Cryptocurrency market saw a huge growth at the end of the year, with NFT trading volume skyrocketing, DeFi and Bitcoin regaining the spotlight, and global interest rate trends sparking market expectations.

Author: Binance Research

Source: https://www.binance.com/en/research/analysis/are-we-entering-a-bull-market-top-10-narratives

Translation: Blockchain in Plain Language

1. Introduction

After reaching its peak in 2021, the cryptocurrency market has been primarily a market focused on building over the past few years. As the frenzy around celebrity-endorsed NFTs, a $69,000 Bitcoin, Dogecoin on SNL, and other narratives subsided, some people left the industry, while others redoubled their efforts and expanded their horizons. In recent weeks, we have seen the market becoming increasingly excited, with signs of a bull market emerging in terms of cryptocurrency activity and asset prices.

While it is too early to assert that we have returned to a bull market, the situation is certainly better than it has been in the past. It is for this purpose that Binance Research has prepared this report to provide readers with some key narratives and indicators to keep an eye on in the coming months.

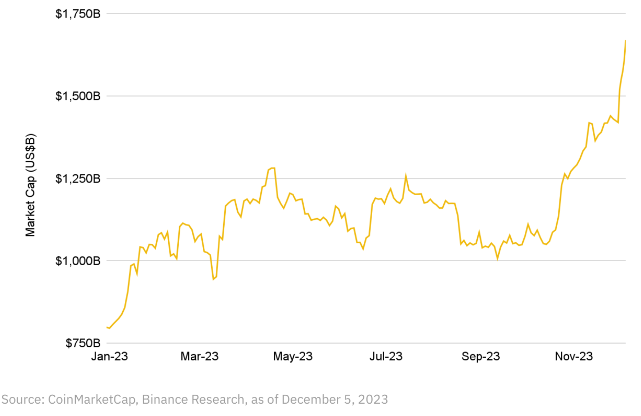

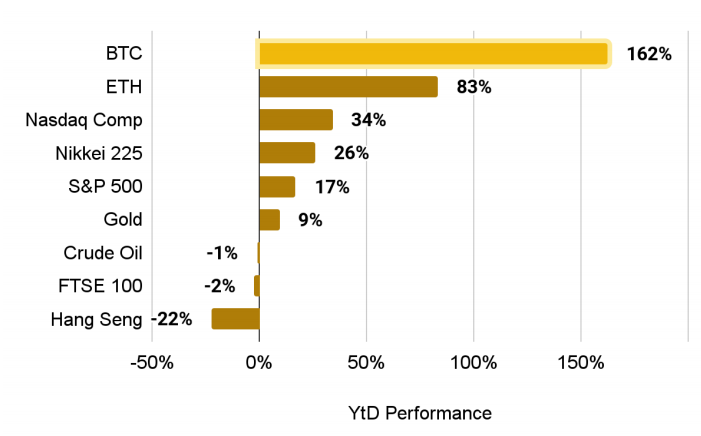

So far this year, the total market capitalization of the cryptocurrency market has grown by about 110%, equivalent to an increase of over $870 billion. As of now, the market has grown by 55% in the fourth quarter (about $596 billion).

2. Some Key Narratives

1. Return of Stablecoin Supply

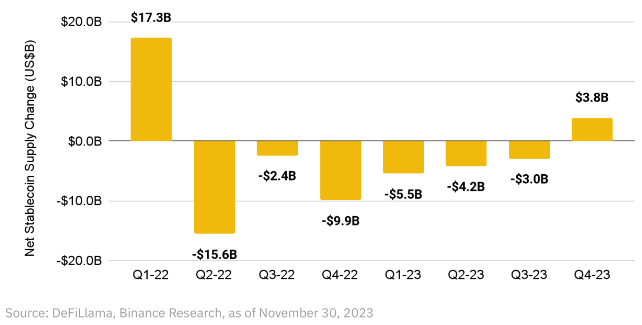

Stablecoin supply is an indicator of the amount of capital ready and available for investment in cryptocurrency assets at any given time. Recent data shows that the net supply change of the top five stablecoins by market capitalization turned positive for the quarter since the first quarter of 2022.

Given that the increase in stablecoin supply represents capital flowing into the cryptocurrency market and indicates potential buying pressure, the recent change can be seen as a positive signal. It is worth closely monitoring the trend of this indicator in the coming months to determine whether this is a temporary change or a more sustained upward trend.

2. Increase in NFT Trading Volume

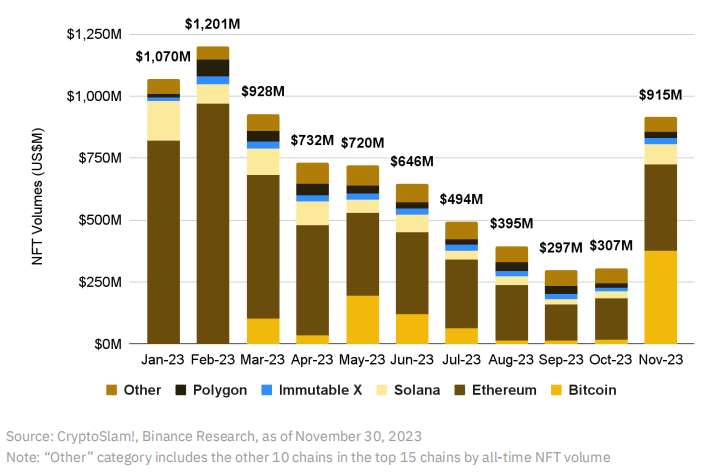

The trading volume of NFTs can be seen as a leading indicator of market sentiment, as NFTs are considered high-volatility investments in the cryptocurrency space. For example, if we consider Bitcoin as the benchmark asset, token substitutes like Ethereum typically exhibit higher volatility, i.e., higher than Bitcoin.

If we continue along the risk spectrum, we eventually arrive at NFTs. The trading volume of NFTs has broken the trend of continuous decline and has seen a significant month-on-month increase, indicating positive market sentiment and a recovery in the speculative NFT market after months of depressed prices and pessimism in this sector.

We should also emphasize the significant growth of Bitcoin NFTs (further discussed in the "Bitcoin" section). Their growth is incredible, as shown in the chart, especially considering that they were (essentially) invented at the end of 2022 and only started gaining popularity in March 2023. Bitcoin NFTs had almost no trading volume in January but became the most popular NFTs in November, with a trading volume exceeding $375 million, surpassing even Ethereum NFTs ($348 million). This is a huge achievement for a chain that has long been considered unsuitable for applications and NFTs, and monitoring the developments in the coming months will be interesting.

3. Rise in Protocol Fees

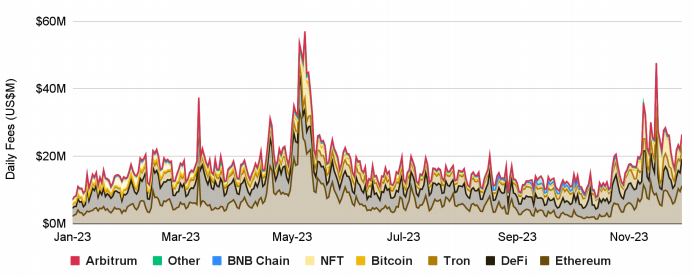

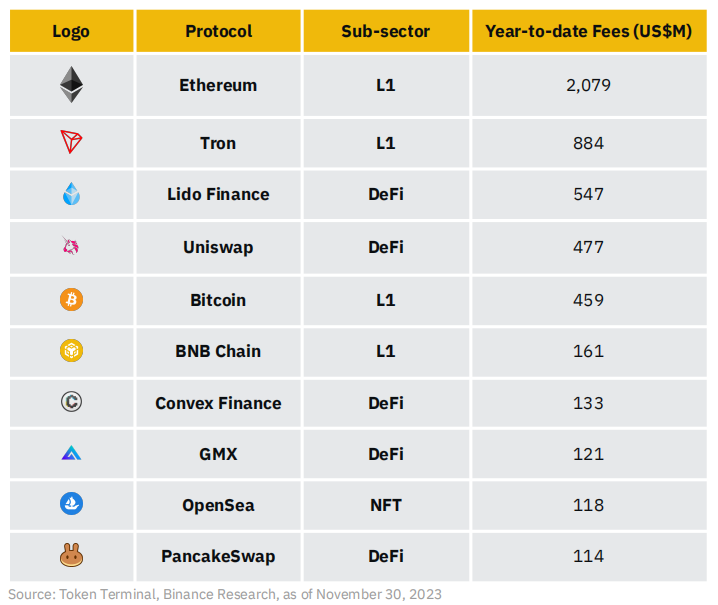

As the industry continues to mature and protocols gradually shift to revenue-generating business models, the fees generated by top cryptocurrency projects are an important indicator that needs to be tracked. Over the past year, these fees have steadily increased, with fees in November increasing by over 88% compared to January.

Note: "DeFi" includes Lido, Uniswap, Convex, GMX, PancakeSwap, MakerDAO, Aave, dYdX, Venus, and Curve. "NFT" includes OpenSea, Manifold.xyz, and Blur. "Others" include Flashbots and friend.tech.

➢ In terms of cumulative fees, Ethereum's total fees so far this year have exceeded those of any other single protocol by more than double, totaling over $20 billion. Tron follows closely, having generated approximately $880 million in fees. Ethereum generates fees by essentially selling its block space. Users paying these fees can range from retail traders using Uniswap to trade memecoins, all the way to L2 protocols like Arbitrum, which pay Ethereum to settle their transactions.

➢ DeFi is the second largest fee generator after Ethereum, with Lido and Uniswap leading the way. Convex, GMX, PancakeSwap, and MakerDAO have each generated over $1 billion in fees so far this year, with Aave following closely.

➢ In the NFT space, OpenSea is clearly in the lead, with fees almost double those of Manifold and more than double those of Blur. The competition between these two major NFT platforms over the past year has been noteworthy. While Blur successfully increased its share of trading volume in the Ethereum NFT market from about 40% to about 80%, and OpenSea's share decreased from about 43% to about 20%, OpenSea still maintains its leading position in fee generation.

The top ten fee generators this year are mainly dominated by Layer 1 networks and DeFi projects.

➢ It is worth noting that friend.tech, launched only in the summer, has entered the top twenty protocols in terms of fees (over $50 million). This helps demonstrate the opportunities for projects that can create a sensation and trend, especially in the growing and relatively emerging sub-industry of social finance (SocialFi).

➢ Equally interesting is that Arbitrum is the only Layer 2 among the top twenty, with fees exceeding $50 million. This is significant, as there has been ongoing discussion around Layer 2, and the L2 sub-industry has become extremely important. Despite this, only Arbitrum is on the list. This could be an interesting indicator, especially considering the recent announcements or launches of new Layer 2 solutions.

➢ Overall, fee generation is a sign of any truly sustainable business. Clearly, certain parts of the cryptocurrency market are able to generate meaningful fees, and seeing these numbers continue to grow in 2023 is encouraging. It is crucial to closely monitor which protocols and sub-industries demonstrate the best fee growth as we move into the next phase of the market cycle.

- Return of DeFi

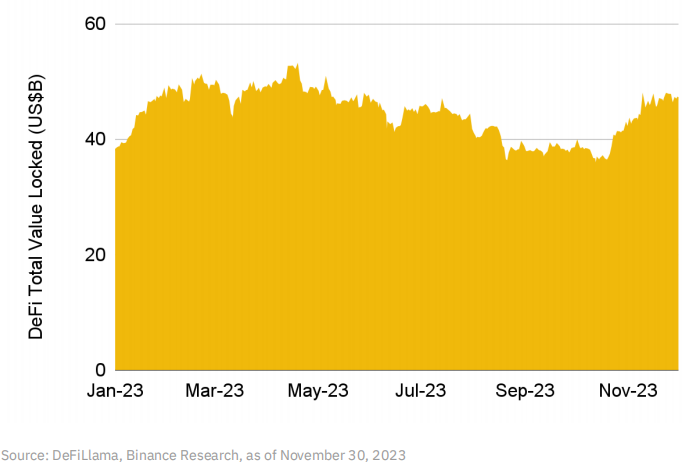

After experiencing relatively limited activity in the DeFi space for several months, we are starting to see some resurgence in activity. The total value locked (TVL) in DeFi has grown by nearly 25% since the beginning of the year, with a 14% month-on-month increase in November. The TVL has been fluctuating between $45 billion and $50 billion since December last year, and it is important to observe whether this latest change can be sustained and comfortably break the $50 billion mark in the coming weeks and months.

In terms of blockchains, Ethereum remains the dominant player, accounting for over 56% of the total TVL. Tron accounts for approximately 16%, while BNB Chain slightly exceeds 6%. Arbitrum (about 4.5%) and Polygon (about 1.8%) make up the rest of the top five. It is worth noting that among the top ten blockchains by DeFi TVL, four are Ethereum Layer 2 networks (in addition to OP Mainnet and Base mentioned earlier).

In terms of categories, liquidity staking (over $27 billion) is one of the biggest winners this year, with Lido being the leader, surpassing $20 billion in TVL. The Shanghai upgrade allowed Ethereum staked assets to be withdrawn, which greatly benefited Lido, leading to its TVL growing from around $12 billion to over $20 billion. Lending ($19 billion), decentralized exchanges ($13 billion), and bridging ($13 billion) are the next most popular categories.

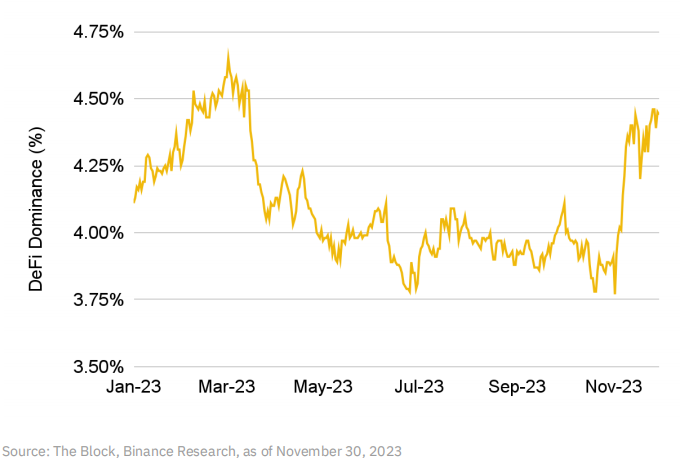

Another chart worth noting is the dominance of DeFi. This is measured by looking at the top DeFi tokens and calculating the percentage of their total market capitalization compared to the entire cryptocurrency market. This number has been hovering in the range of 3.8% to 4.1% since April, and it has started to rise rapidly, increasing by 18% in November to reach 4.44% by the end of the month. Tokens like Thorchain, PancakeSwap, Uniswap, and Synthetix are key drivers of this change.

Several key developments to watch:

❖ MakerDAO will continue to progress towards its ultimate goal, with the first phase of the expected 5 phases set to launch in early 2024.

❖ PancakeSwap recently launched their gaming market and a brand new governance system, introducing a new voting lock-up ("ve") token, veCAKE.

❖ Synthetix's new product, Infinex, is set to launch. Infinex is a forthcoming decentralized perpetual contract trading platform.

❖ The launch of Fluid, a high capital efficiency multi-layer DeFi protocol developed by the Instadapp team.

5. Bitcoin

For Bitcoin, it has been a year filled with events, with investors ranging from extreme crypto-native Ordinals (Bitcoin NFT) collectors to more traditional institutional investors gradually approaching Bitcoin ETFs. So far, this has led to a significant 162% increase in Bitcoin's market value in 2023, outperforming many other crypto assets and most market assets.

Bitcoin has shown strong performance this year.

Some of the most important narratives for Bitcoin:

A. The likelihood of Bitcoin spot ETF approval is higher than ever before

While the potential for a Bitcoin spot ETF in the US has long existed, there have been significant positive developments in 2023. In particular, the dispute between the US Securities and Exchange Commission (SEC) and Grayscale essentially ended with Grayscale winning. This has led to other participants submitting Bitcoin spot ETF applications, including BlackRock, Fidelity, and Invesco.

There are currently 13 Bitcoin spot ETF applications under SEC review, with the earliest deadlines in January 2024 and the latest in August 2024. It is widely expected that these ETFs will be approved in the coming weeks or months, considering the outcome of the SEC's case with Grayscale and the ongoing modifications to the applicants' ETF applications to increase the likelihood of approval.

Many of the final deadlines for the SEC's decision on Bitcoin spot ETFs fall in the first quarter of 2024, starting from January.

If approved, a Bitcoin spot ETF will address two major barriers to Bitcoin adoption: convenience/accessibility and mainstream acceptance.

With this ETF, many institutional investors can easily, regulatedly, and widely incorporate Bitcoin into their portfolios, improving distribution. The endorsement of global asset management giants like BlackRock, Fidelity, and Invesco will elevate the legitimacy of Bitcoin and help alleviate regulatory/compliance concerns for new investors. This is expected to lead to a significant influx of Bitcoin funds from previously sidelined institutional investors and new retail investors who may have had concerns before.

The latest data from CoinShares shows that Bitcoin ETPs have attracted over $1.6 billion in inflows, making it one of the most popular assets. The total assets under management have grown by over 100% since the beginning of the year, reaching $46.2 billion, the highest level since May 2022. This demonstrates increasing investor interest in regulated exposure to cryptocurrencies.

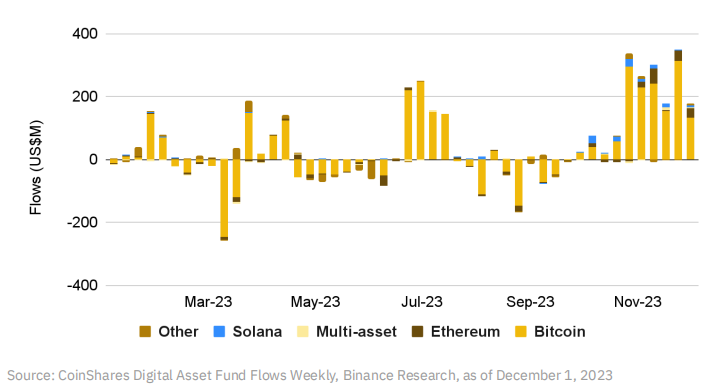

Inflows into global cryptocurrency ETPs showed significant increases in October and November, with Bitcoin being the clear dominant asset.

B. Bitcoin halving is approaching

Bitcoin miners are incentivized through two mechanisms: block rewards and transaction fees.

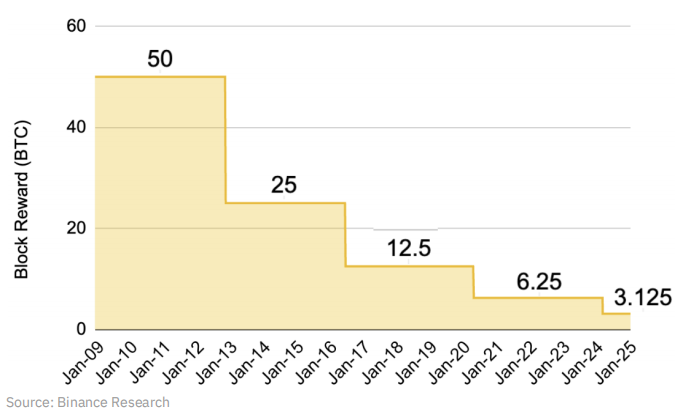

Block rewards traditionally make up the majority of miner income, while transaction fees have only recently shown an increase in volume after the introduction of Ordinals. These block rewards are issued for each new mined block, with an average of one new block every 10 minutes, and halving approximately every four years. Block rewards started at 50 bitcoins per block when the Bitcoin blockchain was first introduced in 2009.

After halvings in 2012, 2016, and 2020, the current block reward per block is 6.25 bitcoins. This number will halve to 3.125 bitcoins per block in April 2024.

Bitcoin's mining reward halves approximately every four years, with the next halving expected to occur in April 2024.

Considering that Bitcoin is an asset with a fixed maximum supply (21 million) and halving reduces the creation rate of new bitcoins by 50%, basic economic principles suggest that a price increase is the natural next step. Halving essentially creates scarcity for Bitcoin and further strengthens the narrative of Bitcoin as digital gold. Historically, this event has been associated with market volatility, although overall, the cryptocurrency market tends to perform well in the year following a halving.

C. Continued growth of "Ordinals" and "Inscriptions"

One of the most significant developments for Bitcoin in 2023 is the emergence of Ordinals and Inscriptions. Casey Rodarmor's "Ordinal Theory" enables tracking of every smallest unit in Bitcoin—Satoshis—and assigns a unique identifier to each Satoshis.

These individual Satoshis can then be "inscribed" with any content, such as text, images, videos, etc. This creates what is known as "Inscriptions" or quickly became known as Bitcoin NFTs. For a more comprehensive understanding, please refer to our report "A New Era for Bitcoin?"

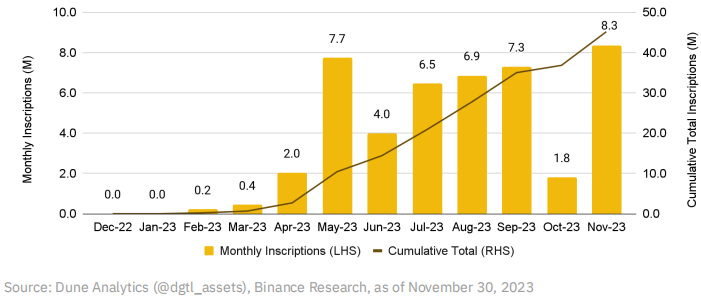

After a recent resurgence in minting in November, the total number of Bitcoin inscriptions is approaching 50 million.

Inscriptions have led to the birth of BRC-20 Tokens, allowing for the first time the deployment, minting, and transfer of fungible tokens on Bitcoin. Check out our full report, "BRC-20 Tokens: A Primer." The market initially saw fervor when inscriptions and BRC-20 were first introduced, but then cooled off. However, there was a significant recovery in activity in November. The total number of inscriptions increased by 362% from the low point in October, marking the highest month ever, exceeding 8.3 million. So far, inscriptions have also generated over $140 million in fees, a popular increase for miners, considering the historically low transaction fee amounts for Bitcoin and the upcoming Bitcoin halving (which will also reduce miner income).

One of the most significant impacts of inscriptions is the excitement and innovation it has sparked, both within and outside the Bitcoin ecosystem. Many new builders are entering Bitcoin, existing projects are releasing updates faster, and various new ideas are circulating within the Bitcoin community.

A recent example is the $7.5 million fundraising by Taproot Wizards, an Ordinal project based on the famous Bitcoin wizard meme. The impact of Ordinals and BRC-20 on increasing transaction fees and Bitcoin network congestion also contributes to a re-examination of Bitcoin Layer 2 protocols ("L2s").

The notable Bitcoin project Stacks and its upcoming sBTC solution, aimed at creating a decentralized, non-custodial Bitcoin Layer 2 protocol, is also an interesting related development.

Overall, between the potential approval of a Bitcoin spot ETF, the upcoming Bitcoin halving, and the innovation brought about by Ordinals, it is clear that Bitcoin is in an exciting period in its history and is worth very close attention.

6. Other Special Layer 1 Protocols on the Rise

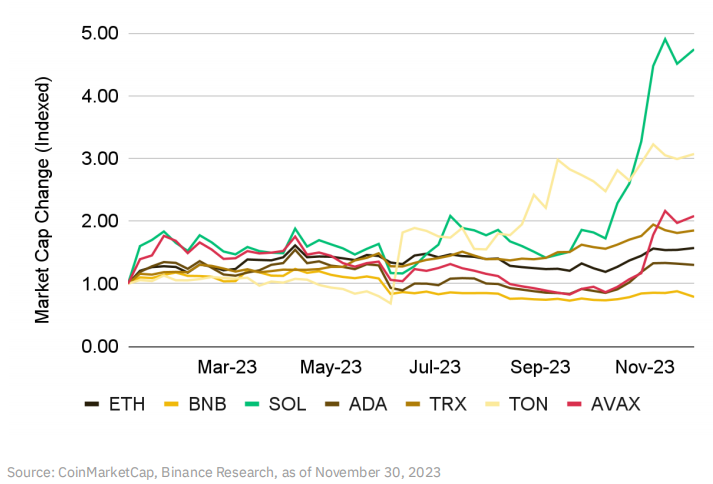

Although Ethereum remains the dominant Layer 1 protocol for smart contracts based on most typical metrics, alternative Layer 1 protocols have shown potential over the past year.

➢ Solana has recently shown strong performance, especially in November, with a 56% increase in the market value of $SOL.

Solana was affected by the FTX collapse in 2022 but successfully weathered the crisis and continued to release new products and improvements, bringing about a new sense of optimism. Despite experiencing network interruptions in 2022, Solana has only experienced one (in February) to date in 2023. It is expected that such events will be further reduced with the upcoming release of Firedancer (a new independent validation client).

Solana has also performed well in the DeFi space, with TVL increasing by 57% from $418 million to over $650 million. This is attributed to the airdrop activities and attention brought by Pyth Network, Jupiter Exchange, and Jito Network. Additionally, some other major DeFi projects have introduced point systems where user activity generates points, potentially becoming a factor for future airdrops.

➢ Toncoin has also performed well, with their recent partnership announcement with Telegram being a significant highlight.

The partnership, announced in September, means that Telegram will rely entirely on TON as its web3 blockchain infrastructure, and TON Space, a self-hosted web3 wallet, has been integrated into Telegram's 800 million monthly active users. Additionally, TON projects and ecosystem partners will benefit from application promotion within Telegram and priority placement on its advertising platform.

Recently, we have seen game/metaverse VC company Animoca Brands announce an investment in the TON Foundation and become the largest validator on the TON blockchain.

Other major Layer 1 protocols have also had many other announcements and developments. Ethereum successfully implemented the withdrawal of staked ETH after the Shanghai upgrade, becoming a largely deflationary asset and nurturing a significant DeFi market in areas such as liquid staking and LSDfi.

➢ BNB Chain continues to develop its ecosystem, with the announcement of BNB Greenfield being particularly noteworthy, as it is a next-generation data storage platform, and opBNB, an optimistic Layer 2 protocol for BNB Chain based on OP Stack.

➢ Avalanche continues to announce partnerships in the gaming and RWA fields. Their announcement of a partnership with J.P. Morgan's Onyx and Apollo Global is a recent noteworthy move.

➢ Cardano continues its efforts to expand, including the development of Hydra and their upcoming data privacy-focused sidechain, Midnight.

➢ Tron remains the largest chain for USDT issuance and continues to be an efficient way for payments of $USDT between users and businesses.

- Emergence of SocialFi

Social media applications have long been seen as potential partners for integration with blockchain technology and cryptocurrencies. In 2023, in this subfield of the crypto economy, product-driven growth has attracted attention, particularly with friend.tech.

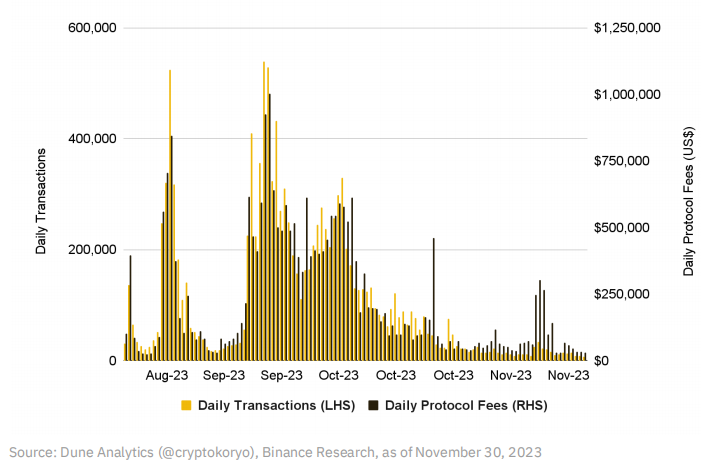

friend.tech is a SocialFi dApp that was first launched on the Ethereum L2 network Base in early August this year. friend.tech essentially allows users to tokenize shares of Twitter profiles (called "Keys"). Holding a Key provides access to exclusive content and private chat rooms with the profile owner (called "Subjects"). Users need to pay transaction fees, with a portion going to the protocol and another portion to the Subjects.

Since its launch, friend.tech has generated over $25 million in total protocol fees. They have also introduced an activity-based point system, reportedly related to potential future airdrops. Although it caused quite a stir in August and September, daily activity has slowed down in the past two months.

Nevertheless, the product is still in the testing phase and is set for a full launch. Perhaps most importantly, friend.tech has been able to attract widespread attention and excitement, including from influencers outside the crypto space, demonstrating the potential of web3 social applications.

friend.tech daily transaction volume (LHS) and daily protocol fees (RHS)

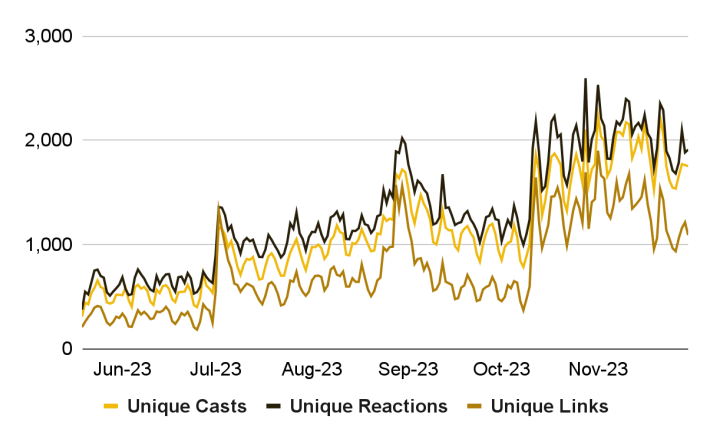

Another noteworthy Web3 social application is Farcaster. Farcaster is a decentralized social media protocol running on the Ethereum L2 network OP Mainnet.

In October, the protocol began open registration without the need for an invitation (moving away from the invitation-only phase), and since then, daily participation has significantly increased. Farcaster aims to foster a community-driven platform with high-quality discussions. To this end, they recently held the Farcaster AMA series, inviting several prominent guests, including Balaji and Vitalik Buterin.

Farcaster's unique daily interactions have steadily increased since the open registration platform was launched in October.

Another notable Web3 social media platform is Lens Protocol, which is also continuing to develop. Built by the Aave team and deployed on Polygon, Lens has shown a great interest in NFTs and is somewhat geared towards creators and artists.

After its initial launch in early 2022, they announced their v2 version earlier this year. New features include "Open Actions" to embed external smart contracts in Lens releases, improved value-sharing opportunities, and a range of new profile-related updates (called "Profiles V2"). The launch of BN Square is also a noteworthy event, providing a new platform for cryptocurrency users to exchange views and track the latest news events.

8. RWAs Enter the System

Real World Assets ("RWAs") refer to assets that exist in the real world and are collectively tokenized and purchased on-chain. Examples of RWAs include real estate, bonds, commodities, stocks, and more. While the tokenization of assets and their introduction to the blockchain has been discussed for a long time, there have been some particularly noteworthy developments this year.

➢ MakerDAO

Maker, the protocol behind the stablecoin DAI, has been involved in RWAs since at least 2020 and has seen significant introductions in 2023.

In brief, Maker allows users to deposit collateral into their vaults and receive debt denominated in DAI in exchange. While initially only ETH was accepted as collateral, it has since expanded to include other assets such as stablecoins, wrapped BTC, liquid staking derivatives (LSDs), and more.

Maker also offers DAI loans collateralized by RWAs for borrowers approved through MakerDAO. Borrowers include institutions like Huntingdon Valley Bank, which has a vault with $100 million worth of collateralized RWA loans.

Now, RWAs account for over 49% of Maker's balance sheet, up from only about 12% at the beginning of the year. A significant portion of the RWAs are U.S. treasuries, benefiting from the rising interest rate environment and yielding high returns over the past 18 months. This means that RWAs currently account for over 60% of Maker's revenue, and Maker's revenue itself reached over $2 billion in November, the highest level in its history (on an annual basis).

➢ Chainlink and CCIP

Chainlink, known for its Oracle network, is a web3 infrastructure company that provides a range of solutions, including Data Streams, Functions (for connecting smart contracts and APIs), and Automation (smart contract automation).

The Cross-Chain Interoperability Protocol (CCIP) is a significant new development. CCIP is a decentralized cross-chain messaging/data transfer protocol. Its goal is to create a shared global liquidity layer that allows all chains to connect to each other—whether they are public chains or private traditional financial chains. Chainlink hopes that CCIP can bridge the value between traditional finance and cryptocurrencies and improve interoperability between these two worlds. Integrating real-world assets more closely into the blockchain is a natural part of this process.

One major advantage of CCIP is that it allows users to define their goals and connect to CCIP using their existing APIs and messaging services, and then transact on-chain. CCIP has made a key integration with Swift, a messaging service used by over 11,000 global traditional financial institutions. Given that Swift can communicate with CCIP, it helps reduce friction for traditional finance in connecting to the blockchain, with hopes of further facilitating the integration of real-world assets.

We have witnessed the early mainnet launch of CCIP (17), with more developments expected in the coming weeks. We have also seen some significant case studies, including ANZ Bank, and more major banks and financial institutions including Citi and BNY Mellon. The institutions that CCIP can attract will be an important development to watch in the coming months.

9. ZK-Everything

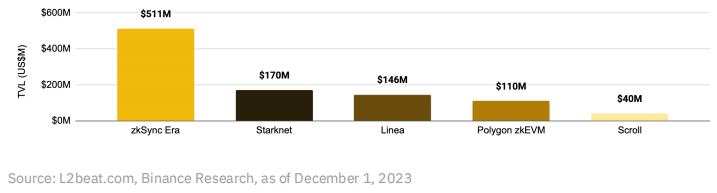

The growth of zero-knowledge ("zk" or "ZK") technology has been a continuous hot topic in the crypto space for many years. However, 2023 has seen notable ZK-related dynamics, including a series of ZK Rollup releases.

Here are some key developments:

In short, there are two types of L2 Rollup solutions: optimistic and ZK. While optimistic Rollup currently dominates most of the L2 market share, ZK Rollup has been rapidly developing and is widely considered the future of scaling. This is because they rely on zero-knowledge proofs (ZKPs), an extremely efficient method of proving transaction validity with various applications in the crypto space.

Until this year, one of the reasons why ZK Rollups were not as popular as OP Rollups was their lack of integration with the Ethereum Virtual Machine (EVM). Given that the EVM is the primary smart contract engine in the market, early ZK Rollups could not support EVM in a user-friendly manner, giving optimistic Rollups an advantage (as they are EVM-compatible). However, zkEVM has changed this landscape. zkEVM is a special type of ZK Rollup that allows smart contracts to be easily deployed on the EVM, enabling developers to seamlessly migrate EVM dApps to their zkEVMs.

2023 has witnessed the launch of many zkEVMs, starting with zkSync Era and Polygon zkEVM in March, followed by Linea and Scroll, among others. StarkNet, another pioneer of ZK technology, also has a ZK Rollup in production, and Kakarot zkEVM brings EVM compatibility to Starknet technology. Taiko is another zkEVM expected to be launched early next year.

In recent months, there has been strong growth in Rollup as a Service (RaaS) providers. While many providers initially focused on optimistic Rollups, the zkRaaS subfield is also growing, with companies like AltLayer, Gelato, and Lumoz being important participants to watch. This may lead to more ZK Rollups entering the market in the coming year.

TVL of the top ZK-rollups

In addition to Rollups, there are many other applications of ZK technology. One upcoming example is ZK coprocessors.

ZK coprocessors are tools for offloading data-intensive and expensive computations off-chain. They reduce gas costs for dApp users while allowing for more complex functionality and computations, improving the user experience. While some computations are moved off-chain, dApps still benefit from the full security of Ethereum.

In web2, many applications shape the user experience by capturing user behavior data, while web3 dApps are limited by the expense of storing data on-chain and running queries. Using ZK coprocessors can unlock the potential of the next generation of web3 dApps, with use cases including on-chain games, DeFi loyalty programs, variable incentive schemes, digital identities, KYC, and more.

The recent release of the new ZK protocol, Succinct, is also an interesting development.

Succinct provides a platform for developers to discover, collaborate, and leverage ZK technology to build applications. As part of this platform, developers can utilize the Succinct Protocol, which is an infrastructure layer designed to make ZK development more coordinated and seamless.

A notable recent collaboration is with the data availability solution Avail. Other upcoming partners include Lido and Celestia.

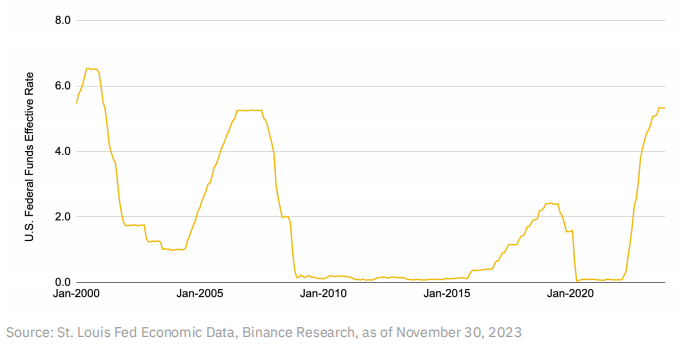

10. Interest Rates Set to Decline?

From a macroeconomic perspective, interest rates are one of the most important factors affecting asset valuations. Taking the United States as an example, the higher the benchmark interest rate set by the Federal Reserve, the higher the risk-free return investors can obtain by investing in ultra-safe government bonds. This naturally reduces the interest of many investors in more volatile options such as tech stocks and cryptocurrencies, as they can obtain good capital returns from the government.

Interest rates in the United States are at their highest level in 22 years, making it one of the fastest periods of rate hikes in U.S. history.

The Federal Reserve has kept the benchmark interest rate at 0-0.25% after the pandemic to stimulate spending, but with rapid inflation, they have made an unprecedented 11 rate hikes, raising rates from 0-0.25% in March 2022 to 5.25-5.5% in July 2023. However, in the most recent two Federal Reserve meetings, they have kept the rates unchanged. Although inflation remains above the Fed's 2% target (3.2% in October 2022), it has significantly decreased from the 5-8% figures in 2022.

The latest Fed forecasts indicate that interest rates will decline in 2024 and 2025, implying that rates may have peaked or are nearing their peak. Other countries have already started cutting rates, with the People's Bank of China lowering banks' reserve requirements twice and reducing the one-year loan rate. Declining inflation in Europe has also led investors to anticipate an early rate cut by the European Central Bank.

While this is only a part of the macroeconomy, considering global rate cuts, investors will need to seek returns beyond government bonds. This will have implications for high-growth areas such as the tech and cryptocurrency markets. At least for the cryptocurrency market, this will be a positive factor, while developments in other aspects of Web3 will continue.

III. Conclusion

The past few weeks have been exciting and a beneficial change after several months focused on building. With increasing noise and new entrants joining the market, things are getting crazier, making it crucial to track the right indicators and focus on important issues. This report aims to serve as an introductory guide to some of the most important points of discussion and observed data to watch for in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。