Authors: Biscuit & Gu Yu, RootData

In November 2023, the financing data in the field of cryptocurrency once again reached an impressive figure, with a total financing amount of 11.8 billion US dollars and over 90 financing cases. This data not only refreshes the record of the past year, but also signifies a warming trend in the investment and financing market. At the same time, a wave of projects such as Pyth and Chainflip issued tokens or launched their mainnets in November, attracting a lot of market attention.

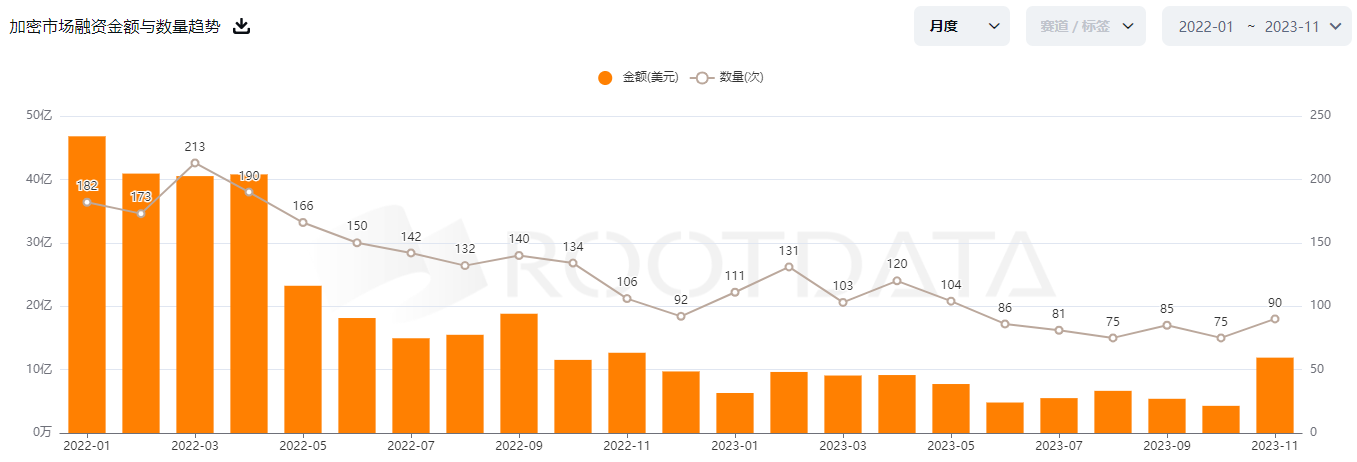

Financing trend in the cryptocurrency field in the past 2 years

In this article, we will focus on specific financing data, active investors, hot search projects, and other aspects to present the changing trends in the cryptocurrency market.

1. Financing Data

In November, the total financing amount in the cryptocurrency field reached 11.97 billion US dollars, an increase of 173.84% month-on-month and a decrease of 5.38% year-on-year. The number of financing cases was 90, an increase of 20% month-on-month and a decrease of 15% year-on-year.

Specifically, the sharp increase in financing amount in November was mainly driven by several large financing cases. This month also saw the most occurrences of large financing events (over 100 million US dollars), including:

- November 21: Phoenix Group completed a 370 million US dollar IPO financing

- November 29: Wormhole completed a 2.25 billion US dollar financing at a valuation of 25 billion US dollars

- November 15: Blockchain.com completed a 1.1 billion US dollar Series E financing at a valuation of 70 billion US dollars

In the previous months of 2023, there were only 3 occurrences of large financing events, including Worldcoin's completion of a 115 million US dollar Series C financing (05-25), LayerZero's completion of a 120 million US dollar Series B financing (04-04), and Ledger's completion of a 1 billion euro financing at a valuation of 13 billion euros (03-30).

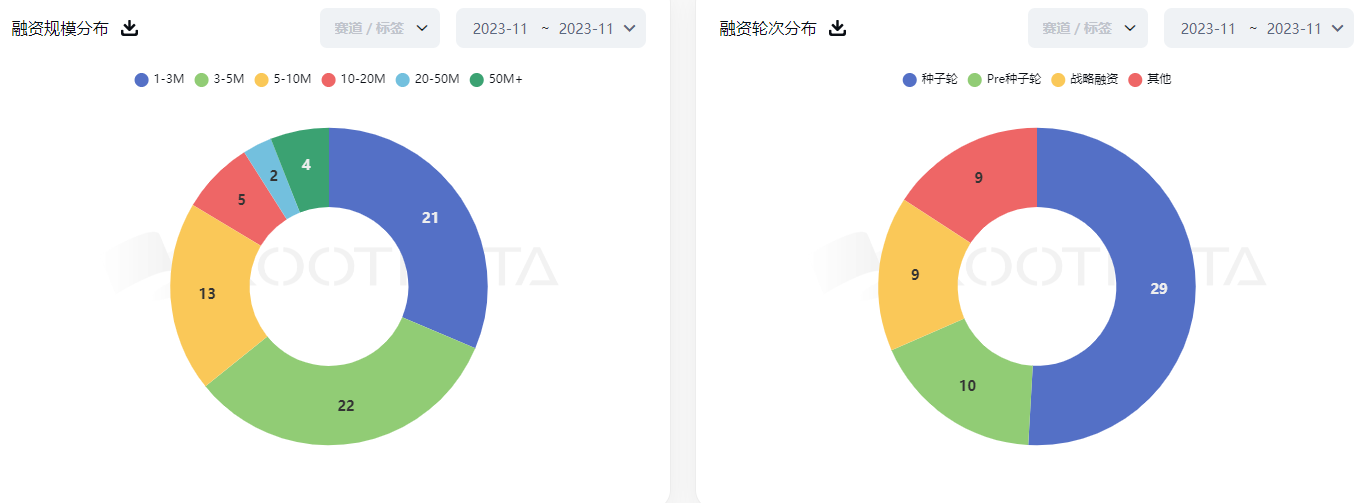

In terms of financing amount, well-known projects in the range of 10-100 million US dollars include EVM-compatible Layer2 network Blast, wallet infrastructure Privy, distributed AI computing platform Ritual, and more. Additionally, the range of 3-5 million US dollars has the most occurrences, with well-known projects including smart contract wallet Pimlico, space-themed game Citadel, decentralized derivatives platform MYX Finance, Web3 social protocol Sleek…

Seed round remains the most popular financing round, with 29 projects completing seed round financing in November, accounting for as high as 50.88%.

In addition, there were 7 merger and acquisition events in November, with the most notable being the acquisition of 2 leading cryptocurrency media companies, Foresight Ventures' acquisition of The Block for 70 million US dollars, and Bullish exchange's acquisition of CoinDesk. In addition, Terraform Labs acquired asset dashboard platform Pulsar Finance, and CoinGecko acquired blockchain indexer Zash.

The rapid increase in merger and acquisition events indicates that leading players in the cryptocurrency field are accelerating their pace of racecourse layout, seeking high-quality targets to improve their own strategic shortcomings and expand ecosystem synergies.

2. Active Investors

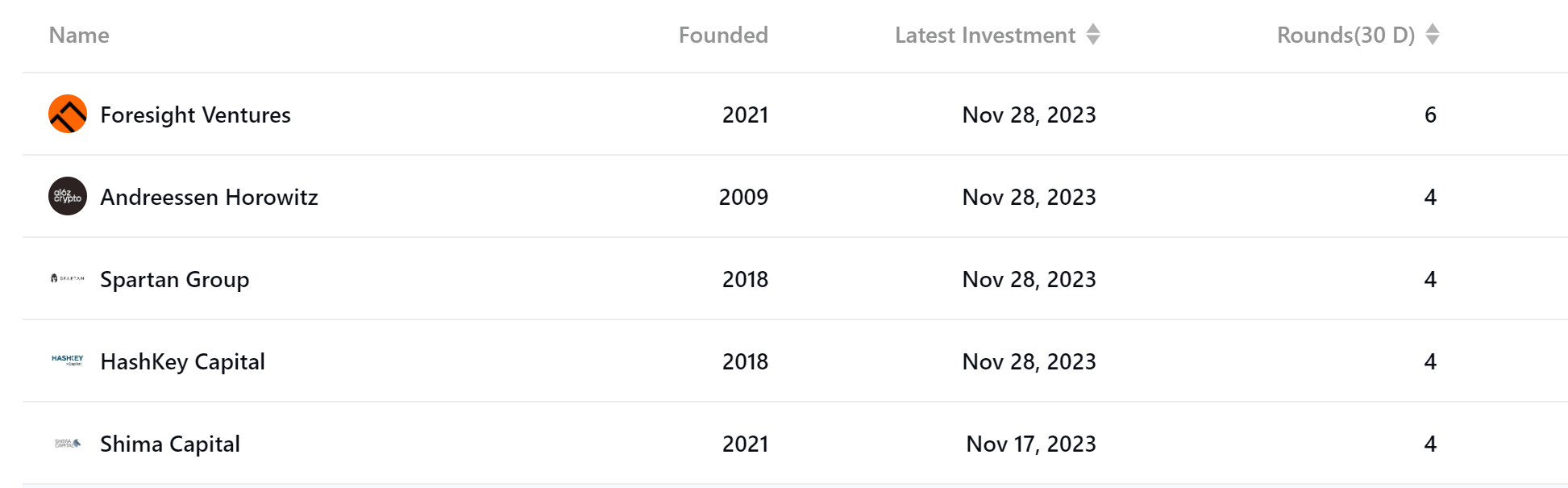

Foresight Ventures, a new and emerging institution established in 2021, participated in 25 rounds of investment in the past year. The institutions it co-invested with the most are HashKey Capital (14 times) and SevenX Ventures (11 times), and the most invested tracks include infrastructure, social entertainment, and gaming.

In November, Foresight Ventures significantly increased its investment frequency, with a record of 6 transactions, including 5 financings and 1 direct acquisition (The Block). This reflects Foresight Ventures' abundant financial strength and full market confidence. In addition, Foresight Ventures' associated exchange Bitget also invested 710 million Hong Kong dollars in the Hong Kong compliant exchange BC Group.

Apart from Foresight Ventures, institutions such as Andreessen Horowitz, Spartan Group, HashKey Capital, and Shima Capital disclosed investment frequencies of 4-5 times in the month.

In November, many investment institutions also launched new funds related to cryptocurrency, providing more diverse financing options for cryptocurrency startups, including:

- Menlo Ventures announced the completion of a 1.35 billion US dollar fundraising, mainly investing in blockchain, gaming, and other directions

- Lightspeed Faction launched a 285 million US dollar early-stage crypto fund

- Web3 venture capital firm MarsX Capital announced the establishment of a 100 million US dollar first-phase fund

- Polygon launched a 90 million US dollar ecosystem development fund

- French investment company Serena launched a new fund of 100 million euros, focusing on the blockchain, AI, and quantum technology fields

- Web3 venture capital firm AC Capital is launching a new fund of 20 million US dollars

- Singapore venture capital fund Leo Ventures launched a new fund of 10 million US dollars, intending to invest in Web3 and other fields

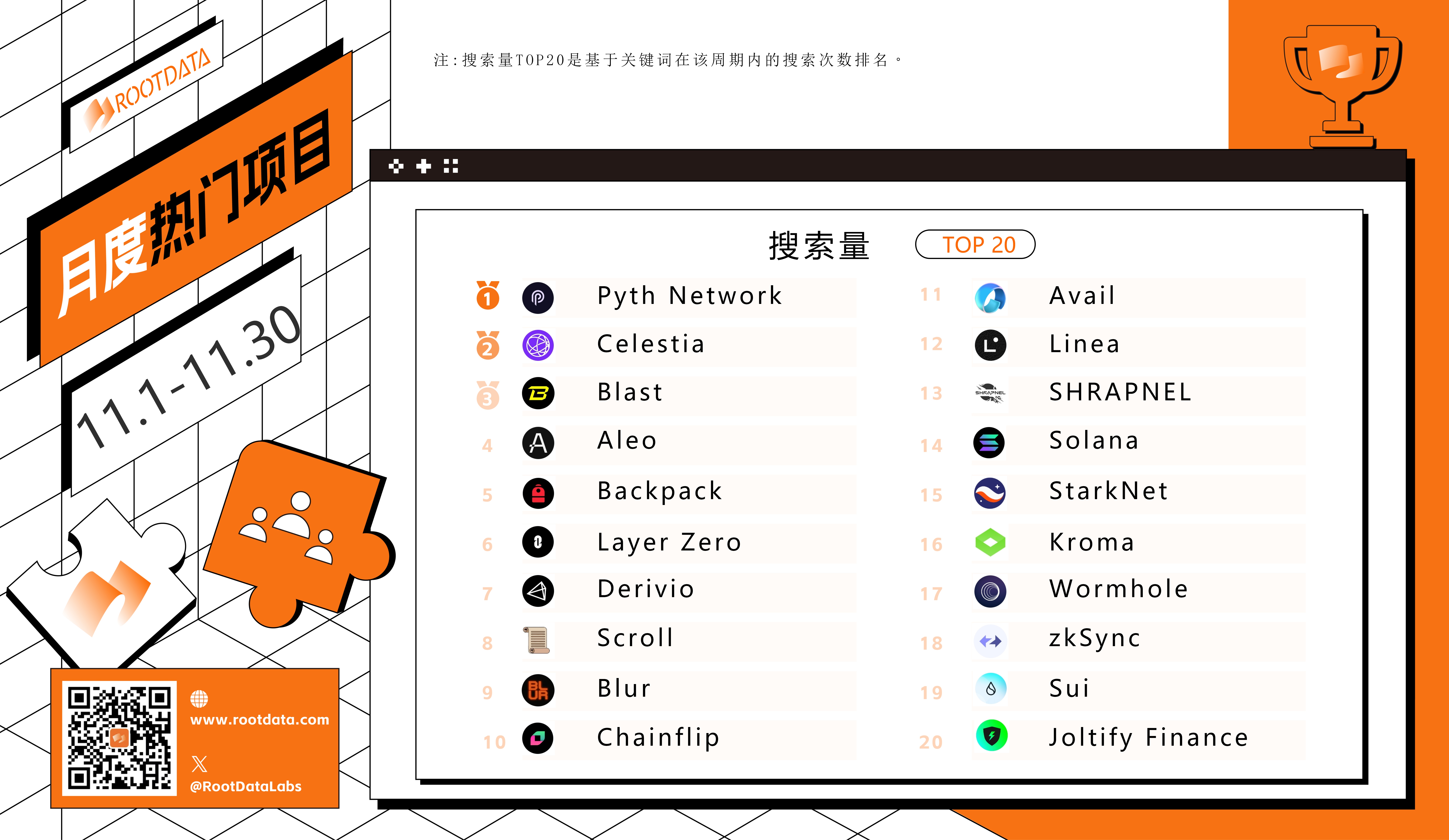

3. Hot Search Projects

Based on a large amount of user search data from RootData, we also summarized some of the projects with the highest user search volume in November, including:

1. Pyth Network

Pyth Network is a next-generation price oracle solution designed to provide valuable on-chain financial market data to projects, protocols, and the public through blockchain technology, including cryptocurrencies, stocks, forex, and commodities. The network aggregates first-party price data from over 70 trusted data providers and publishes it for use by smart contracts and other on-chain or off-chain applications.

2. Celestia

Celestia is a modular blockchain network aimed at building a scalable data availability layer, enabling the next generation of scalable blockchain architecture - modular blockchains, with the goal of allowing anyone to easily deploy their own blockchain at minimal cost. Celestia achieves scalability by decoupling execution from consensus and introducing new data availability sampling.

3. Blast

Blast

Blast is an optimistic rollup that is compatible with EVM and has native yield. On Blast, users' balances automatically compound and earn additional Blast rewards.

4. Aleo

Aleo is a developer platform for building fully private, scalable, and cost-effective applications. Using zero-knowledge cryptography, Aleo moves smart contract execution off-chain to enable a wide range of decentralized applications that are both fully private and scalable to thousands of transactions per second.

5. Backpack

Backpack is the next-generation cryptocurrency exchange and multi-chain wallet. Backpack's technology provides a self-custody solution that integrates multi-party computation (MPC) technology to ensure fund security.

6. LayerZero

LayerZero is an all-chain interoperability protocol designed for lightweight cross-chain messaging. LayerZero provides trusted and guaranteed messaging with configurable trustlessness.

7. Derivio

Derivio is a structured derivatives ecosystem that provides synthetic derivatives, offering risk-adjusted rewards for traders with intelligent leverage, while also providing deep liquidity pools for cryptocurrency operators to effectively hedge.

8. Scroll

Scroll is Ethereum's native zkEVM Layer 2 solution. It enables native compatibility with existing Ethereum applications and tools. Scroll processes off-chain transactions and publishes concise correctness proofs on-chain, resulting in higher throughput and lower costs compared to the Ethereum base layer.

9. Blur

Blur is an NFT marketplace for professional traders, offering aggregation, portfolio analysis, and zero market fees.

10. Chainflip

Chainflip is a cross-chain liquidity network that enables cross-chain transactions between different blockchains. Similar to Uniswap, it allows users to trade between major blockchains without any wrapped tokens, special wallets, or dedicated software.

4. Project Dynamics

In November, RootData also recorded the mainnet launches and new token issuance events of many projects, helping users understand important project dynamics in the market and grasp earlier alpha opportunities.

Some of the recently launched mainnet projects include:

1. SDX

SDX (Solana Derivatives Exchange) is a DeFi options automated market maker (AMM) aimed at establishing a new trading venue for crypto options. On SDX, users can buy and sell fully collateralized, cash-settled European options, including call options, put options, and vertical spread strategies. Users also participate as liquidity providers, providing assets to AMM Pools and earning passive income from trading spreads and capital utilization fees.

2. Socrates

Socrates is a web3 social media and entertainment platform that combines social and gaming networks. Leveraging the potential of technology, Socrates creates an inclusive space where users can profit by participating in multiple-choice quizzes, freely expressing their thoughts, and engaging in meaningful debates. The platform has created an innovative incentive model where any interaction requires an investment in the prize pool for the question, and rewards are distributed after the question ends. The more interactions, discussions, and debates around each question, the higher the potential rewards.

3. IntentX

IntentX is an intent-based decentralized derivatives exchange that offers perpetual futures trading. The platform leverages various cutting-edge technologies, including LayerZero, cross-chain communication protocols, account abstraction, and a groundbreaking request for quote (RFQ) architecture that addresses key challenges in delivering on-chain derivatives.

4. Nocturne

Nocturne is a protocol enabling private, composable accounts on Ethereum. Nocturne allows users to deposit or receive assets from EOAs and contracts to private, confidential addresses. In the future, users can prove ownership of private assets in zero-knowledge for arbitrary transactions or private transfers. In October, Nocturne completed a $6 million seed round financing.

5. Beoble

Beoble is a communication infrastructure and ecosystem that allows users to chat between wallets. Its products include a web-based chat application and a toolkit for Dapps integration. In November, Beoble completed a $2 million pre-seed round financing.

6. Mu Exchange

Mu Exchange is a decentralized perpetual contract exchange (Perp-DEX) that offers leveraged trading using yield tokens ($sDAI) as collateral. Users can continue to earn DAI savings rate even after opening a position during trading.

7. ZKP2P

ZKP2P is building a fiat on-ramp supported by zk proofs. Its smart contracts execute proof verification and custody functions. The on-ramp process will require two transactions. First, users will post orders to the on-chain order book. Then, when off-rampers submit order claims, users will choose to complete the claim on Venmo, generate a proof via email confirmation, and then submit the proof on-chain to unlock fUSDC. The off-ramp process will require a Venmo Id. Additionally, users need to mint fUSDC directly from the contract.

8. Bioniq

Bioniq is a Bitcoin Ordinals market that utilizes Internet Computer and saves time and costs through asset bundling.

9. Derivio

Derivio is a structured derivatives ecosystem that provides synthetic derivatives, offering risk-adjusted rewards for traders with intelligent leverage, while also providing deep liquidity pools for cryptocurrency operators to effectively hedge.

Some of the recently launched token projects include:

1. Vertex

Vertex is a decentralized derivatives protocol for trading spot and perpetual contracts on an order book. With an industry-leading trading engine and comprehensive currency markets, Vertex's cross-margin product suite is designed for both professionals and beginners. In April 2022, Vertex Protocol completed an $8.5 million seed round financing.

2. Chainflip

Chainflip is a cross-chain liquidity network that enables cross-chain transactions between different blockchains. It is similar to Uniswap but allows users to trade between major blockchains without any wrapped tokens, special wallets, or dedicated software. In May 2022, Chainflip completed a $10 million financing.

3. Cradles

Cradles is a time-elapsing virtual world game that provides players with a living, breathing virtual world that continues to evolve and progress, simulating time and physical laws just like in real life. Cradles is also a subscription-based blockchain game, where players need to purchase a monthly subscription card to enter the game. In February 2022, Cradles completed a $5 million private placement financing.

4. Pyth Network

Pyth Network is a next-generation price oracle solution designed to provide valuable on-chain financial market data to projects, protocols, and the public through blockchain technology, including cryptocurrencies, stocks, forex, and commodities. The network aggregates first-party price data from over 70 trusted data providers and publishes it for use by smart contracts and other on-chain or off-chain applications.

5. MultiBit

MultiBit Bridge

MultiBit Bridge provides a secure and efficient bridging mechanism that allows seamless transfer of tokens between the ETH chain, BNB chain, and BTC network. MultiBit Bridge connects ERC20 tokens with BRC20 tokens, enhancing the liquidity of BRC20 tokens and promoting the growth and development of the Bitcoin ecosystem.

6. SHRAPNEL

SHRAPNEL is a AAA-level FPS game supported by blockchain technology, featuring skill-based competition, creative modeling tools, and true digital ownership. As a competitive multiplayer first-person shooter game, SHRAPNEL bundles a rich set of player creation tools, combining combat, creation, management, and connection into a player-owned platform that determines its future within the community. In October of this year, SHRAPNEL completed a $20 million Series A financing.

7. RepubliK

RepubliK is a Web3 content creation platform where content creators can connect with their audience and utilize built-in smart contracts to handle monetization processes. In October of this year, RepubliK completed a $2.3 million seed round financing.

8. Prisma Finance

Prisma Finance is a DeFi-native protocol focused on unlocking the full potential of Ethereum staked tokens (LSTs). Through Prisma, users can use staked tokens as collateral to mint fully collateralized stablecoins (acUSD). This stablecoin will be incentivized on Curve and Convex Finance, providing users with additional rewards such as trading fees, CRV, CVX, and PRISMA.

9. Holdstation

Holdstation is a decentralized derivatives platform that provides traders with opportunities to trade with leverage of up to 500x across multiple assets. Holdstation features a user-friendly interface and a range of advanced trading tools, enabling traders to capitalize on market opportunities and potentially profit from price fluctuations in various markets.

10. TOUCH

TOUCH is building a Web3 community to help users interact with fans and unlock value. Its TouchRoom is a decentralized, censorship-resistant, power-down, consensus-driven web3 community product. Creators can establish FAN Rooms to facilitate collaboration between creators and fans, while sharing the growth rewards of the community within this Web3 community.

Due to space limitations, the above are some of the mainnet and token information. For more complete and timely data, please visit the RootData official website (https://www.rootdata.com/) for more information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。