ICYMI:

Oracle-based perp DEXes/lendings are always a subject to market manipulations. But there are ways to mitigate risks for LPers.

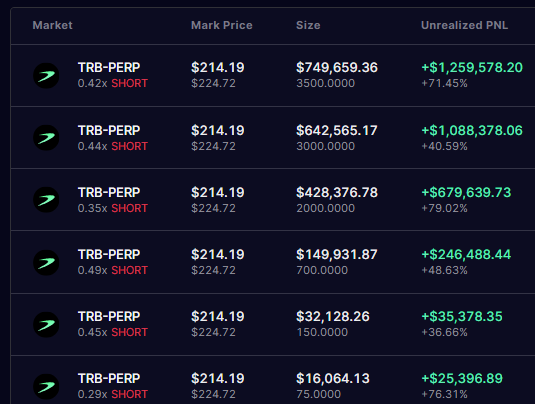

@synthetix_io $snx stakers lost $3.4M on $TRB shorts because the DAO did not properly set risk parameters (Spartan Council).

The "We live, we learn" approach will always be there as long as risk mitigation is in the hands of individuals (eg @adamscochran was responsible for safety parameters) and is not based on a math approach with an automated risk engine.

OI caps that were set on Synthetix are very inefficient, especially taking into account that they were denominated in $TRB but not in $ terms.

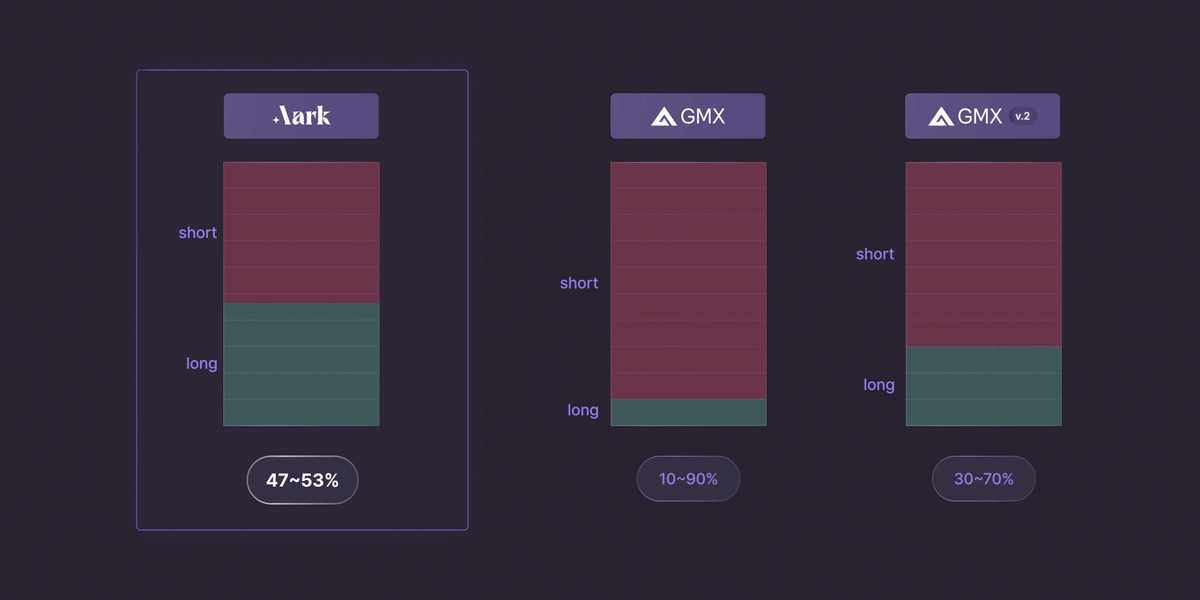

I prefer @Aark_Digital approach to implement a skewness cap rather than a cap on OI. It allows to scale OI while reducing risk for the LPs.

For example, a perp DEX with a $10m ETH OI cap without any skewness cap mechanism could easily have an 80:20 long-skewed OI balance, exposing the pool to a $6m short position.

However, with a $6m skewness cap, the protocol can scale the OI up to $100m, where the skewness is $6m ($53m long - $47m short). Although the pool is exposed to a $6m short position in both cases, the latter case only exposes 6% (6m/100m) of the OI, compared to 60% in the initial case.

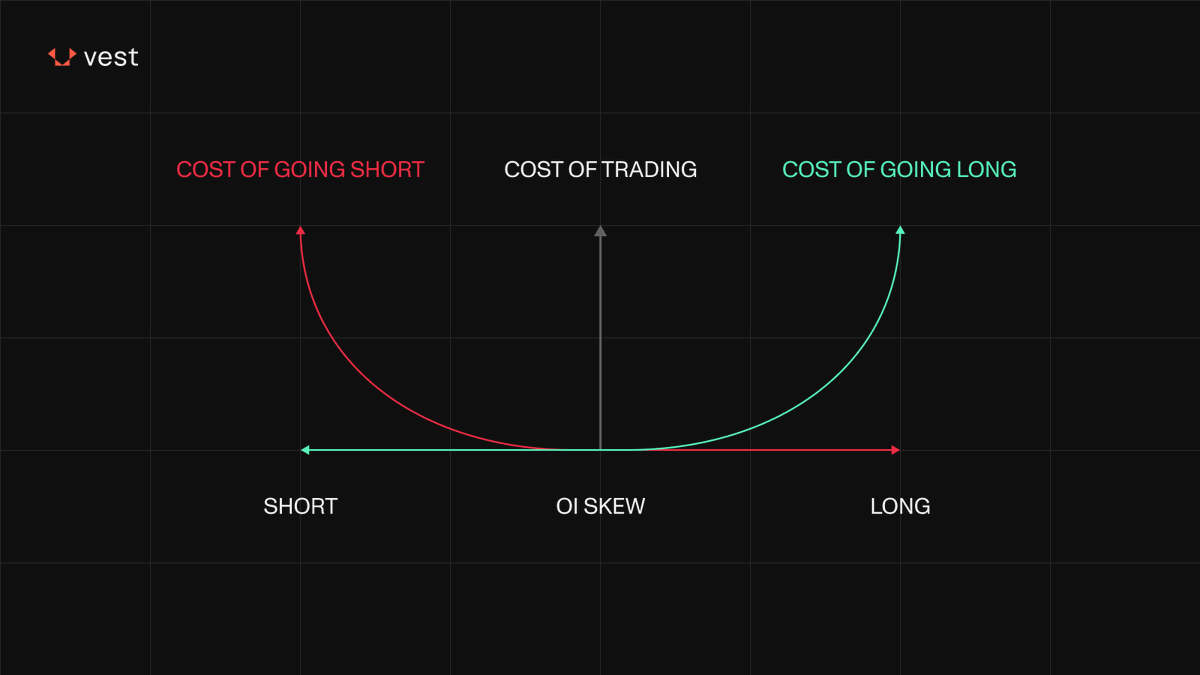

The @VestExchange AMM assigns a monetary risk measure, Entropic Value at Risk (EVaR), to any given trade. It uses a risk engine to dynamically affect the cost of trading based on the quantifiable risk metrics, removing the need for OI caps.

This allows the exchange to safely move past traditional OI caps and even scale OI past TVL without being at risk of insolvency.

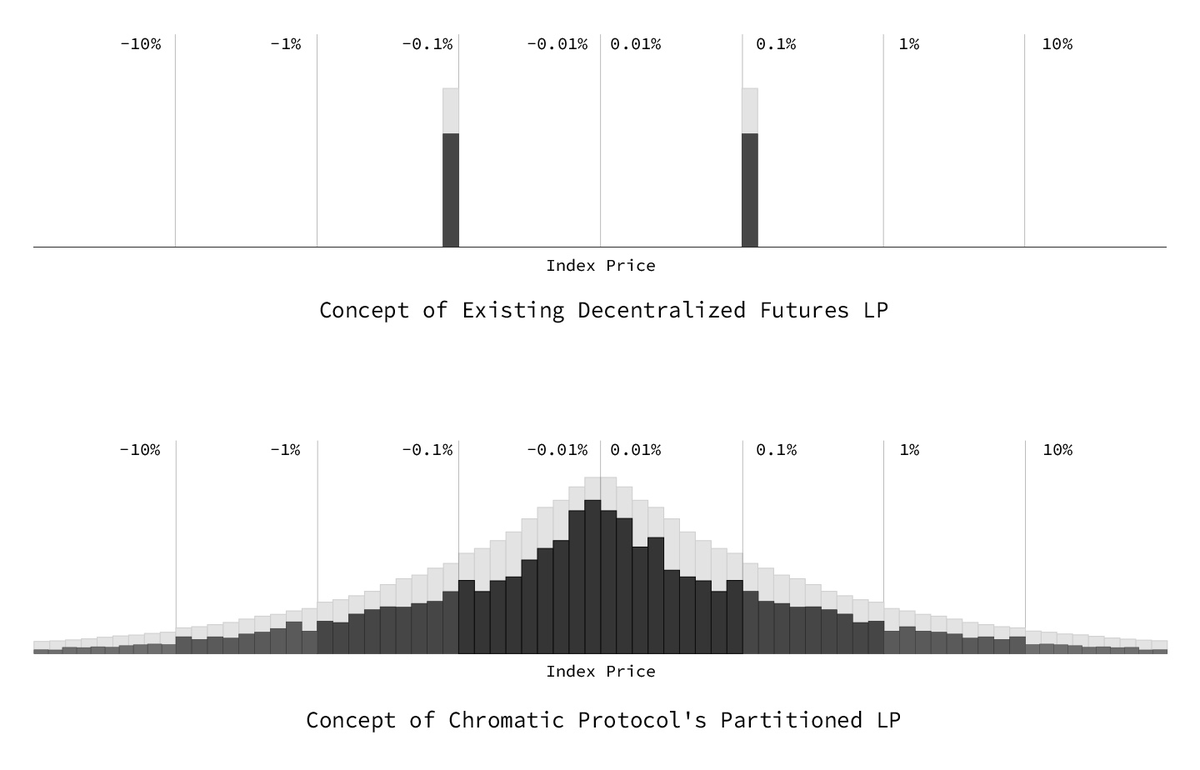

On @chromatic_perp all trades have a price impact based on the liquidity available in the liquidity bins rather than a price impact based on liquidity on CEXes, on OI, or no price impact at all.

On top of that, Chromatic has introduced a predefined TP/SL, that enables the execution of payoffs solely through smart contracts.

Perp DEXes with outdated designs such as fixed fees, OI caps, manual risk engines, etc will be replaced by projects that are ready to evolve fast in this highly competitive space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。