Everyone's life is inevitably filled with setbacks and failures. In the face of repeated setbacks, it's not a failure, but rather not yet a success. For someone who has temporarily suffered a setback, if they continue to strive and intend to win back, then their current setback is not a true failure. The same goes for investments; temporary setbacks do not represent anything significant. A loss over a day or two simply means that you have not yet found a profitable method. Choice is greater than effort, and belief leads to mutual success.

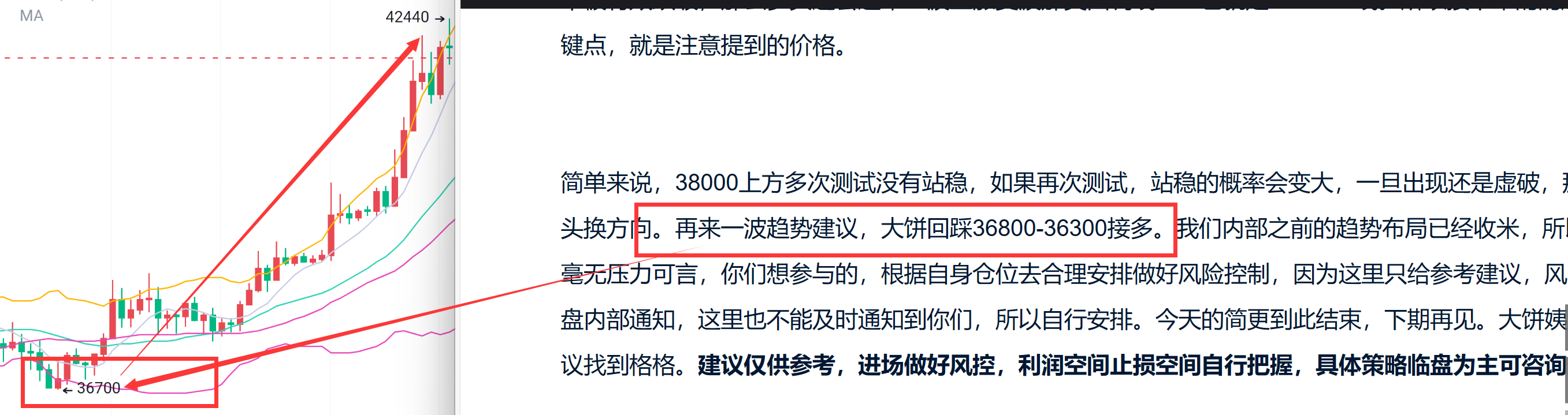

Hello everyone, I am trader Gege. Following up on my previous article, the recent articles have mainly focused on trend recommendations, so the updates are relatively slow. Do you still remember the time and position I mentioned in my previous article? It was written on Sunday the 26th, around 11 p.m., suggesting a long position for the trend of the big cake at 36800-36300. After the price retraced to 36700 on the 27th, those who followed should have reaped substantial gains. Last week, I also mentioned a very critical time point, and the long-awaited level above 40,000 has also arrived as expected.

The level around 42300 has also been successfully reached, and the current high point of the market is around 42440. As for the price of 42300 mentioned earlier and the reasons behind it, I have mentioned it several times before, so I won't go into detail today. For now that the price has reached this level, let's discuss the future market from a technical perspective. First, let's look at the big cake's weekly chart. The candlesticks have formed 8 consecutive bullish patterns. Have you not seen such a candlestick pattern for a long time? To be precise, it's 7 consecutive bullish patterns, as the week has not yet ended, and we don't know what will happen next. Such consecutive bullish patterns on the weekly chart have only appeared during the start of the bull market in 2020. However, I'm not saying that the bull market has started now; there are many factors needed to drive a major bull market. You may know what you're going to do tomorrow, but you can't possibly know what you'll be doing a year from now. Therefore, the market is the same; we can make short-term predictions based on technical analysis, but we can only watch and see for the long term, as unexpected news may occur in between, which we cannot predict.

The technical aspect of the big cake's weekly chart still leans towards the bullish side, and the MACD is still relatively strong. The form of the candlesticks this week is also quite important and requires our attention. The daily chart is similar, but the candlesticks require some adjustments. Setting aside the technical aspect, let's make another prediction from a different perspective. The short positions below have been mostly cleared out by the "whales," so what about the short positions near 40,000? I think as long as the 40600 level is held, there will be an upward trend. When the short positions turn to join the long positions and the long positions continue to gain momentum, that will be the time for the "whales" to clear out the long positions. This is just my prediction; the market still needs to be observed as we proceed, and we need to remain calm when making our moves. Today, I'll provide a mid-term recommendation: buy in the range of 40600-41000 on the big cake's retracement, and pay attention to managing your risks based on your own situation. The big cake is still relatively strong, holding at the 41500 level, while the "auntie" is relatively weak. Based on the price conversion, the "auntie" should at least rise to the 2350 level. It depends on whether the support can hold and drive a wave of upward and compensatory rises. This concludes today's update; see you next time. For more real-time recommendations on the big cake and "auntie," find Gege. The recommendations are for reference only. Enter the market with good risk control, and manage profit and stop-loss spaces on your own. Consult specific strategies during trading hours.

Investing is a rational behavior, which is long-term and even spans a lifetime. A successful investor should persist in not being influenced or misled by market sentiment, always remain calm, not be elated by rises, not be afraid of falls, focus on long-term value analysis and judgment, and let rational and mature investment concepts, rather than emotions, control your investment behavior, eliminating all irrational buying and selling impulses. Only then can your investment have a stable future.

Many individual investors are unable to enter the trading arena simply because they lack a guide. The problems you ponder over may be easily solved with a single piece of advice from an experienced person. Daily real-time market analysis of currencies such as BTC, ETH, BCH, LTC, EOS, XRP, DOT, etc., is promptly disclosed in the social circle, and there is also guidance in the experience exchange group, with 18 hours of online market analysis and operation guidance every day. Feel free to scan and add for real-time guidance. Note! The contact information below does not belong to me!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。