DePIN is a perfect fit for the crypto track, combining decentralized physical infrastructure with blockchain technology and token economics.

Author: Biteye Core Contributor LouisWang

DePIN (Decentralised Physical Infrastructure Networks) is a decentralized physical infrastructure network that utilizes blockchain technology, allowing participants to deploy hardware devices without permission or trust to provide real-world services or digital resources. Its core lies in users obtaining returns by renting out services provided by hardware. According to Messrai, the entire track is currently valued at approximately $9 billion and is expected to grow to a scale of $35 trillion by 2028.

(Source: Messari)

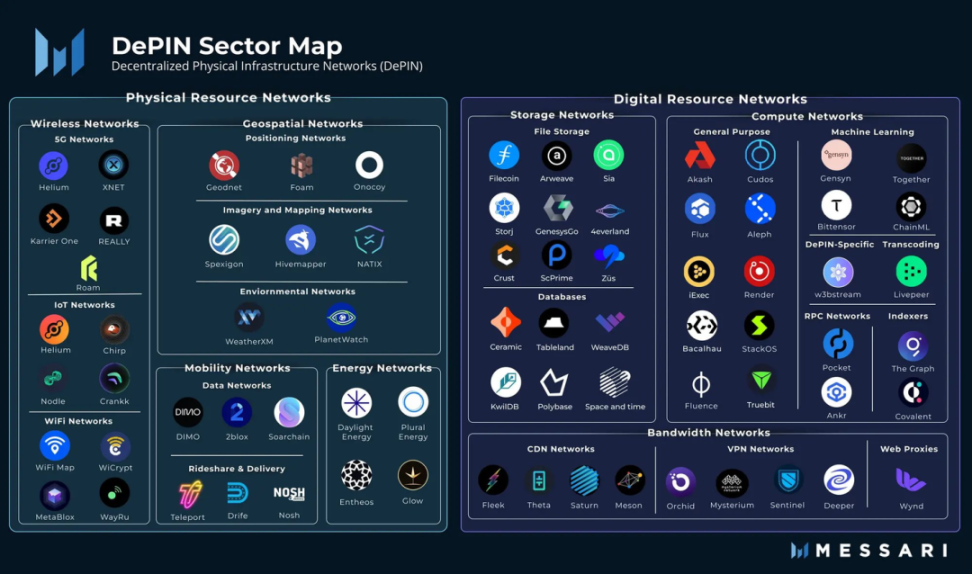

DePIN covers a wide range of areas and, according to Messari's classification, can be divided into two major categories: Physical Resource Networks (PRN) and Digital Resource Networks (DRN). Physical resources include wireless networks, geographic space networks, mobile networks, and energy networks; digital resources include data storage, computing power, and network bandwidth, with further subcategories in each area.

(Source: Messari)

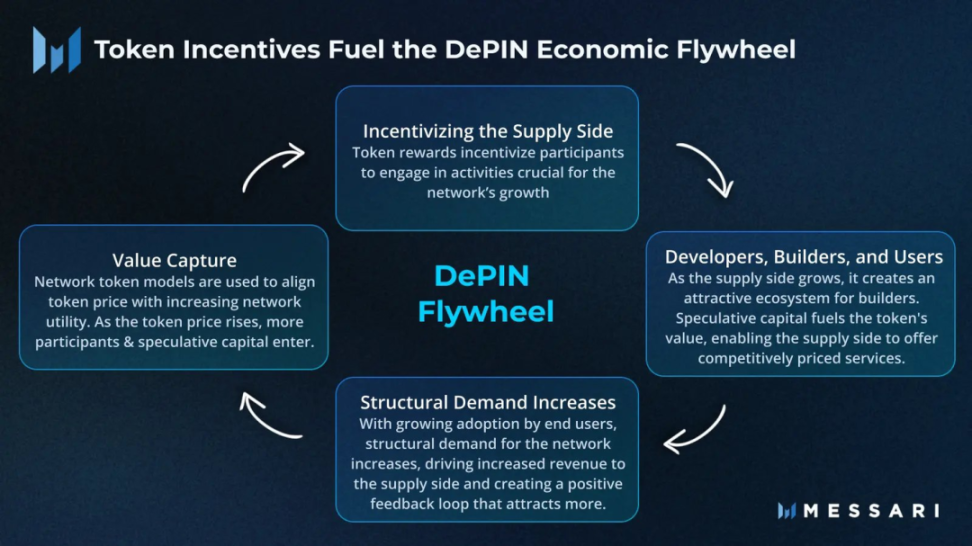

The basic flywheel logic of the DePIN track is to incentivize more supply-side participation through token economics. With sufficient resource supply, price competition will arise, and ample resources and good prices will promote demand, giving tokens value capture and better driving price increases, attracting more resource providers.

This article briefly introduces the projects in the DePIN track:

Render Network

Render Network is a blockchain-based distributed GPU rendering network platform launched by OTOY in 2017, aiming to connect more creators and idle GPUs to provide rendering assistance for movies and animated art. Compared to centralized cloud rendering, Render is an unlimited decentralized network that solves supply and demand issues, breaks the limitations of centralized storage, aggregates idle GPUs, and connects creators in need of additional GPU computing power to maximize resource utilization.

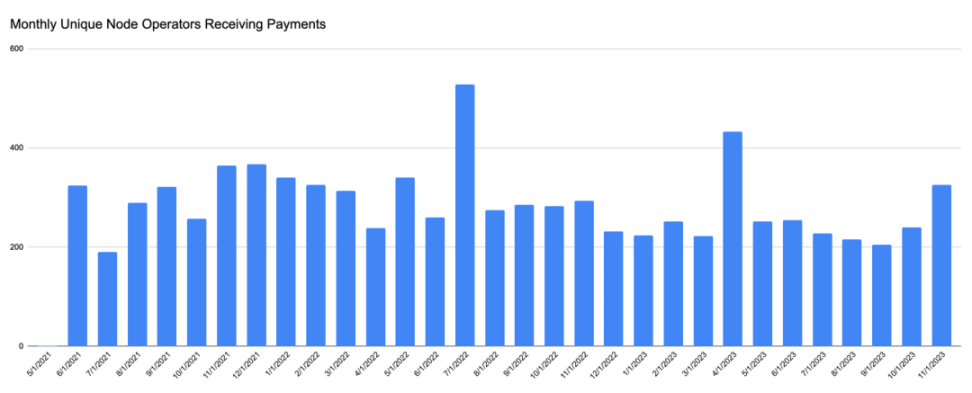

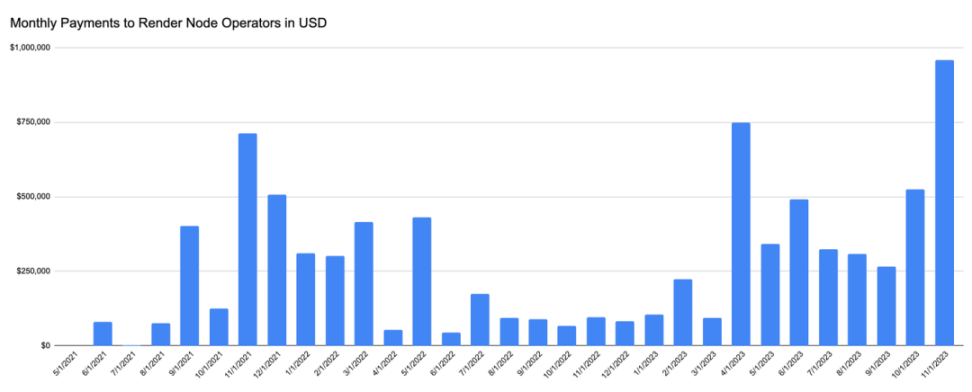

In simple terms, Render Network's business is to match computing power with artistic rendering needs. The computing power supply role is called a node operator, and this number has remained stable, with 326 Render node operators currently providing computing power.

(Source: https://twitter.com/ejwallach)

With the growth in rendering demand and the increase in RNDR prices, node operators received $958,000 in November, an 82% increase month-on-month and an 898% increase year-on-year. However, payments from OTOY to GPU nodes are usually significantly delayed, so the peak may reflect "catch-up" payments from previous months.

(Source: https://twitter.com/ejwallach)

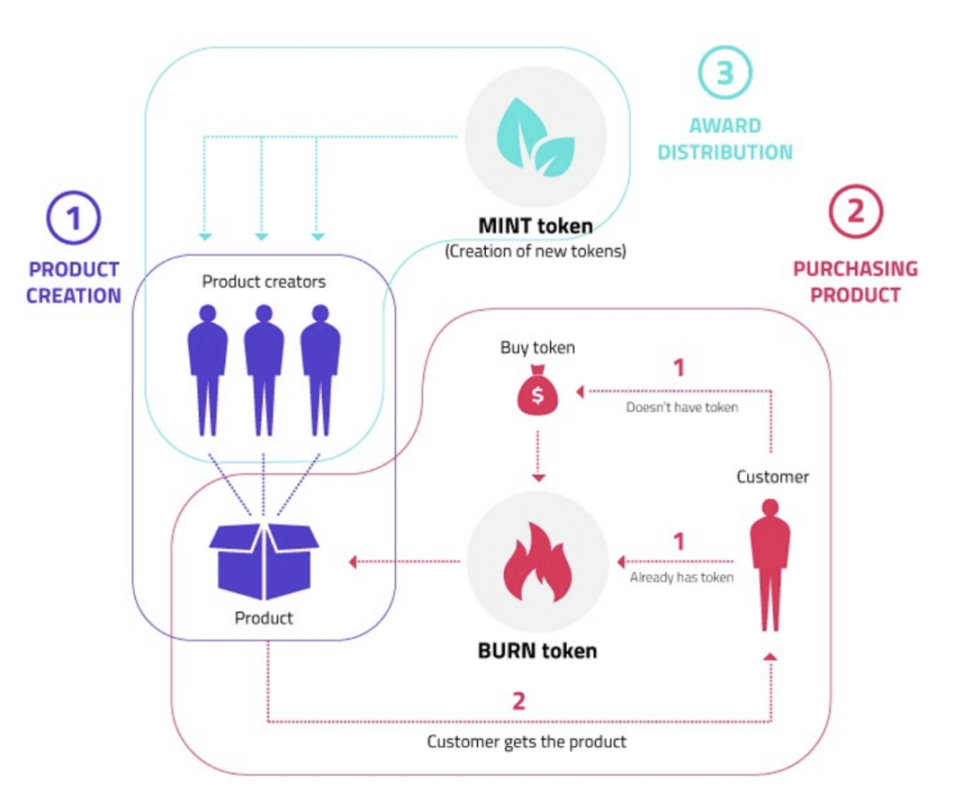

Render Network was originally deployed on the Polygon network. In March of this year, the community voted to migrate from Polygon to Solana and build the BME (Burn and Mint Equilibrium) model on Solana. The BME model describes a state of relative balance between burned tokens and minted tokens in an ideal process and specific consumption markets, and it is a mature token model applied in projects such as Helium.

(https://medium.com/render-token/behind-the-network-btn-july-29th-2022-7477064c5cd7)

In this model, users use RNDR tokens when purchasing GPU rendering services, and the tokens used after the task is completed will be destroyed. Rewards for service providers are distributed using newly issued tokens, based not only on task completion metrics but also on customer satisfaction and other comprehensive factors. As a result, RNDR tokens have more consumption scenarios in the entire economy, and the supply-demand relationship of tokens can be balanced according to the algorithm between token burning and minting, evolving the entire business model from a simple C2C to a more managed B2C model.

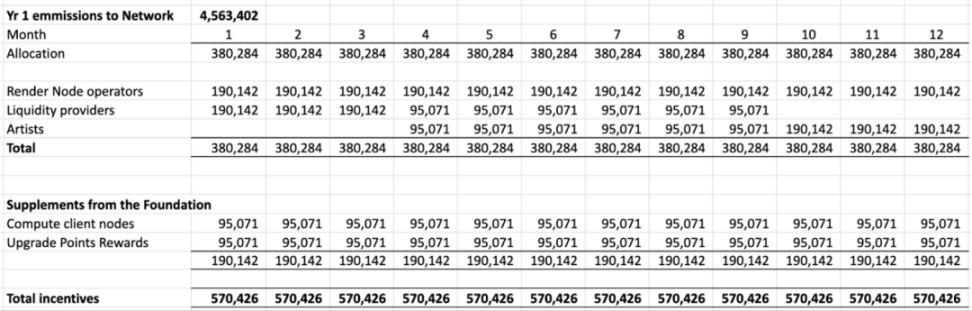

The specific initial allocation of token release is as follows:

(https://github.com/rendernetwork/RNPs/blob/main/RNP-006.md)

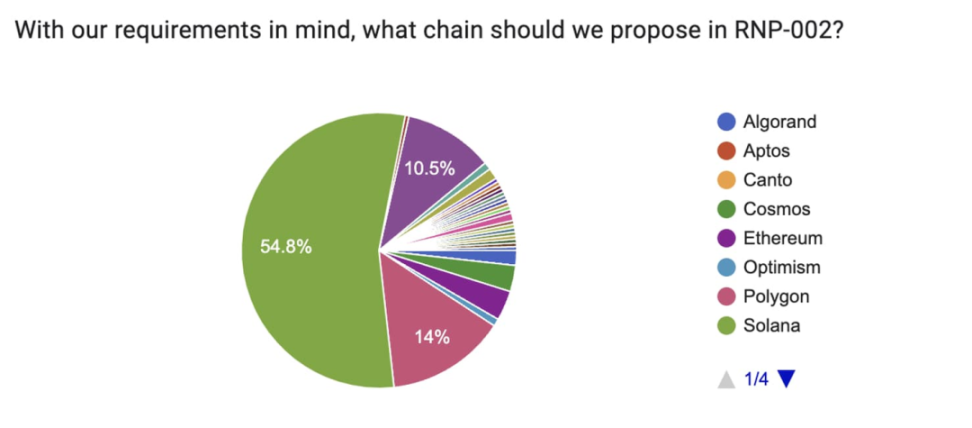

Regarding the destination of the network migration, more than half of the users in the community voted to migrate to Solana. As Render Network has already reached a processing volume of millions of frames per year and this demand will gradually increase with the development of AI, there are higher requirements for on-chain synchronization efficiency, throughput, network latency, and cost. Solana's transactions per second (TPS) of 4000 is approximately 137 times that of Polygon (29), with costs about 1/5000 of Polygon's, and it also has a large number of mature developers, making it an ideal choice.

(Source: https://github.com/rendernetwork/RNPs/blob/main/RNP-002.md)

On November 2, the Render Foundation announced that Render Network had successfully upgraded its core infrastructure from Ethereum to Solana and launched an incentive program to encourage users to upgrade $RNDR on Ethereum to the new token $RENDER on Solana.

(Source: https://coinmarketcap.com/currencies/render/)

So far this year, $RNDR has seen an increase of 800%. Currently, the market cap (MC) and fully diluted valuation (FDV) are $1.5 billion and $2.2 billion, respectively, ranking it 51st in market value. Due to the token's real-world applications, the trend of token prices and business volume is similar. Render has strong business resources and has collaborated with Stable Diffusion this year on AI image rendering. It has also been featured in Apple's promotional videos and has provided services to companies such as HBO and Netflix. The rapid development of AI has greatly increased the project's potential.

Helium

Helium is one of the oldest and most well-known DePIN projects. It is a decentralized wireless network protocol that incentivizes users to deploy gateways to drive a global network based on LoRaWan technology. Initially, it built its own Layer1 network, but adoption was hindered. In April of this year, it completed the migration to the Solana network, hoping to reach a larger user base and liquidity and take full advantage of Solana's efficient expansion.

Helium already has over 350,000 active IoT nodes, and the Long-Fi signals generated by Helium gateways can only be used to support LoRaWAN devices. The gateways in the current Helium network are all full gateways and will gradually be replaced by light gateways.

(Source: https://explorer.helium.com/stats)

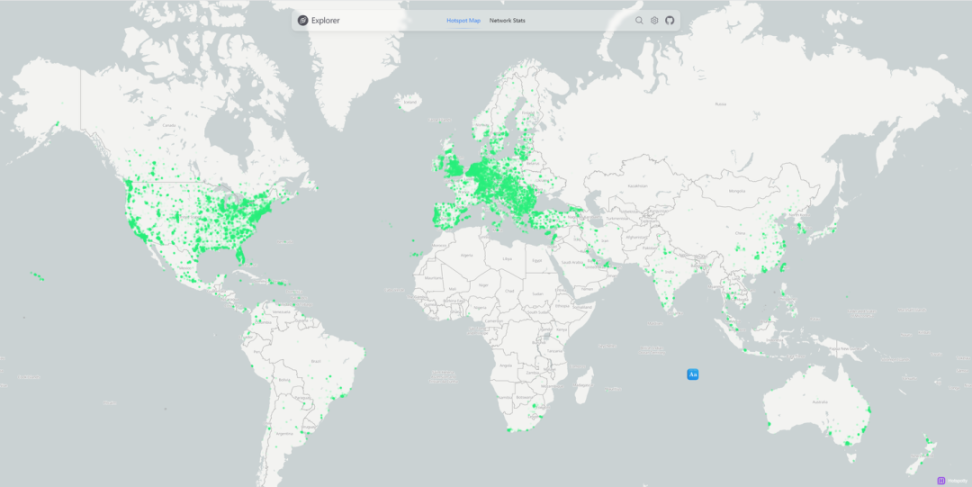

Building a global, hardware-supported decentralized wireless network is a very ambitious vision and also very challenging. The distribution of active Helium nodes globally is mainly concentrated in the United States and Europe. Therefore, Helium's challenge in the coming years will be to drive rapid growth in demand.

(Source: https://explorer.helium.com/)

Helium's 5G business, Helium Mobile, recently announced a pilot program in Miami to provide local residents with unlimited voice/data access for $5 per month. This pilot project reflects Helium's vision for opening up 5G networks in the future, providing low-cost reliable wireless network access services to the public. Additionally, Helium Mobile announced the next generation of 5G hotspots, developer tools, and application-based network coverage recommendations and incentive mechanisms, aiming to strategically encourage rapid growth in network coverage in key areas and locations through lower costs and richer access scenarios.

(Source: https://coinmarketcap.com/currencies/helium/)

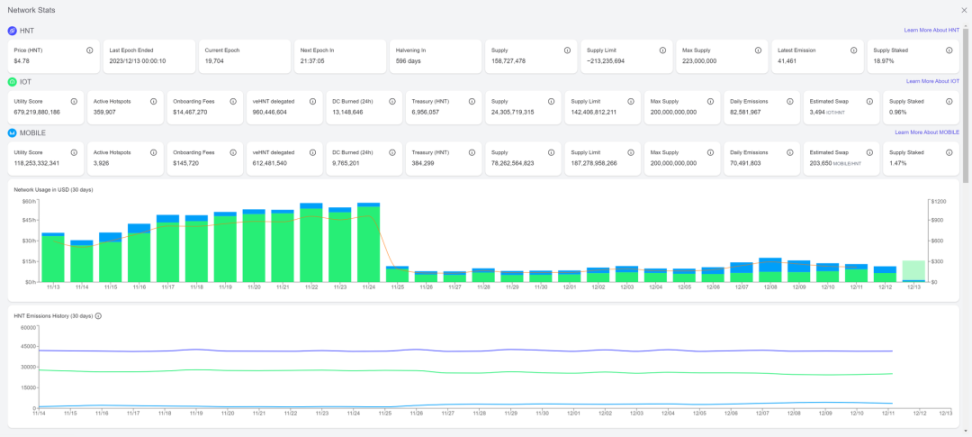

$HNT is the primary economic asset in the Helium ecosystem, and the only way to pay for network data transmission fees is by burning $HNT. It currently has a market value of $1.29 billion and was delisted from spot trading pairs by Binance in October of last year.

This year, Helium issued two new tokens, $Mobile and $IOT, which are subDAO governance tokens for Helium Mobile and Helium IOT, respectively, with the aim of achieving governance separation. The $Mobile is earned by the 5G hotspot business of Helium Mobile, while $IOT is used to reward nodes focused on running IoT. $HNT remains the primary asset in the Helium ecosystem and is the only token that can pay for network data transmission.

The role of Mobile is similar to that of a telecommunications operator, with low service prices and the ability to mine with eSIM. The business model is very simple and effective, and does not require complex physical equipment, making it very attractive to low-income users and highly scalable, thus achieving mass adoption.

Austin Federa, strategic director of the Solana Foundation, recently revealed that all employees of Solana Foundation/Labs/Eco have started using eSIM and network services provided by Mobile. After being online for 2 weeks, Mobile currently has a market value of $541 million, with significant potential for further growth if development proceeds smoothly.

(Source: https://coinmarketcap.com/currencies/helium-mobile/)

Livepeer

Livepeer is a decentralized video transcoding network aimed at providing a decentralized, highly scalable real-time streaming media transmission protocol, significantly reducing the cost of video streaming applications. Founded in 2017, its business has now migrated from Ethereum to Arbitrum.

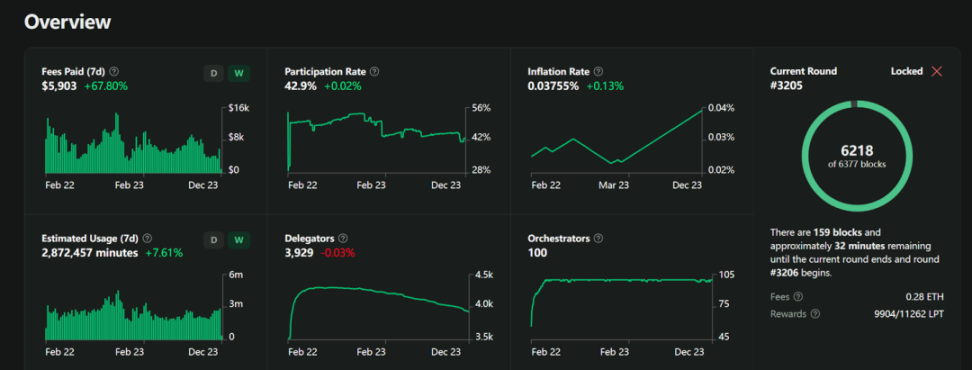

(Source: https://explorer.livepeer.org/)

The overall transcoding business volume of Livepeer has remained stable at over 2 million minutes per week on average. In November, Livepeer successfully transmitted 11.3 million minutes of video. Although the number of streaming minutes continues to increase, the publicly available price competition on the network has reduced the cost-effectiveness of using video encoding by 48% (from $42,100 to $82,700) compared to two months ago (November vs. September). This is consistent with the DePIN flywheel theory, which states that competition between idle computing will reduce user costs.

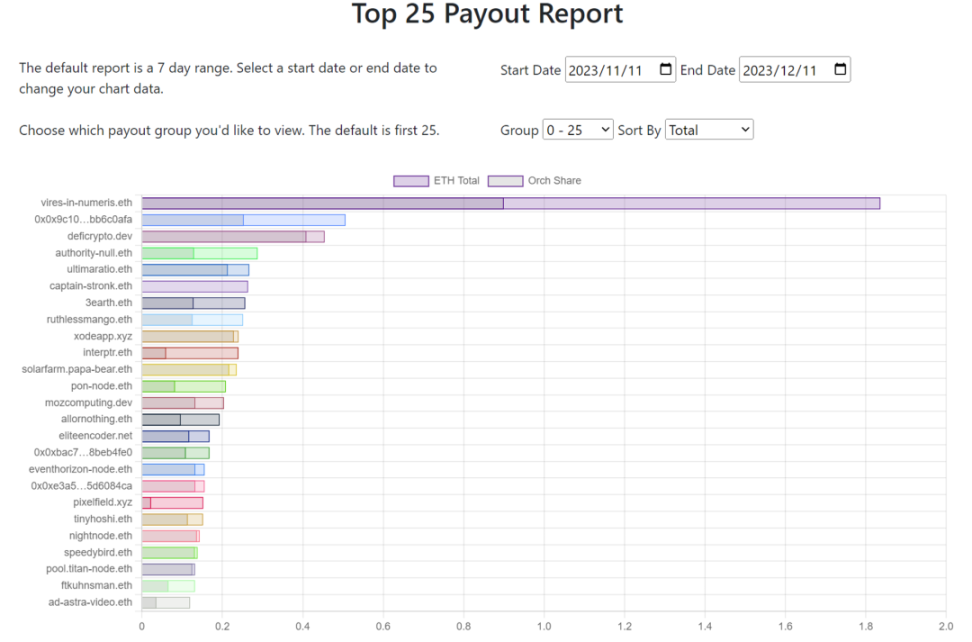

(Source: https://www.livepeer.tools/payout/report)

In addition to the inflationary LPT rewards, node operators can also earn ETH through video transcoding work on the network. This 30-day payment chart highlights the top 25 nodes, each of which can earn rewards ranging from 0.12 to 1.84 ETH.

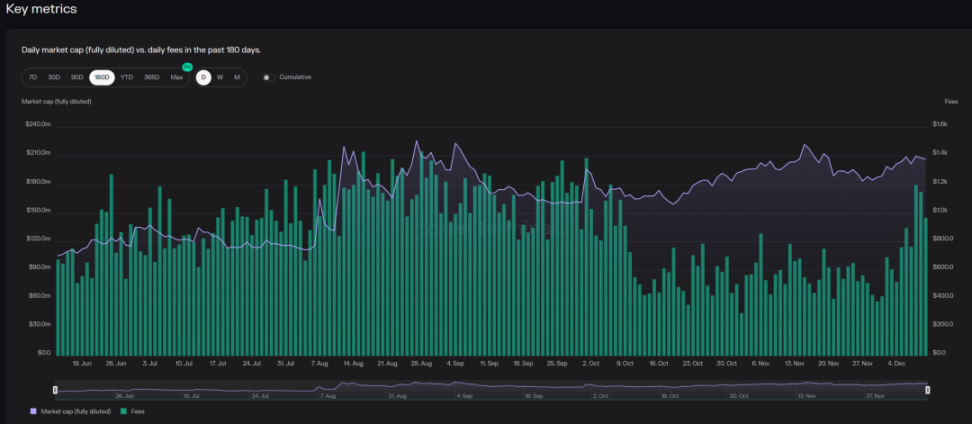

(Source: https://tokenterminal.com/terminal/projects/livepeer)

LPT currently has a market value of $217 million. In August, there was a rapid bottom-up surge, with trading volume increasing thirtyfold in one day, and the price doubling within a week. However, overall, the price is still at a loss compared to the beginning of the year. The protocol's estimated annual revenue is around $290,000, and it does not have strong business cash flow.

(Source: https://coinmarketcap.com/currencies/livepeer/)

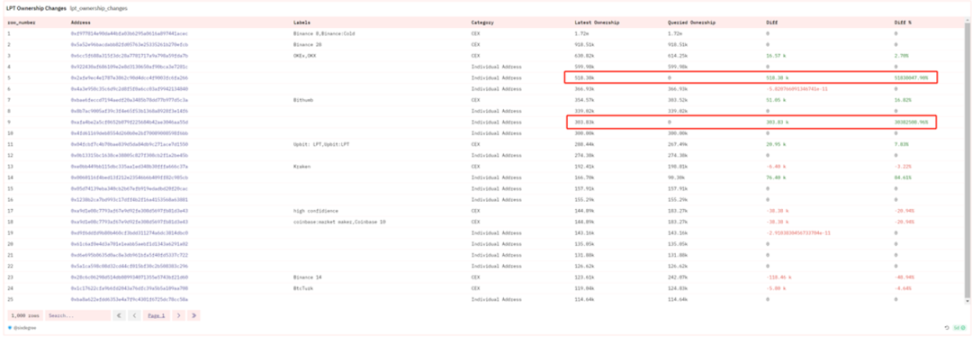

Interestingly, in the past two weeks, a whale has completed accumulation, purchasing a total of approximately 800,000 tokens (~$4.8 million) from exchanges and transferring them to a wallet.

(Source: https://dune.com/sixdegree/liverpeer-lpt-ownership-and-governance)

Arweave

Arweave is a decentralized protocol for permanent data storage, using a Proof of Access (PoA) mechanism to achieve consensus block production. Its main feature, compared to IPFS, is one-time payment for permanent storage. When people spend tokens to store data, a small portion of the paid AR goes directly to the miner (node) responsible for storing the content, while a large portion is stored in an endowment fund, which can slowly release rewards indefinitely. Through this mechanism, Arweave ensures unlimited permanent storage.

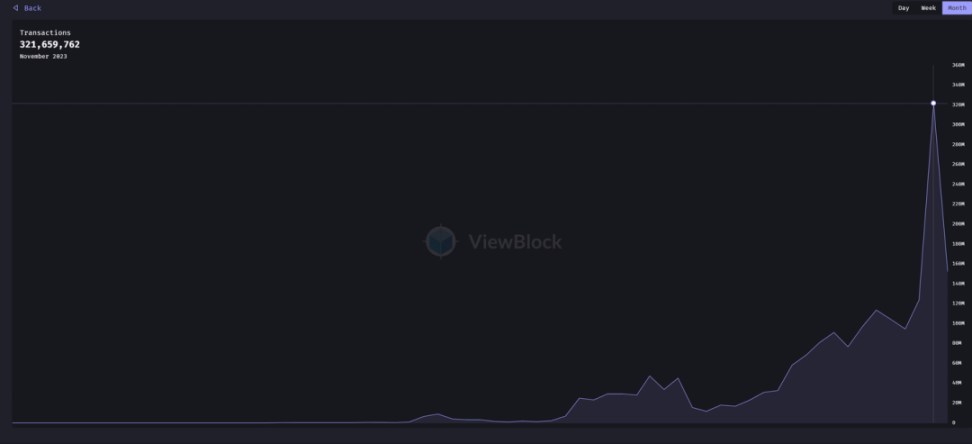

Arweave has many partners and a rich ecosystem. Solana and Nervos use Arweave as the default data storage layer, and through the middleware project KYVE, it provides data storage services for multiple public chains such as Avalanche and Near. As of November 2023, Arweave's monthly transaction volume has reached 321 million. The monthly transaction volume in November increased by over 159% year-on-year and approximately 9.4 times month-on-month.

(Source: https://viewblock.io/arweave/stat/tx?time=month)

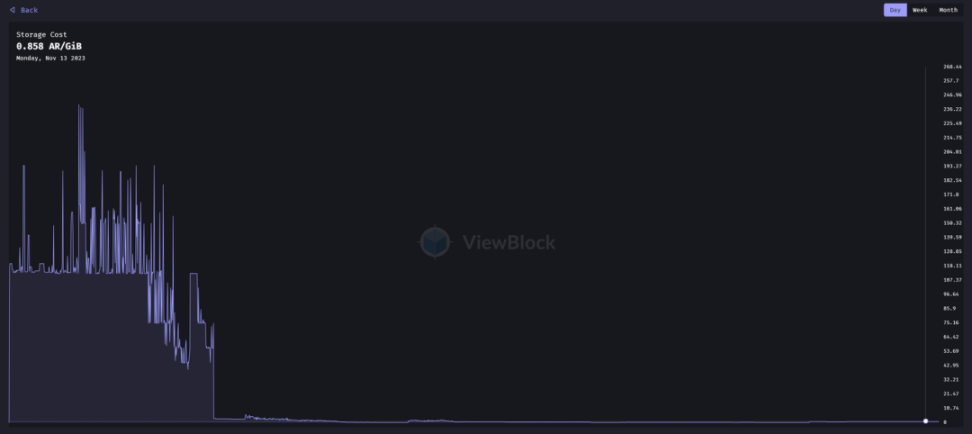

Arweave can currently add approximately 170 pieces of data to the network per second. Although the transaction volume continues to grow monthly, Arweave's fee market remains stable at 0.858 AR/GiB, demonstrating Arweave's scalability.

(Source: https://viewblock.io/arweave/stat/tx?time=month)

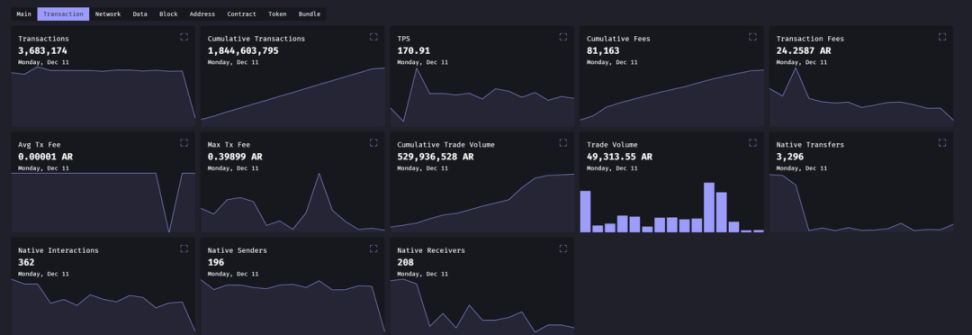

Since its inception, Arweave has completed a total of 1.84 billion transactions, and its business has grown rapidly this year, with approximately 1.2 billion transactions occurring this year.

(Source: https://viewblock.io/arweave/stats?tab=tx)

$AR is currently in a fully circulating state, with a market cap of $583 million. Its business volume is comparable to Filecoin, but its market value is one-fourth of Filecoin's, and there is a significant increase in business volume, but the token's price has not increased much.

(Source: https://coinmarketcap.com/currencies/arweave/)

Irys is the storage solution for the AR ecosystem, handling about 95% of Arweave transactions. It is considering forking Arweave, no longer maintaining the data set, and resetting the token supply, which may result in the data on AR not being permanently stored, potentially having a significant impact on AR's token price.

Hivemapper

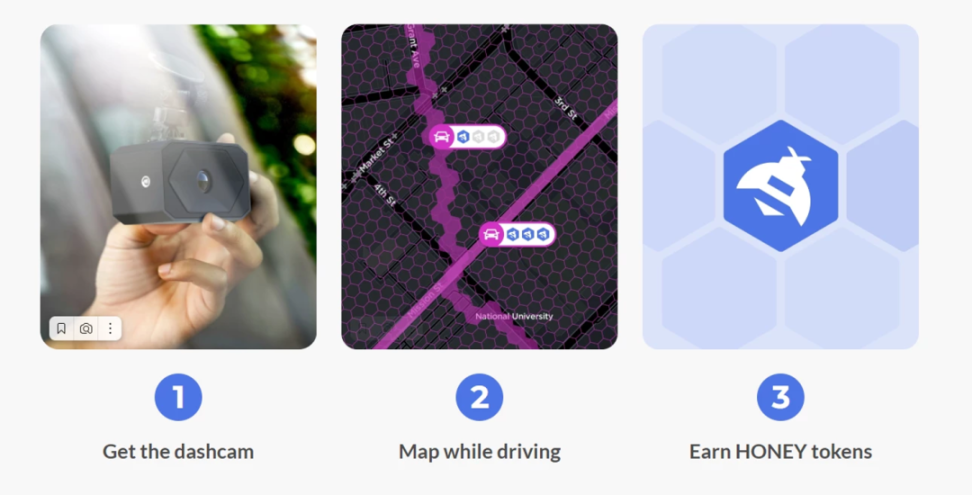

Hivemapper is a blockchain-based mapping network where contributors can collect data by installing Hivemapper's dashcam and earn the token $HONEY as a reward. Token distribution and settlement are done on the Solana network. The dashcam in Hivemapper is similar to a mining machine and interfaces with Hivemapper's application, uploading street view images as data.

(Source: https://hivemapper.com/explorer)

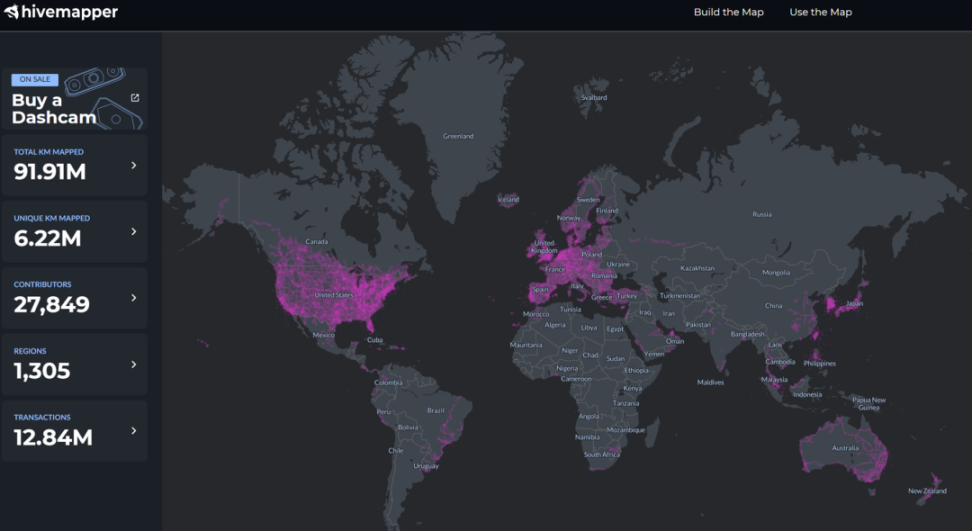

In just one year, Hivemapper has mapped approximately 91 million kilometers of roads, covering 10% of the total global road mileage, with over 6 million kilometers being unique. With the delivery of over 8,000 dashcams globally, drivers are helping to map the freshest maps in the world every day.

(Source: https://hivemapper.com/explorer)

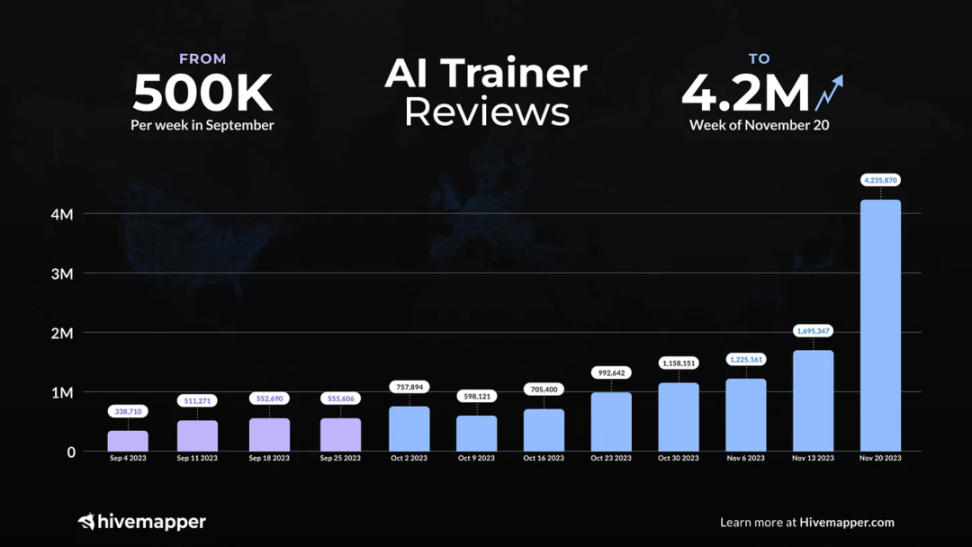

Hivemapper's AI map training is operational, able to autonomously generate map features based on road images, with over 2,000 AI trainers responsible for verifying the system's output results each month. The average number of training results per week in September was over 500,000, which quickly increased to over 4.2 million per week in November.

(Source: https://coinmarketcap.com/currencies/hivemapper/#Chart)

The revenue of Hivemapper comes from two main sources: the sale of dashcams and the sale of map data APIs. The price of each dashcam is $300 (advanced models are $649), and the conservative estimate for annual revenue exceeds two million dollars. The price of the $Honey token cannot be too low, otherwise there will be a lack of demand for the dashcams, and the maps will not be effectively expanded, leading to a stalemate in the entire business. The token has not yet been listed on mainstream exchanges and is mainly traded on Orca. The fully diluted valuation (FDV) is currently at $2.4 billion, but the circulating supply is only 2.6%. Projects with high FDV and low circulation were once a major characteristic of SBF-related tokens, making the price very susceptible to rapid fluctuations.

Summary and Discussion DePIN is a perfect fit for the crypto track, combining decentralized infrastructure with blockchain technology and token economics. Blockchain technology can solve issues such as ownership and verification, while token economics incentivizes more participants, building the source of network effects.

As mentioned at the beginning, DePIN can be simply classified into two categories: physical resources and digital resources. Projects in the physical resources category, such as Helium and Hivemapper, are currently mainly concentrated in the United States and radiate to the European region, with strong geopolitical limitations. How to expand the market while dealing with regulations is an important challenge for these projects. Projects in the digital resources category, although also having physical equipment thresholds (such as GPUs, hard drives, etc.), can overcome geographical limitations and provide peer-to-peer services. With the rapid development of AI and the popularization of large models, ordinary people can also use AI for creation, leading to an increasing demand for computing power. The market reachable by DePIN is therefore larger. Effectively collecting demand and expanding business cooperation are the growth challenges for digital resource DePIN projects.

The DePIN track is still in a very early stage. Although it has great potential for breaking barriers, the actual barrier for non-Web3 users to access, understand, and use it is quite high. There is also a lack of complete infrastructure and unified standards, resulting in a generally average development and usage experience, and insufficient network availability. The moats of each project are not deep. For example, after the entry of the 5G track project Pollen, Helium miners also began to deploy Pollen nodes. The competition in the same sub-track is fierce, and it is important for projects to develop their own moats. Additionally, how to prevent cheating and how to deal with regulatory restrictions are significant obstacles that projects will face in their development.

From an investment perspective, DePIN is a business with both upper and lower limits. Unlike most meme projects without actual applications, DePIN projects all have real demand, supply, and revenue, which can be used to analyze the quality of the targets. Compared to mature centralized services, DePIN services have lower prices, more flexible configurations, and better meet the needs of small-scale users. DePIN is an ideal customer for individuals and startup teams.

Token economics is an important part of DePIN. Without incentives, participants will lose the motivation to become distributed nodes, similar to the fate of BT seeds, which had a good vision but eventually disappeared. Token economics effectively fills this gap, with Filecoin as the incentive layer for IPFS being a good example. Additionally, for some projects, physical equipment is also an important source of revenue, such as Hivemapper's dashcams. If the token does not have an attractive enough price, and cannot even cover the cost, users will have no incentive to purchase hardware devices, and the physical network will not be able to expand further, failing to form network effects, leading the project to a stalemate. Therefore, DePIN track tokens have a certain lower limit, similar to the shutdown price of miners.

Conversely, this will also be a condition that constrains the ceiling of DePIN projects. DePIN projects generally settle with project tokens, such as RNDR, LPT, AR, so an increase in token price will increase the cash expenditure burden for users. When the price advantage is insufficient, users will inevitably be lost, leading to a decline in token price. Therefore, even very successful DePIN projects have an implicit ceiling on token price. More importantly, DePIN projects are too solid, lacking the imagination of Memecoins, and do not have the side-stepping mechanism, making it difficult to be fomo-ed. Therefore, DePIN is an investment track with both lower and upper limits, and finding early, low-market value, and practical projects is a relatively safe approach.

With the maturity of Ethereum Layer2, high-performance public chains such as Solana, Aptos, Sui, etc., are good choices for the future rooting of DePIN. Compared to early projects building their own blockchains, the cost-effectiveness of blockchain network performance improvement is much higher. Recently, a new concept on Solana called "OPOS (Only Possible On Solana)" claims that many applications will only be possible on Solana, with DePIN being one of their main tracks. It can be seen that many DePIN projects are either migrating to Solana or settling with Solana. Solana's high throughput and low fees are very suitable for the needs of DePIN projects, and Solana may become the beta for the rise of the DePIN track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。