Author: Laobai, ABCDE

BitSmiley is the MakerDAO+Compound of the Bitcoin ecosystem, providing a comprehensive solution for Bitcoin DeFi, filling the most missing "stablecoin" + "lending" infrastructure within the current Bitcoin ecosystem.

In addition to providing bitRC20 format stablecoins compatible with BTC over-collateralization, BitSmiley also offers peer-to-peer lending based on BRC20, as well as insurance and CDS derivatives built on top of lending. It has established partnerships with multiple BTC Layer2 to provide stablecoins and DeFi ecosystem products.

I. The Booming BTC Ecosystem and the Missing Infrastructure

Recently, the Bitcoin script ecosystem, represented by Ordi, has clearly entered a booming period, with on-chain Gas often being pushed to over 300 by "certain unknown" scripts, and a single transaction costing tens of dollars, reaching the congestion level of the ETH Defi Summer in the past.

However, unlike the Defi Summer of 2020, when the ETH Defi ecosystem was led by relatively mature Defi infrastructure, with MakerDAO leading the stablecoin race, Compound/AAVE leading the lending, and Uniswap leading the DEX, all of which were established projects in 2018-2019. The current BTC ecosystem, apart from asset issuance, is still in a "wild period." Apart from Unisat providing wallets, markets, and other basic services for BRC20 users, traditional Defi components such as DEX, lending, stablecoins, and advanced derivatives are mostly missing, not to mention the infrastructure for various XXRC20 protocols, which is still under exploration and construction. In addition, similar to how various Alt Layer1+Layer2 carried the value overflow caused by the high Gas fees of ETH during Defi Summer, the concept of BTC Layer2 has entered people's vision. In the BTC ecosystem, we need faster and cheaper Layer2 and a complete Defi infrastructure.

II. BitUSD—BTC-based over-collateralized bitRC20 stablecoin

BitUSD stablecoin is the core component of BitSmiley, first launched on the BTC Layer2 that BitSmiley first cooperated with, and then gradually expanded to other BTC Layer2.

The overall over-collateralization mechanism of BitUSD is similar to MakerDAO, which is familiar to Defi enthusiasts. Here is a brief description:

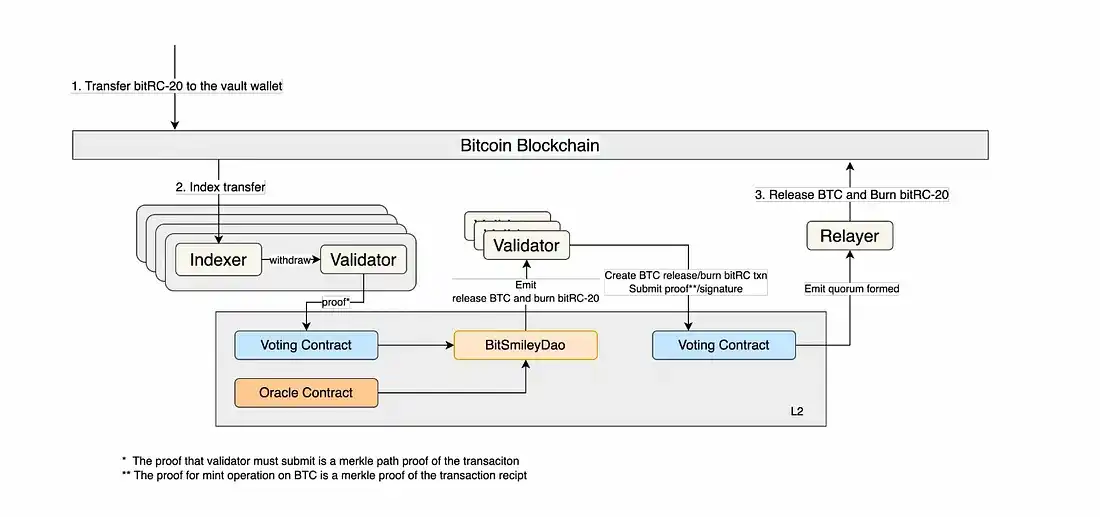

On the minting side, users collateralize BTC (can use Wrapped BTC on the cooperating Layer2 or bridge BTC into BitSmileyDAO using BitSmiley's official bridge) to BitSmileyDAO, and then mint bitUSD.

Redemption follows a reverse mechanism.

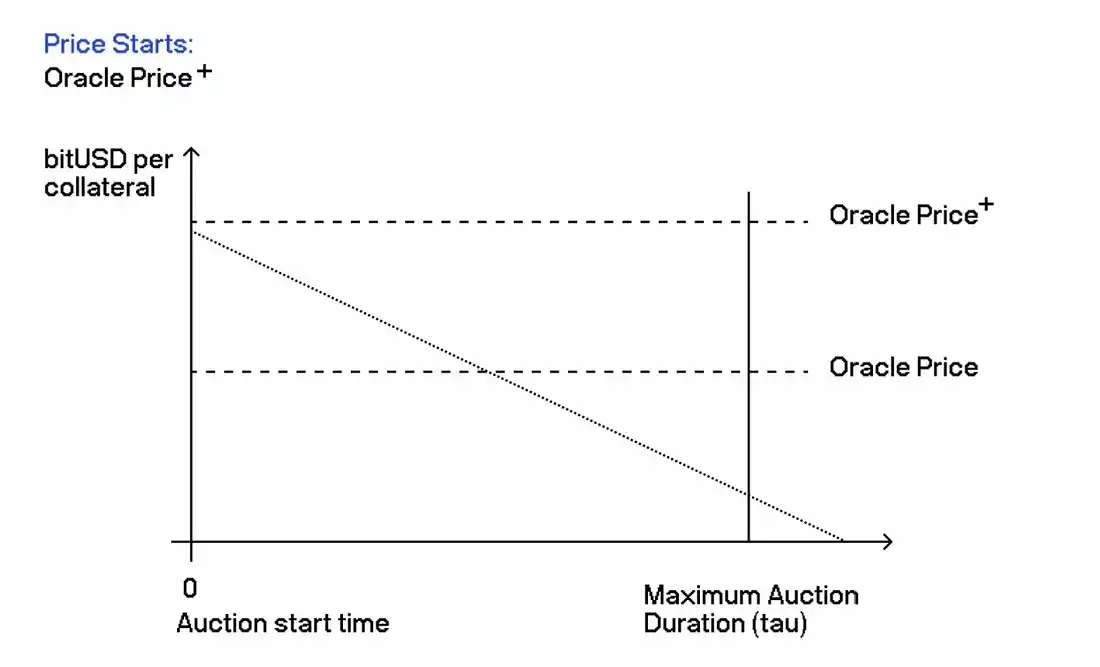

In terms of liquidation, BitSmiley also adopts MakerDAO's latest liquidation 2.0 mechanism, using the Dutch auction model. When the Loan to Value (LTV) falls below the set threshold, the liquidation process is initiated.

Two points worth emphasizing are as follows:

- The first is the final safeguard of liquidation—In MakerDAO's design, when there is insolvency (bad debt) due to market volatility and other reasons, Maker token holders become the last guardians, and MakerDAO will issue MKR to repay the bad debt, effectively diluting the interests of MKR holders. BitSmiley, on the other hand, uses the platform's future income as debt for English auctions. The platform's profits, after deducting basic operating expenses, will prioritize debt repayment.

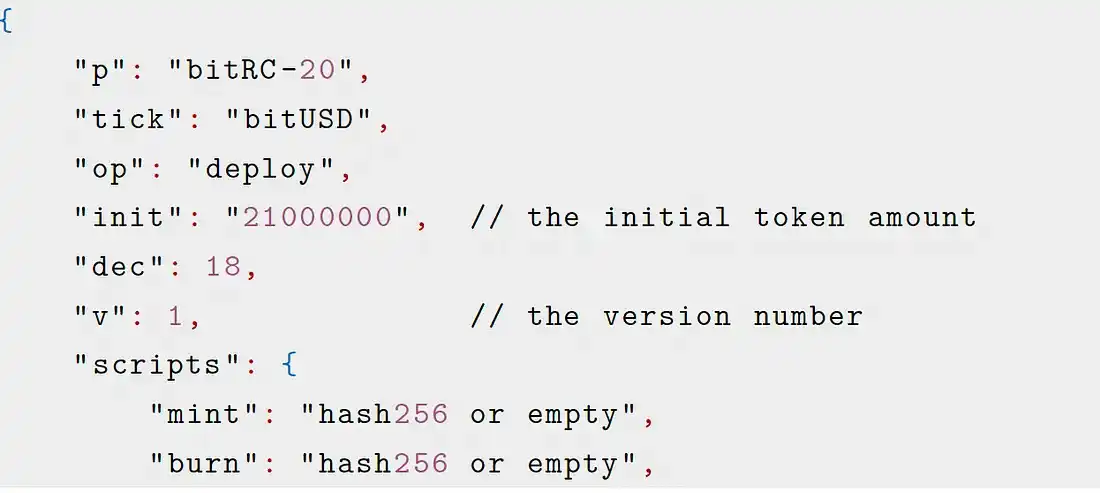

- The second is the format of BitUSD, which will appear in a bitRC20 script form compatible with BRC20.

Because the bitRC20 format script needs to determine the total supply before deployment, it does not meet the requirements of a stablecoin that dynamically adjusts its quantity. Therefore, BitSmiley chooses to use a new script format, bitRC20, which is backward compatible with BRC20, supports access control and upgrades. With version numbers and Burn operations, the flexibility of the entire "stablecoin script" meets the system's needs.

III. Subsequent Defi Products—Lending, Insurance, CDS

In addition to the core stablecoin, BitSmiley has tailored Defi products suitable for the technical characteristics of BTC, based on its stablecoin-supported peer-to-peer lending, and has added insurance and CDS, providing new possibilities for BTC Defi.

1. Peer-to-peer native lending based on bitRC20 -

It is well known that it is difficult to implement pool lending similar to AAVE or Compound based on BTC due to the lack of smart contract support.

In the future, the team also plans to launch features for loan splitting and order merging, aggregating similar peer-to-peer orders to "simulate" a lending model similar to "group-to-group," significantly increasing capital utilization and TVL, catching up with the capital efficiency of pool lending on ETH.

· Insurance -

There is a tricky issue with native lending based on BTC, which is the liquidation mechanism.

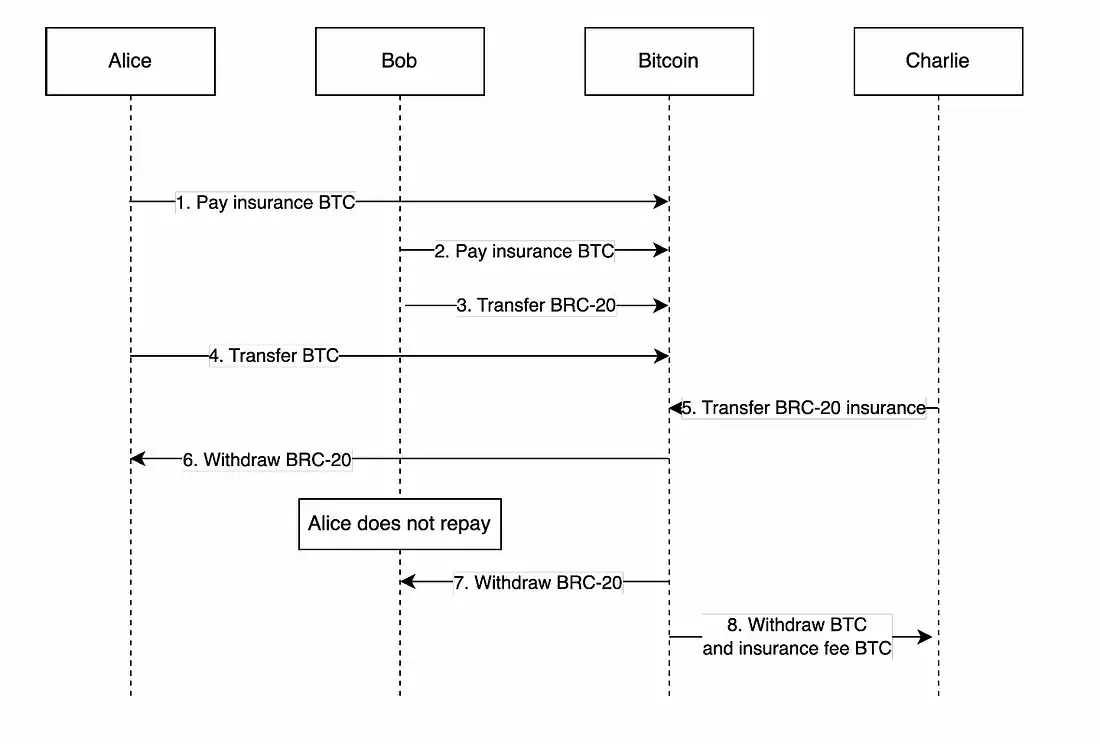

On the ETH side, liquidation is supported by oracles in platforms like Compound or AAVE. However, on the BTC side, the 10-minute block time makes it difficult to replicate the liquidation model of ETH, where a liquidation process triggered in the first minute may become invalid by the 10th minute. Based on this, BitSmiley has designed an alternative, namely liquidation-free lending insurance. When the collateral BTC price drops, the borrower has the right to "forcefully" purchase insurance.

This introduces an insurance seller, Charlie (Alice and Bob are the lending parties).

The pricing model for insurance uses common extreme value theory and T-Copula in the insurance industry. The team has extensive experience in this area, with members having solid expertise in capital pricing theory and financial mathematics, and have participated in projects applying traditional financial derivatives and DeFi derivative pricing. Additionally, the platform's original "Black Box Purchase Mechanism" will increase the efficiency and volume of insurance pricing and transactions.

· CDS -

Those familiar with the 2008 financial crisis are certainly no strangers to CDS (credit default swap), not because of CDS as a derivative tool, but because too many houses were sold to buyers who were not qualified to purchase them.

CDS plays an important role in traditional financial derivatives, helping investors with more efficient risk management, credit assessment, arbitrage trading, and increasing market liquidity and pricing efficiency. However, the reason why advanced derivatives like CDS have not appeared in the ETH Defi ecosystem is that the ETH lending ecosystem has always been based on a pool model, while CDS is built on a peer-to-peer model. BitSmiley's native BTC peer-to-peer lending is more suitable for the development of derivatives like CDS.

In summary, BitSmiley has filled the most missing link in the current BTC ecosystem, "script-based stablecoin," and has opened new doors for BTC Defi through lending, insurance, and CDS derivatives, making it an indispensable key component in the BTC ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。