Compilation | Author | Ektha Surana

Date: June 8, 2023

Source:

https://cleartax.in/s/cryptocurrency-taxation-guide

Overview of Cryptocurrency in India

Is Cryptocurrency Considered "Currency" or "Asset" in India

Cryptocurrencies and NFTs are classified as "Virtual Digital Assets (VDA)" and the term is defined in Section 2(47A) of the Income Tax Act. The definition is very detailed, but primarily includes any information, code, number, or token generated through encryption (not Indian or foreign legal tender). In short, "Virtual Digital Assets" refer to all types of crypto assets, including NFTs, tokens, and cryptocurrencies, but excluding gift cards or vouchers.

Is Cryptocurrency Taxed in India?

Yes, the income from cryptocurrency is taxable in India. The government's official position on cryptocurrency and other virtual digital assets was clarified in the 2022 budget.

How is Cryptocurrency Taxed in India?

In India, cryptocurrency is classified as a virtual digital asset and is subject to taxation.

As per Section 115BBH, income from cryptocurrency transactions is taxed at 30% (plus an additional 4% tax).

As per Section 194S, from July 1, 2022, if the transaction amount within the same fiscal year exceeds 50,000 rupees (in some cases if it exceeds 10,000 rupees), a 1% tax rate is applicable for TDS on the transfer of crypto assets at the source.

Cryptocurrency tax applies to all investors who transfer digital assets in the current year, whether they are individual investors or business investors.

The tax rates for short-term and long-term gains are the same and apply to all types of income earned by investors.

Therefore, the income from trading, selling, or exchanging cryptocurrencies will be taxed at a rate of 30% (plus a 4% surcharge), regardless of whether the income is considered as capital gains or business income. In addition to this tax, the sale of crypto assets exceeding 50,000 rupees (or in some cases 10,000 rupees) will also be subject to a 1% TDS.

Key Points of Cryptocurrency Taxation

Income from cryptocurrency is taxed at 30% as per Section 115BBH applicable from April 1, 2022.

A 1% TDS is applicable for the transfer of VDA as per Section 194S applicable from July 1, 2022.

No other expenses can be deducted apart from the cost of acquisition.

Cryptocurrency gains should be reported in Schedule VDA of the ITR.

Which Cryptocurrency Transactions Require Taxation in India?

You will need to pay a 30% tax if you engage in the following transactions:

Using cryptocurrency to purchase goods or services.

Exchanging cryptocurrency for other cryptocurrencies.

Trading cryptocurrency for fiat currency.

Receiving cryptocurrency as service remuneration.

Receiving cryptocurrency as a gift.

Cryptocurrency mining.

Earning cryptocurrency wages.

Staking cryptocurrency and earning staking rewards.

Receiving airdrops.

How to Calculate Cryptocurrency Tax

Now that you know you have to pay a 30% tax on cryptocurrency profits, let's see how to calculate the profit. Profit is the difference between the selling price and the cost price.

Understanding the Tax Deducted at Source (TDS) for Cryptocurrency Transactions

Tax Deducted at Source (TDS) is aimed at taxing cryptocurrency traders and investors at the time of their transactions by deducting a certain percentage at the source. The buyer owing funds to the seller must deduct the TDS amount and remit it to the central government, paying the balance to the seller. In India, the TDS rate for cryptocurrency is set at 1%. From July 1, 2022, the buyer is responsible for deducting TDS at a rate of 1% when paying the cryptocurrency/NFT transfer fee to the seller. If the transaction occurs on an exchange, the exchange may deduct TDS and pay the balance to the seller. Indian exchanges automatically deduct TDS, while individuals in foreign exchange transactions must manually deduct TDS and submit TDS returns.

P2P Transactions: If it is a P2P transaction, the buyer is responsible for deducting TDS and submitting Form 26QE or 26Q (whichever is applicable). For example, purchasing cryptocurrency using rupees through a P2P platform or international exchange.

Cryptocurrency Transactions: TDS applies at a rate of 1% to both the buyer and the seller. For example, purchasing cryptocurrency with stablecoins.

Airdrop Tax

An airdrop refers to the process of distributing cryptocurrency tokens or coins directly to specific wallet addresses, usually for free. The purpose of an airdrop is to increase awareness of the token and increase liquidity in the early stages of a new currency. Airdrops are taxed at 30%.

So, how much is the tax on airdrops?

Receiving Cryptocurrency: Airdrops are taxed based on the value determined by Rule 11UA, i.e., the market value of the tokens received on the date of receipt at an exchange or decentralized exchange. The tax will be levied at 30% of this value.

Subsequently selling, exchanging, or spending them: If you later sell, exchange, or spend these tokens, a 30% tax will be levied on the income.

For example:

1) Let's assume Mr. Bob received 20,000 ABC tokens as an airdrop on April 1, 2022, but these tokens were not traded on an exchange or DEX. In this case, they would not be taxed.

2) Now, let's assume Mr. Bob also received 20,000 ABC tokens as an airdrop on April 1, 2022, and the ABC tokens were traded on an exchange or DEX (exchanged, purchased, or sold). On April 1, 2022, the price of ABC tokens on the exchange was 10 rupees.

In this scenario, a tax of 30% will be levied on 200,000 rupees (20,000 * 10 rupees).

Now, if Mr. Bob sells these tokens for 500,000 rupees, 200,000 rupees will be considered as the cost, and the remaining 300,000 rupees will be taxed at 30%.

Cryptocurrency Mining Tax

Mining refers to the process of verifying and recording transactions on a blockchain network using powerful computers or specialized mining hardware.

In the blockchain network, transactions are verified by a group of nodes or computers called "miners," who compete to solve complex mathematical problems. The first miner to solve the problem will receive a certain amount of cryptocurrency as a reward, which varies depending on the network.

The mining income received will be uniformly taxed at 30%. The cost of cryptocurrency mining will be considered as "0" when calculating the profits from sales. The cost of acquisition cannot include expenses such as electricity costs or infrastructure fees.

So, how much is the tax on cryptocurrency mining?

Receiving Cryptocurrency: The cryptocurrency assets received during mining will be taxed based on the market value of the tokens received at an exchange or decentralized exchange on the date of receipt, as determined by Rule 11UA. The tax will be levied at 30% of this value.

Selling, exchanging, or using later: If you later sell, exchange, or use these assets, a 30% tax will be levied on the income.

Cryptocurrency Staking/Minting Tax

In the cryptocurrency space, minting refers to the process of generating new blocks in a blockchain using a proof-of-stake algorithm in exchange for newly generated cryptocurrency and commission rewards.

Income earned from staking may be subject to taxation. The amount earned from staking depends on the annual interest rate provided by the validator. For example, if you stake 100 coins at a 10% annual interest rate, you will receive 10% interest per year.

The income earned from staking will be taxed at 30%. Additionally, when you sell cryptocurrency assets, you will need to pay a 30% capital gains tax.

In general, transferring your tokens to a staking pool or wallet usually does not incur taxation. Additionally, transferring assets between wallets is generally considered tax-free.

Cryptocurrency Gift Tax

In the 2022 budget, virtual digital assets were included in the scope of movable property. Therefore, if the total value of gifts exceeds 50,000 rupees, the received cryptocurrency gifts will be taxed as "income from other sources" at the regular fixed tax rate.

Taxation of Cryptocurrency Gifts

Cryptocurrency gifts received from relatives are exempt from tax. However, if the value of cryptocurrency gifts received from non-relatives exceeds 50,000 rupees, they are taxable. Gifts received on special occasions, through inheritance or wills, marriage, or consideration of death are also exempt from tax.

Losses Incurred from Cryptocurrency Transactions

As per Section 115BBH of the tax law, any losses incurred from cryptocurrency cannot be set off against any income, including cryptocurrency gains. Therefore, cryptocurrency investors cannot set off losses from cryptocurrency assets from the previous year when filing their ITR (Income Tax Return) this year.

Additionally, apart from the cost of acquisition or purchase cost, Indian cryptocurrency investors are not allowed to report expenses related to their cryptocurrency activities.

For example, Mr. X purchased Bitcoin worth 60,000 rupees and later sold it for 80,000 rupees. He also purchased Ethereum worth 40,000 rupees and sold it for 30,000 rupees. The exchange charged a transaction fee of 1,000 rupees. The tax implications for these two transactions should be calculated as follows:

Here, the loss of 10,000 rupees is not allowed to be set off against the gain of 20,000 rupees. The entire income of 20,000 rupees is taxed at a rate of 30%. Additionally, the transaction fee of 1,000 rupees is not allowed to be deducted.

Disclosure of Cryptocurrency Assets in the Balance Sheet

The Ministry of Corporate Affairs (MCA) has mandated the disclosure of gains and losses from cryptocurrency. Additionally, the value of cryptocurrency as of the balance sheet date should be reported. Therefore, as of April 1, 2021, there have been changes to Schedule III of the Companies Act. This provision can be seen as the first step of government regulation of cryptocurrency.

Please note that this directive applies only to companies, and individual taxpayers are not required to comply with such regulations. However, reporting and taxation of cryptocurrency gains is mandatory for everyone.

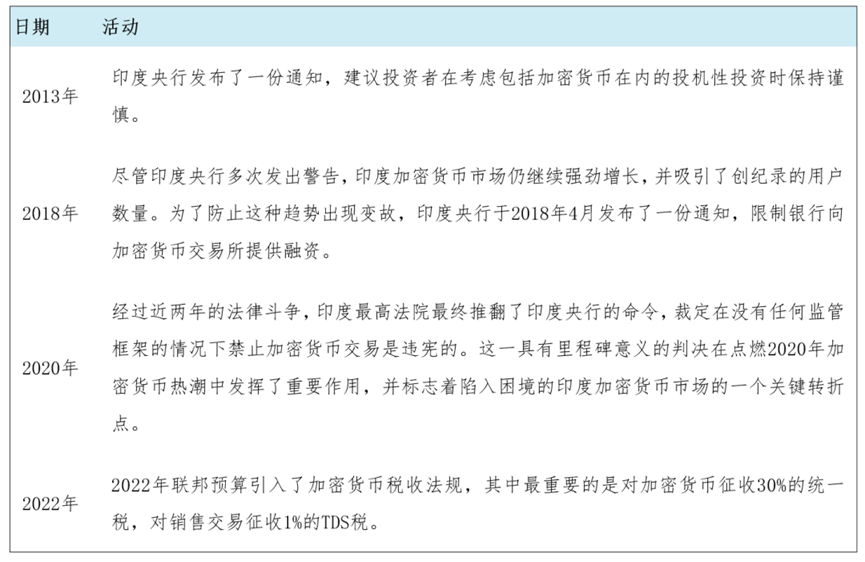

Timeline of Cryptocurrency Tax Regulations in India

FAQs on Cryptocurrency Taxation in India

A. How much tax does India levy on cryptocurrency?

- As per Section 115BBH, cryptocurrency gains are taxed at a rate of 30% (plus applicable surcharge and 4% tax).

B. How is cryptocurrency tax calculated?

- As mentioned above, the taxation of cryptocurrency gains depends on the type of transaction.

C. How is the 30% cryptocurrency tax calculated?

- The income you receive from cryptocurrency will be taxed at a rate of 30%. Income = Selling Price - Cost Price

D. How to report cryptocurrency on the tax return?

For the financial years 2022-23 and 2023-24, you need to use the ITR-2 form (if reporting as capital gains) or ITR-3 form (if reporting as business income) to report cryptocurrency tax. The new ITR forms include a specific section "Schedule VDA" for reporting cryptocurrency gains or income. As per standard income tax rules, the gains from cryptocurrency transactions will be taxed as either (i) business income or (ii) capital gains. The classification depends on the investor's intent and the nature of these transactions.

Business Income: If the transactions are frequent and of substantial volume, the income from cryptocurrency may be classified as "business income." In this case, you can use ITR-3 to report cryptocurrency gains.

Capital Gains: On the other hand, if the primary purpose of holding cryptocurrency is to benefit from long-term value appreciation, the gains will be classified as "capital gains." In this case, you can use ITR-2 to report cryptocurrency gains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。