Original author: Biteye, core contributor Louis Wang

Original editor: Biteye, core contributor Crush

This year can be said to be a big year for Layer2 (mainly referring to rollup), with nearly ten Layer2 mainnets launched.

March 24th, zkSync era launched

March 27th, Polygon zkevm mainnet Beta launched

July 17th, Mantle announced the launch of the mainnet Alpha version

July 18th, Linea launched

August, Base mainnet launched

September 12th, Manta launched its Layer2 mainnet Pacific

October 10th, Scroll mainnet launched…

It is obvious that Layer2 is developing rapidly. Whether it is Op rollup or the ZK rollup that we thought was very distant, they are emerging at an explosive speed. It's worth noting that it's only been a little over half a year since the Arb airdrop.

The original vision of Layer2 technology was to address Ethereum's scalability needs, increase transaction throughput, and rely on Ethereum to maintain decentralization and security, providing users with a better user experience, lower fees than the mainnet, and less congestion.

This article aims to use on-chain data comparison to let readers understand some of the patterns and appearances of the Layer2 competition.

01 Layer2 Overview

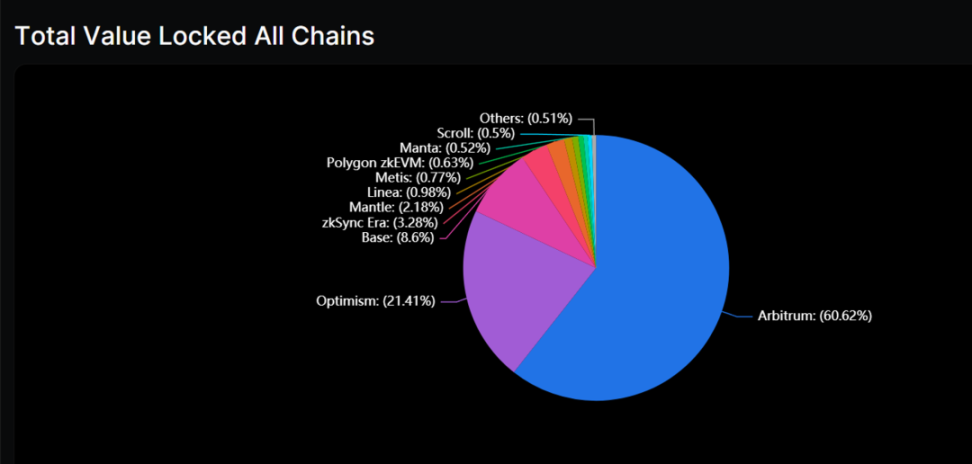

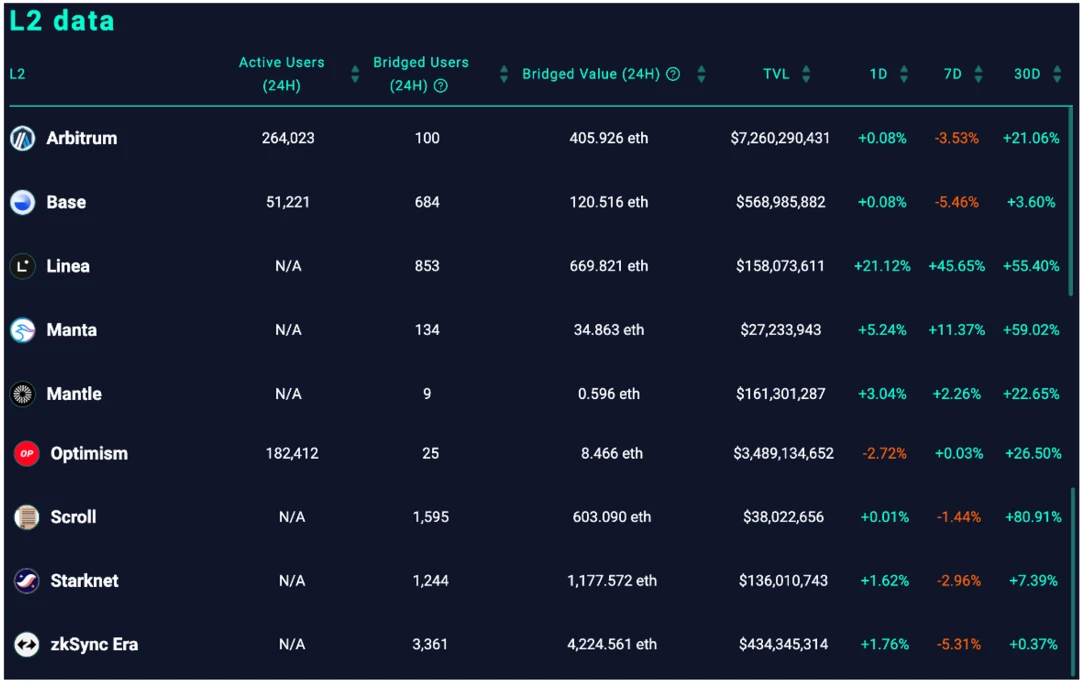

(Source: https://defillama.com/chains/Rollup)

According to DeFiLlama data, the total value locked (TVL) of Layer2 rollup is approximately $3.4 billion. The first place Arbitrum leads by a wide margin with a TVL of $2.06 billion, accounting for 60.62%, followed by Optimism, which holds 21.41% of the market share.

Arbitrum and Optimism have the first-mover advantage in the Layer2 track, being the earliest mainnets to launch, and together they have captured over 80% of the market share.

Those with a TVL exceeding $100 million include Base and zkSync era, while the TVL of other public chains is less than $100 million.

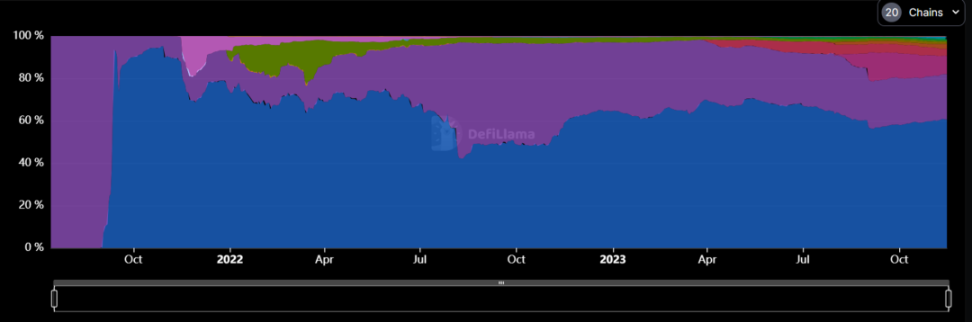

(Source: https://defillama.com/chains/Rollup)

Looking at the time scale, the diversity of the Layer2 market has significantly increased since the beginning of this year. Using January as a reference, Arbitrum's market share has remained stable at around 60%, unaffected by later entrants, while Optimism's share has decreased from 32% to 21%.

Author's note: There is a significant difference between DeFiLlama data and L2BeatsTVL data. For example, in the case of Arbitrum, L2Beats ($7.52 billion) is even more than Defillama ($2.06 billion) by more than 3 times.

This is because the two platforms use different statistical methods. L2Beats calculates cross-chain value, i.e., how much money has crossed to the target chain through cross-chain bridges; while DeFiLlama calculates the total locked amount of various dApps on the target chain.

In simple terms, the $5 billion difference is not being used in any dApp on Arbitrum (possibly being held in wallets), at least not in the dApps counted by DeFiLlama.

02 Arbitrum

(Source: https://defillama.com/chain/Arbitrum?users=false&txs=true&tvl=true)

Arbitrum currently has over 14.29 million unique addresses, with a total of 418.45 million transactions and a TPS of 6.3.

On-chain activity reached its peak during the airdrop in March, with over 3 million transactions in a single day. After the airdrop, on-chain activity has been maintained at a relatively good level and has not been affected by this year's market downturn.

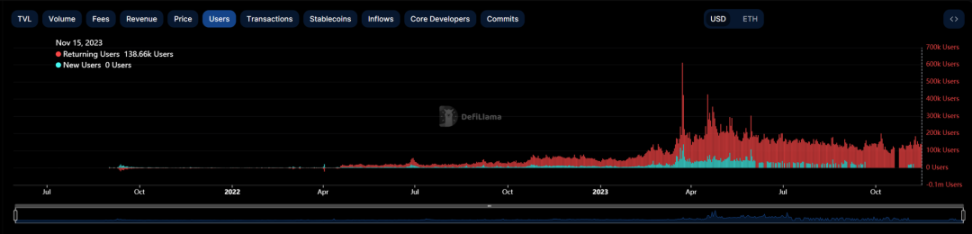

(Source: https://defillama.com/chain/Arbitrum?users=true)

Arbitrum has many flagship projects in its ecosystem, such as GMX, which accounts for 23% of the TVL, and native DEX+LaunchPad project Camelot, as well as the blockchain game TreasureDAO, and more.

Combined with a multitude of projects migrated from the mainnet, the DeFi system is complete and innovative, with a high overall richness of the ecosystem. Therefore, user retention is relatively good, with nearly 3/4 of daily active users being returning users.

03 Optimism

(Source: https://defillama.com/chain/Optimism?txs=true)

Optimism has seen 57.66 million unique addresses conducting 177 million transactions, with a TPS of 4.6. After the airdrop in June last year, OP's activity has maintained a good growth momentum.

The native flagship project Velodrome currently has a TVL of $145 million, and most of the remaining TVL is supported by Synthetix and its DeFi projects in its ecosystem, such as Lyra and Thales.

(Source: https://www.theblockbeats.info/news/44039)

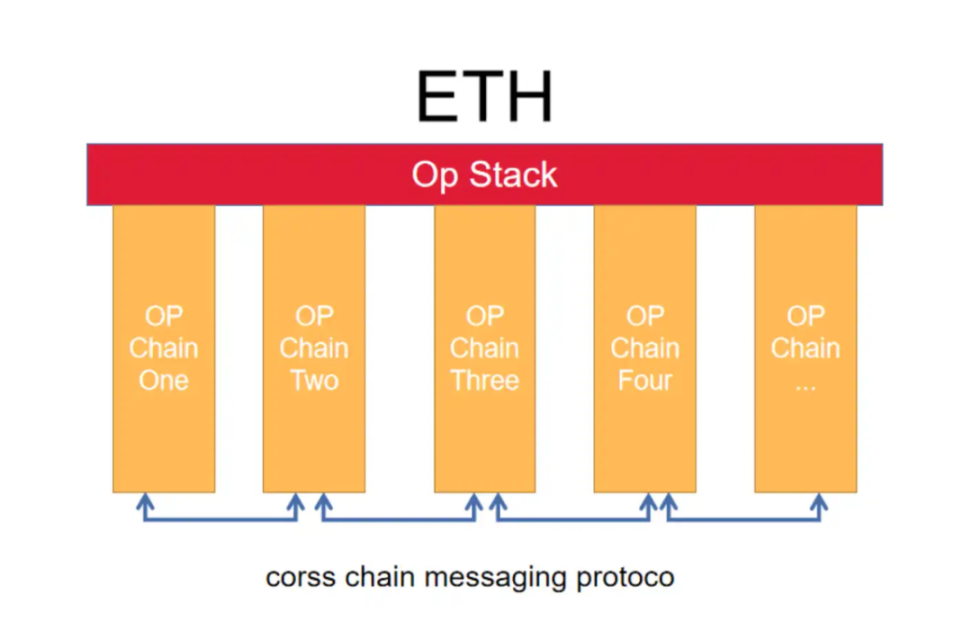

After OP's bedrock upgrade and the release of the modular blockchain solution OP Stack, it has clearly charted its own path.

OP Stack allows developers to customize their Layer2 network by selecting and assembling execution layers, DA layers, etc., based on their own scenarios and needs, reducing the difficulty of launching a chain.

Adopters include Coinbase's Base, BitDAO's Mantle, BN's opBNB, and NFT-focused Zora, among others. Chains using OP Stack will also to some extent contribute back to OP, for example, Base will allocate a portion of its income to the OP treasury.

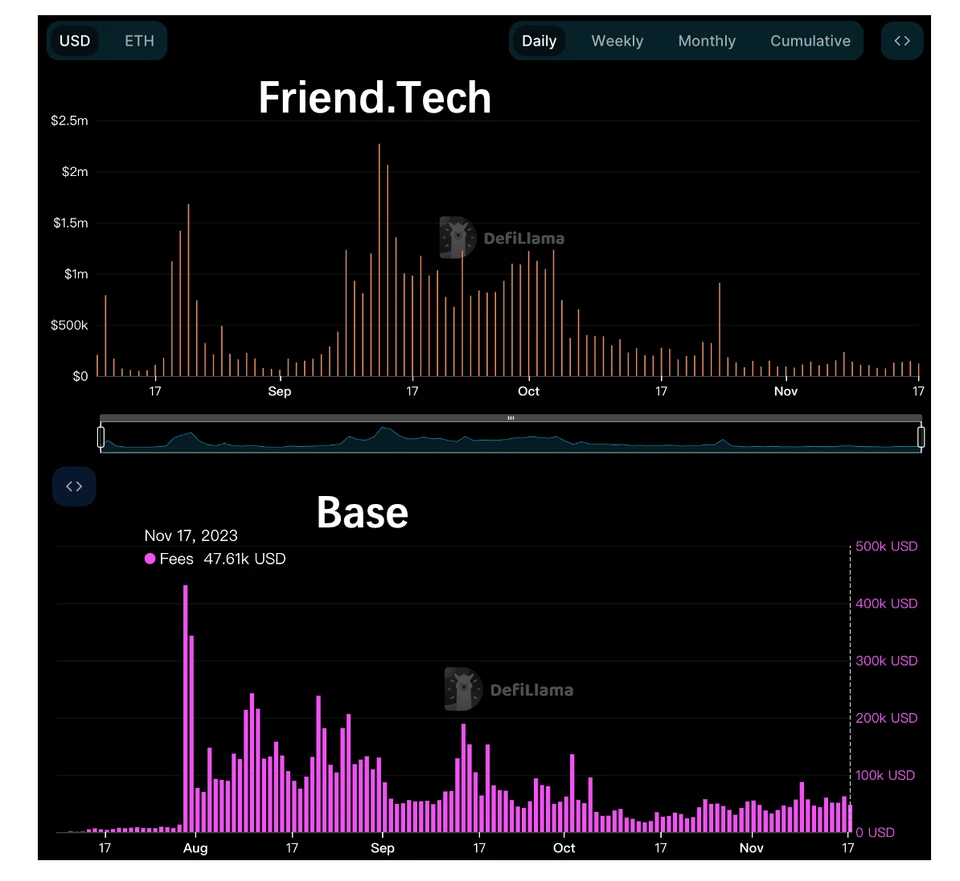

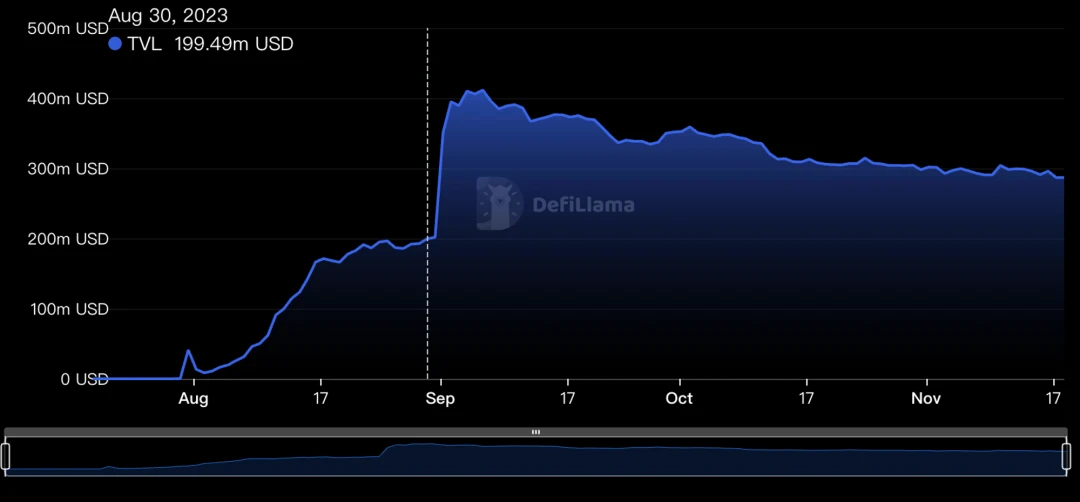

04 Base

As mentioned earlier, Base, launched by Coinbase based on OP Stack, currently has 2.4 million users, 67 million transactions, and a TPS of 3.8.

Its main focus comes from the phenomenal dApp, FriendTech. In the last 30 days, FriendTech generated protocol fees of $5.4 million, while Base generated revenue of approximately $1.32 million during the same period.

During the peak of SocialFi enthusiasm, FriendTech's protocol revenue was second only to Ethereum and Lido.

In addition to FriendTech, the native project that Base can compete with is Aerodrome, a fork of Velodrome on OP, currently with a TVL of $55.53 million, ranking first.

05 Mantle

Mantle is a Layer 2 designed based on the Optimism OVM architecture, using modular design and EigenDA for data availability to significantly reduce the cost of rollup.

Currently, Mantle has 820,000 addresses and has processed 21 million transactions.

Leading projects on Mantle with TVL include several native DEXs, such as Agni and FusionX. Mantle has very strong financial support.

The reserve value in the Mantle Treasury exceeds $2 billion, with over 220,000 ETH, providing a solid foundation for its future LSD track projects with advantages in deposit scale and liquidity.

06 zkSync Era

zkSync is a leading project in the zk rollup space developed by the MatterLabs team.

Version 1.0 Lite only supports token payment scenarios, while version 2.0 era is an EVM-compatible general mainnet, with over 4.67 million unique addresses.

zkSync originally used the zkSTARK algorithm and announced the launch of a new proof system, Boojum, on July 17, transitioning from zkSNARK to zkSTARK proof algorithms.

The launch of zkSync Era closely followed the Arb airdrop, so users have great enthusiasm and expectations for zkSync. In just over half a year, it has accumulated 4.6 million unique addresses and 165 million transactions. zkSync has a native account abstraction, eliminating the need for the ERC4337 solution.

There are very few leading projects migrating to zkSync, such as Uniswap and AAVE, giving native projects and some new projects more opportunities, such as SyncSwap, Mute, and Maverick, with applications currently focused on DeFi.

07 Scroll

The zkevm project Scroll, known as the pride of the Chinese, announced the launch of its mainnet on October 10th, and within a few weeks, the TVL reached $17 million, with over 2 million addresses completing 4.7 million transactions.

Before the mainnet announcement, there were widespread hints about Scroll on Twitter, with many project teams and KOLs, creating a highly anticipated atmosphere for marketing and promotion.

Within a week, Layer0 announced support for the Scroll mainnet, Orbiter supported Scroll mainnet USDT and USDC cross-chain, OKX Wallet integrated with Scroll, and NFTScan supported the Scroll mainnet, demonstrating Scroll's influence.

During the testnet phase, Scroll deployed over 100 projects for testing, covering various tracks.

Currently, there are over 30 projects deployed on the mainnet, similar to zkSync, with a roughly equal split between multi-chain deployment projects and native projects.

08 Starknet

Starknet is a general-purpose public chain using the zk-Stark proof method, running on the Cairo-VM, rather than the EVM compatibility pursued by most Layer2 solutions.

Starknet does not have the concept of EOA, all are native AA accounts, and currently has deployed over 2.9 million accounts.

The contract language used on Starknet is Cairo, rather than the more familiar Solidity, which brings significant technical barriers to project migration.

Starknet restarted its mainnet with a major update of Cairo 1.0 this year, and began official operation. The TVL steadily increased to over $40 million, but experienced a rapid decline in TVL after the Israel-Palestine conflict (StarWare headquarters is located in Israel), and is currently stable at $30 million.

The leading projects in TVL on Starknet are old projects that were deployed during the Beta mainnet period, such as JediSwap and mySwap.

One noteworthy project is Ekubo, ranking fifth in TVL, but accounting for 75% of the total transaction volume on Starknet. Recently, the UniSwap DAO proposed to provide $12 million worth of 3 million UNI to support Ekubo's development in exchange for a 20% token share.

Manta Pacific

Manta Pacific is a zk general Layer2 launched by Manta, which will use Celestia as the data availability layer to maximize the reduction of user interaction costs.

Since its launch in September this year, the TVL has reached $18.59 million in two months, with 166k unique addresses and 2.16 million transactions.

Manta initially considered adopting the OP Stack solution, but later migrated to Polygon CDK, becoming part of the Polygon ecosystem.

Manta's NPO website has minted over 300,000 zkSBT, with over 200,000 wallet installations.

Aperture Finance is a leading liquidity management platform in the industry, using an "Intent-based" architecture that allows users to automate strategies comprehensively. Its project ApertureSwap is a native DEX on Manta, similar to UniV3, allowing users to provide centralized liquidity, currently with a TVL of $4.95 million, ranking second.

Linea

Linea is a zkevm Layer2 solution launched by ConsenSys, the parent company of the MetaMask wallet.

MetaMask, as one of the most important infrastructure in blockchain, has 30 million active users per month, all of whom can be potential users of Linea. With a strong background from the founding team and investors, and a valuation of $7 billion, Linea has become a hot Layer2 solution.

In less than half a year since its launch, Linea has accumulated 1.68 million unique addresses and 18.36 million transactions.

Linea's current TVL has exceeded $27 million, with leading projects SyncSwap and Velocore, both native DEXs on zkSync, migrating to Linea.

Comparison

Regarding the basic data of each Layer2, the summary is as follows:

(TVL data is from DeFiLlama, TPS is from L2Beats November 17th average data, and other data is from various blockchain explorers)

For cross-chain data from the Ethereum mainnet to various Layer2 solutions, you can refer to Chaineye's data dashboard, which provides data and changing proportions over time for easy comparison:

(Source: https://chaineye.tools/)

Conclusion

It used to be said, "Fat protocols, thin applications," indicating that most of the value of blockchain is captured by the protocol layer, with only a small portion distributed in the application layer. Public chains capture most of the profits by selling block space.

However, with the continuous improvement of infrastructure and the emergence of various Layer2 public chains, there is suddenly a feeling of protocol redundancy and insufficient applications.

In the bear market environment, liquidity itself is limited, and this liquidity is also being fragmented among various Layer2 solutions due to the arms race of Layer2.

Each chain is looking forward to incubating native innovative applications, but often there are few moments of inspiration, and more often it is a multi-chain fork of a successful project.

The emergence of FriendTech has brought a lot of attention, funds, and users to the Base chain, and TVL has soared along with the popularity of FT.

Base has stated that it will not issue its own tokens, which can be understood as a low proportion of on-chain users interacting for the purpose of Base airdrops. Users and funds are largely attracted by the phenomenon-level application of FT. The contribution and impact of a killer app on a public chain are evident.

When users profit from such dApps, the profit funds are likely to spill over to other projects in the ecosystem, benefiting the entire public chain.

At the same time, the protocol revenue of FT is much higher than the revenue of the Base public chain, and at its peak, the difference is even more than 5 times. Therefore, in addition to bringing a wave of SocialFi frenzy, the emergence of FT also makes us wonder whether good consumer applications have become scarce due to the maturity of infrastructure?

Future applications no longer need to revolve around public chains with abundant funds, just as the explosion of DeFi on Ethereum was due to a large accumulation of funds.

Mature Layer2 and supporting cross-chain infrastructure are now able to meet the smooth migration of funds, and can pursue good applications. In the future, they may gradually move from "thin applications" to "fat applications."

(Source: https://defillama.com/protocol/friend.tech?fees=true&tvl=false)

This is also why after the explosion of FT, every public chain is trying to support its own SocialFi projects, such as Linea's TOMO, Avalanche's SA, and so on. Regardless of the success of these projects, from the perspective of public chains, it is evident that they all crave native star projects.

(Source: https://defillama.com/chain/Base)

For Layer2, the need to capture users, retain users, and keep funds active cannot rely on airdropped PUA.

Taking the two most mature Layer2 solutions, Optimism and Arbitrum, as examples, after the airdrops ended, the on-chain user activity and transaction volume did not weaken, but instead grew stronger. They each have their own native star projects, such as GMX on Arb and Velo on OP.

Both public chains are also continuously launching incentive programs, such as Arb's short-term incentive project STIP, and OP's successive retrospective incentives.

Maintaining long-lasting vitality for a public chain is a very difficult and complex task, requiring efforts from the public chain project team, as well as the participation of more developers and funds.

From a higher strategic perspective, what truly drives a Layer2 to stand out is the narrative aspect.

For example, the narrative of the "super chain" promoted by OP, the open-source modular solution OP Stack, attempts to shine brighter than Cosmos in the Ethereum Layer2 composition, and has garnered a lot of supporters;

Similarly, Polygon also introduced the zk modular blockchain solution Chain Development Kit (CDK), with adopters including Polygon zkEVM, Manta, Canto, and others;

Arbitrum announced the launch tool for the Layer3 blockchain Arbitrum Orbit, and zkSync subsequently released the open-source toolkit ZK Stack, indicating support for the construction of Layer3;

Starknet is fully promoting full-chain games; Zora focuses on NFTs and commission-based economics…

Each chain is pushing new narratives from various angles, because with the landing of Layer2, Layer2 itself is already difficult to hype as a narrative.

In conclusion, competition between Layer2 solutions is always good for users. While enjoying the security of the Ethereum network, they can also enjoy low fees. The maturity of all infrastructure brings the possibility of large-scale applications. Let's look forward to the future of Layer2 together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。