performance of the US stock market and the change in the Fed's interest rate cut expectations, and internal factors such as the intensified fund game of ETF and the continuous bleeding of long positions.

US stocks experienced a "black opening" in 2024, and crypto stocks were sold off

On January 2, the first trading day of 2024, the tech-heavy Nasdaq index fell by 1.63%, marking the largest decline in over two months, directly wiping out all gains since December 15, 2023, with Apple falling by 3.6%, marking its largest decline since August 4, 2023.

The S&P also closed with a 0.57% decline, similarly wiping out all gains since December 15, 2023, while the Dow Jones index almost closed flat (+0.07%).

Cryptocurrency-related stocks also experienced a pullback, with Coinbase's stock price closing down by 9.8%, marking its worst single-day performance since June last year, and it has been declining for two consecutive trading days.

Cryptocurrency mining companies also saw significant declines: Bitdeer and Bit Digital fell by over 9.9%, Canaan ADR fell by about 6.5%, Hut 8 fell by over 5.5%, Bakkt fell by over 4.9%, Hive Digital fell by about 3.1%, presenting a gloomy picture.

Changes in the Fed's interest rate cut expectations in 2024

In addition, the expectations of Fed fund futures traders for a rate cut by the Fed have also begun to waver. According to the latest estimates, the Fed is expected to cut interest rates 5-7 times in 2024, but they have slightly lowered their expectations for the first rate cut in March:

The likelihood of implementing loose policies in March has decreased from 85% last week to 75%, while reducing bets on the magnitude of the rate cut, expecting the cumulative rate cut for the year not to exceed 150 basis points.

At the same time, the "big three" of the Fed, New York Fed President Williams, led the way in pouring cold water on the rate cut expectations, stating that there is currently no real discussion of a rate cut, and if necessary, the Fed must be prepared to raise rates again. Subsequently, several high-ranking officials, including Cleveland Fed President Mester, Chicago Fed President Gülsün, and San Francisco Fed President Daly, joined the "hawkish camp."

In addition, tonight at 21:30, the Fed's Powell will speak on the economic outlook, and tomorrow at 3:00, the Fed will also release the minutes of the December FOMC monetary policy meeting.

This week also marks a period of intensive release of a series of financial-related data in the United States, including tonight's ISM Manufacturing Index, the Labor Department's Job Openings and Labor Turnover Survey (JOLTS), as well as Thursday's initial jobless claims and Friday's ISM Services Index and non-farm employment data, among others.

In this context, some funds will inevitably make some position adjustments for risk aversion reasons.

Intensified fund game of ETF

In addition, January 3/4 and January 10-17 have been the two main time points for many fund games, which has led to a continuous escalation of the fund game around these time points.

Whether the US SEC ultimately decides to reject or approve the ETF, there will undoubtedly be a large-scale liquidation in the market, which means that any slight movement will be infinitely magnified and become a multiplier of market volatility - just before this round of decline, Matrixport, which has been aggressively bullish for months, kindly warned of the risk and released a market report titled "Why the US SEC will reject Bitcoin spot ETF again."

When the market becomes deadlocked and doubts deepen, funds that entered the market in the first six months will undoubtedly choose to take profits as the time approaches, leading to particularly intense reshuffling during this period.

Continuous bleeding of long positions

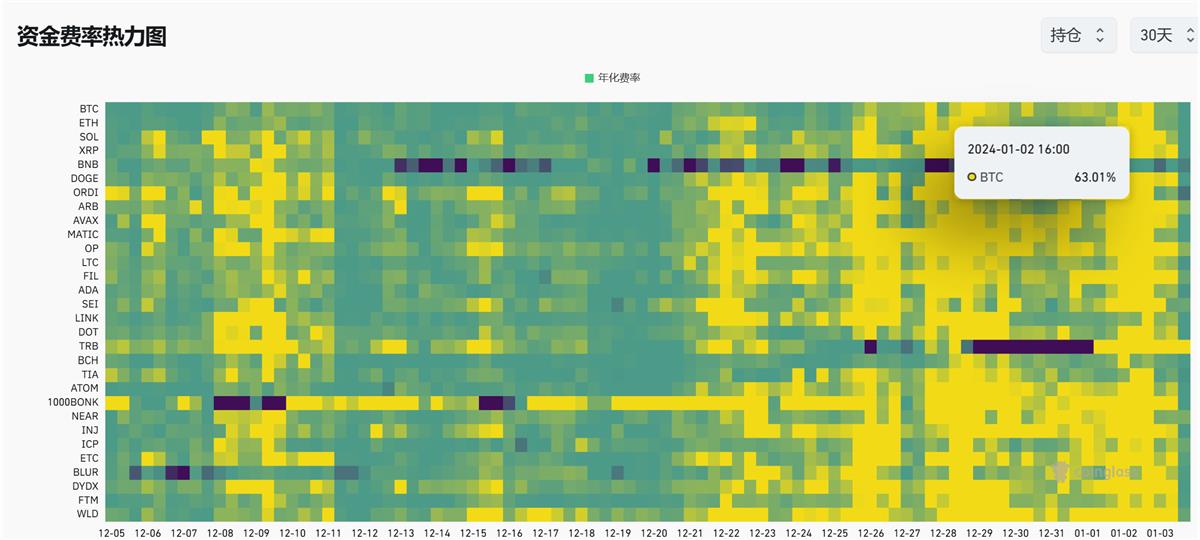

It is worth noting that the perpetual contract funding rates for BTC and ETH have been above an annualized 30% since December 25, with long positions continuously paying out a significant funding fee equivalent to an annualized 30% (recommended reading "What are the trading signals hidden behind the key points of the ETF?").

Especially starting today (January 2, 00:00), the funding rates have both exceeded an annualized 50%, even reaching a high of 65% at one point, which means that long positions are subsidizing short positions heavily every day, continuously bleeding.

As time goes on, the likelihood of the ETF being approved this week is getting lower, and the upward momentum cannot break through. This will cause long positions that have been paying out large funding fees and firmly bullish to quickly close under pressure.

Once some long positions start to close and exit, it will trigger a domino effect, leading to a large-scale liquidation of leveraged positions - as was the case on December 9-10 (Saturday, Sunday) - long positions endured a cost of over 30% for several days, and with the price failing to break through over the weekend, it eventually led to a massive sell-off on Monday morning (recommended reading "Where will the 'Christmas market' go after the slaughter of long positions?").

Conclusion

However, as of the time of writing, Bitcoin has quickly rebounded to 42,000 USDT, and strong coins such as ARB and SEI have also quickly regained lost ground.

Overall, as long as the ETF expectation has not yet been finalized, as long as the market sentiment and trend have not completely reversed, this "flash crash" in the market may still be classified as a "rapid decline in a bull market."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。