LandX Finance is a blockchain protocol aimed at introducing real-world assets (RWAs) into the decentralized finance (DeFi) space through a perpetual bulk commodity insurance pool.

Written by: ROUTE 2 FI

Compiled by: Deep Tide TechFlow

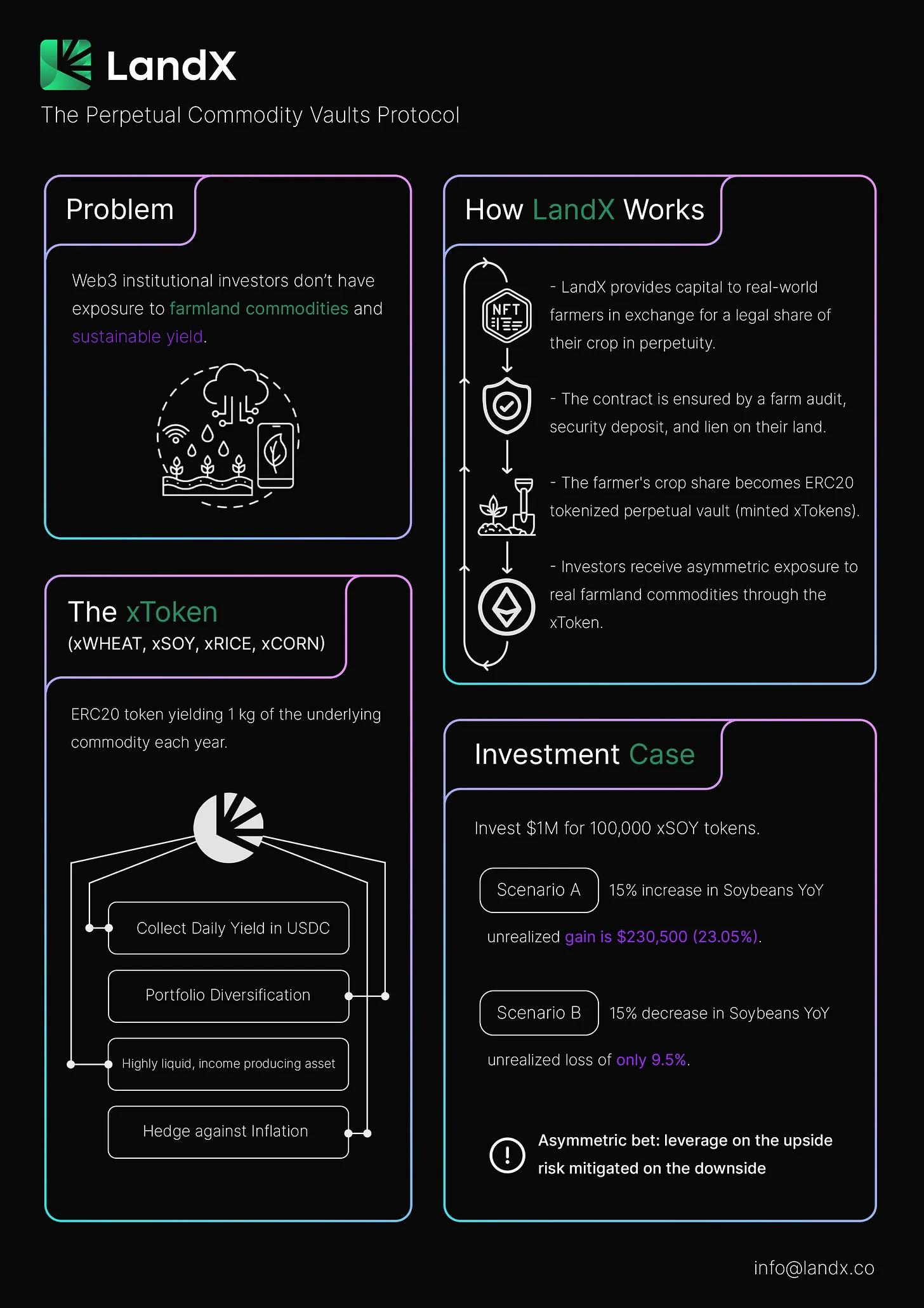

Editor's Note: The RWA track has always attracted high attention. However, the asset categories in the current track are mainly dominated by real-world bonds. LandX provides an alternative choice—bulk agricultural commodities. By combining DeFi and RWA, users can obtain investment returns from bulk agricultural commodity targets, while also boosting farmers' income. The project provides a target independent of encrypted assets, and the relevant tokens will be released soon. This article provides a comprehensive introduction to LandX's product model, economic model, and future development, and is worth paying attention to.

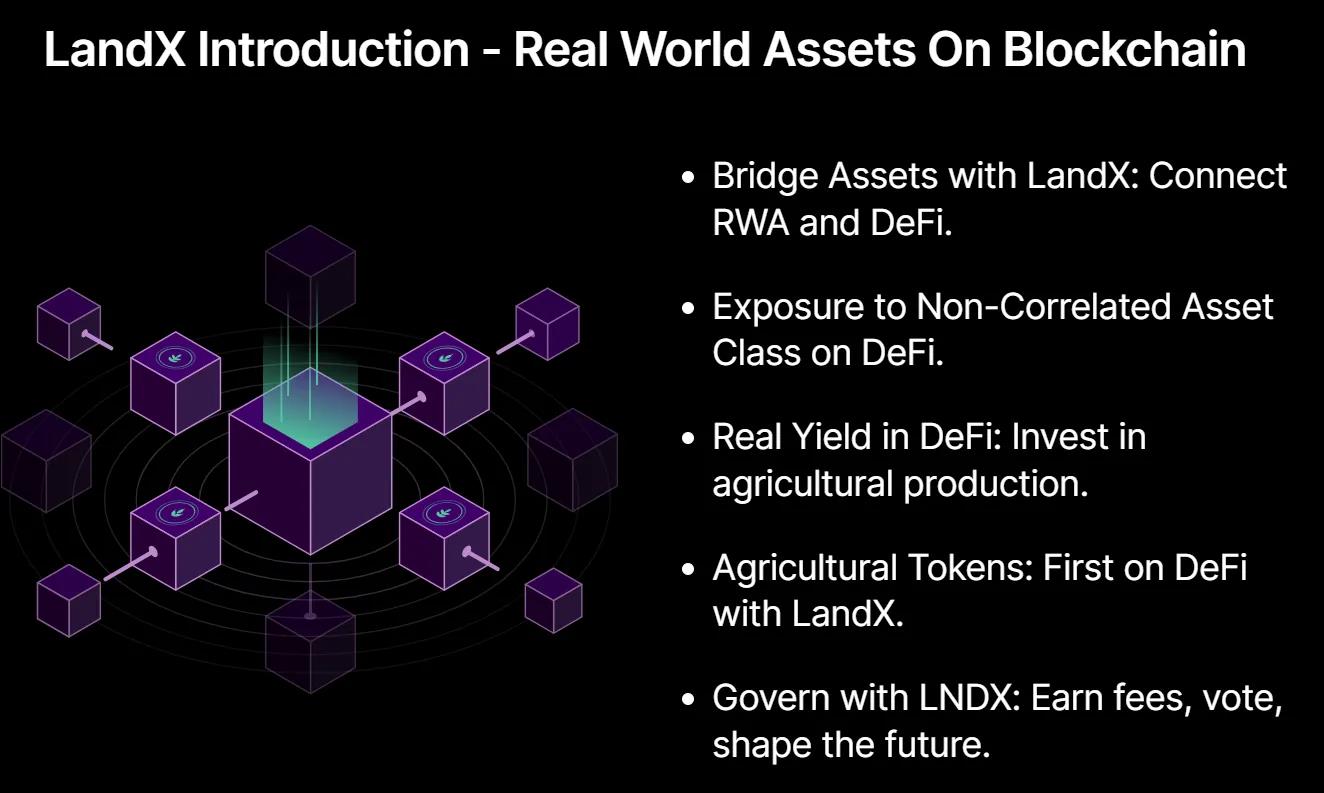

LandX Finance is a blockchain protocol aimed at introducing real-world assets (RWAs) into the decentralized finance (DeFi) space through a perpetual bulk commodity insurance pool. By bringing agricultural RWAs onto the chain, the protocol can provide investment opportunities for investors and access to unrelated asset categories.

As the name LandX suggests, they are narrowing the gap between landowners and crypto investors through a blockchain-based perpetual bulk commodity pool.

The LandX protocol facilitates agreements between borrowers (farmers) and investors. The insurance pool acts as a blockchain-based token traded at a market-determined principal price. Holders of pledged tokens will permanently receive the daily yield of the underlying commodity.

In the past year, we have seen a huge growth of real-world assets (RWA) in DeFi. This field will absorb the next trillion dollars into the crypto market.

LandX plays a crucial role in integrating a $15 trillion asset class (farmland) into DeFi.

It is predicted that by 2040, the total locked value (TVL) of RWAs on the chain will be between 16-20 trillion dollars, while the current TVL in DeFi is only 500 billion dollars.

What are the advantages of LandX? Is it needed in DeFi?

Currently, native DeFi and institutional investors have no way to access agricultural commodities. Therefore, LandX was created to allow native crypto investors to diversify their digital asset portfolios and access sustainable sources of income that are only available off-chain. LandX achieves this by linking digital assets with real-world farmland and agricultural production, providing on-chain users with actual income opportunities.

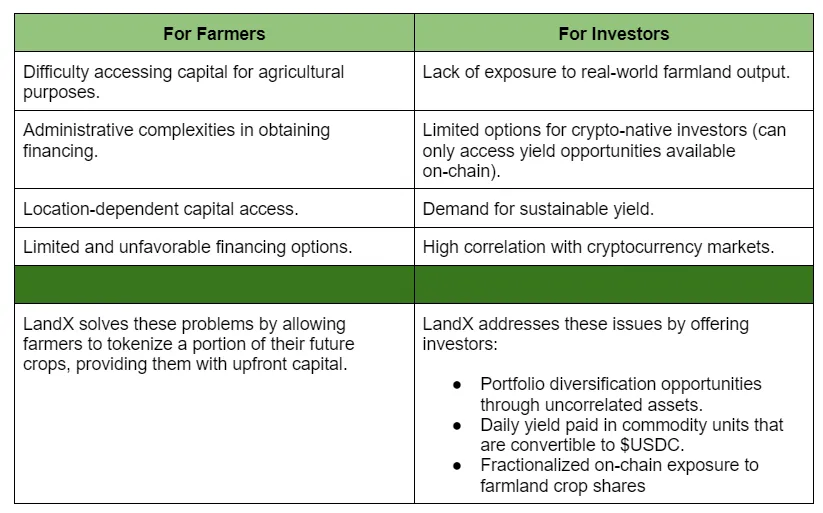

On one hand, farmers often face funding problems. This problem is caused by various factors, such as difficulty in obtaining agricultural financing, cumbersome administrative processes, and dependence on location… Therefore, available options are usually unfavorable.

On the other hand, DeFi investors currently cannot access real-world agricultural production. Therefore, most portfolios in the crypto market are still highly correlated with the overall crypto market (and also have a strong correlation with the US stock market). In addition, most market participants usually look for sustainable sources of income on-chain.

Farmers need funds to purchase additional farmland, new equipment, and improve their facilities. These efforts directly contribute to local food security, but lack of liquidity prevents them from being completed. LandX solves farmers' funding difficulties by providing upfront funding, and in exchange, farmers need to pay a portion of their future agricultural produce.

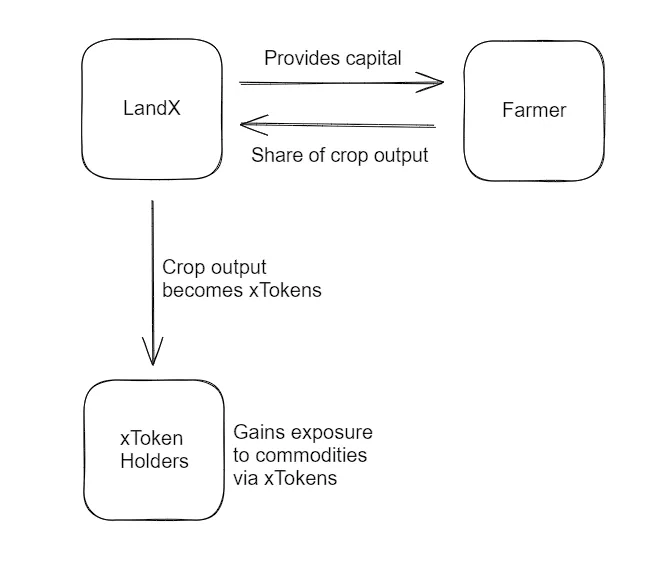

In short, farmers use LandX to convert a portion of their future harvest into tokens to obtain upfront funding. At the same time, crypto investors can directly access the output of underlying farmland. The bulk commodity pool of LandX provides these investors with daily income paid in units of underlying commodities.

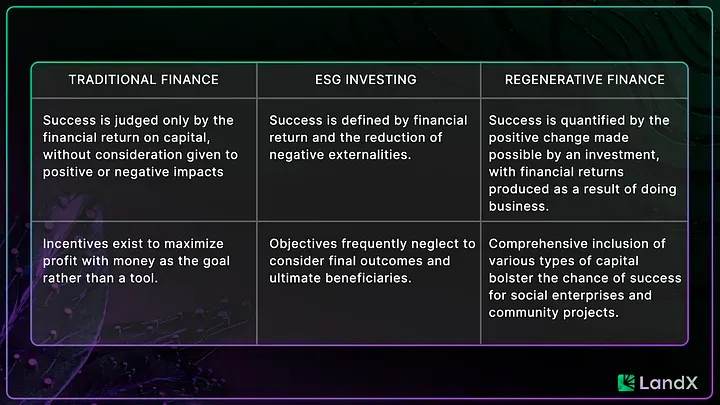

Many DeFi applications often attract liquidity providers through inflationary tokens and aggressive marketing strategies, driving unsustainable returns. These practices may lead to short-term gains, but often lack long-term viability.

LandX takes a different approach, focusing on sustainable income and regenerative finance. The platform uses capital as a tool to invest in real-world income opportunities, while addressing systemic issues to rebuild the natural environment. This approach aims to generate lasting and meaningful impact in DeFi and the environment.

In summary, here are the problems LandX solves:

Token Introduction

LandX primarily uses three types of tokens, xTokens, cTokens, and governance token LNDX.

First, let's look at xTokens.

xTokens—Diversification in DeFi

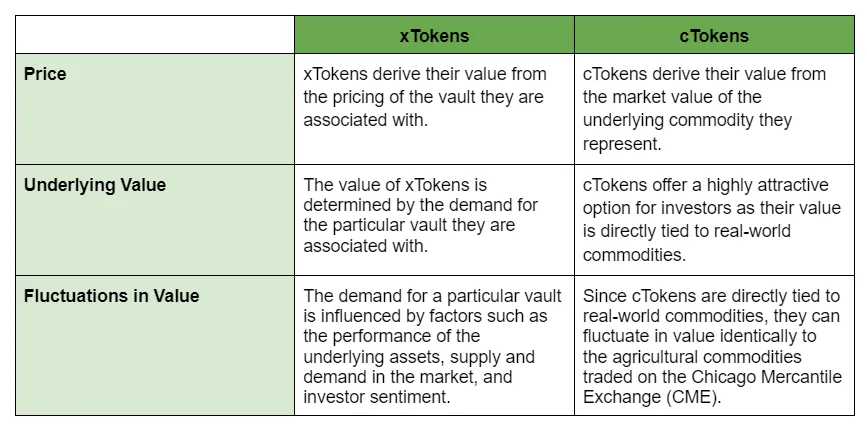

LandX ensures that crop yields are converted into xTokens.

The actual production of crops is represented on-chain in the form of cTokens. xTokens are fragmented debt obligations that farmers must provide to LandX for their share of agricultural produce.

This is illustrated in the diagram below.

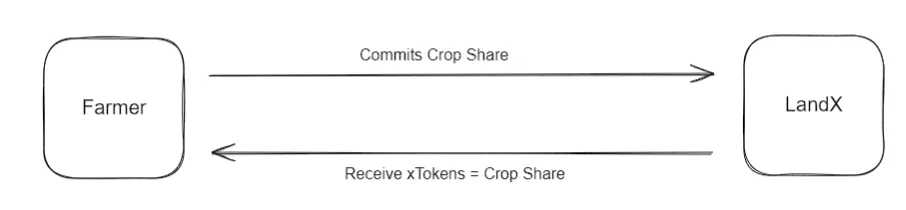

The xTOKEN received by farmers is equivalent to the fragmented debt obligation of their agreed-upon share of agricultural produce (for example, if a farmer commits to providing 1000 kilograms of soybeans annually, they will receive 1000 x soybean tokens).

To counter potential agricultural or cash uncertainty, the LandX platform requires farmers to retain their share of agricultural produce payments on the platform for 12 months, and also requires a 12-month deposit from each farmer.

After undergoing extensive qualification review, farmers commit to a certain percentage of annual harvests through legal contracts (referred to as retention rights). In return, they receive xTokens equivalent to the agreed-upon crop share. These tokens are then sold to interested investors, providing upfront funding for farmers.

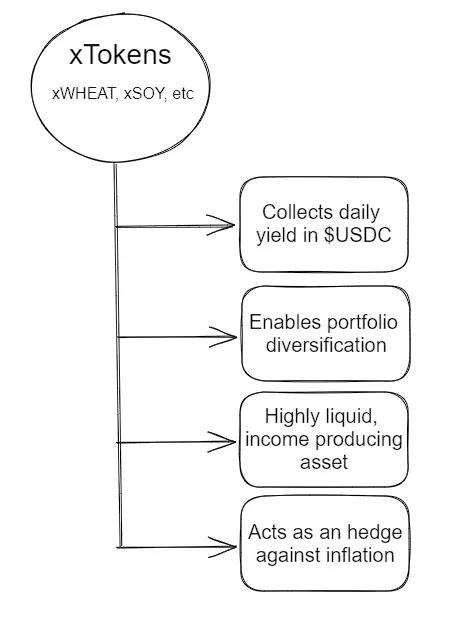

xTOKEN benefits investors in multiple ways:

Hedging against inflation: xTOKEN provides exposure to agricultural crop yields, which has historically been a reliable hedge against inflation.

Liquid, income-generating asset: xTOKENs allow the bulk commodity insurance pool to be traded on decentralized exchanges within 365 days.

Daily income in USDC: Pledged xTokens generate cTokens daily. Through the accessible insurance pool in the LandX dApp, cTokens can be exchanged for USDC.

Portfolio diversification: xTOKENs provide diversification unrelated to crypto, stocks, and traditional insurance pools.

cTokens—Commodity Collateral

Each xTOKEN entitles its owner to a permanent annual yield of 1 kilogram of commodity (CY) in the form of cTokens.

cTokens can be sold in USDC form at the protocol level according to the current market price provided by the Chainlink oracle.

If someone holds xWHEAT, they will receive 0.0027 kilograms of wheat per day, equivalent to 1 kilogram per year. CY is paid daily in units of the underlying commodity (kilograms). When xTOKEN holders want to claim their rewards, the value of their CY will be converted to USDC and paid to the holder.

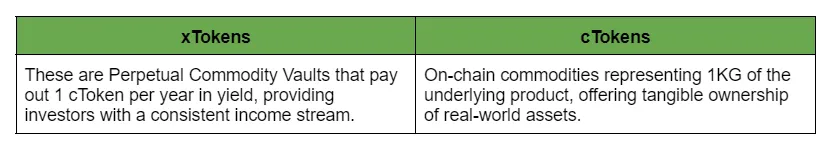

To make it completely clear, let's look at the difference between xTokens and cTokens:

xTokens vs. cTokens

xTokens generate actual income payments in the form of cTokens, which represent a commodity token equivalent to 1 kilogram of wheat, soybeans, rice, or corn. For example, one cWheat equals the current market price of 1 kilogram of wheat.

xTokens can be traded on the open market.

cTokens can be exchanged for $USDC in the LandX dApp. They cannot be traded on the open market.

LNDX Token

xTOKEN represents the perpetual commodity insurance pool, and LNDX is the native token of the LandX protocol. The price of LNDX is driven by speculation and the performance of LandX as a company. Its price is also influenced by the demand to participate in the LandX system.

Here's how LNDX is linked to the protocol:

LNDX tokens receive a portion of the protocol's income. Therefore, it represents the intrinsic value of LandX to some extent.

LNDX holders vote on governance decisions, future updates, etc., on the platform. This is an important part of the LandX DAO.

LNDX stakers are eligible to become validators for LandX. Validators are responsible for onboarding farmers into the protocol and receive commissions in return. There are other conditions for becoming a validator.

Investment Case Example

An investor wants to purchase $1 million worth of xSOY. In exchange for the investment, they will receive 100,000 xSOY tokens at a price of $10 per token. These xSOY tokens represent 100,000 kilograms of soybeans annually.

In addition to owning a bulk commodity insurance pool of 100,000 kilograms of soybeans annually, the holder will also receive approximately a 9% annual percentage yield (APR) as CY.

LandX controls the supply of xSoy (and other xTokens) by controlling the tokenization of farmland on the platform. Due to this ability to control the supply, LandX has set a target asset appreciation rate (currently 10%) for the xToken insurance pool.

In summary, the investor receives:

9% bulk commodity output

10% target asset appreciation rate

Additionally, the investor can capture any potential appreciation in the underlying commodity prices due to the impact of global warming, soil erosion, and rising energy prices.

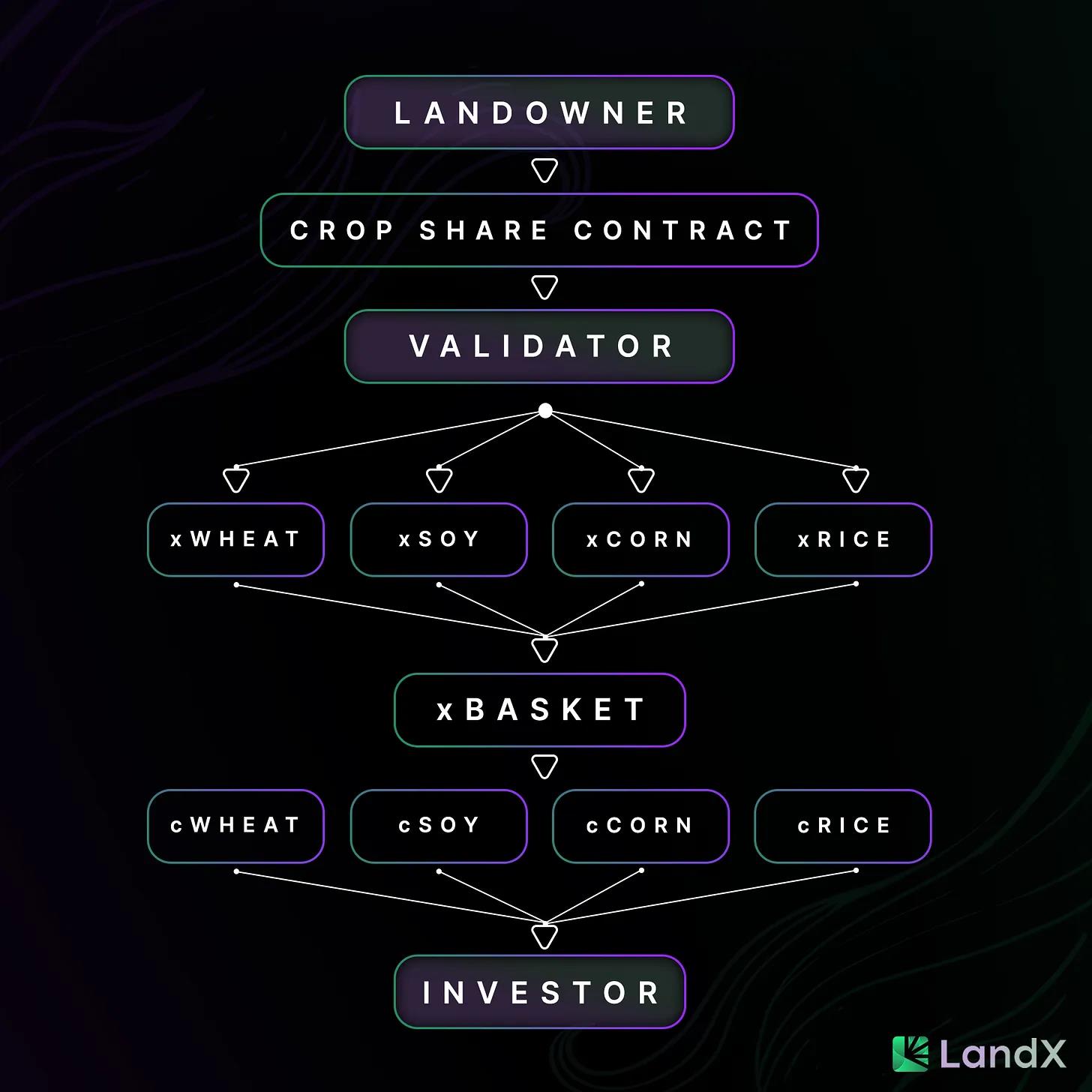

If soybeans appreciate by 15% in the next year and the investor sells their $1 million position, they will profit approximately $230,500 (23.05%).

If soybeans depreciate by 15% in the next year and the investor sells their $1 million position, they will only incur a 9.5% loss, which is $95,000.

This is an asymmetric opportunity that belongs to asset categories that blockchain investors currently cannot access. If the price goes up, you will benefit from the appreciation and yield of xSOY. If the price goes down, some of your losses in xSOY value will be offset by the daily yield you receive.

The value of xTokens comes from their actual income generation and their price appreciation.

The supply of xTokens is controlled by the speed of new farmland access. New farmers will mint xTokens equivalent to their contractual obligations. LandX prudently controls the supply of new xTokens by managing the access speed and providing new farmland-based xTokens only when demand is appropriate.

LandX sets a target asset appreciation rate and evaluates it every 3 months. Currently, the target appreciation rate is set at 10% annually, consistent with actual inflation.

The low volatility of xTokens and the price trajectory of appreciation make xTokens an ideal building block in the DeFi space.

Backed by major crop production such as soybeans, rice, rope, and wheat in the real world, they naturally resist price fluctuations in both directions.

xBasket (LandX's index token, composed of equal parts of each xToken) presents an automatically compounding bulk commodity insurance pool, with a target annual percentage yield of 18.8% based on the appreciation of xTokens and the income they generate.

The Impact of LandX

Many DeFi applications promote unsustainable returns through inflationary tokens and marketing funds.

LandX builds sustainable income through regenerative finance. Capital is used to invest in real-world income opportunities and address systemic issues to rebuild the natural environment.

The LandX protocol is a bridge between real-world assets and blockchain technology. Farmers can reach agreements with investors globally, obtaining capital for business expansion and long-term food security efforts. LandX has created a robust legal and financial framework in a new way, connecting farmers and investors.

Let's summarize the content of this article so far through an infographic:

Why Choose Bulk Commodity Agriculture?

In the current economic environment characterized by crises and soaring inflation rates, agricultural products provide investors with an attractive safe haven and unique investment opportunities.

Land has been proven to be a sustainable asset, with an annual inflation rate of at least over 2%. Additionally, the availability of arable land—land capable of producing high-quality crops—is decreasing due to erosion and industrialization.

According to World Bank data, the per capita arable land area has fallen to below 20 hectares. For example, Europe is currently facing shortages of agricultural products and fertilizers from countries such as Russia, Ukraine, and the Netherlands. Coupled with global warming and the growing world population, major commodities such as wheat, soybeans, rice, and corn are expected to see increased demand, driving their value up.

Unlike limited resources such as gold, arable land is a productive asset. It not only preserves value in inflation but also generates income for the owner through the sale of agricultural products.

The trade of agricultural products such as rice, corn, soybeans, and wheat has a history of thousands of years. Rice futures provide a means for farmers and investors to hedge against agricultural and political uncertainty, a system that still exists today and applies to various agricultural products.

Although agriculture has obvious hedging value in turbulent times, its value is still relatively underestimated in the contemporary financial landscape. While speculative investments in growth stocks and digital assets like Bitcoin are popular, LandX recognizes the significant potential of agricultural commodities when combined with the instant, trustless, and decentralized properties of blockchain technology.

Token Economics of LandX

The structure of LandX is a decentralized autonomous organization (DAO), with voting rights belonging to holders of the LNDX governance token.

LNDX Token Model and Governance

LandX offers something relatively unique in the DeFi market: real income from actual production. This contrasts sharply with most governance tokens built around zero-sum token economics.

The accumulation of LNDX value ensures that the interests of stakeholders are aligned with the project. Validators are required to stake LNDX tokens as part of their commitment to the land protocol.

Traders and investors in the crypto market seek volatility, and LNDX is the best way to gain exposure to LandX. While xTokens are expected to maintain a strong correlation with their underlying assets, LNDX may fluctuate with the overall success of the cryptocurrency market and LandX.

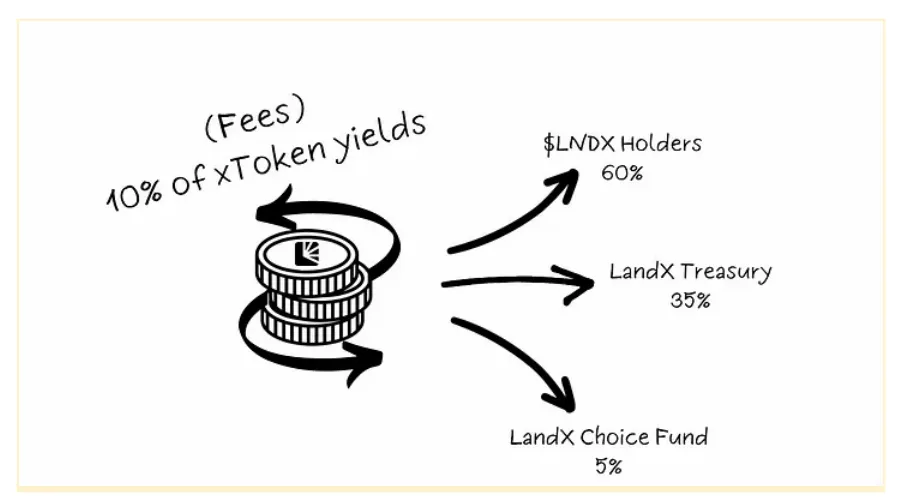

LNDX token holders earn a certain percentage of platform fees from xToken earnings.

Due to the current and future value distribution, these platform fees create utility and demand for LNDX. The pricing of LNDX is based on the potential for future earnings, making it highly volatile and attractive as an altcoin investment.

Platform fees are set at a 3% initial financing amount provided to farmers, a 0.25% payment of agricultural shares, and a 10% tax on the USDX yield collected. The collected fees are allocated in the following manner in USDC:

60% to LNDX token holders

35% to LandX Treasury

5% to LandX Choice

The fee percentages and allocation percentages may be changed through DAO proposals and voting based on market conditions. The estimated potential valuation can be evaluated using existing DeFi protocols and their TVL relative to their governance token market cap.

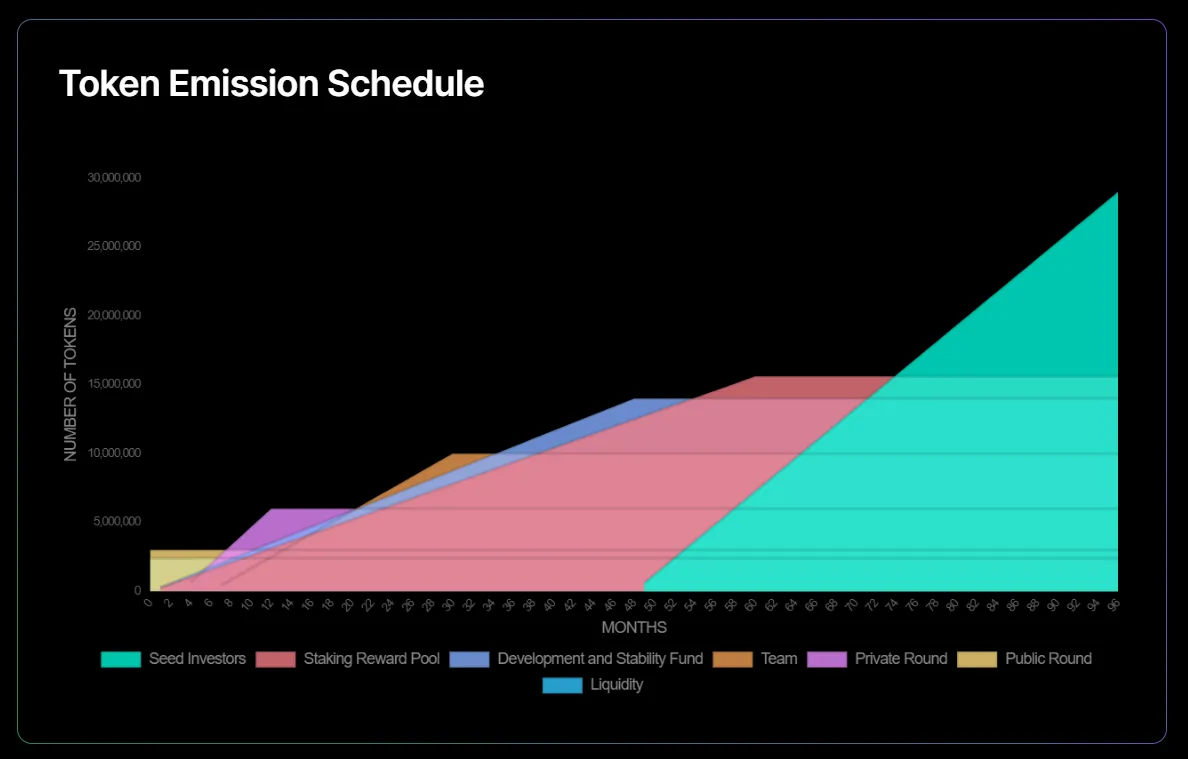

The circulating supply of LNDX is 5.4 million, with 2.4 million held by the treasury.

At a price of $0.50 per LNDX, the initial market value is approximately $2.7 million.

Considering over $6 million in cash reserves, the intrinsic token value could increase significantly.

Tokens from seed investors will be fully locked for 4 years and gradually unlocked over an additional 4 years, reducing immediate market impact.

The fully diluted value (FDV) should be adjusted accordingly, as over 40 million LNDX will be released starting from the 4th year.

55% at issuance is community-held, demonstrating widespread adoption of the circulating supply.

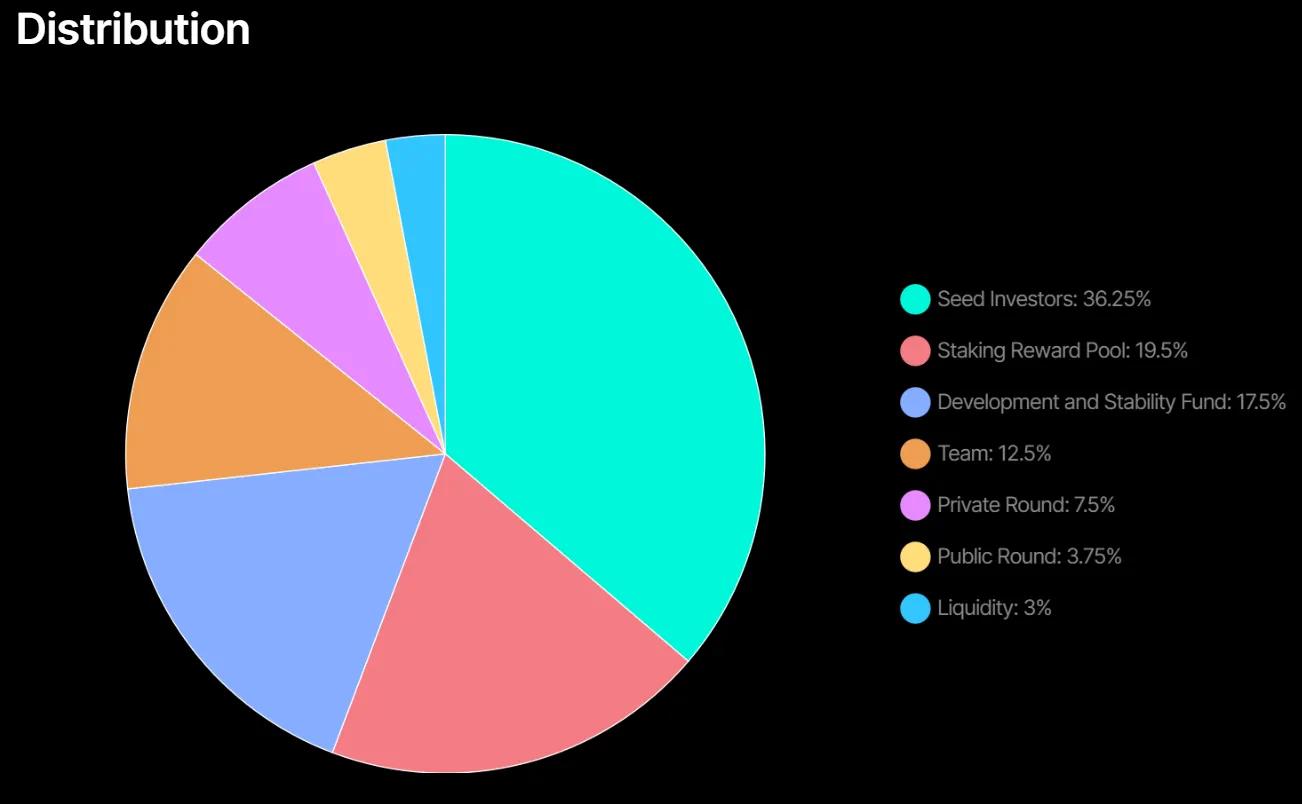

Token distribution for fundraising of 38 million (47.5% of total supply) is as follows:

Seed Round

$0.189 per token.

29 million tokens (36.25% of total supply).

4-year unlock.

Private Round

$0.23 per token.

6 million tokens (7.5% of total supply).

9-month staged unlock.

Public Round

$0.50 per token.

3 million tokens (3.75% of total supply).

Immediate unlock.

The remaining 42 million (52.5% of total supply) is distributed as follows:

Team

10 million tokens

24-month unlock.

Staking Reward Pool

15.6 million tokens (19.5% of total supply)

60-month vesting.

Liquidity

2.4 million tokens (3% of total supply)

Immediate unlock.

Development and Stability Fund

14 million tokens (17.5% of total supply)

48-month vesting.

The staking rewards are substantial and will be distributed to LNDX token stakers over a 5-year period.

The liquidity funds will be used to create a 24/7 trading venue between decentralized and centralized exchanges.

Staking LNDX Tokens

Holders willing to lock their tokens for the long term will receive a higher proportion of staking rewards and voting power.

3 months, 1x voting power and staking rewards

12 months, 2x voting power and staking rewards

48 months, 4x voting power and staking rewards

All stakers will receive veLNDX, a non-transferable token that will serve as a receipt for their deposits.

Who are LandX's Clients?

Currently, there are two target markets that will serve as ideal clients for LandX:

DAO Treasuries seeking diversified crypto investments to hedge bear market cycles

Crypto-native investment funds seeking yield and inflation hedging

DAO Treasuries

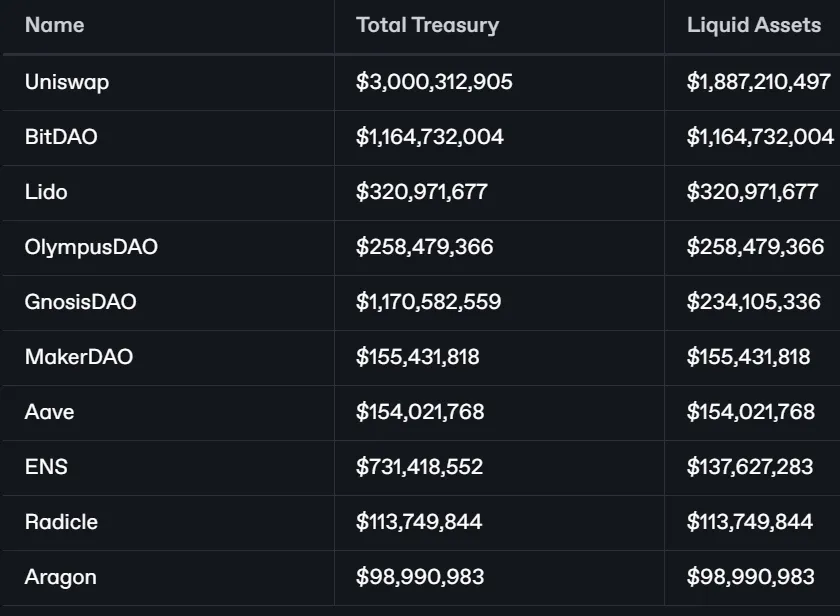

DAO treasuries have accumulated significant capital, currently managed by decentralized autonomous organizations, totaling over $10 billion. Here are the top ten treasuries:

LandX is looking for partners who wish to achieve portfolio diversification, and DAOs are ideal clients with strong balance sheets but an overabundance of crypto assets.

Crypto-Native Investment Funds

In the crypto industry, there are many different types of investment funds that have developed from the success of the industry. Many funds now manage portfolios of digital assets worth billions of dollars, such as Alameda Research, Multicoin Capital, Paradigm, and Wintermute.

Business Model

As LandX expands its business scope and integrates with various DeFi applications, it seeks to further diversify its sources of income. This includes short-term lending/borrowing opportunities, automatic compounding of yields, and more.

Revenue Streams

LandX generates income through various channels that are crucial for the functionality and growth of its ecosystem:

Transaction Fees: LandX charges transaction fees for trading commodities and xTokens on its internal market. These fees contribute to the platform's revenue.

Validator Commissions: Validators play a crucial role in introducing farmers, managing contracts, and ensuring the safety of commitments made by landowners. LandX pays commissions to validators, typically a percentage of the financing amount brought in by farmers.

Revenue Sharing: The $LNDX governance token is a key element of the LandX ecosystem. Token holders earn protocol fees, further incentivizing participation in governance decisions and the growth of the LandX platform.

The native token of LandX, $LNDX, is at the core of its economic model and revenue generation:

Protocol Fees: $LNDX token holders earn a portion of protocol revenue, including trading fees and other platform-related fees. This provides direct financial incentives for holding and staking $LNDX tokens.

Governance: $LNDX holders also have voting rights in platform governance. They participate in decisions related to protocol upgrades, rule changes, and other key matters, influencing the direction of ecosystem development.

Fee Allocation

LandX charges a 3% fee for farm financing and a 0.25% fee for regular crop shares. The allocation of these fees is as follows:

60% to $LNDX stakers

35% to LandX Labs operations

5% to the LandX Choice Fund, supporting regenerative agriculture initiatives, land steward education, SDG goal certification, ESG projects, agricultural monitoring technology, and sustainable agricultural tools and equipment.

Roadmap

LandX has released a roadmap outlining three core objectives guiding its progress:

Tokenizing farm commodities for all crypto-native investors.

Providing a secure, stable, and intuitive platform to access all services and products.

Actively impacting every farm we partner with, encouraging regenerative practices.

LandX's growth strategy includes expanding the scope of farm share opportunities. This expansion will allow the protocol to accommodate a wider range of agricultural assets, providing more diversified choices for farmers and investors.

The next steps for LandX include integration with DeFi applications to enable features such as short-term lending.

The fundraising has been completed, raising a total of $8.38 million. The next steps are to launch the mainnet and progress towards the following goals:

Integration with more networks.

Launch of the xBasket index.

Enhanced security and transparency measures.

Expansion of product range, including xUSD and xNFTs.

Establishment of LandX DAO.

Risks and Audits

Similar to other RWA platforms, LandX has implemented several safeguards and transparency measures to mitigate counterparty risk and protect the interests of various participants.

Margin for Uncertainty Risk: LandX addresses uncertainty in agricultural production by requiring landowners to maintain a security margin equivalent to 12 months of crop shares. This margin serves as a safeguard against potential uncertainty in crop yields or cash flows, providing a buffer for landowners and investors.

Centralized Platform Risk: As a centralized platform dealing with real assets, LandX carries inherent risks associated with such projects. However, it actively works to minimize these risks through robust legal structures and transparency.

Transparency and On-Chain Records: LandX is committed to transparency. Every aspect of the platform, including land details, harvest records, retention documents, payment history, and commodity yields, is recorded on-chain. This ensures immutable and verifiable records of all activities, enhancing accountability and trust.

Revenue Reserves and Staking Mechanism: To further protect investors' interests, revenue reserves are locked in smart contracts. These reserves are paid to stakers through traditional DeFi staking mechanisms, with a staking period exceeding 14-18 months. This extended period provides stability and security in the face of unexpected challenges.

Transparency of Farmers and Land: LandX provides transparency regarding farmers and land. Information about actual land, including its location and historical crop yields, is stored in NFTs and immutable IPFS records. This detailed information is accessible on the platform, ensuring clarity for all participants.

Validators: Validators play a crucial role in the LandX ecosystem. They are responsible not only for introductions but also for timely collection of crop shares. Validators have an incentive to ensure timely crop share payments, as their staking is affected if the farmers they introduce fail to fulfill their obligations.

Prevention of Collusion: Collusion between farmers and validators is prevented through legally binding agreements. Farmers make commitments to LandX, with legal consequences for violations. As trusted third parties, validators undergo rigorous vetting processes, minimizing the risk of collusion.

Conclusion

LandX bridges the gap between real-world assets and decentralized finance. Through LandX, you can access asset classes unrelated to cryptocurrencies and DeFi (e.g., the rapid crash of cryptocurrencies on December 11 had no impact on agricultural commodities).

With a strong token economics, LandX offers investment opportunities in RWA and the potential advantages of the LNDX token. The team's commitment and strategy make me optimistic about the future growth prospects of LandX, and the foundation's fund reserves of over $6 million lay the groundwork for exponential growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。