The performance of Ordinals on major public chains

Author: Terry

Source: https://mp.weixin.qq.com/s/bW7x9JlsXDKI7BNWMxi0Ng

As the craze for Ordinals continues to spread from Bitcoin to other chains, in recent weeks, a series of corresponding "Ordinal projects" have emerged on Ethereum, Solana, EOS, TON, as well as IOST, Conflux, and other public chains. On-chain activities have surged, which can be considered a stress test to some extent.

So, how did the actual performance of public chains, which have always prided themselves on TPS and high performance, fare in this stress test?

01

Congested Bitcoin, a feast for block producers

First, let's take a look at the Bitcoin network, which is at the center of the Ordinals craze. Its most obvious change is "network congestion and a surge in transaction fees."

Similar to NFTs, Ordinals allow users to record various data on the blockchain, but overall, because Bitcoin's transaction fees are paid according to the data size, Ordinal users tend to set relatively low transaction fees.

This also means that they are willing to wait longer for confirmation, which easily leads to Ordinal transactions being replaced by more urgent Bitcoin transfers.

In this context, these massive but patient Ordinal transactions have overwhelmed the Bitcoin memory pool (where all valid transactions not yet officially added to the network are stored).

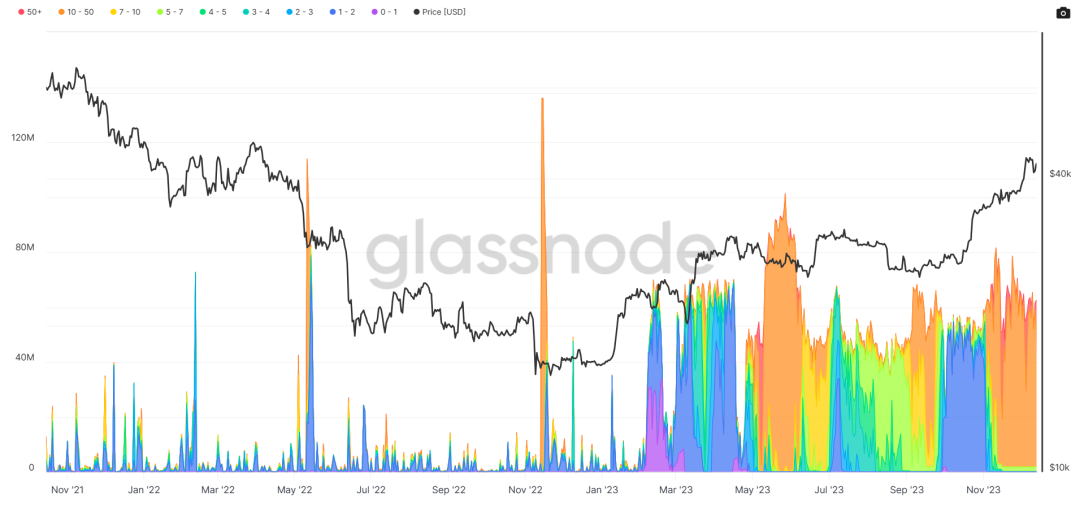

According to statistics from crypto KOL bitrabbit.btc, Bitcoin accumulated 87 million UTXOs over the past 14 years, but after BRC20 started trading on April 24, it surged to 140 million in about 7 months, and among the newly added 50 million UTXOs, 40 million are extremely small transactions of 100-1000 satoshis.

As shown in the above figure, since its launch in February 2023, Ordinals have been the main consumer of Bitcoin block space, and the Bitcoin memory pool has been at full capacity since February, continuing to the present.

This has also led to the Bitcoin network's inability to clear its memory pool, and at the time of writing, it is at a historical high in terms of data recorded in BTC's history.

Given the current situation of the Bitcoin network, especially in order to prevent dust attacks, it is essential to limit the Bitcoin transactions in a single UTXO to no less than 546 satoshis, which means that the vast majority of the small transactions waiting to be processed among the tens of millions of Ordinal transactions are essentially equivalent to DDoS attacks of junk transactions, and may never be packaged, broadcast, and added to the chain.

"Most of these small UTXOs will never be spent, but will lie in Bitcoin nodes, causing tens to hundreds of billions of dollars in hardware and power resource waste for the BTC network for decades to come."

This is also the main reason why Bitcoin Core developer Luke Dashjr publicly criticized ORDI, Ordinals, and BRC20—"Ordinals are using Bitcoin Core vulnerabilities to send junk information to the blockchain."

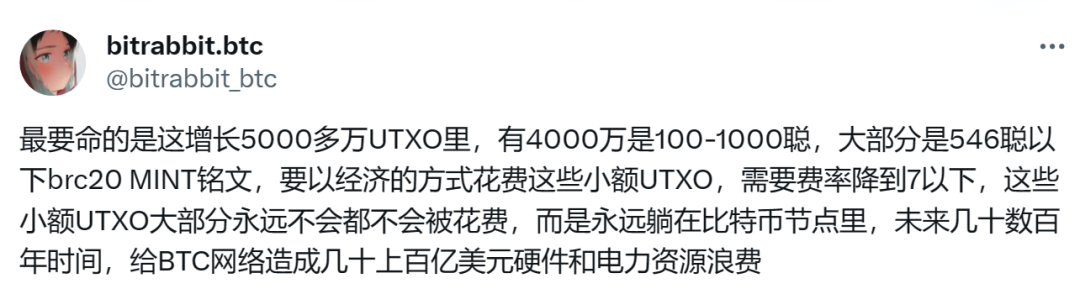

However, for block producers, the Ordinals craze undoubtedly brought a season of abundance. OKLink's statistics show that before November, the transaction fee income accounted for 2%-5% of the block reward structure for Bitcoin block producers.

After the return of the Ordinals craze in November, the proportion of transaction fee income to the total income of block producers began to rise continuously, reaching over 10%, and even exceeding 20% on some dates. As of the time of writing, it reached a recent high on December 14, reaching 25.84%, significantly increasing the income of block producers.

In addition, Dune data shows that the total transaction fees generated by Ordinals for block producers have reached 3615 BTC (about $150 million).

Regardless of the future direction of Ordinals, to some extent, its appearance is closely related to the explosion and the block generation community—with the block reward for Bitcoin block producers declining after each halving cycle, coupled with the continuous expansion of the entire Bitcoin network, the ecological incentives required to maintain the secure operation of the Bitcoin network are objectively increasing, which needs to gradually expand beyond the block reward.

So, the appearance of Ordinals can be said to be timely, and at least the new ecology endowed by programmability may explore a new way of block producer incentives that can replace the block reward, especially as it continues to decrease in the future.

02

"Ethereum Killer" and the performance of new public chains?

After the explosion of Ordinals on Bitcoin, although there were jokes in the market that doing Ordinals on smart contract public chains such as Ethereum is "automatic degradation," the Ordinals craze quickly spread from Bitcoin and Ethereum to other public chains.

In addition to PoW chains such as BCH, other smart contract public chains have also entered the market, giving rise to a large number of Ordinals imitation projects, and also experienced a moment of truth.

Ethereum: Gas fees have moved out of the bottom range

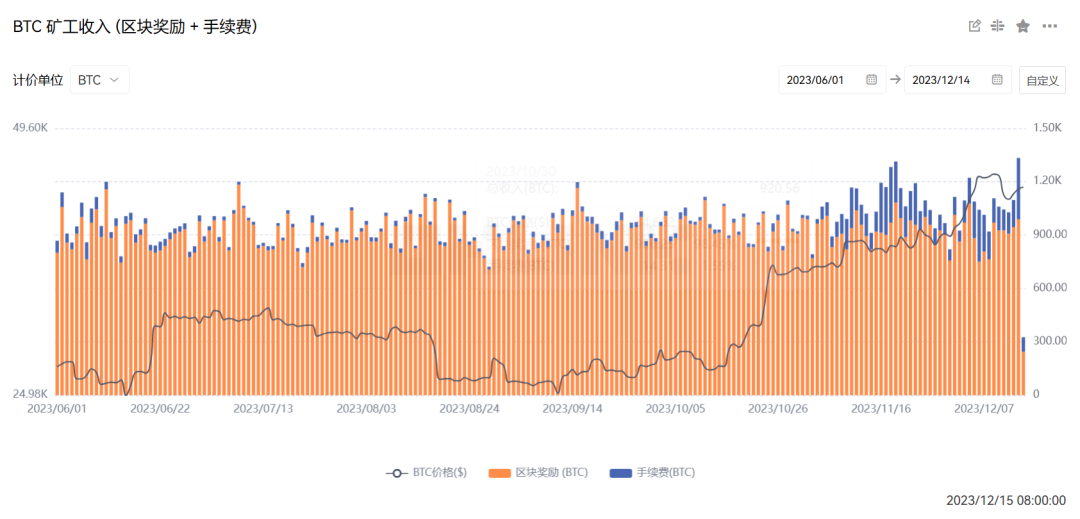

Before the surge in transaction fees caused by ETHS and other Ordinals in this round, the on-chain transaction costs of Ethereum had been gradually decreasing since the middle of the year, reaching a low of $1.4 around October 14, the lowest level in 2023, and Gas also dropped to below 10.

However, starting from late October, as the wealth effect of Bitcoin Ordinals overflowed, ETHS began to usher in a new wave of craze, and Gas began to bottom out and rebound, rising all the way to the current range of 30-50, but still within a normal and acceptable range.

This allows non-financial and arbitrary data to be written to the Ethereum blockchain, as long as the file size does not exceed 96 kilobytes, users can record any type of file. According to its creator, although it currently only allows images, this will change in the future.

In fact, the recording of ETHS uses the so-called Ethereum "call data (Calldata)," which is cheaper and more decentralized than using contract storage, and even the possibility of a new narrative for L2 has emerged—compared to other L2 solutions (such as ZK, ARB), ETHS can achieve lower Gas fees than L2 without the need to switch networks.

EOS: Severe congestion, intermittent suspension of transfers and coin minting

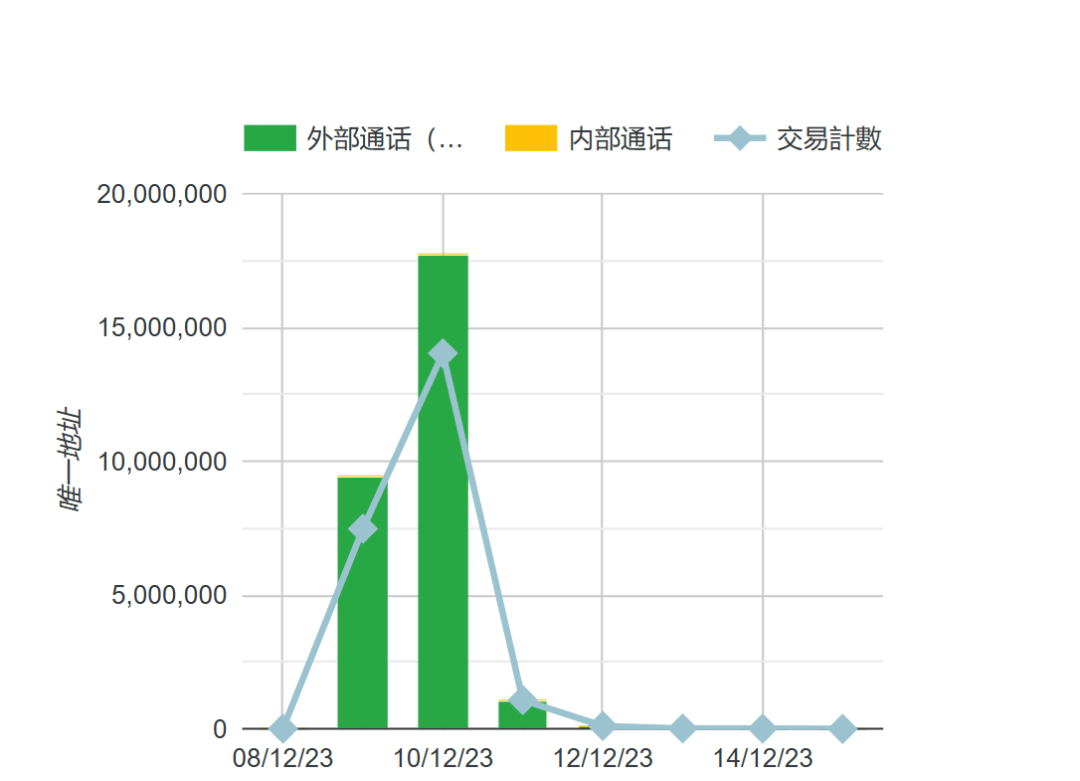

On December 9, the EOS network introduced an Ordinals-inspired minting activity called eoss, leading to a surge in on-chain activity on the EOS EVM chain, with the number of transactions increasing to over 17 million, exceeding the total historical accumulated number of transactions on the chain.

Due to the surge in on-chain activity, the transaction processing speed on the EOS network was severely congested, leading to long delays in transaction processing, with millions of transactions waiting to be processed.

TON: "The fastest blockchain" in a frenzy

Previously planning to apply for a Guinness World Record as "the fastest blockchain" with a claimed transaction volume of over 1 million per second, the TON blockchain also faced setbacks in the Ordinals craze.

After the TON network introduced the Tonado protocol inspired by Bitcoin Ordinals and led to a surge in activity, the network experienced long delays in transaction processing.

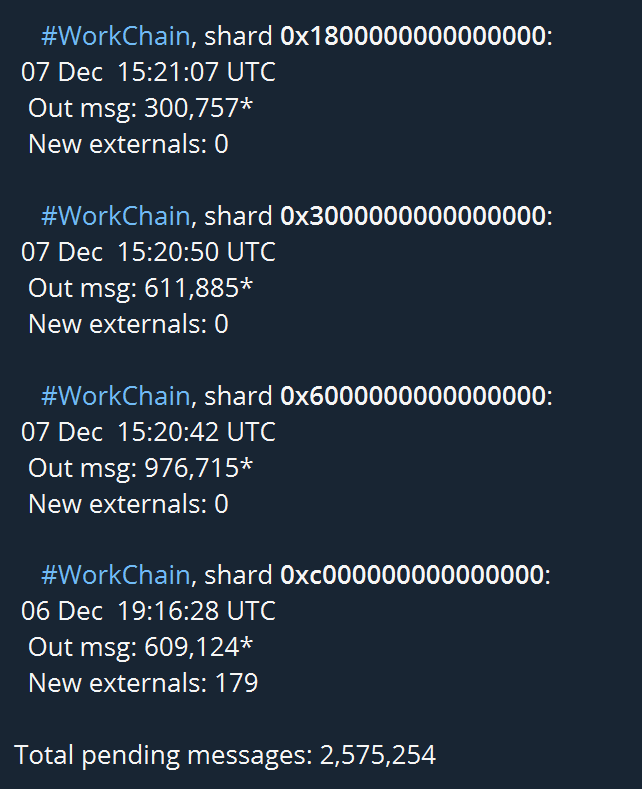

According to monitoring data from the blockchain status monitoring robot dTON, on December 7, there were over 2.5 million transactions waiting to be processed on the TON chain, and the transaction processing speed of the TON blockchain dropped to less than 1 transaction per second.

This situation also forced the TON cryptocurrency wallets, Wallet and Tonkeeper, to suspend their services.

NEAR: Smooth, but with a unique approach

The experience of minting on NEAR was reported to be very smooth, but the way minting transactions are implemented in the Ordinals market is somewhat unique:

The minting is encapsulated into NRC-20 Tokens on the NEAR public chain using official tools, and then traded on DEX such as Ref on the NEAR chain, which is a bit unconventional.

IOST: A feast for scientists

In addition, during the minting process on IOST last night, the "fair launch" was heavily criticized and almost became a monopoly for scientists, with few opportunities for ordinary users to participate successfully. Twitter user @chems_zz reported issues with over a dozen IOST private nodes, all performing poorly.

03

Conclusion

Overall, in this wave of the Ordinals stress test, despite the impressive data usually promoted, these high-performance public chains that emphasize high speed and low cost have consecutively encountered setbacks or performed poorly in the Ordinals wave, laying bare their real capabilities under extreme stress testing.

In contrast, it is Bitcoin and Ethereum that have maintained good transaction execution despite network congestion and soaring transaction fees.

Time reveals the truth, and the diminishing allure of high-performance narratives in recent years is also closely related to this—what matters most for public chains is to provide a stable environment for transaction liquidity.

Indeed, lagging performance will miss out on many use cases, but congestion and even crashes will result in losing everything.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。