After experiencing the FTX bankruptcy event, Solana faced significant challenges. The price of SOL tokens once plummeted to $8, a drop of over 95%. Nevertheless, the Solana ecosystem and its large community demonstrated remarkable resilience. During this period, the number of users surpassed one million, the number of developers exceeded 2,000, and new DeFi and NFT projects continued to emerge in the ecosystem.

The recovery of Bitcoin prices drove a strong rebound in the Solana token, with a price increase of over 200% in just two months. The Grayscale Solana Trust's premium reached as high as 800%, indicating the market's optimistic outlook on Solana's long-term prospects.

Currently, there are 295.7 million SOL tokens staked on the Solana network, but the application of liquid staking derivatives is still relatively limited. During the FTX event, Solana's liquid staking TVL dropped from a peak of 12.8 million SOL to a low of 5 million SOL, but later recovered to around 12M+ SOL. The recently launched Jito staking service has accumulated over $44.86 million (2.3 million SOL) in TVL since its launch.

These data indicate that in the risk-return comparison, Solana staking provides considerable potential. Liquid staking on Solana only accounts for a small portion of its total staking, showing significant room for growth.

In this wave of recovery in the Solana ecosystem, Jito has performed particularly well. In the past 30 days, its TVL has grown by nearly 70%, making it a highlight in the Solana staking ecosystem. Next, we will delve deeper into Jito and other important projects in the Solana staking ecosystem.

Solana's innovative liquid staking mechanism has attracted industry attention, and related project data shows outstanding performance

In the Solana ecosystem, the introduction of liquid staking tokens marks a deep exploration of the DeFi field. These tokens, as derivatives of the native Solana asset SOL, provide a unique staking strategy. Through them, users can earn staking rewards without sacrificing asset liquidity, achieving a dual advantage of participating in DeFi applications while still enjoying staking rewards.

In traditional blockchain ecosystems, users often have to choose between staking rewards and other potential high-return opportunities. However, Solana's liquid staking tokens have changed this situation. With this mechanism, users no longer need to choose between staking rewards and participating in the DeFi market, but can enjoy both simultaneously.

In addition to providing greater flexibility for users, this strategy also contributes to network security and decentralization. With the existence of liquid staking tokens, users' assets are no longer concentrated with a single validator, reducing the risk of fund loss and increasing the network's decentralization.

The liquid staking projects in the Solana ecosystem each have their own characteristics, including different staking strategies and fee structures. These projects such as Jito, Marinade, BlazeStake, marginfi, and Jpool not only provide users with a variety of choices, but also demonstrate the innovative spirit and development potential of the Solana ecosystem. Next, we will delve into the specific details of these projects, including their strategies, advantages, and challenges.

An overview of LSD projects on Solana: Different mechanisms and future spaces are worth exploring in detail

Marinade Finance: Allows users to convert staked assets into liquid assets at any time

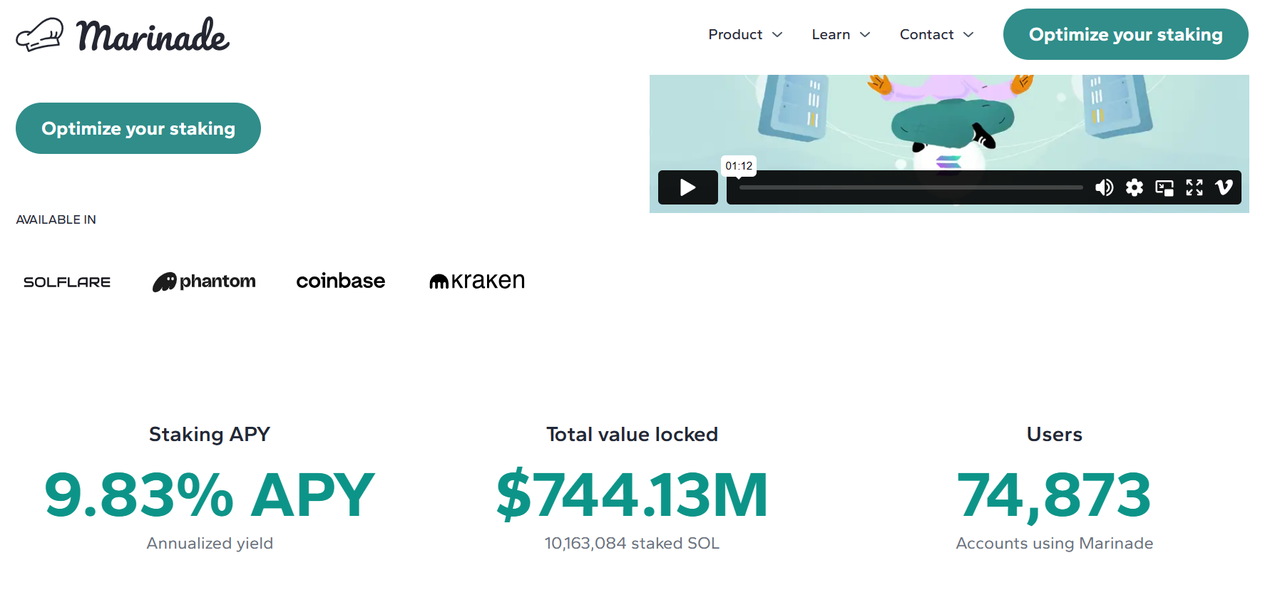

Marinade Finance stands out in the Solana ecosystem with its highest Total Value Locked (TVL), focusing on providing convenient staking solutions for Solana. The core service of this platform is "liquid staking," which allows users to convert staked assets into liquid assets at any time without going through a lengthy unlocking process.

To keep up with the development of emerging protocols in the market, Marinade launched a reward program in mid-September. Although Marinade's SOL TVL saw a slight decline during the quarter, it rebounded since September 20. In addition, the launch of Marinade Native at the end of July as a supplement to its liquid staking service is an automated platform that allocates staking to over 100 outstanding validators, with the advantage of not paying performance fees and reducing smart contract risk.

Marinade recently launched the Marinade Native program, which allows users to easily delegate their staking rights while retaining the right to withdraw funds. Marinade also initiated the Marinade Earn reward program from October 1, 2023, to January 1, 2024, where participants will receive additional MNDE rewards, and a referral system to incentivize users to invite new participants.

Since its launch in 2021, Marinade, as a mature DeFi protocol, had a TVL that exceeded $1.5 billion during the market peak. Although there has been a decline compared to the peak, Marinade still ranks first in TVL in the Solana ecosystem. Its token mSOL has strong liquidity in the market and is listed on exchanges such as Coinbase and Kraken.

Marinade Finance currently maintains a dominant position in the Solana liquid staking market, with a staking volume of over 5.47 million SOL. Its project TVL reaches $613 million, with a monthly growth rate of 78%, demonstrating not only its strong influence in the Solana ecosystem but also indicating its future development potential.

Jito: Early layout in the Solana MEV (Maximum Extractable Value) field

In November 2022, on the eve of the FTX collapse, Jito Labs officially announced the launch of its Jito staking service, marking its active progress in the liquid staking (LSD) protocol field. Users who delegate SOL to validators can receive JitoSOL as a liquidity certificate, the value of which grows with the accumulation of validator rewards. Jito Labs' early layout in the Solana MEV field enables Jito to distribute MEV rewards to stakers, thereby increasing overall staking rewards.

However, Jito's launch coincided with the FTX collapse, and the closely related Solana also experienced a significant loss of liquidity. Initially, Jito's Total Value Locked (TVL) did not significantly increase due to the lack of market confidence and liquidity demand.

With the gradual recovery of the Solana ecosystem in the second half of 2022, Jito's TVL also began to steadily increase. In particular, in August, Jito launched a points incentive program to encourage users to participate in Jito staking, hold JitoSOL, participate in DeFi activities, and refer new users, significantly boosting Jito's TVL growth.

In addition, Lido DAO decided to no longer support new SOL staking from October 2022, and its operator began to gradually exit the SOL staking market from November. Lido's exit led to nearly 6 million stSOL needing to find new staking locations. With its dual advantage of staking and MEV rewards, as well as the points incentive program, Jito successfully attracted a large amount of stSOL, leading to a significant increase in its TVL and quickly becoming one of the top two LSD protocols on Solana.

The liquidity staking protocol of Jito delegates users' SOL to validator nodes that support MEV, with MEV earnings distributed as additional rewards to stakers. At the end of August, Jito launched a referral program and introduced a points system in mid-September, and announced an airdrop on November 28.

Compared to Marinade, the gap in the ecological composition, decentralization, and staking mode singularity of Jito is gradually narrowing. Jito's core competitive advantage in capturing and distributing MEV value, along with the prosperity of the Solana network, will continue to expand. Therefore, we have extremely optimistic expectations for the future development of Jito, as it is expected to become the largest LSD protocol in the Solana ecosystem.

Jito's project TVL is currently $4.12 billion, with a monthly growth rate of 90%, demonstrating strong momentum in the Solana liquid staking market. As Jito continues to develop, we look forward to its playing a more important role in the Solana ecosystem.

BlazeStake: Committed to promoting decentralization of Solana nodes

BlazeStake, as an emerging liquidity staking protocol in 2023, is committed to promoting the decentralization of Solana nodes. On the BlazeStake platform, stakers have two options: joining a standard delegation pool or staking SOL with any validator. In either case, stakers receive bSOL as proof of their liquidity staking rewards.

BlazeStake has been hinting at airdrops for bSOL holders since last year. In August 2023, BlazeStake launched a points system and its own token BLZE, and conducted an airdrop based on user points. This strategy not only incentivized user participation and holding of bSOL but also increased the project's attractiveness and visibility.

As of November 30, BlazeStake's locked SOL value achieved an astonishing growth, with a year-on-year growth rate of 1,234%, reaching a total locked amount of 678,560 SOL, equivalent to $40 million. This achievement significantly reflects the rapid growth of BlazeStake in the Solana ecosystem and the positive market response.

The project's Total Value Locked (TVL) has reached $50.33 million, with a monthly growth rate of 124%, demonstrating strong momentum in the Solana ecosystem. Although BlazeStake has not issued its own token, its airdrop plan is clearly mentioned in the whitepaper, despite specific details not being disclosed.

This series of actions by BlazeStake indicates that it is rapidly becoming an important force for decentralization and innovation in the Solana staking ecosystem. As the project continues to develop and consolidate its market position, we can expect BlazeStake to play an even more crucial role in the Solana ecosystem.

MarginFi: Completed a $3 million seed round financing

MarginFi, as one of the leading lending protocols in the decentralized finance (DeFi) ecosystem of Solana, has stood out in the market with its innovative strategies. On July 3, 2023, MarginFi launched a points system, incentivizing user participation through rewards for deposits, borrowing, and referrals.

This strategy has been remarkably effective, with a year-on-year growth rate of Total Value Locked (TVL) reaching 743%, propelling MarginFi to sixth place in the Solana DeFi TVL rankings. This achievement not only reflects MarginFi's strong growth in the market but also its important position in the Solana DeFi ecosystem.

At the end of the quarter, MarginFi further expanded its business by launching its own liquidity staking token LST. This made MarginFi one of the platforms with the highest natural returns among all liquidity staking (LST) on Solana. This move further solidified MarginFi's leadership position in the Solana staking market.

As of now, MarginFi's project TVL has reached $149 million, with a monthly growth rate of 153%, once again emphasizing its rapid growth and market attractiveness in the Solana ecosystem. Although MarginFi has not issued its own token, its business model and market performance have garnered widespread attention.

In terms of funding, MarginFi completed a $3 million seed round financing on February 23, 2022, providing a solid financial foundation for its future development. Considering MarginFi's innovative strategies and significant growth in the Solana DeFi market, we can expect it to continue to play an important role in driving the development of the Solana ecosystem.

JPool: Utilizes an intelligent allocation mechanism to automatically distribute users' staked assets based on overall yield

JPool is notable in the Solana ecosystem for its liquidity staking protocol. The protocol's feature is that it does not support users directly selecting validator nodes. Instead, JPool utilizes an intelligent allocation mechanism to automatically distribute users' staked assets based on overall yield. This approach simplifies the user's decision-making process while aiming to optimize the overall performance of staking rewards.

As of the latest data, JPool's Total Value Locked (TVL) has reached $40.35 million, showing a 62% monthly growth rate. This significant growth indicates that despite JPool adopting a relatively non-traditional staking method, it has still received a positive response in the market.

It is worth noting that JPool has not yet issued its own token. This means that JPool's growth and attractiveness are primarily based on the strengths of its staking service itself, rather than the short-term appeal brought about by token incentives. This strategy demonstrates JPool's confidence in its service quality and user experience.

JPool's success in the Solana DeFi ecosystem demonstrates the potential of the liquidity staking model, especially in optimizing and automating staking strategies. JPool's model provides an attractive option for users seeking simplified and efficient staking solutions in the Solana ecosystem.

JPool is gradually developing in the Solana ecosystem with its unique intelligent liquidity staking model, and its future performance may further reflect the effectiveness and attractiveness of intelligent staking strategies in the DeFi field.

The Solana ecosystem continues to expand, expecting more innovative applications to continue emerging

As the Solana ecosystem continues to mature and expand, its staking ecosystem is showing a trend of diversification and innovation. From Jito's strong performance, Marinade Finance's steady growth, MarginFi's innovative strategies, to JPool's intelligent staking model, each project contributes to the overall prosperity of the ecosystem in its unique way. These projects not only reflect the dynamism and diversity of the Solana ecosystem but also demonstrate the spirit of continuous exploration and innovation in the decentralized finance field.

Although each project differs in growth rate, strategy selection, and market positioning, they collectively drive the overall development of the Solana ecosystem and provide users with a rich array of choices. With the development of the market and technological advancements, we can expect the Solana ecosystem to continue attracting more participants, continuously driving innovation and development in decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。