Recently, besides BTC continuously hitting new highs, the most eye-catching player in the coin circle is undoubtedly SOL! And there is a strong market sentiment that SOL may replace ETH as the second in the coin circle.

SOL has surged from less than $18 in September to today's $95 in just over three months, a more than 5x increase! What caused the explosive rise of SOL?

The founder of the well-known DeFi project MakerDAO, Rune Christensen, published an article titled "Exploring NewChain as a Solana Codebase Branch," in which he mentioned that Maker hopes to build its "final" stage infrastructure based on Solana and believes that Solana's technical stack is the most promising.

At that time, this caused quite a stir. Because of its praise for Solana over Ethereum (Maker is currently built on Ethereum), it was refuted by Ethereum's founder, Vitalik Buterin, forcing MakerDAO founder Rune Christensen to come out and apologize to Vitalik, saying a lot of conciliatory words. After the controversy gradually subsided, SOL began its soaring ascent.

Even the research institution Messari, which to a certain extent represents the mainstream opinion of Western crypto investment institutions, strongly expressed a bullish view on SOL and a bearish view on Ethereum in its year-end report.

Bullish momentum is justice! The focus of our article today is not to discuss whether SOL has the potential to replace ETH, and it is still too early to say that SOL will replace ETH. What we want to analyze today is whether the already surging SOL is worth chasing, whether there is still room for profit, and whether those who already hold it can continue to hold it. This is the most important thing.

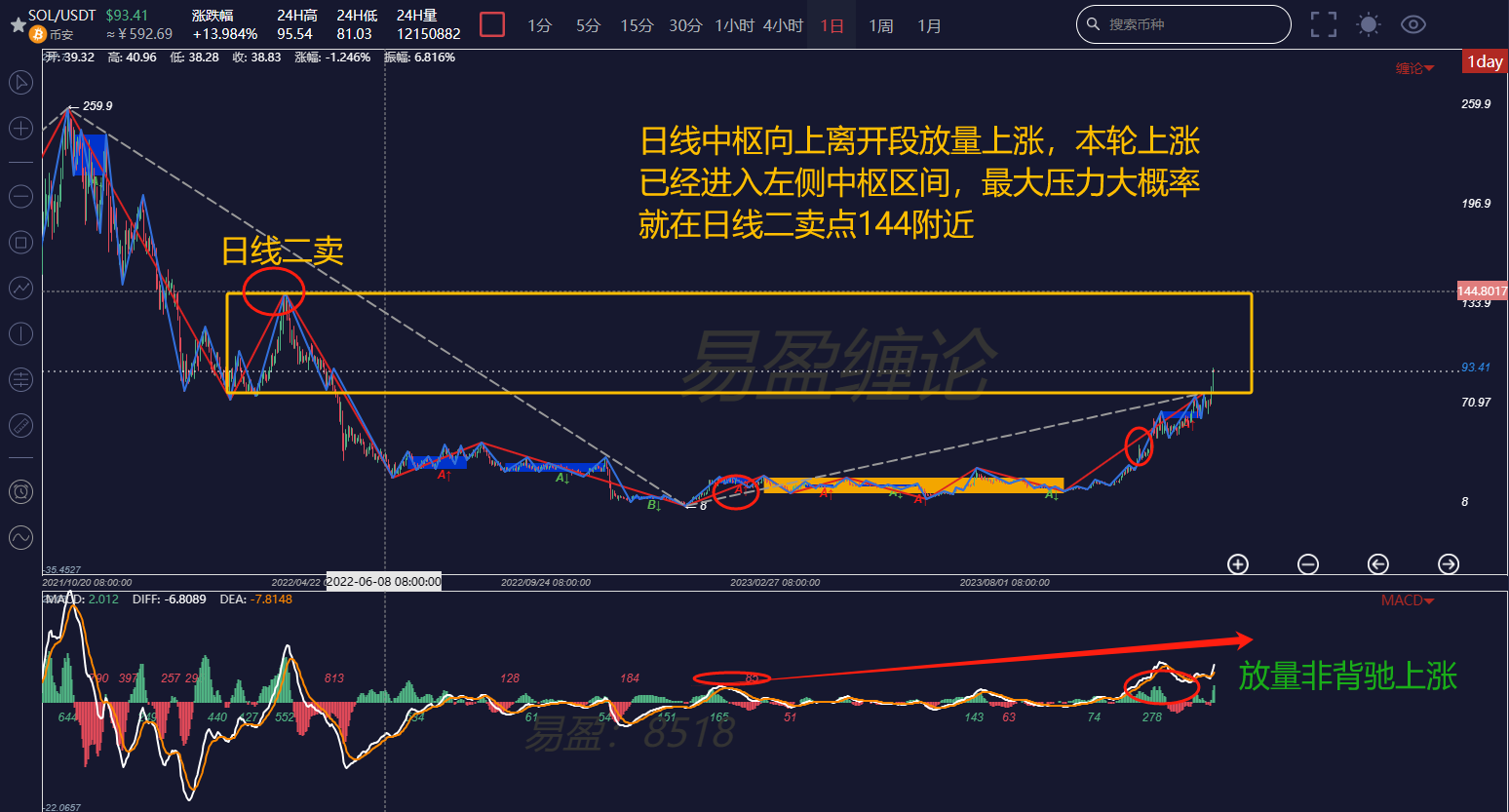

First, let's look at the daily chart. The daily center has moved up and is currently in a phase of volume-led rise, with no signs of the rise ending. If a pressure level must be given, the most important reference point is around the left daily line's second sell point at 144. As for whether it can reach that level, it depends on the evolution of the sub-level trend type. If the chips were acquired at a cost below 30, they can continue to be held, but for those with less cost advantage, it is recommended to reduce holdings at the sub-level sell point. As for whether to chase higher, it still depends on entering at the buy point. Blindly chasing higher is not recommended without a buy point.

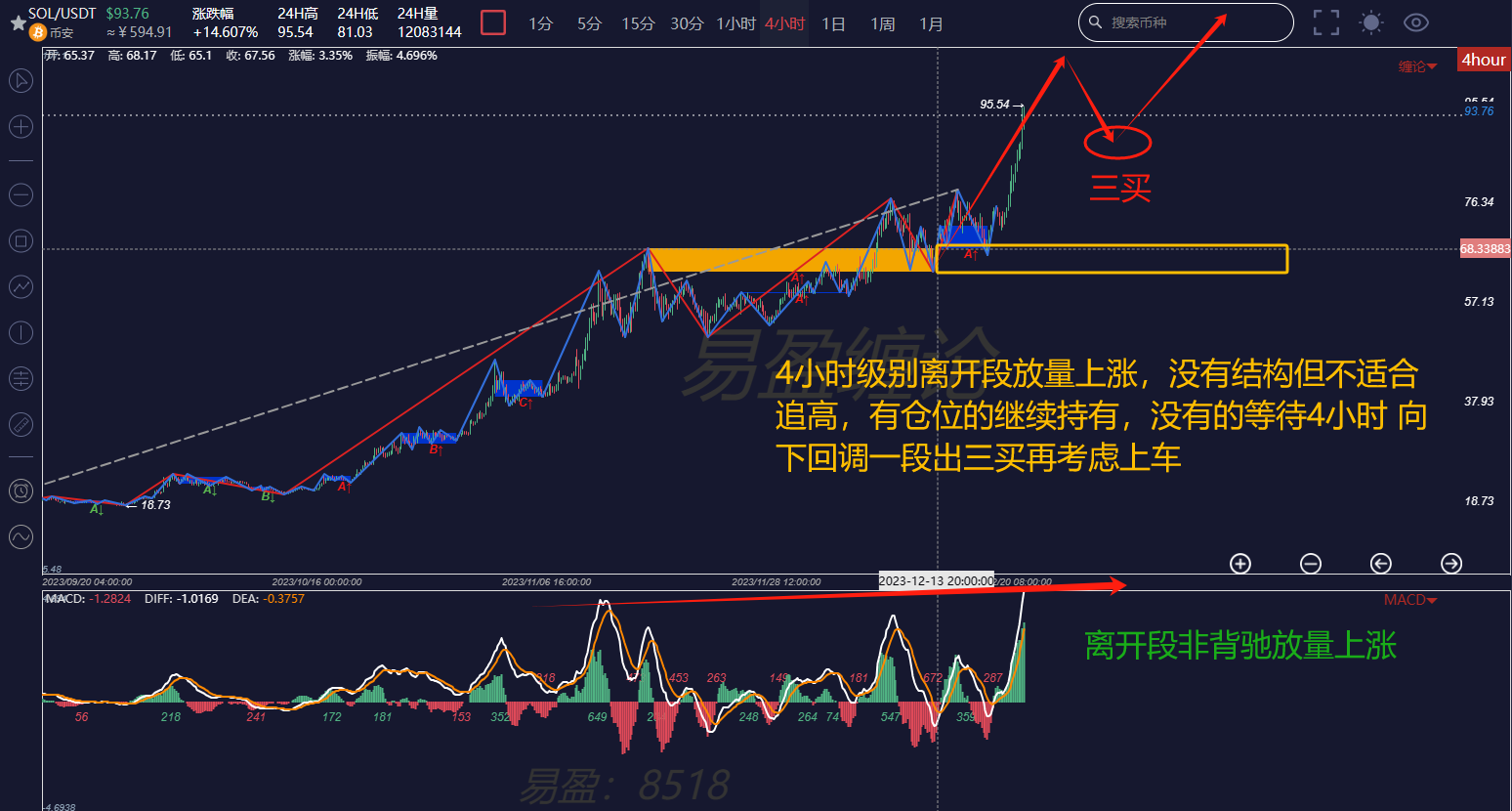

Next, let's look at the 4-hour chart. The 4-hour center has moved away with a strong volume-led rise, and no sell points have appeared. The rise will not end until there is no range-bound structure within the upward line segment. For those who have not entered, it is recommended to patiently wait for the end of the segment, wait for the downward pullback, and then enter after the third buy signal.

Finally, let's look at the 30-minute chart. After the third buy signal, there is a volume-led rise. A basic conclusion can be drawn: as long as a new center has not appeared in the 30-minute chart, the rise will not end.

If you are interested in the "缠论" (Chan's Theory) and want to obtain learning materials for free, watch public live broadcasts, participate in offline training camps, improve your trading skills with "缠论," and build your own trading system to achieve stable profitability, and use "缠论" technology to timely escape peaks and buy bottoms, you can scan the QR code to follow the public account and chat privately to obtain and add the WeChat group for learning!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。