Introduction

From a marketing perspective, the recent event is undoubtedly a market competition between strong technical Layer2 and strong consensus Layer2.

Author: YBB Capital Researcher Ac-Core

Preface

With the recent launch of the Layer2 network Blast by the founder of Blur, there has been a mixed market sentiment in the face of strong expectations for airdrop returns. According to the official announcement, the Blast mainnet will go live in February next year, and will continue the airdrop based on points similar to the previous Blur model. Within a few days of the news, the growth of Blast's TVL is impressive, but this sudden assault by Blur on the Layer2 narrative undoubtedly leads to three possible outcomes: sparking a new round of hotspots; planting a huge landmine and "plagiarism" of related track projects. From a marketing perspective, this event is undoubtedly a market competition between strong technical Layer2 and strong consensus Layer2.

Review of the Basic Structure of Ethereum Layer2

Image Source: Top Ethereum Layer 2 Networks

After Blur proposed its "Stake Layer2" narrative, let's first understand the basic types of Ethereum Layer2 structures before making a judgment. It is a scalability solution aimed at increasing transaction throughput and reducing transaction costs by introducing second-layer protocols or protocol stacks on the Ethereum blockchain. It can be roughly summarized as the following types:

State Channels

Definition: State channels are a solution that allows parties to exchange signatures directly without the need to write every transaction to the blockchain. The basic principle is to create an off-chain environment between participants, allowing transactions to take place off-chain, and only broadcasting to the network when the final state needs to be submitted to the blockchain. This method greatly improves transaction efficiency and throughput.

Working Principle: In state channels, participants can open a channel, conduct multiple transactions, and then submit the final state of the channel to the blockchain. This way, only the opening and closing of the channel require on-chain transactions, while transactions within the channel can take place off-chain, avoiding the cost and time delay of every transaction on the blockchain.

Example: The Lightning Network, which is a state channel solution for Bitcoin. Users can conduct fast and low-cost micropayments off-chain, and only submit the final state to the blockchain when the channel needs to be closed. On Ethereum, Raiden Network is a similar state channel solution that achieves highly scalable transactions through the creation of a multi-hop network.

Sidechains

Definition: Sidechains are chains that are separate from the main blockchain but compatible with it, and can have their own consensus mechanism and block generation rules. Users can lock assets on the main chain and then conduct transactions on the sidechain, ultimately submitting the transaction results to the main chain. This method improves overall network performance by achieving higher throughput on the sidechain. Here are several common ways of bridging sidechain contracts:

Pegged Bridge: This is a mechanism for cross-chain interaction by anchoring or mapping assets between two chains. In this bridging method, users lock assets on one chain, and the corresponding amount of assets is generated on the other chain. This usually involves some trusted intermediaries responsible for supervising the locking and releasing of assets.

Lock-and-Mint Bridge: This bridge works by locking assets on one chain and then creating the corresponding amount of assets on another chain. Users lock assets on the original chain, and the bridging protocol issues the corresponding amount of tokens or assets on the target chain. This method usually requires a trusted intermediary or multi-signature contract to ensure the security of the locking and releasing process.

Cross-Chain Atomic Swap: This is a decentralized way that allows users to conduct atomic-level exchanges on two chains, either completing the entire transaction or none at all. This method usually uses smart contracts and hash locking to ensure the reliability of transactions. Atomic swap methods do not involve trusted intermediaries, but require more complex smart contract designs.

Proxy Bridge: This is a way of cross-chain interaction through an intermediary proxy. Users send assets to the bridging proxy, which then performs the corresponding operations on the other chain and sends the corresponding assets to the target address. An example of this method is executing transactions between two chains using a multi-signature contract.

Light Client Bridge: This bridge uses lightweight clients to track the state on the source chain and then generate the corresponding state on the target chain. This method does not require locking and unlocking of assets, but ensures the reliability of interaction by verifying the state on both chains. This is quite common in some Layer2 solutions on Ethereum.

Plasma

Definition: Plasma is a Layer2 framework, originally proposed by one of the co-founders of Ethereum, Vitalik Buterin. It is inspired by a tree structure, containing multiple independently operated child chains. Each child chain can process transactions and only submits the final state to the main chain in case of disputes. This structure allows each child chain to be considered as an independent sidechain, capable of running at lower costs and higher throughput.

Working Principle: The key idea of Plasma is to distribute transaction processing to multiple child chains, thereby reducing the burden on the main chain. This layered structure helps to improve the scalability of the entire system while maintaining the security requirements of the main chain. However, Plasma also faces some challenges, such as designing exit and dispute resolution mechanisms for child chains.

Hybrid Solutions:

Definition: These are hybrid approaches adopted by some Layer2 solutions, combining the advantages of state channels and sidechains to provide more flexible solutions in different usage scenarios.

Working Principle: The system can use state channels to process certain high-frequency transactions, while using sidechains to handle larger-scale or less frequent transactions. This hybrid approach can choose the optimal solution according to actual needs, thereby enhancing the flexibility of the entire network system.

Rollups

This is the current mainstream and well-known scaling solution, which mainly involves moving computation and storage off-chain. According to a recent report from the blockchain infrastructure department Chainstack, without Layer2 Rollup networks such as Optimism and Arbitrum, Ethereum transaction fees would be four times the current price. It mainly consists of two major categories: Optimistic Rollup and ZK Rollup.

● Optimistic Rollup: It adopts an "optimistic execution" approach, assuming that transactions are valid, and only rolls back in case of disputes. This reduces the burden on the main chain and increases overall throughput. However, an effective dispute resolution mechanism is needed to ensure the security of the system.

● ZK Rollup: It uses zero-knowledge proofs to verify transactions on the sidechain, ensuring the validity and security of transactions. This method executes transactions on the sidechain and then submits the verification data to the main chain, fully leveraging the powerful capabilities of zero-knowledge proofs to provide high privacy and security.

Validium Chains

Validium Chains combines the characteristics of sidechains and state channels, executing transactions off-chain while using zero-knowledge proofs to ensure the validity of transactions. This method processes transactions off-chain, avoiding the cost of executing every transaction on the main chain, while ensuring the security and verifiability of transactions. This provides a novel combination of high performance and privacy protection.

State Rent

First, it should be noted that State Rent is not a Layer2 solution, but an improvement mechanism on the main chain. It encourages users to release unused states by introducing rent, thereby reducing the storage pressure on the chain. Although it does not directly increase transaction throughput, State Rent helps optimize the use of on-chain resources and improve overall network efficiency.

Back to Blast Itself

Image Source: Season 3 Rewards & Loyalty

The above different types of Layer2 solutions are all dedicated to solving the scalability issues of blockchain, and each solution has its unique advantages and use cases. The choice of the appropriate method often depends on the specific application's needs, security requirements, and user experience considerations. It has been confirmed that Blast relies on a 3/5 multi-signature to control the recharge address, similar to most Layer2 solutions that also rely on multi-signatures for management (see extended reading [2]). Even though the issue of centralization of the Rollup sequencer has not been resolved, from the perspective of community consensus, Blast has still achieved tremendous success in the short term.

Potential Risks for Lido:

Image Source: ASIA ARYPTO

Lido is a decentralized staking service based on Ethereum, allowing users to stake their ETH tokens in the Ethereum 2.0 network to support Ethereum's Proof of Stake (PoS) mechanism. The Stake model of Blast essentially involves users staking their ETH assets in Lido and RWA, and distributing the returns to users and developers, with native tokens as additional rewards. Therefore, staking a large amount of funds in Lido's network also increases the security risk for stakers, facing a somewhat continuously "centralized" staking method, which may have the following impact on the risk factors for the Lido project:

Liquidity Risk: The liquidity of Lido is a key factor for the successful operation of the project. If there is insufficient liquidity, users may face difficulties when trying to unstake or withdraw funds. This situation may be influenced by market factors, network congestion, and other factors. Solutions to this problem may include formulating more flexible unstaking policies, increasing the number of market participants, or collaborating with other DeFi projects to improve overall liquidity.

Technical Upgrade and Evolution Risk: The Ethereum network and blockchain technology are in a rapid development stage and may undergo upgrades and evolution. Lido must keep up with these changes in a timely manner to ensure that its technical infrastructure can adapt to the latest standards and upgrades, to maintain the security and availability of the system.

Over-centralization Risk:

● Node Centralization: Although Lido aims to be decentralized, the actual validator nodes are still operated by specific institutions or individuals. If these nodes are subject to some form of control or collusion, it may lead to centralized control of the entire system;

● Social Engineering and Malicious Behavior: Validator node operators may be subject to social engineering attacks or other forms of malicious behavior, which may include attacks on nodes, offline or malicious manipulation;

● Technical Centralization: The core functionality and key infrastructure of the Lido protocol may be controlled by a few technical entities, which may lead to technical centralization risks. For example, if the upgrade of the core protocol is too centralized, it may lead to excessive control of the protocol;

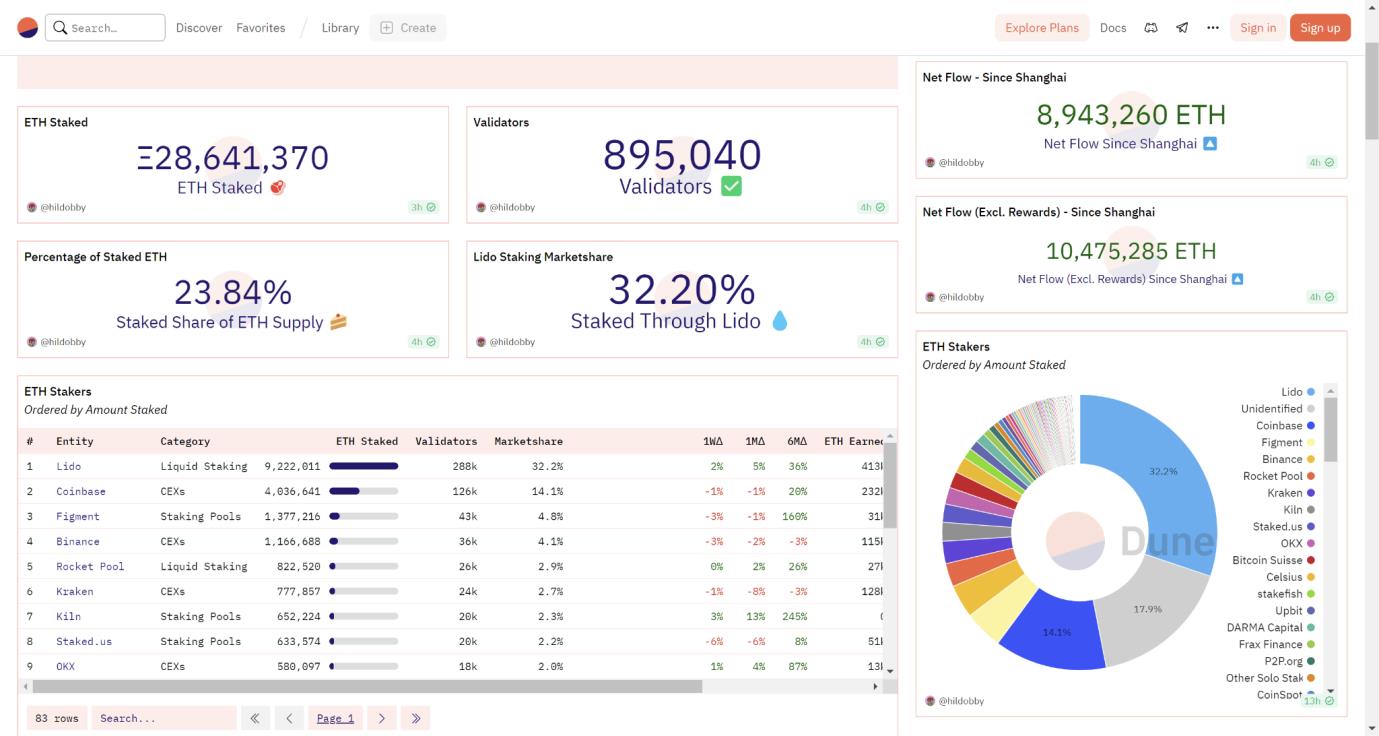

● Funds Centralization: The token issuance and staking of Lido may be controlled by some large holders, who may have disproportionate influence on the protocol. As shown in the data from Dune, on November 29th: the total staked amount on the Ethereum Beacon Chain exceeded 28.64 million ETH, with Lido's market share reaching 32.20%;

● Governance Centralization: If the governance mechanism of the protocol is too centralized, decision-making power may be concentrated in the hands of a few entities or individuals, ignoring the voice of the wider community;

Data Source: Dune

Contract Economics Risk: The project's economic incentive mechanism needs to be carefully designed to ensure the long-term interests of users and the ecosystem are protected. Improper incentive mechanisms may lead to fund loss, system instability, or other negative consequences. The project team should continuously evaluate and optimize these incentive mechanisms to adapt to changing market conditions and user behavior;

Security Audit Risk: The security of smart contracts is the cornerstone of the success of the Lido project. If smart contracts have vulnerabilities, it may lead to the loss of user funds. Therefore, thorough and regular security audits of the contracts are crucial. At the same time, the project team needs to actively adopt feedback from the security community and promptly fix any discovered vulnerabilities;

Community Governance Risk: The design and implementation of the community governance model may affect the development direction and decision-making process of the project. Ineffective community governance may lead to difficult decision-making and hinder the development of the project. Therefore, the project team should work closely with the community to establish a transparent governance mechanism and encourage broad community participation;

Black Swan Events: Unpredictable events may have a significant impact on Lido. The project team needs to establish flexible risk management strategies to deal with unexpected events and ensure the system has sufficient resilience against risks.

Thoughts and Impact on Blast:

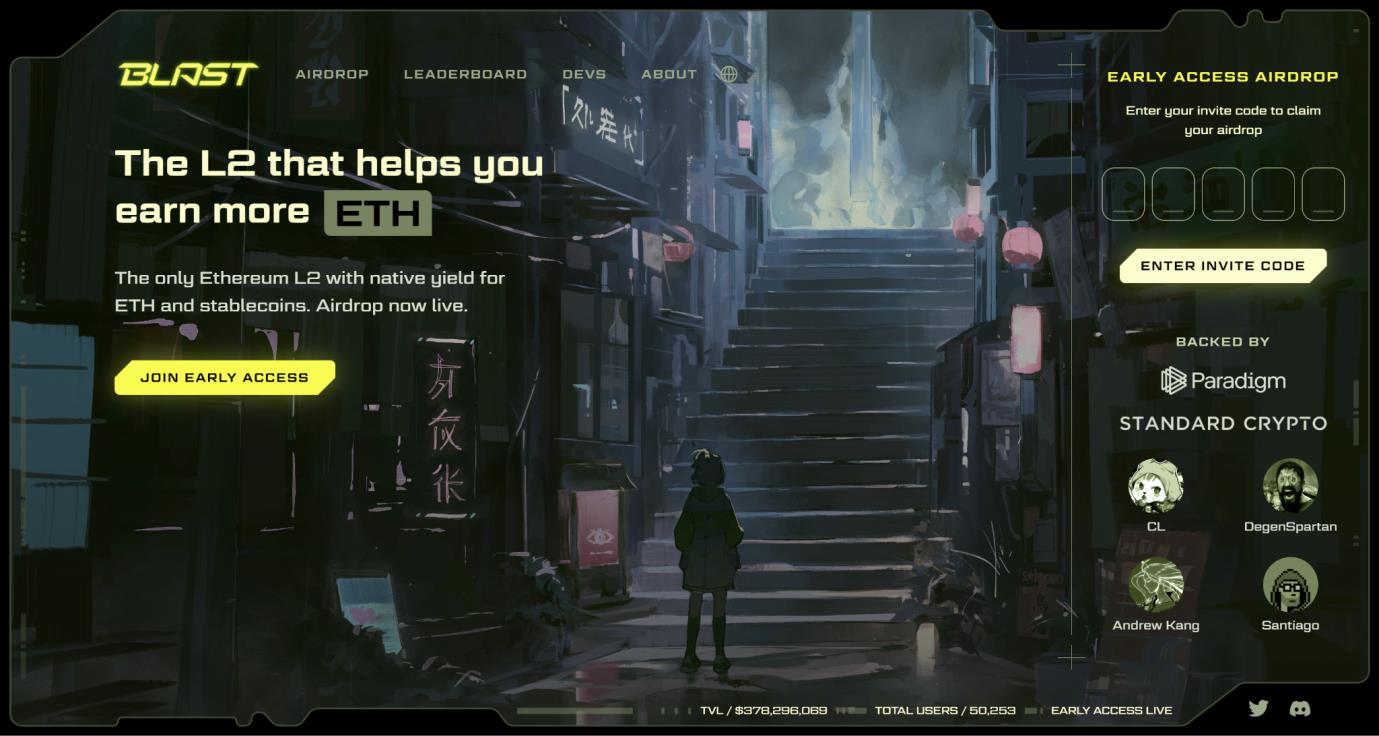

Image Source: Blast Official

Pacman announced that it has raised $40 million for the Blur ecosystem, with participation from angel investors such as Paradigm, Standard Crypto Investment, and advisors from Lido including Hasu and The Block CEO Larry. The birth of Blast comes with the aura of Blur and the financing support from Paradigm, attracting a lot of attention from the start, especially with the endorsement of the new narrative in recent times, which also brings us a lot of food for thought.

1. Where does the native interest rate provided by Layer2 Blast come from?

When users deposit tokens into the Blast (L2) network, they are actually locking an equivalent amount of tokens, which Blast then puts into Lido and RWA for staking. Blast distributes the returns to users and also distributes the original points to users. At the same time, this also brings two direct issues:

● Staking a large amount of user assets in Lido to a certain extent increases the centralization of the staking track, and for users, they not only need to consider the operational security of Blast but also the operational security of Lido. Assuming that both are secure, if TVL continues to maintain its current upward trend, and due to the uncertainty brought about by the secondary market price, multiple factors to a certain extent will bring more uncertainty to the entire Ethereum network;

● If Blast is seen as a new "Stake Layer2", where users lock a large amount of ETH assets to earn returns and also lock a large amount of liquidity, how Dapp applications in the Blast ecosystem obtain liquidity and how to explain the new coin issuance expectations are also worth considering.

2. Which direction of technology and consensus in Layer2 is more likely to be accepted by the market?

First of all, the main goal of blockchain is to solve the trust and security issues in transactions. Once information is confirmed and added to the blockchain, it will be permanently stored, and unless someone controls more than 51% of the nodes in the system, a single node cannot modify the data. The development of the industry cannot be separated from technological progress. From a technological perspective, Blast is not innovative, but rather taking a different approach. Strictly speaking, Blast does not belong to Layer2.

However, the strongest essence of blockchain is still finance, where technology relies more on mathematics and code, while finance involves more psychological expectations. The most successful aspect of Blast is leveraging its own strong traffic and that of Paradigm to directly address users' expectations for project airdrops. In comparison to other strong technical Rollups, it undoubtedly distributes the profits to users through the Stake results by earning the price difference through Gas. Liquidity is the soul of all public chain systems, and Blast has achieved a strong consensus trend in the short term through the expected airdrop. In the short term, strong consensus will still be accepted by the market, but long-term sustainability requires more opportunities.

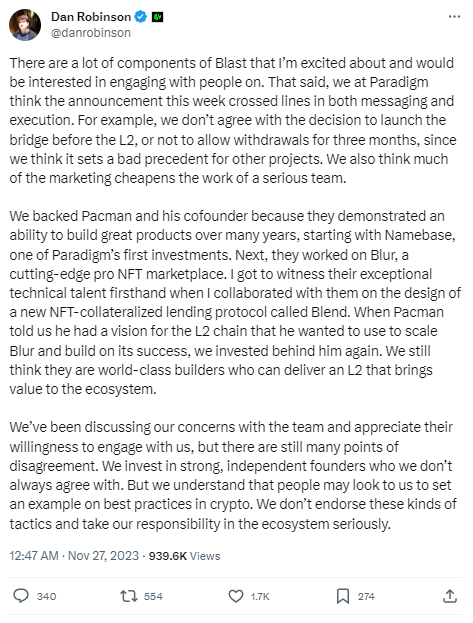

3. Hint from Dan Robinson, Research Director at investment firm Paradigm?

Image Source: X (Twitter) @danrobinson

Different opinions on Blast project decisions:

Order of bridging and L2: Paradigm mentioned that they disagree with the decision to launch bridging before L2. This may indicate that they believe there are risks in launching bridging before the L2 (Layer 2) solution is ready, which may affect the stability and security of the project.

No withdrawals for three months: Similarly, the decision not to allow withdrawals for three months may be seen as setting an unfavorable precedent for users, which may cause user concerns and dissatisfaction.

Concerns about marketing approach:

The article mentioned dissatisfaction with the marketing approach of the Blast project, pointing out that these methods may tarnish the image of a serious team. Specifically, it may refer to problems in the promotion of the project or technology, possibly presented in an exaggerated or inaccurate manner.

Support for Pacman and the team's past work:

Paradigm reviewed their support for Pacman and his partners' past work, from Namebase to Blur and then to Blend. This indicates that Paradigm has a certain level of trust in this team, based on their demonstrated technical abilities and track record of building excellent products over the past few years.

Support for the L2 vision:

Paradigm stated that they invested in the Blast team because Pacman presented a vision for the L2 chain and hoped to use it to expand the success of the Blur project. This indicates that Paradigm believes that the Blast team is capable of providing a valuable L2 solution and making a positive contribution to the entire ecosystem.

Discussions with the team:

Paradigm emphasized that they have had discussions with the Blast team, expressing their concerns, and the team has shown willingness to engage with them. This indicates that when difficulties or disagreements arise, both parties are willing to resolve issues through dialogue.

Responsibility and role model:

Paradigm emphasized their sense of responsibility in the crypto space, acknowledging that people may look to them for guidance in the field. They explicitly stated that they do not support certain strategies, emphasizing that they take their responsibility in the ecosystem seriously.

Overall, this passage reflects some specific objections from Paradigm to the Blast project decisions, but also expresses their support for the Blast team's past work and emphasizes their sense of responsibility in the crypto ecosystem. Subsequently, according to Wu Shuo's blockchain news, Pacman also tweeted to clarify a few necessary points:

The high returns offered by Blast are not a Ponzi scheme; the returns come from Lido and MakerDAO, based on Ethereum staking returns and on-chain T-Bills. These returns are a core part of the on-chain and off-chain economy and are sustainable.

The market strategy (GTM) is unrelated to Paradigm. Although Paradigm provides consultation on the technical L2 design, the GTM is entirely decided by Blast internally.

The invitation system of Blast is not a new mechanism; it has been in place for a long time. This mechanism aims to reward users who contribute to the L2 ecosystem, as a way to give back to the community, which is the reason for the existence of the invitation rewards.

Note: This analysis represents the author's personal opinion and does not involve guidance. Any objections can be ignored.

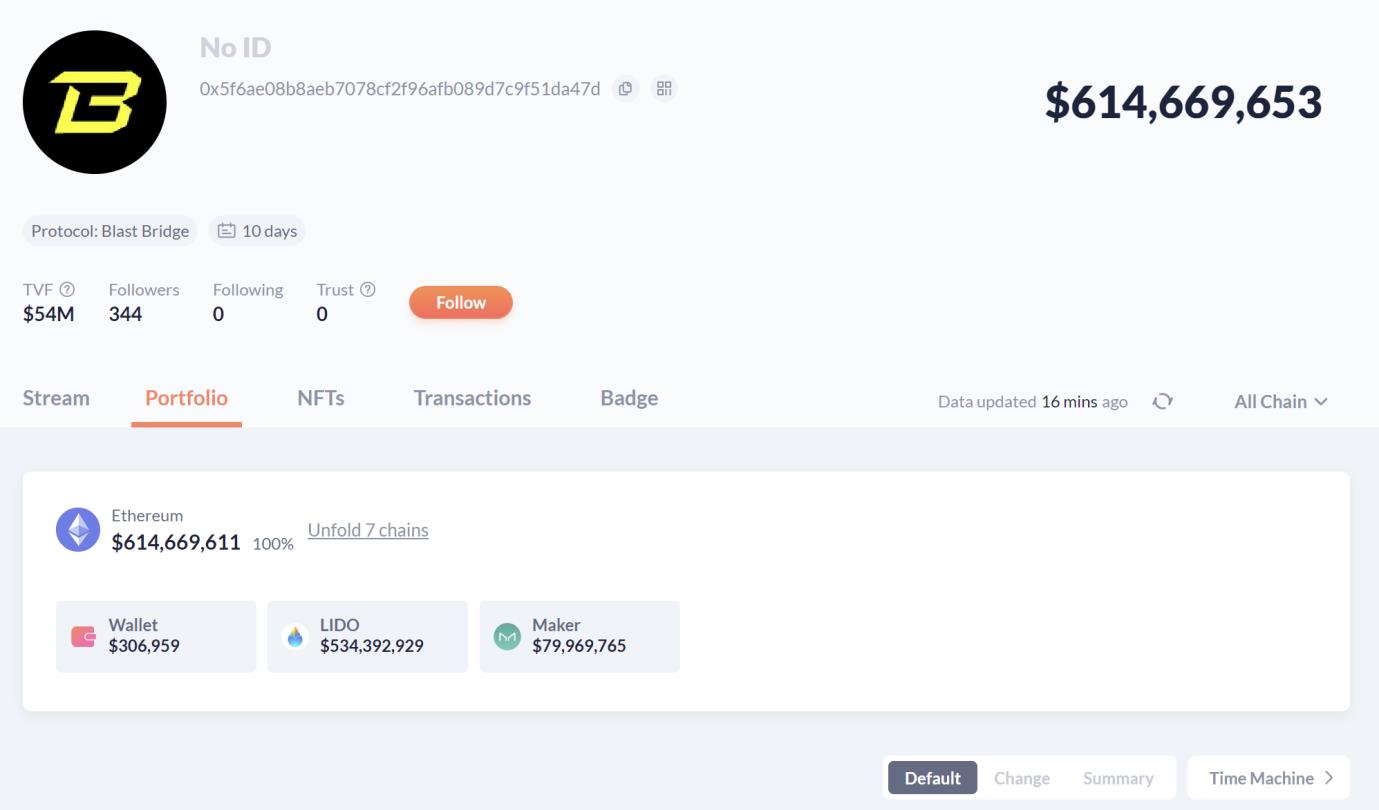

4. Rapidly increasing TVL market of over $600 million

Data Source: DeBank

Since Blur founder Pacman announced the launch of the new project Blast on November 21, as of November 29, the total locked value (TVL) of cryptocurrencies in Blast has reached $614 million in just one week, sparking a widespread discussion within the industry. This "Stack-centric Layer2" trend has undoubtedly achieved great success in market consensus.

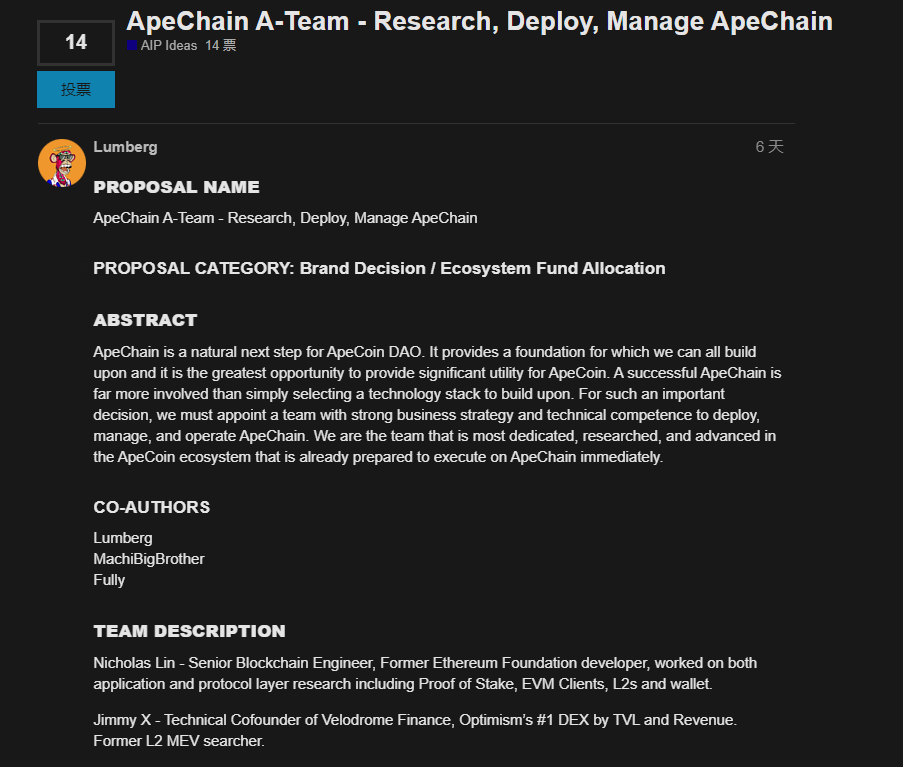

5. "New Task" from ApeCoin

Image Source: ApeCoin Official

The original text mentioned a proposal called "ApeChain," which aims to promote the research, deployment, and management of ApeChain within the ApeCoin DAO ecosystem. The team met with multiple technical solution partners and discussed the strengths and weaknesses of each technical solution to seek support from each partner. After careful consideration, the project team chose to support Layer2 Rollups to better attract developers to build on ApeChain.

This leads us to wonder if ApeCoin intends to catch up with the hype around Blast at the earliest opportunity?

Its future development will be compatible with the Optimism Superchain ecosystem and promises to provide basic token grants to participate in Superchain governance, which may lead us to think that Ape is quickly catching up with a wave of hotspots by leveraging the TVL siphon effect from Blast. The specific costs of the DAO include infrastructure, business operations, developer relations, and ecosystem development.

Infrastructure includes:

- Block explorers such as Blockscout, Etherscan, or open-source alternatives like Otterscan;

- Oracles: Chainlink, Pyth, or Redstone;

- Layer 1 data publishing costs in ETH;

- Costs related to the operation of the sequencer.

Two ways to handle discussion stage costs:

- Directly launch ApeChain (AC) tokens, with no cost to the DAO;

- The team will raise funds for the operation and development of ApeChain, and in the future, governance tokens will be distributed to supporters of ApeCoin.

Finally, the launch of Blast itself from a marketing perspective is undoubtedly a successful attempt, leveraging its industry influence to directly explain the airdrop rules in a straightforward manner, attracting a large amount of staked funds in the short term, igniting a new wave of enthusiasm in the market for Stake. Its TVL of over $600 million in the short term has also attracted attention from other Layer2 and Ape communities, but it is worth noting that it has related uncertain risks and should be approached with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。