1. About Vortex

Vortex is a multi-chain liquidity aggregation exchange based on the ZK-SNARKs protocol, committed to providing fully decentralized spot and perpetual contract order book trading. Currently, the daily trading volume on the BSC chain is approximately $8 million. In addition to basic trading products, Vortex will gradually introduce RWA products and trading identity NFTs based on ERC 6551. Vortex incentivizes traders through trading mining, burning mining, providing liquidity, and referral programs.

At the same time, the second-layer scalable engine can achieve a trade execution speed of 10ms. Vortex also encourages users to become liquidity providers for the order book, allowing users to not only earn token rewards through trading but also receive additional incentives by providing liquidity.

Vortex has currently opened spot trading for the BSC chain order book and will use the core governance token VTX for trading incentives, liquidity provision incentives, burning incentives, and share fee income with node users. This article will provide an in-depth discussion of Vortex's product features and latest activities.

2. Introduction to Orderbook Trading Mechanism

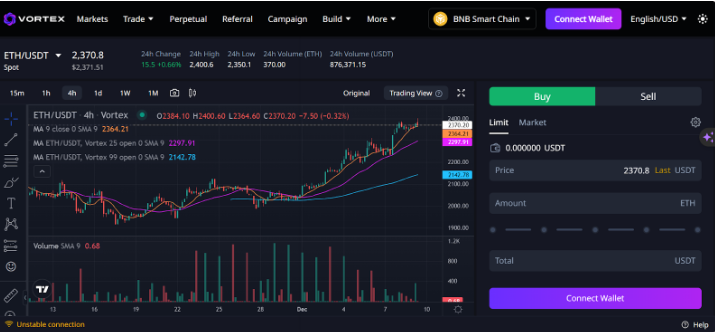

On the Vortex platform, users can engage in OrderBook spot trading and perpetual contract trading. As an L2 exchange, users need to deposit funds from their L1 wallet (such as MetaMask, etc.) into the corresponding L2 account before trading, and then use the funds on L2 to trade on Vortex (buy, sell, open, close). Of course, users can recharge, withdraw, and transfer L1 assets and L2 assets under their address at any time.

The Vortex account system is divided into spot accounts and perpetual contract accounts, which are independent of each other.

In Vortex's OrderBook spot trading, the system can aggregate the real-time prices of leading CEX and automatically conduct arbitrage. This means that regardless of market price fluctuations, users can trade at the best price. In addition, users can choose between market orders or limit orders for trading.

In Vortex's OrderBook contract trading, Vortex uses the funding rate model to balance the convergence of contract prices with the market prices of underlying assets, thereby maintaining the stability of the trading market and the accuracy of contract pricing.

At the same time, the funding rate model of Vortex provides traders with a more stable and predictable trading environment. However, traders using this model need to be aware of the impact of the funding rate on long-term holdings, as well as the potential trading costs resulting from deviations between contract prices and index prices.

3. Encouraging Users to Become Orderbook Liquidity Providers

Vortex also encourages users to collectively become market makers and share liquidity incentives. 16% of VTX token rewards will be used to incentivize user liquidity provision. Vortex will reward order volume, normal operating time, and bid-ask spread depth. Users can provide liquidity for order book by placing deep orders for trading pairs such as BTC/ETH/BNB/DOGE. The rewards for trading mining output will be distributed 30 days later. It is important to note that these incentive rewards are only applicable to deep orders within ± 0.2% of the corresponding token price range. Orders outside the fluctuation range will not be eligible for rewards. Users also need to ensure stable liquidity provision within the monthly cycle.

4. Trading Mining and Burning Mining

After the IDO, Vortex will conduct trading mining (15% token output) and burning mining (20% token output). Users can earn VTX rewards by participating in trading on the Vortex platform. 15% of VTX tokens will be used for trading mining rewards (45 million VTX), producing 60,000 VTX per day, and this portion will be fully released over 25 months.

The trading mining rewards will be displayed on the same day; 50% of the trading mining output for the day will be distributed 30 days later, with the remaining 50% automatically entering the burning mining pool of that account. After the launch of VTX, the trading mining output APY is close to 400%.

At the same time, burning mining is also an important VTX output scenario. Users can indirectly trigger token burning by purchasing VTX in the secondary market or through trading. Every 200,000 tokens burned will trigger a reduction, and the APR (compounding) for burning mining is as high as 1000%+. The total amount of tokens burned through burning mining is between 40-50 million VTX, promoting positive growth in the circulating market value.

5. Current Activities

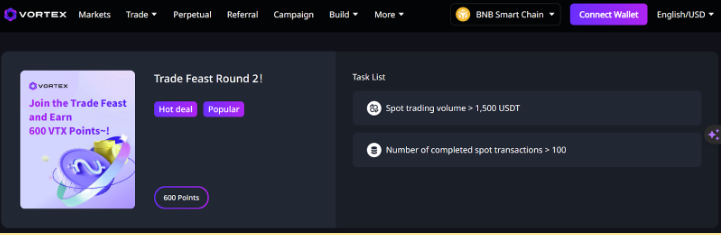

Vortex has set up a dedicated activity interface on its official website, making it convenient for users to participate in activities related to Vortex in a timely manner. Currently, the official has launched three trading-related activities:

- Spot trading over 1500 USDT + 100 trades to earn 600 points

- 30 trades to earn 100 points

- Trading over 500 USDT to earn 150 points. Points will be exchanged for VTX at a 10:1 ratio after the VTX IDO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。