Author: Will Awang

Real-world assets exist off-chain, and owners can derive expected returns from them. The relevant ownership benefits are regulated by the legal system and are rooted in our social contract. For the crypto world, Real World Asset Tokenization (RWA) can help crypto capital capture real-world business opportunities; for the real world, RWA can help assets capture immediate liquidity in the crypto world.

In the compiled report "Citi RWA Research Report: Money, Tokens, and Games," Citi stated that tokenization can bridge the on-chain and off-chain worlds, helping the industry achieve one billion users and ten trillion in asset value by 2030. As the first protocol to bring real-world assets onto the chain, Centrifuge provides a channel to integrate RWA assets into the decentralized financial system, facilitating the landmark practical application of RWA assets in the crypto world.

This article is an extension of the previous article "Thousands of Words Research Report on RWA: Analyzing the Current Implementation Path of RWA and Exploring the Development Logic of Future RWA-Fi," which will deeply analyze Centrifuge from the essence of RWA, further understanding the demand for RWA in the crypto world, outlining Centrifuge's transformation from a startup project to RWA financial infrastructure, and exploring possible developments of future projects in the RWA field.

I. The Essence of RWA

Before looking at Centrifuge, it is necessary to outline the essence of RWA from my personal perspective (especially from the perspective of Crypto RWA). This will help us understand the current market landscape of RWA in the crypto world from a macro perspective and find the positioning of protocols/projects like Centrifuge.

As shown in the above figure, the most important aspect of RWA is the asset side and the capital side, both of which have their own demands.

The real-world asset side requires financing, whether through Security Token Offerings or through collateralized lending (Centrifuge). The essence of asset financing remains unchanged, but the source of capital has changed—DeFi's immediate liquidity and the efficiency gains brought by blockchain and smart contracts in financing channels (such as the Centrifuge protocol).

The demand for crypto capital on the funding side is investment. The key is to capture real-world assets that are low-risk, stable-yielding, scalable, and unrelated to crypto volatility. From a stability perspective, stablecoins are a key use case, serving as a medium of exchange unaffected by crypto volatility. From the perspective of stability, yield, and scalability, US Treasury RWA is a key use case, helping capture risk-free returns.

More importantly, RWA can create U-denominated yield assets, becoming a new asset class in the crypto world. Based on this, this U-denominated yield asset class and the composability of DeFi can bring about great potential, such as yield stablecoin projects and the recent popular yield Layer 2 projects.

After clarifying the essence of RWA as I see it, the positioning of Centrifuge in the RWA ecosystem becomes clear: as a channel to help off-chain assets capture liquidity in the crypto world and to reduce the cost and improve the efficiency of financing channels through blockchain and smart contract technology.

II. Introduction to Centrifuge

2.1 Project Overview

Centrifuge is a decentralized RWA asset financing protocol designed to bring real-world assets onto the chain, allowing borrowers to obtain financing without banks or unnecessary intermediaries. By creating on-chain lending pools through asset collateralization, Centrifuge helps borrowers access immediate liquidity in the crypto world.

By integrating the entire private credit market onto the chain (securitization, tokenization, DAO governance, and liquidity), Centrifuge is building a more open, transparent, lower-cost, and all-weather liquidity decentralized financial system (The Platform for Onchain Credit) to reduce the cost of capital for small and medium-sized enterprises and provide DeFi investors with stable sources of income unrelated to crypto market fluctuations.

In the traditional financial system, the lack of an open and transparent lending market, inefficient capital allocation, and high transaction costs make it difficult for some small and medium-sized enterprises to obtain competitive financing terms. DeFi, on the other hand, is a financial system that is open to everyone in the world without any barriers and is continuously maturing. Centrifuge aims to bring the benefits of DeFi to borrowers who have so far been unable to access DeFi liquidity.

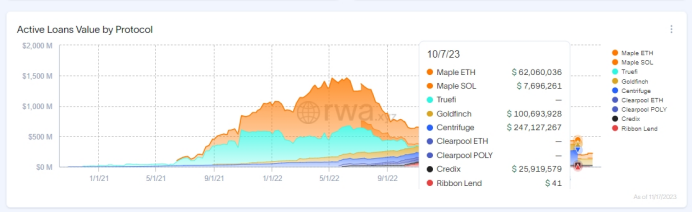

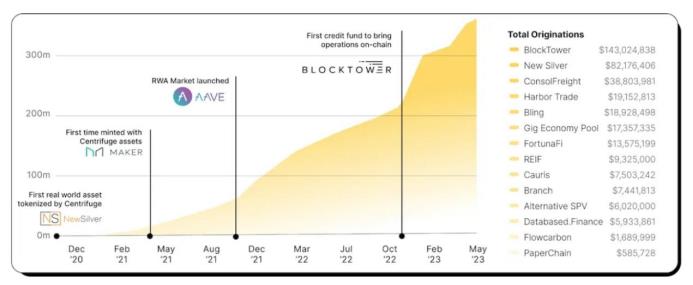

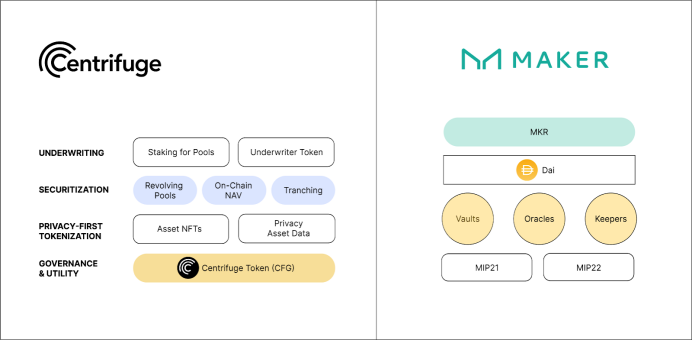

As an important financial infrastructure in the RWA market, Centrifuge has become a leader in RWA private credit (raising financing for $494 million in assets, with a current TVL of $250 million), has created a large number of RWA asset pools for MakerDAO, and together with Aave, launched the RWA market, bringing the operation of the first credit fund onto the chain with BlockTower.

2.2 Team and Financing

Centrifuge was launched by Lucas Vogelsang and Martin Quensel in 2017.

Lucas Vogelsang, the founding engineer of Centrifuge, is the CEO of the company. Previously, Vogelsang founded an e-commerce startup called DeinDeal, which he successfully sold. He then moved to Silicon Valley and became a technical manager at Taulia before co-founding Centrifuge in October 2017.

Martin Quensel, one of the founders of Centrifuge, is currently the Chief Operating Officer. Quensel's career began at SAP, where he worked as a software developer and architect. Before founding Centrifuge, he co-founded Taulia.

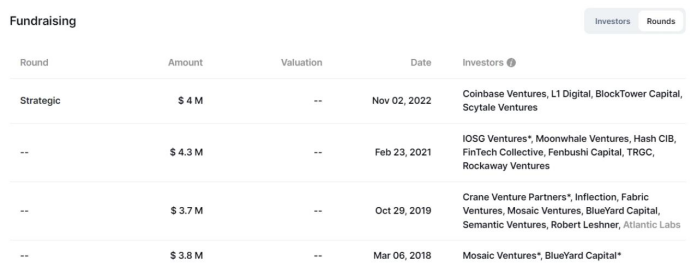

Centrifuge's financing history is as follows:

In February 2021, Centrifuge raised $4.3 million through SAFT, with Galaxy Digital and IOSG leading the investment, and participation from Rockaway, Fintech Collective, Moonwhale, Distributed Capital, TRGC, and HashCIB.

On May 18, 2022, Centrifuge established a strategic partnership with BlockTower for a $3 million Treasury Token Sale. BlockTower has become a very active member of the Centrifuge community and has provided $150 million in real-world assets to MakerDAO through Centrifuge.

In November 2022, Centrifuge completed a $4 million financing round with participation from Coinbase Ventures, BlockTower, Scytale, L1 Digital, and others.

The strong VC lineup has brought abundant resources in terms of assets, funds, compliance, and more to Centrifuge.

III. Key Business Architecture of Centrifuge

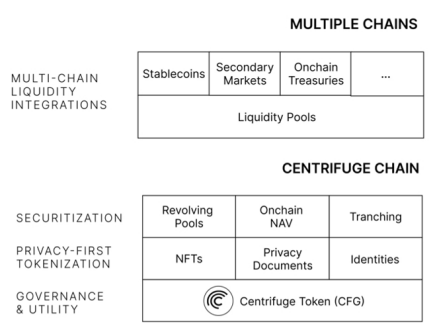

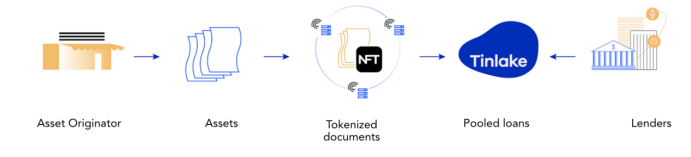

As a platform/protocol, Centrifuge focuses on bridging the off-chain asset side and the on-chain capital side, and achieving cost reduction and efficiency gains through blockchain and smart contracts. The current Centrifuge DApp has integrated the previous Ethereum-based Tinlake protocol (acting as an open market for RWA asset pools and accessing Ethereum liquidity) and uses the Centrifuge Chain to achieve fast, low-cost transactions and capture cross-chain liquidity (built on the Polkadot Substrate framework as a Polkadot parachain for cross-chain interoperability).

The most important part of the business architecture is the Tinlake protocol, which is an open asset pool based on smart contracts. It tokenizes real-world assets through NFT collateralization and provides access to liquidity in the crypto world, serving as Centrifuge's main frontend product.

Over the 4 years since Tinlake's launch, it has made significant contributions to Centrifuge, including creating the world's first RWA asset pool for MakerDAO, launching the RWA market with Aave, and bringing the operation of the first credit fund onto the chain with BlockTower.

In May of this year, for a better user experience, Centrifuge officially launched a new, secure, reliable, and streamlined upgraded version of the DApp, gradually replacing the Tinlake protocol. However, some core functions and business logic of the Tinlake protocol still apply, including asset onboarding, structured investment layers, on-chain net asset value, and revolving funding pools.

3.1 Logic of Asset Onboarding (Borrower, SPV, Centrifuge Asset Pool)

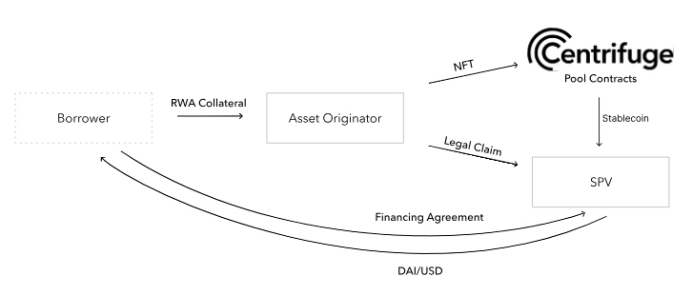

Borrowers can tokenize their real-world assets through a special purpose vehicle (SPV) established by the asset originator in the Centrifuge asset pool, allowing them to access stablecoin funding from on-chain investors. The entire logic of asset onboarding follows the logic of traditional asset securitization that has been in operation in the traditional financial industry for many years, and connects to DeFi liquidity through the Centrifuge asset pool.

The logic of asset onboarding is as follows:

- Borrower intends to finance their real-world assets (such as property loans, accounts receivable, invoices, etc.);

- The asset originator (engaged in business with the borrower and assuming some underwriting functions) establishes an independent SPV for the borrower's real-world assets (the SPV acts as an independent financing entity, providing bankruptcy isolation from the asset originator);

- The asset originator initiates and verifies the borrower's real-world assets in the SPV and mints an NFT on-chain related to the condition of the real-world assets;

- The borrower signs a financing agreement with the SPV and collateralizes the NFT in the Centrifuge asset pool to connect to DeFi liquidity;

- The SPV acts only as a pass-through financing tool, with its business scope strictly limited through the SPV Operating Agreement;

- The Centrifuge asset pool provides stablecoins such as DAI to the SPV, which are then transferred to the borrower's account;

- The entire transaction's fund flow involves only the borrower, SPV, and Centrifuge asset pool (connecting to DeFi liquidity);

- Ultimately, the borrower repays the principal and interest to the SPV according to the financing agreement, and the SPV returns the funds to the Centrifuge asset pool. After the repayment is completed, the Centrifuge asset pool unlocks the NFT and returns it to the asset originator for destruction.

3.2 Logic of Centrifuge Asset Pool Investment (Structured Layers)

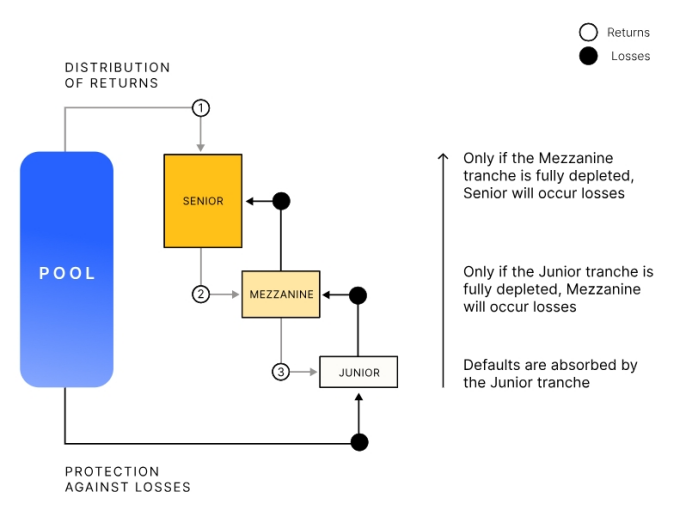

Once the assets are onboarded to the Centrifuge asset pool, it introduces investment opportunities for DeFi investors with different risk levels and returns through structured product design. Investors can purchase products with corresponding risk-return levels based on their risk tolerance and return expectations.

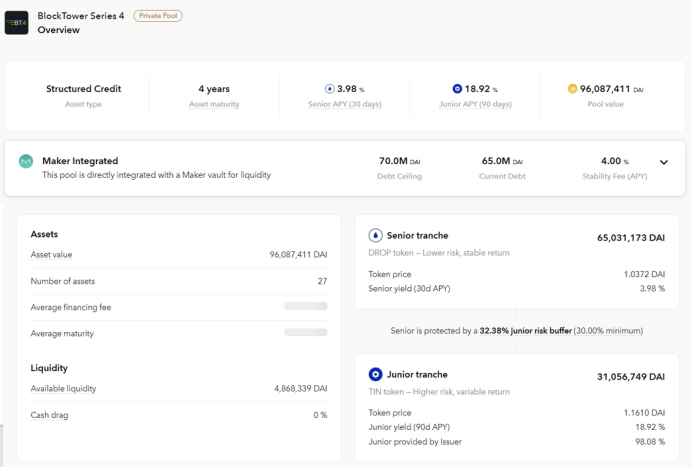

Generally, the structured products of the Centrifuge asset pool provide two types of ERC20 tokens: DROP and TIN. Using the example of the BlockTower S4 asset pool in the above image:

The DROP token is a senior tranche product, representing the fixed-rate portion (3.98%) of the Centrifuge asset pool, typically with lower risk and lower returns. DROP token holders have priority in profit distribution from the asset pool and have a smaller risk exposure (e.g., loan defaults) compared to TIN token holders.

The TIN token is a junior tranche, representing the floating-rate portion (18.92%) of the Centrifuge asset pool, typically with higher risk and higher returns. Compared to DROP token holders, TIN token holders have lower priority in profit distribution from the asset pool and have a relatively larger risk-return exposure.

In the waterfall model in the image below, although junior tranche products offer high returns, they will bear the first losses in the event of default. Similarly, senior tranche products offer stable, relatively lower returns, but will bear losses last in the event of default (with junior and mezzanine tranche investors bearing the risk first).

Investors can make investments based on their risk preferences, typically involving the following steps:

Investors need to complete the KYC and AML verification process on the Centrifuge DApp first.

After verification, investors can review the executive summary of the corresponding SPV assets in the Centrifuge asset pool and sign an investment agreement (Subscription Agreement) with them. The agreement includes investment structure, risks, terms, etc.

Investors can then choose to purchase DROP or TIN tokens using stablecoins such as DAI.

Investors can request to redeem their DROP or TIN tokens at any time.

3.3 Centrifuge Chain Realizes Multi-Chain Liquidity Capture

Centrifuge previously built asset pools through the Tinlake protocol to capture liquidity on Ethereum (including multiple RWA asset pools for MakerDAO). In order to expand into a broader crypto world, Centrifuge has built the Centrifuge Chain as a Polkadot parachain on the Polkadot Substrate framework to connect to more EVM-compatible chain scenarios, aiming to capture more liquidity on Layer 2 solutions (such as Base, Arbitrum, etc.).

As a result, CentrifugeLiquidity Pools based on Centrifuge Chain have emerged, allowing investors on any EVM-compatible chain to directly invest in the Centrifuge protocol through Centrifuge Liquidity Pools without the need to switch wallets or perform other operations.

CentrifugeLiquidity Pools act as a bridge across different chains.

Since the launch of the Centrifuge DApp in May of this year, several significant projects based on the Centrifuge Chain are also set to launch, such as the Anemoy Liquid Treasury Series 1 (applicable to Aave's treasury for US bond RWA asset pools), New Silver Series 3 (bridge loan fund pool for real estate), and Flowcarbon Nature Offsets Series 2 (voluntary carbon offset project in collaboration with Celo).

IV. Current Project Progress of Centrifuge

As the first decentralized RWA asset financing protocol, thanks to its collaboration with MakerDAO, Centrifuge has become the project with the highest TVL in the private credit sector of the DeFi market, exceeding $250 million. Additionally, Centrifuge is also building a US bond RWA market, attracting funds from encrypted capital including Aave's treasury.

4.1 Shaping the King of the Private Credit Sector through Collaboration with MakerDAO

Since collaborating with BlockTower in 2019 to create the first RWA asset pool on MakerDAO, Centrifuge has continuously explored the potential of RWA for MakerDAO. The BlockTower Series and New Silver Series created still account for the majority of the RWA asset pools on MakerDAO.

Through the Centrifuge DApp, we can see that out of the currently active 14 asset pools, 8 are specifically designed for MakerDAO, and these 8 Maker Pools account for over 80% of Centrifuge's total TVL (these Maker Pools include the senior tranche subscribed by MakerDAO and the junior tranche subscribed by the asset originator). If we calculate the share subscribed by MakerDAO alone, it exceeds 50% of Centrifuge's total TVL.

In addition to the Maker Pool, we also see asset pools from other asset originators involving a variety of private credit financial instruments such as shipping invoices, prepayments from fintech companies, inventory financing, commercial real estate, consumer loans, accounts receivable, and structured credit, among others.

Currently, the largest RWA asset pools for MakerDAO are BlockTower Andromeda ($1.21 billion TVL) and Monetalis Clydesdale ($1.15 billion TVL), both of which are US bond RWA projects. This demonstrates the strong demand for US bond RWA from encrypted capital, which also motivates Centrifuge's determination to enter the US bond RWA market from the private credit sector.

4.2 Entering the US Bond RWA Market through Collaboration with Aave

As early as December 28, 2021, Aave announced the launch of the RWA market, which is built on top of 7 asset pools of the Centrifuge Tinlake protocol and requires KYC for investment. Investors in Aave can deposit stablecoins to earn stable and interest income from real-world assets.

Essentially, the Aave RWA market is the asset pools on Centrifuge borrowing liquidity from Aave's investors, and it has been lukewarm. It wasn't until the Aave community proposed on August 8, 2023, to collaborate with Centrifuge to invest $5 million of Aave's treasury assets into RWA assets.

The proposal stated that currently, 65% of Aave's treasury assets exist in the form of stablecoins (approximately $15 million), and by investing just $5 million in RWA assets, they could earn $250,000 in risk-free income (based on a 5% risk-free return rate for US bond RWA), making it one of the most profitable ways for the DAO at present.

Centrifuge has launched Prime services to help Aave achieve a compliant path for purchasing RWA assets. The service aims to help encrypted capital/DeFi protocols/DAO treasuries capture the income value of real-world assets (such as risk-free returns on US bonds). Through this collaboration with Aave, Centrifuge has created a US bond fund, entering the US bond RWA field.

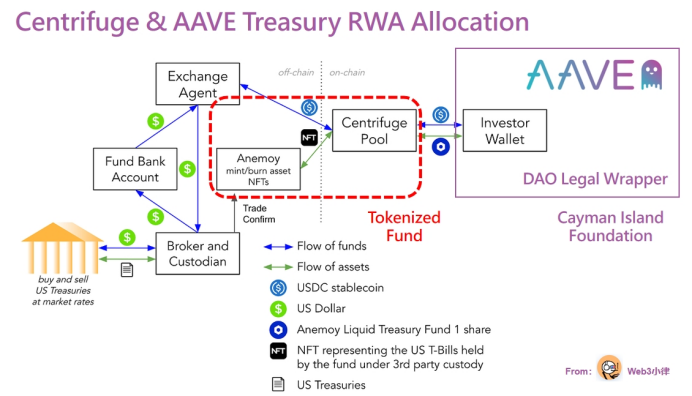

The Centrifuge Prime service in the above image is divided into two parts:

Step 1: Legal wrapping for on-chain DeFi protocols, such as establishing a dedicated legal entity—Cayman Foundation—for Aave. This legal entity can replace the unlimited liability of DAO members and serve as an independent entity for implementing RWA value capture, governed and controlled by the Aave community, acting as a bridge between DeFi and TradiFi.

Step 2: Centrifuge will establish a dedicated asset pool for Anemoy Liquid Treasury Fund 1. Unlike previous asset pools where the underlying assets were private credit assets (placing private credit assets into an SPV, generating NFTs, and collateralizing them in the corresponding Centrifuge asset pool), the underlying assets of the Anemoy Liquid Treasury Fund 1 asset pool are US bonds, requiring direct tokenization of the Anemoy LTF fund holding US bond assets.

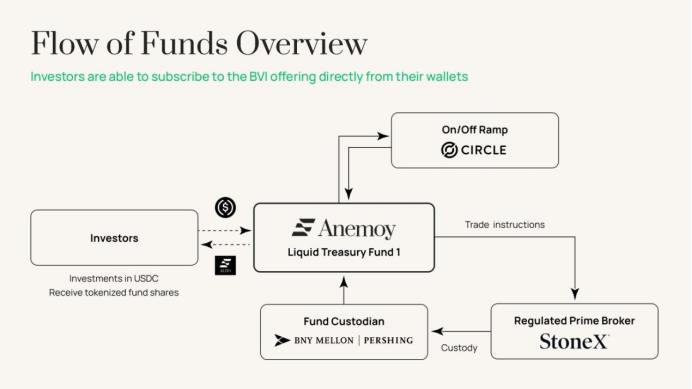

As shown in the image, Anemoy LTF is a fund registered in BVI, which will first tokenize the fund through the Centrifuge protocol. Then, Aave will invest its treasury funds in the corresponding Centrifuge asset pool for Anemoy LTF and generate fund token certificates. Subsequently, the Centrifuge asset pool will allocate the assets invested by Aave's treasury to the Anemoy LTF fund. Finally, the Anemoy LTF fund will realize US bond returns on-chain through deposits and withdrawals, custody, and broker purchases of US Treasury bonds.

Although the initial amount in Aave's proposal is $1 million, it is only an experiment in the early stages. After all, Aave's treasury still holds $15 million in stablecoin assets, and it is expected that 20% of the stablecoin holdings in Aave's treasury will be invested in the future.

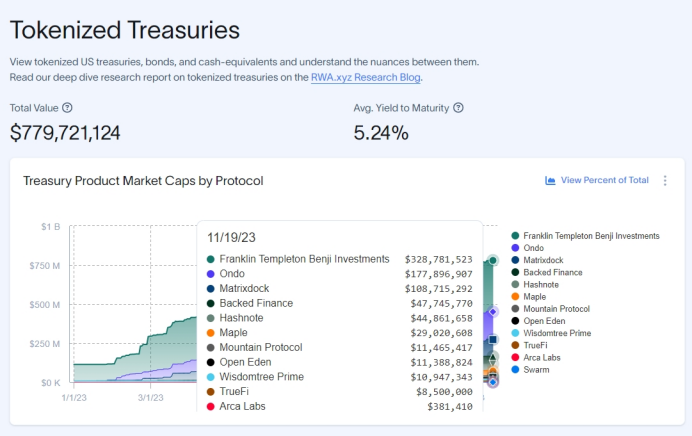

More importantly, this move allows Centrifuge to enter the US bond RWA market, characterized by risk-free, stable returns, and scalability. Currently, the TVL of some US bond RWA projects has reached $779 million, and MakerDAO's US bond RWA holdings have exceeded $2 billion.

V. Centrifuge Tokenomics and Governance

5.1 Centrifuge Tokenomics

CFG is the native token of the Centrifuge Chain, used to incentivize the operation of the network protocol and the sustainable development of the ecosystem.

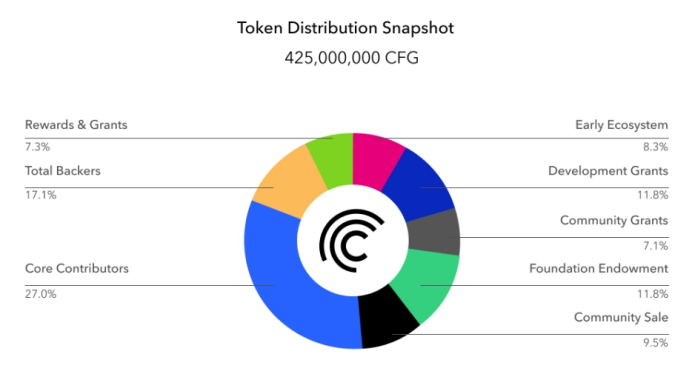

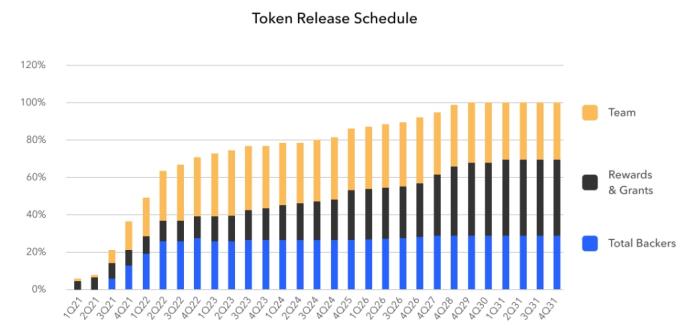

According to the official website, the initial total supply of CFG is 400 million tokens (with an annual inflation rate of 3%), and the current total supply is 425 million tokens. CFG has several use cases, including network node staking incentives, on-chain transaction fee payments, asset pool liquidity incentives, staking for financing eligibility, and participation in governance. The distribution of CFG tokens is as follows:

Most CFG tokens have a long lock-up period. Core team members have a 48-month lock-up period after joining, followed by a linear release over the next 12 months.

Previously, in May 2021, Centrifuge conducted two rounds of Token Sale on Coinlist, with a token supply limit of 17 million for each round. The price of the first round was $0.55 (unlocked directly on July 14, 2021), and the price of the second round was $0.38 (linearly unlocked over two years after July 14, 2021).

5.2 Centrifuge Governance

Previously, Centrifuge products and protocols were mainly led by the Centrifuge founding team, gradually transitioning to a Centrifuge DAO-led form in recent years. The Centrifuge founding team also established organizations such as K/Factory, Centrifuge Network Foundation, EMBRIO.tech, and co-built the Centrifuge protocol as active contributors, entering a progressive and decentralized process.

At the Centrifuge DAO level, in November 2022, the community passed the DAO's Founding Documents and gradually introduced protocol development groups (Protocol and Engineering Group), governance coordination groups (Governance & Coordination Group), and on-chain asset evaluation groups (Centrifuge Credit Group) around the goal of creating an on-chain credit system (Bring the World of Credit Onchain).

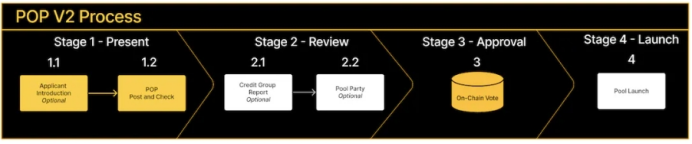

Although the protocol is built on a decentralized network, the inherent risks of the off-chain financial asset system cannot be ignored. Therefore, the asset pool on-chain evaluation group (Centrifuge Credit Group), composed of experts in the financial and lending fields, introduced the Pool Onboarding Process V2 to further enhance the transparency of the asset onboarding process and manage risks.

In addition, as the Centrifuge protocol continues to improve, the community actively discusses incentivized management uses for the protocol treasury and how the protocol should charge fees, further enhancing the utility of CFG. This is crucial and will determine the future value trajectory of CFG.

VI. Centrifuge's RWA Narrative

6.1 Collaboration with MakerDAO to Build a Decentralized Financial Lending Market

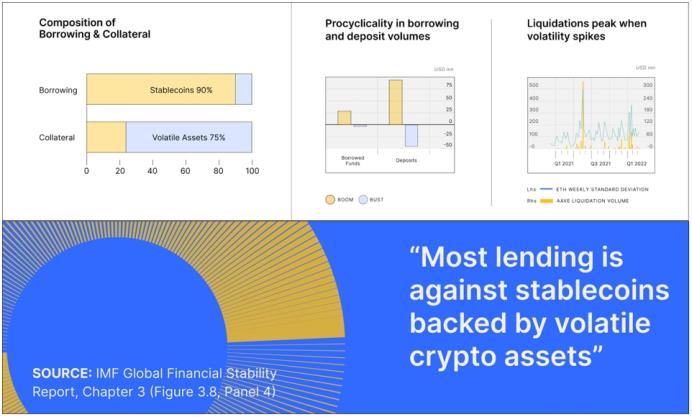

The narrative of RWA can also be seen as the narrative of DeFi for MakerDAO, and it is essential to consider the significance of RWA for the DeFi world from the perspective of MakerDAO.

During the DeFi Summer of 2021, many unsustainable DeFi yield products emerged, leading to a major collapse in the crypto market and the spread of credit defaults throughout the ecosystem. Although native crypto assets are a key component of DeFi and a long-term differentiating factor, the current real-world demand does not match long-term development value.

For lending protocols like MakerDAO, a key consideration is the stability of collateral value. We have seen that previously, MakerDAO's collateral included volatile cryptocurrencies, which posed risks to lending and severely limited MakerDAO's development space.

Therefore, MakerDAO and DeFi urgently need a more stable underlying collateral (a Baselayer Level of Collateral) to support the widespread adoption of the stablecoin DAI in the crypto world and build a sustainable, scalable pathway.

RWA, as one of the most important topics for MakerDAO, is continuously discussed and validated by the community, seen as an important solution. The benefits of RWA include: (1) increasing transparency in market risk and asset usage; (2) providing composability for DeFi; (3) improving accessibility for underserved populations with limited banking services and funding; (4) capturing value from larger, more stable traditional financial markets.

For MakerDAO, RWA has two important characteristics—stability and scalability. Furthermore, DAI can expand its utility by anchoring to assets with no crypto volatility, stable returns, and scalability, especially in the current market environment of low crypto asset yields and high US bond yields. Through the capture of RWA value, MakerDAO can continue to expand and grow in bear markets and be well-prepared for the next bull market cycle.

Most importantly, RWA can help MakerDAO achieve its grand vision: to allow for a credit-neutral, decentralized channel that adds utility to people's daily lives and the development needs of businesses. This will open up a completely new DeFi financial market in an open, on-chain, community-driven, programmable, and decentralized protocol manner.

However, bringing real-world assets on-chain is not easy and involves challenges in new product architecture design, financial and technological risks, and unknown unknowns. Ultimately, achieving a balance between cutting-edge innovation and stability in traditional finance will require the collective efforts of RWA industry participants.

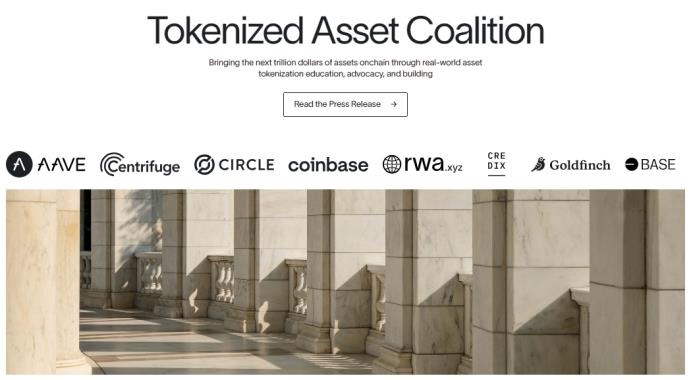

6.2 Tokenized Asset Coalition

In September 2023, Centrifuge, along with Aave, Circle, Coinbase, RWA.xyz, Credix, Goldfinch, and Base, jointly launched the Tokenized Asset Coalition. The coalition aims to bring together the traditional financial system and the crypto financial system through education, advocacy, and co-building. The goal is to accelerate global institutional adoption of tokenized assets on the blockchain and collectively drive trillions of dollars of assets onto the chain. The coalition collaborates to unite organizations with a shared vision to facilitate impactful use cases for tokenization in the real world, thereby realizing the true value of crypto assets.

The Tokenized Asset Coalition consists of seven founding members, all of whom are currently the most important players in the RWA field: Centrifuge and Credix represent asset financing protocols, representing the asset side; Aave and Goldfinch represent DeFi lending protocols, representing the capital side; Circle and Coinbase serve as important RWA infrastructure, providing stablecoin exchange and asset custody services; RWA.xyz is an on-chain data analysis platform for RWA; Base is involved in RWA as a Layer 2 participant. The coalition also invites all market participants to contribute to the transformation of the traditional financial system and jointly build a new open decentralized financial market.

VII. Future Outlook for Centrifuge

While we can see the efforts of the Centrifuge team in continuously improving the protocol, as well as the benefits brought by heavyweight capital and top-tier partners, before envisioning the bright future of RWA, it is necessary to discuss the potential development obstacles for Centrifuge.

7.1 Potential Development Obstacles

From a liquidity perspective, expanding from Ethereum's Tinlake protocol to the multi-chain Centrifuge Chain seems to open up more scenarios and capture more DeFi liquidity. However, from another perspective, is Ethereum's liquidity already at its peak?

Additionally, Centrifuge still needs to overcome the limitation of a single large client (MakerDAO).

From a macro perspective of the crypto market, the current development of RWA is limited by the size of the $1.5 trillion crypto market, the integration of deposits and withdrawals, regulatory relaxation, and public education are not processes that can be achieved overnight. However, traditional finance's recognition of distributed ledger technology, blockchain payment settlement, and tokenized assets will accelerate this process, especially with the approval of BTC ETFs.

From a project governance perspective, designing Protocol Fees to help CFG capture value and effectively utilizing treasury funds to incentivize users and ecosystem development are more immediate practical issues.

7.2 The Improvement of the Centrifuge Protocol Will Create More Connections

Previously deployed on Ethereum, the Tinlake protocol helped Centrifuge become a leader in the private credit field. Integrating the Centrifuge DApp with the Tinlake protocol can bring a richer cross-chain experience. With the improvement of the Centrifuge Chain and the continuous launch of Centrifuge Liquidity Pools on Layer 2 solutions like Arbitrum and Base, it will help capture more DeFi liquidity.

The improvement of the protocol will bring benefits to the capital side. On the asset side, continuous improvement in governance, such as the introduction of the POP V2 plan by the asset on-chain evaluation group, will help create better asset pools and reduce overall protocol risk.

RWA is most important for both the asset side and the capital side, and the continuous improvement of the Centrifuge protocol will create more connections for these two sides.

7.3 Consolidating the Leadership in the Private Credit Field and Expanding into the US Bond RWA Field

US bonds have important characteristics such as risk-free, stable returns, and scalability. Therefore, once the crypto market expands, US bond RWA becomes more widely applicable. This can be seen from Tether's issuance of $72.5 billion in US bond assets and MakerDAO's largest US bond RWA asset pool.

After establishing leadership in the private credit field, Centrifuge has significant potential in entering the US bond RWA market through collaboration with Aave.

Currently, Franklin Onchain Funds alone has a TVL of $3.28 billion, followed closely by Ondo Finance with a TVL of $1.77 billion. This does not include MakerDAO's two largest US bond RWA asset pools: BlockTower Andromeda ($12.1 billion TVL) and Monetalis Clydesdale ($11.5 billion TVL).

7.4 Experiment Based on U-Based Interest-Bearing Assets

In the previous article "In-depth Analysis of RWA: Breaking Down the Current Implementation Path of RWA and Exploring the Development Logic of Future RWA-Fi," we stated that the application logic of U-based RWA interest-bearing assets is consistent with the application logic of ETH-based LSD interest-bearing assets. Mapping interest-bearing assets to the chain is just the first step for RWA, and how to use DeFi composability to build a DeFi Lego will become very interesting.

Case One: Interest-bearing stablecoin based on US bonds.

The interest-bearing stablecoin project Mountain Protocol, previously invested in by Coinbase Ventures, has achieved a TVL of $12.14 million since the launch of USDM on September 11, 2023. Unlike USDC/USDT, USDM provides daily rewards to users in the form of Rebase, with a current annual interest rate of 5%, derived from the underlying asset of US bonds. Non-US users can also hold USDM to earn stablecoin returns, as USDM aims to provide an opportunity for users outside the US with a crypto wallet to access US bond yields.

Case Two: Layer2 based on US bonds and ETH collateral—Blast

Blast is the only Ethereum Layer 2 project with native ETH and stablecoin returns, launched by Pacman, the founder of Blur. The project has previously raised $20 million in funding from Paradigm and Standard Crypto.

Blast believes that cryptocurrencies also experience inflation, and funds deposited on other Layer 2 solutions have a baseline interest rate of 0%, causing the value of users' assets to depreciate over time. Blast's goal is to enable Layer 2 to generate returns automatically, meaning that when users deposit assets, Blast will distribute returns regularly. The essence of Blast's return generation is to stake ETH with Lido and use stablecoins to purchase US bonds.

The above two cases perfectly demonstrate the value of U-based interest-bearing assets. Therefore, for the current positioning of Centrifuge's RWA asset financing protocol, if it can integrate this scenario effectively, it will bring about a qualitative leap.

VIII. Conclusion

As lawyer Waxy said, RWA has long existed, and project parties have already received multiple rounds of financing. Despite taking different paths, they all have their own strengths.

However, there is no doubt that RWA has become an important form of asset in the crypto world. The Centrifuge team has made significant progress in helping RWA make strides in the crypto industry through years of effort and practice. They are also collaborating with heavyweight partners in the crypto industry to jointly promote the development of the RWA industry. The future looks promising.

But before unlocking the imagination of RWA, Centrifuge still needs to achieve more market depth (in the US bond RWA market) and breadth (capturing multi-chain liquidity).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。