Stablecoin is one of the important infrastructures in our industry. It achieves the stability of the coin value by anchoring it to the legal tender of a certain real-world country. Ordinary users use it as an important means of storage and payment, while web3 institutions use it as an operational tool. The rich demand has created a thriving stablecoin market. Therefore, it is also utilized by illegal activities such as network black markets, online gambling, and money laundering. When ordinary investors or web3 enterprises inadvertently receive stablecoins associated with such illegal activities, they may face enforcement risks.

Bitrace's research found that in the process of laundering encrypted funds, illegal elements generally accept stablecoins of different risk categories at significantly deviated market exchange rates. Taking Tether (USDT), which has the highest market share in the stablecoin market, as an example.

Risks of "Black U"

"Reverse freezing" is a phrase popular among cryptocurrency acceptance groups, meaning that receiving USDT involved in a case can lead to the freezing of the exchange account by law enforcement agencies. Unlike the more widespread freezing of bank accounts due to receiving illicit funds, this is referred to as reverse freezing based on law enforcement agencies' sanctions on tracing encrypted funds.

Such law enforcement freezing activities are not limited to centralized cryptocurrency exchanges. In decentralized on-chain addresses, Tether's issuer, Tether Limited, can also legally assist law enforcement agencies worldwide in sanctioning certain addresses involved in cases, effectively freezing the funds in those addresses by selectively "blacklisting" the operation permissions for USDT.

A few days ago, the cryptocurrency exchange OKX announced that it had cooperated with Tether Limited to carry out targeted freezing of assets totaling 225 million USDT in multiple on-chain addresses, which were associated with illegal activities such as Ponzi schemes and human trafficking.

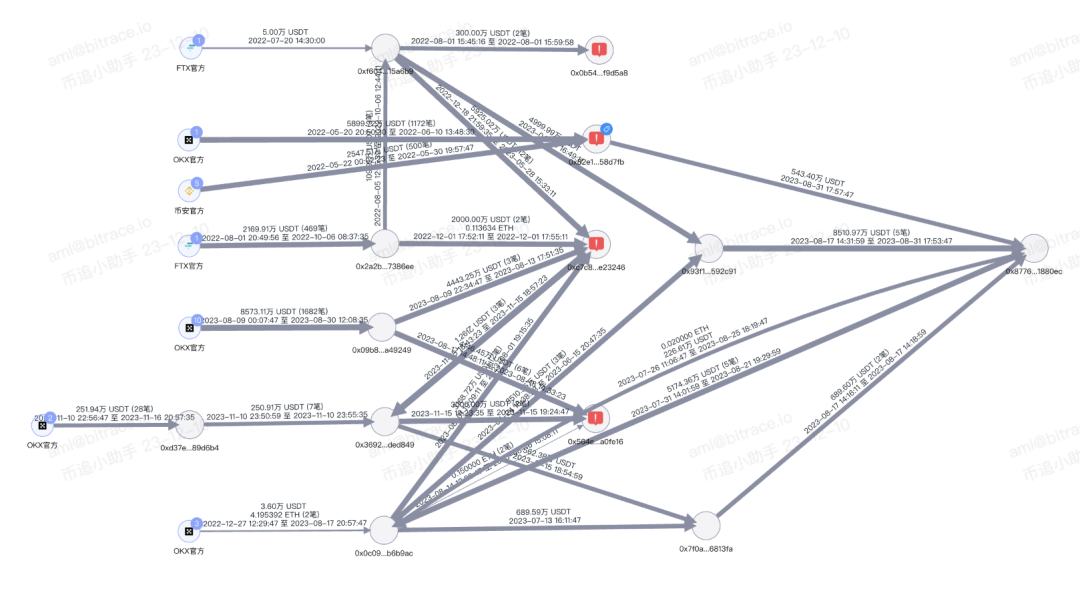

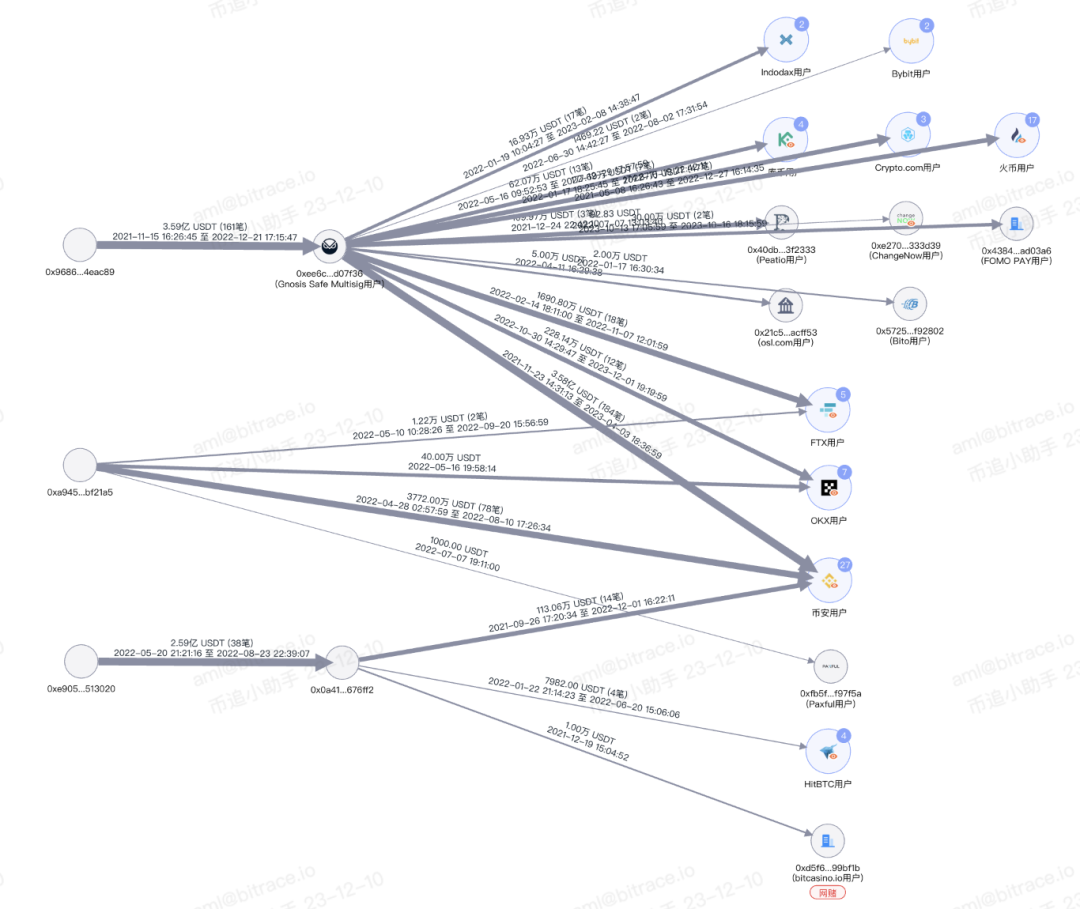

Bitrace conducted a fund audit on some disclosed addresses. In the fund sources, we found that this criminal group not only used OKX for fund turnover, but also well-known cryptocurrency exchanges such as FTX and Binance, and the scale of the funds involved was enormous.

Subsequent fund tracking shows that more centralized exchanges, payment platforms, and even online gambling platforms have been involved, unfortunately becoming laundering venues for illegal elements.

Clearly, even if OKX does not cooperate with law enforcement, the aforementioned web3 enterprises may also, for the purpose of compliance, assist law enforcement agencies in sanctioning the hoarded addresses of the funds involved. In other words, whether it is fiat currency or compliant stablecoin, it is not a "safe" value storage tool for criminal groups. They often need to quickly launder the assets involved to eliminate risks or realize them in a timely manner.

We believe that this need for laundering and risk aversion is the main reason for the significant deviation in the exchange rate of illegal transactions.

"Floating U" Scenarios

"Running points" is a term used by illegal elements to refer to money laundering activities. The purpose of such activities is to transfer payments from high-risk users to accounts of low-risk users to evade the risk control measures of payment institutions. Traditionally, running points involve using personal accounts such as banks, WeChat, and Alipay to transfer, split, and cash out funds involved in cases. In recent years, however, cryptocurrencies—especially stablecoins—have become new tools for running points.

The typical mode is that running point platforms recruit various individuals to register accounts on cryptocurrency exchanges and link their bank cards, allowing them to take orders on the platform. They buy a specific amount of USDT at market prices from the over-the-counter (OTC) section of the exchange and sell it back to the running point platform at a higher price, with the difference being the income for the running point personnel. In reality, the funds used by the running point platform to repurchase USDT are involved in cases. Through this method, the running point platform can launder funds without directly handling fiat currency.

The profits of the running point platform come from upstream activities, including online gambling, black markets, and money laundering. Different risk categories of funds have different commission rates. For example, gambling funds are considered lower risk, so the commission is lower, while fraudulent funds are often considered higher risk, with higher commissions, and some running point platforms even refuse to accept them.

The different commissions directly reflect in the exchange rate of USDT transactions. Higher-risk funds mean higher price markups. In investigative practice, it is not difficult to encounter illegal USDT transactions at prices of 8 RMB or even more than 10 RMB.

"Sinking U" Scenarios

So far, the majority of various low-priced USDT transactions based on reasons such as "black U brick-moving" and "black/white fund receipt U" are fraudulent activities. Bitrace has previously discussed black U Ponzi schemes and offline cash transaction robberies in earlier articles, which you can refer to for more information.

However, there are still quite a few scenarios of black and gray USDT transactions at rates lower than the market exchange rate, such as with illegal payment platforms. Some payment platforms accept USDT deposits and use fiat funds to help users make payments on other platforms, including distributing funds on gambling platforms, settling member funds in investment schemes, gifting on live streaming platforms, placing orders on e-commerce platforms, and even paying salaries to employees.

These payment platforms do not discern the source of users' USDT and do not have a comprehensive Know Your Customer (KYC) mechanism, resulting in an influx of high-risk funds. This is why the fee sources and destinations of illicit gains in some cases are associated with gambling platform addresses on the blockchain. By using this almost anonymous transaction method to cash out, those in the black market do not need to register accounts on compliant centralized cryptocurrency exchanges, greatly reducing the possibility of being "reverse frozen."

Investigative practice shows that the USDT involved in such illegal payment activities often deviates from the market exchange rate by 0.05 to 0.3 RMB, and the specific degree of deviation depends on the source of fiat funds for the payment platform and the scale of the users' funds.

Beware of USDT Money Laundering Risks

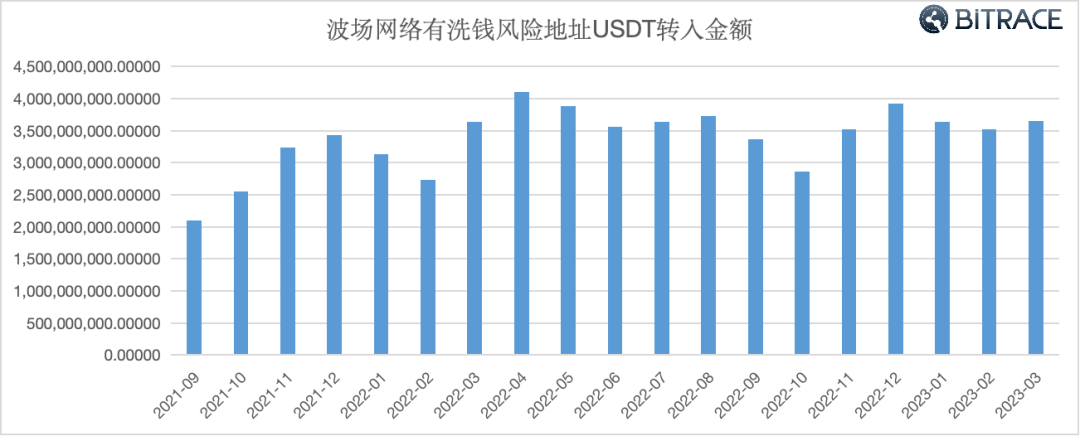

Bitrace conducted a fund audit on some addresses in the Tron network that were labeled as having money laundering risks and had a fund scale of over 1 million USDT. The audit period was from September 2021 to March 2023, and the audit content was USDT inflows.

The data shows that from September 2021 to March 2023, addresses in the Tron network with money laundering risks received a total of over 64.25 billion USDT, and the fund scale was not affected by the bear market in the cryptocurrency secondary market. It is evident that the participants in their business are not genuine investors.

Combining the above two risk scenarios, this indicates that cryptocurrencies, primarily stablecoins, are being maliciously exploited by money laundering groups. In order to evade sanctions from centralized exchanges and law enforcement agencies, illegal elements will confuse funds through the addresses of illegal entities or use off-exchange transactions to disrupt the fund analysis chain, and illegal USDT transactions with significant deviations from the market exchange rate are typical characteristics.

Conclusion

According to The Block's report, the issuer of USDT has published a letter to the U.S. Senate Committee on Banking, Housing, and Urban Affairs and the U.S. House Committee on Financial Services, outlining its "commitment to security and close working relationship with law enforcement agencies," and announced that it will include the U.S. Secret Service and the Federal Bureau of Investigation, which "are doing the same thing," in its platform.

This fully demonstrates Tether Limited's compliance intentions in the stablecoin business category. For web3 enterprises serving a large number of ordinary C-end customers, optimizing the platform's anti-money laundering risk control strategies for risk cryptocurrencies, establishing cooperation with law enforcement and compliance departments of various governments, has become an important matter that cannot be ignored.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。